TIDMAUTG

RNS Number : 9521D

Autins Group PLC

27 June 2023

27 June 2023

Autins Group plc

("Autins" the "Company" or the "Group")

Interim Results

Autins Group plc (AIM: AUTG), the UK and European based

manufacturer of the patented Neptune melt-blown material and

specialist in the design, manufacture, and supply of acoustic and

thermal insulation solutions, announces its results for the six

months ended 31 March 2023.

Financial Summary

-- Revenue increased by 15.4% to GBP10.84m (H1 22: GBP9.39m)

-- Gross profit increased by 30.2% to GBP3.06m (H1 22: GBP2.35m)

-- Gross margins increased by 3.1%pts to 28.2% (H1 22: 25.1%)

-- EBITDA(1) was a profit of GBP0.34m (H1 22: GBP0.35m loss)

-- Loss after tax of GBP0.90m (H1 22: loss of GBP1.38m)

-- Loss per share of 1.65p (H1 22: loss of 2.83p)

-- Operating cashflow was a GBP0.36m net inflow (H1 22: GBP0.36m net outflow)

-- Net debt(2) excluding IFRS16 lease liabilities increased to GBP2.42m (H1 22: GBP1.03m)

-- Cash and cash equivalents were GBP1.27m at the period end (H1 22 GBP2.78m)

-- Group c ash headroom(3) was GBP3.50m (H1 22: GBP5.15m)

1: EBITDA is stated on an IFRS 16 basis.

2. Net debt is cash less bank overdrafts, loans, invoice

discounting, hire purchase finance and excludes right of use lease

liabilities .

3. Sum of net cash at bank and residual invoice financing

capacity.

Operational Highlights

-- Significant financial benefits from price, material and cost

improvements, adjustments to commercial contracts, and

restructuring actions.

-- The supply chain to the UK automotive market is more stable,

although s ales volumes were c.5% lower than the prior year.

-- Automotive sales in Germany are up 65% year on year including 2022 EV platform wins.

-- Flooring product sales were down 26% to GBP1.3m due to a

slowdown in European construction activity.

-- Neptune retail sales continue to increase and are up 34% on H1 22 to GBP4.4m.

-- Gross profit increased primarily as a result of price,

material and improved labour productivity which more than offset

input cost pressures, leading to higher Group gross margins.

-- Overheads were largely consistent year on year, despite

Germany adding a stock storage facility to assist growth.

-- EBITDA improved by GBP0.7m, which was mirrored by an

equivalent improvement in operating cashflow year on year.

Gareth Kaminski-Cook, Chief Executive, said:

"I am pleased to report that we have seen a significant

improvement in margins and a return to EBITDA profitability, during

the first half of 2023.

We have worked closely with our customers over the past 18

months to recover the impact of increased input costs. Changes to

our commercial contracts in all regions during the first six months

of the year are now flowing to the bottom line. On top of this,

actions taken in the period on headcount reductions, improved

operational efficiencies and smarter material sourcing are all

positively impacting performance. Whilst H2 2023 will see the full

benefits of these actions they will be partially offset by recent

workforce salary increases.

We were delighted to see our German automotive sales grow by 65%

as project wins, primarily with Neptune for EVs, began production.

The flooring market however has suffered as European construction

activity weakened against a tougher economic background.

Whilst margins have improved, it is clear that the business now

needs more volume. Although the automotive supply chains have

stabilised somewhat, market recovery is expected to remain modest

into the medium term. This is partly due to the economic backdrop,

but also because of the limited number of new vehicle models being

launched by our major customers at this time. The focus within the

management team will continue to be on winning new business and

managing costs and margins."

For further information please contact:

Autins Group plc

Gareth Kaminski-Cook, Chief Executive Via SEC Newgate

Kamran Munir, CFO

Singer Capital Markets Tel: 020 7496 3000

(Nominated Adviser and Broker)

James Moat / Asha Chotai

SEC Newgate Tel: 020 7653 9850

(Financial PR)

Bob Huxford

Molly Gretton

About Autins

Autins is a UK and continental Europe based industrial materials

technology business that specialises in the design, manufacture,

and supply of acoustic and thermal products. Its key markets are

automotive, flooring, and commercial vehicles where it supplies

products and services to more than 160 customer locations across

Europe.

