TIDMPETS

RNS Number : 1341I

Pets At Home Group Plc

03 August 2023

FOR IMMEDIATE RELEASE, 03 AUGUST 2023

Pets at Home Group Plc: Q1 FY24 Trading Statement

for the 16 week period to 20 July 2023

Strong sales momentum and further strategic progress

Financial Highlights

-- Consumer revenue(1) up 10.2% to GBP568.2m supported by both volume

and value growth.

-- Consumer numbers continued to grow with our active VIP base increasing

4% to 7.7m, with over 22,000 new Puppy & Kitten sign ups and 18,000

new pet registrations a week in our Vet Group.

-- Total Group revenue growth of 7.9% to GBP436.8m, with Group like-for-like(2)

(LFL) revenue up 7.9%.

-- Vet Group revenue was up 16.3%, with LFL(2) of 16.6%, increasingly

supported by number of visits (as we increased vet capacity),

improving mix and continued growth in average spend.

-- Retail revenue growth of 7.1%, and LFL(2) up 7.1%. Our food category

remains in volume growth across grocery and premium categories

supported by further progress in our relative price position.

Accessories trends were consistent with previous quarters, as

expected.

Business Highlights

-- Opened 2 new pet care centres with in-store JV vets, both under

our new integrated brand, and completed 9 refits, including our

Leeds Birstall centre, with a significant extension of an existing

vet hospital, providing 24-hour patient care, additional services

and consult rooms, and training facilties.

-- Continued progress in the development of our digital platform,

remaining on track for cut over of our consumer app and website

later this year, a key foundation for growth in the years ahead.

-- We also launched nutrition subscription capability in-store resulting

in accelerated Easy Repeat sign ups. We also relaunched our care

plans in the quarter which have seen strong consumer uptake.

-- As part of our food strategy, we continued the rollout of new freezer

space across the estate, alongside the introduction of new ranges,

resulting in good sales uplift in our frozen category.

-- Encouraging activity within vet recruitment and retention with

turnover down 7% YoY, the impacts of which are already being seen

in our revenue growth. We have doubled the number of graduate places

on offer and have filled over two thirds to date, and our JV partner

pipeline is in very strong shape

-- Good progress in our sustainability agenda. We now have fed over

1.5m pets through our foodbank partnership with Blue Cross, launched

a sustainable anaesthetic programme, and raised GBP1.5m for charities

in the quarter. We are also pleased to be included in the FTSE4Good

Index.

Current trading and outlook

-- We make no change to guidance for FY24 and remain comfortable with

current analyst expectations for Group underlying PBT*, noting

that our H1 profits will carry additional costs to ramp up the

new DC (GBP6m) and the cost of our brand relaunch (GBP2m), both

in line with our plan.

-- In addition, in line with our strategy to integrate our business,

we made the decision to consolidate our vet and retail support

offices. This move will result in a GBP3m one-off transition cost

in the year.

-- Our balance sheet remains robust and we are progressing our GBP50m

share buyback programme.

(*Consensus currently GBP136.8m, with a range of GBP132m to

GBP142m.)

Lyssa McGowan, Chief Executive Officer, commented:

Our performance in the first quarter has been encouraging. The

quality of our growth has remained strong as we grew transaction

volumes and continued to acquire new consumers at an impressive

rate, as our compelling value, range and service continues to

resonate with consumers.

It has also been a quarter of steady delivery against our

strategic plan we set out in May. We have expanded and enhanced our

physical estate, made good progress in the development of our

digital platform, and continued the transition to our new

distribution facility, as we execute on our ambition to build the

world's best pet care platform.

1. Consumer revenue includes total revenue across the Group

including consumer sales made by Joint Venture vet practices, and

therefore differs to the fee income recognised within Vet Group

statutory revenue.

2. Like-for-like revenue comprises total revenue in a financial

period compared to revenue achieved in a prior period, for stores,

omnichannel operations, grooming salons, and vet practices that

have been trading for 52 weeks or more.

Our next scheduled update will be our FY24 interim results

announcement on 28 November 2023.

Investor Relations Enquiries

Pets at Home Group Plc:

Andrew Porteous, Director of Investor

Relations +44 (0) 7740 361 849

Chris Ridgway, Head of Investor

Relations +44 (0) 7788 783 925

Media Enquiries

Pets at Home Group Plc:

Natalie Cullington, Head of Communications +44 (0) 7974 594 701

Citigate Dewe Rogerson:

Lorna Cobbett +44 (0) 7771 344 781

Angharad Couch +44 (0) 7507 643 004

About Pets at Home

Pets at Home Group Plc is the UK's leading pet care business,

providing pets and their owners with the very best advice, products

and care. Pet products are available online or from our 458 stores,

many of which also have vet practices and grooming salons. The

Group also operates a leading small animal veterinary business,

with 445 veterinary General Practices located both in our stores

and in standalone locations. For more information visit:

http://investors.petsathome.com/

Disclaimer

This trading statement does not constitute an invitation to

underwrite, subscribe for, or otherwise acquire or dispose of any

Pets at Home Group Plc shares or other securities nor should it

form the basis of or be relied on in connection with any contract

or commitment whatsoever. It does not constitute a recommendation

regarding any securities. Past performance, including the price at

which the Company's securities have been bought or sold in the

past, is no guide to future performance and persons needing advice

should consult an independent financial adviser. Certain statements

in this trading statement constitute forward-looking statements.

Any statement in this document that is not a statement of

historical fact including, without limitation, those regarding the

Company's future plans and expectations, operations, financial

performance, financial condition and business is a forward-looking

statement. Such forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially.

These risks and uncertainties include, among other factors,

changing economic, financial, business or other market conditions.

These and other factors could adversely affect the outcome and

financial effects of the plans and events described in this

statement. As a result you are cautioned not to place reliance on

such forward-looking statements. Nothing in this statement should

be construed as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUUUWROSUWRAR

(END) Dow Jones Newswires

August 03, 2023 02:00 ET (06:00 GMT)

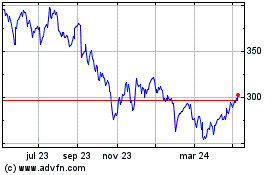

Pets At Home (LSE:PETS)

Gráfica de Acción Histórica

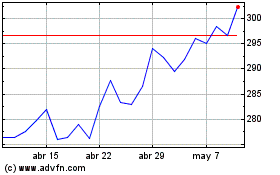

De Abr 2024 a May 2024

Pets At Home (LSE:PETS)

Gráfica de Acción Histórica

De May 2023 a May 2024