Eurozone Private Sector Recovery Gains Strength On New Orders

23 Mayo 2024 - 4:10AM

RTTF2

The euro area private sector activity grew at the fastest pace

in a year in May on bigger increases in new orders, employment and

an improvement in business confidence, flash survey data from

S&P Global showed on Thursday.

The flash composite output index posted 52.3 in May, up from

51.7 in the previous month. The score was also above economists'

forecast of 52.0.

The score suggested that the activity growth accelerated for the

second straight month to post the fastest expansion in a year. The

overall expansion was driven by the service sector but the pace of

growth was unchanged since April.

The services Purchasing Managers' Index held steady at 53.3 in

May but was below the expected reading of 53.6.

Although the manufacturing activity remained in the negative

territory for 14th straight month, the PMI rose to a 15-month high

of 47.4 from 45.7 in the previous month. The score was seen at

46.2.

Overall new order growth strengthened in May on solid expansion

in the service sector, where the increase reached a 13-month high.

Meanwhile, manufacturing new business continued to fall. In

response to new order growth, employment increased at the most

marked pace since last June. In line with the output and new orders

conditions, the rise in staffing was centered on the services

sector. Firms continued to scale back their purchasing activity.

Stocks of both purchases and finished goods were reduced and

suppliers' delivery times continued to shorten. On the price front,

the survey showed that both input and output price inflation eased

in May, but each case remained above the pre-pandemic average.

Companies were more optimistic about the future business

activity with confidence hitting the highest since February

2022.

Considering the PMI numbers, the Eurozone will probably grow at

a rate of 0.3 percent during the second quarter, putting aside the

specter of recession, said Hamburg Commercial Bank Chief Economist

Cyrus de la Rubia.

Among big two economies of the currency bloc, Germany's private

sector grew the most in a year, while France slid into the

contraction zone.

Germany's private sector expanded at the fastest pace in a year

in May on strengthening services activity. The flash HCOB composite

output index rose more-than-expected to 52.2 in May from 50.6 in

April. The expected score was 51.0.

Growth continued to be driven by the service sector. Moreover,

the drag from the manufacturing sector eased notably mid-way

through the second quarter, the survey showed.

The services PMI registered an 11-month high of 53.9, rising

from 53.2 in April, and stayed above economists' forecast of

53.5.

At the same time, the manufacturing PMI advanced to 45.4 from

42.5 in the prior month. The reading was seen at 43.4.

France's private sector unexpectedly contracted in May after

returning to growth in the previous month. The headline HCOB flash

composite output index dropped to 49.1 in May from 50.5 in April.

The reading was forecast to climb to 51.0.

The services PMI posted 49.4 in May, down from 51.3 in April and

economists' forecast of 51.8.

Meanwhile, the manufacturing PMI rose to a three-month high of

46.7 from 45.3 in the previous month. The reading was also above

forecast of 45.8.

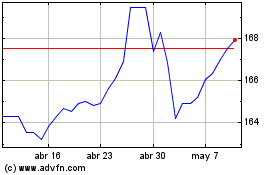

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De May 2024 a Jun 2024

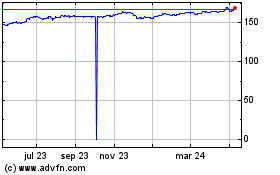

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De Jun 2023 a Jun 2024