Dogecoin Sights Rebound As RSI Hits Oversold Levels Near $0.3563

19 Diciembre 2024 - 1:00PM

NEWSBTC

Dogecoin is approaching a critical juncture as it hovers near the

$0.3563 mark, with the Relative Strength Index (RSI), signaling

oversold conditions. This suggests that the recent sell-off may

have pushed the asset into undervalued territory, raising the

possibility of a rebound. However, whether the bulls can seize this

opportunity to drive a recovery remains uncertain. With the market

showing signs of fatigue, $0.3563 emerges as a pivotal level to

watch. How the price reacts in the coming sessions could set the

tone for Dogecoin’s next significant move. Understanding Current

Price Action And The Overbought RSI Signal Current price action

reveals that Dogecoin, despite trading below the 100-day Simple

Moving Average (SMA), is showing promising signs of bullish

momentum. The meme coin has briefly regained strength, hinting at a

possible upward trajectory as it seeks to challenge overhead

resistance levels. Significantly, this movement suggests that buyer

interest is gradually increasing, which could lay the groundwork

for a sustained recovery if key levels are breached. While the

100-day SMA often acts as a significant hurdle in bearish markets,

DOGE’s resilience at this juncture indicates that bulls are making

an effort to reclaim control. The evolving price structure

underscores the importance of maintaining momentum to confirm a

bullish breakout, with the next steps likely influenced by market

sentiment and broader trading dynamics. Related Reading: Ex-Hedge

Fund Guru Bets Big On Dogecoin As ‘Core Crypto Bet’ DOGE’s Relative

Strength Index (RSI) is currently hovering at 30%, which indicates

a firm position within the oversold zone. This technical indicator

suggests that Dogecoin may have experienced significant selling

pressure, pushing its price to undervalued levels. An RSI reading

at or below 30% typically offers an opportunity for buyers to

re-enter the market and initiate a rebound. Although this does not

guarantee an immediate recovery, it highlights the potential for a

reversal in the coming sessions, especially if other bullish

signals align. Traders are closely watching whether the RSI will

rise soon, as this could signal strengthening momentum and a shift

in sentiment. Combined with price action near key support levels,

the RSI’s positioning might be crucial in shaping Dogecoin’s next

moves. A Rebound Or Continued Rally For Dogecoin? DOGE’s

current price action presents two key scenarios to consider: a

potential rebound or the continuation of its rally. Given the

oversold signal from the RSI near $0.3563, a rebound is possible if

the bulls step in and drive the price higher, capitalizing on the

undervalued conditions. A successful recovery could see DOGE

challenge previous resistance points, such as $0.4484, and restore

its upward pressure. Related Reading: Dogecoin (DOGE) Rally on

Hold: Can Momentum Kick Back In? On the other hand, if the bearish

pressure persists, the cryptocurrency could struggle to regain

bullish control, leading to further declines toward $0.1800. The

next few trading sessions will be crucial in determining which path

Dogecoin will take, with support and resistance levels playing key

roles in shaping its direction. Featured image from Unsplash, chart

from Tradingview.com

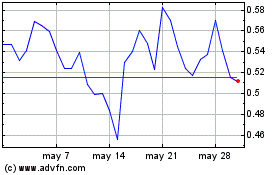

Sei (COIN:SEIUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Sei (COIN:SEIUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024