TIDMNCYF

RNS Number : 5191M

CQS New City High Yield Fund Ltd

14 September 2023

A copy of the Company's Annual Report will shortly be available

on the Company's website (

https://ncim.co.uk/cqs-new-city-high-yield-fund-ltd ), on the

National Storage Mechanism (

https://data.fca.org.uk/#/nsm/nationalstoragemechanism ) and will

also be provided to those shareholders who have requested a printed

or electronic copy

CQS NEW CITY HIGH YIELD FUND LIMITED

Annual Results Announcement

for the year ended 30 June 2023

Financial Highlights

12 months to 12 months to

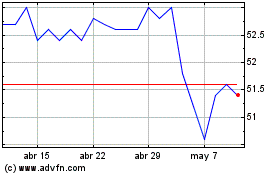

NAV and share price total return(2) 30 June 2023 30 June 2022

NAV(1) 2.04% 2.04%

Ordinary share price (0.68)% 1.21%

As at As at

Capital values 30 June 2023 30 June 2022 % change

Total assets less current liabilities (with the exception of

the bank loan facility) GBP275.4m GBP268.0m 2.76%

NAV per ordinary share(1) 45.83p 49.30p (7.04)%

Share price (bid)(3) 46.60p 51.20p (8.98)%

12 months to 12 months to

Revenue and dividends 30 June 2023 30 June 2022 % change

Revenue earnings per ordinary share(2) 4.51p 4.16p 8.41%

Annual dividends per ordinary share(2) 4.49p 4.48p 0.22%

Dividend cover(2) 1.00x 0.93x

Revenue reserve per ordinary share (after recognition of

annual dividends)(2) 3.05p 3.26p

Dividend yield(2) 9.64% 8.75%

Premium(2) 1.68% 3.86%

Gearing(2) 11.81% 12.35%

Ongoing charges ratio(2) 1.16% 1.19%

Dividend history Rate xd date Record date Payment date

First interim 2023 1.00p 27 October 2022 28 October 2022 25 November 2022

Second interim 2023 1.00p 26 January 2023 27 January 2023 28 February 2023

Third interim 2023 1.00p 27 April 2023 28 April 2023 26 May 2023

Fourth interim 2023 1.49p 27 July 2023 28 July 2023 31 August 2023

------------------------------------------------- ------------ ---------------- ---------------- -----------------

Annual dividend per ordinary share 4.49p

------------------------------------------------- ------------ ---------------- ---------------- -----------------

First interim 2022 1.00p 28 October 2021 29 October 2021 30 November 2021

Second interim 2022 1.00p 27 January 2022 28 January 2022 25 February 2022

Third interim 2022 1.00p 28 April 2022 29 April 2022 27 May 2022

Fourth interim 2022 1.48p 28 July 2022 29 July 2022 26 August 2022

------------------------------------------------- ------------ ---------------- ---------------- -----------------

Annual dividend per ordinary share 4.48p

------------------------------------------------- ------------ ---------------- ---------------- -----------------

(1) The definition of the terms used can be found in the

glossary below.

(2) A description of the Alternative Performance Measures

("APMs") used above and information on how they are calculated can

be found below.

(3) Source: Bloomberg

Statement from the Chair

Key Points

-- NAV total return of 2.04%

-- Ordinary share price total return decline of 0.68%

-- Dividend yield of 9.64%, based on dividends at an annualised

rate of 4.49 pence and a share price of 46.60 pence as at 30 June

2023

-- Ordinary share price at a premium of 1.68% at 30 June 2023

-- GBP24,235,000 of equity issued during the year to 30 June 2023

-- Dividend cover of 1.00x

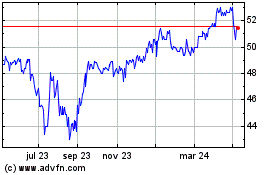

Investment and share price performance

The NAV total return of the Company for this financial period

was a positive 2.04% (coincidentally the exact same level as the

previous year), thanks to the dividends paid to Shareholders during

the year. This outcome was despite a difficult background as rising

inflation and interest rates worried investors in the high yield

debt markets in which the Company mainly invests. Many investment

trusts, particularly those with an income focus, were negatively

impacted by this environment with premiums eroded and in many

cases, wide discounts appearing. The Company was not immune and the

share price premium declined but only modestly (from 3.86% at the

close of the last financial year to 1.68% this year) which resulted

in a slight fall in the share price total return of 0.68%. In these

circumstances, I believe this is a commendable outcome,

particularly as the Company's shares remained on a premium and we

were able to continue issuing shares (see below). I also believe

that the Company's longer term performance remains strong.

In the early part of the year under review, the UK debt market

was rattled by the short lived "mini budget" which triggered an

increase in UK Gilt yields to levels not seen in 15 years. Although

they then fell back, investor concerns about the UK, particularly

stubborn inflationary pressures, have subsequently pushed yields

back up, nearly to the levels seen at the time of the mini budget.

Furthermore, the rapid demise of Credit Suisse in March was an

issue for the portfolio. The junior debt of Credit Suisse was

written down to zero ahead of the Company's equity and this unusual

turn of events destabilised the junior debt of banks and financial

companies across the UK and Europe and led to bond prices of these

instruments being written down. Although the Credit Suisse holding

was small, the Company has a material position in other such

instruments. The investment manager, Ian "Franco" Francis, gives

more detail in his report and believes that these junior debt

prices will recover. He discusses the financial year in his review

below.

Earnings and dividends

Despite this difficult environment, I am pleased to report that

the Company's revenue earnings per ordinary share were 4.51 pence

for the year to 30 June 2023, which compares to 4.16 pence earned

in the same period last year. This 8.41% increase was the result of

the Investment Manager being able to take advantage of the decrease

in prices to invest in more quality higher yielding bonds as

interest rates rose. We also saw the repayment of previous arrears

by several positions in the portfolio.

The Board decided to increase this year's dividend, albeit

marginally, maintaining the Company's record of annual dividend

increases which has been unbroken since 2007. The Company declared

three interim dividends of 1.00 pence in respect of the period and

one interim dividend of 1.49 pence since the year end. The

aggregate payment of 4.49 pence per ordinary share represents a

0.22% increase on the 4.48 pence paid last year. It is pleasing to

be able to report that this year's total dividend is covered by

revenue earnings.

As things stand, the Board intends to follow the same pattern of

dividend payments as declared last year and maintain or slightly

increase the total level of dividends for the year. Based on an

annual rate of 4.49 pence and a share price of 47.40 pence at the

time of writing, this represents a dividend yield of 9.47%. As I

stress in every report, the Board pays great attention to dividend

payments as we understand how much shareholders value this aspect

of the Company.

Gearing

The Company has a GBP45,000,000 loan facility with Scotiabank

which is due to expire in December 2023. Out of this facility,

GBP35,000,000 was drawn down as at 30 June 2023 and at the time of

writing the Company has an effective gearing rate of 13.45%. As

interest rates have risen, the cost of borrowing to gear has

increased. The Board monitors this on a regular basis to judge

whether the benefits of gearing outweigh these costs. At present,

we believe that Shareholders will benefit from a modest but

meaningful amount of gearing (a notable advantage of closed-ended

funds compared to open-ended) and expects to maintain approximately

this level of gearing during the next financial year.

Share issuance

Taking advantage of the premium rating that the market continued

to attach to the Company's shares, GBP24,235,000 was raised from

new and existing shareholders during the financial year, with

47,950,000 ordinary shares issued from the block listing facility.

