TIDMBGEU

RNS Number : 7676T

Baillie Gifford European Growth Tst

17 November 2023

RNS Announcement

Baillie Gifford European Growth Trust plc

Legal Entity Identifier: 213800QNN9EHZ4SC1R12

Results for the year to 30 September 2023

Over the year to 30 September 2023, the Company's net asset

value per share (NAV) total return was 8.3% compared to a total

return of 20.5% for the comparative index. The share price total

return for the same period was 8.6%.

-- Positive contributors in the period included: Ryanair, which

continued to take market share from weaker airlines and invest in

new capacity; and online classified companies Adevinta and its

major shareholder Schibsted which showed that they can offset

temporarily weaker volumes with price increases.

-- Negative contributors in the period included: battery startup

Northvolt which was written down to reflect moves in public

benchmarks, though operational progress remains good; and payments

processing company Adyen which fell after announcing some market

share losses in the US.

-- Annual turnover was 9% and gearing stood at 15.6% of

shareholders' funds as at the year end.

-- The portfolio now contains five unlisted companies accounting

for 10.9% of total assets as at 30 September 2023 (2022: 11.0% in

four companies).

-- The net revenue for the year was 2.68p per share (2022:

0.79p). A special interim dividend of 2.20p was paid on 15

September 2023. A final dividend of 0.40p per share is being

recommended (2022: 0.70p).

-- Over the year a total of 538,471 shares were bought back into treasury.

For a definition of terms see Glossary of terms and alternative

performance measures at the end of this announcement. Total return

information is sourced from Baillie Gifford/Refinitiv and relevant

underlying index providers; see disclaimer at the end of this

announcement.

Baillie Gifford European Growth Trust's principal investment

objective is to achieve capital growth over the long-term from a

diversified portfolio of European securities.

The Company is managed by Baillie Gifford & Co, an Edinburgh

based fund management group with around GBP217 billion under

management and advice as at 15 November 2023.

Past performance is not a guide to future performance. Baillie

Gifford European Growth Trust plc is a listed UK company. The value

of its shares and any income from them can fall as well as rise and

investors may not get back the amount invested. The Company is

listed on the London Stock Exchange and is not authorised or

regulated by the Financial Conduct Authority. You can find up to

date performance information about Baillie Gifford European Growth

Trust plc on the Company's page of the Managers' website at

bgeuropeangrowth.com ++

++ Neither the contents of the Managers' website nor the

contents of any website accessible from hyperlinks on the Managers'

website (or any other website) is incorporated into, or forms part

of, this announcement.

For further information please contact:

Naomi Cherry, Baillie Gifford & Co

Tel: 0131 275 2000

Jonathan Atkins, Four Communications

Tel: 0203 920 0555 or 07872 495396

Chairman's Statement

Performance

The net asset value per share ('NAV') total return over the

Company's financial year was 8.3% compared to a total return of

20.5% for the FTSE Europe ex UK Index, in sterling terms. The share

price total return over the year was 8.6%; as at 30 September 2023

the discount to NAV of the Company's shares was 13.6%.

The dramatic shift in macroeconomics and interest rates of all

durations has continued to make it a challenging time for growth

investors. Discount rates have risen; price earnings ratios are

conversely lower. Despite strong operational performance from most

of our holdings (further detail provided in the Managers' report on

below) the share prices of the types of companies we own have not

recovered from the significant falls we saw in the previous year,

and in some cases have fallen further.

Since Baillie Gifford began managing the portfolio in November

2019, the NAV total return has been 9.3% compared to a total return

of 25.1% for the FTSE Europe ex UK Index, in sterling terms. The

share price total return has been 2.6%, with the discount widening

from 7.5% to 13.6%.

After an initially strong run of performance, the Company has

suffered two years of poor investment results. This has damaged the

longer run outcome for now. The Board is painfully aware of the

volatility and disappointment this has entailed for shareholders

but is confident that Baillie Gifford's currently out-of-favour

growth style will be vindicated in the longer term. The reason

equity investment yields the best long run returns is that it

involves volatility and requires patience and, on occasion, a

degree of endurance. The Board therefore considers it premature to

make a proper assessment of long-term performance.

Earnings and dividend

During the year the Company received a repayment of tax (and

interest) from HMRC, totalling GBP7.9 million (2.20p per share)

following receipt of a settlement agreement in relation to the

Franked Investment Group ('FII GLO') computational-based claims.

The Board distributed this to shareholders as a special interim

dividend of 2.20p per ordinary share on 15 September 2023.

Revenue return per share for the year was 2.68p (2022 - 0.79p)

and the Board is recommending a final dividend of 0.40 p per

ordinary share (2022 - 0.70p). Subject to shareholder approval at

the Annual General Meeting ('AGM'), the dividend will be paid on 2

February 2024 to shareholders on the register on 5 January 2024.

The ex-dividend date will be 4 January 2024.

Borrowings

The Company has two EUR30 million long-term debt facilities: the

first has a remaining duration of 17 years and is priced at a fixed

rate of 1.57% and the other has over 12 years outstanding at a

fixed rate of 1.55%. The Company also has an undrawn EUR30 million

overdraft facility with The Northern Trust Company, which at

present is capped at EUR15 million following Board agreement. At

the year end, the Company had gearing of 15.6% of shareholders'

funds.

Share buybacks, issuance and discount

Over the course of the Company's financial year, the share price

moved from a 13.5% discount to NAV to a 13.6% discount to NAV.

During this period, the Company bought back 538,471 shares at a

total cost of approximately GBP501,000. The shares repurchased by

the Company are held in treasury and are available to be reissued,

at a premium, when market conditions allow.

The Board is of the view that the Company should retain the

power to buy back shares during the year and so, at the AGM, is

seeking to renew the annual authority to repurchase up to 14.99% of

the shares in the Company in issue. When buying back shares, the

Board does not have a formal discount target and is prepared to buy

back shares opportunistically.

The Company also has authority to issue new shares and to

reissue any shares held in treasury for cash on a non pre-emptive

basis. Shares are issued/reissued only at a premium to NAV, thereby

enhancing NAV for existing shareholders. The Directors are, once

again, seeking 10% share issuance authority at the AGM. As with the

buy back authority, this authority would expire at the conclusion

of the AGM to be held in 2025.

The Board

As noted in the 2022 Annual Report, Dr. Woodward will stand down

from the Board at the AGM. The Board therefore undertook a

recruitment process seeking to appoint an additional independent

non-executive Director and was pleased to announce the appointment

of David Barron with effect from 1 October 2023. David has spent 25

years working in the investment management sector and was until

November 2019 Chief Executive Officer of Miton Group PLC following

six years with the firm. Prior to this he was Head of Investment

Trusts at JP Morgan Asset Management for more than ten years having

joined Robert Fleming in 1995. David will stand for election at the

upcoming AGM. On Dr Woodward's departure from the Board, Andrew

Watkins will become Chair of the Audit Committee and Emma Davies

Senior Independent Director. It is my intention to stand down at

the 2025 AGM, at which time David will replace me as Chair. The

Board intends to undertake a recruitment process next year and

anticipates appointing a further Director by 30 September 2024.

The Board wishes to thank Dr Woodward for his many years of

commitment, service, energy and insight and, in particular, for his

assiduity and experience in the role of Chairman of the Audit

Committee.

