TIDMHDT

RNS Number : 2808X

Holders Technology PLC

26 August 2022

Holders Technology plc

("Holders Technology", the "Company" or the "Group")

Half Year Report

Holders Technology, (AIM: HDT), is pleased to announce its

unaudited half year results for the six months ended 31 May

2022.

Highlights

Holders Technology operates as a lighting and wireless control

solutions ("LCS") provider and supplies specialty laminates and

materials for printed circuit board ("PCB") manufacturers.

Unaudited results for the half year ended 31 May 2022 are

summarised as follows:

2022 2021

GBP'000 GBP'000

------- -------

Revenue LCS 2,227 1,991

PCB 1,227 3,798

Total 3,454 5,789

-------

Gross profit 1,207 1,718

Margins 34.9% 29.7%

Overheads 1,450 1,616

Operating (loss)/ profit (243) 102

Finance expense (1) (10)

Income from joint ventures 18 12

(Loss)/ profit before tax (226) 104

Taxation - -

(Loss)/ profit after tax (226) 104

======= =======

(Loss)/ earnings per share (5.35p) 2.46p

Interim dividend per share 0.50p 0.50p

Net assets per share 99p 95p

---------------------------- ------ ------- -------

Chairman's statement

Half year ended 31 May 2022

The Group has undergone a transformation during the last two

financial years. In 2021, the Group disposed of its lower growth,

lower margin PCB consumable activities. During 2022 the Group has

refocused on its continuing specialist PCB businesses and invested

further in the LCS divisions. Details of this are set out

below.

Revenue for the 6 months to 31 May 2022 was GBP3,454,000.

Revenue for the 6 months to 31 May 2021 ("H1 2021") from the

continuing business (i.e. excluding discontinued PCB revenues) was

GBP3,373,000, and therefore growth from the continuing revenues was

3.3%. This figure however does not include the Group share of joint

venture revenues of GBP193,000 (2021: 48,000); if this is included

then Group revenue growth was 7.5%.

Gross margins increased from 29.7% to 34.9%, and the pre-tax

Group result was a loss of GBP226,000 (H1 2021: profit of

GBP104,000).

LCS

UK revenue growth was strong however market demand in Germany

was weakened by project delays and cancellations. LCS revenue

increased by 11.9% overall to GBP2,227,000 (2021: GBP1,991,000) and

by 18.7%, when including the Group share of the joint venture

revenue. We have continued to invest across the Group in staff,

technology and product development. These costs have initially

contributed to a margin decrease from 37.7% to 34.3%, which we are

seeking to improve. The overall result for the LCS divisions was an

operating loss of GBP216,000 (H1 2021: profit of GBP53,000).

In addition to the above, the four LCS joint ventures, Holders

Technology Austria, Holders Technology Data Analytics, Holders

Technology New Zealand and Holders Technology Australia made

further progress during the period and overall were profitable.

PCB

Results from the restructured PCB divisions were broadly in line

with expectations, in spite of difficult market conditions.

Revenues from the continuing product ranges decreased by 11.2% from

GBP1,382,000 to GBP1,227,000, partly because shorter supplier lead

times enabled customers to hold less stock. Gross margins improved

from 25.5% to 36.1%, due to the product mix of the retained PCB

business and the overall result was an operating profit of

GBP83,000 (H1 2021: GBP134,000 profit).

Cash and Debt

Group cash at the period end was GBP2,490,000 (31 May 2021:

GBP1,277,000). Other than lease liabilities, the Company has no

debt.

Outlook

The second half of the financial year has started well, with

improving revenue and profitability. We will continue with our

strategy to invest in sales and technical resources, new products

and technology to enable the Group to be a leader in our markets.

Whilst we are cautious regarding the global economic outlook, we

remain confident that future performance will demonstrate the

validity of this approach.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

Rudolf W. Weinreich Holders Technology plc

Executive Chairman 27-28 Eastcastle Street

London W1W 8HD

For further information, contact:

Holders Technology plc

Rudi Weinreich, Executive Chairman 01896 758781

Victoria Blaisdell, Group Managing Director

Paul Geraghty, Group Finance Director

SP Angel Corporate Finance LLP - Nomad and Broker

Matthew Johnson/ Caroline Rowe, Corporate Finance

020 3470 0470

Website

www.holdersgroup.com

Consolidated income statement

for the half year ended 31 May 2022 (Unaudited)

Half year Half year Full year

ended ended 31 ended 30

31 May 2021 Nov 2021

May 2022

========== ========== ==========

Notes GBP'000 GBP'000 GBP'000

Revenue 3 3,454 5,789 12,386

Cost of sales (2,247) (4,071) (8,516)

========== ========== ==========

Gross profit 1,207 1,718 3,870

Distribution costs (88) (213) (408)

Administrative expenses (1,359) (1,399) (3,001)

Impairment of goodwill - - (146)

