TIDMLND

RNS Number : 8981N

Landore Resources Limited

27 September 2023

LANDORE RESOURCES LIMITED

(AIM Ticker : LND.L)

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

London, United Kingdom - 28 September 2023 - Landore Resources

Limited (AIM : LND) ("Landore Resources" or the "Company") is

pleased to announce its unaudited interim results for the six

months ended 30 June 2023.

The Company notes that the interim results also include results

for the three month period ended 30 June 2023, and associated

comparatives, in order to facilitate the Company's planned

forthcoming dual listing on the TSX Venture Exchange ("TSX-V").

Full copies of the Company's unaudited interim results for the

three and six months ended 30 June 2023 (the "Interim Results"),

together with the separate accompanying Management's Discussion and

Analysis ("MD&A"), will shortly be made available to download

on the Company's website at: www.landore.com .

For further information, please contact:

Landore Resources Limited

Claude Lemasson, Chief Executive Officer Tel: +1-807-623-3770

Glenn Featherby, Finance Director

Strand Hanson Limited (Nominated Adviser

and Joint Broker)

James Dance/Matthew Chandler/Robert Collins Tel: 020 74093494

Novum Securities Limited (Joint Broker)

Jon Belliss/Colin Rowbury Tel: 020 73999402

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended by virtue of the Market Abuse

(Amendment) (EU Exit) Regulations 2019.

Key Extracts from the Interim Results and MD&A are set out

below :

General

The following MD&A of Landore Resources Limited (the

"Company", the "Group" or "Landore") should be read in conjunction

with the unaudited condensed interim consolidated financial

statements for the three and six months ended 30 June, 2023 with

comparatives for the three and six month periods ended 30 June,

2022 and the notes thereto. The Company's unaudited condensed

interim consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards

("IFRS"). Unless otherwise stated, all amounts discussed herein are

denominated in British Pounds.

Overview

The Company is quoted on AIM with the trading symbol LND.L. The

Company is based in Guernsey in the Channel Islands and its 100 per

cent. owned operating subsidiary, Landore Resources Canada Inc.

("Landore Canada"), is engaged in the exploration and development

of a portfolio of precious and base metal properties in North

America.

Financial Results :

The financial results for the six months to 30 June 2023 show a

loss before income tax of GBP822,251 (30 June 2022: GBP794,385),

and for the three months ended 30 June 2023 a loss of GBP771,560

(30 June 2022: GBP308,022). Exploration costs for the six months

ended 30 June 2023 were GBP242,502 (30 June 2022: GBP398,341), and

for the three months ended 30 June 2023 GBP142,752 (30 June 2022

GBP248,834).

The Company's cash and cash equivalents balance was GBP397,109

at 30 June, 2023 compared to GBP1,235,528 at 31 December, 2022.

Operations Report

The Junior Lake Property :

The Junior Lake property, 100 per cent. owned by Landore Canada,

is located in the province of Ontario, Canada, approximately 235

kilometres north-northeast of Thunder Bay and is host to the BAM

Gold Deposit, the B4-7 Nickel-Copper-Cobalt-PGEs deposit and the

adjacent Alpha PGEs zone. Junior Lake also contains the VW Nickel

deposit and numerous other highly prospective mineral occurrences

including lithium.

BAM Gold Deposit :

Works to-date have brought the BAM Gold Project's In-Situ NI

43-101 compliant resource to 49,231,000 tonnes (t) at 1.0

grams/tonne (g/t) for 1,496,000 ounces of gold (oz Au) including

30,965,000t at 1.0g/t for 1,029,000 ounces gold in the Indicated

Category (February 2022 mineral resource estimate, at a 0.3g/t

cut-off).

On 9 May 2022, Landore announced a positive preliminary economic

assessment ("PEA") which indicated that under certain conditions

the BAM Gold Project generates pre-tax and post-tax NPVs of,

respectively, US$333.6M and US$231.2M and pre-tax and post-tax real

IRRs of 87.4% and 66.7%. The BAM Gold Project has an after-tax

simple pay back of 1.25 years from the start of production or 2.25

years from the start of the project.

Landore Canada's focus for the remainder of 2023 and going

forward is on advancing its highly prospective BAM Gold Project,

targeting a two-million-ounce resource together with completing a

Pre-Feasibility Study, concentrating on:

-- The underground potential at BAM as identified by CUBE in its

May 2022 resource upgrade and presentation.

-- Advancing the existing Inferred resource into an Indicated

Resource together with infilling the exploration targets to the

immediate east and west of the current resource.

-- Commencing a pre-feasibility study to advance the BAM Gold Project towards production.

Gold-Strategic Metals Exploration :

Exploration drilling in 2022 over a distance of 8 kilometres

westwards along strike from the BAM Gold and B4-7 Nickel-

Copper-Cobalt-PGEs Deposits successfully intersected gold and

strategic metals mineralisation in all areas including the highly

prospective Felix-Grassy Pond Prospects located from 1100W to

5000W. Drilling also infilled and extended the Carrot Top zone

located 7 to 8 kilometres west of the BAM Gold Deposit to allow

modelling for resource purposes.

During 2022 a soil-till sampling programme was completed in the

Felix Lake, Lamaune Gold and Carrot Top Ni-Cu-Co- PGEs prospect

areas to build on Landore Canada's extensive dataset of soil

sampling results along the Junior Lake shear zone. Soil sampling

covering 16 kilometres from the Placer Dome Gold prospect in the

west, to east of the BAM Gold Deposit successfully confirmed the

presence of highly anomalous gold occurrences and trends on the

Felix prospect and south of Felix westwards into the Lamaune Gold

area, identifying direct drill targets.

Preparatory work is currently underway to follow up on the

promising drill and soil results with the aim of expanding the BAM

Gold Deposit to the west and east, as well as further delineating

strategic metals trends.

The continued rapid growth of the BAM Gold Deposit together with

the possible future development of the other known gold prospects

along this highly prospective 31 kilometre long Archean greenstone

belt bodes well for the future of the Junior Lake Property

potentially hosting a multi-million ounce gold deposit.

Junior Lake Lithium Prospects :

On 6 March 2023, Landore announced that it had entered into an

option agreement with Green Technology Metals Limited ("GT1") which

provides GT1 with the right to purchase an 80 per cent. interest

(the "Option") in certain tenements which contain Lithium prospects

in return for staged payments over three years to Landore Canada

totalling C$2,500,000 in cash and an additional C$1,500,000 either

in cash or by issuing Landore Canada with new common shares in GT1

(the "Lithium Claim Blocks").

The Lithium Claim Blocks, located in the northern part of the

Junior Lake Property, consist of 10,856 hectares and host a number

of lithium-bearing pegmatites, with three drill-ready prospects

identified from previous exploration activity, the historical

Despard Lithium deposit, the Swole Lake spodumene-bearing pegmatite

and Tape Lake pegmatites, both discovered by Landore Canada. As an

exploration asset, the Lithium Claim Blocks currently generate no

revenues or profits and as at 31 December 2022 and 30 June 2023,

for accounting purposes, had a book value of nil.

