TIDMSKA

RNS Number : 4189N

Shuka Minerals PLC

25 September 2023

25 September 2023

SHUKA MINERALS PLC

("Shuka" or the "Company")

Interim Results for the six months to 30 June 2023

Shuka Minerals plc (AIM: SKA), an African focused mine operator

and developer, announces the Company's unaudited interim results

for the six months ended 30 June 2023.

CEO'S report

I am pleased to present the Company's Interim Results for the

six-month period from 1 January 2023 to 30 June 2023. The period

was a transformative one for the Company, particularly from a

corporate perspective with a strategic investment of GBP1.47

million secured from two African focused mining investment groups,

an intended significant restructuring of the Board of Directors, a

change of name to Shuka Minerals plc (which was successfully

approved by shareholders subsequent to the end of the period) and

the application of the funds raised to not only fund its ongoing

working capital requirements at its operating Rukwa Coal Mine, but

also to fund due diligence costs associated with ongoing review

work of potential new and strategically complimentary projects in

Africa.

The most notable development during the six-month period, was

the strategic investment that the Company was able to secure with Q

Global Commodities Group, one of South Africa's leading independent

commodity, mining, logistics and investment funds and with Gathoni

Muchai Investments Limited, an East Africa based mining investment

group. As part of this investment, the Company received an

aggregate GBP1.47 million of new funding, with GBP575,000 received

in June 2023, and the GBP893,000 balance received in September 2023

following shareholder approval at the Annual General Meeting held

on 3 August 2023.

In conjunction with this strategic investment, the Company

commenced a major restructuring and strengthening of its Board, and

I was pleased to confirm the appointment of Mr Jason Brewer, a

director of Gathoni Muchai Investments and the CEO of London-listed

Marula Mining Plc, as Executive Director of the Company in June

2023. I am also looking forward to the proposed appointment of Mr

Quinton van der Burgh later this year, who is the founder and CEO

of Q Global Commodities and one of South Africa's leading mining

entrepreneurs, and who will join the Company as Director and

Non-Executive Chairman, subject to satisfactory completion of

customary due diligence by the Company's Nominated Adviser. Mr

Nicholas von Schirnding, resigned as a director of the Company,

with effect from 31 October 2023. I would like to thank Nick for

his work and commitment to the Company over the years and would

like to welcome Jason and, in due course, Quinton to the Board,

whom I believe will be transformative appointments for the Company

as it looks to re-establish itself over the coming months as a

leading African focused mining and development company.

During the period and while the Company completed its corporate

restructuring and recapitalisation, the Company continued to manage

day-to-day operations at its wholly owned Rukwa Coal Mine in

Tanzania. Operations during the period were quite challenging as a

result of the high moisture content in the run-of-mine ("ROM") coal

stockpile, which impacted on the coal washing process and coal

production over the period. As a result of the wash plant

performance and ongoing maintenance work on plant and equipment

during the period, only limited coal sales were made into the

regional markets during the period. The Company continues to review

its ongoing investment in the Rukwa Coal Mine and targeted

production rates. In parallel with its operational activities, the

Company continued in its discussions with the Mining Commission in

Tanzania, to ensure ongoing compliance with local regulations, and

to address previously disclosed outstanding legacy matters

concerning claims and litigation and the status of the mining

licence.

The strategic investment received from Gathoni Muchai

Investments and Q Global Commodities has ensured that the Company

has been able to fund its ongoing working capital needs and

corporate and mining development activities, and importantly fund

costs associated with the evaluation of potential complementary

advanced mining and mine development projects across Africa with

the support and active involvement of these two new major

shareholders.

I look forward to providing further updates as we progress our

strategy and to operating under our new company name of Shuka

Minerals plc which was approved by shareholders at the Annual

General Meeting held on 3 August 2023, and officially announced on

1 September 2023. This is a name which certainly reflects our

position as a mine operator in east Africa and as a truly African

focused mining and development company that is committed to

ensuring its activities demonstrate a commitment to environmental

sustainability, community engagement, and responsible mining

practices.

I would like to thank all our shareholders for their ongoing

support and I look forward to working alongside my fellow directors

and all key stakeholders over the rest of 2023.

