Who Profited During Bitcoin’s $100,000 Surge? Analyst Breaks Down the Data

26 Diciembre 2024 - 5:30PM

NEWSBTC

Bitcoin ongoing price movement has sparked intense analysis as it

continues to hover below the $100,000 mark. Despite reaching an

all-time high above $108,000 last week, the cryptocurrency has

struggled to maintain upward momentum ever since. With this

performance, BTC’s on-chain data has been brought to the spotlight

to uncover the factors driving recent selling pressures and

investor behavior. One key focus has been the Spent Output Age

Bands (SOAB) indicator, which provides valuable insights into

Bitcoin holders’ activity based on their holding periods. Related

Reading: Bitcoin Is Forming A Symmetrical Triangle – Can BTC

Reclaim $100K? Who Cashed Out Their Bitcoin Gains? According to a

CryptoQuant analyst known as Yonsei Dent, data reveals that Bitcoin

investors who bought their holdings between six to twelve months

ago were the most active sellers during the recent price surge.

This group largely entered the market during the initial excitement

surrounding the launch of spot Bitcoin exchange-traded funds (ETFs)

earlier in the year. While this selling activity exerted downward

pressure on Bitcoin’s price, the asset has managed to stabilize

within the $90,000–$100,000 range. Interestingly, long-term

holders, defined as those holding Bitcoin for over a year, have

shown minimal selling activity. Historical trends suggest that

these seasoned investors are likely anticipating elevated price

levels before considering substantial profit-taking. Meanwhile,

Dent pointed to the Binary Coin Days Destroyed (CDD) metric showing

a noticeable decline in older Bitcoin being moved in December

compared to November. Historically, reduced activity from long-term

holders during price corrections often signals market resilience

and potential for future upward momentum. The analyst wrote: The

‘Binary CDD’ indicator at the bottom of the chart shows a decline

in the selling of older Bitcoin in December compared to November.

This suggests that many long-term holders may anticipate even

higher prices before selling. Binance Reserves Signal Market

Confidence Speaking of higher prices, another crucial metric

suggesting a significant move brewing for Bitcoin comes from

Binance’s Bitcoin reserves, which have been steadily declining

since August. CryptoQuant analyst Darkfost highlighted that

Binance’s reserves recently hit their lowest level since January.

This trend is significant because a similar decline earlier in the

year preceded a 90% surge in Bitcoin’s price. The reduction in

exchange reserves typically indicates that investors are moving

their Bitcoin holdings away from centralized exchanges and into

private wallets. Such behavior suggests reduced selling pressure

and a preference for long-term holding strategies. Historically,

declining reserves on exchanges have often aligned with periods of

strong market optimism and price rallies. Notably, as BTC currently

still trades at a price of $95,567 down by 2.7% in the past day,

the confluence of these factors—long-term holder confidence,

reduced activity from older wallets, and declining exchange

reserves—presents a cautiously optimistic picture for Bitcoin’s

near-term trajectory. Related Reading: Bitcoin Sentiment Still

Close To Extreme Greed: More Cooldown Needed For Bottom? However,

it is cautioned that sustained buying activity will be required to

break through psychological resistance levels and maintain upward

momentum. Featured image created with DALL-E, Chart from

TradingView

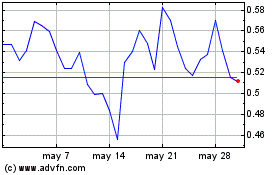

Sei (COIN:SEIUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Sei (COIN:SEIUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024