Autins is the UK and European manufacturer of the patented

Neptune melt-blown material and specialises in the design,

manufacture, and supply of acoustic and thermal insulation

solutions.

Overview

Group revenue in the period increased by GBP1.45m to GBP10.84m

(H1 22: GBP9.39m), which, combined with other actions, led to an

EBITDA improvement of GBP0.69m to GBP0.34m (H1 22: EBITDA loss of

GBP0.35m).

Revenue in our automotive division improved in all three regions

as supply chains appeared to stabilise, albeit UK automotive

volumes reduced slightly. Germany benefited from new project

starts, whilst the flooring business was negatively impacted by

slower European construction activity.

Protracted efforts with all our customers to recover the

increased input costs of the previous 12 months finally bore fruit

with adjustments to almost all customer contractual arrangements.

The business also undertook further restructuring actions and

improved resourcing for key materials which cumulatively have

contributed to improve the gross margin by 3.1%pts to 28.2% since

the end of the last financial year.

Revenue

Revenue across the Group increased by 15.4% to GBP10.84m (H1 22:

GBP9.39m) driven primarily by price and contract improvements and

automotive recovery in Germany. Excluding some new contract wins,

sales volumes declined from our key automotive customers in the UK

and German flooring customers.

Sales through the European operations made up 40% of Group

turnover, slightly up from H1 2022 at 37%, on the back of stronger

performance in Germany.

Group automotive sales increased by 25% to GBP9.5m (H1 2022:

GBP7.6m), driven primarily by price increases and strong growth in

Germany.

Automotive revenue in the UK increased by 11% to GBP6.5m (H1

2022: GBP5.9m), with component revenue increasing by 11% and

tooling remaining consistently low, as the OEMs continue to release

very few new projects.

German automotive sales benefited from the start of new projects

that were won in the previous years and more than compensated for

the lower flooring sales that reflect the weak European

construction market. As a result, German sales increased 25% to

GBP3.7m (H1 22: GBP3.0m), with automotive sales up by 85% to

GBP2.4m (H1 22: GBP1.3m), and flooring sales declining by 22% to

GBP 1.3m (H1 22: GBP1.7m). Sweden automotive sales increased by 20%

to GBP0.6m (H1 22: GBP0.5m).

Non-automotive sales were lower by 24% in H1 23at GBP1.4m (H1

22: GBP1.8m), driven by the drop in flooring demand described

above. As a result, non-automotive sales now account for 13% of

Group turnover, down from 19% in H1 22.

Sales concentration of our largest customer was 32.9% in H1 23,

reducing from 38.3% last year, driven primarily by new projects in

Germany. In the short to medium term, management would expect this

concentration will revert back towards c.50% as UK automotive sales

recover. Over the longer term, the sales concentration is expected

to reduce as we develop demand from a larger customer base.

Gross margin

The collective actions taken to secure customer price increases,

improve operational efficiencies and lower material purchasing

costs have improved margins progressively since the end of the last

financial year. Within this, labour productivity and restructuring

actions have also added significantly to gross margin improvement.

These actions have largely offset the significant input cost

challenges from the previous year and restored margins.

We are now in a situation where the largest impact on our gross

profit is the residual impact of low customer volumes flowing

through the business that reduce the absorption of fixed production

overhead costs.

EBITDA profit and operating loss

The reported H1 23 EBITDA profit of GBP0.34m improved by GBP0.7m

year over year, (H1 22: EBITDA loss of GBP0.35m) and the reported

operating loss was GBP0.65m (H1 22: loss of GBP1.1m). For both

years the EBITDA and operating loss do not include any exceptional

costs.

Joint venture

The Group's share of joint venture activities relates solely to

Indica Automotive, a UK based foam conversion business.

