3rd Quarter Results

08 Abril 2002 - 11:32AM

UK Regulatory

RNS Number:2027U

Centamin Egypt Limited

8 April 2002

REPORT FOR QUARTER ENDED 31 MARCH 2002

HIGHLIGHTS

• Drill hole SDDH208 in the southern section of the RA zone,

(10625 N 10428E) intersected very strongly altered mineralised porphyry

virtually from the collar. The hole is almost horizontal, being drilled

to the east at -3 degrees (3 degrees below horizontal). At 67.27m depth

the hole entered a very strongly brecciated and veined zone which

continued for 10 metres and contained visible gold in the

diamond core. This zone is a repetition but stratigraphically higher,

"closer to the hanging wall" of the Sukari porphyry and in an area of the

resource currently classified as either inferred or waste.

This zone will be drilled in detail, as it could provide access to high

grade feed early in the development stage of Sukari, this would increase

the economics at the start up period of the project.

The core from hole SDDH208 is currently amongst the batch being prepared

for shipment to Australia for assaying.

• A major drilling program, utilizing 6 drilling rigs has commenced. The

program is designed to significantly increase the current reserve and to

provide the resource base for a 4 to 5 million tonne p.a. production

facility.

• Infill drilling continues to confirm that the AMUN Zone of the Sukari

porphyry is substantially mineralised. Further significant gold

intersections through the main mineralised zone include:-

114.2m @ 1.33g/t Au

21.0m @ 2.53g/t Au

4.0m @ 4.56g/t Au

15.0m @ 2.65g/t Au

10.0m @ 2.67g/t Au

41.0m @ 1.53g/t Au

1.0m @ 228.00g/t Au (Provisional subject to check assay).

• Feasibility Study review by SNC Lavalin continued.

• Legal Action COR350 of 1998 was dismissed in the Supreme Court of Western

Australia.

REVIEW OF OPERATIONS

• CORPORATE

• With the successful listing on the AIM market of the London Stock

Exchange, completed in December 2001, the board has now reviewed the

development plan for the Sukari project with the intention of developing the

Company into a substantial mining house.

• The current recoverable resource at Sukari is 1.7 million ounces which is

contained in less than 10% (by volume) of the mineralised system tested to

date, to a depth of 100m below the valley floor. The original plan was to

develop the Sukari project into a mining operation with a throughput of 2

million tonne per annum, producing approximately 130,000 ounces of gold per

year. Following the review it was decided to embark on an aggressive

drilling program, designed to at least double the current resources and

increase the Sukari operation to a much larger capacity of 5 million tonne

per annum, producing in excess of 300,000 ounces of gold per year. To

accelerate this development the company has increased the drilling fleet by

the addition of two large multi purpose rigs and one RC rig to bring the

total drilling fleet on site to 6 rigs. The Company has also increased its

field support facilities to enable speedy processing of the new data

generated.

The Company is also continuing to up-grade the 2 million tonne per annum

feasibility study to reduce the time required for a final study of a 5

million tonne per annum operation after the resource increase is

attained, planned for the third quarter period.

• Discussions are in progress with number of international banks, to develop

a financial package for the Sukari operation, this will run in coordination

with the project up-grade.

• Discussions are also in progress with number of financial institutions to

underwrite the Company's current listed and unlisted options. This will

provide additional working capital and provide the Company's equity

requirement for the Sukari development.

• On 25th March 02, Justice Templeman, in the Supreme Court of Western

Australia, dismissed the application brought against Sami El-Raghy, Michael

Kriewaldt, El-Raghy Kriewaldt, Nordana P/L, Pharaoh Gold Mines NL and

Centamin (respondents) by Mohamed El-Ansary and Barbara El-Ansary

(applicants).

Mohamed and Barbara El-Ansary contended that, Sami El-Raghy and Michael

Kriewaldt in their capacity as company directors of Pharaoh Gold Mines

NL and the associated companies, issued shares for the sole or

substantial purpose of diluting the shareholding of the applicants and

that the directors' conduct was accordingly oppressive, or unfairly

prejudicial to, or unfairly discriminatory against them.

