TIDMPALM

RNS Number : 5830R

Panther Metals PLC

08 November 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO AUSTRALIA, CANADA, JAPAN,

THE REPUBLIC OF SOUTH AFRICA, THE UNITED STATES OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS

(SI 2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN .

FOR IMMEDIATE RELEASE

PANTHER METALS PLC

("Panther" or the "Company")

(Incorporated in the Isle of Man with company number

009753V)

8 November 2021

Proposed Listing on the ASX-Update

Panther Metals Limited ("PML"), the Australian subsidiary of

Panther Metals plc confirms today that it is expecting to list on

the Australian Securities Exchange ("ASX") on the 10 December 2021,

following an initial public offering ("IPO") to raise A$5,000,000

following the issue of 25,000,000 ordinary shares in PML (the

"Offer"). The fundraise is being supported by Sanlam Private Wealth

Pty Ltd and Kerr Allan Financial Pty Ltd as joint lead

managers.

As a result of this fundraise Panther Metals plc will be diluted

to 36.6% of PML, which will have 54,625,001 (undiluted) shares in

issue following the IPO. The opening date of the Offer is 8

November 2021 and the closing date of the Offer is 22 November

2021; the issue of shares under the Offer is expected to occur on

26 November 2021.

Shareholders are referred to the Panther Metals Limited website

for more information: http://www.panthermetals.com.au

Darren Hazelwood, Chief Executive Officer, commented:

"Providing the working capital to develop the exciting portfolio

held in Australia by Panther Metals Limited is the key aim of the

process to listing the business on the ASX. Achieving this goal is

now within sight. The world class expertise and network provided by

the board in Australia gives Panther Metals plc a great foundation

for building value via its equity stake in the ASX listed vehicle

at no extra capital cost to its shareholders.

Our corporate strategy of building underlying value within the

business while managing the risk/reward profile, that is the

foundation of exploration, is being defined in this transaction.

Having a liquid asset on our balance sheet with untapped growth

potential focused on nickel and gold that on listing will exceed in

value the total amount ever raised in capital by Panther Metals plc

shows the strength of the company in identifying and executing on

great targets and shareholders seeing value retained."

About Panther Metals Limited

The following information is derived from stock exchange

announcements by Panther Metals plc (principally 21 June 2021, 27

May 2021, 8 July 2020 and 18 June 2020). Panther Metals Limited

("PNT") is a majority-owned subsidiary of Panther Metals plc

(LSE:PALM), and is focused on mineral exploration in Western

Australia and the Northern Territory. PNT is presently pursuing a

listing on the Australian Securities Exchange (the "ASX" or "ASX

Exchange").

Western Australia Projects

The Merolia Project ("Merolia") comprises a series of largely

contiguous exploration licences located from 35km to the southeast

of the town of Laverton (population: 340) in the Eastern Goldfields

Province of Western Australia. The area around Laverton includes

several major gold mines, including Granny Smith (3 Moz), Sunrise

Dam (8 Moz) and Wallaby (8 Moz), and many significant gold

deposits. It is one of the most prolific gold producing areas in

Western Australia and is consequently well-serviced by

infrastructure and has a skilled local work-force.

The Archaean greenstone belts in the Laverton region are

dominantly basaltic in composition, containing ultramafic

intercalations, which were subsequently intruded by dolerite dykes

in places and which are particularly prospective for gold and

nickel mineralisation. The areas under licence are partly obscured

by a veneer of partly lateritic transported cover and exploration

in the area has consequently been limited.

Within the eastern part of Merolia are a series of gold

prospects, notably Burtville East, Comet Well and Ironstone.

Regional magnetic data over this part of the project identifies

several NW-SE trending shear systems which have potential to host

gold mineralisation. This potential has been confirmed by surface

geochemical sampling along the 15km long Comet Well gold trend,

which has identified several significant and coherent linear gold

in soil anomalies at Comet South, Comet North, Comet West,

Ironstone and the recently discovered 40 Mile Camp anomaly.

