TIDMSAG

RNS Number : 5949T

Science Group PLC

21 March 2023

21 March 2023

SCIENCE GROUP PLC

AUDITED RESULTS

FOR THE YEARED 31 DECEMBER 2022

Science Group plc (the 'Company') together with its subsidiaries

('Science Group' or the 'Group') reports its audited results for

the year ended 31 December 2022.

Summary

Science Group reports another resilient performance, ahead of

the Board's expectations, despite the deterioration in the global

economy. The acquisition of TP Group plc ("TPG"), completed in

January 2023, significantly increases the scale of Science Group

and provides a strategic entry into the defence sector. The Group's

robust balance sheet, including substantial cash resources,

provides both a solid foundation for the existing operations and

the potential to pursue further growth opportunities should they

arise.

-- Group revenue increased to GBP86.3 million (2021: GBP81.2 million)

-- Adjusted* operating profit increased to GBP17.6 million (2021: GBP16.3 million)

-- Adjusted* basic earnings per share increased to 29.4 pence (2021: 28.5 pence)

-- Dividend maintained at 5.0p (2021: 5.0p)

-- Year-end cash of GBP43.6 million and net funds of GBP29.5

million (2021: GBP34.3 million and GBP19.0 million, respectively)

with undrawn credit facility of GBP25.0 million

-- Acquisition of TP Group plc completed post year-end, funded

from organic operating cash flow

Science Group plc

Martyn Ratcliffe, Executive Chair Tel: +44 (0) 1223 875 200

Jon Brett, Finance Director www.sciencegroup.com

Stifel Nicolaus Europe Limited (Nominated Adviser

and Joint Broker)

Tel: +44 (0) 20 7710 7600

Nick Adams, Alex Price, Richard Short

Liberum Capital Limited (Joint Broker)

Kate Bannatyne, Max Jones Tel: +44 (0) 20 3100 2000

* Alternative performance measures are provided in order to

enhance the shareholders' ability to evaluate and analyse the

underlying financial performance of the Group. Refer to Note 1 for

detail and explanation of the measures used.

Statement of Executive Chair

Science Group is an international science, engineering and

technology ('SET') business. The Group provides SET services to the

medical, defence, industrial, and consumer sectors, supplemented by

a products division where the Group holds leading market positions

in related technology sectors. The Group also has significant

freehold property assets which host the business operations.

In 2022, Science Group again demonstrated its resilience and

delivered another solid performance, despite the deterioration in

the global economy. While all businesses performed creditably,

those servicing the consumer sector were most impacted by the

economic slowdown. The acquisition of TP Group plc ("TPG"),

completed in January 2023 and funded through Science Group's

organic operating cash flow, significantly increases the scale of

the Group and provides a strategic entry into the defence

sector.

Financial Summary

For the year ended 31 December 2022, Science Group reported

revenue of GBP86.3 million (2021: GBP81.2 million). Group adjusted

operating profit was GBP17.6 million (2021: GBP16.3 million).

Adjusted basic earnings per share was 29.4 pence (2021: 28.5

pence).

Amortisation of acquisition related intangibles, acquisition

advisor fees and integration costs, together with the share-based

payment charge totalled GBP6.5 million (2021: GBP3.6 million) and

the Group's share of the estimated profit in TPG was GBP0.6 million

(2021: GBP1.1 million loss). As a result, the Group reported

operating profit of GBP11.7 million for the year (2021: GBP11.6

million) and, after net finance costs of GBP0.6 million (2021:

GBP0.7 million), profit before tax of GBP11.1 million (2021:

GBP10.9 million), with basic earnings per share of 23.2 pence

(2021: 22.4 pence).

The past year saw substantial volatility in Sterling exchange

rates, particularly during the period of UK political instability

in the late summer. With a significant proportion of income

generated in US Dollars, the Group benefitted from such dynamics

offsetting the significant increase in energy prices and other cost

inflation.

