TIDMCLIG

RNS Number : 0556C

City of London Investment Group PLC

18 February 2022

18th February 2022

CITY OF LONDON INVESTMENT GROUP PLC

("City of London", "the Group" or "the Company")

HALF YEAR RESULTS TO 31ST DECEMBER 2021

City of London (LSE: CLIG) announces that it has today made

available on its website, https://www.clig.com/ , the Half Year

Report and Financial Statements for the six months ended 31st

December 2021.

The above document has been uploaded to the National Storage

Mechanism, in accordance with Listing Rule 9.6.1 R, and will

shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

HALF YEAR SUMMARY

- Funds under Management (FuM) of US$11.1 billion (GBP8.2

billion) at 31st December 2021. This compares with US$11.4

billion (GBP8.3 billion) at the beginning of this financial

year on 1st July 2021 and US$10.9 billion (GBP8.0 billion)

at 31st December 2020.

- FuM at 31st January 2022 of US$10.8 billion (GBP8.0 billion)

- Net fee income representing the Group's management fees

on FuM was GBP29.8 million (31st December 2020: GBP22.6

million)

- Underlying profit before tax* was GBP15.5 million (31st

December 2020: GBP11.2 million). Profit before tax was

GBP13.6 million (31st December 2020: GBP8.8 million)

- Maintained interim dividend of 11p per share (31st December

2020: 11p) payable on 25th March 2022 to shareholders

on the register on 25th February 2022

- Special dividend of 13.5p per share (31st December 2020:

nil) payable on 25th March 2022 to shareholders on the

register on 25th February 2022

*This is an Alternative Performance Measure (APM). Please

refer to the CEO review for more details on APMs.

For access to the full interim report, please follow the link

below:

http://www.rns-pdf.londonstockexchange.com/rns/0556C_1-2022-2-17.pdf

This release includes forward-looking statements, which may

differ from actual results. Any forward-looking statements are

based on certain factors and assumptions, which may prove

incorrect, and are subject to risks, uncertainties and assumptions

relating to future events, the Group's operations, results of

operations, growth strategy and liquidity.

For further information, please visit www.clig.co.uk or

contact:

Tom Griffith, CEO

City of London Investment Group PLC

Tel: 001-610-380-0435

Martin Green

Zeus Capital Limited

Financial Adviser & Broker

Tel: +44 (0)20 3829 5000

CHAIR'S STATEMENT

The familiar refrain that "it ain't over, till it's over" has

often been used in connection with sporting contests but the events

of recent months show that it has at least equal validity to global

pandemics. Just as the world was recovering some level of normality

in the autumn of 2021, courtesy of a global vaccination campaign

that now totals 10.4 billion doses, the Omicron variant brought

that progress to an abrupt but temporary halt in the closing weeks

of the year. The good news for investors is that markets have

become less "COVID-sensitive" with each wave recognising perhaps

that, over time, vaccine-led herd immunity will outweigh any risk

of a return to the extreme social disruption of the last two

years.

While the ripple effects of the pandemic will continue to

reverberate for some time, particularly in relation to supply chain

bottlenecks, equity markets are increasingly directing their focus

back to the more traditional issues of growth, inflation, monetary

policy and geopolitics, each of which present potential challenges

in 2022. Meanwhile, as CEO Tom Griffith explains in his report,

both CLIG operating subsidiaries have continued to navigate the

challenges posed by on/off remote working requirements with full

functionality and, on behalf of your Board, I would like to extend

our sincere thanks once again to our hard-working employees across

all the offices.

Assets and performance

Funds under Management (FuM) fell by 2.6% in the six months

ended 31st December 2021 to US$11.1 billion due to mixed conditions

across the Group's products but were still 2% ahead of the

comparable figure at the end of 2020. Although the more defensive,

value-driven characteristics of closed-end funds (CEFs) provided

positive attribution for the Emerging Markets (EM) strategy in the

half year, the 23% fall in Chinese equities, which accounts for

around one-third of the index, proved a major drag on both the

benchmark and FuM, with an 11% fall over the period to US$4.8

billion. Despite lacklustre markets in the International strategy,

this product has continued to attract impressive inflows. The

strategy FuM stands at US$2.1 billion, a 14.2% increase in FuM as

compared to 30th June 2021 and a 26.3% increase in FuM as compared

to 31st December 2020. While the aggregate FuM numbers at CLIM were

little changed over the half-year period at US$7.2 billion, each of

the major strategies recorded robust outperformance against their

respective benchmarks. Looking forward, the combination of this

strong relative performance and an ability to re-commence

face-to-face meetings with clients and consultants are anticipated

to translate into further inflows in the coming months.

KIM's FuM grew by c.1% to US$3.9 billion as compared to 30th

June 2021 despite the normal seasonal withdrawals that arise in the

final weeks of the calendar year. In comparison with 31st December

2020, however, FuM was 7% higher, thanks mainly to very strong

relative performance, particularly in the dominant fixed income

space. The issuance of approximately 250 Special Purpose

Acquisition Companies (SPACs), represents an addition of US$54

billion to KIM's investable universe. SPACs can offer a fixed

income return profile with lower risk, and potential for upside.

Pre-merger SPAC investments were an important contributor to

returns for KIM in the first half of the financial year. With c.60%

of KIM's assets invested in fixed income securities, it is very

encouraging to note that they have been able to show strong

performance through a period of rising inflation and interest rate

expectations and this bodes well for both client retention and new

business potential in the coming year.

Results

For CLIG, the six months ended December 2021 showed solid

progress and it was pleasing to see the positive impact of the

merger with KIM in terms of both profits and earnings per share

(EPS). Profit before tax for the six months to 31st December 2021

was GBP13.6 million (31st December 2020: GBP8.8 million). Following

previous practice, I will comment on our results by reference to an

Alternative Performance Measure (APM) of "Underlying" profits and

EPS, which exclude exceptional or non-recurring items, as we

believe that these provide shareholders with a more accurate

measure of the Group's financial performance.

Underlying profit before tax of GBP15.5 million was 38.4% up on

the equivalent period of 2020, but this figure translates to a 7.8%

gain when adjusted for the limited three-month contribution from

KIM in the previous period. KIM's underlying profit before tax of

GBP6.9 million was marginally ahead of the previous period on a

comparable basis, having absorbed increased costs associated with

upgrades to KIM's operating infrastructure. The 11% increase in

CLIM's contribution to GBP8.6 million owes much to the buoyancy of

global equity markets in the early months of 2021, which partially

reversed in the EM space in the second half of calendar year 2021.

The combination of a 10% fall in the MXEF EM index coupled with a

3% rise in the average rate for sterling (vs. US$) in the six

months to 31st December 2021 pared growth somewhat but, pleasingly,

the blended net fee margin across both operating subsidiaries

remained steady at an average rate of 74 bps. Diluted EPS for the

first half of the financial year was 21.2p per share on a statutory

basis, while underlying EPS rose 3% to 24.1p (2020: 23.4p) on a

fully diluted basis.

Dividends

Inflationary pressures and a near-term tapering of quantitative

easing signal a clear tightening bias from Central Banks and,

mindful that economic activity remains "COVID-constrained" in many

countries, the outlook for global equities is far from assured in

2022. Against this uncertain background, your Board has declared an

unchanged interim dividend of 11p per share, a level which leaves a

small degree of "headroom" within the stated dividend cover policy

of 1.2/1 over a rolling five-year period. At the same time, the

Board is conscious that any accumulation of capital over and above

that which is needed for capital investment, regulatory

requirements and a prudential cash buffer should be returned to

shareholders. Accordingly, the Board has also declared a special

dividend of 13.5p per share, making this the second such special

distribution in the last three years. Both dividends will be paid

on 25th March 2022 to those shareholders registered at the close of

business on 25th February 2022.

The Board

There were no changes to the Board's membership during the

half-year period. However, as acknowledged in our 2021 Annual

Report & Accounts, compliance with the UK Corporate Governance

Code in respect of independence, together with upcoming rules

concerning diversity and inclusion, will necessitate significant

changes to the Board's composition going forward. Following a

thorough review of these issues, later this year we will present

shareholders with a road map towards compliance, recognising the

need to reconcile an appropriate level of continuity with adherence

to our governance obligations as a UK-listed entity.