Turnover at Indica Automotive decreased marginally to GBP0.91m

(H1 22: GBP0.92m), with a loss after tax of GBP0.01m (H1 22: profit

of GBP0.01m). The Group remains the largest customer of the joint

venture, and the ratio of sales to the Group as a percentage of

total sales has reduced from 73% to 52%.

Net finance expense

Net Finance expense for the period was consistent at GBP0.25m

(H1 22: GBP0.26m) including IFRS 16 charges of GBP0.13m (H1 22

GBP0.14m). The interest element of hire purchase agreements is

GBP0.01m (H1 22: GBP0.01m) with interest charged on bank borrowings

of GBP0.11m (H1 22: GBP0.12m).

Taxation

Given the continuing economic conditions, none of the losses

carried forward are recognised in deferred tax balances, consistent

with the judgement made in September 2022. A tax credit of GBP0.01m

(H1 22: GBP0.01m) has been recognised.

Dividends

The Board continues to believe that a suspension in dividend

payments remains appropriate. As such, no interim dividend is

proposed.

Net debt and financing

The Group ended the period with net debt (being the net of cash

and cash equivalents and the Group's loans and borrowings,

excluding right of use lease liabilities) of GBP2.42m (H1 22

GBP1.03m). Including GBP5.04m (H1 22 GBP5.25m) arising from IFRS 16

lease liabilities, the Group's net debt would be GBP7.46m (H1 22

GBP6.28m). Net debt has increased as a result of trading outflows.

Cash and cash equivalents at the period end were GBP1.3m (H1 22:

GBP2.8m).

In January 2023, the Company secured a further deferment of UK

loan repayments until July 2023 from its primary lender and until

the end of March 2024 from its secondary lender. At 31 March 2023,

the Group's UK HSBC facilities provided up to GBP3.5m (H1 22:

GBP3.5m) of invoice financing facility (subject to available

accounts receivable balances). In addition, GBP0.5m (H1 22:

GBP0.5m) of asset finance facilities are available, subject to

covenant compliance. At the end of the period, none of the invoice

financing facility had been utilised (H1 22: GBPnil) with GBP0.1m

used from the asset finance facility (H1 2022: GBP0.4m). Group c

ash headroom, being the sum of net cash at bank and residual

invoice financing capacity, was GBP3.5m (H1 22 GBP5.1m). Currently,

the HSBC term loan will re-commence quarterly payments of GBP146k

in July 2023.

Capital expenditure

The Group invested GBP0.1m (H1 22: GBP0.1m) in its operating

facilities during the period. The Group will commission new

equipment in Germany during H2 with a value of c.GBP300k, which

will replace old equipment and improve efficiency and capacity to

meet growing demand.

Employees

In the UK, we have continued to focus on maximising employee

engagement and retention. We continue to maintain a high visibility

of senior management with staff through a combination of regular

weekly cross functional planning meetings coupled with informal

feedback "coffee" sessions. The banked hours scheme continues to be

successful by providing surety of workers' income whilst customer

demand patterns continue to be variable. We have continued to

convert the majority of temporary staff positions to permanent

roles to aid core team strength. Production pay rates have been

increased by more than 8% and continue to exceed the national

living wage. Overtime rates continue with strong premiums to

improve net take home pay, with pay bandings related to

multi-skilling and personal performance also being improved. Staff

retention, excluding redundancies, has been in excess of 93% during

the period.

Teamwork has improved over the last 18 months positively

impacting productivity, quality, customer service and the net cost

in the factories. This has been critically important during a

period where availability of labour continues to be a key challenge

for manufacturers, and it is pleasing to see that some former

colleagues have chosen to return to Autins. Latterly we have

introduced a bonus scheme for all UK operators to recognise when

teams or individuals have directly and positively impacted

margins.

The German and Swedish businesses both have very strong team

cultures which benefit from strong leadership and stable, highly

committed people.

Board

In May 2023, we announced that Andrew Burn had joined the Board

as a Non-Executive Director.

Neil MacDonald will resign from the Board of Directors at the

end of June 2023. We would like to thank him for his excellent

service and wish him well for the future.