The consideration received by the Company pursuant to the Option

agreement will be applied towards the Group's working capital

requirements, specifically the advancement of the BAM Gold Project

to the Pre-Feasibility Stage.

COVID-19 :

The spread of a novel strain of coronavirus ("COVID-19") and

measures taken to contain the spread of the virus caused

significant disruption to Landore Canada's exploration activities

during the first half of 2020. By mid-2020 the Company resumed

Canadian operations, and since then has successfully operated in

accordance with Canadian Government's COVID-19 guidelines.

Social and environmental responsibilities :

The Group believes that a successful project is best achieved

through maintaining close working relationships with First Nations

and other local communities. This social ideology is at the

forefront of the Group's exploration initiatives and the Company

seeks to establish and maintain co-operative relationships with

First Nations communities, hiring local personnel and using local

contractors and suppliers where possible. Careful attention is

given to ensure that all exploration activity is performed in an

environmentally responsible manner and abides by all relevant

mining and environmental acts. Landore Canada takes a conscientious

role towards its operations and is aware of its social

responsibilities and its environmental duties.

28 September 2023

Unaudited Condensed Interim Consolidated Statement of

Comprehensive Income

For the three and six months ended 30 June 2023

Three months ended Six months ended

30 June 30 June

2023 2022 2023 2022

Notes GBP GBP GBP GBP

Exploration costs 6 (142,752) (248,834) (242,502) (398,341)

Administrative expenses (527,331) (499,277) (964,773) (818,316)

Operating loss (670,083) (748,111) (1,207,275) (1,216,657)

Other income 19 - 467,715 451,988 448,779

Loss on disposal of non-current

investments (54,225) - (54,887) -

Loss on non-current investments

measured at fair value 9 (47,252) (27,626) (12,077) (26,507)

Loss before income tax (771,560) (308,022) (822,251) (794,385)

Income tax 5 - - - -

Loss for the period (771,560) (308,022) (822,251) (794,385)

Other comprehensive income

Items that will subsequently

be reclassified to profit

or loss :

Exchange differences on

translating foreign operations 10,620 26,500 (24,678) 58,021

Other comprehensive income/(loss)

for the period net of

tax 10,620 26,500 (24,678) 58,021

Total comprehensive loss

for period (760,940) (281,522) (846,929) (736,364)

Loss attributable to

:

Equity holders of the

Company (771,644) (308,163) (822,610) (794,153)

Non-controlling interests 84 141 359 (232)

Total comprehensive loss

attributable to:

Equity holders of the

Company (761,024) (281,663) (847,288) (736,132)

Non-controlling interests 84 141 359 (232)

Loss per share for losses

attributable to the equity

holders

of the Company during

the period

- Basic and diluted (GBP) 7 (0.007) (0.003) (0.008) (0.007)

The above Unaudited Condensed Interim Consolidated Statement of

Comprehensive Income should be read in conjunction with the

accompanying notes.

Unaudited Condensed Interim Consolidated Statement of Financial

Position

As at 30 June 2023

As at As at

30 June 31 December

2023 2022

Notes GBP GBP

Assets

Non-current assets

Property, plant and equipment 8 59,870 68,432

Investments 9 87,970 169,682

---------------------------------- ----- ------------ ------------

147,840 238,114

Current assets

Trade and other receivables 10 68,331 110,890

Cash and cash equivalents 397,109 1,235,528

---------------------------------- ----- ------------ ------------

465,440 1,346,418

---------------------------------- ----- ------------ ------------

Total assets 613,280 1,584,532

---------------------------------- ----- ------------ ------------

Equity

Capital and reserves attributable

to the Company's

equity holders

Share capital - nil par value 12 51,926,526 51,926,526

Share-based payment reserve 13 570,500 584,266

Accumulated deficit (51,948,655) (51,139,811)

Translation reserve (325,711) (301,033)

Total equity shareholders' funds 222,660 1,069,948

---------------------------------- ----- ------------ ------------

Non-controlling interests (5,339) (5,698)

Total equity 217,321 1,064,250

---------------------------------- ----- ------------ ------------

Liabilities

Current liabilities

Trade and other payables 11 395,959 520,282

395,959 520,282

---------------------------------- ----- ------------ ------------

Total liabilities 395,959 520,282

---------------------------------- ----- ------------ ------------

Total equity and liabilities 613,280 1,584,532

---------------------------------- ----- ------------ ------------

The above Unaudited Condensed Interim Consolidated Statement of

Financial Position should be read in conjunction with the

accompanying notes.

Unaudited Condensed Interim Consolidated Statement of Changes in

Equity

For the six months ended 30 June 2023

Equity shareholders' funds

---------------------------------------------- -------------

Share Non-controlling

capital Share-based Accumulated Translation

nil par interest

value payment deficit reserve Total

GBP GBP GBP GBP GBP GBP

Balance as at 1

January 2022 50,179,599 979,409 (49,692,080) (322,611) (4,901) 1,139,416

------------ ----------- -------------- ----------- ----------------- -------------

Issue of ordinary

share capital - nil

par value (note 12) 909,605 - - - - 909,605

Warrants exercised - (12,529) 12,529 - - -

---------------------- ------------ ----------- -------------- ----------- ----------------- -------------

Total transactions

with owners 909,605 (12,529) 12,529 - - 909,605

---------------------- ------------ ----------- -------------- ----------- ----------------- -------------

Loss for the period - - (794,153) - (232) (794,385)

---------------------- ------------ ----------- -------------- ----------- ----------------- -------------

Exchange difference

from translating

foreign operations - - - 58,021 - 58,021

---------------------- ------------ ----------- -------------- ----------- ----------------- -------------

Total comprehensive

loss for the period - - (794,153) 58,021 (232) (736,364)

Balance as at 30

June 2022 51,089,204 966,880 (50,473,704) (264,590) (5,133) 1,312,657

---------------------- ------------ ----------- -------------- ----------- ----------------- -------------

Balance as at 1

July 2022 51,089,204 966,880 (50,473,704) (264,590) (5,133) 1,312,657

---------------------- ------------ ----------- -------------- ----------- ----------------- -------------

Issue of options

(note 13) - 16,914 - - - 16,914

Issue of ordinary

share capital - nil

par value (note 12) 837,322 - - - - 837,322

Options exercised - (16,727) 16,727 - - -

Options lapsed - (339,382) 339,382 - - -

Warrants exercised - (8,134) 8,134 - - -

Warrants Lapsed - (35,285) 35,285 - - -

Total transactions

with owners 837,322 (382,614) 399,528 - - 854,236

---------------------- ------------ ----------- -------------- ----------- ----------------- -------------

Loss for the year - - (1,065,635) - (565) (1,066,200)

Exchange difference

from translating

foreign operations - - - (36,443) - (36,443)

