TIDMRBN

RNS Number : 0708A

Robinson PLC

18 January 2024

Robinson plc

18 January 2024

YEAR END TRADING STATEMENT

Robinson plc ("Robinson", the "Company" or the "Group" stock

code: RBN), the custom manufacturer of plastic and paperboard

packaging based in Chesterfield, is pleased to issue the following

trading statement, prior to the announcement of its final results

for the year ended 31 December 2023, which are scheduled to be

released on 22 March 2024 .

Revenue for 2023 is anticipated to be GBP49.6m, which is 1.8%

below the prior year. After adjusting for price changes and foreign

exchange, sales volumes are 6% lower than in 2022. However, the

Company is pleased to report that 2023 operating profit before

exceptional items and amortisation of intangible assets is expected

to be ahead of 2022, and in line with current market

expectations.

We anticipated that sales volumes would come under further

pressure because of inflation, the cost-of-living crisis, the

de-listing of some products by our customers, and certain of our

customers continuing to prioritise existing business over

innovation projects, a characteristic which started during the

Covid-19 pandemic. These factors have manifested in lower sales in

2023, notably in the first half of the financial year. As

previously announced, with the lower demand and continued

inflationary pressures, we implemented a restructuring program in

June, which resulted in exceptional costs of c.GBP0.4m and annual

savings of c.GBP0.7m, of which GBP0.4m benefited 2023.

We believe we have now passed the worst of the downturn with our

customers; sales volumes in the second half of 2023 were 1% above

the comparative period in 2022, as implemented new projects began

to take effect. As a result of successful sales activity, we expect

a substantial increase in sales volume in the plastics business in

2024.

Net debt at 31 December 2023 is expected to be GBP6.3m

(31/12/2022: GBP9.2m) including the receipt of GBP0.7m proceeds on

sale of surplus property and the return of the defined benefit

pension escrow funds of GBP3.3m in the period.

Impact of Storm Babet

The Company announced on 24 October 2023 that the River Hipper,

which flows through our premises in Chesterfield, had risen to its

highest ever recorded level and flooded part of the site. Part of

the premises are occupied by the Group, including the Paperbox

manufacturing business and the Group head office; the remainder is

let to tenants. The Paperbox business represented 4.5% of the

Group's revenues in 2023 (2022: 4.0%). The Group's plastics

business was unaffected.

Despite the substantial efforts of our employees, some damage

was caused to facilities, materials and equipment and manufacturing

operations were paused. Our insurance covers facilities, materials,

equipment and business interruption, with an excess of GBP100,000.

The insurers' liability for the loss was confirmed in November and

subsequently an interim payment of GBP450,000 was received by

Robinson in December. The impact on the 2023 results is expected to

be an exceptional cost of GBP0.1m.

The majority of the cleaning activities are now complete, but

on-site manufacturing continues to be disrupted due to the scale of

the clean-up operations and complications in re-instating damaged

plant and machinery. Customer orders are being met through

sub-contracting.

CEO position

As previously announced, Dr Helene Roberts resigned as CEO and a

Director of the Company on 1 September 2023, at which point Sara

Halton assumed responsibility as the Interim CEO. The selection

process is underway, and the Directors expect to make an

announcement on the appointment of a permanent CEO in due

course.

Property

As previously announced, part of the Walton Works surplus

property in Chesterfield, known as "Mill Lane", was sold on 30 May

2023. The consideration of GBP0.7m was received in cash and used to

reduce bank debt.

On 11 August 2023, the Company also exchanged contracts for the

sale of c.1.3 acres of the Walton Works surplus property.

Completion is subject to conditions, notably including satisfactory

planning approval, and is currently expected to take up to 18

months. The consideration payable on completion would be GBP1.5m in

cash, with estimated Company costs of GBP0.4m. The net proceeds of

GBP1.1m would be used by the Company to reduce current bank debt or

invested in the listed Walton Mill buildings to enhance their

saleability. Including this property transaction, which is not yet

completed, the Directors estimate that the current market value of

the remaining surplus properties held by the Group is approximately

GBP7.4m.

We expect further sales of surplus property in Chesterfield to

be achieved in the next 12 months . The intention of the Group is,

over time, to realise value from the disposal of surplus properties

and use the proceeds to reduce indebtedness and develop our

packaging business.

Defined benefit pension scheme

In December 2022, the Robinson & Sons' Limited Pension Fund

(the "Scheme") completed a buy-in of all the Group's defined

benefit pension scheme liabilities with a plan to complete a full

buy-out during 2023. A data cleanse exercise was completed, and the

administration and payroll functions were handed over to Legal and

General Assurance Society Limited from 1 August 2023. Whilst the

final buy-out has been delayed slightly, full completion is now

expected to take place very shortly . Any surplus remaining in the

Scheme after the full buy-out would be used to augment member

benefits. Non-cash exceptional costs are estimated to be

approximately GBP0.3m in 2023, including the costs of enhancing the

benefits of active members and the expenses of moving towards

buyout. These costs are payable by the Scheme but accounted for in

the Company under IAS19.

As announced on 14 August 2023, the Company reached agreement

with the trustees of the Scheme for the funds held in the pension

escrow account, totalling c.GBP3.3m, to be returned to the Group

(of which, GBP2.7m was already loaned to the Company), and this was

included in the reduced net debt at 31 December 2023. The Group

will recognise an exceptional profit of c.GBP3.3m for this item in

its income statement for 2023.

2024 Outlook

Following improved momentum in the second half of 2023 and

reflecting the effect of new customer projects and the full year

impact of cost savings, the Company expects revenue, and operating

profit (before amortisation of intangible assets and any

exceptional items), for the 2024 financial year to be ahead of

2023.

Robinson plc www.robinsonpackaging.com

Sara Halton, Interim CEO Tel: 01246 389280

Mike Cusick, Finance Director

Cavendish Capital Markets Limited

Ed Frisby / Seamus Fricker, Corporate Tel: 020 7220 0500

Finance

Tim Redfern, Corporate Broking

About Robinson:

Being a purpose-led business, Robinson specialises in custom

packaging with technical and value-added solutions for food and

consumer product hygiene, safety, protection, and convenience;

going above and beyond to create a sustainable future for our

people and our planet. Its main activity is in injection and blow

moulded plastic packaging and rigid paperboard luxury packaging,

operating within the food and beverage, homecare, personal care and

beauty, and luxury gift sectors. Robinson provides products and

services to major players in the fast-moving consumer goods market

including Procter & Gamble, Reckitt Benckiser, SC Johnson and

Unilever.

Headquartered in Chesterfield, UK, Robinson has plants in the

UK, Poland and Denmark. Robinson was formerly a family business

with its origins dating back to 1839, currently employing nearly

400 people. The Group also has a substantial property portfolio

with development potential.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAPFXFSELEFA

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

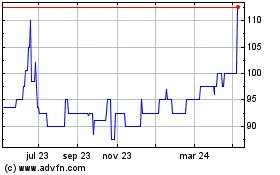

Robinson (LSE:RBN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

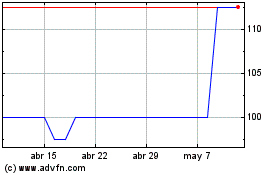

Robinson (LSE:RBN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024