Annual General Meeting

The AGM will be held at 11 a.m. on 18 January 2024 at the

Institute of Directors, 116 Pall Mall, London, SW1Y 5ED. The

Managers will make a presentation and I look forward to meeting

shareholders who are able to attend. To accurately reflect the

views of shareholders of the Company, the Board intends to hold the

AGM voting on a poll, rather than by a show of hands as has been

customary. This will ensure an exact and definitive result. The

Board encourages all shareholders to exercise their votes on the

AGM resolutions by completing and submitting the form of proxy

enclosed with the Annual Report to ensure that your votes are

represented at the meeting (whether or not you intend to attend in

person).

If you hold shares through a share platform or other nominee,

the Board encourages you to contact these organisations directly as

soon as possible to arrange for you to submit votes in advance of

the AGM. Alternatively, the Association of Investment Companies'

('AIC') website theaic.co.uk/how-to-vote-your-shares has

information on how to vote your shares if you hold them via one of

the major platforms. The following link will also take you through

to the AIC website where there is information on how your platform

can help you attend the AGM in person

theaic.co.uk/aic/ready-to-invest/shareholder-voting/attending-an-agm

.

Should shareholders have questions for the Board or the

Managers, or any queries as to how to vote, they are welcome, as

always, to submit them by email to

trustenquiries@bailliegifford.com or call 0800 917 2112.

Information on the resolutions can be found on pages 110 and 111

of the Annual Report. The Directors consider that all resolutions

to be put to shareholders are in their and the Company's best

interests as a whole and recommend that shareholders vote in their

favour.

Outlook

Fund managers are nearly always prone to regard the current

environment as difficult. It is no exaggeration, however, to

describe the present geopolitical turmoil and deterioration in the

fabric and harmony of both democratic and autocratic societies as

troubling and unusual. 25 years of unprecedented and arguably

reckless money printing has come home to roost. Adding value in

anticipating big picture change either good or bad is difficult,

even accepting an element of reflexivity: one thing leads to

another. Inflation leads to falling living standards and,

historically, wars. The good news, as ever, is in the degree of

innovation, disruption and commercial success that can flow from

human ingenuity. Stock-picking in the form of focussing on what

might go right is the best way to explore and mine this seam.

Growing, high quality companies delivering goods and services that

enhance their customers' lives are worthy of attention and

investment. Our Managers are adept at this activity. They have been

sticking to their guns. In this we support them.

Michael MacPhee

Chairman

16 November 2023

Managers' Report

We took over management of the Company four years ago with the

aim of investing in Europe's most dynamic growth companies. Since

then, the share price has experienced a spectacular rise and

equally spectacular fall. Adjusted for the share split, we started

at just over 80p, peaked at around 170p, and ended the current

period almost where we started. While we continually ask ourselves

what we could have done differently, Baillie Gifford has been

managing European portfolios since 1985 and has experienced poor

performance before. Many of our most successful companies have been

through similarly difficult bouts. Just as those companies did, we

emerged from each one in a stronger position. We do not wish to

downplay the recent period of poor performance. We think about it

every

day. Disappointing as this is, however, it is more important to

consider where the share price will be five years from now.

Over short periods there are many variables that help dictate

what a company is worth. These include interest rates, risk

appetite, social media, and many of the behavioural shortcomings

from which we humans regularly suffer. Companies make mistakes too

- operational hiccups happen. These are businesses run by real

people trying to navigate complex issues and unpredictable events.

Over longer periods of time, however, these variables play a far

less significant part. What is more important for value creation is

a strong, durable corporate culture, and the ability to grow

profitably over time. We will make mistakes, but if we build and

maintain a portfolio of high-quality growing businesses run by

people we trust, we believe that we can deliver for our

shareholders.

Performance

Over the last financial year, the Company's NAV delivered a

total return of 8.3% while the FTSE Europe ex UK index returned

20.5% in sterling terms. The Company's share price total return was

8.6%, ending the period at 83.6p, representing a discount of 13.6%

to the NAV. This compares to a discount of 13.5% at the beginning

of the period.

Despite these relative returns, we are increasingly optimistic

about the future. Operational progress has been at least in line

with our expectations, and we are seeing many affirming signals

that our companies are taking advantage of this environment,

investing while peers retrench, carrying out acquisitions, and

buying back shares. We are not the only ones who think the selloff

is overdone.

Positive contributors in the period include Ryanair, which

continued to take market share from weaker airlines and invest in

new capacity. Online classified companies Adevinta and its major

shareholder Schibsted showed that they can offset temporarily

weaker volumes with price increases. Both companies' share prices

have also been boosted by news that a private equity consortium is

looking to acquire Adevinta. Freight forwarder DSV and building

materials manufacturer Kingspan continue to execute well, and both

have been linked with potential large-scale acquisitions made

feasible by their strong balance sheets. Spotify continues to grow

healthily and now boasts over 550m monthly active users. After much

investment, its recent focus has shifted to profitability using

cost reductions and price increases as levers. This shift is

underway at many technology companies, although Spotify is the

first to be rewarded by the market.

Some companies performed less well. Battery startup Northvolt

was written down to reflect moves in public benchmarks, though

operational progress remains good. Elsewhere, payments processing

company Adyen fell almost 50% in the week after announcing some

market share losses in the US. This looks temporary to us, though

we continue to monitor progress and debate the attractiveness of

the new, lower valuation. Sartorius Stedim Biotech, which

manufactures bioprocessing equipment for the biologics industry,

also reported negative news, noting a slowdown in demand and higher

inventories. Again, these issues feel temporary, and

we have made a modest addition. Swedish gaming company Embracer

has been more disappointing. The investment case centred on the

founder's strategy of acquiring media content and gaming studios

and letting their founders flourish in a decentralised

organisation. Unfortunately, this was a case of overpromising and

underdelivering, and management is now being forced to sell assets

to pay down debt. We have some sympathy for the idea that the

company is now undervalued, but we have lost faith in the

management team and the board. Trust in management and alignment

are non-negotiable for us so we have sold our entire position.

Improving performance

We genuinely believe that the future looks brighter than the

past. Cynics may argue that this is what all underperforming fund

managers say, so the onus is on us to explain the underpinnings of

our optimism. So, what are the catalysts to drive improving

performance?

Cognitive psychologist Gary Klein, in his book 'Seeing What

Others Don't', suggests that performance is improved by 'reducing

errors and increasing insights'. As we have written before, our

main error has been misjudging the impact of rapidly shifting

monetary policy on the valuations of growth companies. Because the

companies in the portfolio tend to be smaller and grow much faster

than average, most of their lifetime cashflows are in the future,

and these are now being discounted at a much higher rate than they

were. We have therefore felt the impact of rising rates much more

acutely. When panic sweeps the market,

it is the more nascent, higher growth companies that get hit

hardest.

In order to minimise future valuation risk, we monitor interest

rate and duration risk in the portfolio and construct a reverse

discounted cashflow model for every company we look at. These

process tweaks will help us test our assumptions on valuation, but

also to take advantage of opportunities in a volatile market. This

is crucial - the potential upside is much greater than the

potential downside, so while minimising errors is important, it is

less important than identifying insights to help us invest today in

tomorrow's winners.