Noel Lyons

Chief Executive Officer

For further information please contact:

Shuka Minerals Plc info@shukaminerals.com

Jason Brewer - Executive Director

Noel Lyons - Chief Executive Officer

Strand Hanson Limited +44 (0) 20 7409 3494

(Financial and Nominated Adviser)

James Harris

Richard Johnson

Tavira Securities Limited +44 (0) 20 7100 5100

(Joint Broker)

Oliver Stansfield

Jonathan Evans

Peterhouse Capital Limited +44 (0) 20 3934 6630

(Joint Broker)

Charles Goodfellow

Duncan Vasey

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

23 22 22

Unaudited Unaudited Audited

Note GBP GBP GBP

Revenue 68,926 56,146 183,448

Cost of sales (151,627) (452,484) (896,147)

Gross loss (82,701) (396,338) (712,699)

Administrative expenses (656,060) (423,627) (1,038,384)

Group operating loss (738,761) (819,965) (1,751,083)

Finance income - - 68

Finance costs (7,562) (675) (4,747)

Loss on operations before taxation (746,323) (820,640) (1,755,762)

Taxation - - (917)

Loss for the period after taxation (746,323) (820,640) (1,756,679)

Other comprehensive income/(loss): - - -

(Loss)/gain on translation of

overseas subsidiary (335,033) 624,211 691,850

Total comprehensive loss for

the period (1,081,356) (196,429) (1,064,829)

Attributable to:

Equity holders of the Company (1,080,722) (195,155) (1,062,161)

Non-controlling interest (634) (1,274) (2,668)

(1,081,356) (196,429) (1,064,829)

Loss per share

- basic and diluted (pence) 2 (2.54) (3.79) (7.97)

The income for the period arises from the Group's continuing

operations.

CONSOLIDATED statement of financial position

as at 30 June 2023

As at As at As at

30 June 30 June 31 Dec

23 22 22

Unaudited Unaudited Audited

Note GBP GBP GBP

Non-current assets

Property, plant and equipment 4 5,568,304 5,906,709 5,911,876

Intangible assets 5 333,907 349,607 352,627

5,902,211 6,256,316 6,264,503

Current assets

Inventories 111,516 180,124 117,766

Trade and other receivables 309,778 353,457 347,984

Cash and cash equivalents 440,655 477,438 237,300

861,949 1,011,019 703,050

Current liabilities

Trade and other payables (745,718) (308,174) (402,200)

Borrowings (27,817) (5,206) (29,376)

(773,535) (313,380) (431,576)

Current assets less current

liabilities 88,414 697,639 271,474

Total assets less current liabilities 5,990,625 6,953,955 6,535,977

Non - current liabilities

Borrowings (52,375) - (67,128)

Environmental rehabilitation

liability (28,984) (27,339) (30,609)

Net assets 5,909,266 6,926,616 6,438,240

Capital and reserves

Called-up share capital 4,348,744 4,176,601 4,233,744

Share premium account 23,009,976 22,254,317 22,569,976

Share based payment reserve 210,037 346,774 277,654

Foreign currency translation

reserve 937,960 1,205,354 1,272,993

Retained earnings (22,574,502) (21,038,103) (21,896,430)

Issued capital and reserves

attributable to owners of the

parent company 5,932,215 6,944,943 6,457,937

Non-controlling interest (22,949) (18,327) (19,697)

Total equity 5,909,266 6,926,616 6,438,240

CONSOLIDATED statement of changes in equity

--------------------------------------------------Equity

Interests---------------------------------------

Share Share Retained Share Foreign Total Non-controlling Total

Capital Premium Earnings Option Currency interest

Account Reserve Translation

Reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2023 4,233,744 22,569,976 (21,896,430) 277,654 1,272,993 6,457,937 (19,697) 6,438,240

Comprehensive

Income

for the year

Foreign

currency

translation - - - - (335,033) (335,033) (2,464) (337,497)

Loss for the

year - - (745,689) - - (745,689) (634) (746,323)

---------- ----------- ------------- --------- ------------ ------------ ---------------- ------------

Total

comprehensive

income for

the year - - (745,689) - (335,033) (1,080,722) (3,098) (1,083,820)

Transactions

with

owners

Issue of share

capital 115,000 460,000 - - - 575,000 - 575,000

Share issue

costs - (20,000) - - - (20,000) - (20,000)

Lapsed share

options - - 67,617 (67,617) - - - -

---------- ----------- ------------- --------- ------------ ------------ ---------------- ------------

Total

transactions

with owners 115,000 440,000 67,617 (67,617) - 555,000 - 555,000

Non-

controlling

interest

share of

goodwill - - - - - - (154) (154)