Shares were only issued when the Investment Manager was confident

it could invest the additional funds favourably. As well as a

modest increase in NAV from any issue of shares, the Board believes

that over time, existing Shareholders will benefit from lower

ongoing charges and greater liquidity in the Company's shares, all

other things being equal.

Environmental, Social and Governance ("ESG") statement

The Board's intention is to invest responsibly and to consider

the Company's broader impact on society and the environment. We

believe the integration of ESG factors in the investment process is

consistent with delivering sustainable attractive returns for

Shareholders through deeper, more informed investment decisions.

The Board has reviewed and agreed the ESG approach adopted by the

Company and a summary of this is set out in the Company's Annual

Financial Report and Financial Statements.

Outlook

With the majority of UK interest rate increases likely to be

behind us and inflation showing some signs of moderation, the

outlook for Sterling fixed interest securities appears more stable.

Nevertheless, potential for turbulent events in the macro economic

and geopolitical space remains and although the UK has managed to

avoid a recession thus far, concerns linger. In his 'Outlook'

report, your investment manager provides a bit more detail on what

he is particularly watching. From a revenue perspective the Board

maintains a positive outlook, anticipating strong revenue earnings

and the ability to sustain the relatively high dividend levels

appreciated by our shareholders.

Caroline Hitch

Chair

14 September 2023

Investment Manager's Review

Introduction

All our previously expressed fears about higher inflation and

correspondingly higher interest rates came home to roost over the

course of our last financial year to 30 June 2023. For a high

yielding bond fund, higher interest rates are a mixed blessing. On

one hand there are more opportunities to find quality investments

in stocks and sectors that have previously been too difficult to

invest in as yields have been lower. This has helped the revenue

account and we have covered the dividend this year. On the other

hand, higher rates put pressure on the operating abilities of

companies in the portfolio which can lead to problems. We saw

issues in the retail sector with our holding of Matalan Finance

9.5% 18-31/01/2024 and also in the banking sector where the

troubles of Credit Suisse affected the portfolio. More details of

that are in the portfolio review below. The Company raised new

monies this year as we issued shares at a premium. Proceeds have

been invested into a wide range of sectors and the continuing

diverse nature of the portfolio has meant that the overall NAV

total return for the 12 months to 30 June 2023 is a positive one at

a modest 2.04%.

Market and economic review

When I wrote the market review for the interim report six months

ago, I noted that the period under review from 30 June 2022 to 31

December 2022 was one which most people would want to forget. The

seemingly unending litany of woe - weak markets, higher inflation,

unstable governments, crippling energy prices and rising interest

rates were but a few of the horror stories we saw during the late

Summer and Autumn of 2022. With a feeling of déjà vu, we have moved

six months further on and it feels hard to be more positive -

interest rates have continued to rise and are probably yet to peak

in the UK, US and Europe. Inflation in the UK is starting to come

down with the last reading at 6.80% but food price inflation

remains stubbornly high. The bright spot in the UK has been the

service sector which has seen consumer spending continue at

elevated levels. Despite all the bad news, we saw some signs of

stabilisation towards the end of the year and the forward-looking

stock markets managed to eke out a positive return for the six

months.

The bond markets had a very volatile year. UK 10-year gilts

reached a 15 year high at 4.5% at the end of September on the back

of former Prime Minister Liz Truss's growth plan which proposed

billions of pounds in unfunded tax cuts, shooting up the country's

risk premium. 10-year gilt yields then fell back to 3.7% at the end

of December 2022 but have risen over the last six months as

stubbornly high inflation and weak growth have worried

international investors. At the time of writing the UK 10 year gilt

yield is at 4.44%. This is an important measure for the bond market

as companies wishing to raise money have to reference the gilt

yield which pushes their interest costs up.

In the US, the economy appears to be proving more resilient to

the effects of inflation. Nevertheless the US Federal Reserve has

continued to raise interest rates to try and tame inflation.

Whether this policy will work remains to be seen. In Europe,

interest rates have risen at a slower pace as EU policy makers

worry about anaemic job growth.

Portfolio and revenue review

During the period from June to December 2022, there were several

bonds called or repaid and we were able to invest the proceeds at

higher coupon rates than we have done previously. Good examples of

this would be the Barclays AT1 (Additional Tier 1 bond) 7.75% being

rolled over into an 8.75% coupon and the Shawbrook Group 7.785% FRN

(Floating Rate Note) being called and replaced with a 12.10%

coupon. We also took the opportunity in September when sterling was

weak to sell some of our US dollar denominated Bombardier 7.5% 2025

bonds and replaced them with more attractive UK and Euro bonds. The

Company still has a meaningful exposure to the US$ with 19.09% of

the portfolio investment in that currency and a further 13.79% in

the Euro and other currencies.

There were two major disappointments in the portfolio to report.

Firstly, Matalan Finance 9.5% 18-31/01/2024 underwent a refinancing

of its various bonds and equities in early 2023 and unfortunately

our position was reduced to zero. This reduced the NAV by 1.20%.

Secondly, we had a small position in Credit Suisse 31/12/2049 FRN

AT1 which was written to zero in March 2023 following a forced

take-over of Credit Suisse by Union Bank of Switzerland ("UBS").

This affected the NAV by 0.30% but the forced write-down to zero

ahead of equity holders was unprecedented and rocked the bond

markets. AT1 holdings are the junior debt of banks and financial

institutions and are normally ranked higher than shareholder

equity. The AT1 market is spooked at the possibility of being

ranked lower than equity and caused the bond prices of these

instruments to fall sharply. The Company's portfolio is exposed to

around 18.00% in AT1 holdings in companies such as Barclays and

Deutsche Bank and on average the prices of those securities have

been marked down by between 5.00% and 10.50%. We believe these

positions to be robust and will recover and regulators in the UK

have taken pains to state that the situation that arose in

Switzerland with Credit Suisse would not occur here. We have added

to some of our investments at attractive prices.

New entries into the top 10 this year are Barclays Plc

22-15/12/2170 FRN in the global banking sector and Albion Financing

8.75% 21-15/04/2027 which is the financing company for Aggreko, a

global provider of power and temperature control solutions.

For the year to 30 June 2023, the revenue account earnings were

4.51 pence compared to 4.16 pence for the same period last year.

Earnings per share have improved as we have invested at slightly

higher yields and received repayment of historic arrears from the

REA preference shares we hold. It is noticeable that as markets

settle around current levels, there are more opportunities to

invest, particularly as UK Gilt yields have elevated which pushes

up the coupons paid by companies when they issue debt instruments

priced at a margin over the relevant UK Gilt. In our regular

discussions with Shareholders, the revenue and dividends are topics

of crucial importance and the ability of any portfolio company to

pay its coupon or expected dividend is one of the major indicators

we follow.

Outlook

The economic outlook for the UK will be affected by several

factors in the months ahead. These include any continued rise in

interest rates, how fast inflation continues to fall towards

Government targets and whether the UK falls back into recession.

Another factor we look at is the UK housing market, how resilient

prices are over the next 12 months and whether the recent weakness

is set to continue. Finally, as we approach the end of 2024, the

prospect of the general election with a possible (at this time

according to polls) change of Government makes us look at how

policies could change.

Globally, a lot will depend on the world's two biggest

economies, the USA and China. The USA economy is moving along

nicely but there will be a lot of political factors to consider in

the run up to the 2024 Presidential elections. The Chinese

macro-economic picture looks horrible with major weakness in the

property sector which is 30% of their GDP.

As regards markets affecting the Company, we believe that we are

nearing the top of the interest rate cycle and that we will see a

recovery in capital values of higher yielding bonds in the next

year or so which would positively impact the ability of companies

to refinance debt. But a word of caution: all of this can be

affected by external influences.