Total comprehensive

loss for the period - - (1,065,635) (36,443) (565) (1,102,643)

---------------------- ------------ ----------- -------------- ----------- ----------------- -------------

Balance as at 31

December 2022 51,926,526 584,266 (51,139,811) (301,033) (5,698) 1,064,250

---------------------- ------------ ----------- -------------- ----------- ----------------- -------------

Balance as at 1

January 2023 51,926,526 584,266 (51,139,811) (301,033) (5,698) 1,064,250

--------------------- ---------- --------- -------------- ----------- --------- -----------

Warrants lapsed - (13,766) 13,766 - - -

--------------------- ---------- --------- -------------- ----------- --------- -----------

Total transactions

with owners - (13,766) 13,766 - - -

--------------------- ---------- --------- -------------- ----------- --------- -----------

Loss for the period - - (822,610) - 359 (822,251)

--------------------- ---------- --------- -------------- ----------- --------- -----------

Exchange difference

from translating

foreign operations - - - (24,678) - (24,678)

--------------------- ---------- --------- -------------- ----------- --------- -----------

Total comprehensive

loss for the period - - (822,610) (24,678) 359 (846,929)

--------------------- ---------- --------- -------------- ----------- --------- -----------

Balance as at 30

June 2023 51,926,526 570,500 (51,948,655) (325,711) (5,339) 217,321

--------------------- ---------- --------- -------------- ----------- --------- -----------

The above Unaudited Condensed Interim Consolidated Statement of

Changes in Equity should be read in conjunction with the

accompanying notes.

Unaudited Condensed Interim Consolidated Statement of Cash

Flows

For the six months ended 30 June 2023

6 months ended

30 June

2023 2022

Notes GBP GBP

Cash flows from operating activities

Loss for the period (822,251) (794,385)

Loss on disposal of non-current asset 54,887 -

investments

Depreciation of tangible fixed assets 8 6,728 8,371

Foreign exchange loss on non-cash items 856 (25,466)

Non-cash option income - (299,186)

Decrease/(increase) in trade and other

receivables 40,662 (8,406)

(Decrease)/increase in trade and other

payables (116,611) 17,255

Fair value loss on financial assets 9 12,077 26,507

Net cash used in operating activities (823,652) (1,075,310)

Cash flows from investing activities

Proceeds from disposal of non-current 10,896 -

asset investments

Net cash used in investing activities 10,896 -

Cash flows from financing activities

Proceeds from issue of ordinary shares - 909,605

Net cash generated by financing activities - 909,605

Net (decrease)/increase in cash and cash

equivalents (812,756) (165,705)

Cash and cash equivalents at the beginning

of the period 1,235,528 875,658

Exchange (loss)/gain on cash and cash

equivalents (25,663) 30,452

Cash and cash equivalents at the end

of the period 397,109 740,405

The above Unaudited Condensed Interim Consolidated Statement of

Cash Flow should be read in conjunction with the accompanying

notes.

Notes to the Unaudited Condensed Interim Consolidated Financial

Statements

1. General information

The Company was registered in Guernsey, Channel Islands on 16

February 2005 with registered number 42821 under the Companies

(Guernsey) Law, 2008. The Company is quoted on the AIM with the

trading symbol LND.L. The principal activity, mainly in Canada, is

mineral exploration including the identification, acquisition and

development of technically and economically sound mineral projects

either alone or with joint venture partners.

2. Basis of accounting and accounting policies

The unaudited condensed interim consolidated financial

statements have been prepared in accordance with IAS 34, Interim

Financial Reporting ("IAS 34") and do not include all of the

information required in annual financial statements. These

unaudited condensed interim consolidated financial statements

should be read in conjunction with the audited consolidated

financial statements for the year ended 31 December 2022.

The condensed interim consolidated interim financial statements

have not been audited and have been prepared on the historical cost

basis. The principal accounting policies adopted are consistent

with those adopted in the audited annual consolidated financial

statements for the year ended 31 December 2022.

The unaudited condensed interim consolidated financial

statements incorporate the financial statements of the Company and

entities controlled by the Company (its subsidiaries and

collectively the "Group") made up to 30 June 2023.

Changes in accounting policies

New and revised standards that are effective for annual periods

beginning on or after 1 January 2023 have been adopted in these

unaudited condensed interim consolidated financial statements.

During the financial period, the Group has adopted the following

new IFRSs (including amendments thereto), which became effective

for the first time:

Standard Effective date, annual period beginning on or after

IFRS 17 - Insurance Contracts 1 January 2023

----------------------------------------------------

Amendments to IFRS 17 - Insurance Contracts 1 January 2023

and Extension of the Temporary Exemption from Applying IFRS 9

(Amendments to IFRS 4 Insurance Contracts)

----------------------------------------------------

Disclosure of Accounting Policies (Amendments to IAS 1 1 January 2023

Presentation of Financial Statements

and IFRS Practice Statement 2 Making Materiality Judgements)

----------------------------------------------------

Definition of Accounting Estimates (Amendments to IAS 8 1 January 2023

Accounting Policies, Changes in Accounting

Estimates and Errors)

----------------------------------------------------

Deferred Tax related to Assets and Liabilities arising from a 1 January 2023

Single Transaction (Amendments

to IAS 12 Income Taxes)

----------------------------------------------------

Classification of Liabilities as Current or Non-Current: 1 January 2024

amendments to IAS 1

----------------------------------------------------

The Company's management have reviewed the application of the

amendments and have concluded that there is no impact on these

unaudited condensed interim consolidated financial statements.

3. Basis of consolidation

The unaudited condensed interim consolidated financial

statements incorporate the financial statements of the Company and

entities controlled by the Company (its subsidiaries and

collectively the "Group") made up to 30 June 2023. Control is

achieved where the Company is exposed, or has rights, to variable

returns from its involvement with the investee and has the ability

to affect those returns through its power over the investee. The

financial statements of subsidiaries are included in the unaudited

condensed interim consolidated financial statements from the date

that control commences until control ceases.

On acquisition, the assets and liabilities and contingent

liabilities of a subsidiary are measured at their fair values at

the date of acquisition. Any excess of the cost of acquisition over

the fair values of the identifiable net assets acquired is

recognised as goodwill. Any deficiency of the cost of acquisition

below the fair values of the identifiable net assets acquired

(i.e., discount on acquisition) is credited to the Statement of

Comprehensive Income in the period of acquisition.

Where necessary, adjustments are made to the financial

statements of subsidiaries to bring the accounting policies used

into line with those used by the Company. All intra-group

transactions, balances, income and expenses are eliminated on

consolidation.

The Directors consider that the Company exerts control over its

subsidiaries by virtue of its ownership of 100% of the share

capital in each of those companies and therefore 100% of the voting

rights and rights to variable returns from its involvement with

those companies (apart from Lamaune Iron Inc. which is owned

90.2%). The Directors therefore consider that the Company has

control over the companies it identifies as its subsidiaries in

accordance with IFRS 10.