Going Concern

In approving these Interim Financial Statements, the Board has

considered current trading, profit and cash flow forecasts and

assessed existing borrowings and available sources of finance.

At the time of releasing our full year financial statements,

forward looking profit, and cash flow projections for FY23, and

FY24 were prepared and considered. As reported in January, our

major UK lenders extended covenant waivers until the end of March

2024 and capital payment deferments were extended until July 2023

with our primary lender, and until at least April 2024 with our

secondary lender.

Financial forecasts and related sensitivities, compared with the

prevailing key customer demand schedules and forecasts, were

assessed in detail in January 2023. These assessments were

documented in detail in our FY22 audited financial statements.

UK sales volumes in H1 23 remained marginally below these

forecasts, although EBITDA and cash performance remained above the

targets presented to the UK lenders. The Board has assumed a slight

improvement in revenues for H2 23, with further improvement and new

wins expected in FY24. However, there remains uncertainty on the

exact timing and sales improvement for the automotive market

against the current backdrop of global supply chain considerations

and continuously evolving vehicle platforms for which the technical

specifications and likely production quantities are still to be

reliably communicated.

Actions taken to protect gross margins against increases in

energy, materials, and labour costs have been successful in

restoring gross margins.

The Company will continue further covenant compliance and

capital repayment review discussions with its two major lenders

over the coming months for the period beyond March 2024. Reaching

an appropriate outcome is required to ensure covenant compliance

prevails beyond March 2024, albeit expected trading and existing

facilities should allow loans to be serviceable for at least the

next 12 month period. As at 20 June 2023, the last practicable date

prior reporting date, the Group's liquidity cash headroom was in

excess of GBP3.5m.

Having due regard to all the matters described above, the Board

have a reasonable expectation that the Group will continue to have

adequate resources to remain in operation for at least 12 months

after the release of these financial statements. The Board has

therefore determined to adopt the going concern basis in preparing

these financial statements.

Outlook

The price increases and cost reductions secured during H1 23

were critical to protecting our financial position and improving

our profitability, whilst we strive to bring additional volume

across our asset base. We will continue this focus in H2 23.

The outlook for the automotive sector is improving but we expect

our growth to be modest in the short term. In particular, our

ability to increase volumes in the UK will be affected by the

limited release of new vehicle models by key OEMs, coupled with few

opportunities to switch existing product programmes away from

incumbent suppliers.

The construction and building market activity is currently

depressed due to weak global economies, but we would expect our

flooring sales to recover once economic confidence rises across

Europe.

Customers are requesting more environmentally friendly solutions

and we have responded by expanding the proportion of our product

offering that is either fully recyclable or made of recycled

material. We have developed Neptune Green and Neptune-R, and also

launched a trademarked encapsulation product SilentShell,

specifically targeting NVH problems in electric vehicles. Feedback

has been positive from our major customers, and this will form the

backbone of our value proposition for future vehicles.

The focus of the management team will continue to be on winning

new business and further improving costs and margins .

Interim Consolidated Income Statement

Unaudited Unaudited Audited

Period Period Year Ended

1/10/22-31/3/23 1/10/21-31/3/22 30/09/22

Notes GBP'000 GBP'000 GBP'000

Revenue 2 10,843 9,392 18,873

Cost of sales (7,780) (7,039) (14,638)

Gross profit 3,063 2,353 4,235

Other operating income - 21 28

Distribution and administrative

expenses (3,711) (3,504) (7,247)

Operating loss (648) (1,130) (2,984)

Finance expense (253) (263) (542)

Share of post-tax (loss)/profit

of equity accounted

joint ventures (6) 4 (26)

Loss before tax (907) (1,389) (3,552)

Tax credit 8 8 277

Loss after tax for the period (899) (1,381) (3,275)

Earnings per share for loss

attributable to the owners

of the parent during the period

Basic (pence) 3 (1.65)p (2.83)p (6.34)p

================ ================ =============

Diluted (pence) 3 (1.65)p (2.83)p (6.34)p

================ ================ =============

Interim Consolidated Statement of Comprehensive Income

Unaudited Unaudited Audited

Period Period Year Ended

1/10/22-31/3/23 1/10/21-31/3/22 30/09/22

GBP'000 GBP'000 GBP'000

Loss after tax for the period (899) (1,381) (3,275)