ESG

The proposed changes to the Board composition, referred to

above, form only part of CLIG's commitment to address ESG

challenges both within the business and in the wider communities in

which we operate. While many of the criteria being codified to

measure ESG performance have been a natural part of our culture

over many years, it is important for us to record our "ESG modus

operandi" in a more formal way in order to apprise shareholders of

our ongoing commitment to good governance. To that end, our website

has been updated with an Anti-Slavery statement and regular

engagement meetings between employees and independent Directors

have been established on a rotational basis. Increased emphasis on

employee training and initiatives to prioritise diversity and

inclusion through each layer of the business also form part of this

process. CLIG is firmly committed to the goal of high attainment in

the ESG sphere.

Outlook

As mentioned earlier, global markets will be confronted this

year with progressive reductions in monetary stimulus as pandemic

support measures are gradually withdrawn and this is likely to

create headwinds for both equity and debt markets. Indeed,

benchmarks such as the tech-heavy NASDAQ, which rose by c.130% in

the 20 months to November 2021, have appeared more vulnerable to a

correction recently with a 9% fall over the last two months. While

international equity markets may be less vulnerable to these tech

valuation bubbles, the tapering of monetary support, ongoing supply

disruptions and geopolitical tensions each have the capacity to

destabilise markets in the months ahead and point to the need for a

cautious stance. Within the EM space, China will continue to exert

a strong influence and the recent tightening of the regulatory

environment, coupled with large-scale mobility restrictions arising

from China's zero-tolerance COVID policy will constrain both the

pace and timing of an economic recovery.

It is now 15 months since the merger with KIM and we believe

that the results during this period demonstrate the benefits of a

more diversified revenue base in terms of both clients and market

segments. Thus, despite the clear challenges ahead, we remain

optimistic that the value-driven characteristics of CEFs, supported

by a macro-economic research focus, will continue to offer enhanced

relative performance for our clients and shareholders over the

longer term.

Barry Aling

Chair

17th February 2022

CHIEF EXECUTIVE OFFICER'S REVIEW

Diversification

Diversification has been a long-standing theme in our reports

over many years in recognition of the need to expand our product

offerings, opportunities for employees and our revenue stream.

Whilst our unique focus on closed-end funds (CEFs) has enabled us

to deliver relative outperformance against a relevant benchmark to

our clients over multiple investment cycles, capacity limitations

in the CEF universe of available securities have constrained

growth.

Our approach to this constraint for CLIM has been to apply our

team's expertise in CEFs to additional market segments. Sustained

CLIM diversification has reached a major milestone over the period

with CLIM's International Equity strategy (INTL) surpassing US$2

billion in Funds under Management (FuM) representing 30% of CLIM

FuM as of 31st December 2021. As many of our shareholders will

recognise, this "overnight success" has taken over a decade to

achieve and was only possible as a result of the relentless efforts

of the INTL team. Reaching this milestone is a reflection of the

hard work by many of our colleagues along with the patience of

shareholders.

Further, and as a result of top quartile relative performance of

the INTL strategy, clients and consultants have shown interest in a

Global product, to offer exposure to US and non-US equities. In

December 2021, a new product managed by the INTL team was seeded

with US$2.5 million, which we expect will attract client assets

over the next two years.

We refer to the second part of our diversification efforts as

CLIG diversification. As indicated in our most recent annual

report, the evolution of your company featured the merger with

Karpus Investment Management (KIM) in the prior financial year

which progressed our diversification efforts.

We have expanded our reporting in the below table from previous

reporting periods to include both the percentage of FuM for CLIM

& KIM strategies along with the percentage of FuM for CLIG.

This further breakdown of reporting provides shareholders with an

additional data point to follow our diversification efforts,

inclusive of the relative growth of the CLIM INTL strategy

mentioned previously, over the past five years.

FuM flows

Although CLIM's net client flows remain negative for the

financial year to date to 31st December 2021 at (US$58.7 million)

we have seen this recent trend over the past several quarters begin

to reverse. Quarterly inflows increased to US$311 million in the

second quarter of the financial year relative to US$123.8 million

in the first quarter of the financial year, while outflows reduced

to (US$198.5 million) from (US$295 million) respectively.

CLIG - FUM by line of business (US$m)

CLIM 30 Jun 30 Jun 30 Jun 30 Jun 2021 31 Dec 2021

2018 2019 2020

--------------- ---------------- ---------------- ------------------------- -------------------------

US$m % US$m % US$m % US$m % % US$m % %

of of of of of of of

CLIM CLIM CLIM CLIM CLIG CLIM CLIG

total* total* total* total total total total

------ ------ -------- ------ -------- ------- ------- ------- ------- ------- -------

Emerging

Markets 4,207 83% 4,221 78% 3,828 69% 5,393 72% 47% 4,800 67% 43%

------ ------- ------ -------- ------ -------- ------- ------- ------- ------- ------- -------

International 480 9% 729 14% 1,244 23% 1,880 25% 17% 2,147 30% 19%

------ ------- ------ -------- ------ -------- ------- ------- ------- ------- ------- -------

Opportunistic

Value 174 3% 233 4% 256 5% 231 3% 2% 232 3% 2%

------ ------- ------ -------- ------ -------- ------- ------- ------- ------- ------- -------

Frontier 245 5% 206 4% 175 3% 13 0% 0% 10 0% 0%

------ ------- ------ -------- ------ -------- ------- ------- ------- ------- ------- -------

Other/REIT 1 0% 7 0% 9 0% 13 0% 0% 12 0% 0%

------ ------- ------ -------- ------ -------- ------- ------- ------- ------- ------- -------

CLIM total 5,107 100% 5,396 100% 5,512 100% 7,530 100% 66% 7,201 100% 64%

------ ------- ------ -------- ------ -------- ------- ------- ------- ------- ------- -------

KIM 30 Jun 30 Jun 30 Jun 30 Jun 2021 31 Dec 2021

2018 2019 2020

--------------- ---------------- ---------------- ------------------------- -------------------------

US$m % US$m % US$m % US$m % % US$m % %

of of of of of of of

KIM KIM KIM KIM CLIG KIM CLIG

total* total* total* total total total total

------ ------- ------ -------- ------ -------- ------- ------- ------- ------- ------- -------

Retail 2,098 67% 2,291 67% 2,401 69% 2,804 72% 24% 2,830 72% 26%

Institutional 1,019 33% 1,105 33% 1,087 31% 1,115 28% 10% 1,119 28% 10%

------ ------- ------ -------- ------ -------- ------- ------- ------- ------- ------- -------

KIM total 3,117 100% 3,396 100% 3,488 100% 3,919 100% 34% 3,949 100% 36%

------ ------- ------ -------- ------ -------- ------- ------- ------- ------- ------- -------

CLIG total 11,449 100% 11,150 100%

---------------- ------ ------- ------ -------- ------ -------- ------- ------- ------- ------- ------- -------

*Pre-merger

Net investment flows (US$000's)

CLIM FYE Jun FYE Jun FYE Jun FYE Jun FY 2022,

2018 2019 2020 2021 as of Dec

2021

---------------------- ----------- ---------- ---------- ---------- -----------

Emerging Markets (215,083) (183,521) (279,459) (275,493) (279,104)

International 279,394 252,883 551,102 (14,145) 231,705

Opportunistic

Value 54,251 48,236 45,914 (102,663) (6,700)

Frontier 67,000 (21,336) 16,178 (168,843) (4,575)

REIT - 6,000 4,600 - -

---------------------- ----------- ---------- ---------- ---------- -----------

CLIM total 185,562 102,262 338,335 (561,144) (58,674)

---------------------- ----------- ---------- ---------- ---------- -----------

KIM FYE Jun FYE Jun FYE Jun FYE Jun FY 2022,

2018 2019 2020 2021* as of Dec

2021

---------------------- ----------- ---------- ---------- ---------- -----------

Retail 46,550 33,701 26,323 (104,222) (34,452)

Institutional (107,410) 9,050 (67,087) (130,911) (19,033)

---------------------- ----------- ---------- ---------- ---------- -----------

KIM total (60,860) 42,751 (40,764) (235,133) (53,485)

---------------------- ----------- ---------- ---------- ---------- -----------

*Includes net investment flows for Retail - (24,407) and Institutional

- (20,264) pertaining to period before 1st October 2020 (pre-merger).