4. Going concern

Note 15 to the unaudited condensed interim consolidated

financial statements includes the Group's objectives, policies and

processes for managing its capital; its financial risk management

objectives; details of its financial instruments; and its exposures

to credit risk and liquidity risk.

Due to the location of the Group's principal assets, it is well

protected from the effects of any potential COVID-19 resurgence on

its operations. Whilst the Group is exposed to any wider economic

implications from any further restrictions, the Board believes that

its interests in a range of precious metals combined with the

drilling progress achieved in 2022 provide a significant hedge to

the potential exposure to any further COVID-19 impacts. The Group's

operations during the period were unaffected by the pandemic which

has now abated.

As at 30 June 2023, the Group had cash balances of GBP397,109.

In addition, the Group is due to receive the following further

sums:

- A cash payment of C$250,000 and a convertible cash payment of

C$500,000 on or before 24 November 2023;

- A cash payment of C$500,000 and a convertible cash payment of

C$750,000 on or before 24 May 2024; and

- Furthermore, a cash payment of C$500,000 is due in March 2024

in relation to the option for the sale of the Lithium Claim

Blocks.

Whilst the Group has reported a comprehensive loss after tax for

the period ended 30 June 2023 amounting to approximately GBP0.85m,

the above mentioned expected further receipts, plus the GBP600,000

(before expenses) via the fundraising announced on 29 June 2023,

together with cash balances held at the period end means that the

Board is satisfied that the Group has sufficient cash to meet its

operational requirements for a period of at least 12 months from

the date of approval of these unaudited condensed interim

consolidated financial statements.

The Group currently has no debt. Future development activities

to continue to grow the Group's resources can be adjusted based on

the Group's ability to raise additional funds as necessary.

The unaudited condensed interim consolidated financial

statements have been prepared on a going concern basis with a

reasonable expectation that the Group has adequate resources to

continue in operational existence for a period of at least 12

months from the date of approval of these unaudited condensed

interim consolidated financial statements.

5. Taxation

The Company is taxed at the company standard rate of 0%.

The Company's subsidiary, Landore Resources Canada Inc., is

subject to Canadian Federal tax. No tax has been provided in the

accounts of Landore Resources Canada Inc. since there were no

taxable profits generated by the company during the year.

Landore Resources Canada Inc. has potential deferred tax assets

of approximately C$17m (31 December 2022: C$17m) which are not

recognised at the end of the period. These deferred tax assets are

in relation to exploration expenditures which are carried forward

to be utilised against future profits.

Landore Resources Canada Inc. also has a subsidiary, Brancote US

Inc. which is subject to taxation in the United States.

6. Mineral properties

Exploration expenditure and mineral properties Accumulated

Net expense Net expense expenditure at

in the three month in the six month 30 June

period to 30 June 2023 period to 30 June 2023 2023

GBP GBP GBP

Junior Lake 135,388 197,657 29,423,835

Miminiska Lake - 716 1,535,047

Frond Lake - - 90,341

Wottam - - 61,558

Lessard - - 709,122

Other, including Swole Lake

and Root Lake 7,364 44,129 146,026

----------------------------- ---------------------- ---------------------- --------------

142,752 242,502 31,965,929

---------------------------- ---------------------- ---------------------- --------------

Accumulated

Net expense Net expense expenditure at

in the three month in the six month 30 June

period to 30 June 2022 period to 30 June 2022 2022

GBP GBP GBP

Junior Lake 240,561 383,523 27,458,707

Miminiska Lake 1,186 1,139 1,534,291

Frond Lake - 1,490 89,949

Wottam - - 61,558

Lessard 505 4,133 709,480

Other, including Swole Lake

and Root Lake 6,582 8,056 98,949

----------------------------- ---------------------- ---------------------- --------------

248,834 398,341 29,952,934

---------------------------- ---------------------- ---------------------- --------------

6.1 Junior Lake

Junior Lake is a nickel, copper, platinum group metals, iron,

gold, and lithium property located north of Thunder Bay in Northern

Ontario, Canada, wholly owned by the Group. The Junior Lake

property also encompasses the Lamaune property block and the Swole

property block.

On 5 March 2023, Landore Resources Canada entered into an

agreement with Green Technology Metals Limited ("GT1") which

provides GT1 with the right to purchase an 80 per cent. interest

(the "Option") in certain tenements which contain Lithium

prospects, located within the Junior Lake Property, (the "Lithium

Claim Blocks"). Under the terms of the Option, GT1 has the right to

purchase an 80 per cent. interest in the Lithium Claim Blocks, in

return for staged payments over three years to Landore Resources

("Staged Payments") totalling C$2,500,000 in cash and an additional

C$1,500,000 either in cash or by issuing Landore Resources with new

common shares in GT1 as set out below:

- Initial cash payment of C$500,000 (within 5 business days of

execution of the option agreement (the "Effective Date"))

(received);

- Cash payment of C$500,000 on or before the date which is 12 months after the Effective Date;

- Cash payment of C$500,000, plus a further C$500,000 payable

either in cash or through the issue of new shares in GT1 to Landore

(at GT1's election) on or before the date which is 24 months after

the Effective Date; and

- Cash payment of C$1,000,000, plus a further C$1,000,000

payable either in cash or through the issue of new shares in GT1 to

Landore Canada (at GT1's election ) on or before the date which is

36 months after the Effective Date.

6.2 Miminiska Lake

Miminiska Lake is a gold exploration project located east of

Pickle Lake in Northern Ontario, Canada. Following the April 2018

conversion of all claims in the province of Ontario, the property

consists of a southern block ("Miminiska Lake"), and a northern

block ("Keezhik Lake"). Both blocks are wholly owned by the Group

(collectively, the "Property"). On 5 May 2021, the Group entered

into an agreement with Lithoquest Resources Inc. ("Lithoquest")

granting Lithoquest the exclusive right and option (the "Option")

to acquire a 100% interest in and to the Property and all of

Landore Resource's rights, licences and permits appurtenant thereto

or held for the specific use and enjoyment thereof, including all

of Landore Resource's interest in the underlying agreements by

paying to Landore Resources the staged sum of C$1,375,000 cash and

an additional sum of C$2,625,000 in cash or in new Lithoquest

common shares (hereinafter referred to as "Convertible Cash"), to

be paid as follows:

i. C$25,000 cash on the execution and delivery of the option agreement (received);

ii. an additional C$100,000 cash within ten business days

following the date (the "Effective Date") of acceptance of the

agreement by the TSX Venture Exchange (the "TSXV") (received);

iii. an additional C$250,000 cash and C$400,000 in Convertible

Cash to be paid within six months of the Effective Date

(received);

iv. an additional C$250,000 cash and C$500,000 in Convertible

Cash to be paid within 12 months of the Effective Date

(received);

v. an additional C$250,000 cash and C$750,000 in Convertible

Cash to be paid within 18 months of the Effective Date; and

vi. an additional C$500,000 cash and C$1,000,000 in Convertible

Cash to be paid within 24 months of the Effective Date.

