Ethereum Dips Below $3,100 – New All-Time High Possible Before 2025?

22 Diciembre 2024 - 10:30AM

NEWSBTC

Ethereum (ETH), the second-largest cryptocurrency by market

capitalization, recently experienced a significant price

correction, dropping below $3,100 for the first time in 29 days.

This marks a notable shift from its peak performance in December,

when it reached this year’s high of $4,106 on December 16. However,

the all-time high for ETH, set at $4,877 on November 8, 2021,

remains unbroken. Since reaching that high, Ethereum has been

forming lower highs and lower lows, indicating bearish momentum in

the market. Ethereum Market Sentiment And Support Levels The year

2024 has been tumultuous for Ethereum, with a blend of bullish

catalysts and market downturns. Early in the year, Ethereum saw a

47% increase, although it lagged behind Bitcoin’s substantial

gains. A key driver of optimism was the SEC’s approval of Ethereum

spot ETFs in May, which not only attracted institutional investors

but also contributed to a 24.7% return for that month. However,

geopolitical tensions and broader market dynamics, including the

Bitcoin halving, led to volatile periods, with April witnessing a

17.2% decline in ETH’s value. Despite these fluctuations, Ethereum

has maintained its stronghold in the decentralized finance (DeFi)

space, with its Total Value Locked approaching $80 billion,

underscoring its fundamental strength. However, the second quarter

was less favorable, with ETH posting a -5.08% quarterly return due

to external factors like the Middle East crisis. Related Reading:

Sentiment For Ethereum Hits 1-year Low, Analyst Says A Massive Run

Is Coming As December 2024 unfolds, Ethereum was trading at around

$3,648, showing signs of recovery in the last month of the year and

outperforming other major cryptocurrencies like Bitcoin and Solana.

However, the recent dip below $3,100 has sparked discussions about

the potential for further declines or a swift recovery to new

highs. Market sentiment, as indicated by the Fear and Greed Index

at 57 (greed), suggests that retail investors see the current dip

as a buying opportunity rather than a reason for panic selling.

This sentiment is crucial as Ethereum navigates through its support

levels, with the immediate one at $2,900 being a focal point. If

Bitcoin experiences a significant drop to around $90,000, it could

further influence ETH’s price, potentially pushing it towards its

next significant support at $2,900. Related Reading: 7.8M Ethereum

Leaves Binance In Two Months—What Does This Mean for ETH? Can

Ethereum Hit A New All-Time High Before 2025? Looking towards the

possibility of hitting a new all-time high before 2025, several

factors come into play: Institutional Adoption: The ongoing

investment from institutional players, especially through ETFs,

could lead to increased demand. Network Upgrades: Upcoming Ethereum

upgrades and improvements in scalability could enhance investor

confidence. Market Sentiment: The crypto market’s general mood,

influenced by broader economic conditions, technological

advancements, and regulatory news, will be pivotal. The

concentration of Ethereum holdings also plays a role. The Beacon

Chain Deposit Contract holds over 38 million ETH, crucial for

Ethereum’s transition to Proof-of-Stake. Other significant holders

include exchanges like Binance and Coinbase, which could influence

market liquidity and price movements through their strategic asset

management. In conclusion, while Ethereum’s dip below $3,100

signals a moment of caution, the underlying fundamentals and market

dynamics suggest there’s still a pathway to new highs before 2025.

However, this would require positive developments in both the

crypto-specific and broader economic landscapes. Investors should

watch closely how Ethereum interacts with its support levels and

responds to upcoming market catalysts. Featured image created with

DALL-E, Chart from Tradingview.com

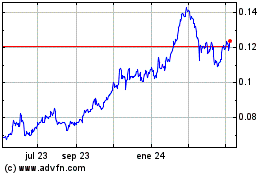

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

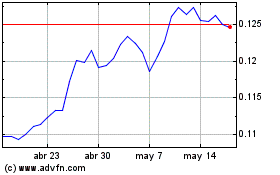

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024