Other operating expenses (3) (4) 8

========== ========== ==========

Operating (loss)/ profit (243) 102 323

Income from joint ventures 18 12 3

Profit on disposal of assets - - 471

Finance costs (1) (10) (10)

========== ========== ==========

(Loss)/ profit before taxation (226) 104 787

Taxation 4 - - (92)

========== ========== ==========

(Loss)/ profit for the period (226) 104 695

========== ========== ==========

Total and continuing

Basic (loss)/ earnings per

share 6 (5.35p) 2.46p 16.45p

========== ========== ==========

Diluted (loss)/ earnings per

share 6 (5.35p) 2.46p 16.45p

========== ========== ==========

Consolidated statement of comprehensive income

for the half year ended 31 May 2022 (Unaudited)

Half year Half year Full year

ended ended 31 ended 30

31 May 2021 Nov 2021

May 2022

========== ================ ==========

GBP'000 GBP'000 GBP'000

Profit/ (loss) for the period (226) 104 695

Exchange differences on

translation of foreign operations 7 (89) (134)

========== ================ ==========

Total comprehensive income

for the period (219) 15 561

========== ================ ==========

Consolidated statement of changes in equity

for the half year ended 31 May 2022 (Unaudited)

Capital

Share redemption Translation Retained

Share capital premium reserve reserve earnings Total equity

============== ============ ================== ================ ================ =============

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance 1 Dec

2020 422 1,590 1 248 1,738 3,999

Dividends - - - - (32) (32)

Transactions

with owners - - - - (32) (32)

============== ============ ================== ================ ================ =============

Profit for the

year - - - - 695 695

Exchange

differences on

translating

foreign

operations - - - (134) - (134)

============== ============ ================== ================ ================ =============

Total

comprehensive

income for the

year - - - (134) 695 561

============== ============ ================== ================ ================ =============

Balance 30 Nov

2021 422 1,590 1 114 2,401 4,528

============== ============ ================== ================ ================ =============

Dividends - - - - (106) (106)

- - - - (106) (106)

Loss for the

period - - - - (226) (226)

Exchange

differences on

translating

foreign

operations - - - 7 - 7

============== ============ ================== ================ ================ =============

Total

comprehensive

income for the

period - - - 7 (226) (219)

============== ============ ================== ================ ================ =============

Balance 31 May

2022 422 1,590 1 121 2,069 4,203

============== ============ ================== ================ ================ =============

Consolidated balance sheet

at 31 May 2022 (Unaudited)

Half year Half year Full year

ended ended 31 ended 30

31 May 2021 Nov 2021

May 2022

========== ========== ==========

Notes GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible fixed assets 172 378 220

Property, plant and equipment 186 1,127 82

Leased assets 87

Investment in joint ventures 130 40 111

Deferred tax assets 12 12 12

========== ========== ==========

500 1,557 512

========== ========== ==========

Current assets

Inventories 1,623 1,953 1,180

Trade and other receivables 1,173 1,642 1,593

Cash and cash equivalents 2,490 1,277 3,192

========== ========== ==========

5,286 4,872 5,695

Liabilities

Current liabilities

Trade and other payables (1,389) (1,270) (1,661)

Lease liabilities 3 - (930) (58)

Current tax liabilities - - -

========== ========== ==========

(1,389) (2,200) (1,719)

Net current assets 3,897 2,672 4,246

========== ========== ==========

Non-current liabilities

Retirement benefit liability (185) (216) (186)

Lease liabilities - - (35)

Deferred tax liabilities (9) (9) (9)

(194) (225) (230)

Net assets 4,203 4,004 4,528

========== ========== ==========

Shareholders' equity

Share capital 422 422 422

Share premium account 1,590 1,590 1,590

Capital redemption reserve 1 1 1

Retained earnings 2,069 1,829 2,401

Cumulative translation

adjustment 121 162 114

========== ========== ==========

Equity attributable to

the shareholders of the

parent 4,203 4,004 4,528

Consolidated cash flow statement

for the half year ended 31 May 2022 (Unaudited)

Half year Half year Full year

ended ended 31 ended 30

31 May 2021 Nov 2021

May 2022

========== ========== ==========

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

(Loss)/ profit before tax (244) 104 787

Depreciation 43 131 168

Gain on disposal of property,

plant and equipment - - (471)

Impairment - Goodwill - - 146

(Increase)/ decrease in inventories (442) 323 1,093

(Increase)/ decrease in trade

and other receivables (83) (579) (527)

Increase/ (decrease) in trade

and other payables 233 350 702

Interest expense 1 10 10

Cash generated from operations (492) 339 1,908

Income from investments (18) (12) (3)

Tax paid - - (92)

Interest paid (1) (10) (10)

Net cash generated from operations (511) 317 1,803

========== ========== ==========

Cash flows from investing activities

Purchase of property, plant, and

equipment (69) (30) (65)

Investment in joint venture 18 - (80)

Proceeds from sale of property,

plant and equipment - - 553

Net cash used in investing activities (51) (30) 408

========== ========== ==========

Cash flows from financing activities

Equity dividends paid (106) - (32)

Lease repayments (26) (95) (37)

Net cash used in financing activities (132) (95) (69)

========== ========== ==========

Net change in cash and cash equivalents (694) 192 2,142

Cash and cash equivalents at start

of period 3,192 1,113 1,113

Effect of foreign exchange rates (8) (28) (63)

Cash and cash equivalents at end

of period 2,490 1,277 3,192

========== ========== ==========

Notes

1. General information

Holders Technology plc is incorporated in the United Kingdom

under the Companies Act 2006. The principal activity of the group

is to provide specialised materials, components and solutions to

the electronics and lighting industries.