Ian "Franco" Francis

New City Investment Managers

14 September 2023

Classification of Investment Portfolio

As at 30 June 2023

By currency 2023 Total 2022 Total

investments investments

% %

Sterling 67.12 62.16

------------- -------------

US dollar 19.09 23.59

------------- -------------

Euro 11.59 12.14

------------- -------------

Swedish krona 1.69 1.52

------------- -------------

Norwegian krone 0.35 0.40

------------- -------------

Canadian dollar 0.09 0.12

------------- -------------

Australian dollar 0.07 0.07

------------- -------------

Total investments 100.00 100.00

------------- -------------

By asset class 2023 Total 2022 Total

investments investments

% %

------------- -------------

Fixed income securities(1) 82.80 81.14

------------- -------------

Equity shares(2) 17.20 18.86

------------- -------------

Total investments 100.00 100.00

------------- -------------

(1) Fixed income securities include fixed and floating rate

securities, convertible securities and preference shares.

(2) Equity shares include investment funds.

Classification of Investment Portfolio by Sector

As at 30 June 2023

2023 Total 2022 Total

investments investments

% %

Financials 44.21 36.88

------------- -------------

Energy 21.47 21.82

------------- -------------

Consumer staples 9.55 8.96

------------- -------------

Consumer discretionary 6.98 4.91

------------- -------------

Industrials 6.50 10.80

------------- -------------

Information technology 6.22 10.10

------------- -------------

Real estate 3.17 4.27

------------- -------------

Materials 1.90 2.26

------------- -------------

Total investments 100.00 100.00

------------- -------------

Investment Portfolio

As at 30 June 2023

Company Sector Valuation GBP'000 Total investments %

Galaxy Finco Ltd 9.25% 31/07/2027 Financials 12,346 4.64

------------------------ ------------------ --------------------

Co-Operative Fin 25/04/2029 FRN Financials 11,952 4.49

------------------------ ------------------ --------------------

Shawbrook Group 22-08/06/2171 FRN Financials 11,917 4.48

------------------------ ------------------ --------------------

Aggregated Micro 8% 17/10/2036 Energy 11,110 4.18

------------------------ ------------------ --------------------

Virgin Money FRN PERP Financials 10,811 4.06

------------------------ ------------------ --------------------

REA Finance 8.75% 31/08/2025 Consumer staples 8,592 3.23

------------------------ ------------------ --------------------

Stonegate Pub 8.25% 31/07/2025 Consumer discretionary 8,326 3.13

------------------------ ------------------ --------------------

Barclays Plc 22-15/12/2170 FRN Financials 8,262 3.11

------------------------ ------------------ --------------------

Albion Financing 8.75% 21-15/04/2027 Industrials 7,724 2.90

------------------------ ------------------ --------------------

Diversified Energy Co Plc Energy 7,187 2.71

------------------------ ------------------ --------------------

Top ten investments 98,227 36.93

------------------ --------------------

Inspired Enterta 7.875% 21-01/06/2026 Information technology 7,021 2.64

------------------------ ------------------ --------------------

Mangrove Luxco Ltd 7.775% 19-09/10/2025 Financials 6,792 2.55

------------------------ ------------------ --------------------

Boparan Finance 7.625% 30/11/2025 Consumer staples 6,666 2.51

------------------------ ------------------ --------------------

Just Group Plc 31/12/2059 FRN Financials 6,605 2.48

------------------------ ------------------ --------------------

Euronav NV Energy 6,553 2.46

------------------------ ------------------ --------------------

American Tanker 7.75% 02/07/2025 Energy 6,455 2.43

------------------------ ------------------ --------------------

Azerion Holdings 7.25% 28/04/2024 Information technology 5,174 1.95

------------------------ ------------------ --------------------

Transocean Inc 11.5% 20-30/01/2027 Energy 4,904 1.84

------------------------ ------------------ --------------------

TVL Finance 9% 20-15/01/2025 Financials 4,884 1.84

------------------------ ------------------ --------------------

VPC Specialty Lending Invest Financials 4,636 1.73

------------------------ ------------------ --------------------

Top twenty investments 157,917 59.36

------------------ --------------------

Garfunkelux Hold 7.75% 20-01/11/2025 Financials 4,568 1.72

------------------------ ------------------ --------------------

RL Finance No6 23-25/11/2171 FRN Financials 4,417 1.66

------------------------ ------------------ --------------------

Lloyds Banking 29/12/2049 FRN Financials 4,211 1.58

------------------------ ------------------ --------------------

M&G Plc Financials 4,211 1.58

------------------------ ------------------ --------------------

Arrow Bidco Llc 9.5% 15/03/2024 Consumer discretionary 4,197 1.58

------------------------ ------------------ --------------------

Shamaran 12% 21-30/07/2025 Energy 4,063 1.53

------------------------ ------------------ --------------------

Ithaca Energy N 9% 21-15/07/2026 Energy 4,014 1.51

------------------------ ------------------ --------------------

REA Holdings Plc PREF Consumer staples 3,986 1.50

------------------------ ------------------ --------------------

Co-op Wholesale 7.5% 11-08/07/2026 Consumer staples 3,871 1.46

------------------------ ------------------ --------------------

Enquest Plc 7% 15/10/2023 Energy 3,581 1.34

------------------------ ------------------ --------------------

Top thirty investments 199,036 74.82

------------------ --------------------

Stonegate Pub 8% 20-13/07/2025 Consumer discretionary 3,274 1.23

------------------------ ------------------ --------------------

Phoenix Group Holdings Plc Financials 3,191 1.20

------------------------ ------------------ --------------------

Welltec A/S 9.5% 01/12/2022 Energy 3,191 1.20

------------------------ ------------------ --------------------

Summer BC Holdco 9.25% 19-31/10/2027 Industrials 3,152 1.18

------------------------ ------------------ --------------------

Deutsche Bank AG 30/05/2049 FRN Financials 3,060 1.15

------------------------ ------------------ --------------------

Channel Island Property Fund Real estate 2,880 1.08

------------------------ ------------------ --------------------

Coburn Resources 12% 20/03/2026 Materials 2,807 1.06

------------------------ ------------------ --------------------

Barclays Plc 29/12/2049 FRN Financials 2,703 1.02

------------------------ ------------------ --------------------

Bidco Rely 23-12/05/2026 FRN Financials 2,581 0.97

------------------------ ------------------ --------------------

Booster Precisio 22-28/11/2026 SR Industrials 2,576 0.97

------------------------ ------------------ --------------------

Top forty investments 228,451 85.88

------------------ --------------------

Doric Nimrod Air Three Ltd Industrials 2,380 0.89

------------------------ ------------------ --------------------

RM Infrastructure Income Plc Financials 2,176 0.82

------------------------ ------------------ --------------------

HDL Debenture 10.375% 93-31/07/2023 Real estate 2,100 0.79

------------------------ ------------------ --------------------

First Quantum 7.5% 01/04/2025 Materials 2,052 0.77

------------------------ ------------------ --------------------

Quilter Plc 23-18/04/2033 FRN Financials 2,034 0.76

------------------------ ------------------ --------------------

Tufton Oceanic Assets Ltd Financials 1,894 0.71

------------------------ ------------------ --------------------

Bluewater Hold 12% 22-10/11/2026 Energy 1,805 0.68

------------------------ ------------------ --------------------

Gaming Innovation 11/06/2024 FRN Information technology 1,797 0.68

------------------------ ------------------ --------------------

NewRiver REIT plc Real estate 1,655 0.62

------------------------ ------------------ --------------------

Hipgnosis Songs Fund Ltd Consumer discretionary 1,592 0.61

------------------------ ------------------ --------------------

Top fifty investments 247,936 93.21

------------------ --------------------

Greenfood AB 21-04/11/2025 FRN Consumer staples 1,486 0.56

------------------------ ------------------ --------------------