The above shift resulted from increased CLIM marketing efforts

in calendar year 2021 that began to turn the tide of flows positive

in the second quarter of this financial year with US$112.5 million

of net inflows. Re-opening our INTL strategy to new investors

contributed significantly to net inflows after being closed to new

investors for the year to December 2020 following a period of

strong growth. Currently, we are projecting this positive trend of

net inflows to continue through the remainder of the financial

year.

A handful of CLIM clients in the past six months transferred

their account balance from the Emerging Market (EM) strategy to the

INTL strategy, illustrating another positive effect of CLIM

diversification. Whilst the EM equity asset class may be out of

favour, client assets remained at CLIM. Year-end tax planning led

to outflows from the KIM strategies.

Both CLIM and KIM remain constrained by clients and prospects

limiting their access via in-person marketing; we believe in-person

marketing and client discussions are a strength of both operating

subsidiaries, as investment management remains a

relationship-driven business. With this said, we are prepared

moving forward with the ability to provide in-person or virtual

meetings with clients, consultants and prospective clients

depending on their preference.

Relative investment performance at both CLIM and KIM was strong

during the six months ending 31st December 2021 and for calendar

year 2021. All strategies with impactful FuM at both CLIM and KIM

outperformed their respective benchmarks in calendar year 2021.

These strong returns should buoy marketing efforts in 2022. On the

downside, the underperformance of EM equities over the past six

months compared to other asset classes did weigh on the ability for

CLIM's FuM to grow during what otherwise was a strong equity rally,

in particular in US equities.

Business integration

While the investment personnel at each subsidiary remain

separate and distinct, there is ongoing integration of

non-investment management resources to allow for both subsidiaries

to benefit from the experience and expertise of colleagues. Both

CLIM and KIM have strong brands and reputations in the United

States, and operational teams who support the investment personnel

are being leveraged to work together.

Information Technology (IT) infrastructure integration is

ongoing, linking the two networks together and allowing for

failover and other synergies to exist. We expect this

infrastructure integration to be complete by financial year end at

the latest. Additionally, when acting on behalf of the larger,

combined entity, there are economies of scale available with IT

vendors and contracts for services required by both operating

subsidiaries.

CLIM Dubai office

CLIM's Dubai office opened in 2007 to allow CLIM to research

investment opportunities in the region as well as to increase the

Group's visibility in the area. As a number of frontier

(pre-emerging) markets were in the region, the office was staffed

by two employees to conduct research on the underlying portfolio

investments and was critical to the initial development and

marketing of the CLIM Frontier strategy. At that time, the weight

of the Middle Eastern markets was approximately 12% and 70% of the

EM and Frontier equity indices respectively, but are now in the

single digits. As a result of the shift in markets that make up the

frontier indices from the Middle East and Africa to Asia, we are

letting the Dubai office lease expire in March 2022. One employee

from the Dubai office has already transferred to CLIM's office in

Pennsylvania, while the remaining employee will end his tenure with

CLIM in March after taking the necessary steps with regulators,

local authorities and vendors to close the office.

Financial results

Group FuM as at 31st December 2021 was US$11.1 billion (GBP8.2

billion). Net fee income currently accrues at a weighted average

rate of approximately 74 basis points of FuM. The Group's net fee

income for the six months ended 31st December 2021 was GBP29.8

million, with GBP10.9 million coming from KIM (31st December 2020:

GBP22.6 million, with GBP5.1 million coming from KIM for the three

months ended 31st December 2020).

Profit before tax for the six months ended 31st December 2021

increased to GBP13.6 million (31st December 2020: GBP8.8 million).

EPS increased by 21% to 21.5p per share for the six months ended

31st December 2021 from 17.7p per share for the six months ended

31st December 2020.

Currency exposure

The Group's revenue is almost entirely US dollar based whilst

its costs are incurred in US dollars, sterling, and to a lesser

degree Singapore dollars and UAE dirhams (which will no longer be

applicable after 31st March 2022). The following table aims to

illustrate the effect of a change in the US dollar/sterling

exchange rate on the Group's post-tax profits at various FuM

levels, based on the assumptions given, which are a close

approximation of the Group's current operating parameters. It is

evident that a stronger US dollar increases sterling post-tax

profits, whilst a weaker US dollar causes the opposite. During the

six months ended 31st December 2021, the average FX rate was

1.3612, with a closing FX rate of 1.3532 as compared to the average

FX rate of 1.3219 for the six months ended 31st December 2020 and a

closing FX rate of 1.367 as 31st December 2020.

FX/Post-tax profit

matrix

Illustration of US$/GBP

rate effect:

-------------------------------------- -------------- ----------- -------- ---------

FuM US$bn: 9.3 10.2 11.1 11.7 12.2

----------- -------------- ----------- -------- ---------

US$/GBP Post-tax, GBPm

-------------------------------------------------------------

1.26 16.6 19.5 22.5 24.4 26.2

1.31 15.7 18.5 21.4 23.2 24.9

1.36 14.9 17.6 20.3 22.1 23.8

1.41 14.1 16.7 19.4 21.0 22.7

1.46 13.4 15.9 18.5 20.1 21.7

----------- -------------- ----------- -------- ---------

Assumptions: CLIM KIM

-------------------------------------- ------------------------------------- ---------

1. Average net fee 72bps 76bps

2. Annual operating GBP6.7m plus US$8.5m plus S$0.6m US$8.3m

costs (GBP1 = S$1.82)

3. Average tax 21% 24%

4. Amortisation of intangible GBP3m per annum

Note: The above table is intended to illustrate the approximate

impact of movement in US$/GBP, given an assumed set of trading

conditions. It is not intended to be interpreted or used as

a profit forecast.

Cash and dividends

The CLIG Board reviews its cash position and overall

distribution policy on a regular basis and believes that our policy

of a rolling five year dividend cover of 1.2x remains appropriate.

Our cash position has grown to GBP24.5 million at calendar year end

in addition to the seed investments of GBP6.1 million (including

GBP4.0 million in REITs and GBP1.9 million in the Global product

funded in December 2021). After considering the alternatives for

returning a portion of this cash to shareholders, the Board has

announced an interim dividend of 11p per share in line with last

year amounting to c.GBP5.4 million and a 13.5p special dividend

amounting to c.GBP6.6 million.

The first special dividend was paid to shareholders in March

2019, which was 13 years from our original listing date. This

second special dividend comes a relatively short three years later

due to strong cash generation and was made possible by the support

and patience of our shareholders through the recent merger and

other diversification efforts. After both the interim and special

dividend, and inclusive of seed investments, the Group meets

regulatory and statutory requirements with significant operating

capital. The option of increasing the final dividend at year end,

dependent upon market conditions, remains open.

Dividend cover chart

We have provided an illustrative framework which we update twice

a year to enable shareholders and other interested parties to

calculate our post-tax profits based upon some key assumptions.

This dividend cover chart can be found on our website at

https://www.clig.com/dividend-cover.php, and is also shown on page

10 of our interim accounts, and shows the quarterly estimated cost

of a maintained dividend against actual post-tax profits for last

year, the current six months ended 31st December 2021 and the

assumed post-tax profit for the six months ended 30th June 2022 and

the next financial year based upon assumptions included in the

chart.

Alternative Performance Measures

The Directors use the following Alternative Performance Measures

(APMs) to evaluate the performance of the Group as a whole:

Underlying profit before tax - Profit before tax, adjusted for

gain/loss on investments, acquisition-related costs and

amortisation of acquired intangibles. This provides a measure of

the profitability of the Group for management's

decision-making.