At 30 June

2023 4,348,744 23,009,976 (22,574,502) 210,037 937,960 5,932,215 (22,949) 5,909,266

========== =========== ============= ========= ============ ============ ================ ============

--------------------------------------------------Equity

Interests---------------------------------------

Share Share Retained Share Option Foreign Total Non-controlling Total

Capital Premium Earnings Reserve Currency interest

Account Translation

Reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January 2022 4,176,601 22,254,317 (20,325,577) 453,614 581,143 7,140,098 (17,328) 7,122,770

Comprehensive

Income

for the year

Foreign currency

translation - - - - 624,211 624,211 - 624,211

Loss for the year - - (819,366) - - (819,366) (1,274) (820,640)

---------- ----------- ------------- ------------ ---------- ------------------ ---------------- ------------

Total

comprehensive

income for the

year - - (819,366) - 624,211 (195,155) (1,274) (196,429)

Transactions with

owners

Lapsed share

options - - 106,840 (106,840) - - - -

---------- ----------- ------------- ------------ ---------- ------------------ ---------------- ------------

Total

transactions

with owners - - 106,840 (106,840) - - - -

Non- controlling

interest share

of

goodwill - - - - - - 275 275

At 30 June 2022 4,176,601 22,254,317 (21,038,103) 346,774 1,205,354 6,944,943 (18,327) 6,926,616

========== =========== ============= ============ ========== ================== ================ ============

--------------------------------------------------Equity

Interests---------------------------------------

Share Share Retained Share Foreign Total Non-controlling Total

Capital Premium Earnings Option Currency interest

Account Reserve Translation

Reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January 2022 4,176,601 22,254,317 (20,325,577) 453,614 581,143 7,140,098 (17,328) 7,122,770

Comprehensive

Income

for the year

Foreign currency

translation - - - - 691,850 691,850 691,850

Loss for the year - - (1,754,011) - - (1,754,011) (2,668) (1,756,679)

---------- ----------- ------------- ---------- ------------ ------------ ---------------- ------------

Total

comprehensive

income for the

year - - (1,754,011) - 691,850 (1,062,161) (2,668) (1,064,829)

Transactions with

owners

Issue of share

capital 57,143 342,857 - - - 400,000 - 400,000

Share issue costs - (20,000) - - - (20,000) - (20,000)

Share

options/warrants

charge - (7,198) - 7,198 - - - -

Lapse of share

options/warrants - - 183,158 (183,158) - - - -

---------- ----------- ------------- ---------- ------------ ------------ ---------------- ------------

Total

transactions

with owners 57,143 315,659 183,158 (175,960) - 380,000 - 380,000

Non- controlling

interest share

of

goodwill - - - - - - 299 299

At 31 December

2022 4,233,744 22,569,976 (21,896,430) 277,654 1,272,993 6,457,937 (19,697) 6,438,240

========== =========== ============= ========== ============ ============ ================ ============

consolidated CASH FLOW STATEMENT

Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

23 22 22

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating activities

Operating loss (738,761) (819,965) (1,751,083)

Depreciation 30,542 144,039 324,790

Movement in inventories - (20,310) 40,903

Movement in trade and other receivables (16,825) 185,761 (92,615)

Movement in trade and other payables 358,750 (112,135) (26,820)

Loss on foreign exchange (1,977) (115,391) (4,614)

Expected credit losses - - 242,780

----------- ----------- ------------

Net cash used in operating activities (368,271) (738,001) (1,266,659)

----------- ----------- ------------

---

Tax Paid - - (1,319)

Cash flows from investing activities

Purchase of property, plant and

equipment - - (41,236)

Finance income - 48 68

Net cash used in investing activities - 48 (41,168)

----------- ----------- ------------

Cash flows from financing activities

Repayment of lease liabilities (11,536) (14,078) (22,138)

Lease interest (4,483) (723) (1,793)

Other interest paid (3,079) - -

Proceeds on issue of ordinary

shares 614,850 - 360,150

Share issue costs (20,000) - (20,000)

Net cash generated from financing

activities 575,752 (14,801) 316,219

----------- ----------- ------------

Net increase/(decrease) in cash

and cash equivalents 207,481 (752,754) (992,927)

Cash and cash equivalents at beginning

of year 237,300 1,229,801 1,229,801

Exchange losses on cash and cash

equivalents (4,126) 391 426

Cash and cash equivalents at

end of year 440,655 477,438 237,300

=========== =========== ============

NOTES TO THE INTERIM REPORT

1. Financial information and basis of preparation

The interim financial statements of Shuka Minerals Plc are

unaudited consolidated financial statements for the six months

ended 30 June 2023 which have been prepared in accordance with UK

adopted international accounting standards. They include unaudited

comparatives for the six months ended 30 June 2022 together with

audited comparatives for the year ended 31 December 2022.