Kent Global Plc 10% 28/06/2026 Energy 1,363 0.51

------------------------ ------------------ --------------------

Eurobank Ergasia 22-06/12/2032 Frn Financials 1,343 0.50

------------------------ ------------------ --------------------

Skill Bidco APS 23-02/03/2028 FRN Industrials 1,231 0.46

------------------------ ------------------ --------------------

Cabonline GR 22-19/04/2026 FRN Information technology 1,223 0.46

------------------------ ------------------ --------------------

Palace Capital Plc Real estate 1,099 0.41

------------------------ ------------------ --------------------

West Bromwich BS 18-20/08/2170 Financials 1,072 0.40

------------------------ ------------------ --------------------

N0r5ke Viking 21-03/05/2024 FRN Information technology 918 0.35

------------------------ ------------------ --------------------

Independent Oil 20/09/2024 FRN Energy 867 0.33

------------------------ ------------------ --------------------

REA Trading 9.5% 21-30/06/2024 Consumer discretionary 863 0.33

------------------------ ------------------ --------------------

Top sixty investments 259,401 97.52

------------------ --------------------

Navigator Holdings 8% 10/09/2025 Energy 773 0.29

------------------------ ------------------ --------------------

REA Holdings Plc 7.5% 30/06/2026 Consumer staples 732 0.28

------------------------ ------------------ --------------------

Regional REIT Ltd Real estate 693 0.26

------------------------ ------------------ --------------------

Marex Group 22-30/12/2170 FRN Financials 585 0.22

------------------------ ------------------ --------------------

Hoist Finance AB 31/12/2060 FRN Financials 548 0.21

------------------------ ------------------ --------------------

Harbour Energy Plc Energy 546 0.21

------------------------ ------------------ --------------------

West Bromwich BS 11% 18-12/04/2038 Financials 454 0.17

------------------------ ------------------ --------------------

Croma Security Solutions Group Information technology 420 0.16

------------------------ ------------------ --------------------

Secured Income Fund Plc Financials 321 0.11

------------------------ ------------------ --------------------

New Look Pik Facility16.5% 09/11/2025 Consumer discretionary 307 0.11

------------------------ ------------------ --------------------

Top seventy investments 264,780 99.54

------------------ --------------------

Other investments (38) 1,231 0.46

------------------ --------------------

Total investments 266,011 100.00

------------------ --------------------

Notes:

FRN - Floating Rate Note

PERP - Perpetual

PREF - Preference shares

REIT - Real Estate Investment

Trust

Ten Largest Holdings

Valuation Purchases Sales Revaluation Valuation

30 June GBP'000 GBP'000 gain/(loss) 30 June

2022 GBP'000 2023

GBP'000 GBP'000

Galaxy Finco Ltd 9.25% 31/07/2027

A specialist provider of warranties

for consumer electric products. 12,774 405 - (833) 12,346

---------- ---------- --------- ------------- ----------

Co-Operative Finance 25/04/2029

FRN

A retail and commercial bank

in the United Kingdom. 8,616 2,979 - 357 11,952

---------- ---------- --------- ------------- ----------

Shawbrook Group 22-08/06/2171

FRN

A holding company of Shawbrook

Bank Limited, a specialist lending

and savings bank serving consumers

in the UK. - 13,066 - (1,149) 11,917

---------- ---------- --------- ------------- ----------

Aggregated Micro 8% 17/10/2036

A British company using small

scale, established technologies

to convert wood and waste into

energy in the form of heat and

electricity. 10,900 470 (279) 19 11,110

---------- ---------- --------- ------------- ----------

Virgin Money FRN PERP

A British banking company concentrating

on UK Retail and small and medium

enterprises regional banking

services. 12,188 - - (1,377) 10,811

---------- ---------- --------- ------------- ----------

REA Finance 8.75% 15-31/08/2025

Cultivator of oil palms in the

Indonesian province of East

Kalimantan and producer of crude

palm oil and palm products from

fruit harvested from oil palms. 8,592 - - - 8,592

---------- ---------- --------- ------------- ----------

Stonegate Pub 8.25% 20-31/07/2025

Operator of various formats

ranging from high-street pubs

and traditional country inns

to local community pubs, student

pubs and late-night bars and

venues in the UK. 8,308 - - 18 8,326

---------- ---------- --------- ------------- ----------

Barclays Plc 22-15/12/2170

FRN

A global financial services

provider engaged in retail banking,

credit cards, wholesale banking,

investment banking, wealth management

and investment management services. - 8,676 - (414) 8,262

---------- ---------- --------- ------------- ----------

Albion Financing 8.75% 21-15/04/2027

A financing company for Aggreko

which is a global provider of

power and temperature control

solutions to customers. 7,221 - - 503 7,724

---------- ---------- --------- ------------- ----------

Diversified Energy Co Plc

Energy Company focusing on US

natural gas. 7,490 1,435 - (1,738) 7,187

---------- ---------- --------- ------------- ----------

76,089 27,031 (279) (4,614) 98,227

---------- ---------- --------- ------------- ----------

Strategic Review

Introduction

This review is part of a Strategic Report being presented by the

Company and is designed to provide information primarily about the

Company's business and results for the year ended 30 June 2023. It

should be read in conjunction with the Statement from the Chair and

the Investment Manager's Review above, which give a detailed review

of the investment activities for the year and look to the

future.

Principal activity and status

The Company is a closed-ended investment company and was

incorporated with limited liability in Jersey under the Companies

(Jersey) Law 1991 on 17 January 2007, with registered number 95691.

In addition, the Company constitutes and is regulated as a

collective investment fund under the Collective Investment Funds

(Jersey) Law 1988.

The Company's ordinary shares are listed on the Official List

maintained by the Financial Conduct Authority ("FCA") and admitted

to trading on the Main Market of the London Stock Exchange

("LSE").

Investment policy

The Company invests predominantly in fixed income securities,

including, but not limited to, preference shares, loan stocks,

corporate bonds (convertible and/or redeemable) and government

stocks. The Company also invests in equities and other income

yielding securities.

Exposure to higher yielding securities may also be obtained by

investing in other closed-ended investment companies and open-ended

collective investment schemes.

There are no defined limits on countries, size or sectors,

therefore the Company may invest in companies regardless of

country, size or sector and accordingly, the Company's portfolio is

constructed without reference to the composition of any stock

market index or benchmark.

The Company may, but is not obliged to, invest in derivatives,

financial instruments, money market instruments and currencies for

the purpose of efficient portfolio management.

There are no defined limits on listed securities and,

accordingly, the Company may invest up to 100% of total assets in

any particular type of listed security.

The Company may acquire securities that are unlisted or unquoted

at the time of investment, but which are about to be convertible,

at the option of the Company, into securities which are listed or

traded on a stock exchange. The Company may continue to hold

securities that cease to be listed or traded if the Investment

Manager considers this appropriate. The Board has established a

maximum investment limit in this regard of 10% (calculated at the

time of any relevant investment) of the Company's total assets. In

addition, the Company may invest up to 10% (calculated at the time

of any relevant investment) of its total assets in other securities

that are neither listed nor traded at the time of investment.

The Company will not invest more than 10% (calculated at the

time of any relevant investment) of its total assets in other

collective investment undertakings (open-ended or

closed-ended).