Underlying earnings per share - Underlying profit before tax,

adjusted for tax as per income statement, tax effect of adjustments

and non-controlling interest, divided by the weighted average

number of shares in issue as at the period end. Refer to note 4 in

the interim financial statements for reconciliation.

Alternative Performance Measures

Underlying profit and profit before Six months Six months Year ended

tax ended Dec ended Dec Jun 21

21 20

-------------------------------------

GBP GBP GBP

------------------------------------- ------------ ------------ ------------

Net fee income 29,839,500 22,599,770 52,450,936

Administrative expenses (14,282,692) (11,355,646) (25,631,432)

Net interest paid (72,107) (54,479) (117,063)

------------------------------------- ------------ ------------ ------------

Underlying profit before tax 15,484,701 11,189,645 26,702,441

------------------------------------- ------------ ------------ ------------

(Deduct)/add back:

(Loss)/gain on investments (33,142) 454,278 540,172

Acquisition-related costs - (1,743,424) (1,743,424)

Amortisation on acquired intangibles (1,876,979) (1,083,395) (3,250,185)

------------------------------------- ------------ ------------ ------------

Profit before tax 13,574,580 8,817,104 22,249,004

------------------------------------- ------------ ------------ ------------

Cybersecurity update

In order to counter evolving cybersecurity threats, the Group

has recently engaged an external vendor to assess our overall

program's operating effectiveness, identify gaps and recommend

enhancements.

All employees will continue to receive training on a variety of

cybersecurity topics throughout the year. We are also expanding the

Diversity/Equality/Inclusion training provided in 2021 to include

additional related topics.

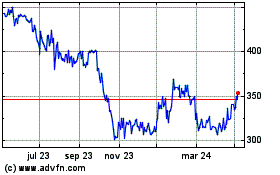

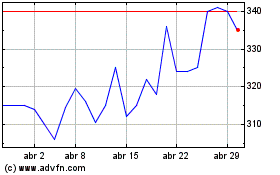

CLIG KPI

As noted in the 2021 Annual Report and Accounts, due to the

continued diversification of CLIG's business away from CLIM's core

EM strategy, the comparison to MXEF (MSCI EM Index) as a Key

Performance Indicator (KPI) is no longer relevant. We retain the

share price KPI to show the total return of CLIG over a market

cycle. The goal of this KPI is for the total return (share price

plus dividends) to compound annually in a range of 7.5% to 12.5%

over a five-year period. This KPI is meant to stretch the

management team, without incentivising managers to take undue

levels of risk.

For the five years ended 31st December 2021, CLIG's cumulative

total return was 108.7%, or 15.8% annualised, which exceeded the

KPI by 3.3 percentage points on an annualised basis. Since listing

in April 2006, the annualised return of a CLIG share is 14.4%. All

values are sourced from Bloomberg.

CLIG outlook

Efforts to diversify from CLIM's EM-centric strategy via

development of the INTL strategy proved timely with the

underperformance of EM equities over the past five years relative

to other equity asset classes. We believe that ongoing growth via

diversification, including the merger with KIM, will continue to

benefit all stakeholders by reducing the volatility of earnings and

broadening our client base. The support of our stakeholders is

appreciated as we continue to grow the combined business.

We remain guided in our decision-making by considering the best

interests of our three major stakeholders - Clients, Employees, and

Shareholders. We operate in a global market environment which

remains volatile. Investors are concerned by a variety of factors

including inflationary pressures, the response of central banks,

geopolitical risks and the ongoing nature of the pandemic.

Nevertheless, our continued strong cash position, while allowing

for the payment of a special dividend, maintains a margin of safety

for the Group in the face of any sustained downturn in markets and

FuM.

Additionally, the efforts of our colleagues at both CLIM and KIM

during another challenging six-month period is a key

differentiator. They remain committed to the business and their

responsibilities in the face of ongoing volatility and uncertainty

caused by the ongoing pandemic. The Group has largely been spared

from the impact of "The Great Resignation", and we hope that our

colleagues continue to feel supported and valued, while also

recognising the impact and contribution of their hard work being

reflected in the strong position of the larger Group. Their

attitude, perseverance, and determination are the engine room that

continue to drive this Group forward.

Tom Griffith

Chief Executive Officer

17th February 2022

CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHSED 31ST DECEMBER 2021

Six months Six months

ended ended Year ended

31st Dec 31st Dec 30th June

2021 2020 2021

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

================================== ==== ============ ============ ============

Revenue

Gross fee income 2 31,444,729 23,733,759 55,123,274

Commissions payable (782,728) (358,662) (1,100,708)

Custody fees payable (822,501) (775,327) (1,571,630)

================================== ==== ============ ============ ============

Net fee income 29,839,500 22,599,770 52,450,936

================================== ==== ============ ============ ============

Administrative expenses

Employee costs 11,162,624 8,853,182 20,045,406

Other administrative

expenses 2,767,044 2,139,428 4,866,625

Depreciation and amortisation 2,230,003 1,446,431 3,969,586

================================== ==== ============ ============ ============

(16,159,671) (12,439,041) (28,881,617)

Operating profit before

exceptional item 13,679,829 10,160,729 23,569,319

Exceptional item

Acquisition-related costs - (1,743,424) (1,743,424)

================================== ==== ============ ============ ============

Operating profit 13,679,829 8,417,305 21,825,895

================================== ==== ============ ============ ============

Net interest (payable)/receivable

and similar (losses)/gains 3 (105,249) 399,799 423,109

================================== ==== ============ ============ ============

Profit before taxation 13,574,580 8,817,104 22,249,004

Income tax expense (3,021,473) (2,241,835) (5,258,486)

================================== ==== ============ ============ ============

Profit for the period 10,553,107 6,575,269 16,990,518

================================== ==== ============ ============ ============

Profit attributable to:

Non-controlling interests (4,093) 12,330 19,285

Equity shareholders of

the parent 10,557,200 6,562,939 16,971,233

================================== ==== ============ ============ ============

Basic earnings per share 4 21.5p 17.7p 39.4p

================================== ==== ============ ============ ============

Diluted earnings per

share 4 21.2p 17.4p 38.8p

================================== ==== ============ ============ ============

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 31ST DECEMBER 2021

Six months Six months

ended ended Year ended

==================================

31st Dec 31st Dec 30th June

2021 2020 2021

==================================

(unaudited) (unaudited) (audited)

GBP GBP GBP

================================== ============ =========== ============

Profit for the period 10,553,107 6,575,269 16,990,518

Other comprehensive income:

Items that may be subsequently

reclassified to income statement

Foreign currency translation

difference 2,064,275 (175,923) (6,675,136)

---------------------------------- ------------ ----------- ------------

Total comprehensive income

for the period 12,617,382 6,399,346 10,315,382

================================== ============ =========== ============

Attributable to:

Equity shareholders of the

parent 12,621,475 6,387,016 10,296,097

Non-controlling interests (4,093) 12,330 19,285

---------------------------------- ------------ ----------- ------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31ST DECEMBER 2021

31st Dec 31st Dec 30th June

2021 2020 2021

(unaudited) (unaudited) (audited)

=============================

Note GBP GBP GBP

============================= ==== ============= ============= ==============

Non--current assets

Property and equipment 2 541,920 512,846 455,983

Right-of-use assets 2 2,483,666 1,863,368 2,757,179

Intangible assets 2,5 101,119,637 110,260,241 100,961,992

Other financial assets 6,210,092 4,326,183 4,373,485

Deferred tax asset 370,265 317,371 366,405

============================= ==== ============= ============= ==============

110,725,580 117,280,009 108,915,044

============================= ==== ============= ============= ==============

Current assets

Trade and other receivables 6,484,325 7,011,563 6,953,470

Cash and cash equivalents 24,506,056 17,545,110 25,514,619

============================= ==== ============= ============= ==============

30,990,381 24,556,673 32,468,089

============================= ==== ============= ============= ==============

Current liabilities

Trade and other payables (7,031,598) (5,910,861) (8,260,597)

Lease liabilities (402,151) (584,404) (392,954)