Insights

"Insights shift us toward a new story, a new set of beliefs that

are more accurate, more comprehensive, and more useful. Our

insights transform us in several ways. They change how we

understand, act, see, feel, and desire."

- Gary Klein

We strive to identify insights. We look for new ways of seeing

companies, truths that others are perhaps less able to see,

potential that the market is not currently discounting. This is how

one outperforms the market over the long term. Klein suggests that

insights are often generated through pattern recognition and making

connections as a by-product of coincidence or curiosity. Insights

can also come from contradictions and inconsistencies. When we come

across things that don't make sense, we need to build new mental

models to understand what is going on. For us this is happening

more and more when thinking about company valuations.

We have underperformed over the past two years - this simple

observation is irrefutable. Interest rates have risen, and

valuation multiples have fallen. However, here's the contradiction:

over the past two years, the forward price-to-earnings multiple of

our portfolio has fallen by 50%, from 34x to 17x*, which is a 40%

premium to the index we are trying to outperform. If you believe

sell-side analysts, earnings per share (EPS) of our portfolio are

expected to grow 12% per annum over the next three years which

compares favourably to 4% per annum for the index. At those rates,

the valuation multiple of our portfolio would be below that of the

index within five years, although we would be disappointed if it

wasn't sooner. This doesn't make any sense to us. The companies we

invest in typically grow faster than the index and we would expect

this to continue for far longer than five years. We think they are

higher quality, have unique corporate cultures, have less debt, and

are run by some of the best capital allocators in Europe. Things

can always get cheaper but even the idea that our portfolio would

trade at a discount to the index in a few years highlights just how

inefficient the market is at valuing growth.

So, what's going on? Part of the explanation could be related to

hyperbolic discounting. This is a complicated sounding way of

saying that future profits are being excessively discounted. We are

reminded of the 1972 Stanford marshmallow experiment, led by

psychologist Walter Mischel, which set out to measure a child's

willingness to defer gratification. Children would often choose to

devour one marshmallow immediately rather than wait fifteen minutes

to receive two. This desire to experience immediate rewards at the

expense of bigger rewards in the future plagues markets as much as

children.

As long-term investors, we believe that the market tends to

underestimate the attractiveness of special companies over long

periods. This inefficiency becomes much more acute during times of

stress, when time horizons shrink, risk appetite diminishes, and a

premium is placed on certainty. It's no great surprise, then, that

market breadth has narrowed sharply since 2021. Many have sought

refuge in the perceived safety of the largest companies in the

index regardless of their fundamentals or valuations. We've long

believed that the midcap space in Europe contains a high proportion

of future outliers, but this view is increasingly at odds with what

the market is pricing in. This won't last forever, so we believe

that this is the time to be adding to those stocks where we see

asymmetric payoffs.

Portfolio

Portfolio turnover for the year was 9%, implying an average

holding period of just over 10 years. During the second half of our

financial year, we made six new investments in public companies:

EQT, one of the world's largest and most reputable private equity

firms; LVMH and Moncler, two luxury goods companies that are

getting better as they get bigger; Soitec, an innovative French

semiconductor company exposed to rapidly growing markets; Royal

Unibrew, a multi-beverage company with serial acquirer

characteristics; and Eurofins, a global lab testing business we've

been waiting patiently to buy for many years. We also made a new

investment in an unlisted Italian software company called Bending

Spoons, which has a unique approach to monetising consumer mobile

apps. This is a diverse, high-quality, highly profitable collection

of companies growing much faster than the market, with meaningful

inside ownership and attractive valuations.

During the same period, to make way for these new holdings, we

completely sold five investments. We have already mentioned

Embracer, but food delivery firm Just Eat Takeaway.com and green

holding company Aker Horizons didn't work out either. Just Eat

Takeaway.com suffered from an ill-timed acquisition in the highly

competitive US market. Legislators also introduced fee caps which

effectively turned a profitable business into a loss making one.

With Aker Horizons we underestimated how difficult it would be for

its portfolio of clean tech businesses to generate profits. MedTech

distributor Addlife, and heat pump manufacturer NIBE, have been

more successful. During the Covid pandemic, Addlife benefitted from

increased demand for diagnostics and hospital equipment, while

demand for NIBE's energy efficient heat pumps far exceeded supply

during the energy crisis. In both cases we determined that

valuations had risen too much, and that the capital would be best

redirected into better ideas.

Private companies

While the Company can invest up to 20% of total assets in

private companies, we currently have five investments accounting

for around 11%: Northvolt (4.9%), McMakler (1.8%), sennder (1.8%),

Flix (1.5%) and Bending Spoons (0.9%). Overall operational progress

has been good and both Northvolt and Flix are rumoured to be

considering an initial public offering ('IPO') in 2024.

We think giving investors low-cost access to private companies

that would otherwise be unavailable is an attractive proposition.

Companies are staying private for longer, as many of them are

relatively asset light and therefore require little capital to

grow. As a result, many are in the fortunate position to be able to

choose their investors. We think our reputation as long-term growth

investors and our ability to invest in both private and public

markets mean we are advantaged when it comes to deal flow. We

absolutely believe that investing in Europe's increasingly dynamic

private companies can generate significant value and provide

insights into a level of disruption not normally seen in public

markets.

Northvolt

Our very first private investment is becoming increasingly

important to us and the broader European economy. Northvolt was

founded in 2016 by two former Tesla executives backed by two

Swedish entrepreneurs who wanted to accelerate decarbonisation.

Their mission was to produce the world's greenest batteries with

the lowest carbon footprint. In just seven years, the company has

taken on over 4,000 employees, secured more than $8bn in funding,

and received more than $55bn in orders from customers like BMW, VW,

Scania, Siemens and ABB. This is truly remarkable.

At 4.9% it is the largest position in the portfolio, so its

success will help underpin any rebound in performance. The rumoured

IPO in 2024 is just a milestone for us if it happens as we can

continue holding the shares if there remains sufficient upside.

Either way it should be very high profile particularly given its

strategic importance to Europe's automotive industry, politicians,

and financial institutions who all want to see it succeed. Europe

cannot afford to rely on Asian battery manufacturers. It needs to

build its own supply chain and Northvolt is the best chance we

have.

Northvolt's opportunity is large and growing. In Europe alone,

battery demand is expected to increase from around 150GWh in 2022

to 1,370GWh in 2030. This is likely to be revised upwards as new

markets and applications emerge. We suspect this will be a

commoditised market, but Northvolt's strategy seems well-suited.

Important aspects of this strategy include:

-- An ambition to lower the carbon footprint of a battery to

10kg of carbon dioxide equivalent per kilowatt hour, a 90%

reduction from the current industry benchmark. This will be driven

by access to very cheap renewable hydroelectric power, using

responsibly sourced raw materials, and using at least 50% recycled

material.

-- Its unique vertical integration. Everything from cathode

production to cell assembly to recycling will be done in-house.

This not only lowers carbon emissions but also helps capture more

recycled materials and improves quality.

-- A European supply chain. A local champion needs local supply,

and Northvolt's aim is to source 90% of components from within

Europe. This creates a lot of alignment with those customers and

politicians responsible for orders and subsidies.