----------------- ----------------- ------------------------------------

Other comprehensive expense:

----------------- ----------------- ------------------------------------

Items that may be reclassified

subsequently to

----------------- ----------------- ------------------------------------

profit and loss:

----------------- ----------------- ------------------------------------

Currency translation differences (9) (17) (15)

----------------- ----------------- ------------------------------------

Other comprehensive expense

----------------- ----------------- ------------------------------------

for the period (9) (17) (15)

----------------- ----------------- ------------------------------------

Total comprehensive expense

----------------- ----------------- ------------------------------------

for the period (908) (1,398) (3,290)

----------------- ----------------- ------------------------------------

Interim Consolidated Statement of Financial Position

Unaudited Unaudited Audited

As at 31/3/23 As at 31/3/22 As at 30/9/22

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 8,477 9,390 8,949

Right-of-use assets 4,143 4,475 4,549

Intangible assets 2,937 2,991 2,987

Investments in equity-accounted

joint ventures 68 103 74

Deferred tax asset - 95 -

Total non-current assets 15,625 17,054 16,559

Current assets

Inventories 1,999 2,107 2,669

Trade and other receivables 4,624 3,954 3,433

Cash in hand and at bank 1,273 2,775 1,786

Total current assets 7,896 8,836 7,888

Total assets 23,521 25,890 24,447

Current liabilities

Trade and other payables 3,831 3,070 3,358

Loans and borrowings 848 384 860

Lease liabilities 785 830 825

Total current liabilities 5,464 4,284 5,043

Non-current liabilities

Trade and other payables 102 108 105

Loans and borrowings 2,847 3,417 2,907

Lease liabilities 4,259 4,415 4,627

Deferred tax liability 22 39 30

Total non-current liabilities 7,230 7,979 7,669

Total liabilities 12,694 12,263 12,712

Net assets 10,827 13,627 11,735

Equity attributable to equity

holders of the

Company

Share capital 1,092 1,092 1,092

Share premium account 18,366 18,366 18,366

Other reserves 1,886 1,886 1,886

Currency differences reserve (149) (142) (140)

Accumulated losses (10,368) (7,575) (9,469)

Total equity 10,827 13,627 11,735

Interim Consolidated Statement of Changes in Equity

Unaudited

Currency

Share premium Other differences Retained Total

Share capital account reserves reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October 2022 1,092 18,366 1,886 (140) (9,469) 11,735

Comprehensive expense for

the period

Loss for the period - - - - (899) (899)

Other comprehensive expense - - - (9) - (9)

Total comprehensive expense

for the period - - - (9) (899) (908)

At 31 March 2023 1,092 18,366 1,886 (149) (10,368) 10,827

Profit

Currency and loss

Share premium Other differences account Total

Share capital account reserves reserve (adjusted) equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October 2021 792 15,866 1,886 (125) (6,194) 12,225

Comprehensive expense for

the period

Loss for the period - - - - (1,381) (1,381)

Other comprehensive expense - - - (17) - (17)

Total comprehensive expense

for the period - - - (17) (1,381) (1,398)

Contributions by and distributions

to

owners

Shares issued in the period

(note 4) 300 2,700 - - - 3,000

Share issue expenses (note

4) - (200) - - - (200)

Total contributions by and

distributions to

owners 300 2,500 - - - 2,800

At 31 March 2022 1,092 18,366 1,886 (142) (7,575) 14,169

The balance sheet has been adjusted at 1 October 2021 and at 31 March 2022,

increasing accumulated losses and trade payables by GBP542,000, to reflect the

prior year adjustment reported in the 30 September 2022 financial statements.

