ARGAN: FULL SPEED TOWARDS DEBT REDUCTION!

10 Diciembre 2024 - 10:45AM

UK Regulatory

ARGAN: FULL SPEED TOWARDS DEBT REDUCTION!

Press release – Neuilly-sur-Seine, Tuesday, December

10, 2024 – 5.45 pm

Full speed towards debt

reduction!

- LTV below the 40% threshold by the end of 2025

(vs. 50% end of 2023)

- Net debt to EBITDA of 8X by the end of 2025

(vs. 11X end of 2023)

As early as 2023, ARGAN presented a

roadmap to combine growth and debt reduction. Today, ARGAN

confirmed this commitment. This strategy is built around three

pillars: a strongly cash generating

growth thanks to a solid business model,

the repayment of mortgage loans (around €100

million per year) and a selective assets disposals

program.

In 2024, ARGAN started the debt

reduction process, as the company notably successfully sold assets

in an amount of €77 million, raised capital for €150 million and

repaid €94 million in mortgage loans. As at

December 2024, our announced

targets1 should be

reached, namely:

- An EPRA LTV ratio

(excluding duties) of 44%;

- A net debt to EBITDA ratio

of 9.5X.

Now, ARGAN is turning towards 2025, with

the aim to pursue the pace of debt reduction, and the company is

thus announcing targeting the following ratios by the end of the

coming year:

- An EPRA LTV ratio

(excluding duties) below

40%2 (vs. 50% at the

end of 2023);

- A net debt to EBITDA ratio

of about 8X (vs. 11X at the end of

2023).

Our debt is under control

with:

- A cost of debt under

control of 2.25% end of 2024 and expected at 2.10% by the end of

2025;

- A structure that limits

risks, with a debt mostly incurred with fixed or hedged variable

rates:

- 59% fixed-rate

debt,

- 39% of hedged variable

debt,

- Only 2% of non-hedged

variable debt.

ARGAN will present its strategic plan as

part of the annual results release to take place on

January 16, 2025 (after closing of the stock

exchange).

2025 financial calendar (Publication of the

press release after closing of the stock exchange)

- January 3: Net sales of 4th quarter 2024

- January 16: Annual results 2024

- March 20: General Assembly 2025

About ARGAN

ARGAN is the only French real

estate company specializing in the DEVELOPMENT & RENTAL OF

PREMIUM WAREHOUSES listed on EURONEXT and is the leading player of

its market. Building on a unique client-tenant-centric approach,

ARGAN builds pre-let PREMIUM warehouses for

blue-chip clients and supports them throughout all project phases

from the development milestones to the rental management.

Profitability, tight control over our debt and sustainability are

at the heart of ARGAN’s DNA. Its strongly

proactive ESG policy has very concrete results with our Aut0nom®

concept, the “in-use” Net Zero warehouse.

As at June 30, 2024, our portfolio represented 3.6 million sq.m,

across about a hundred warehouses, exclusively located in the

continental part of France, and this portfolio was valued €3.8

billion for a yearly rental income of about €200

million.

ARGAN is a listed real estate investment company

(French SIIC), on Compartment A of Euronext Paris (ISIN

FR0010481960 - ARG) and is included in the Euronext SBF 120, CAC

All-Share, EPRA Europe and IEIF SIIC France indices.

www.argan.fr

Francis Albertinelli – CFO

Aymar de Germay – General Secretary

Samy Bensaid – Head of Investor Relations

Phone: +33 1 47 47 47 40

E-mail: contact@argan.fr

www.argan.fr |

Marlène Brisset – Media relations

Phone: +33 6 59 42 29 35

E-mail: argan@citigatedewerogerson.com

|

|

|

1 Press release dated April 24, 2024 for more information: based

on the assumption of a capitalisation rate (excluding duties) of

5.25%.

2 Based on the assumption of a capitalisation rate (excluding

duties) of 5.25%.

- 20241210 - Full speed towards debt reduction

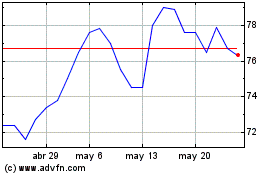

Argan (EU:ARG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Argan (EU:ARG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025