Justice Templeman, accepting the evidence given on behalf of the

respondents dismissed the application. His Honour found that the conduct

of the directors in making the share placement complained of was, in all

the circumstances, commercially reasonable and not oppressive or

unfairly prejudicial or unfairly discriminatory against the applicants

(Mohamed and Barbara El-Ansary), having regard to ordinary standards of

reasonableness and fair dealing.

EXPLORATION AND DEVELOPMENT

Drilling:

The drilling programme now in progress is designed to at least double the

Sukari recoverable resource and to test continuation both to the surface and

along strike of the Hapi Shoot which returned high grade intersections

including 14.25m of 94.43 g/tonne, also testing for similar high grade

repetition.

One large Multi purpose rig, LMP 850 has started on line 10700mN. This rig

will drill a fan of RC (with diamond tail) holes on 50 metre sections moving

north through the RA zone. The three smaller diamond rigs will drill

horizontal and inclined holes both from the west and eastern boundaries of

the RA zone so as to give full coverage of each section. Drilling will be

down to the same level (100m below the valley floor) as drilled in the AMUN

Zone. Taking into consideration that the RA zone is at least four times the

width of the AMUN Zone, around 120m higher together with surface trenching

and mineralisation, the Company is confident that substantial resources will

be drilled out in this Zone.

The other large multi purpose rig LK600 has commenced drilling in the wadi

area on the western side of the Sukari hill to test the extension of AMUN

zone and the Hapi shoot. Due to coverage by unconsolidated valley sediments

it was previously impossible to drill in the wadi using the Company's small

diamond drill rigs. This rig will initially drill RC holes north to line 10

600mN on 25 and 50 metre traverses. The rig will also infill any gaps in the

traverses previously drilled, so as to up-grade the quality of the current

resource to predominantly a measured and indicated category. At the

completion of this program the rig will be moved to the eastern side of the

hill, to drill RC holes (with diamond tail) to infill sections of the AMUN

Zone between

10400mN and 10600mN.

The small RC rig will drill 50-60m deep holes to test the surface

mineralisation of the RA zone where trenching has outlined up to 400m in

width of mineralisation, at a considerably higher grade than the surface

mineralisation contained on the AMUN zone.

The Company has contracted a full time 'D8' dozer and rock breaker to

construct roads and drilling platforms over the rugged Sukari hill, this

will enable greater access along the traverses for the drill rigs and

support vehicles.

Drill holes currently in progress are listed in Table 1.

Table 1

Sukari Diamond Drilling

Holes SDDH 200 to SDDH 216

Hole Collars and Length

Hole Length Bearing Inclin'n North East RL

No m degrees degrees m m m

SDDH200 163.72 270 -70 10525.0 10570.0 1170.0

SDDH201A 43.52 270 -80 10450.0 10519.0 1160.0

SDDH201 222.12 270 -80 10450.0 10519.0 1160.0

SDDH202 283.55 270 -45 10575.0 10642.0 1189.0

SDDH203 301.92 270 -78 10475.0 10538.0 1163.0

SDDH204A 150.67 270 -55 10598.6 10618.8 1196.5

SDDH204 197.78 270 -55 10598.6 10618.8 1196.5

SDDH205 267.79 270 -60 10624.2 10606.4 1202.0

SDDH206 275.92 270 -60 10650.9 10618.4 1206.2

SDDH207 199.14 270 -25 10650.0 10618.0 1206.0

SDDH208 119.02 090 -03 10625.0 10428.0 1136.0

SRC209 100 00 -90 10000.0 9300.0 1070.0

SDDH210A 11.27 90 -01 10725.0 10335.0 1125.0

SDDH210 In Progress 90 -01 10725.0 10335.0 1125.0

SRC211 22 (Abd) 270 -60 9975.0 10525.0 1114.0

SDDH212 In Progress 270 -20 10600.0 10620.0 1197.0

SRC213 184 270 -60 10700.0 10582.0 1213.0

SDDH214 In Progress 90 -02 10650.0 10400.0 1139.0

SRC215 147.3 270 -80 10700.0 10582.0 1213.0

SDDH215 (Tail) In Progress 270 -80 Continuation of

SRC215

SRC216 In Progress 270 -60 9975.0 10475.0 1113.0

NOTE SDDH=Diamond Drill Hole, SRC=Reverse Circulation Drill

Hole, Abd=Abandoned. (Tail) denotes First section of hole is RC with

Diamond continuing from final RC Depth.