Currency

Share premium Other differences Retained Total

Share capital account reserves reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October 2021 792 15,866 1,886 (125) (6,194) 12,225

Comprehensive expense for

the year

Loss for the year - - - - (3,275) (3,275)

Other comprehensive income - - - (15) - (15)

Total comprehensive expense

for the year - - - (15) (3,275) (3,290)

------------- ------------- --------- ------------ --------- --------

Contributions by and distributions

to

owners

Shares issued in the period

(note 4) 300 2,700 - - - 3,000

Share issue expenses (note

4) - (200) - - - (200)

Total contributions by and

distributions to

owners 300 2,500 - - - 2,800

At 30 September 2022 1,092 18,366 1,886 (140) (9,469) 11,735

Interim Consolidated Statement of Cash Flows

Unaudited Unaudited Audited

Period Period Year ended

1/10/22-31/3/23 1/10/21-31/3/22 30/09/22

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Loss after tax (899) (1,381) (3,275)

Adjustments for:

Income tax (8) (8) (277)

Finance expense 253 263 542

Depreciation of property, plant

and equipment 543 340 884

Depreciation of right-of-use

assets 384 377 831

Amortisation of intangible assets 81 81 163

Share of post-tax loss/(profit)

of equity accounted

joint ventures 6 (4) 26

360 (332) (1,106)

(Increase)/decrease in trade

and other receivables (1,250) (360) 261

Decrease/(increase) in inventories 670 326 (236)

Increase/(decrease) in trade

and other payables 518 (32) 255

Cash flows from operations 298 (398) (826)

Income taxes received 59 37 291

Net cash flows from/(used in)

operating activities 357 (361) (535)

Investing activities

Purchase of property, plant

and equipment (82) (123) (219)

Purchase of intangible assets (75) (30) (112)

Dividend received from equity

accounted

joint venture - 20 20

Net cash used in investing

activities (157) (133) (311)

Financing activities

Interest paid (245) (255) (527)

Proceeds from issue of shares - 3,000 3,000

Share issue expenses paid - (200) (200)

Loan issue costs paid - - (3)

Repayment of loans (17) (100) (108)

Repayment of hire purchase liabilities (61) (44) (87)

Payment of lease liabilities (385) (366) (688)

Net cash flows (used in)/from

financing activities (708) 2,035 1,387

Net (decrease)/increase in cash

and cash equivalents (508) 1,541 541

Cash and cash equivalents at

beginning

of period 1,786 1,238 1,238

Exchange losses on cash and

cash equivalents (5) (4) 7

Cash and cash equivalents at

end of period (all cash balances) 1,273 2,775 1,786

Notes to the Interim Consolidated Financial Information

1. Accounting policies

Description of business

Autins Group plc is a public limited company domiciled in the

United Kingdom and quoted on AIM, a market operated by the London

Stock Exchange. The principal activity of the Group is the design,

manufacture, and supply of acoustic and thermal insulation

solutions. The address of the registered office is Central Point

One, Central Park Drive, Rugby, Warwickshire, CV23 0WE.

Basis of preparation

In preparing these interim financial statements, the Board have

considered the impact of any new standards or interpretations which

will become applicable for the FY23 Annual Report and Accounts

which deal with the year ending 30 September 2023 and there are not

expected to be any changes in the Group's accounting policies

compared to those applied at 30 September 2022.

A full description of those accounting policies are contained

within our FY22 Annual Report and Accounts which are available on

our website ( Autins FY22 ARA ).

This interim announcement has been prepared in accordance with

the recognition and measurement requirements of International

Financial Reporting Standards issued by the International

Accounting Standards Board, as adopted by the United Kingdom as

effective for periods beginning on or after 1 January 2022.

New accounting standards applicable to future periods

There are no new standards, interpretations and amendments which

are not yet effective in these financial statements, expected to

have a material effect on the Group's future financial

statements.

This unaudited consolidated interim financial information has

been prepared in accordance with IFRS as adopted by the United

Kingdom. The principal accounting policies used in preparing the

interim results are those the Group expects to apply in its

financial statements for the year ending 30 September 2023.

The financial information does not contain all of the

information that is required to be disclosed in a full set of IFRS

financial statements. The financial information for the six months

ended 31 March 2023 and 31 March 2022 is unreviewed and unaudited

and does not constitute the Group's statutory financial statements

for those periods.

