U.S. Dollar Rises As Traders Focus Of U.S. Fed Rate Decision

29 Enero 2025 - 12:00AM

RTTF2

The U.S. dollar strengthened against other major currencies in

the European session on Wednesday, as traders await the U.S. Fed's

interest rate decision later in the day.

The Fed is widely expected to leave interest rates unchanged,

but traders will pay watch for the accompanying statement for clues

about the outlook for rates.

Recent economic data has led to concerns about the Fed leaving

rates on hold for a prolonged period, but many economists still

expect the central bank to resume cutting rates sometime in the

first half of the year.

CME Group's FedWatch Tool is currently indicating a 74.5 percent

chance rates will be lower by at least a quarter point following

the Fed's June meeting.

Traders also focus their attention on the Fed Chair Jerome

Powell's press conference for any hints regarding the future

direction of monetary policy.

The European Central Bank is scheduled to announce its policy on

Thursday. The ECB is expected to announce a 25-basis point rate

cut.

In the European trading today, the U.S. dollar rose to a 6-day

high of 1.0395 against the euro and a 5-day high of 1.2412 against

the pound, from early lows of 1.0444 and 1.2464, respectively. If

the greenback extends its uptrend, it is likely to find resistance

around 1.01 against the euro and 1.22 against the pound.

Against the yen and the Swiss franc, the greenback edged up to

155.45 and 0.9068 from early lows of 155.00 and 0.9032,

respectively. On the upside, 159.00 against the yen and 0.92

against the franc are seen as the next resistance levels for the

greenback.

Against Australia, the New Zealand and the Canadian dollars, the

greenback advanced to 8-day highs of 0.6223, 0.5644 and 1.4434 from

early lows of 0.6256, 0.5669 and 1.4392, respectively. The

greenback is likely to find resistance around 0.61 against the

aussie, 0.55 against the kiwi and 1.46 against the loonie.

Looking ahead, U.S. mortgage approvals data, goods trade balance

for December, retail and wholesale inventories data for December

and U.S. EIA crude oil data are slated for release in the New York

session.

At 9:45 am ET, the Bank of Canada will announce its interest

rate decision at the monetary policy meeting. The bank is expected

to slash the policy rate 25bps to 3.00%.

After 45 minutes, the Bank of Canada Governor Tiff Macklem will

speak at a press conference.

At 2:00 pm ET, the U.S. Federal Reserve is set to announce its

first monetary policy decision of 2025. The Fed expect the federal

funds rate to remain unchanged in the 4.25%-4.50% range.

Half-an-hour later, the U.S. Fed Chair Jerome Powell will speak

at a press conference on future rate cuts and the Fed's economic

outlook.

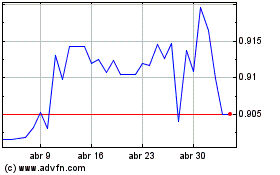

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Dic 2024 a Ene 2025

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Ene 2024 a Ene 2025