Current tax payable (1,374,356) (2,061,263) (1,367,564)

============================= ==== ============= ============= ==============

Creditors, amounts

falling due within

one year (8,808,105) (8,556,528) (10,021,115)

============================= ==== ============= ============= ==============

Net current assets 22,182,276 16,000,145 22,446,974

============================= ==== ============= ============= ==============

Total assets less

current liabilities 132,907,856 133,280,154 131,362,018

----------------------------- ---- ------------- ------------- --------------

Non--current liabilities

Lease liabilities (2,126,921) (1,301,128) (2,348,101)

Deferred tax liability (8,389,334) (9,809,808) (8,696,813)

Net assets 122,391,601 122,169,218 120,317,104

============================= ==== ============= ============= ==============

Capital and reserves

Share capital 506,791 506,791 506,791

Share premium account 2,256,104 2,256,104 2,256,104

Merger relief reserve 101,538,413 101,538,413 101,538,413

Investment in own

shares 6 (6,926,039) (4,575,581) (6,068,431)

Share option reserve 168,935 186,470 195,436

EIP share reserve 1,071,618 900,795 1,282.884

Foreign currency differences

reserve (4,564,976) (130,038) (6,629,251)

Capital redemption

reserve 26,107 26,107 26,107

Retained earnings 28,129,274 21,277,645 27,019,584

============================= ==== ============= ============= ==============

Attributable to:

Equity shareholders

of the parent 122,206,227 121,986,706 120,127,637

Non-controlling interests 185,374 182,512 189,467

----------------------------- ---- ------------- ------------- --------------

Total equity 122,391,601 122,169,218 120,317,104

============================= ==== ============= ============= ==============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 31ST DECEMBER 2021

Total

Foreign Capital attributable

Share Merger Investment Share EIP currency redemption to

Share premium relief in own option share diff reserve Retained share-

capital account reserve shares reserve reserve reserve GBP earnings holders NCI Total

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

------------------- --------- ----------- ------------- ------------- ---------- ----------- ------------- ----------- ------------- -------------- --------- --------------

At 1st July

2021 506,791 2,256,104 101,538,413 (6,068,431) 195,436 1,282,884 (6,629,251) 26,107 27,019,584 120,127,637 189,467 120,317,104

Profit for

the period - - - - - - - - 10,557,200 10,557,200 (4,093) 10,553,107

Other comprehensive

income - - - - - - 2,064,275 - - 2,064,275 - 2,064,275

Total comprehensive

income - - - - - 2,064,275 - 10,557,200 12,621,475 (4,093) 12,617,382

Transactions

with owners

Share option

exercise - - - 124,250 (12,787) - - - 12,787 124,250 - 124,250

Purchase

of own shares - - - (2,349,321) - - - - - (2,349,321) - (2,349,321)

Share-based

payment - - - - 17,285 465,900 - - - 483,185 - 483,185

EIP

vesting/forfeiture - - - 1,367,463 - (677,166) - - - 690,297 - 690,297

Deferred

tax on share

options - - - - (30,999) - - - (2,992) (33,991) - (33,991)

Current

tax on share

options - - - - - - - - 12,890 12,890 - 12,890

Dividends

paid - - - - - - - - (9,470,195) (9,470,195) - (9,470,195)

------------------- --------- ----------- ------------- ------------- ---------- ----------- ------------- ----------- ------------- -------------- --------- --------------

Total transactions

with owners - - - (857,608) (26,501) (211,266) - - (9,447,510) (10,542,885) - (10,542,885)

------------------- --------- ----------- ------------- ------------- ---------- ----------- ------------- ----------- ------------- -------------- --------- --------------

As at

31st December

2021 506,791 2,256,104 101,538,413 (6,926,039) 168,935 1,071,618 (4,564,976) 26,107 28,129,274 122,206,227 185,374 122,391,601

------------------- --------- ----------- ------------- ------------- ---------- ----------- ------------- ----------- ------------- -------------- --------- --------------

Total

Foreign attributable

Share Share Merger Investment Share EIP currency Capital to

capital premium relief in own option share diff redemption Retained share-

GBP account reserve shares reserve reserve reserve reserve earnings holders NCI Total

GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP GBP

------------------- --------- ----------- ------------- ------------- ---------- ----------- ----------- ----------- ------------- ------------- --------- -------------

At 1st July

2020 265,607 2,256,104 - (5,765,993) 241,467 1,232,064 45,885 26,107 20,626,405 18,927,646 170,182 19,097,828

Profit for

the period - - - - - - - - 6,562,939 6,562,939 12,330 6,575,269

Other comprehensive

income - - - - - - (175,923) - - (175,923) - (175,923)

------------------- --------- ----------- ------------- ------------- ---------- ----------- ----------- ----------- ------------- ------------- --------- -------------

Total comprehensive

income - - - - - (175,923) - 6,562,939 6,387,016 12,330 6,399,346

Transactions

with owners

Issue of

ordinary

shares on

merger 241,184 - 101,538,413 - - - - - - 101,779,597 - 101,779,597

Share issue

costs - - - - - - - - (967,880) (967,880) - (967,880)

Share option

exercise - - - 221,712 (34,709) - - - 34,709 221,712 - 221,712

Purchase

of own shares - - - (401,288) - - - - - (401,288) - (401,288)

Share-based

payment - - - - (20,288) 371,035 - - - 350,747 - 350,747

EIP

vesting/forfeiture - - - 1,369,988 - (702,304) - - - 667,684 - 667,684

Deferred

tax on share

options - - - - - - - - 1,777 1,777 - 1,777

Dividends

paid - - - - - - - - (4,980,305) (4,980,305) - (4,980,305)

------------------- --------- ----------- ------------- ------------- ---------- ----------- ----------- ----------- ------------- ------------- --------- -------------

Total transactions

with owners 241,184 - 101,538,413 1,190,412 (54,997) (331,269) - - (5,911,699) 96,672,044 - 96,672,044

------------------- --------- ----------- ------------- ------------- ---------- ----------- ----------- ----------- ------------- ------------- --------- -------------

As at

31st December

2020 506,791 2,256,104 101,538,413 (4,575,581) 186,470 900,795 (130,038) 26,107 21,277,645 121,986,706 182,512 122,169,218

------------------- --------- ----------- ------------- ------------- ---------- ----------- ----------- ----------- ------------- ------------- --------- -------------

Total

attributable

Share Investment Share EIP Foreign Capital to

Share premium in own option share exchange redemption Retained share-

capital account Merger shares reserve reserve reserve reserve earnings holders NCI Total

GBP GBP reserve GBP GBP GBP GBP GBP GBP GBP GBP GBP

GBP

------------------- -------- --------- ----------- ----------- --------- --------- ----------- ----------- ------------ ------------ -------- ------------

As at 1st

July 2020 265,607 2,256,104 - (5,765,993) 241,467 1,232,064 45,885 26,107 20,626,405 18,927,646 170,182 19,097,828

Profit for

the period - - - - - - - - 16,971,233 16,971,233 19,285 16,990,518

Other comprehensive

income - - - - - - (6,675,136) - - (6,675,136) - (6,675,136)

------------------- -------- --------- ----------- ----------- --------- --------- ----------- ----------- ------------ ------------ -------- ------------

Total comprehensive

income - - - - - - (6,675,136) - 16,971,233 10,296,097 19,285 10,315,382

Transactions

with owners

Issue of

ordinary

shares on

merger 241,184 - 101,538,413 - - - - - - 101,779,597 - 101,779,597

Share issue

costs - - - - - - - - (967,881) (967,881) - (967,881)

Share option

exercise - - - 830,819 (119,787) - - - 119,787 830,819 - 830,819

Purchase

of own shares - - - (2,503,244) - - - - - (2,503,244) - (2,503,244)

Share-based

payment - - - - (12,023) 760,645 - - - 748,622 - 748,622

EIP

vesting/forfeiture - - - 1,369,987 - (709,825) - - - 660,162 - 660,162

Deferred

tax on share

options - - - - 85,779 - - - (20,574) 65,205 - 65,205

Current tax

on share

options - - - - - - - - 33,738 33,738 - 33,738

Dividends

paid - - - - - - - (9,743,124) (9,743,124) - (9,743,124)