The Board has established a maximum investment limit whereby, at

the time of investment, the Company may not invest more than 5% of

its total investments in the same investee company.

The Company uses gearing and the Board has set a current limit

that gearing will not exceed 25% of Shareholders' funds at the time

of borrowing. This limit is reviewed from time to time by the

Board.

The Investment Manager expects that the Company's assets will

normally be fully invested. However, during periods in which

changes in economic circumstances, market conditions or other

factors so warrant, the Company may reduce its exposure to

securities and increase its positions in cash, money market

instruments and derivative instruments in order to seek protection

from stock market falls or volatility.

Investment approach

Investments are typically made in securities which the

Investment Manager has identified as undervalued by the market and

which it believes will generate above average income returns

relative to their risk, thereby also generating the scope for

capital appreciation. In particular, the Investment Manager seeks

to generate capital growth by exploiting the opportunities

presented by the fluctuating yield base of the market and from

redemptions, conversions, reconstructions and take-overs.

Performance measurement and Key Performance Indicators

("KPIs")

The Board uses a number of performance measures to monitor and

assess the Company's success in meeting its objectives and to

measure its progress and performance. The KPIs are as follows:

-- Dividend yield and dividend cover

The Company pays four quarterly dividends each year and

accordingly, the Board reviews the Company's dividend yield and

dividend cover on a quarterly basis. For the year ended 30 June

2023, the Company's dividend yield was 9.64% (2022: 8.75%) based

upon a share price of 46.60 pence (bid price) as at 30 June 2023

(2022: 51.20 pence) and its dividend cover was 1.00x (2022:

0.93x).

-- Revenue earnings and dividends per ordinary share

The Company has opted to follow the AIC Statement of Recommended

Practice ("SORP") and in accordance with the provisions of the AIC

SORP, distinguishes its profits derived from revenue and capital

items. The Company declares and pays its dividend out of only the

revenue profits of the Company. The revenue earnings , whether

generated this year or in previous years and held in revenue

reserves, represent the total available funds that the Directors

are able to make a dividend payment from. The Board reviews revenue

forecasts on a quarterly basis in order to determine the quarterly

dividend. In respect of the current financial year, the Company

declared dividends of 4.49 pence per ordinary share (2022: 4.48

pence) out of revenue earnings per ordinary share of 4.51 pence per

ordinary share (2022: 4.16 pence).

-- Ongoing charges

The ongoing charges ratio represents the Company's management

fee and all other operating expenses incurred by the Company

expressed as a percentage of the average Shareholders' funds over

the year. The Board regularly reviews the ongoing charges and

monitors all Company expenses. The ongoing charges ratio for the

year ended 30 June 2023 was 1.16% (2022: 1.19%).

The Board measures the Company's performance by reviewing the

KPIs against their expectations of performance from their knowledge

of the industry sector.

These KPIs fall within the definition of APMs under guidance

issued by the European Securities and Markets Authority. Additional

information explaining how these are calculated is set out in the

APMs section below.

Going concern

The Company does not have a fixed winding-up date and therefore,

unless Shareholders vote to wind-up the Company, Shareholders will

only be able to realise their investment through the secondary

market.

At each AGM of the Company, Shareholders are given the

opportunity to vote on an ordinary resolution to continue the

Company as an investment company. If any such resolution is not

passed, the Board will put forward proposals at an extraordinary

general meeting to either liquidate or otherwise reconstruct or

reorganise the Company. Given the performance of the Company, input

from the Company's major Shareholders and its Broker and

considering that 98% of the Shareholder's votes at the last AGM

held on 1 December 2022, were in favour of the continuation of the

Company, the Board considers it likely that Shareholders will vote

in favour of continuation at the forthcoming AGM.

The Company's existing loan facility as detailed below is due to

expire on 17 December 2023 after which it is anticipated the

Company will take out a new facility on comparable terms. After

making enquiries of the Investment Manager and having considered

the Company's investment objective, nature of the investment

portfolio, loan facility, expenditure projections and impact of the

current geo-political and market uncertainty on the Company, the

Directors consider that the Company has adequate resources to

continue in operational existence for the foreseeable future. For

this reason, the Directors continue to adopt the going concern

basis in preparing the Financial Statements, notwithstanding that

the Company is subject to an annual continuation vote as described

above.

Viability Statement

In accordance with the provisions of the AIC Code, the Directors

have assessed the viability of the Company over a period longer

than the 12 months required by the 'Going concern' provision. The

Board conducted this viability review for a period of three years.

The Board continues to consider that this period reflects the

long-term objectives of the Company, being a Company with no fixed

life, whilst taking into account the impact of uncertainties in the

markets.

Whilst the Directors do not expect there to be any significant

changes to the current principal and emerging risks facing the

Company, certain risks have increased due to the general economic

environment, rising interest rates and global rise in inflation.

Despite these increased risks, the Directors believe that the

Company has sufficient controls in place to mitigate those risks.

Furthermore, the Directors do not envisage any change in strategy

which would prevent the Company from operating over the three year

period. This is based on the assumption that there are no

significant changes in market conditions or the tax and regulatory

environment that could not reasonably have been foreseen. The Board

also considers the annual continuation vote should not be a factor

to affect the three year period given the strong demand seen for

the Company's shares.

In making this statement the Board: (i) considered the

continuation vote to be proposed at the AGM which the Board

considers will be voted in favour of by Shareholders; and (ii)

carried out a robust assessment of the principal and emerging risks

facing the Company. These risks and their mitigations are set out

under Principal Risks and Uncertainties and Risk Mitigation section

of the Company's Annual Financial Report and Financial

Statements.

The principal risks identified as most relevant to the

assessment of the viability of the Company were those relating to

potential under-performance of the portfolio and its effect on the

ability to pay dividends. When assessing these risks the Directors

have considered the risks and uncertainties facing the Company in

severe but reasonable scenarios, taking into account the controls

in place and mitigating actions that could be taken.

When considering the risk of under-performance, a series of

stress tests was carried out including in particular the effects of

any substantial future falls in investment value on the ability to

re-pay and re-negotiate borrowings, potential breaches of loan

covenants and the maintenance of dividend payments.

The Board considered the Company's portfolio and concluded that

the diverse nature of investments held contributes to the stability

and liquidity along with flexibility to be able to react positively

to market and political forces beyond the Board's control.

The Board also considered the impact of potential regulatory

changes and the control environment of significant third party

providers, including the Investment Manager.

The Scotiabank Europe Plc ("Scotiabank") loan facility is due to

expire on 17 December 2023. It is anticipated a new facility on

comparable terms will be negotiated prior to this date.

The Board carries out stress testing on a range of downside

scenarios to ensure that the Company can meet its liabilities in

full.

Based on the Company's processes for monitoring revenue and

costs, with the use of frequent revenue forecasts and the

Investment Manager's compliance with the investment objective and

policies, the Directors have concluded that there is a reasonable

expectation that the Company will be able to continue in operation

and meet its liabilities as they fall due for a period of three

years from the date of approval of this Report.

Social, community, human rights, employee responsibilities and

environmental policy

The Directors recognise that their first duty is to act in the

best financial interests of the Company's Shareholders and to

achieve good financial returns against acceptable levels of risk,

in accordance with the objectives of the Company. In asking the

Company's Investment Manager to deliver against these objectives,

they have also requested that the Investment Manager take into

account the broader social, ethical and environmental issues of

companies within the Company's portfolio, acknowledging that

companies failing to manage these issues adequately run a long-term

risk to the sustainability of their businesses.