-- A focus on talent. Northvolt has assembled one of the best

R&D teams in the world. Battery chemistries and technological

roadmaps will evolve so it is important that the company can adapt

and compete with its Asian competitors.

During an investment trip to Sweden with the Board, we recently

visited Northvolt's first factory, Northvolt Ett, in the small town

of Skellefteå. The 200-hectare site near the Arctic Circle is

equivalent to around 300 football pitches, so is a highly ambitious

project. The current plan is to produce 150GWh of batteries by

2030, but there is upside potential to this figure. To put this

into context, if the average electric car has a 70kWh battery, this

would be enough to power more than 2 million of the 11 million cars

sold in Europe in 2022. Using public estimates for battery prices

in 2030, this could result in $10-15bn in sales. Engineering and

manufacturing at this scale poses tremendous challenges, and there

will no doubt be delays and setbacks. If Northvolt succeeds,

however, the payoff for investors could be huge.

Outlook

Our investment style is very much out of favour, and we have

undoubtedly made mistakes, but we have the right people and

corporate culture at Baillie Gifford to persevere through this

difficult time. There are plenty of geopolitical tensions and

economic headwinds to worry about, but we must not let such factors

overshadow the adaptability, innovation, and capital allocation of

the companies we invest in. We are riding on the coat-tails of

founders, families and management teams who are doing all the hard

work. That this work is being so discounted by the market gives us

confidence in a brighter outlook for returns from here.

Stephen Paice

Chris Davies

Baillie Gifford

16 November 2023

* Representative portfolio and index figures are calculated

excluding negative earnings.

List of investments

As at 30 September 2023

2023 2023

Value % of total

Name Geography Business GBP'000 assets

----------------------- ------------ ----------------------------------------------------- --------- -----------

Northvolt (U) Sweden Battery developer and manufacturer 18,752 4.9

Prosus Netherlands Portfolio of online consumer companies 18,710 4.9

Ryanair Ireland Low-cost airline 16,791 4.4

Topicus.com Netherlands Acquirer of vertical market software companies 16,053 4.2

Schibsted Norway Media and classifieds advertising platforms 14,381 3.8

Atlas Copco Sweden Industrial group 13,070 3.5

DSV Denmark Freight forwarder 12,473 3.3

ASML Netherlands Semiconductor equipment manufacturer 12,247 3.2

Allegro.eu Poland E-commerce platform 12,058 3.2

Kingspan Ireland Building materials provider 11,356 3.0

EXOR Netherlands Investment company specialising in industrials 10,774 2.8

Kering France Owner of luxury fashion brands 10,570 2.8

IMCD Netherlands Speciality chemicals distributor 9,697 2.6

Adevinta Norway Online classifieds marketplaces 9,606 2.5

Avanza Bank Sweden Online investment platform 9,396 2.5

Richemont Switzerland Owner of luxury goods companies 8,907 2.3

Spotify Sweden Online audio streaming service 8,528 2.2

Manufacturer of precision instruments for

Mettler-Toledo Switzerland laboratories 8,302 2.2

Dassault Systèmes France Develops software for 3D computer-aided design 8,137 2.1

Adyen Netherlands Online payments platform 8,024 2.1

Nexans France Cable manufacturing company 8,003 2.1

Reply Italy IT consulting and systems integration provider 7,089 1.9

sennder (U) # Germany Freight forwarder focused on road logistics 6,938 1.8

McMakler (U) Germany Digital real estate broker 6,668 1.8

Sartorius Stedim

Biotech France Pharmaceutical and laboratory equipment provider 6,531 1.7

Zalando Germany Online fashion retail platform 5,848 1.5

Flix (U) Germany Long-distance bus and train provider 5,841 1.5

Hypoport* Germany FinTech platform 5,633 1.5

Hexpol Sweden Manufacturer of rubber and polymer compounds 5,591 1.5

Investment company specialising in digital

Kinnevik Sweden consumer businesses 5,508 1.5

Delivery Hero Germany Online food delivery platform 4,968 1.3

Epiroc Sweden Mining and infrastructure equipment provider 4,910 1.3

Evotec Germany Contract research and drug discovery company 4,793 1.3

HelloFresh Germany Meal kit delivery company 4,775 1.3

LVMH* France Luxury goods 4,626 1.2

Wizz Air Hungary Low-cost airline 4,583 1.2

Manufactures engineered substrates for semiconductor

Soitec* France wafers 4,508 1.2

Hemnet Sweden Online real estate platform 4,400 1.2

adidas Germany Sports shoes and clothing manufacturer 4,170 1.1

Beijer Sweden Wholesaler of cooling technology 3,827 1.0

AUTO1 Germany Online platform for used car selling in Europe 3,785 1.0

Moncler* Italy Manufactures luxury apparel products 3,693 1.0

Bending Spoons (U)

* Italy Mobile application software developer 3,243 0.9

AutoStore* Norway Warehouse automation and cubic storage systems 3,121 0.8

Tonies Germany Musical storybox toys for children 3,099 0.8

Royal Unibrew* Denmark Alcoholic and non-alcoholic beverages 2,892 0.8

Eurofins* France Analytical testing services 2,862 0.8

Developer of treatments based on gene editing

Crispr Therapeutics Switzerland technology 2,701 0.7

Investment firm, investing in equity, ventures,

EQT* Sweden infrastructure and real estate 2,688 0.7

Investment company specialising in early-stage

VNV Global Sweden technologies 2,253 0.6

Cellectis France Biotech focused on genetic engineering 433 0.1

----------------------- ------------ ----------------------------------------------------- --------- -----------

Total Investments 377,812 99.6

-------------------------------------------------------------------------------------------- --------- -----------

Net Liquid Assets* 1,536 0.4

-------------------------------------------------------------------------------------------- --------- -----------

Total Assets 379,348 100.0

-------------------------------------------------------------------------------------------- --------- -----------

Borrowings (51,960) (13.7)

-------------------------------------------------------------------------------------------- --------- -----------

Shareholders' funds 327,388 86.3

-------------------------------------------------------------------------------------------- --------- -----------

(U) Denotes private company investment.

* New holding bought during the year (Addlife, Aker Horizons,

Embracer, NIBE Industrier, Takeaway.com, Ubisoft Entertainment were

sold during the year)

Includes American Depositary Receipt.

# Includes convertible loan note.

Income Statement

2023 2023 2023 2022 2022 2022

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ----- --------- -------- -------- --------- --------- ---------

Gains/(losses) on investments - 19,795 19,795 - (241,839) (241,839)

Currency (losses)/gains (40) 533 493 104 (1,145) (1,041)

Income 2 3,912 - 3,912 4,313 - 4,313

Investment management fee 3 (354) (1,416) (1,770) (412) (1,647) (2,059)

Other administrative expenses (564) - (564) (572) - (572)

-------------------------------- ----- --------- -------- -------- --------- --------- ---------

Net return before finance costs

and taxation 2,954 18,912 21,866 3,433 (244,631) (241,198)

-------------------------------- ----- --------- -------- -------- --------- --------- ---------

Finance costs of borrowings (164) (653) (817) (214) (652) (866)

-------------------------------- ----- --------- -------- -------- --------- --------- ---------

Net return before taxation 2,790 18,259 21,049 3,219 (245,283) (242,064)

-------------------------------- ----- --------- -------- -------- --------- --------- ---------

Tax on ordinary activities 6,835 - 6,835 (358) - (358)

-------------------------------- ----- --------- -------- -------- --------- --------- ---------

Net return after taxation 9,625 18,259 27,884 2,861 (245,283) (242,422)

-------------------------------- ----- --------- -------- -------- --------- --------- ---------

Net return per ordinary share 4 2.68p 5.09p 7.77p 0.79p (67.98p) (67.19p)

-------------------------------- ----- --------- -------- -------- --------- --------- ---------

The total column of this statement is the profit and loss

account of the Company. The supplementary revenue and capital

return columns are prepared under guidance published by the

Association of Investment Companies.