Science Group continues to deliver strong cash conversion and

retains a robust balance sheet. At 31 December 2022, Group cash was

GBP43.6 million (2021: GBP34.3 million) and net funds were GBP29.5

million (2021: GBP19.0 million). The Group's term loan, which

expires in 2026, was GBP14.2 million (2021: GBP15.4 million). In

addition to the term loan, in December 2021, a GBP25 million

Revolving Credit Facility ("RCF") was arranged. As a result, the

Group has significant existing cash resources and available

facilities to continue its strategy, such that at 28 February 2023,

following the completion of the TPG acquisition, Group cash was

GBP33.4 million and net funds were GBP19.3 million and the RCF

remained undrawn.

R&D Consultancy

The R&D Consultancy business provides science-led advisory

and product/technology development services. The division combines

science and engineering capabilities with expertise in key vertical

sectors, namely: Medical; Consumer; Food & Beverage; and

Industrial, Chemicals & Energy ('ICE').

For the year ended 31 December 2022, the R&D Consultancy

division generated revenue of GBP38.7 million (2021: GBP34.3

million). A significant proportion of revenue in the R&D

Consultancy business is invoiced in US dollars but the cost base is

predominantly in Sterling. As a result, the business benefitted

from the favourable US Dollar:Sterling rate during 2022. In view of

the currency volatility, a hedging instrument to cap the rate at

US$1.20:GBP1 for $1.25 million per month was taken out to the end

of 2023. There is no obligation to sell at this rate and the

instrument is designed to protect against the strengthening of

Sterling or weakening of the US Dollar.

Regulatory & Compliance

The Regulatory & Compliance business provides scientific and

regulatory advice together with registration and compliance

services for the Chemicals, Consumer, Food & Beverage and

Medical sectors. The division comprises the European and North

American operations of TSG Consulting, together with Leatherhead

Food Research.

For the year ended 31 December 2022, the Regulatory &

Compliance division generated revenue of GBP22.0 million (2021:

GBP21.4 million). Of this revenue around 27% is of a recurring

nature, primarily within the Food & Beverage sector and the

North American registration renewals activities. While the North

American business had a tough comparator, having benefitted from

increased regulatory applications being sought during the pandemic,

the European business made progress, signing strategic contracts

with global agri-chemicals businesses, providing an improved

platform for the year ahead.

Frontier Smart Technologies

Frontier Smart Technologies ('Frontier') is the market leader in

DAB/DAB+/SmartRadio and connected audio technology chips and

modules.

The Frontier business reported revenue of GBP25.0 million (2021:

GBP24.9 million) and an adjusted operating profit margin of 15%

(2021: 21%). The business started the year supply-constrained,

however, as the global economic environment deteriorated, demand

for consumer electronics reduced significantly in the second half

of the year. Independent market data showed a decline of 16% in Q3

2022, directly impacting the Frontier business. In view of the

current economic environment, it is not anticipated that demand for

consumer electronics will recover until H2 2023.

Freehold Properties

Science Group owns two freehold properties, Harston Mill near

Cambridge and Great Burgh in Epsom, which host the Group's

operations. The last independent valuation in March 2021 indicated

an aggregate value of these properties in the range of GBP21.0

million to GBP35.0 million. The properties are held on the balance

sheet on a cost basis at GBP20.8 million (2021: GBP21.0

million).

The Group charges market rents to the operating businesses and

lets out part of the Harston site to third parties. For the year

ended 31 December 2022, the rental and associated services income

derived from this activity was GBP4.1 million (2021: GBP3.6

million), of which GBP0.7 million (2021: GBP0.6 million) was

generated from third party tenants. Intra-group rental charges are

eliminated on Group consolidation.

