TIDMFAR

RNS Number : 8354J

Ferro-Alloy Resources Limited

21 August 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) NO. 596/2014 (INCLUDING AS IT

FORMS PART OF THE LAWS OF ENGLAND AND WALES BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

21 August 2023

Ferro-Alloy Resources Limited

("Ferro-Alloy" or the "Company")

Trading update

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer

and developer of the large Balasausqandiq vanadium deposit in

Southern Kazakhstan today provides a trading update in respect of

recent developments at the Company's existing operations.

Trading Update

With all factory upgrades complete, the Company is focussed on

increasing production and recovering more value from each tonne

treated, as demonstrated by Q2 2023's best production quarter to

date (announced 17 July 2023), in terms of both volumes of

concentrate treated and tonnes of metal recovered across all

product lines.

As previously announced, the Company had entered into a number

of contracts for the supply of vanadium-bearing concentrates to the

Company's existing processing operation. In order for there to be a

constant pipeline of concentrate available to process, the Company

is dependent on the suppliers of the concentrates fulfilling their

contractual obligations, including timely delivery and quality of

concentrate, and on the efficient operation of transport routes for

delivery to Kazakhstan.

In the year to date, one of the Company's major suppliers

defaulted on its monthly supply commitments. Although deliveries

from this supplier were still expected, albeit with a long-delayed

start date, the Company responded by entering into further

contracts with other suppliers, both long term and on a spot basis.

The Company was previously satisfied that sufficient deliveries

were scheduled to enable the Company to run at full operating

capacity from mid-July 2023 onwards. However, further unanticipated

supplier and transport delays have been experienced and have

impacted output across the first two months of Q3 2023.

Concentrate supplies already in transit and ready for shipment

are sufficient to allow the resumption of full operations from

around the beginning of September. However, there is a possibility

of further delays in the Southern, trans-Caspian Sea transport

routes, caused by Ukraine-related disruption to other import routes

and exacerbated by winter conditions in the Caspian Sea. There is,

therefore, a possibility of some more limited shortfalls affecting

production in Q4 2023. Subject to this, the Company expects the

processing and output of the plant for Q4 2023 to be at or close to

planned capacity.

Vanadium prices have remained depressed compared with prices

earlier this year, attributed to the economic slow-down in China

resulting in net exports of vanadium from China, although this is

likely to be offset by significant demand for vanadium for energy

storage batteries.

As a result, the Company anticipates that the concentrate supply

delays experienced in Q3 2023, and continuing low vanadium prices,

will have a material impact on the Company's financial results for

Q3 2023.

Feasibility study

The feasibility study into the Balasausqandiq deposit, the main

value driver of the Company, is ongoing and reaching the final

stages.

The previous Competent Person's Report issued in 2018 showed a

combined (Phases 1 and 2) Net Present Value of US$2 billion. Since

then, as previously announced, the ore resource estimated for the

first ore body (OB1) showed an increase of 23% in contained

vanadium compared with the previous estimate and the ongoing

investigation of the possibility to use a concentrate of the carbon

content of the ore as carbon black has produced exciting results.

Other results have been in line with previous expectations.

The Company announced on 27 July 2023 the launch of an exempt

offer bond programme on the Astana International Exchange. So far,

a total of US$1.3m has been raised out of the first US$3m tranche

of the programme. The US$1.3m, and all subsequent funds raised

under the first tranche of the programme, will be used to fund the

ongoing feasibility study to completion.

Outlook

The Company believes that both the production and financial

results for 2023 are still likely to be significantly better than

those achieved during 2022 notwithstanding the concentrate supply

issues incurred to date.

The main activity for the remainder of 2023 will continue to be

the completion of the Balasausqandiq feasibility study. Current

schedules indicate that the study will be completed before the end

of the year but indications of possible delays have been received

from our consultants which might extend the delivery of the study

into the first quarter of 2024.

Nick Bridgen, CEO, commented : "With all plant modifications now

complete and operating efficiently, these supply chain issues are

disappointing. That said, the progress in the feasibility study,

the main driver of the Company's value, is very encouraging and I

look forward to updating shareholders on its results."

ENDS

For further information, visit www.ferro-alloy.com or contact:

Ferro-Alloy Resources Nick Bridgen (CEO)/William info@ferro-alloy.com

Limited Callewaert (CFO)

Shore Capital Toby Gibbs/Lucy Bowden

(Joint Corporate Broker) +44 207 408 4090

Liberum Capital Limited Scott Mathieson/Kane

(Joint Corporate Broker) Collings +44 20 3100 2000

St Brides Partners

Limited

(Financial PR & IR Catherine Leftley/Ana

Adviser) Ribeiro +44 207 236 1177

About Ferro-Alloy Resources Limited:

The Company's operations are all located at the Balasausqandiq

deposit in Kyzylordinskoye Oblast in the South of Kazakhstan.

Currently the Company has two main business activities:

a) the high grade Balasausqandiq vanadium project (the

"Project"); and

b) an existing vanadium concentrate processing operation (the

"Existing Operation")

Balasausqandiq is a very large deposit, with vanadium as the

principal product together with several by-products. Owing to the

nature of the ore, the capital and operating costs of development

are very much lower than for other vanadium projects.

The most recent mineral resource estimate for ore-body one (of

seven) provided an Indicated Mineral Resource of 32.9 million

tonnes at a mean grade of 0.62% V(2) O(5) equating to 203,364

contained tonnes of vanadium pentoxide ("V(2) O(5) "). In the

system of reserve estimation used in Kazakhstan the reserves are

estimated to be over 70m tonnes in ore-bodies 1 to 5 but this does

not include the full depth of ore-bodies 2 to 5 or the remaining

ore-bodies which remain substantially unexplored.

The Project will be developed in two phases, Phase 1 and Phase

2, treating 1m tonnes per year and an additional 3m tonnes per

year. Production will be some 5,600 tonnes of V(2) O(5) from Phase

1, rising to 22,400 tonnes V(2) O(5) after Phase 2 is

commissioned.

There is an existing concentrate processing operation at the

site of the Balasausqandiq deposit. The production facilities were

originally created from a 15,000 tonnes per year pilot plant which

was then expanded and adapted to recover vanadium, molybdenum and

nickel from purchased concentrates.

The existing operation is located on the same site and uses some

of the same infrastructure as the Project, but is a separate

operation which will continue in parallel with the development and

operation of the Project.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKFBNABKDKFD

(END) Dow Jones Newswires

August 21, 2023 02:00 ET (06:00 GMT)

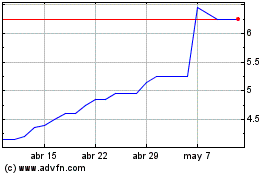

Ferro-alloy Resources (LSE:FAR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ferro-alloy Resources (LSE:FAR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024