Yen Slides As BOJ Delays Bond Purchase Reduction

13 Junio 2024 - 9:59PM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Friday, after the Bank of Japan announced its

interest rate to remain steady and announced plans to reduce bond

buying in the future.

At the June meeting, the BoJ policymakers decided to unveil a

detailed plan for reducing its bond purchase programme at its

upcoming meeting in July.

The policy board governed by Ueda Kazuo, decided to conduct

purchases of Japanese government bonds, CP, and corporate bonds in

accordance with the decision made at the March meeting but voted

8-1 to cut its purchases thereafter to ensure that long-term

interest rates would be formed more freely in financial

markets.

Markets widely expected the bank to scale back its bond purchase

programme at the current June meeting.

The board today unanimously decided to maintain the

uncollateralized overnight call rate to remain at around 0 to 0.1

percent.

In the Asian trading today, the yen declined to a record low of

176.69 against the Swiss franc, a 16-year low of 201.46 against the

pound and a 16-year low of 201.46 against the U.S. dollar, from

yesterday's closing quotes of 174.90, 200.39 and 157.13,

respectively. If the yen extends its downtrend, it is likely to

find support around 178.00 against the franc, 202.00 against the

pound and 160.00 against the greenback.

Against the euro and the NZ dollar, the yen edged down to 169.65

and 97.21 from Thursday's closing value of 168.71 and 96.79,

respectively. The yen may test support near 172.00 against the euro

and 99.00 against the kiwi.

Against the Australia and the Canadian dollars, the yen slid to

near 2-week lows of 104.77 and 115.00 from yesterday's closing

quotes of 104.19 and 114.32, respectively. On the downside, 106.00

against the aussie and 117.00 against the loonie are seen as the

next support level for the yen.

Looking ahead, Eurozone foreign trade data for April is due to

be released at 5:00 am ET in the European session.

In the New York session, Canada manufacturing sales and

wholesale sales data for April, U.S. export and import prices for

May, U.S. University of Michigan's preliminary consumer sentiment

index for June and U.S. Baker Hughes oil rig count data are slated

for release.

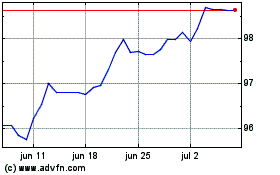

NZD vs Yen (FX:NZDJPY)

Gráfica de Divisa

De May 2024 a Jun 2024

NZD vs Yen (FX:NZDJPY)

Gráfica de Divisa

De Jun 2023 a Jun 2024