Bearing=Sukari grid (Grid north nominally 020degrees Magnetic)

Inclination=Below horizontal (-ve); Above horizontal (+ve)

RL=arbitrary 1100m at grid origin 10,000N 10,000E.

Drill hole SDDH208 in the southern section of the RA zone, (10625 N 10428E)

intersected very strongly altered mineralised porphyry virtually from the

collar. The hole is almost horizontal, being drilled to the east at -3

degrees (3 degrees below horizontal). At 67.27m depth the hole entered a

very strongly brecciated and veined zone which continued for 10 metres and

contained visible gold in the diamond core. This zone is a repetition but

stratigraphically higher, "closer to the hanging wall" of the Sukari

porphyry, it is part of the main structure of the AMUN zone, previously

mined in Pharaonic times. This zone will be drilled in detail, as it could

provide access to high grade feed early in the development stage of Sukari,

this would increase the economics at the start up period of the project.

The core from hole SDDH208 is currently amongst the batch being prepared for

shipment to Australia for assaying.

SIGNIFICANT ASSAYS RECEIVED DURING THE QUARTER

Hapi Shoot

A one metre assay of 228g/t was recorded in the provisional results from the

laboratory (check assays awaited). This assay was between 289-290m depth in

hole SDDH203, this hole is on traverse 10475N or 75m north of traverse

10400N. The intersection is at the correct depth and line of strike to

suggest that it may be an extension of the Hapi shoot.

Amun Zone

Significant assays received during the quarter are listed in table 2. The

whole of drill hole SDDH201 appears to be mineralized, the section of the

Sukari porphyry between 108m to the bottom of the hole at 222.2m, averaged

1.33g/t over 114.22m.

Table 2

Sukari Gold Mine

Selected Gold Assays

Diamond Drill Holes SDDH200 to SDDH 206

Drill Hole Intersection Grades From To

No. m g/t m m

SDDH200 24 1.18 122 146

(incl) 3 3.17 122 125

(incl) 3 2.22 141 144

5 1.36 153 158

SDDH201 4.25 2.22 75 79.25

11.25 2.51 82 93.25

(incl) 5 3.81 84 89

(incl) 1 6.30 85 86

114.2 1.33 108 222.2

(incl) 21 2.53 116 137

(incl) 3 9.18 119 122

19 1.98 149 168

(incl) 5 2.92 155 160

(incl) 1 7.11 163 164

11 2.57 178 189

(incl) 4 4.07 180 184

10 1.07 210 220

SDDH202 3 3.17 175 178

3 2.34 192 195

29 1.75 229 258

(incl) 4 4.56 232 236

SDDH203 15 2.65 86 101

(incl) 4 4.56 89 93

3 1.69 111 114

36 1.94 124 160

(incl) 10 2.67 135 145

6 1.47 166 172

41 1.53 248 289

(incl) 6 2.18 265 271

(incl) 4 2.27 274 278

(incl) 4 2.93 284 287

(Provisional)(Hapi) 1 228.0 289 290

SDDH204 Assays to come

SDDH205 Assays to come

SDDH206 11 1.79 178 179

(incl) 2 3.72 187 189

3 1.75 197 200

1 2.95 209 210

1 2.72 258 259

FEASIBILITY STUDY

SNC Lavalin has continued its review of the 2 million tonne p.a. Feasibility

Study.

The data generated from the accelerated drilling program will enable the

feasibility study to be upgraded to facilitate an increase from a 2 million

tonne per year to a 5 million tonne per year operation. The Company expects to

be in a position to commence construction early in 2003.

Australia:

No exploration or mining activities were carried out in Australia during the

quarter and none are expected to occur in the next quarter.

