Life Settlement Assets PLC Statement re agreement to reduce performance fee (7164Q)

30 Junio 2022 - 1:00AM

UK Regulatory

TIDMLSAA

RNS Number : 7164Q

Life Settlement Assets PLC

30 June 2022

LIFE SETTLEMENT ASSETS PLC (the "Company" or "LSA")

AGREEMENT OF REDUCED ACL PERFORMANCE FEE

30 June 2022

As referred to in the Company's annual results for the year

ended 31 December 2021, LSA has been in discussions with Acheron

Capital Limited ("ACL") regarding the re-negotiation of the

performance fee payable to ACL, which is currently defined as an

amount equal to 20% of the total distributions made by the Company

over an agreed hurdle rate. Agreement has now been reached with ACL

that once the current litigation process with one of the policy

trustees has been resolved, which is expected to occur during 2022,

the performance fee will be reduced from 20% as described above to

10% over the existing hurdle rate.

The resolution of the legal dispute is expected to be

accompanied by a judicially approved sale of the policies in the

relevant trustee portfolio. The completion of such a sale process,

including LSA`s participation therein whether successful or not,

would mark the end of LSA`s need to accumulate cash to purchase the

relevant policies, so enabling LSA to resume further distributions

to Shareholders. Assuming resolution of the dispute, following the

first such distribution LSA has agreed to make a one-off payment to

ACL of any accrued performance fee payable to ACL held by the

Company in excess of $1m, based on the 2022 financial results and

subject to the cash requirements of the business. As at 31 December

2021 the accrued performance fee stood at $2.8m. However, in

acknowledgement of the significant work that ACL has had to perform

with regard to engagement with the legal dispute over a long

period, the Directors of LSA have agreed to make an immediate

advance to ACL, subject to an agreed clawback mechanism, of $0.5m

which will be credited against any amount to be paid under the

above one-off payment arrangement, following the publication of the

2022 financial results.

For further information contact

Acheron Capital Limited (Investment Manager)

Jean-Michel Paul

020 7258 5990

Shore Capital (Financial Adviser and Broker)

Robert Finlay

020 7408 4090

ISCA Administration Services Limited

Company Secretary

Tel: 01392 487056

Notes to Editors

Life Settlement Assets PLC is a closed-ended investment trust

company which invests in, and manages, portfolios of whole and

fractional interests in life settlement policies issued by life

insurance companies operating predominantly in the United States.

The Company seeks to generate long-term returns for investors by

investing in the life settlement market, through each of the

separate Share Classes. The Company aims to manage its investment

in portfolios of life settlement products so that the realised

value of the policy maturities exceeds the aggregate cost of

acquiring the policies, ongoing premiums, management fees and other

operational costs.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRSEAFWUEESEFM

(END) Dow Jones Newswires

June 30, 2022 02:00 ET (06:00 GMT)

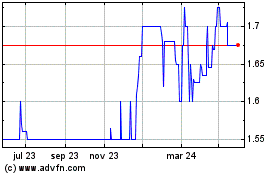

Life Settlement Assets (LSE:LSAA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

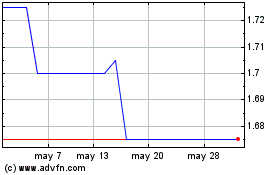

Life Settlement Assets (LSE:LSAA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024