On 30 November 2022, an amendment agreement was signed with

Storm Exploration Inc. ("Storm") (formerly named Lithoquest

Resources Inc.) to amend the payment schedule, resulting in the

following revised remaining payments:

vii. an additional $250,000 cash and $250,000 in Convertible

Cash to be paid within 19 months of the Effective Date

(received);

viii. an additional C$250,000 cash and C$500,000 in Convertible

Cash to be paid within 25 months of the Effective Date (received);

and

ix. an additional C$500,000 cash and C$500,000 in Convertible

Cash to be paid within 31 months of the Effective Date.

On 31 January 2023, Landore Resources received a further payment

under the Lithoquest Option, comprising of C$251,824 cash and

2,175,939 new common shares in Storm to the value of C$248,176.

In addition, Landore Resources agreed to further amend the terms

of the Option such that Storm could now acquire a 100% interest in

the Property by making staged payments to Landore Resources

totalling C$1,625,000 in cash and an additional C$2,400,000 either

in cash or new common shares in Storm (previously these payments

from inception were to comprise C$1,375,000 in cash and C$2,625,000

in Convertible Cash), with the remaining payments to be made in

accordance with the revised schedule below:

(i) a cash payment of C$250,000 and a Convertible Cash payment

of C$500,000 on or before 24 July 2023; and

(ii) a cash payment of C$500,000 and a Convertible Cash payment

of C$750,000 on or before 24 January 2024.

Storm has exclusive discretion to determine if each tranche of

the Convertible Cash payments is settled in cash or in new Storm

shares.

Following receipt of the remaining Cash payments, Convertible

Cash payments and exercise of the Option by Storm, Landore

Resources shall be entitled to receive a 2% net smelter returns

royalty ("NSR") from the Property. Storm will retain the right to

reduce the NSR to 1% by paying Landore Resources the sum of

C$1,000,000 in cash .

On 5 July 2023, Landore Resources and Storm agreed to a further

variation of four months to the scheduling of each of the remaining

payments due from Storm in respect of the pre-existing option

arrangement as follows:

(i) a cash payment of C$250,000 and a Convertible Cash payment

of C$500,000 on or before 24 November 2023; and

(ii) a cash payment of C$500,000 and a Convertible Cash payment

of C$750,000 on or before 24 May 2024.

6.3 Frond Lake

Frond Lake is a gold property located east of Pickle Lake in

Northern Ontario, Canada. The property is comprised of a number of

patented claims contiguous to the east of the Wottam Property. The

Frond Lake property claims are wholly owned by the Group subject to

a 2% NSR to the original owners of the property.

6.4 Wottam

Wottam is a gold property located east of Pickle Lake in

Northern Ontario, Canada. The property is wholly owned by the Group

and includes a number of claims contiguous between the Miminiska

and Frond properties.

6.5 Lessard

Lessard is a zinc and copper property located north of

Chibougamau in Quebec, Canada. The property is wholly owned by the

Group.

6.6 Swole Lake

Swole Lake is host to nickel, copper, platinum group metals and

lithium occurrences. The Swole Lake mining claim, wholly owned by

the Group, is consolidated into the greater Junior Lake property.

The Swole Lake legacy claim is subject to a 2% NSR royalty to the

original holder of the claim.

Sale of Net Smelter Returns Royalty ("NSR")

On 28 October 2022, the Group entered into an agreement with

Green Technology Metals Limited whereby Landore Resources sold its

3% Net Smelter Royalty ("Root Lake NSR") on the Root Lake Property,

Ontario (the "Root Lake NSR").

In consideration for the sale of the 3% NSR, the Group received

cash proceeds of C$3,000,000.

Purchase of Net Smelter Returns Royalty ("NSR")

On 21 September 2020, the Group entered into a Royalty Purchase

Agreement with Stares Contracting Corp., Stephen Stares, Michael

Stares and James Dawson (the "Agreement"), whereby Landore

Resources acquired one-half of the 2% NSR (the "Lamaune NSR") that

is held on Landore Canada's 90.2% owned Lamaune Lake Property,

Ontario.

In consideration for the purchase of 1% of the Lamaune NSR, the

Group made a cash payment of C$75,000 and issued 227,733 new

ordinary shares in Landore Resources at a price of 19.25 pence per

share, for total consideration of C$149,964.

7. Loss per share

The loss per share is based on the loss for the relevant period

and the weighted number of ordinary shares in issue during the

relevant period.

The potential ordinary shares which arise as a result of the

options in issue are not dilutive under the terms of IAS 33 because

they would not increase the loss per share. Accordingly, there is

no difference between the basic and dilutive loss per share.

The loss per share and diluted loss per share for the periods

concerned were:

Three Months Ended Six Months Ended

30 June 30 June

2023 2022 2023 2022

Loss attributable to:

Equity holders of the Company GBP (771,644) (308,163) (822,610) (794,153)

Weighted average number

of shares 106,553,257 109,585,744 106,553,257 108,209,176

- Basic and diluted GBP (0.007) (0.003) (0.008) (0.007)

------------------------------ ---- ----------- ----------- ----------- -----------

8. Property, plant and equipment

Automotive Computers and Machinery and

equipment office equipment equipment Total

GBP GBP GBP GBP

Cost

At 31 December 2021 196,497 55,208 119,856 371,561

Foreign exchange movements 10,861 3,052 6,625 20,538

--------------------------- ---------- ---------------- ------------- --------

At 31 December 2022 207,358 58,260 126,481 392,099

Foreign exchange movements (5,787) (1,627) (3,530) (10,944)

At 30 June 2023 201,571 56,633 122,951 381,155

Depreciation

At 31 December 2021 127,112 50,032 113,358 290,502

Charge for the period 14,829 1,105 1,389 17,323

Foreign exchange movements 6,841 2,751 6,250 15,842

At 31 December 2022 148,782 53,888 120,997 323,667

Charge for the period 5,758 430 540 6,728

Foreign exchange movements (4,217) (1,509) (3,384) (9,110)

At 30 June 2023 150,323 52,809 118,153 321,285

--------------------------- ---------- ---------------- ------------- --------

Net book value

At 30 June 2023 51,248 3,824 4,798 59,870

--------------------------- ---------- ---------------- ------------- --------

At 31 December 2022 58,576 4,372 5,484 68,432

--------------------------- ---------- ---------------- ------------- --------

9. Non-current asset investments

Investment

in equities

GBP

Cost

At 31 December 2021 287,259

Additions at cost 309,578

Fair value loss (444,719)

Foreign exchange movements 17,564

At 31 December 2022 169,682

Disposals at cost (65,783)

Fair value loss (12,077)

Foreign exchange movements (3,852)

--------------------------- -----------

At 30 June 2023 87,970

--------------------------- -----------

Investments consist of 7,688,009 (31 December 2022: 7,929,009)

common shares of Storm Exploration Inc. (formerly known as

Lithoquest Resources Inc. - a publicly traded company listed on the

TSX Venture Exchange) received pursuant to the Miminiska property

option agreement (see note 6.2).