All revenue and capital items in this statement derive from

continuing operations.

A Statement of Comprehensive Income is not required as all gains

and losses of the Company have been reflected in the above

statement.

The accompanying notes below are an integral part of the

Financial Statements.

Balance Sheet

2023 2023 2022 2022

Notes GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------- ----- -------- -------- -------- --------

Fixed assets

Investments held at fair value through

profit or loss 6 377,812 358,105

Current assets

Debtors 2,406 2,797

Cash and cash equivalents 907 3,571

------------------------------------------------- ----- -------- -------- -------- --------

3,313 6,368

------------------------------------------------- ----- -------- -------- -------- --------

Creditors

Amounts falling due within one year: (1,775) (1,516)

------------------------------------------------- ----- -------- -------- -------- --------

Net current assets 1,538 4,852

------------------------------------------------- ----- -------- -------- -------- --------

Total assets less current liabilities 379,350 362,957

------------------------------------------------- ----- -------- -------- -------- --------

Creditors

Amounts falling due after more than one

year: 7 (51,960) (52,560)

------------------------------------------------- ----- -------- -------- -------- --------

Net assets 327,390 310,397

------------------------------------------------- ----- -------- -------- -------- --------

Capital and reserves

Share capital 8 10,061 10,061

Share premium account 125,050 125,050

Capital redemption reserve 8,750 8,750

Capital reserve 176,215 158,457

Revenue reserve 7,314 8,079

------------------------------------------------- ----- -------- -------- -------- --------

Shareholders' funds 327,390 310,397

------------------------------------------------- ----- -------- -------- -------- --------

Net asset value per ordinary share * (borrowings

at book value) 91.4p 86.5p

------------------------------------------------- ----- -------- -------- -------- --------

Net asset value per ordinary share * (borrowings

at fair value) 96.7p 91.9p

------------------------------------------------- ----- -------- -------- -------- --------

The accompanying notes below are an integral part of the

Financial Statements.

* See Glossary of terms and alternative performance measures at

the end of this announcement.

Statement of Changes in Equity

For the year ended 30 September 2023

Share Capital

Share premium redemption Capital Revenue Shareholders'

capital account reserve reserve reserve funds

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ----- -------- -------- ----------- -------- -------- -------------

Shareholders' funds at 1 October

2022 10,061 125,050 8,750 158,457 8,079 310,397

Dividends paid during the year 5 - - - - (10,390) (10,390)

Shares bought back into treasury - - - (501) - (501)

Net return on ordinary activities

after taxation - - - 18,259 9,625 27,884

------------------------------------ ----- -------- -------- ----------- -------- -------- -------------

Shareholders' funds at 30 September

2023 10,061 125,050 8,750 176,215 7,314 327,390

------------------------------------ ----- -------- -------- ----------- -------- -------- -------------

For the year ended 30 September 2022

Share Capital

Share premium redemption Capital Revenue Shareholders'

capital account reserve reserve reserve funds

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ----- -------- -------- ----------- ---------- -------- -------------

Shareholders' funds at 1 October

2021 10,061 125,050 8,750 411,184 6,494 561,539

Dividends paid during the year 5 - - - - (1,276) (1,276)

Shares bought back into treasury - - - (7,444) - (7,444)

Net return on ordinary activities

after taxation - - - (245,283) 2,861 (242,422)

------------------------------------ ----- -------- -------- ----------- ---------- -------- -------------

Shareholders' funds at 30 September

2022 10,061 125,050 8,750 158,457 8,079 310,397

------------------------------------ ----- -------- -------- ----------- ---------- -------- -------------

The accompanying notes below are an integral part of the

Financial Statements.

Cash Flow Statement

2023 2023 2022 2022

Notes GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ ----- -------- -------- --------- --------

Cash flows f rom operating activities

Net return on ordinary activities

before taxation 21,049 (242,064)

Net (gains)/losses on investments (19,795) 241,839

Currency (gains)/losses (533) 1,041

Finance costs of borrowings 817 866

Tax repayment received 7,034 -

Overseas withholding tax suffered (199) (284)

Overseas withholding tax received 451 459

Changes in debtors* (170) (214)

Changes in creditors* 29 (316)

------------------------------------------ ----- -------- -------- --------- --------

Cash from operations 8,683 1,327

Interest paid (813) (852)

------------------------------------------ ----- -------- -------- --------- --------

Net cash inflow from operating activities 7,870 475

------------------------------------------ ----- -------- -------- --------- --------

Cash flows from investing activities

Acquisitions of investments(#) (46,765) (147,499)

Disposals of investments(#) 47,203 147,012

------------------------------------------ ----- -------- -------- --------- --------

Net cash inflow/(outlow) from investing

activities 438 (487)

------------------------------------------ ----- -------- -------- --------- --------

Cash flows from financing activities

Shares bought back into treasury (509) (7,436)

Equity dividends paid 5 (10,390) (1,276)

------------------------------------------ ----- -------- -------- --------- --------

Net cash outflow from financing

activities (10,899) (8,712)

------------------------------------------ ----- -------- -------- --------- --------

Decrease in cash and cash equivalents (2,591) (8,724)

Exchange movements (73) 43

Cash and cash equivalents at start

of year 3,571 12,252

------------------------------------------ ----- -------- -------- --------- --------

Cash and cash equivalents at end

of year 907 3,571

Comprising:

Cash at bank 907 3,571

------------------------------------------ ----- -------- -------- --------- --------

907 3,571

------------------------------------------ ----- -------- -------- --------- --------

* Change in debtors is made up of changes in accrued income,

prepaid expenses and taxation recoverable (excluding overseas

withholding tax received in the year). Change in creditors is made

up of changes in other creditors and accruals.

Cash from operations includes dividends received of GBP2,839,000

(2022 - GBP4,284,000) and interest received of GBP919,000 (2022 -

GBP2,000).

# Acquisitions of investments is made up of the current year

purchases at cost, plus opening purchases for subsequent

settlement, less

closing purchases for subsequent settlement (see note 11).

Disposals of investments is made up of the current year sales

proceeds plus

opening investment sales awaiting settlement, less closing

investment sales awaiting settlement.

The accompanying notes below are an integral part of the

Financial Statements.

Notes to the Condensed Financial Statements

1. The Financial Statements for the year to 30 September 2023

have been prepared in accordance with FRS 102 'The

Financial Reporting Standard applicable in the UK and Republic

of Ireland' on the basis of the accounting policies

set out below which are consistent with those applied for the

year ended 30 September 2022.