------------------- -------- --------- ----------- ----------- --------- --------- ----------- ----------- ------------ ------------ -------- ------------

Total transactions

with owners 241,184 - 101,538,413 (302,438) (46,031) 50,820 - - (10,578,054) 90,903,894 - 90,903,894

------------------- -------- --------- ----------- ----------- --------- --------- ----------- ----------- ------------ ------------ -------- ------------

As at 30th

June 2021 506,791 2,256,104 101,538,413 (6,068,431) 195,436 1,282,884 (6,629,251) 26,107 27,019,584 120,127,637 189,467 120,317,104

------------------- -------- --------- ----------- ----------- --------- --------- ----------- ----------- ------------ ------------ -------- ------------

CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHSED 31ST DECEMBER 2021

Six months Six months

ended ended Year ended

====================================

31st Dec 31st Dec 30th June

2021 2020 2021

====================================

(unaudited) (unaudited)** (audited)

Note GBP GBP GBP

==================================== ==== ============= ============= =============

Cash flow from operating

activities

Profit before taxation 13,574,580 8,817,104 22,249,004

Adjustments for:

Depreciation of property

and equipment 89,650 95,595 187,714

Depreciation of right-of-use

assets 259,144 242,037 492,730

Amortisation of intangible

assets 5 1,881,209 1,108,799 3,289,142

Share-based payment charge/(credit) 17,285 (20,288) (12,023)

EIP-related charge 466,945 548,098 802,314

Loss/(gain) on investments 3 33,142 (454,278) (540,172)

Interest receivable 3 (4,926) (12,823) (17,689)

Interest payable 3 77,033 67,302 134,752

Translation adjustments 185,970 (35,628) 33,529

------------------------------------ ---- ------------- ------------- -------------

Cash generated from operations

before changes in working

capital 16,580,032 10,355,918 26,619,301

Decrease/(increase) in

trade and other receivables 469,138 (235,649) (439,607)

(Decrease)/(increase)

in trade and other payables (540,999) 140,932 2,800,465

------------------------------------ ---- ------------- ------------- -------------

Cash generated from operations 16,508,171 12,261,201 28,980,159

Interest received 3 4,926 12,823 17,689

Interest paid on leased

assets 3 (77,033) (67,302) (133,827)

Interest paid - - (925)

Taxation paid (3,496,583) (1,646,534) (5,841,493)

==================================== ==== ============= ============= =============

Net cash generated from

operating activities 12,939,481 8,560,188 23,021,603

==================================== ==== ============= ============= =============

Cash flow from investing

activities

Purchase of property and

equipment and intangibles (173,807) (55,314) (93,342)

Purchase of non-current

financial assets (1,889,216) - (715)

Proceeds from sale of

non-current financial

assets 7,080 - -

Cash consideration paid

on merger net of cash

acquired - 946,773 946,773

Net cash (used in)/generated

from investing activities (2,055,943) 891,459 852,716

==================================== ==== ============= ============= =============

Cash flow from financing

activities

Ordinary dividends paid 8 (9,470,195) (4,980,305) (9,743,124)

Purchase of own shares

by employee benefit trust (2,349,321) (401,288) (2,503,244)

Proceeds from sale of

own shares by employee

benefit trust 124,250 221,712 830,819

Payment of lease liabilities (243,459) (247,139) (486,680)

Share issue costs - (967,881) (967,881)

Net cash used in financing

activities (11,938,725) (6,374,901) (12,870,110)

==================================== ==== ============= ============= =============

Net (decrease)/increase

in cash and cash equivalents (1,055,187) 3,076,746 11,004,209

Cash and cash equivalents

at start of period 25,514,619 14,594,333 14,594,333

Cash held in funds* 41,574 12,588 20,357

Effect of exchange rate

changes 5,050 (138,557) (104,280)

==================================== ==== ============= ============= =============

Cash and cash equivalents

at end of period 24,506,056 17,545,110 25,514,619

==================================== ==== ============= ============= =============

*Cash held in funds was consolidated using accounts drawn up as

at end of period.

**Following an FRC corporate reporting review of the Group's

2020 Annual Report and Accounts, in accordance with IAS 7 paragraph

16, acquisition-related costs and share issue costs disclosed as

cash flows from investing activities in the 2020/2021 half year

report have been restated as cash flows from operating and

financing activities within the 2020 comparative above. This

restatement does not impact closing cash; it solely relates to the

classification of these 2020 exceptional cash outflows as operating

activities and net cash used in financing activities respectively

as opposed to investing activities as previously reported. Refer

note 11 'Restatement of comparative cash flow information'.

NOTES

1 BASIS OF PREPARATION AND SIGNIFICANT ACCOUNTING POLICIES

The financial information contained herein is unaudited and does

not comprise statutory financial information within the meaning of

section 434 of the Companies Act 2006. The information for the year

ended 30th June 2021 has been extracted from the latest published

audited accounts and delivered to the Registrar of Companies. The

report of the independent auditor on those financial statements

contained no qualification or statement under s498(2) or (3) of the

Companies Act 2006.

These interim financial statements have been prepared in

accordance with the UK-adopted International Accounting Standard 34

'Interim Financial Reporting' and the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority. The accounting policies adopted and the

estimates and judgements used in the preparation of the unaudited

consolidated financial statements are consistent with those set out

and applied in the statutory accounts of the Group for the year

ended 30th June 2021, which were prepared in accordance with

International Financial Reporting Standards (IFRSs) adopted

pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union and in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006.

The consolidated financial information contained within this

report incorporates the results, cash flows and financial position

of the Company and its subsidiaries for the period to 31st December

2021.

Group companies are regulated and perform annual capital

adequacy and liquidity assessments, which incorporates a series of

stress tests on the Group's financial position over a three-year

period from 30th November 2021. These forecasts have been prepared

taking into account the potential impact of COVID-19 on the Group's

operations.

The Group's financial projections and the capital adequacy and

liquidity assessments provide comfort that the Group has adequate

financial and regulatory resources to continue in operational

existence for the foreseeable future. Accordingly, the Directors

continue to adopt the going concern basis of accounting in

preparing the interim financial statements.

New or amended accounting standards and interpretations

adopted

The Group has adopted all relevant new or amended International

Accounting Standards and interpretations as adopted by the UK that

are mandatory for the current reporting period. Any new or amended

accounting standards that are not mandatory have not been early

adopted. None of the standards not yet effective are expected to

have a material impact on the Group's financial statements.

2 SEGMENTAL ANALYSIS

The Directors consider that the Group has only one reportable

segment, namely asset management, and hence only analysis by

geographical location is given.

Europe

USA Canada UK (ex UK) Other Total

GBP GBP GBP GBP GBP GBP

======================= ============ =========== ========= =========== ======= ============

Six months to 31st

Dec 2021

Gross fee income 29,950,594 739,166 160,150 594,819 - 31,444,729

Non-current assets:

Property and equipment 262,246 - 255,745 - 23,929 541,920

Right-of-use assets 1,278,965 - 1,174,344 - 30,357 2,483,666

Intangible assets 101,116,490 - 3,147 - - 101,119,637

Six months to 31st

Dec 2020

Gross fee income 22,387,190 699,921 163,838 482,810 - 23,733,759

Non-current assets:

Property and equipment 184,989 - 296,693 - 31,164 512,846

Right-of-use assets 394,820 - 1,352,725 - 115,823 1,863,368

Intangible assets 110,248,634 - 11,607 - - 110,260,241

======================= ============ =========== ========= =========== ======= ============

Year to 30th June

2021

Gross fee income 52,215,280 1,458,957 356,462 1,092,575 - 55,123,274

Non-current assets:

Property and equipment 175,387 - 254,197 - 26,399 455,983

Right-of-use assets 1,421,279 - 1,263,534 - 72,366 2,757,179

Intangible assets 100,954,615 - 7,377 - - 100,961,992

----------------------- ------------ ----------- --------- ----------- ------- ------------

The Group has classified gross fee income based on the domicile

of its clients and non-current assets based on where the assets are

held.