Company

At 30 June 2023, the Company held interests in the issued share

capital of the following subsidiary undertakings which have all

been included in the consolidated interim financial statements:

Subsidiary Nature of business Country of incorporation

Landore Resources Canada Exploration of precious Canada

Inc. (100%) metals

Brancote US Inc.* (100%) Exploration of precious United States

metals

Lamaune Iron Inc.** Exploration of precious Canada

(90.2%) metals

------------------------ ----------------------- ------------------------

*The entire issued share capital of Brancote US Inc. is held by

Landore Resources Canada Inc.

**90.2% of the issued share capital of Lamaune Iron Inc. is held

by Landore Resources Canada Inc.

10. Trade and other receivables

As at As at 31

30 June December

2023 2022

GBP GBP

Due within one year:

Trade receivables and prepayments 68,331 110,890

68,331 110,890

---------------------------------- -------- ---------

11. Trade and other payables: amounts falling due within one year

As at As at 31

30 June December

2023 2022

GBP GBP

Trade payables 395,959 520,282

--------------- -------- ---------

395,959 520,282

--------------- -------- ---------

12. Share capital

As at 30 As at 31

June December

2023 2022

GBP GBP

Issued and fully paid:

115,346,391 (31 December 2022: 115,346,391) ordinary

shares of nil par value each ranking pari passu 51,926,526 51,926,526

Ordinary

Shares of

nil par value

GBP

Cost

At 31 December 2021 50,179,599

Issued in the period to 30 June 2022 909,605

Issued in the period to 31 December 2022 837,322

Issued in the period to 30 June 2023 -

At 30 June 2023 51,926,526

Movements in the Group's share capital of no par value ordinary

shares during the period were as follows:

Nominal Share

Number value capital

of shares GBP GBP

Balance at 1 January 2022 106,553,257 - 50,179,599

20 January 2022 - Warrant exercise 95,570 - 19,114

4 February 2022 - Warrant exercise 100,000 - 20,000

22 February 2022 - Warrant exercise 175,000 - 35,000

22 March 2022 - Warrant exercise 500,000 - 100,000

28 March 2022 - Warrant exercise 200,000 - 40,000

12 April 2022 - Warrant exercise 500,000 - 100,000

13 April 2022 - Warrant exercise 185,185 - 37,037

26 April 2022 - Warrant exercise 148,148 - 29,630

28 April 2022 - Warrant exercise 435,622 - 87,124

3 May 2022 - Warrant exercise 888,888 - 177,778

10 May 2022 - Warrant exercise 300,000 - 60,000

13 May 2022 - Warrant exercise 83,500 - 16,700

18 May 2022 - Warrant exercise 111,111 - 22,222

6 June 2022 - Warrant exercise 299,999 - 60,000

15 June 2022 - Warrant exercise 125,000 - 25,000

23 June 2022 - Warrant exercise 400,000 - 80,000

5 July 2022 - Warrant exercise 185,185 - 37,037

11 July 2022 - Warrant exercise 1,444,444 - 288,889

13 July 2022 - Warrant exercise 1,308,982 - 261,796

14 July 2022 - Warrant exercise 1,006,500 - 201,300

25 July 2022 - Option exercise 300,000 - 48,300

Balance at 31 December 2022 and 30

June 2023 115,346,391 - 51,926,526

------------------------------------ ----------- ------- ----------

Issue costs of GBPNil (2022: GBPNil) were incurred when issuing

shares.

The total gross cash proceeds received from the shares issued in

the period under review amounted to GBPNil (Year to 31 December

2022: GBP1,746,927).

13. Share-based payment reserve

As at 30 As at 31

June December

2023 2022

GBP GBP

Share options reserve 570,500 570,500

Share options reserve - warrants - 13,766

Total 570,500 584,266

--------------------------------- -------- ---------

13.1 Share options reserve

Number of Number of

Exercise options at (Lapsed or options at

price 1 January exercised)/ 30 June Fair value

granted

Grant date Expiry date GBP 2023 2023 GBP

24 July 2019 24 July 2024 0.161 1,500,000 - 1,500,000 83,637

24 July 2020 23 July 2025 0.24 2,400,000 - 2,400,000 253,501

31 December

1 January 2021 2025 0.31 100,000 - 100,000 4,627

20 July 2021 19 July 2026 0.323 2,200,000 - 2,200,000 211,821

22 July 2022 21 July 2027 0.25 1,150,000 - 1,150,000 16,914

7,350,000 - 7,350,000 570,500

------------------------------- ---------- ------------- -------------- -------------- -------------------------

Number of Number of

Exercise options at (Lapsed or options at

price 1 January exercised)/ 31 December Fair value

granted

Grant date Expiry date GBP 2022 2022 GBP

5 July 2017 5 July 2022 0.638 1,075,000 (1,075,000) - -

22 December 2017 22 December 2022 0.44 250,000 (250,000) - -

24 July 2019 24 July 2024 0.161 1,800,000 (300,000) 1,500,000 83,637

24 July 2020 23 July 2025 0.24 2,400,000 - 2,400,000 253,501

1 January 2021 31 December 2025 0.31 100,000 - 100,000 4,627

20 July 2021 19 July 2026 0.323 2,200,000 - 2,200,000 211,821

22 July 2022 21 July 2027 0.25 - 1,150,000 1,150,000 16,914

----------------- ----------------- ---------- --------------- ---------------- ---------------- ---------------

7,825,000 (475,000) 7,350,000 570,500

----------------------------------- ---------- --------------- ---------------- ---------------- ---------------

No options were exercised during the period (Year to 31 December

2022: 300,000).

No share options lapsed in the period (Year to 31 December 2022:

1,325,000).

All of the above options vested in full on the grant date other

than 2,400,000 options issued in July 2020 which vested in January

2021. 7,350,000 options were exercisable at both 30 June 2023 and

31 December 2022.

The weighted average exercise prices relating to the above

movements in the number of share options are as follows:

2023 2022

GBP GBP

Outstanding at beginning of the period 0.251 0.307

Granted during the period - 0.250

Exercised during the period - 0.161

Lapsed during the period - 0.601

Outstanding at end of the period 0.251 0.251

Exercisable at end of the period 0.251 0.251

Weighted average share price of share options

exercised in year - 0.161

Weighted average remaining contractual life of

share options outstanding 2.48 2.97

at end of the period (years)

The estimated fair value of the options issued during the prior

period was calculated by applying the Black-Scholes pricing

model.

The model inputs were:

Options granted 22 July 2022

Share price at grant date GBP0.18125

Expected volatility 18.49%

Risk-free interest rate 1.704%

Exercise price GBP0.25

Option life 5 years

The expected volatility is wholly based on the historic

volatility of the Company's share price (calculated based on the

average life of the share options).