Acquisition of TP Group plc

Science Group acquired a strategic shareholding in TPG in 2021,

resulting in the appointment of two directors onto the TPG Board,

as Executive Chairman and Chair of Audit Committee. Following the

renegotiation of onerous contracts (which came to light after the

strategic investment was made) and the disposal of non-core

operations, Science Group completed the acquisition of TPG on 26

January 2023. The acquisition was effected by a court-approved

Scheme of Arrangement. Including the share purchases in 2021, the

professional fees incurred and restructuring costs, the aggregate

investment in TPG is approximately GBP30 million. In 2022, TPG was

accounted for as an associate and the Group results include GBP0.6

million being the estimated share of TPG profit related to the

Science Group shareholding during the year.

TPG is a UK-based Defence and Aerospace business comprising TPG

Se r vices (including Osprey), which is a s pecialist consultancy

providing technical expertise, and TPG Maritime, which is in the

process of being rebranded, and is a leading provider of

atmosphere- management systems for submarines . The non-core

businesses of Sapienza and Northstar were disposed of in the course

of 2022 and the disposal of Westek was completed in February 2023.

As a result of the TPG acquisition, approximately 290 employees

joined Science Group.

Corporate

The corporate function is responsible for the strategic

development of Science Group. Corporate costs were GBP3.2 million

(2021: GBP4.4 million). This includes the TPG acquisition-related

costs (legal and advisory) but is offset by the share of the TPG

profit resulting from its being accounted for as an associate,

which is reported as corporate in segmental reporting.

During the year, the Company repurchased 323,453 shares at a

total cost of GBP1.3 million, equivalent to an average price of 408

pence per share (2021: GBP0.6 million). At 31 December 2022, shares

in issue (excluding treasury shares held of 0.7 million) were 45.4

million (2021: 45.7 million excluding treasury shares held of 0.5

million). The Board is recommending maintaining the dividend at 5.0

pence per share (2021: 5.0 pence per share). Subject to shareholder

approval at the Annual General Meeting ('AGM'), the dividend will

be payable on 16 June 2023 to shareholders on the register at the

close of business on 19 May 2023.

Summary and Outlook

In summary, Science Group has reported another solid performance

in 2022. This resilience has been achieved against the backdrop of

geopolitical instability, substantial energy (and other) cost

increases and an economic downturn. Whilst inflationary pressures

appear to be easing, the economic environment remains

unpredictable, compounded by the recent instability in the banking

sector undermining market confidence in a near-term recovery. Such

a climate inevitably produces uncertainty. The Board anticipates

this fragile environment to continue through the first half of 2023

and is therefore cautious in its outlook and prudent in its

decision-making.

The acquisition of TPG, funded through Science Group's organic

operating cash flow, adds significant scale to the Group and

provides a strategic entry into the defence sector, a market

anticipated to be less affected by short-term economic volatility.

The integration of TPG is proceeding rapidly, benefitting from the

period of active management of the strategic investment prior to

the acquisition.

The Group's strong balance sheet, with significant cash

resources, unused debt facilities and freehold property assets,

provides a robust foundation for the enlarged Group while also

enabling the Board to pursue further corporate opportunities should

they arise.

Martyn Ratcliffe

Executive Chair

Finance Director's Report

Overview of Results

In the year ended 31 December 2022, the Group generated revenue

of GBP86.3 million (2021: GBP81.2 million). Revenue from the

services operating businesses, that is revenue derived from

consultancy services and materials recharged on these projects,

increased to GBP60.7 million (2021: GBP55.7 million) while product

revenue generated by Frontier was GBP25.0 million (2021: GBP24.9

million). Revenue generated by freehold properties, comprising

property and associated services income derived from space let to

third parties in the Harston Mill facility, was GBP0.7 million

(2021: GBP0.6 million).

Adjusted operating profit for the Group increased to GBP17.6

million (2021: GBP16.3 million). The Group's statutory operating

profit of GBP11.7 million (2021: GBP11.6 million) includes the

amortisation of acquisition related intangible assets (GBP3.8

million), share-based payment charges (GBP1.6 million), a share of

the estimated profit of associate investment, TP Group plc, of

GBP0.6 million, and associated acquisition costs of TP Group plc of

GBP1.1 million. The statutory profit before tax was GBP11.1 million

(2021: GBP10.9 million). After net finance costs of GBP0.6 million

(2021: GBP0.7 million) and a tax charge of GBP0.5 million (2021:

GBP1.4 million), statutory profit after tax was GBP10.6 million

(2021: GBP9.6 million). Statutory basic earnings per share ('EPS')

was 23.2 pence (2021: 22.4 pence).

