U.S. Dollar Advances After Strong Economic Data

19 Diciembre 2024 - 8:38AM

RTTF2

The U.S. dollar rose against its major counterparts in the New

York session on Thursday, as better-than-expected economic data

suggested that economy is on solid footing.

Data from the Commerce Department showed that the pace of U.S.

economic growth unexpectedly surged more than previously estimated

in the third quarter.

The report said gross domestic product shot up by 3.1 percent in

the third quarter, reflecting an upward revision from the 2.8

percent jump previously reported. Economists had expected the pace

of growth to be unrevised.

Data from the Labor Department showed that first-time claims for

U.S. unemployment benefits pulled back by more than expected in the

week ended December 14th.

The Labor Department said initial jobless claims fell to

220,000, a decrease of 22,000 from the previous week's unrevised

level of 242,000. Economists had expected jobless claims to dip to

230,000.

The greenback climbed to more than a 3-week high of 1.2508

against the pound and a 5-month high of 157.80 against the yen, off

its early lows of 1.2666 and 154.42, respectively. The next

possible resistance for the currency is seen around 1.24 against

the pound and 161.00 against the yen.

The greenback recovered to 1.0354 against the euro. The currency

is poised to challenge resistance around the 1.02 level.

The greenback rose back to 0.8996 against the franc. This may be

compared to an early 5-1/2-month high of 0.9022. Immediate

resistance for the currency is seen around the 0.92 level.

In contrast, the greenback eased to 1.4344 against the loonie,

0.6265 against the aussie and 0.5662 against the kiwi, from an

early 4-1/2-year high of 1.4467 and more than 2-year highs of

0.6198 and 0.5608, respectively. The next possible support for the

greenback is seen around 1.36 against the loonie, 0.64 against the

aussie and 0.60 against the kiwi.

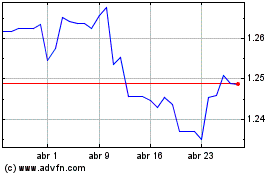

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Nov 2024 a Dic 2024

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Dic 2023 a Dic 2024