VanEck Gives Official Backing To Donald Trump’s Bitcoin Reserve Strategy

19 Noviembre 2024 - 2:56PM

NEWSBTC

On Tuesday, Matthew Sigel, the head of digital asset research at

asset management firm and crypto exchange-traded fund (ETF) issuer

VanEck, officially endorsed President-elect Donald Trump’s proposal

for a national strategic Bitcoin reserve. Major Financial

Players Align This endorsement comes as discussions about BCT’s

role in US economic policy are intensifying, most notably with

Dennis Porter, co-founder and CEO of the non-profit Satoshi Action

Fund (SAF), reaffirming BlackRock’s support for the strategic

Bitcoin reserve. Related Reading: Bitcoin Reaches New High Of

$94,000: Blockstream CEO Anticipates $1 Million Ahead Porter

emphasized that the Trump administration is actively working

towards creating this reserve through an executive order,

highlighting a significant alignment among major financial players

and lawmakers regarding Bitcoin’s future. During a series of social

media posts on X (formerly Twitter), Porter also outlined a series

of steps he believes will facilitate the establishment of the

strategic Bitcoin reserve, suggesting that the process will begin

with Trump appointing a pro-Bitcoin Treasury Secretary. Key

Steps For Establishing A US Strategic Bitcoin Reserve Porter

asserts that Donald Trump would then sign an executive order to

create the reserve, which would also involve halting the auction of

Bitcoin currently held by the US Marshals Service. The next

phase would see the Treasury absorb these Bitcoin assets and place

them into the Exchange Stabilization Fund. Over time, the Treasury

would continue to accumulate Bitcoin for the reserve. Porter also

noted the importance of legislative support, stating that since

executive orders can be easily reversed, it would be crucial for

Congress to pass a formal bill establishing the strategic reserve,

spearheaded by pro-crypto Senator Cynthia Lummis. Related Reading:

Solana Analyst Expects A Retrace Before It Breaks ATH – Targets

Revealed The potential for a US strategic Bitcoin reserve has

generated substantial excitement in the market, contributing to

Bitcoin’s recent surge to an all-time high of $94,000. This

reflects growing confidence among investors and speculation that

such government actions could lead to significant buying pressure

and further institutional adoption. At the time of writing, BTC has

fallen back to $93,380 after hitting its new all-time high, marking

a 40% increase in just two weeks. Featured image from DALL-E,

chart from TradingView.com

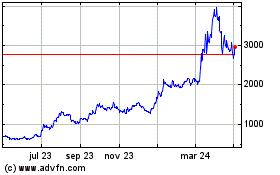

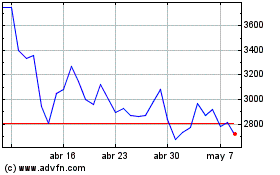

Maker (COIN:MKRUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Maker (COIN:MKRUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024