Greenhouse gas emissions

The Board recognises its impact on the environment, including

greenhouse gas emissions, through the underlying portfolio

companies which it invests in. The Board requested that ESG factors

be incorporated into the Company's investment strategy and further

details on ESG can be found in the Company's Annual Financial

Report and Financial Statements.

Modern slavery

The Company would not fall into the scope of the UK Modern

Slavery Act 2015 (as the Company does not have any turnover derived

from goods and services) if it was incorporated in the UK.

Furthermore, as a closed-ended investment company, the Company has

a non-complex structure, no employees and its supply chain is

considered to be low risk given that suppliers are typically

professional advisers based in either the Channel Islands or the

UK. Based on these factors, the Board determined that it is not

necessary for the Company to make a slavery and human trafficking

statement.

By Order of the Board

Caroline Hitch

Chair

14 September 2023

Statement of Directors' Responsibilities in respect of the

Annual Report and Financial Statements

The Directors are responsible for preparing the Annual Report

and Financial Statements in accordance with applicable law and

regulations. Company law requires the Directors to prepare

financial statements for each financial year. Under that law they

have elected to prepare the Financial Statements in accordance with

the International Financial Reporting Standards ("IFRS") as adopted

by the EU and applicable law.

Under Companies (Jersey) Law 1991, the Directors must not

approve the Financial Statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

Company and of its profit or loss for that period. In preparing

these Financial Statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and estimates that are reasonable, relevant and reliable;

-- state whether applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the Financial Statements;

-- assess the Company's ability to continue as a going concern,

disclosing, as applicable, matters relating to going concern;

and

-- use the going concern basis of accounting unless they either

intend to liquidate the Company or to cease operations, or have no

realistic alternative but to do so.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the Financial Statements comply with Companies (Jersey) Law, 1991.

They are responsible for such internal control as they determine is

necessary to enable the preparation of financial statements that

are free from material misstatement, whether due to fraud or error

and have general responsibility for taking such steps as are

reasonably open to them to safeguard the assets of the Company and

to prevent and detect fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. The Financial Statements are published on the

www.ncim.co.uk website, which is a website maintained by the

Company's Investment Manager. Legislation in Jersey governing the

preparation and dissemination of Financial Statements may differ

from legislation in other jurisdictions.

Responsibility statement of the Directors in respect of the

Annual Financial Report

We confirm that to the best of our knowledge:

-- the Financial Statements, prepared in accordance with the

IFRS as adopted by the EU, give a true and fair and balanced view

of the assets, liabilities, financial position and profit or loss

of the Company; and

-- the Strategic Report and Directors' Report include a fair

review of the development and performance of the business and the

position of the Company, together with a description of the

principal risks and uncertainties that the Company faces.

We consider the Annual Report and Financial Statements, taken as

a whole, is fair, balanced and understandable and provides the

information necessary for Shareholders to assess the Company's

position and performance, business model and strategy.

On behalf of the Board

Caroline Hitch

Chair

14 September 2023

Statement of Comprehensive Income

For the year ended 30 June 2023

Year ended Year ended

30 June 2023 30 June 2022

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ------ --------- ----------- ----------- --------- ----------- -----------

Net capital gains/(losses)

Losses on financial assets at fair

value 9 - (17,988) (17,988) - (14,459) (14,459)

Foreign exchange (loss)/gain(1) - (252) (252) - 61 61

Revenue

Investment income 2 26,229 - 26,229 22,362 - 22,362

------------------------------------ ------ --------- ----------- ----------- --------- ----------- -----------

Total Income 26,229 (18,240) 7,989 22,362 (14,398) 7,964

------------------------------------ ------ --------- ----------- ----------- --------- ----------- -----------

Expenses

Investment management fee 3 (1,591) (530) (2,121) (1,595) (531) (2,126)

Other expenses 4 (647) (89) (736) (772) (75) (847)

------------------------------------ ------ --------- ----------- ----------- --------- ----------- -----------

Total expenses (2,238) (619) (2,857) (2,367) (606) (2,973)

------------------------------------ ------ --------- ----------- ----------- --------- ----------- -----------

Profit/(loss) before finance

income/(costs) and taxation 23,991 (18,859) 5,132 19,995 (15,004) 4,991

------------------------------------ ------ --------- ----------- ----------- --------- ----------- -----------

Finance income/(costs)

Interest income 124 - 124 1 - 1

Interest expense 5 (1,167) (389) (1,556) (456) (152) (608)

------------------------------------ ------ --------- ----------- ----------- --------- ----------- -----------

Profit/(loss) before taxation 22,948 (19,248) 3,700 19,540 (15,156) 4,384

Irrecoverable withholding tax 6 (505) - (505) (377) - (377)

------------------------------------ ------ --------- ----------- ----------- --------- ----------- -----------

Profit/(loss) after taxation and

total comprehensive income/(loss) 22,443 (19,248) 3,195 19,163 (15,156) 4,007

Basic and diluted earnings/(losses)

per ordinary share (pence) 8 4.51p (3.87)p 0.64p 4.16p (3.29)p 0.87p

(1) Excludes foreign exchange gains and losses on financial

assets at fair value through profit and loss which are presented

within losses on financial assets at fair value.

The total column of this statement represents the Company's

Statement of Comprehensive Income, prepared in accordance with IFRS

as adopted by the EU (refer to note 1). The supplementary revenue

return and capital return columns are both prepared under guidance

published by the AIC.

There is no other comprehensive income as all income is recorded

in the Statement of Comprehensive Income above.

All revenue and capital items in the above statement are derived

from continuing operations.

No operations were acquired or discontinued in the year.

The accompanying notes below are an integral part of these

Financial Statements.

Statement of Financial Position

As at 30 June 2023

As at 30 June 2023 As at 30 June 2022

Notes GBP'000 GBP'000

------------------------------------------------------- ------ ------------------- -------------------

Non-current assets

Financial assets at fair value through profit or loss 9 266,011 263,393

------------------------------------------------------- ------ ------------------- -------------------

Current assets

Debtors and other receivables 10 7,010 3,819

Cash and cash equivalents 6,597 3,985

------------------------------------------------------- ------ ------------------- -------------------

13,607 7,804

------------------------------------------------------- ------ ------------------- -------------------

Total assets 279,618 271,197

------------------------------------------------------- ------ ------------------- -------------------

Non-current liabilities

Bank loan 11 - (33,000)

------------------------------------------------------- ------ ------------------- -------------------

Current liabilities

Bank loan 11 (35,000) -

Creditors and other payables 12 (4,187) (3,211)

------------------------------------------------------- ------ ------------------- -------------------

Total liabilities (39,187) (36,211)

------------------------------------------------------- ------ ------------------- -------------------

Net asset value 240,431 234,986

------------------------------------------------------- ------ ------------------- -------------------

Stated capital and reserves

Stated capital account 13 244,884 220,649

Special distributable reserve 50,385 50,385

Capital reserve (70,858) (51,610)

Revenue reserve 16,020 15,562

------------------------------------------------------- ------ ------------------- -------------------

Equity Shareholders' funds 240,431 234,986

------------------------------------------------------- ------ ------------------- -------------------

Net asset value per ordinary share (pence) 15 45.83p 49.30p

------------------------------------------------------- ------ ------------------- -------------------

The Financial Statements were approved by the Board of Directors

and authorised for issue on 14 September 2023 and were signed on

its behalf by:

Caroline Hitch

Chair

14 September 2023

The accompanying notes below are an integral part of these

Financial Statements.

