Why One Analyst Says Now’s The Time To Buy XRP—Before It Hits $14

04 Noviembre 2024 - 6:00AM

NEWSBTC

A few analysts say Ripple’s XRP is preparing for an explosive price

action. Steph, an analyst under the “StephIsCrypto” username,

offers a bold, positive outlook for XRP, saying that a significant

price rally is in the pipeline thanks to increased global

liquidity. Related Reading: Solana DeFi Momentum Soars With $5.7

Billion Locked In Q3 In a published analysis, Steph highlighted the

token’s historical relationship with increased liquidity and

structural patterns like the descending channel and the Bollinger

Bands. According to Steph, these are the primary factors that set

up XRP for a price ascent soon. At the time of writing, XRP was

trading at $0.5052, up 0.5% in the last 24 hours, but sustained a

nearly 2% rally in the last week, data from Coingecko shows. XRP

And Its Relationship With Global Liquidity Higher global liquidity

often favors Ripple’s XRP, fueling price rallies. In Steph’s

analysis, a token’s liquidity, or the available cash flow across

the market, traditionally helps XRP sustain price action in past

cycles. BUY #XRP BEFORE IT HITS $14.00 !!!

pic.twitter.com/e8wY3UVq11 — STEPH IS CRYPTO (@Steph_iscrypto)

November 3, 2024 Steph is now looking at the same trajectory, where

global liquidity is increasing thanks to favorable policies from

central banks. He cites the possible move of the Federal Reserve,

which can introduce additional money into circulation, thus

weakening the fiat currencies but creating more capital. Steph sees

the token as a great investment when the liquidity surge happens.

As Weighted Global Liquidity Index Moves Up, Riskier Assets

Increase Steph’s thesis on XRP is also based on the Weighted Global

Liquidity Index (WGLI) movement. The WGLI tracks the world’s money

supply by looking at central banks’ balance sheets and other

important financial statements. The analyst argues that the index

reflects possible price movements of risky assets, like XRP. If the

index trends upward, crypto assets tend to increase as well.

According to the analyst, every XRP price surge happened

immediately after an increase in the index. Currently, there’s a

divergence between XRP’s price and the index. Although there’s an

increase in global liquidity, XRP’s price appears stable. But for

Steph, this setup acts as his bullish signal. Bollinger Bands

Squeeze And Descending Channel Favor SRP According to Steph, even

the Bollinger Bands and Descending Channel set up the altcoin for a

favorable run. Since 2021, XRP has been trading in a descending

channel, with multiple resistance price points and declining

volumes. Related Reading: GRASS Token Fails To Break $2 Level – Is

It Time To Buy? He pointed out that the asset’s Bollinger Bands are

compressed. If the bands tighten in crypto, it suggests a probable

price action. For example, XRP’s Bollinger Bands compressed in

2017, which was followed by the asset’s price rally. If the

analysis and data trends hold true, the analyst expects XRP to

trade at $14, translating to an increase of 2,670%. Featured image

from Techopedia, chart from TradingView

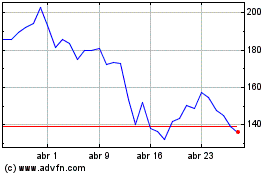

Solana (COIN:SOLUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Solana (COIN:SOLUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024