Minoan Group PLC Loan Repayment & Extension and Share Issuance (5463K)

29 Agosto 2023 - 1:00AM

UK Regulatory

TIDMMIN

RNS Number : 5463K

Minoan Group PLC

29 August 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014. Upon the publication of this

announcement this information will be considered to be in the

public domain.

29 August 2023

Minoan Group Plc

("Minoan" or the "Company")

Loan Repayment and Extension

Share Issuance at a Premium

Headlines

Further to recent announcements by the Company, in particular

the initial agreement with the International Hotel Operator and the

timescales to delivery, the Board wishes to streamline and

strengthen the Company's balance sheet in anticipation of reaching

additional contractual and commercial agreements on its Project in

Crete. As part of this process, the Board is pleased to announce

that it has reached agreement (the "Agreement") with DAGG LLP

("DAGG") for repaying part of the only secured debt (the "Loan") of

the Company. This Agreement will, inter alia, result in certain

members of DAGG becoming material shareholders in the Company

having agreed to accept shares in Minoan at a premium to the mid

market price in respect of a substantial part of the Loan. The

Board considers this to be a landmark decision by the lenders and

one which the Directors take as a substantial vote of confidence in

the short-term prospects of the Company.

Details

The Loan with DAGG stood at GBP1,414,462 as at 31 December 2022.

It has been agreed with the partners of DAGG, that half of this

amount, being GBP707,231, will be immediately redeemed by the issue

to the members of DAGG of 70,723,100 new ordinary shares in Minoan

("Ordinary Shares") at 1p per Ordinary Share, an 11% premium to the

closing mid-market price of the Company's shares on 25 August

2023.

The remaining balance of the Loan will be extended to 31

December 2024 for a fee of GBP175,000 which will be added to the

principal of the Loan. The interest rate on the Loan remains at 10%

per annum. All other terms of the Loan remain unchanged and as

originally announced on 21 July 2020.

The 35,000,000 warrants held by the members of DAGG to subscribe

for Ordinary Shares in Minoan at 1.4p per Ordinary Shares issued in

July 2020 which had expired on 31 December 2022 are being

reinstated with an exercise price of 1.1p per Ordinary Share and an

expiry date of 31 December 2024 to be coterminous with the debt. In

addition, as part of the Agreement, DAGG has been given the right

to appoint a director to the Board of Minoan Group Plc. DAGG will

put forward three potential directors for the Board to choose one.

Any appointment will be subject to the suitability checks of the

Companies Act and AIM rules.

The agreement with DAGG is subject to the approval by

Shareholders in a General Meeting of the authorities to allot the

new Ordinary Shares. It is expected that the General Meeting will

be held prior to the end of September 2023.

Nicholas Day, who currently holds 9.42% of Minoan's issued share

capital and is a director of Minoan's 100% owned subsidiary

Loyalward Limited, is a member of DAGG. Therefore the Agreement and

the reinstatement of the Warrants constitute related party

transactions under Rule 13 of the AIM Rules for Companies. The

Directors of Minoan consider, having consulted with the Company's

nominated adviser, WH Ireland Limited, that the terms of the

Agreement and the reinstatement of the Warrants are fair and

reasonable insofar as its shareholders are concerned.

Conclusion

Minoan is very pleased to have successfully concluded these

negotiations and looks forward to introducing a new Board member,

once approved at the General Meeting. The Company believes that

this addition, amongst others, will considerably strengthen the

Board at this crucial time as commercialisation of the Project has

now started.

We look forward with some confidence to reporting on a number of

developments on the contractual and commercial fronts in addition

to the recent announcement of the "collaboration agreement" with an

International Operator of luxury hotels. The team will now fully

focus on delivery against the timeline outlined in the financial

statements to 31 October 2022 and reconfirmed in the announcement

of the Interims on 31 July.

For further information visit www.minoangroup.com or

contact:

Minoan Group Plc

Christopher Egleton christopher.egleton@minoangroup.com

George Mergos georgios.mergos@minoangroup.com

W H Ireland Limited 020 7220 1666

Antonio Bossi

Peterhouse Capital Limited 020 7469 0930

Duncan Vasey

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUWVBRORUWUAR

(END) Dow Jones Newswires

August 29, 2023 02:00 ET (06:00 GMT)

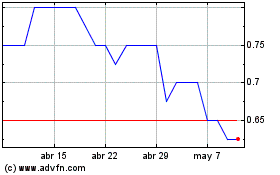

Minoan (LSE:MIN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Minoan (LSE:MIN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024