2. Income

2023 2022

GBP'000 GBP'000

------------------------ -------- --------

Income from investments

Overseas dividends 2,890 4,311

Overseas interest 103 -

------------------------ -------- --------

Other income

Interest 919 2

------------------------ -------- --------

Total income 3,912 4,313

------------------------ -------- --------

Interest for 2023 includes GBP869,000 interest received from

HMRC with the tax repayment (see note 6 on page 96 of the Annual

Report and Financial Statements).

3. Investment Management Fee

2023 2023 2023 2022 2022 2022

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- -------- -------- -------- -------- -------- --------

Investment management

fee 354 1,416 1,770 412 1,647 2,059

---------------------- -------- -------- -------- -------- -------- --------

Baillie Gifford & Co Limited, a wholly owned subsidiary of

Baillie Gifford & Co, was appointed as the Company's

Alternative Investment Fund Manager ('AIFM') and Company Secretary

on 29 November 2019. Baillie Gifford & Co Limited has delegated

portfolio management services to Baillie Gifford & Co. Dealing

activity and transaction reporting has been further sub-delegated

to Baillie Gifford Overseas Limited and Baillie Gifford Asia (Hong

Kong) Limited.

The Investment Management Agreement between the AIFM and the

Company sets out the matters over which the Managers have authority

in accordance with the policies and directions of, and subject to

restrictions imposed by, the Board. The Investment Management

Agreement is terminable on not less than three months' notice or on

shorter notice in certain circumstances. Compensation would only be

payable if termination occurred prior to the expiry of the notice

period. The annual management fee is 0.55% of the lower of (i) the

Company's market capitalisation and (ii) the Company's net asset

value (which shall include income), in either case up to GBP500

million, and 0.50% of the amount of the lower of the Company's

market capitalisation or net asset value above GBP500 million,

calculated and payable quarterly.

4. Net return per ordinary share

2023 2023 2023 2022 2022 2022

Revenue Capital Total Revenue Capital Total

------------------------ -------- -------- ------ -------- -------- --------

Net return per ordinary

share 2.68p 5.09p 7.77p 0.79p (67.98p) (67.19p)

------------------------ -------- -------- ------ -------- -------- --------

Revenue return per ordinary share is based on the net revenue

return on ordinary activities after taxation of GBP9,625,000 (2022

- GBP2,861,000), and on 358,552,904 (2022 - 360,823,119) ordinary

shares, being the weighted average number of ordinary shares in

issue during each year.

Capital return per ordinary share is based on the net capital

gain for the financial year of GBP18,259,000 (2022 - net capital

loss of GBP245,283,000), and on 358,552,904 (2022 - 360,823,119)

ordinary shares, being the weighted average number of ordinary

shares in issue during each year.

There are no dilutive or potentially dilutive shares in

issue.

5. Ordinary Dividends

2023 2022

2023 2022 GBP'000 GBP'000

---------------------------------------- ----- ----- -------- --------

Amounts recognised as distributions

in the period:

Previous year's final (paid 10 February

2023) 0.70p 0.35p 2,511 1,276

Special Interim Dividend (paid 15

September 2023) 2.20p - 7,879 -

---------------------------------------- ----- ----- -------- --------

2.90p 0.35p 10,390 1,276

---------------------------------------- ----- ----- -------- --------

Also set out below are the total dividends paid and proposed in

respect of the financial year, which is the basis on which the

requirements of section 1158 of the Corporation Tax Act 2010 are

considered. The revenue available for distribution by way of

dividend for the year is GBP9,625,000 (2022 - GBP2,861,000).

2023 2022

2023 2022 GBP'000 GBP'000

------------------------------------- ----- ----- -------- --------

Dividends paid and proposed in the

period:

Special Interim Dividend (paid 15

September 2023) 2.20p - 7,879 -

Proposed final dividend per ordinary

share

(payable 10 February 2024) 0.40p 0.70p 1,433 2,511

------------------------------------- ----- ----- -------- --------

2.60p 0.70p 9,312 1,276

------------------------------------- ----- ----- -------- --------

6. Investments

Level Level Level

1 2 3 Total

As at 30 September 2023 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- -------- -------- -------- --------

Securities

Listed equities 336,369 - - 336,369

Unlisted equities - - 41,443 41,443

---------------------------------- -------- -------- -------- --------

Total financial asset investments 336,369 - 41,443 377,812

---------------------------------- -------- -------- -------- --------

Level Level Level

1 2 3 Total

As at 30 September 2022 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- -------- -------- -------- --------

Securities

Listed equities 318,506 - - 318,506

Unlisted equities - - 39,599 39,599

---------------------------------- -------- -------- -------- --------

Total financial asset investments 318,506 - 39,599 358,105

---------------------------------- -------- -------- -------- --------

Investments in securities are financial assets designated at

fair value through profit or loss on initial recognition. In

accordance with FRS 102 the tables above provide an analysis of

these investments based on the fair value hierarchy described below

which reflects the reliability and significance of the information

used to measure their fair value.

Fair value hierarchy

The levels are determined by the lowest (that is the least

reliable or least independently observable) level of input that is

significant to the fair value measurement for the individual

investment in its entirety as follows:

Level 1 - using unadjusted quoted prices for identical

instruments in an active market;

Level 2 - using inputs, other than quoted prices included within

Level 1, that are directly or indirectly observable (based on

market data); and

Level 3 - using inputs that are unobservable (for which market

data is unavailable).

The valuation techniques used by the Company are explained in

the accounting policies on pages 92 and 93 of the Annual Report and

Financial Statements. A sensitivity analysis by valuation technique

of the unlisted securities is on pages 104 and 105 of the Annual

Report and Financial Statements.

7. Creditors - amounts falling due after more than one year

2023 2022

GBP'000 GBP'000

----------------------------- -------- --------

Unsecured loan notes:

EUR30m 1.55% 24 June 2036 25,998 26,299

EUR30m 1.57% 8 December 2040 25,962 26,261

----------------------------- -------- --------

51,960 52,560

----------------------------- -------- --------

The company has EUR30 million of long-term, fixed rate, senior,

unsecured privately placed loan notes, with a fixed coupon of 1.57%

to be repaid on 8 December 2040 and a further EUR30 million of

long-term, fixed rate, senior, unsecured privately placed loan

notes with a fixed coupon of 1.55% to be repaid on 24 June

2036.

The main covenants which are tested monthly are: (i) Net

tangible assets shall not fall below GBP200,000,000. (ii) Total

borrowings shall not exceed 30% of the Company's adjusted assets.

(iii) The Company's number of holdings shall not fall below 30.

The Company currently has a EUR30,000,000 bank overdraft credit

facility agreement with The Northern Trust Company (the 'Bank') for

the purpose of pursuing its investment objective. As at 30

September 2023, nil had been drawn down (2022 - nil). The facility

is uncommitted. Interest is charged at 1.25% above the European

Central Bank Main Financing Rate. The Board has currently agreed to

cap a drawdown under this facility at EUR15,000,000.