Statement of Changes in Equity

For the year ended 30 June 2023

Stated Special Capital Revenue Total

capital distributable reserve reserve

account reserve (1) (3)

Notes (1) (2)

GBP'000 GBP'000 GBP'000

GBP'000 GBP'000

----------------------- -------- --------- --------------- --------- --------- ---------

At 1 July 2022 220,649 50,385 (51,610) 15,562 234,986

Total comprehensive

income for the year:

Profit/(loss) for

the year - - (19,248) 22,443 3,195

Transactions with

owners recognised

directly in equity:

Dividends paid 7 - - - (21,985) (21,985)

Net proceeds from

issue of shares 13 24,235 - - - 24,235

At 30 June 2023 244,884 50,385 (70,858) 16,020 240,431

----------------------- -------- --------- --------------- --------- --------- ---------

For the year ended 30 June 2022

Stated Special Capital Revenue Total

capital distributable reserve reserve

account reserve (1) (3)

Notes (1) (2)

GBP'000 GBP'000 GBP'000

GBP'000 GBP'000

----------------------- -------- --------- --------------- --------- --------- ---------

At 1 July 2021 203,416 50,385 (36,454) 16,831 234,178

Total comprehensive

income for the year:

Profit/(loss) for

the year - - (15,156) 19,163 4,007

Transactions with

owners recognised

directly in equity:

Dividends paid 7 - - - (20,432) (20,432)

Net proceeds from

issue of shares 13 17,233 - - - 17,233

At 30 June 2022 220,649 50,385 (51,610) 15,562 234,986

----------------------- -------- --------- --------------- --------- --------- ---------

(1) Following a change in Companies (Jersey) Law 1991 effective

27 June 2008, dividends can be paid out of any capital account of

the Company subject to certain solvency restrictions. However, it

is the Company's policy to account for revenue items and pay

dividends, drawing where necessary from a separate revenue

reserve.

(2) The balance on the special distributable reserve of

GBP50,385,000 (2022: GBP50,385,000) is treated as distributable

profits available to be used for all purposes permitted by Jersey

Company Law including the buying back of ordinary shares, the

payment of dividends and the payment of preliminary expenses.

(3) The balance on the revenue reserve of GBP16,020,000 (2022:

GBP15,562,000) is available for paying dividends.

The accompanying notes below are an integral part of these

Financial Statements.

Cash Flow Statement

For the year ended 30 June 2023

Year ended Year ended

30 June 2023 30 June 2022

Notes GBP'000 GBP'000

------------------------------------------------------------------------------ ------ -------------- --------------

Operating activities

Profit before taxation(1) 3,700 4,384

Adjustments to reconcile profit before taxation to net cash flows:

Realised losses/(gains) on financial assets at fair value through

profit or loss 9 1,273 (3,631)

Unrealised losses on financial assets at fair value through profit

or loss 9 16,715 18,090

Effective interest adjustment 9 (243) (154)

Foreign exchange loss/(gain) 252 (61)

Finance costs (1) 1,432 607

Purchase of financial assets at fair value through profit or loss (2) (77,242) (110,433)

Proceeds from sale of financial assets at fair value through profit or loss

(3) 57,170 85,833

Changes in working capital

Increase in other receivables (3,191) (508)

Increase in other payables 657 2,266

Irrecoverable withholding tax paid (505) (377)

------------------------------------------------------------------------------ ------ -------------- --------------

Net cash generated from/(used in) operating activities 18 (3,984)

------------------------------------------------------------------------------ ------ -------------- --------------

Financing activities

Dividends paid 7 (21,985) (20,432)

Drawdown of bank loan 11 2,000 -

Finance costs (1,404) (595)

Proceeds from issuance of ordinary shares(4) 13 24,235 17,508

------------------------------------------------------------------------------ ------ -------------- --------------

Net cash generated from/(used in) financing activities 2,846 (3,519)

------------------------------------------------------------------------------ ------ -------------- --------------

Increase/(decrease) in cash and cash equivalents 2,864 (7,503)

------------------------------------------------------------------------------ ------ -------------- --------------

Cash and cash equivalents at the start of the year 3,985 11,427

Exchange (loss)/gain (252) 61

------------------------------------------------------------------------------ ------ -------------- --------------

Cash and cash equivalents at the end of the year 6,597 3,985

------------------------------------------------------------------------------ ------ -------------- --------------

(1) For the comparative year, in accordance with IAS 7 Statement

of Cash Flows, the Cash Flow Statement has been re-presented to

start with 'profit before taxation' of GBP4,384,000 instead of

'profit before finance income/costs and taxation' of GBP4,991,000.

Subsequently, 'finance costs' of GBP607,000 have been added under

'Adjustments to reconcile profit before taxation to net cash flows

'.

Included within profit before taxation is dividend income of

GBP4,964,000 (2022: GBP3,684,000) and interest income of

GBP21,265,000 (2022: GBP18,678,000).

(2) Amounts due to brokers as at 30 June 2023 relating to

purchases of financial assets at fair value through profit amounted

to GBP904,000 (2022: GBP613,000).

(3) Amounts due from brokers as at 30 June 2023 relating to

sales of financial assets at fair value through profit amounted to

GBP nil (2022: GBP nil ).

(4) Amounts due on new share issuance not yet received as at 30

June 2023 amounted to GBPnil (2022: GBPnil).

The accompanying notes below are an integral part of these

Financial Statements.

Notes to the Financial Statements

1 Accounting Policies

(a) Basis of accounting

These Financial Statements have been prepared in accordance with

IFRS as adopted by the EU and in accordance with the guidance set

out in the SORP: Financial Statements of Investment Trust Companies

and Venture Capital Trusts issued by the AIC in November 2014 and

updated most recently in July 2022 with consequential amendments.

Notwithstanding that the Company is not an investment trust

company, given the purpose of the Company and certain similar

characteristics, the Company has chosen to follow the guidance set

out in the SORP where it is consistent with the requirements of

IFRS.

The functional and reporting currency of the Company is pound

sterling because that is the primary economic environment in which

the Company operates. The Financial Statements and notes are

presented in pound sterling and are rounded to the nearest thousand

except where otherwise indicated.

The Financial Statements have been prepared on the historical

cost basis, except that investments are stated at fair value and

categorised as financial assets at fair value through profit or

loss.

Going concern

At each AGM of the Company, Shareholders are given the

opportunity to vote on an ordinary resolution to continue the

Company as an investment company. If any such resolution is not

passed, the Board will put forward proposals at an extraordinary

general meeting to liquidate or otherwise reconstruct or reorganise

the Company. Given the performance of the Company, input from the

Company's major Shareholders and its Broker and considering that

98% of the Shareholder's votes at the last AGM held on 1 December

2022, were in favour of the continuation of the Company, the Board

considers it likely that Shareholders will vote in favour of

continuation at the forthcoming AGM.

The Company's existing loan facility as detailed below, is of an

amount of up to GBP45,000,000 and is due to mature on 17 December

2023 after which it is anticipated the Company will take out a new

facility on comparable terms. After making enquiries of the

Investment Manager and having considered the Company's investment

objective, nature of the investment portfolio, loan facility,

expenditure projections and the impact of the current geo-political

and market uncertainty on the Company, the Directors consider that

the Company has adequate resources to continue in operational

existence for the foreseeable future. For this reason the Directors

continue to adopt the going concern basis in preparing the

Financial Statements, notwithstanding that the Company is subject

to an annual continuation vote as described above.

Accounting developments

Standards and amendments to existing standards effective in

current year

There were no new standards, amendments or interpretations that

are effective for the financial year beginning 1 July 2022 which

the Directors consider to have a material impact on the Financial

Statements of the Company.

