Litecoin Price Falters Amid Doubts Over LTC ETF Approval

13 Enero 2025 - 11:00AM

NEWSBTC

When the US Securities and Exchange Commission (SEC) approved the

11 initial applications for spot ETFs last January 2024, it

signaled a favorable environment for Bitcoin. The top digital

asset’s price surged thanks to increasing institutional attention.

So, it isn’t surprising that other top crypto projects follow suit,

with Litecoin (LTC), a proof-of-work coin, on the deciding table.

Related Reading: $7,000 Ethereum In Sight? Expert Breaks Down The

Potential Path However, Litecoin is having a rough start to the

year. It’s currently trading at $94.89, down 22% in the last 30

days. Litecoin’s price performance this week aligns with other

altcoins, which surrendered some of their gains last year. Also,

crypto analysts attribute Litecoin’s slide to the diminishing odds

that spot LTC ETFs will be approved in 2025. According to

Polymarket’s tracking, the odds of approving the spot LTC ETFs this

year dipped to 24% as of January 13th. Odds Of Spot ETFs For

Litecoin Continue To Drop For months, the crypto industry and

betting markets have been projecting the odds of finally having

these spot Litecoin ETFs. On December 19th, the Polymarket odds put

the chances at 75% before starting to dip as the year closed. The

odds were close to 50% at the start of the year, but this soon

began to taper, and it’s now at 24%. However, some crypto analysts

are optimistic that these ETFs will be approved soon. Eric

Balchunas, a Bloomberg analyst, shared his optimism in a post. He

explained that the SEC would approve these funds since they are a

fork of Bitcoin. A Wave Of Crypto ETFs Soon? According to

Bloomberg’s Balchunas, the market is ready to welcome the approval

of new spot ETFs for different coins. In his Twitter/X post shared

on December 18th, he said that the Bitcoin and Ether ETF combo may

be approved, and there’s a probability that Litecoin’s ETFs may be

next. He argued that since Litecoin is Bitcoin’s fork, it will be

easier for proponents to gain approval. In addition to Litecoin,

Balchunas also predicted that HBAR may be next since it’s not

identified as a security, followed by XRP/Solana. However, XRP has

the lowest odds of being approved since it has a pending lawsuit

over its securities labelling. Related Reading: Bitcoin To

$350,000? Top Crypto Influencer Makes Bold Prediction What’s Ahead

For Spot Litecoin ETFs Canary Capital was the only company to file

an application for Litecoin’s ETF. Analysts also expect Grayscale

to follow suit if it decides to convert its Litecoin Trust, which

boasts over $215 million in assets. Some experts say that the spot

ETFs for Litecoin may have an uncertain future even if it gains SEC

approval. Some say that it’s questionable whether institutional

investors will pick these investments. Even Bitcoin and Ether’s

spot ETF performances are relatively weak. For example, Bitcoin

funds are backed by $107 billion in assets, representing just 5.7%

of the total coin’s market cap. Ethereum, on the other hand, boasts

$11.6 billion, just 2.96% of the total asset’s market cap. Since

Litecoin is a smaller cryptocurrency project, many analysts don’t

expect much from the spot LTC ETFs. Featured image from Pexels,

chart from TradingView

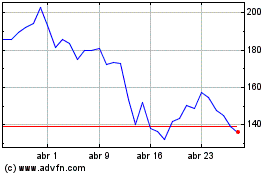

Solana (COIN:SOLUSD)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Solana (COIN:SOLUSD)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025