The comparative financial information for the full year ended 30

September 2022 has, however, been derived from the audited

statutory financial statements for that period. A copy of those

statutory financial statements has been delivered to the Registrar

of Companies. The auditor's report on those accounts was

unqualified, did not include references to any matters to which the

auditor drew attention by way of emphasis without qualifying its

report and did not contain a statement under section 498(2)-(3) of

the Companies Act 2006.

The financial information in the Interim Report is presented in

Sterling, the Group's presentational currency.

Basis of consolidation

The consolidated financial statements present the results of the

Company and its subsidiaries (the "Group") as if they formed a

single entity. Intercompany transactions and balances between group

companies are therefore eliminated in full.

Subsidiaries are all entities over which the Group has control.

The Group controls an entity when it is exposed to, or has rights

to, variable returns from its involvement with the entity and has

the ability to affect those returns through its power over the

entity. Subsidiaries are fully consolidated from the date on which

control is transferred to the Group and cease to be consolidated

from the date on which control is transferred out of the Group.

The consolidated financial statements incorporate the results of

business combinations using the acquisition method. In the

statement of financial position, the acquiree's identifiable

assets, liabilities and contingent liabilities are initially

recognised at their fair values at the acquisition date.

Operating segments

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker.

The chief operating decision maker has been identified as the

management team including the Chief Executive, Chief Financial

Officer and Chairman.

The Board considers that the Group's activity constitutes one

primary operating and one separable reporting segment as defined

under IFRS 8. Management consider the reportable segment to be

Automotive NVH. Revenue and profit before tax primarily arises from

the principal activity based in the UK. All material assets are

based in the UK. Management reviews the performance of the Group by

reference to total results against budget.

The total profit measure is operating (loss)/profit as disclosed

on the face of the consolidated income statement. No differences

exist between the basis of preparation of the performance measures

used by management and the figures in the Group financial

information

2 Revenue

Unaudited Unaudited Audited

Period Period Year ended

1/10/22-31/3/23 1/10/21-31/3/22 30/09/22

GBP'000 GBP'000 GBP'000

Revenue arises from:

Component sales 10,791 9,283 18,577

Sales of tooling 52 109 296

10,843 9,392 18,873

Segmental information

The Group currently has one main reportable segment in each

year/period, namely Automotive NVH which involves provision of

insulation materials to reduce noise, vibration and harshness to

automotive manufacturing. Turnover and Operating Profit are

disclosed for other segments in aggregate as they individually have

not had a significant impact on the Group result. In H1 FY23 and in

FY22 with a continuing subdued automotive market, a majority of the

other revenue arises from acoustic flooring sales.

Measurement of operating segment profit or loss, assets and

liabilities

The accounting policies of the operating segments are the same

as those applied by the Group in the FY22 annual report and

accounts.

The Group evaluates performance on the basis of operating

(loss)/profit.

1/10/22-31/3/23

Automotive Others Total

NVH GBP'000 GBP'000

GBP'000

Group's revenue per Consolidated

Statement of Comprehensive

Income 9,468 1,375 10,843

Depreciation of property,

plant and equipment 543 - 543

Depreciation of right-of-use

assets 384 - 384

Amortisation 81 - 81

Segment operating loss (626) (22) (648)

Finance expense (253)

Share of post tax loss of

equity accounted

joint venture (6)

Group loss before tax (907)

As at 31/3/23

Automotive Others Total

NVH GBP'000 GBP'000

GBP'000

Additions to non-current

assets 157 - 157

Reportable segment assets 23,453 - 23,453

Investment in joint ventures 68 - 68

Total Group assets 23,521 - 23,521

Reportable segment liabilities/

total Group liabilities 12,694 - 12,694

Segmental information (continued)

1/10/21-31/3/22

Automotive Others Total

NVH GBP'000 GBP'000

GBP'000

Group's revenue per Consolidated

Statement of Comprehensive

Income 7,577 1,815 9,392

Depreciation of property,

plant and equipment 340 - 340

Depreciation of right-of-use

assets 377 - 377

Amortisation 81 - 81

Segment operating (loss)/profit (1,214) 84 (1,130)