Yours faithfully

G B Speechly

Director

ASX Listing Rules 5.10 1

Information in this report which relates to exploration, geology, sampling and

drilling is based on information compiled by consulting geologist Mr M Kriewaldt

who is a corporate member of the Australasian Institute of Mining and Metallurgy

with more than five years experience in the fields of activity being reported on

and is not a full time employee of the Company. His written consent has been

received by the Company for this information to be included in this report in

the form and context which it appears. Mr Kriewaldt declares an interest in

shares of the Company.

Rule 5.3

Appendix 5B

Mining exploration entity quarterly report

Introduced 1/7/96. Origin: Appendix 8. Amended 1/7/97, 1/7/98, 30/9/

2001.

Name of entity

Centamin Egypt Limited

ABN Quarter ended ("current quarter")

86 007 700 352 31 March 2002

Consolidated statement of cash flows

Cash flows related to operating activities Current quarter Year to date

(...9....months)

$A'000

$A'000

1.1 Receipts from product sales and related debtors

1.2 Payments for:

(a) exploration and evaluation (1,571) (4,140)

(b) development

(c) production

(d) administration (264) (1,707)

1.3 Dividends received

1.4 Interest and other items of a similar nature 66 113

received

1.5 Interest and other costs of finance paid

1.6 Income taxes paid (16)

1.7 Other (provide details if material)

Net Operating Cash Flows (1,769) (5,750)

Cash flows related to investing activities

1.8 Payment for purchases of:

(a)prospects

(b)equity investments

(c) other fixed assets (35) (53)

1.9 Proceeds from sale of:

(a)prospects

(b)equity investments

(c)other fixed assets 1

1.10 Loans to other entities

1.11 Loans repaid by other entities

1.12 Other (provide details if material)

Net investing cash flows (35) (52)

1.13 Total operating and investing cash flows (carried (1,804) (5,802)

forward)

1.13 Total operating and investing cash flows (brought (1,804) (5,802)

forward)

Cash flows related to financing activities

1.14 Proceeds from issues of shares, options, etc. 7,750

1.15 Proceeds from sale of forfeited shares

1.16 Proceeds from borrowings

1.17 Repayment of borrowings

1.18 Dividends paid

1.19 Other (provide details if material)

Net financing cash flows 7,750

Net increase (decrease) in cash held (1,804) 1,948

1.20 Cash at beginning of quarter/year to date 6,769 3,060

1.21 Exchange rate adjustments to item 1.20 (319) (362)

1.22 Cash at end of quarter 4,646 4,646

Payments to directors of the entity and associates of the directors

Payments to related entities of the entity and associates of the related

entities

Current quarter

$A'000

1.23 Aggregate amount of payments to the parties included in item 1.2

87

1.24 Aggregate amount of loans to the parties included in item 1.10

1.25 Explanation necessary for an understanding of the transactions

(a) A Director of the Company, Mr. S. El-Raghy, is also a Director and

Shareholder of Nordana Pty Ltd ("Nordana"). Nordana provides

consulting and management services, including the provision of office

premises, to the Company and its subsidiaries. All dealings with

Nordana are in the ordinary course of business and on normal terms

and conditions. Fees paid to Nordana during the current quarter,

including reimbursement of expenditure, were $82,510 ($266,241 for

the year to date).

Mr. S. El-Raghy is also a Director and Shareholder of El-Raghy

Kriewaldt Pty Ltd ("El-Raghy Kriewaldt"). El-Raghy Kriewaldt took

over the provision of office premises to the Company from 1

(b) March 2002. All dealings with El-Raghy Kriewaldt are in the ordinary

course of business and on normal terms and conditions. Fees paid to

El-Raghy Kriewaldt during the current quarter amounted to

$4,000 ($4,000 for the year to date).

Directors Fees

(c) Directors fees and superannuation paid during the quarter were

$20,250 ($65,875 for the year to date).

Audit Committee

The Company does not have a formally constituted Audit Committee of

the Board of Directors.

(d)

Non-cash financing and investing activities

2.1 Details of financing and investing transactions which have had a

material effect on consolidated assets and liabilities but did not

involve cash flows

Nil

2.2 Details of outlays made by other entities to establish or increase

their share in projects in which the reporting entity has an interest

Financing facilities available

Add notes as necessary for an understanding of the position.