Standards and amendments becoming effective in future

periods

The following standards become effective in future accounting

periods and have not been adopted by the Company:

Effective

for periods

beginning on

Standards or after

1 January 2023

* IFRS 17 Insurance Contracts

-----------------

1 January 2023

* Amendments to IFRS 17

-----------------

1 January 2023

* Disclosure of Accounting Policies (Amendments to IAS

1 and IFRS Practice Statement 2)

-----------------

1 January 2023

* Definition of Accounting Estimate (Amendments to IAS

8)

-----------------

* Deferred Tax Related to Assets and Liabilities 1 January 2023

Arising from a Single Transaction - Amendments to IAS

12 Income Taxes

-----------------

* Initial Application of IFRS 17 and IFRS 9 - 1 January 2023

Comparative Information (Amendments to IFRS 17)

-----------------

1 January 2024

* Classification of liabilities as current or

non-current (Amendments to IAS 1)

-----------------

1 January 2024

* Lease Liability in a Sale and Leaseback (Amendments

to IFRS 16)

-----------------

1 January 2024

* Non-current Liabilities with Covenants (Amendments to

IAS 1)

-----------------

* Sale or Contribution of Assets between an Investor

and its Associate or Joint Venture (Amendments to

IFRS 10 and IAS 28) Optional

-----------------

The Directors believe that the application of these amendments

and interpretations will not materially impact the Company's

Financial Statements when they become effective.

Critical accounting estimates and judgements

The preparation of the Financial Statements necessarily requires

the exercise of judgement both in application of accounting

policies which are set out below and in the selection of

assumptions used in the calculation of estimates. These estimates

and judgements are reviewed on an ongoing basis and are continually

evaluated based on historical experience and other factors.

However, actual results may differ from these estimates.

The valuation of financial assets involves estimation and

judgements. The major part of the Company's financial assets is its

financial assets held at fair value through profit or loss which

are valued by reference to listed and quoted bid prices, however

some of these financial assets are thinly traded. Such financial

assets are best valued by reference to current market price quotes

provided by independent brokers. The Directors may overlay such

prices with situation specific adjustments including (a) taking a

second independent opinion on a specific investment, or (ii)

reducing the value to a net present value, to reflect the likely

time to be taken to realise a stock which the Company is actively

looking to sell. The outturn is reflected in the valuations of

investments as set out in note 22 to the Financial Statements.

Financial assets which are not listed or where trading in the

securities of an investee company is suspended are valued at the

Board's estimate of fair value in accordance with International

Private Equity and Venture Capital valuation guidance. Unquoted

financial assets are valued by the Directors on the basis of all

the information available to them at the time of valuation. This

includes a review of the financial and trading information of the

investee company, covenant compliance, ability to pay the interest

due and cash held. For convertible bonds this also includes

consideration of their discounted cash flows and underlying equity

value based on information provided by the Investment Manager.

There were no other significant accounting estimates or

significant judgements in the current or previous year.

A summary of the principal accounting policies which have been

applied to all periods presented in these Financial Statements is

set out below.

(b) Financial assets

Financial assets which comprise equity shares, convertible bonds

and fixed income securities, are classified as held at fair value

through profit or loss as the Company's business model is not to

hold these financial assets for the sole purposes of collecting

contractual cash flows. In making this assessment, the Directors

have given regard to the investment strategy of the Company, the

fact that the performance of the portfolio is evaluated on a fair

value basis and the fact that the Investment Manager is remunerated

on a percentage of total assets.

Purchases or sales of financial assets are

recognised/derecognised on the date the Company trades the

investments. On initial recognition investments are measured at

fair value and classified as fair value through profit or loss with

any subsequent gain or loss, including any gain or loss arising

from a change in exchange rates, recognised in the Statement of

Comprehensive Income.

Financial assets held at fair value through profit or loss are

valued in accordance with the policies described in the critical

accounting estimates and judgements section above .

Financial assets also include the Company's cash and cash

equivalents (comprising of cash held in current accounts and

overdraft balances) and debtors and other receivables which are

held at amortised cost using effective interest rate, less any

impairment.

(c) Financial liabilities

Financial liabilities include amounts due to brokers, bank loan,

interest on bank loan and other creditors which are held at

amortised cost using the effective interest rate method. Financial

liabilities are recognised initially at fair value, net of

transaction costs incurred and are subsequently carried at

amortised cost using the effective interest rate method. Financial

liabilities are derecognised when the obligation specified in the

contract is discharged, cancelled or expires.

(d) Income

Dividends receivable on equity shares (including preference

shares) are recognised as income on the date that the related

investments are marked ex-dividend. Dividends receivable on equity

shares where no ex-dividend date is quoted are recognised as income

when the Company's right to receive payment is established.

Dividends from overseas companies are shown gross of any

non-recoverable withholding taxes which are disclosed separately in

the Statement of Comprehensive Income.

Fixed returns on non-equity shares and debt securities

(including preference shares) are recognised on a time apportioned

basis so as to reflect the effective interest rate on those

instruments. Other returns on non-equity shares are recognised when

the right to the return is established.

Where the Company has elected to receive its dividends in the

form of additional shares rather than cash, an amount equal to the

cash dividend is recognised as income. Any excess in the value of

the shares received over the amount of the cash dividend is

recognised in the capital reserve.

(e) Expenses, including finance charges

All expenses are accounted for on an accruals basis. Expenses

are charged through the revenue account except as follows:

- expenses which are incidental to the acquisition of an

investment are charged to the capital account;

- expenses which are incidental to the disposal of an investment charged to the capital account;

- the Company charges 25% of investment management fees and

interest costs to capital, in line with the Board's expected long

term return in the form of capital gains and income respectively

from the investment portfolio of the Company. For further details

refer to notes 3 and 5; and

- expenses incurred in connection with the maintenance or

enhancement of the value of the investments or for the long term

benefit of the Company are charged to capital.

(f) Foreign currencies

Transactions denominated in foreign currencies are recorded in

the functional currency at actual exchange rates at the date of the

transaction. Monetary assets and liabilities denominated in foreign

currencies at the period end are reported in sterling at the rates

of exchange prevailing at the period end. Exchange gains and losses

on investments held at fair value through profit or loss are

included in 'Gains or losses on investments held at fair value

through profit or loss'. Exchange gains and losses on other

balances are disclosed separately in the Statement of Comprehensive

Income.

(g) Reserves

(i) Capital reserve. Following a change in Jersey Company law

effective 27 June 2008, dividends can be paid out of any capital

account of the Company subject to certain solvency restrictions. It

is the Company's policy however to account for revenue items and

pay dividends through a separate revenue reserve. The following are

accounted for in the capital reserve:

-- gains and losses on the realisation of investments;

-- realised and unrealised exchange differences of a capital nature;

-- expenses and finance costs charged in accordance with the policies above; and

-- increases and decreases in the valuation of investments held at the period end.

(ii) Special distributable reserve. This reserve is treated as

distributable profits available to be used for all purposes

permitted by Jersey company law including the buying back of

ordinary shares, the payment of dividends (see note 7 ) and the

payment of preliminary expenses.

(iii) Revenue reserve. The net profit/(loss) and total

comprehensive income/(loss) arising in the revenue column of the

Statement of Comprehensive Income is added to or deducted from this

reserve and is available for paying dividends.

(h) Share capital

Ordinary shares

The Company's ordinary shares are classified as equity based on

the substance of the contractual arrangements and in accordance

with the definition of equity instruments under International

Accounting Standard ("IAS") 32. The proceeds from the issue of

ordinary shares are recognised in the Statement of Changes in

Equity, net of issue costs.

Treasury shares

When the Company purchases its ordinary shares to be held in