The interim financial statements do not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006. The statutory accounts for the year ended 31 December 2022

have been reported on by the company's auditors and have been filed

with the Registrar of Companies. The report of the auditors

contained a qualified opinion and an Emphasis of mater paragraph on

Operationalisation of up to 16% Government of Tanzania non-dilutive

free carried share interest and the recoverability of VAT in

Tanzania. Aside from the Qualification and Emphasis of matter

paragraphs above, the auditor's report did not contain any

statement under section 498 of the Companies Act 2006.

The interim consolidated financial statements for the six months

ended 30 June 2023 have been prepared on the basis of accounting

policies expected to be adopted for the year ended 31 December

2023. These are anticipated to be consistent with those set out in

the Group's latest financial statements for the year ended 31

December 2022. These accounting policies are drawn up in accordance

with adopted International Accounting Standards ("IAS") and

International Financial Reporting Standards ("IFRS") as issued by

the International Accounting Standards Board.

2. Loss per share

The calculation of the basic and diluted loss per share is based

on the following data:

30 June 23 30 June 22 31 December

22

GBP GBP GBP

Loss after taxation (746,323) (820,640) (1,756,679)

Weighted average number

of shares in the period 29,329,474 21,645,575 22,036,964

Basic and diluted loss

per share (pence) (2.54) (3.79) (7.97)

The loss attributable to equity shareholders and weighted

average number of ordinary shares for the purposes of calculating

diluted earnings per ordinary share are identical to those used for

basic earnings per ordinary share. This is because the exercise of

share options and warrants would have the effect of reducing the

loss per ordinary share and is therefore anti-dilutive.

3. Dividends

No dividends are proposed for the six months ended 30 June 2022

(six months ended 30 June 2021: GBPnil, year ended 31 December

2021: GBPnil).

4. Property, plant and equipment

Coal Production Plant Fixtures Motor vehicles

assets & machinery & fittings Total

GBP GBP GBP GBP GBP

Cost or valuation

As at 1 January

2023 5,855,019 1,344,491 7,554 328,480 7,535,544

Foreign exchange

adjustment (310.858) (70,984) (180) (16,553) (398,575)

At 30 June 2023 5,544,161 1,273,507 7,374 311,927 7,136,969

Accumulated depreciation

As at 1 January

2023 173,642 1,301,920 7,445 140,661 1,623,668

Depletion/Charge

for the year 3,849 3,760 13 22,920 30,542

Foreign exchange

adjustment (9,227) (68,846) (180) (7,292) (85,545)

At 30 June 2023 168,264 1,236,834 7,278 156,289 1,568,665

Net book value

As at 30 June 2023 5,375,897 36,673 96 155,638 5,568,304

Coal Production Plant Fixtures Motor vehicles

assets & machinery & fittings Total

GBP GBP GBP GBP GBP

Cost or valuation

As at 1 January

2022 5,230,294 1,201,831 7,191 193,620 6,632,936

Foreign exchange

adjustment 574,580 131,210 334 19,437 725,561

At 30 June 2022 5,804,874 1,333,041 7,525 213,057 7,358,497

Accumulated depreciation

As at 1 January

2022 114,026 925,484 7,045 134,460 1,181,015

Depletion/Charge

for the year 3,587 132,234 18 8,200 144,039

Foreign exchange

adjustment 12,518 100,880 334 13,002 126,734

At 30 June 2022 130,131 1,158,598 7,397 155,662 1,451,788

Net book value

As at 30 June 2022 5,674,743 174,443 128 57,395 5,906,709

4. Property, plant and equipment (continued)

Coal Production Plant Fixtures Motor vehicles

assets & machinery & fittings Total

GBP GBP GBP GBP GBP

Cost or valuation

As at 1 January

2022 5,230,294 1,201,831 7,191 193,620 6,632,936

Additions - - - 141,141 141,141

Adjustments - - - (27,414) (27,414)