8. Share Capital

2023 2023 2022 2022

Number GBP'000 Number GBP'000

----------------------------------- ----------- -------- ------------ --------

Allotted, called up and fully paid

ordinary shares of 2.5p each 358,149,200 8,954 358,687,671 8,967

Treasury shares of 2.5p each 44,294,490 1,107 43,756,019 1,094

----------------------------------- ----------- -------- ------------ --------

Total 402,443,690 10,061 402,443,690 10,061

----------------------------------- ----------- -------- ------------ --------

The Company's shareholder authority permits it to hold shares

bought back in treasury. Under such authority, treasury shares

may be subsequently either sold for cash (at a premium to net

asset value per ordinary share) or cancelled. At 30 September 2023

the Company had authority to buy back 53,228,811 ordinary shares.

During the year to 30 September 2023, no ordinary shares (2022 -

nil) were bought back for cancellation and 538,471 ordinary shares

were bought back into treasury at a cost of GBP500,000 (2022 -

GBP7,444,000). Under the provisions of the Company's Articles of

Association share buy-backs are funded from the capital reserve.

The Company has authority to allot shares under section 551 of the

Companies Act 2006. The Board has authorised use of this authority

to issue new shares at a premium to net asset value per share in

order to enhance the net asset value per share for existing

shareholders and improve the liquidity of the Company's shares.

During the year to 30 September 2023 no shares were issued (in the

year to 30 September 2022 - no shares were issued).

9. Analysis on change in net debt

1 October Other non-cash Exchange 30 September

2022 Cash flows changes movement 2023

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- --------- ---------- -------------- --------- ------------

Cash and cash equivalents 3,571 (2,591) - (73) 907

Loans due in more than one

year (52,560) - (6) 606 (51,960)

--------------------------- --------- ---------- -------------- --------- ------------

(48,989) (2,591) (6) 533 (51,053)

--------------------------- --------- ---------- -------------- --------- ------------

10. The financial information for 2022 is derived from the

statutory accounts for 2022 which have been delivered to the

Registrar of Companies. Statutory accounts for 2023 will be

delivered to the Registrar of Companies in due course. The Auditors

have reported on the 2022 and 2023 accounts, their report was (i)

unqualified; (ii) did not include a reference to any matters to

which the Auditors drew attention by way of emphasis without

qualifying their report; and (iii) did not contain a statement

under sections 498(2) or (3) to 497 of the Companies Act 2006.

11. Transactions with related parties and the managers and

secretaries

The Directors' fees for the year and interests in the Company's

shares at the end of the year are detailed in the Directors'

Remuneration Report on page 76 of the Annual Report and Financial

Statements. The Directors' Fees are included in note 4 on page 95

of the Annual Report and Financial Statements. No Director has a

contract of service with the Company. During the years reported, no

Director was interested in any contract or other matter requiring

disclosure under section 412 of the Companies Act 2006.

The Management fee due to Baillie Gifford & Co Limited is

set out in note 3 on page 95 of the Annual Report and Financial

Statements and the amount accrued at 30 September 2023 is set out

in note 11 on page of the Annual Report and Financial Statements.

Details of the Investment Management Agreement are set out on page

58 of the Annual Report and Financial Statements.

The Company is part of a marketing programme which includes all

the investment trusts managed by the Manager. The Company's

marketing contribution, recharged by the Manager, was GBP88,000

(GBP100,000) as disclosed in note 4 on page 95 of the Annual Report

and Financial Statements.

12. The Annual Report and Financial Statements will be available

on the Company's page of the Managers' website at

bgeuropeangrowth.com on or around 1 December 2023.

None of the views expressed in this document should be construed

as advice to buy or sell a particular investment.

Automatic Exchange of Information

In order to fulfil its obligations under UK tax legislation

relating to the automatic exchange of information, the Company is

required to collect and report certain information about certain

shareholders.

The legislation requires investment trust companies to provide

personal information to HMRC on certain investors who purchase

shares in investment trusts. As an affected company, Baillie

Gifford European Growth Trust will have to provide information

annually to the local tax authority on the tax residencies of a

number of non-UK based certificated shareholders and corporate

entities.

Shareholders, excluding those whose shares are held in CREST,

who come on to the share register will be sent a certification form

for the purposes of collecting this information.

For further information, please see HMRC's Quick Guide:

Automatic Exchange of Information - information for account holders

gov.uk/government/publications/exchange-of-information-account-holders.

Third Party data provider disclaimers

No third party data provider ('Provider') makes any warranty,

express or implied, as to the accuracy, completeness or timeliness

of the data contained herewith nor as to the results to be obtained

by recipients of the data.

No Provider shall in any way be liable to any recipient of the

data for any inaccuracies, errors or omissions in the index data

included in this document, regardless of cause, or for any damages

(whether direct or indirect) resulting therefrom. No Provider has

any obligation to update, modify or amend the data or to otherwise

notify a recipient thereof in the event that any matter stated

herein changes or subsequently becomes inaccurate.

Without limiting the foregoing, no Provider shall have any

liability whatsoever to you, whether in contract (including under

an indemnity), in tort (including negligence), under a warranty,

under statute or otherwise, in respect of any loss or damage

suffered by you as a result of or in connection with any opinions,

recommendations, forecasts, judgements, or any other conclusions,

or any course of action determined, by you or any third party,

whether or not based on the content, information or materials

contained herein.

FTSE Index Data

Source: London Stock Exchange Group plc and its group

undertakings (collectively, the 'LSE Group'). (c)LSE Group 2023.

FTSE Russell is a trading name of certain of the LSE Group

companies. 'FTSE(R)' 'Russell(R)', 'FTSE Russell(R), are trade

marks of the relevant LSE Group companies and are used by any other

LSE Group company under license.

All rights in the FTSE Russell indices or data vest in the

relevant LSE Group company which owns the index or the data.

Neither LSE Group nor its licensors accept any liability for any

errors or omissions in the indices or data and no party may rely on

any indices or data contained in this communication. No further

distribution of data from the LSE Group is permitted without the

relevant LSE Group company's express written consent. The LSE Group

does not promote, sponsor or endorse the content of this

communication.

Sustainable Finance Disclosure Regulation ('SFDR')

The EU SFDR does not have a direct impact in the UK due to

Brexit, however, it applies to third-country products marketed in

the EU. As Baillie Gifford European Growth Trust is marketed in the

EU by the AIFM, Baillie Gifford & Co Limited, via the National

Private Placement Regime, the following disclosures have been

provided to comply with the high-level requirements of SFDR. The

AIFM has adopted Baillie Gifford & Co's Governance and

Sustainable Principles and Guidelines as its policy on integration

of sustainability risks in investment decisions.

Baillie Gifford & Co's approach to investment is based on

identifying and holding high quality growth businesses that enjoy

sustainable competitive advantages in their marketplace. To do this

it looks beyond current financial performance, undertaking

proprietary research to build an in-depth knowledge of an

individual company and a view on its long- term prospects. This

includes the consideration of sustainability factors

(environmental, social and/or governance matters) which it believes

will positively or negatively influence the financial returns of an

investment. More detail on the Managers' approach to sustainability

can be found in the Governance and Sustainability Principles and

Guidelines document, available publicly on the Baillie Gifford

website bailliegifford.com.

Taxonomy Regulation

The Taxonomy Regulation establishes an EU-wide framework of

criteria for environmentally sustainable economic activities in

respect of six environmental objectives. It builds on the

disclosure requirements under SFDR by introducing additional

disclosure obligations in respect of alternative investment funds

that invest in an economic activity that contributes to an

environmental objective. The Company does not commit to make

sustainable investments as defined under SFDR. As such, the

underlying investments do not take into account the EU criteria for

environmentally sustainable economic activities.

