Canadian Dollar Climbs After BoC Decision

11 Diciembre 2024 - 7:08AM

RTTF2

The Canadian dollar strengthened against its major counterparts

in the New York session on Wednesday, as the Bank of Canada cut the

policy rate by 50 basis points and said that it will evaluate the

need for additional easing.

The central bank lowered its target for the overnight rate to

3.25 percent, with the bank rate at 3.50 percent and the deposit

rate at 3.25 percent.

The Canadian central bank said the decision to continue slashing

rates is intended to support growth and keep inflation close to the

middle of the 1-3 percent target range.

Noting that rates have been reduced substantially since June,

the BoC said the need for further rate cuts would be evaluated "one

decision at a time."

"Our decisions will be guided by incoming information and our

assessment of the implications for the inflation outlook," the BoC

said. "The Bank is committed to maintaining price stability for

Canadians by keeping inflation close to the 2% target."

In its statement, the BoC noted the possibility U.S.

President-elect Donald Trump's incoming administration will impose

new tariffs on Canadian exports to the U.S. has increased

uncertainty and clouded the economic outlook.

The loonie rose to a 6-day high of 1.4821 against the euro, more

than 4-month high of 0.8983 against the aussie and near a 2-week

high of 107.90 against the yen, off its early lows of 1.4947,

0.9048 and 106.48, respectively. The currency is likely to locate

resistance around 1.46 against the euro, 0.89 against the aussie

and 109.00 against the yen.

The loonie advanced to a 2-day high of 1.4119 against the

greenback, from an early 4-1/2-year low of 1.4198. If the currency

rises further, it is likely to test resistance around the 1.38

region.

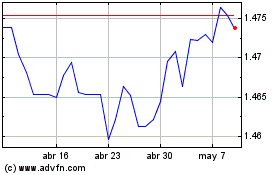

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Nov 2024 a Dic 2024

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Dic 2023 a Dic 2024