Amount available Amount used

$A'000 $A'000

3.1 Loan facilities *NOTE 937 Nil

3.2 Credit standby arrangements

*NOTE: This facility is with MI Bank in Egypt for US$.5 million and may only be

drawn on if the equivalent amount of the draw-down is provided by way of

security.

Estimated cash outflows for next quarter

$A'000

4.1 Exploration and evaluation 1,200

4.2 Development

Total 1,200

Reconciliation of cash

Reconciliation of cash at the end of the quarter (as Current quarter Previous quarter

shown in the consolidated statement of cash flows) to the

related items in the accounts is as follows. $A'000 $A'000

5.1 Cash on hand and at bank (8) 982

5.2 Deposits at call -

5.3 Bank overdraft -

5.4 Other (term deposits) 4,654 5,787

Total: cash at end of quarter (item 1.22) 4,646 6,769

Changes in interests in mining tenements

Tenement Nature of interest Interest at Interest at

reference beginning of end of quarter

(note (2)) quarter

6.1 Interests in mining

tenements relinquished,

reduced or lapsed

6.2 Interests in mining

tenements acquired or

increased

Issued and quoted securities at end of current quarter

Description includes rate of interest and any redemption or conversion rights

together with prices and dates.

Total number Number quoted Issue price per Amount paid up per

security (see note security (see note 3)

3) (cents) (cents)

7.1 Preference +securities

(description)

7.2 Changes during quarter

(a) Increases through

issues

(b) Decreases through

returns of capital,

buy-backs, redemptions

7.3 +Ordinary securities 357,950,949 357,950,949

7.4 Changes during quarter

(a) Increases through

issues

(b) Decreases through

returns of capital,

buy-backs

7.5 +Convertible debt

securities (description)

7.6 Changes during quarter

(a) Increases through

issues

(b) Decreases through

securities matured,

converted

7.7 Options (description and Exercise price Expiry date

conversion factor)

7,700,000 Nil 20c 30.11.2002

113,679,293 113,679,293 20c 03.03.2003

49,999,744 Nil 20c 09.11.2003

7.8 Issued during quarter

7.9 Exercised during quarter

7.10 Expired during quarter

7.11 Debentures

(totals only)

7.12 Unsecured notes (totals

only)

Compliance statement

1 This statement has been prepared under accounting policies which comply

with accounting standards as defined in the Corporations Act or other

standards acceptable to ASX (see note 4).

2 This statement does give a true and fair view of the matters disclosed.

Sign here: ......................... Date:............................

(Director)

Print name: G.B. Speechly................

Notes

1 The quarterly report provides a basis for informing the market how the

entity's activities have been financed for the past quarter and the

effect on its cash position. An entity wanting to disclose additional

information is encouraged to do so, in a note or notes attached to this

report.

2 The "Nature of interest" (items 6.1 and 6.2) includes options in respect

of interests in mining tenements acquired, exercised or lapsed during the

reporting period. If the entity is involved in a joint venture agreement

and there are conditions precedent which will change its percentage

interest in a mining tenement, it should disclose the change of

percentage interest and conditions precedent in the list required for

items 6.1 and 6.2.

3 Issued and quoted securities The issue price and amount paid up is not

required in items 7.1 and 7.3 for fully paid securities.

4 The definitions in, and provisions of, AASB 1022: Accounting for

Extractive Industries and AASB 1026: Statement of Cash Flows apply to

this report.

5 Accounting Standards ASX will accept, for example, the use of

International Accounting Standards for foreign entities. If the standards

used do not address a topic, the Australian standard on that topic (if

any) must be complied with.

== == == == ==

This information is provided by RNS

The company news service from the London Stock Exchange

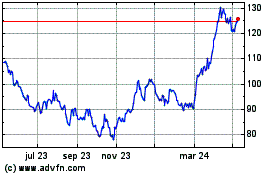

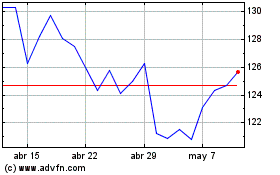

Centamin (LSE:CEY)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Centamin (LSE:CEY)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024