Glossary of Terms and Alternative Performance Measures (APM)

An Alternative Performance Measure ('APM') is a financial

measure of historical or future financial performance, financial

position, or cash flows, other than a financial measure defined or

specified in the applicable financial reporting framework. The APMs

noted below are commonly used measures within the investment trust

industry and serve to improve comparability between investment

trusts.

Total assets

This is the Company's definition of Adjusted Total Assets, being

the total value of all assets less current liabilities, before

deduction of all borrowings.

Shareholders' funds

Shareholders' Funds is the value of all assets held less all

liabilities, with borrowings deducted at book value.

Net asset value

Net Asset Value is the value of total assets less liabilities

with borrowings deducted at either book value or fair value as

described below. The net asset value per share (NAV) is calculated

by dividing this amount by the number of ordinary shares in issue

(excluding treasury shares).

Net asset value (borrowings at fair value) (APM)

Borrowings are valued at an estimate of market worth. The fair

value of the Company's loan notes is set out in note 19 on page 107

of the Annual Report and Financial Statements

.

A reconciliation from shareholders' funds (borrowings at book

value) to net asset value after deducting borrowings at fair value

is provided below.

2023 2023 2022 2022

GBP'000 per share GBP'000 per share

-------------------------------- -------- ---------- -------- ----------

Shareholders' funds (borrowings

at book value) 327,390 91.4p 310,397 86.5p

Add: book value of borrowings 51,960 14.5p 52,560 14.7p

Less: fair value of borrowings (32,869) (9.2p) (33,425) (9.3p)

--------------------------------- -------- ---------- -------- ----------

Net asset value (borrowings at

fair value) 346,481 96.7p 329,532 91.9p

--------------------------------- -------- ---------- -------- ----------

The per share figures above are based on 358,149,200 (2022 -

358,687,671) ordinary shares of 2.5p, being the number of ordinary

shares in issue at the year end.

Net liquid assets

Net liquid assets comprise current assets less current

liabilities, excluding borrowings.

Discount/premium (APM)

As stockmarkets and share prices vary, an investment trust's

share price is rarely the same as its NAV. When the share price is

lower than the NAV it is said to be trading at a discount. The size

of the discount is calculated by subtracting the share price from

the NAV and is usually expressed as a percentage of the NAV. If the

share price is higher than the NAV, it is said to be trading at a

premium.

2023 2023 2022 2022

NAV (book) NAV (fair) NAV (book) NAV (fair)

-------------------- ----------- ----------- ----------- -----------

Closing NAV 91.4p 96.7p 86.5p 91.9p

Closing share price 83.6p 83.6p 79.5p 79.5p

--------------------- ----------- ----------- ----------- -----------

Discount 8.5% 13.6% 8.1% 13.5%

--------------------- ----------- ----------- ----------- -----------

Total return (APM)

The total return is the return to shareholders after reinvesting

the net dividend on the date that the share price goes

ex-dividend.

2023 2022

2023 Share 2022 Share

NAV price NAV price

--------------------------------- ----------- ------ ------ ------- -------

Closing NAV/share price (a) 96.7p 83.6p 91.9p 79.5p

Dividend adjustment factor* (b) 1.0286 1.0328 1.0024 1.0025

--------------------------------- ----------- ------ ------ ------- -------

(c) = (a)

Adjusted closing NAV/share price x (b) 99.5p 86.3p 92.1p 79.7p

--------------------------------- ----------- ------ ------ ------- -------

Opening NAV/share price (d) 91.9p 79.5p 154.5p 152.4p

--------------------------------- ----------- ------ ------ ------- -------

(c) ÷

Total return (d) -1 8.3% 8.6% (40.4%) (47.7%)

--------------------------------- ----------- ------ ------ ------- -------

* The dividend adjustment factor is calculated on the assumption

that the dividends of 0.7p and 2.20p (2022 - final dividend 0.35p)

paid by the Company during the year were reinvested into shares of

the Company at the cum income NAV/share price, as appropriate, at

the ex-dividend date.

The NAV (fair) total return for the period since Baillie Gifford

began managing the portfolio in November 2019 can be calculated

using the methodology shown in the table above and an opening NAV

of 93.7p, a dividend adjustment factor of 1.0585 and a closing NAV

of 96.7p.

Ongoing charges (APM)

The total expenses (excluding borrowing costs) incurred by the

Company as a percentage of the average net asset value with

borrowings at fair value. The ongoing charges have been calculated

on the basis prescribed by the Association of Investment

Companies.

A reconciliation from the expenses detailed in the Income

Statement is provided below.

2023 2022

------------------------------------------ ---- -------------- --------------

Investment management fee GBP1,770,000 GBP2,059,000

Other administrative expenses GBP564,000 GBP572,000

------------------------------------------ ---- -------------- --------------

Total expenses (a) GBP2,334,000 GBP2,631,000

------------------------------------------ ---- -------------- --------------

Average net asset value (with borrowings (b) GBP379,519,000 GBP439,950,000

deducted at fair value)

------------------------------------------ ---- -------------- --------------

Ongoing charges ((a) ÷ (b) expressed

as a percentage) 0.62% 0.60%

------------------------------------------------ -------------- --------------

Gearing (APM)

At its simplest, gearing is borrowing. Just like any other

public company, an investment trust can borrow money to invest in

additional investments for its portfolio. The effect of the

borrowing on shareholders' funds is called 'gearing'. If the

Company's assets grow, shareholders' funds grow proportionately

more because the debt remains the same. But if the value of the

Company's assets falls, the situation is reversed. Gearing can

therefore enhance performance in rising markets but can adversely

impact performance in falling markets.

Gearing is the Company's borrowings adjusted for cash and cash

equivalents expressed as a percentage of shareholders' funds.

Gross gearing is the Company's borrowings expressed as a

percentage of shareholders' funds.

Leverage (APM)

For the purposes of the Alternative Investment Fund Managers

(AIFM) Regulations, leverage is any method which increases the

Company's exposure, including the borrowing of cash and the use of

derivatives. It is expressed as a ratio between the Company's

exposure and its net asset value and can be calculated on a gross

and a commitment method. Under the gross method, exposure

represents the sum of the Company's positions after the deduction

of sterling cash balances, without taking into account any hedging

and netting arrangements.

Under the commitment method, exposure is calculated without the

deduction of sterling cash balances and after certain hedging and

netting positions are offset against each other.

Active share (APM)

Active share, a measure of how actively a portfolio is managed,

is the percentage of the portfolio that differs from its

comparative index. It is calculated by deducting from 100 the

percentage of the portfolio that overlaps with the comparative

index. An active share of 100 indicates no overlap with the index

and an active share of zero indicates a portfolio that tracks the

index.

-end-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BRBMTMTIBMPJ

(END) Dow Jones Newswires

November 17, 2023 02:00 ET (07:00 GMT)

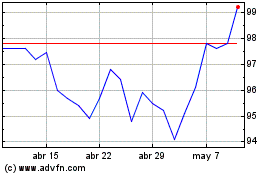

Baillie Gifford European... (LSE:BGEU)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Baillie Gifford European... (LSE:BGEU)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025