The movements on the share options reserve are detailed

below:

Six months

to 30 Year

June to 31 December

2023 2022

GBP GBP

Share options reserve as at 1 January 570,500 909,694

Charge in Statement of Comprehensive Income -

options issued - 16,914

Transfer to retained earnings - lapsed and exercised

options - (356,108)

----------------------------------------------------- ---------- ---------------

Share options reserve at period end 570,500 570,500

----------------------------------------------------- ---------- ---------------

13.2 Share options reserve - warrants

Grant date Expiry Exercise Number (Lapsed Number Fair value

date price (GBP) of warrants or exercised)/ of warrants (GBP)

at 1 January granted at 30 June

2023 2023

16 February 16 February

2021 2023 0.45 700,000 (700,000) - -

------------ ------------ ------------ ------------- --------------- ------------ ----------

700,000 (700,000) - -

------------------------- ------------ ------------- --------------- ------------ ----------

Grant date Expiry Exercise Number (Lapsed Number Fair value

date price (GBP) of warrants or exercised)/ of warrants (GBP)

at 1 January granted at 31 December

2022 2022

4 May 2020 4 May 2022 0.2 1,229,705 (1,229,705) - -

14 July 14 July

2020 2022 0.2 19,887,249 (19,887,249) - -

16 February 16 February

2021 2023 0.45 700,000 - 700,000 13,766

------------ ------------ ------------ ------------- --------------- --------------- ----------

21,816,954 (21,116,954) 700,000 13,766

------------------------- ------------ ------------- --------------- --------------- ----------

In consideration of the then broker's services as part of a

February 2021 share placing and subscription, 700,000 warrants were

issued. The warrants were exercisable until February 2023 at

GBP0.45 each.

Costs that were settled by way of the issue of warrants were

directly attributable to the issue of shares and therefore charged

against share premium in accordance with IAS 32.

The weighted average exercise prices relating to the movements

in the number of warrants are as follows:

30

June 31 December

2023 2022

GBP GBP

Outstanding at beginning of the period 0.45 0.208

Granted during the period - -

Exercised during the period - 0.2

Lapsed during the period 0.45 0.2

Outstanding at end of the period - 0.45

Exercisable at end of the period - 0.45

Weighted average share price of warrants exercised

in period - 0.2

Weighted average remaining contractual life of

warrants outstanding

at end of the period (years) - 0.129

The movements on the warrant reserve are detailed below:

Six months

to 30 Year

June to 31 December

2023 2022

GBP GBP

Warrant reserve as at 1 January 13,766 69,715

Share issue costs - -

Transfer to retained earnings - lapsed and exercised

warrants (13,766) (55,949)

Warrant reserve at period end - 13,766

----------------------------------------------------- ---------- ---------------

14. Related party transactions

Helen Green, a Director of the Group, is also a Director of

Saffery Champness Management International Limited ("SCMIL") and

Rysaffe International Services Limited ("Rysaffe"). SCMIL were paid

GBP143,891 (Six months to 30 June 2022: GBP99,821) in the period in

respect of its role in performing administrative duties for the

Group and Rysaffe was paid GBP5,000 (Six months to 30 June 2022:

GBP5,000) in respect of its role as Secretary. An amount of

GBP83,016 (31 December 2022: GBP24,510) was owed to SCMIL at the

period end and the amount owing to Rysaffe was GBPNil (31 December

2022: GBPNil). All transactions are at market value.

Key management includes the Company's directors, officers and

any employees with authority and responsibility for planning,

directing and controlling the activities of an entity, directly or

indirectly.

Compensation awarded to key current and former management

includes the following:

Three months ended 30 June Six months ended 30 June

2023 2022 2023 2022

GBP GBP GBP GBP

Executive Directors:

William Humphries 48,144 45,000 97,644 90,000

Glenn Featherby 26,125 23,750 52,250 47,500

74,269 68,750 149,894 137,500

Non-Executive Directors:

Helen Green 4,125 3,750 8,250 7,500

Huw Salter 4,125 3,750 8,250 7,500

Charles Wilkinson 5,349 5,000 10,849 10,000

------------------------- ------------- ------------- ------------- ------------

13,599 12,500 27,349 25,000

------------------------- ------------- ------------- ------------- ------------

Total 87,868 81,250 177,243 162,500

------------------------- ------------- ------------- ------------- ------------

The Group does not have any single ultimate controlling party.

In addition, the Directors are reimbursed authorised travel

expenses, office costs and sundry items amounting to GBP48,985

(2022: GBP39,242) incurred on the Group's behalf.

In July 2022, William Humphries subscribed for 300,000 shares at

the issue price of GBP0.161 per share.

In July 2022, William Humphries, Glenn Featherby, Charles

Wilkinson, Helen Green, Huw Salter and Michele Tuomi received

500,000, 250,000, 50,000, 50,000, 50,000 and 250,000 share options

respectively, exercisable at GBP0.25 each. William Humphries and

Charles Wilkinson, former Chief Executive Officer and Non-Executive

Chairman, respectively, stepped down from the Board on conclusion

of the Company's Annual General Meeting held on 29 June 2023.

15. Financial instruments/Financial risk management

In the course of its business, the Group is exposed primarily to

liquidity risk. As the Company grows it is expected that capital

management risk, liquidity risk, foreign exchange risk, credit risk

and interest rate risk will also become focuses of the Group's

financial risk management policies.

Capital management risk

The Group's objectives when managing capital are to safeguard

the Group's ability to continue as a going concern in order to

provide returns for shareholders and benefits for other

stakeholders, to provide adequate resources to fund its exploration

activities with a view to providing returns to its investors and to

maintain sufficient financial resources to mitigate against risk

and unforeseen events.

The Company meets its capital needs by equity financing. The

Group sets the amount of capital it requires in proportion to risk.

The Group manages its capital structure and makes adjustments to it

in the light of changes in economic conditions and the risk

characteristics of the underlying assets.

The objectives will be achieved by maintaining and adding value

to existing extraction projects and identifying new exploration

projects, adding value to these projects and ultimately taking them

through to potential future production and cash flow, either with

partners or by the Group's own means.

The Group monitors capital on the basis of the carrying amount

of equity less cash and cash equivalents as presented on the face

of the statement of financial position. Capital for the reporting

periods under review is summarised in the consolidated statement of

changes in equity and at the period end is GBP217,321.

The Group sets the amount of capital in proportion to its

overall financing structure, i.e., equity and financial

liabilities. The Group manages the capital structure and makes

adjustments to it in the light of changes in economic conditions

and the risk characteristics of the underlying assets. In order to

maintain or adjust the capital structure, the Group may adjust the

amount of dividends paid to shareholders in the future, return

capital to shareholders or issue new shares.

Liquidity risk

Liquidity risk is the risk that the Group will not be able to

meet its financial obligations as they fall due. The Group attempts

to accurately forecast the cash flow requirements of its ongoing

operations and ensures that it has sufficient funding in place to

meet these needs. The Group currently uses equity finance as its

main source of funding.