Previous drilling across these prospect areas includes 8m at 6.7

g/t Au at Burtville East and 9m at 46.5 g/t Au at Ironstone. In

addition, historic drilling at Burtville East includes 5m at 27.8

g/t Au and 24m at 8.6g/t Au at Ironstone. The Comet Well area has

not been drilled to date, but contains a series of distinct

sub-parallel 1.25 to 2.5km long NW-trending gold anomalous zones

(gold in soils reaching a peak of 2.6 g/t Au), which yielded

substantial quantities of angular gold nuggets through surface

prospecting. The angular nature of the gold nuggets suggests a

proximal gold source, which will become the focus of further work

in this area.

Approximately 15km to the west of Laverton lies the Red Flag

Project ("Red Flag"). Previous exploration in the area around Red

Flag identified a WNW-trending gold anomalous zone coinciding with

a distinct magnetic low. The geology of the area is dominated by

mafic volcanic rocks intruded by dolerite dykes, displaying sheared

gold mineralised margins in places. This area was drilled, yielding

a best near surface intercept of 2m at 9.20 g/t Au. The licence

area is also significantly prospective for nickel-cobalt sulphide

mineralisation, containing the Mt. Goose and Salimas prospects, and

with several resources identified on adjacent tenements.

Panther has also recently defined a JORC Exploration Target for

nickel and cobalt at the Coglia Project ("Coglia") on the

southernmost area encompassed by the Merolia project tenements.

This target provided a tonnage range of 30-50Mt at 0.6 to 0.8%

nickel and 400 to 600ppm cobalt. The mineralisation is developed

along a lateritic horizon lying above largely ultramafic host rocks

which are themselves mineralised with sulphides in places. It is

expected that Panther will be able to define at least an Inferred

JORC Resource with certain additional drilling and other work at

Coglia.

Northern Territory Projects

The Annaburroo and Marrakai gold projects comprise two granted

licences (EL32140 and EL32121 respectively) covering a total area

of 160km2, located from 70km to the southeast of Darwin, Northern

Territory (Figure 1). The projects are situated within the

Palaeoproterozoic Pine Creek Orogen ("PCO"), which hosts over 250

gold occurrences and several operating gold mines. Both licence

areas are close to good infrastructure and the Toms Gully and

Rustlers Roost deposits, which are owned by China Hanking Holdings

Limited. Toms Gully is a high-grade underground mine containing

1.1Mt @ 8.9 g/t Au (0.3 Moz); operations are expected to recommence

following recent EIA approval. Rustlers Roost contains 51Mt @ 1.0

g/t Au (1.6Moz) and is one of the largest gold projects in the

region.

The project areas contain several gold prospects at Donkey Hill,

Johns Reef, Chins Gully and Jasons Rise, some of which have yielded

substantial quantities of gold nuggets, individually up to 30oz in

weight. These prospects have all yielded high-grade gold from grab

samples (e.g. c. 30-60 g/t Au), trenching (e.g. 5m @ 6.68 g/t Au)

and limited RAB or RC drilling (e.g. 2m @ 5.74g/t Au from surface).

In more detail, several NE and NW trending linear features cut the

local geology and may provide control on the distribution of gold

mineralisation. These will be the focus of future ground-based

exploration work. The mineralisation consists largely of sulphidic

quartz veins hosted by banded greywacke and siltstones of the

Finnis River, South Alligator and Mt. Partridge Groups, which are

metamorphosed to lower greenschist facies. It is expected that

Panther will continue to explore and ultimately drill-test several

of these prospect areas during the next few years.

The person who arranged the release of this information is

Darren Hazelwood, Chief Executive Officer.

Panther Metals plc:

Darren Hazelwood, Chief Executive Officer: +44(0) 1462 429 743

+44(0) 7971 957 685

Mitchell Smith, Chief Operating Officer: +1(604) 209 6678

Broker:

SI Capital Limited

Nick Emerson +44(0) 1438 416 500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FURUPGBGGUPGPWM

(END) Dow Jones Newswires

November 08, 2021 02:00 ET (07:00 GMT)

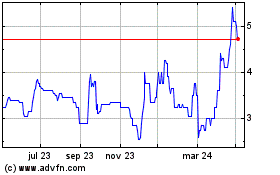

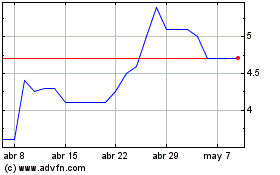

Panther Metals (LSE:PALM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Panther Metals (LSE:PALM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024