Foreign exchange

adjustment 624,725 142,660 363 21,133 788,881

At 31 December

2022 5,855,019 1,344,491 7,554 328,480 7,535,544

---------------- ------------- ------------ --------------- ----------

Accumulated depreciation

As at 1 January

2022 114,026 925,484 7,045 134,460 1,181,015

Depletion/Charge

for the year 46,002 259,777 37 18,974 324,790

Adjustments - - - (27,414) (27,414)

Foreign exchange

adjustment 13,614 116,659 363 14,641 145,277

At 31 December

2022 173,642 1,301,920 7,445 140,661 1,623,668

---------------- ------------- ------------ --------------- ----------

Net book value

As at 31 December

2022 5,681,377 42,571 109 187,819 5,911,876

---------------- ------------- ------------ --------------- ----------

5. Intangible assets

Mining Licences Total

GBP GBP

Cost or valuation

As at 1 January 2023 1,667,530 1,667,530

Foreign exchange

adjustment (88,530) (88,530)

At 30 June 2023 1,579,000 1,579,000

------------------ ------------

Accumulated amortisation

and impairment

As at 1 January 2023 1,314,903 1,314,903

Foreign exchange

adjustment (69,810) (69,810)

At 30 June 2023 1,245,093 1,245,093

------------------ ------------

Net book value

------------------ ------------

As at 30 June 2023 333,907 333,907

------------------ ------------

5. Intangible assets (continued)

Mining Licences Total

GBP GBP

Cost or valuation

As at 1 January 2022 1,489,604 1,489,604

Foreign exchange adjustment 163,644 163,644

At 30 June 2022 1,653,248 1,653,248

------------------ ------------

Accumulated amortisation

and impairment

As at 1 January 2022 1,174,602 1,174,602

Foreign exchange adjustment 129,039 129,039

At 30 June 2022 1,303,641 1,303,641

------------------ ------------

Net book value

------------------ ------------

As at 30 June 2022 349,607 349,607

------------------ ------------

Mining Licences Total

GBP GBP

Cost or valuation

As at 1 January 2022 1,489,604 1,489,604

Foreign exchange adjustment 177,926 177,926

At 31 December 2022 1,667,530 1,667,530

------------------ ------------

Accumulated amortisation

and impairment

As at 1 January 2022 1,174,602 1,174,602

Foreign exchange adjustment 140,301 140,301

At 31 December 2022 1,314,903 1,314,903

------------------ ------------

Net book value

------------------ ------------

As at 31 December 2022 352,627 352,627

------------------ ------------

6. Share capital

No GBP No GBP GBP

Ordinary Ordinary Deferred Deferred Total

shares shares shares of shares share

of 1p each of 0.02p/1p 0.001p each of 0.001p capital

each each

Issued and fully

paid

At 1 January 2022 21,645,575 216,457 396,014,437,346 3,960,144 4,176,601

On 7 December

2022 the company

issued 5,714,286

Ordinary 1p shares

at 7p each 5,714,286 57,143 - - 57,143

As at 31 December

2022 27,359,861 273,600 396,014,437,346 3,960,144 4,233,744

============ ============= ================ =========== ==========

No GBP No GBP GBP

Ordinary Ordinary Deferred Deferred Total

shares shares shares of shares share

of 1p each of 0.02p/1p 0.001p each of 0.001p capital

each each

Issued and fully

paid

At 1 January 2022

and 30 June 2022 21,645,575 216,457 396,014,437,346 3,960,144 4,176,601

============ ============= ================ =========== ==========

No GBP No GBP GBP

Ordinary Ordinary Deferred Deferred Total

shares shares shares of shares share

of 1p each of 0.02p/1p 0.001p each of 0.001p capital

each each

Issued and fully

paid

At 1 January 2023 27,359,861 273,600 396,014,437,346 3,960,144 4,233,744

On 31 May 2023

the company issued

11,500.000 Ordinary

1p shares at 5p

each 11,500,000 115,000 - - 115,000

As at 31 December

2022 38,859,861 388,600 396,014,437,346 3,960,144 4,348,744

============ ============= ================ =========== ==========

7. Distribution of interim report to shareholders

The interim report will be available for inspection by the

public at the registered office of the Company during normal

business hours on any weekday and from the Company's website

http://www.shukaminerals.com/ . Further copies are available on

request.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUACBUPWGAP

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

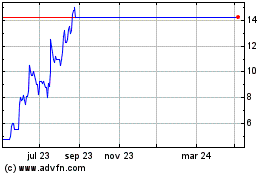

Edenville Energy (LSE:EDL)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

Edenville Energy (LSE:EDL)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025