Accounts payable and accrued liabilities are due within the

current operating period.

Foreign currency risk

The Group primarily operates in Canada but reports its financial

results in GBP Sterling. It manages the potential exposure to

fluctuations in the GBP Sterling to Canadian Dollar exchange rate

by holding its main asset, being its cash reserves, in GBP

Sterling. Cash is converted to Canadian Dollars to meet the

expenditure requirements of its Canadian business only when

required. Currently, the Group's net asset position is not

significantly impacted by movements in the exchange rate.

As the Group remains a development phase entity it only has

small and infrequent foreign currency transaction exposures.

In addition, the market for metals is principally denominated in

United States dollars. As the Group has not reached the production

stage it does not currently engage in active hedging to minimise

exchange rate risk, although this will remain under review.

Credit risk

Credit risk is the risk that a counterparty will not meet its

obligations under a financial instrument or customer contract,

leading to a financial loss. The Group is exposed to credit risk

from its financing activities, including deposits with banks and

financial institutions, foreign exchange transactions and other

financial instruments. The Group does not hold collateral as

security.

Credit risk from balances with banks and financial institutions

is managed by the Board. Investments of surplus funds are made only

with approved counterparties and within credit limits assigned to

each counterparty.

Counterparty credit limits are reviewed by the Board on a

regular basis. The limits are set to minimise the concentration of

risks and therefore mitigate financial loss through potential

counterparty failure.

The maximum exposure at the period end was GBP68,331 (31

December 2022: GBP110,890). No financial assets are credit impaired

or past due.

Ongoing global economic uncertainty arising from the economic

climate is being monitored by the Board but is not affecting the

Company at present.

Interest rate risk

The Group has insignificant exposure to interest rate

fluctuations.

Financial instruments

The Group's financial instruments consist of cash, trade and

other receivables, other financial assets and trade and other

payables.

The Group characterises inputs used in determining fair value

using a hierarchy that prioritises inputs depending on the degree

to which they are observable. The fair value hierarchy establishes

three levels to classify the inputs to valuation techniques used to

measure fair value. The three levels of the fair value hierarchy

are as follows:

- Level 1: inputs are quoted prices (unadjusted) in active

markets for identical assets or liabilities. Active markets are

those in which transactions occur in sufficient frequency and

volume to provide pricing information on an ongoing basis.

- Level 2: inputs, other than quoted prices, that are

observable, either directly or indirectly. Level 2 valuations are

based on inputs, including quoted forward prices for commodities,

market interest rates, and volatility factors, which can be

observed or corroborated in the marketplace.

- Level 3: inputs are less observable, unavoidable or where the

observable data does not support the majority of the instruments'

fair value.

As at 30 June 2023, there were no changes in levels in

comparison to 31 December 2022. The fair values of financial

instruments are summarised as follows:

As at As at 31

30 June December

2023 2022

GBP GBP

Carrying Carrying

amount amount

and fair and fair

value value

Financial assets

Cash and cash equivalents 397,109 1,235,528

Trade and other receivables 68,331 110,890

Other financial assets 87,970 169,682

Financial liabilities

Trade and other payables 395,959 520,282

Other financial assets are measured at Level 1 inputs of the

fair value hierarchy on a recurring basis.

The c arrying value of trade and other receivables and trade and

other payables approximate their fair value because of the

short-term nature of these instruments. The Group assessed that

there were no indicators of impairment for the financial

assets.

16. Lease commitments

As at 30 June 2023, the Group had no significant lease

commitments (31 December 2022: None).

17. Contractual commitments

As at 30 June 2023, the Group had no significant contractual

obligations (31 December 2022: None).

18. Administrative expenses

Three months ended Six months ended

30 June 30 June

2023 2022 2023 2022

GBP GBP GBP GBP

Administrative expenses 229,793 272,446 488,846 440,608

Directors' fees 87,868 85,000 177,243 162,500

Legal and professional, accountancy

and audit expenses 209,670 141,831 298,684 215,208

Share-based payments expense - - - -

527,331 499,277 964,773 818,316

------------------------------------ --------- --------- -------- --------

19. Other income

Three months ended Six months ended

30 June 30 June

2023 2022 2023 2022

GBP GBP GBP GBP

Option income - 467,715 451,988 448,779

- 467,715 451,988 448,779

-------------- ------- ----------- -------- --------

20. Subsequent events

As announced on 29 June 2023 with closing on 20 July 2023, the

Company raised GBP600,000 before expenses by way of a placing

6,666,667 new ordinary shares of nil par value each in the capital

of the Company (the "Placing Shares") at a price of 9 pence per

share (the "Placing"). The Placing successfully completed upon

admission of the Placing Shares to trading on AIM on 20 July 2023

("Admission").

Every Placing Share has one warrant attached, resulting in the

issue of 6,666,667 warrants, with each warrant having the right to

acquire one new Ordinary Share at an exercise price of 18 pence on

or before the second anniversary of Admission of the Placing

Shares.

The Placing was arranged by Novum Securities Limited ("Novum")

which assumed the role of Joint Broker to the Company. Accordingly,

in connection with the Placing, the Company agreed to issue 400,000

'broker' warrants to Novum, giving them the right to acquire such

number of new ordinary shares at an exercise price of 9 pence per

share for a period of two years from the date of Admission of the

Placing Shares.

Of the 6,666,667 Placing shares, 611,111 shares were subscribed

for by certain Directors. William Humphries acquired 277,778 shares

and Glenn Featherby 333,333 shares. They also received the

associated investor warrants referred to above.

On 29 June 2023, following completion of the Company's Annual

General Meeting ("AGM"), William Humphries and Charles Wilkinson

stepped down from the Board and relinquished their roles as Chief

Executive Officer and Non-Executive Chairman respectively. Huw

Salter, previously Non-Executive Director, assumed the role of

Non-Executive Chairman of the Company also with effect from

conclusion of the AGM.

On 5 July 2023, Storm and Landore Resources agreed a further

amendment to the pre-existing option agreement, details of which

are set out in note 6.2.

On 21 July 2023, Claude Lemasson was appointed as a Director and

the Company's new Chief Executive Officer. On 4 July 2023, upon

joining the Company's management team, Claude was awarded options

over 2,000,000 ordinary shares, exercisable from 4 July 2024 for a

period of four years, at a price of GBP0.0875 each.

On 3 August 2023, the Company's shareholders approved certain

amendments and updates to the Company's existing articles of

incorporation to facilitate such dual listing process on the TSX

Venture Exchange and add certain additional corporate governance

and shareholder protections as required under Canadian securities

laws.

- ENDS -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QDLFLXKLXBBQ

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

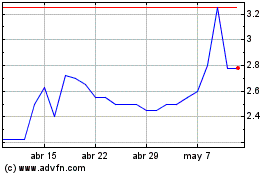

Landore Resources (LSE:LND)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Landore Resources (LSE:LND)

Gráfica de Acción Histórica

De May 2023 a May 2024