Included in gross fee income are fees of GBP2,966,412 (year to

30th June 2021 - GBP5,470,051; six months to 31st December 2020 -

GBP2,488,298) which arose from fee income from the Group's largest

customer. No other single customer contributed 10 per cent or more

to the Group's revenue in any of the reporting periods.

3 NET INTEREST (PAYABLE)/RECEIVABLE AND SIMILAR (LOSSES)/GAINS

Six months Six months Year ended

ended ended

=============================

31st Dec 31st Dec 30th June

2021 2020 2021

=============================

(unaudited) (unaudited) (audited)

GBP GBP GBP

============================= ================ ================ ============

Interest on bank deposit 4,926 12,823 17,689

Unrealised (loss)/gain

on investments (36,511) 454,278 540,172

Realised gain on investments 3,369 - -

Interest payable on lease

liabilities (77,033) (67,302) (133,827)

Interest payable on restated

US tax returns - - (925)

(105,249) 399,799 423,109

============================= ================ ================ ============

4 EARNINGS PER SHARE

The calculation of earnings per share is based on the profit for

the period attributable to the equity shareholders of the parent

divided by the weighted average number of ordinary shares in issue

for the six months ended 31st December 2021.

As set out in note 6 the Employee Benefit Trust held 1,689,428

ordinary shares in the Company as at 31st December 2021. The

Trustees of the Trust have waived all rights to dividends

associated with these shares. In accordance with IAS 33 "Earnings

per share", the ordinary shares held by the Employee Benefit Trust

have been excluded from the calculation of the weighted average

number of ordinary shares in issue.

The calculation of diluted earnings per share is based on the

profit for the period attributable to the equity shareholders of

the parent divided by the diluted weighted average number of

ordinary shares in issue for the six months ended 31st December

2021.

Reported earnings per share

Six months Six months Year ended

ended ended

==============================

31st Dec 2021 31st Dec 2020 30th June

2021

==============================

(unaudited) (unaudited) (audited)

GBP GBP GBP

============================== ========================== ========================== ============

Profit attributable to

the equity shareholders

of the parent for basic

earnings 10,557,200 6,562,939 16,971,233

------------------------------ -------------------------- -------------------------- ------------

Number of shares Number of Number of

shares shares

------------------------------ -------------------------- -------------------------- ------------

Issued ordinary shares

as at 1st July 50,679,095 26,560,707 26,560,707

Effect of own shares held

by EBT (1,558,012) (1,537,864) (1,502,266)

Effect of shares issued

in the period - 12,059,194 18,039,233

------------------------------ -------------------------- -------------------------- ------------

Weighted average shares

in issue 49,121,083 37,082,037 43,097,674

Effect of movements in

share options and EIP awards 636,718 615,017 677,739

------------------------------ -------------------------- -------------------------- ------------

Diluted weighted average

shares in issue 49,757,801 37,697,054 43,775,413

------------------------------ -------------------------- -------------------------- ------------

Basic earnings per share

(pence) 21.5 17.7 39.4

Diluted earnings per share

(pence) 21.2 17.4 38.8

------------------------------ -------------------------- -------------------------- ------------

Underlying earnings per share*

Underlying earnings per share is based on the underlying profit

after tax*, where profit after tax is adjusted for gain/loss on

investments, acquisition-related costs, amortisation of acquired

intangibles, their related tax impact and non-controlling

interest.

Underlying profit for calculating underlying earnings per

share

Six months Six months Year ended

ended ended

----------------------------------

31st Dec 2021 31st Dec 2020 30th June

2021

----------------------------------

(unaudited) (unaudited) (audited)

GBP GBP GBP

---------------------------------- ------------------------ ------------------------ ------------

Profit before tax 13,574,580 8,817,104 22,249,004

Add back/(deduct):

- Loss/(gain) on investments 33,142 (454,278) (540,172)

- Acquisition-related costs - 1,743,424 1,743,424

- Amortisation on acquired

intangibles 1,876,979 1,083,395 3,250,185

---------------------------------- ------------------------ ------------------------ ------------

Underlying profit before

tax 15,484,701 11,189,645 26,702,441

Tax expense as per the

consolidated income statement (3,021,473) (2,241,835) (5,258,486)

Tax effect of acquisition-related

costs and amortisation

of acquired intangibles (456,805) (117,190) (677,412)

Adjustment for NCI 4,093 (12,330) (19,285)

---------------------------------- ------------------------ ------------------------ ------------

Underlying profit after

tax for the calculation

of underlying earnings

per share 12,010,516 8,818,290 20,747,258

---------------------------------- ------------------------ ------------------------ ------------

Underlying earnings per

share (pence) 24.5 23.8 48.1

Underlying diluted earnings

per share (pence) 24.1 23.4 47.4

---------------------------------- ------------------------ ------------------------ ------------

* This is an Alternative Performance Measure (APM). Please refer

to the CEO review for more details on APMs.

5 INTANGIBLE ASSETS

31st 30th

31st December 2021 Dec 2020 Jun 2021

------------------------------------------------------------------------------- ------------ ------------

Direct Long

customer Distribution Trade term

Goodwill relationships channels name software Total Total Total

GBP GBP GBP GBP GBP GBP GBP GBP

-------------- ----------- -------------- ------------- ---------- --------- ------------ ------------ ------------

Cost

At start

of period 65,123,297 33,472,334 4,590,186 1,018,983 689,100 104,893,900 761,971 761,971

Acquired

on

acquisition - - - - - - 111,323,195 111,323,195

Currency

translation 1,438,949 559,626 66,246 18,856 (4,865) 2,078,812 (65,428) (7,191,266)

At close

of period 66,562,246 34,031,960 4,656,432 1,037,839 684,235 106,972,712 112,019,738 104,893,900

-------------- ----------- -------------- ------------- ---------- --------- ------------ ------------ ------------

Amortisation

charge

At start

of period - 2,673,300 522,535 54,350 681,723 3,931,908 714,662 714,662

Charge

for the

period - 1,543,828 301,764 31,387 4,230 2,061,955 1,108,799 3,289,142

Currency

translation - 36,867 7,207 749 (4,865) (140,788) (63,964) (71,896)

At close

of period - 4,253,995 831,506 86,486 681,088 5,853,075 1,759,497 3,931,908

-------------- ----------- -------------- ------------- ---------- --------- ------------ ------------ ------------

Net book

value 66,562,246 29,777,965 3,824,926 951,353 3,147 101,119,637 110,260,241 100,961,992

-------------- ----------- -------------- ------------- ---------- --------- ------------ ------------ ------------

Goodwill, direct client relationships, distribution channels and

trade name acquired through business combination relates to the

merger with KIM on 1st October 2020 (see note 7).

The fair values of KIM's direct customer relationships and the

distribution channels have been measured using a multi-period

excess earnings method. The model uses estimates of annual

attrition driving revenue from existing customers to derive a

forecast series of cash flows, which are discounted to a present

value to determine the fair values of KIM's direct customer

relationships and the distribution channels.

The fair value of KIM's trade name has been measured using a

relief from royalty method. The model uses estimates of royalty

rate and percentage of revenue attributable to trade name to derive

a forecast series of cash flows, which are discounted to a present

value to determine the fair value of KIM's trade name.

The total amortisation charged to the income statement for the

six months ended 31st December 2021 in relation to direct client

relationships, distribution channels and trade name, was

GBP1,876,979 (nine-month period from the date of the merger to 30th

June 2021 - GBP3,250,185, three-month period from the date of the

merger to 31st December 2020 - GBP1,083,395).

Impairment

Goodwill acquired through business combination is in relation to

the merger with KIM and relates to the acquired workforce and

future expected growth of the Cash Generating Unit (CGU).