2. Basis of preparation

The condensed consolidated half year financial statements have

been prepared in accordance with the AIM Rules for Companies and

prepared on a basis consistent with International Financial

Reporting Standards ("IFRS") as adopted by the EU and the

accounting policies set out in the Group's financial statements for

the year ended 30 November 2021.

The half year financial statements are unaudited and include all

adjustments which management considers necessary for a fair

presentation of the Group's financial position, operating results

and cash flows for the 6-month periods ended 31 May 2021 and 31 May

2022.

The half year financial statements do not constitute statutory

accounts as defined by Section 434 of the Companies Act 2006. A

copy of the Group's financial statements for the year ended 30

November 2021 prepared in accordance with IFRS as adopted by the EU

has been filed with the Registrar of Companies. The auditors'

report on those financial statements was not qualified and did not

contain statements under s498(2) of s498(3) of the Companies Act

2006.

As permitted, the Group has chosen not to adopt IAS 34 'Interim

Financial Statements' in preparing these half year financial

statements and therefore the half year financial information is not

in full compliance with IFRS.

The preparation of half year financial statements requires

management to make judgements, estimates and assumptions that

affect the application of policies and reported amounts of assets

and liabilities, income, and expenses. Actual results may differ

from these estimates.

These half year financial statements have been prepared under

the historical cost convention.

The board of Holders Technology plc approved this half yearly

report on 25 August 2022.

Notes (continued):

3. Segmental information

Management currently identifies two operating segments:

1. LCS provides lighting and control solutions.

2. PCB distributes materials, equipment, and supplies to the PCB industry.

Analysis by operating segment for the half year ended 31 May

LCS PCB Central Costs Total

2022 2021 2022 2021 2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

======== ======== ======== ======== ======== ======== ======== ========

Revenue 2,227 1,991 1,227 3,798 - - 3,454 5,789

Cost of

sales 1,463 1,241 784 2,830 - - 2,247 4,071

======== ======== ======== ======== ======== ======== ======== ========

Gross Profit 764 750 443 968 - - 1,207 1,718

Distribution

costs 65 54 23 159 - - 88 213

Administration

costs and

other operating

expenses 915 643 338 675 109 85 1,253 1,403

======== ======== ======== ======== ======== ======== ======== ========

Operating

Profit/

(Loss) (216) 53 82 134 (109) (85) (243) 102

======== ======== ======== ======== ======== ======== ======== ========

4. The tax provision for the six months ended 31 May 2022 is

calculated based on the tax rates applicable in the country in

which each company operates.

5. A special dividend of 2.00p per share on the total issued

share capital of 4,224,164 10p ordinary shares was approved by the

board on 21 December 2021 and paid on 28 January 2022.

A final dividend of 0.50p (2021: 0.25p per share) per share on

the total issued share capital of 4,224,164 10p ordinary shares was

approved by the board on 28 January 2022, and paid on 31 May 2022,

in respect of the year ended 30 November 2021.

An interim dividend payment of 0.50p per share (2021: 0.25p per

share) will be payable on 4 October 2022 to shareholders on the

register on 9 September 2022. The shares will go ex-dividend on 8

September 2022. The interim dividend had not been approved by the

board on 31 May 2022 and accordingly, has not been included as a

liability as at that date.

6. The basic earnings per share for continuing operations are

based on the loss for the period of GBP226,000 (2021: profit

GBP104,000) and on 4,224,164 ordinary shares (2021: 4,224,164), the

weighted average number of shares in issue during the period. There

were no share options in issue in 2021 or 2022 and therefore

diluted earnings per share and basic earnings per share are the

same value for each year.

7. A copy of this half yearly report will be sent to

shareholders and is available for inspection at the company's

offices at Holders Technology (UK) Ltd., Units 1-4, Block 9,

Tweedbank Industrial Estate, Galashiels TD1 3RS and via its website

www.holderstechnology.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFSETFIEFIF

(END) Dow Jones Newswires

August 26, 2022 02:00 ET (06:00 GMT)

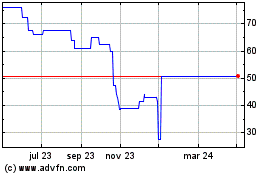

Holders Technology (LSE:HDT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Holders Technology (LSE:HDT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024