Finance expense (263)

Share of post tax profit

of equity accounted

joint venture 4

Group loss before tax (1,389)

As at 31/3/22

Automotive Others Total

NVH GBP'000 GBP'000

GBP'000

Additions to non-current

assets 153 - 153

Reportable segment assets 25,787 - 25,787

Investment in joint ventures 103 - 103

Total Group assets 25,890 - 25,890

Reportable segment liabilities/

total Group liabilities 12,263 - 12,263

Segmental information (continued)

Automotive Year Ended

NVH Others 30/9/22 Total

GBP'000 GBP'000 GBP'000

Group's revenue per Consolidated

Statement of Comprehensive

Income 15,271 3,602 18,873

Depreciation of property,

plant and equipment 884 - 884

Depreciation of right-of-use

assets 831 - 831

Amortisation 163 - 163

Segment operating(loss)/profit (2,968) (16) (2,984)

Finance expense (542)

Share of post-tax loss of

equity accounted

joint venture (26)

Group loss before tax (3,552)

Automotive As at 30/9/22

NVH Others Total

GBP'000 GBP'000 GBP'000

Additions to non-current

assets 1,036 - 1,036

Reportable Segment assets 24,373 - 24,373

Investment in joint venture 74 - 74

Total Group assets 24,447 - 24,447

Reportable segment liabilities/

Total Group liabilities 12,712 - 12,712

Reporting of external revenue by location of customers is as

follows:

Unaudited Unaudited Audited

Period Period Year ended

1/10/22-31/3/23 1/10/21-31/3/22 30/09/22

GBP'000 GBP'000 GBP'000

United Kingdom 6,170 5,531 10,570

Germany 3,252 2,764 5,917

Sweden 366 311 645

Other European 1,050 771 1,706

Rest of the World 5 15 35

10,843 9,392 18,873

3 Earnings per share

Unaudited Unaudited Audited

Period Period Year Ended

1/10/22-31/3/23 1/10/21-31/3/22 30/09/22

GBP'000 GBP'000 GBP'000

Loss used in calculating

basic and

diluted earnings per share (899) (1,381) (3,275)

Weighted average number

of GBP0.02 shares

for the purpose of:

* basic earnings per share ('000) 54,601 48,832 51,683

* diluted earnings per share ('000) 54,601 48,832 51,683

Basic and diluted earnings

per share (pence) (1,65)p (2.83)p (6.34)p

Loss per share is calculated based on the share capital of

Autins Group plc and the earnings of the Group for all periods.

There are options in place over 2,523,648 ordinary shares at 31

March 2023 with vesting dependent on meeting a combination of

EBITDA and share price targets over the period to September 2023.

These options were anti-dilutive at the period end but may dilute

future earnings per share.

4 Share capital

In December 2021, 15,000,000 additional GBP0.02 ordinary shares

were issued at 20 pence each. Net proceeds of GBP2,800,000 arose

after incurring issue expenses of GBP200,000. This resulted in an

increase in the nominal value of share capital of GBP300,000 and an

increase of GBP2,500,000 in the share premium account net of the

issue expenses. The total number of ordinary shares in issue since

December 2022 is 54,600,984.

5 Taxation

The tax credit for the period reflects only the deferred tax

related to amortisation of intangible assets. Given the continuing

economic conditions, losses carried forward are not yet recognised

in deferred tax balances, consistent with the judgement made at 30

September 2022.

6 Interim Report

A copy of the Interim Report will be available on the Company's

website: www.autins.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UNANROUUNUAR

(END) Dow Jones Newswires

June 27, 2023 02:00 ET (06:00 GMT)

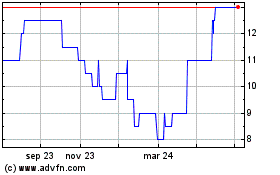

Autins (LSE:AUTG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Autins (LSE:AUTG)

Gráfica de Acción Histórica

De May 2023 a May 2024