The Group's policy is to test goodwill arising on acquisition

for impairment annually, or more frequently if changes in

circumstances indicate a possible impairment. The Group has

considered whether there have been any indicators of impairment

during the six months ended 31st December 2021, which would require

an impairment review to be performed. The Group has considered

indicators of impairment with regard to a number of factors,

including those outlined in IAS 36 'Impairment of assets'. Based

upon this review, the Group has concluded that there are no such

indicators of impairment as at 31st December 2021.

6 INVESTMENT IN OWN SHARES

Investment in own shares relates to City of London Investment

Group PLC shares held by an Employee Benefit Trust on behalf of

City of London Investment Group PLC.

At 31st December 2021 the Trust held 1,001,315 ordinary 1p

shares (30th June 2021 - 913,038; 31st December 2020 - 679,038), of

which 366,750 ordinary 1p shares (30th June 2021 - 405,750; 31st

December 2020 - 420,750) were subject to options in issue.

The Trust also held in custody 688,113 ordinary 1p shares (30th

June 2021 - 678,120; 31st December 2020 - 678,120) for employees in

relation to restricted share awards granted under the Group's

Employee Incentive Plan (EIP).

The Trust has waived its entitlement to receive dividends in

respect of the total shares held (31st December 2021 - 1,689,428;

30th June 2021 - 1,591,158; 31st December 2020 - 1,357,138).

7 BUSINESS COMBINATIONS

On 1st October 2020 City of London Investment Group PLC

completed the merger of Snowball Merger Sub, Inc. with and into

Karpus Management Inc. dba Karpus Investment Management (KIM), a

US-based investment management business, on a debt free basis, by

way of a scheme of arrangement in accordance with the New York

Business Corporation Law, with KIM being the surviving entity in

the Merger. CLIG acquired 100% of voting equity interest in KIM and

the merger was satisfied by issue of new ordinary shares and cash

for a total consideration of GBP101,887,540. KIM uses closed-end

funds (CEFs) amongst other securities as a means to gain exposure

for its client base comprising of US high net worth clients and

corporate accounts. It qualifies as a business as defined in IFRS 3

"Business Combinations". The merger is considered to be of

substantial strategic and financial benefit to the Group and its

shareholders.

Details of the net assets acquired, goodwill and purchase

consideration are detailed in note 6 on pages 107 to 108 of the

Annual Report and Accounts for the year ended 30th June 2021.

8 DIVIDS

A final dividend of 22p per share (gross amount payable

GBP11,149,401; net amount paid GBP9,470,195*) in respect of the

year ended 30th June 2021 was paid on 29th October 2021.

An interim dividend of 11p per share (2021 - 11p) (gross amount

payable GBP5,574,700; net amount payable GBP5,388,863*) in respect

of the year ending 30th June 2022 will be paid on 25th March 2022

to members registered at the close of business on 25th February

2022.

In addition, a special dividend of 13.5p per share (2021 - nil)

(gross amount payable GBP6,841,678; net amount payable

GBP6,613,605*) in respect of the year ending 30th June 2022 will be

paid on 25th March 2022 to members registered at the close of

business on 25th February 2022.

* Difference between gross and net amounts is on account of

shares held at EBT that do not receive dividend and 25% waived

dividend on new shares issued upon merger in accordance with the

lockup deed (applicable for dividends for the year ended 30th June

2021 only).

9 PRINCIPAL RISKS AND UNCERTAINTIES

In the course of conducting its business operations, the Group

is exposed to a variety of risks including market, liquidity,

operational and other risks that may be material and require

appropriate controls and on-going oversight.

The principal risks to which the Group will be exposed in the

second half of the financial year are substantially the same as

those described in the last annual report (see page 28 and 29 of

the Annual Report and Accounts for the year ended 30th June 2021),

being the impact of the COVID-19 pandemic, the potential for loss

of FuM as a result of poor investment performance, client

redemptions, breach of mandate guidelines or material error, loss

of key personnel, Technology/IT, cybersecurity and business

continuity, legal and regulatory risks.

Changes in market prices, such as foreign exchange rates and

equity prices will affect the Group's income and the value of its

investments.

Most of the Group's revenues, and a significant part of its

expenses, are denominated in currencies other than sterling,

principally US dollars. These revenues are derived from fee income

which is based upon the net asset value of accounts managed, and

have the benefit of a natural hedge by reference to the underlying

currencies in which investments are held. Inevitably, debtor and

creditor balances arise which in turn give rise to currency

exposures.

10 FINANCIAL INSTRUMENTS

The Group's financial assets include cash and cash equivalents,

investments and other receivables.

Its financial liabilities include accruals and other payables.

The fair value of the Group's financial assets and liabilities is

materially the same as the book value.

Fair value measurements recognised in the statement of financial

position

The following table provides an analysis of financial

instruments that are measured subsequent to initial recognition at

fair value, grouped into levels 1 to 3 based on the degree to which

the fair value is observable.

- Level 1: fair value derived from quoted prices (unadjusted)

in active markets for identical assets and liabilities.

- Level 2: fair value derived from inputs other than quoted

prices included within level 1 that are observable for

the assets or liability, either directly (i.e. as prices)

or indirectly (i.e. derived from prices).

- Level 3: fair value derived from valuation techniques

that include inputs for the asset or liability that are

not based on observable market data.

The fair values of the financial instruments are determined as

follows:

- Investments for hedging purposes are valued using the

quoted bid price and shown under level 1.

- Investments in own funds are determined with reference

to the net asset value (NAV) of the fund. Where the NAV

is a quoted price the fair value is shown under level

1, where the NAV is not a quoted price the fair value

is shown under level 2.

- Forward currency trades are valued using the forward exchange

bid rates and are shown under level 2.

- Unlisted equity securities are valued using the net assets

of the underlying companies and are shown under Level

3.

The level within which the financial asset or liability is

classified is determined based on the lowest level of significant

input to the fair value measurement.

31st December 2021 Level 1 Level 2 Level Total

GBP GBP 3 GBP

GBP

-------------------------------- --------- --------- ----- ---------

Financial assets at fair value

through profit or loss

Investment in other non-current

financial assets 4,366,296 1,843,796 - 6,210,092

Forward currency trades - 37,650 - 37,650

-------------------------------- --------- --------- ----- ---------

Total 4,366,296 1,881,446 - 6,247,742

-------------------------------- --------- --------- ----- ---------

There are no financial liabilities at fair value at 31st

December 2021.

31st December 2020 Level 1 Level 2 Level Total

GBP GBP 3 GBP

GBP

================================ ========= ========= ===== =========

Financial assets at fair value

through profit or loss

Investment in other non-current

financial assets 2,424,277 1,901,906 - 4,326,183

Forward currency trades - 261,379 - 261,379

================================ ========= ========= ===== =========

Total 2,424,277 2,163,285 - 4,587,562

================================ ========= ========= ===== =========

There are no financial liabilities at fair value at 31st

December 2020.

30th June 2021 Level 1 Level 2 Level Total

GBP GBP 3 GBP

GBP

-------------------------------- --------- --------- ----- ---------

Financial assets at fair value

through profit or loss

Investment in other non-current

financial assets 2,498,719 1,874,766 - 4,373,485

-------------------------------- --------- --------- ----- ---------

Total 2,498,719 1,874,766 - 4,373,485

-------------------------------- --------- --------- ----- ---------

Financial liabilities at fair

value through profit or loss

Forward currency trades - 69,558 - 69,558

-------------------------------- --------- --------- ----- ---------

Total - 69,558 - 69,558

-------------------------------- --------- --------- ----- ---------

There were no transfers between any of the levels in the

reporting period.

All fair value gains and losses included in other comprehensive

income relate to the investment in own funds.

Where there is an impairment in the investment in own funds, the

loss is reported in the income statement. No impairment was

recognised during the period or the preceding year.

The fair value gain on the forward currency trades is offset in

the income statement by the foreign exchange losses on other

currency assets and liabilities held during the period and at the

period end. The net loss reported for the period is GBP19,116 (30th

June 2021: net loss GBP60,607; 31st December 2020: net loss

GBP3,416).

11 RESTATEMENT OF COMPARATIVE CASH FLOW INFORMATION

The FRC's corporate reporting review of the Group's Annual