Adjusted operating profit is an alternative profit measure that

is calculated as operating profit excluding acquisition integration

costs, amortisation of acquisition related intangible assets,

share-based payment charges, and other specified items that meet

the criteria to be adjusted. Refer to the notes to the financial

statements for further information on this and other alternative

performance measures.

TP Group plc

The Group made further on-market purchases of shares in TP Group

plc ('TPG') during 2022, increasing its holding from 28.0% to 29.2%

at 31 December 2021. Throughout 2022, the Group accounted for its

shareholding in TPG as an associate under the equity accounting

method. On 31 October 2022, the Group made an offer to acquire the

remainder of TPG shares at a price of 2.25 pence per share, to be

effected through a court-approved Scheme of Arrangement. This

acquisition completed subsequent to the year end, on 26 January

2023, at which point TPG became a wholly owned subsidiary of the

Group.

TPG has not released its results for the period ended 31

December 2022. A share of associate profit after tax of GBP0.6

million has been included within the Science Group Income

Statement, which is an estimate based on expected final TPG

financial statements for the year ended 31 December 2022,

proportionate to the Group's associate shareholding.

In December 2021, the Group made available a standby revolving

credit facility to TPG. The facility is for a maximum of GBP5.0

million for the period from the date of signing until 30 September

2023. The facility, which incurs an interest rate of 1% per month

on sums drawn or 0.4% per month on undrawn amounts, was used for

short periods in 2022 to provide liquidity to TPG however was

undrawn at 31 December 2022.

Foreign Exchange

A considerable proportion of the Group's revenue is denominated

in currencies other than Sterling. Changes in exchange rates can

have a significant influence on the Group's financial performance.

In 2022, GBP54.7 million of the Group's operating business revenue

was denominated in US Dollars (2021: GBP50.2 million), including

all of Frontier's revenue. In addition, GBP2.7 million of the Group

operating business revenue was denominated in Euros (2021: GBP3.1

million). The average exchange rates during 2022 were US$1.24/GBP1

and EUR1.18/GBP1 (2021: US$1.37/GBP1 and EUR1.16/GBP1).

During 2022, in order to provide greater forward visibility

around foreign exchange, the Group acquired a currency exchange

instrument to cap the US Dollar:Sterling rate in relation to the

R&D Consultancy division through to the end of 2023. Initially

the US Dollar:Sterling cap was set at $1.30/GBP1, but in October

2023 the Group took advantage of the low exchange rates to improve

the cap to $1.20/GBP1. The instrument, which applies to US$1.25

million per month, still enables the business to benefit from lower

exchange rates, should such rates apply.

Taxation

The tax charge for the year was GBP0.5 million (2021: GBP1.4

million). The underlying tax charge on the profits generated by the

operating businesses has been partially offset through brought

forward Frontier losses and a Research and Development tax credit

of GBP0.5 million (2021: GBP0.3 million). Science Group recognises

R&D tax credits within tax reporting, not as a credit against

operating costs.

At 31 December 2022, Science Group had GBP26.7 million (2021:

GBP27.8 million) of tax losses of which GBP17.1 million (2021:

GBP17.6 million) related to trading losses in Frontier. Of the

Frontier losses, GBP8.7 million (2021: GBP10.0 million) is

recognised as a deferred tax asset which is anticipated to be used

to offset future taxable profits. The balance of GBP8.4 million

(2021: GBP7.6 million) has not been recognised as a deferred tax

asset due to the uncertainty in the timing or feasibility of

utilisation of these losses. Aside from Frontier, the Group has

other tax losses of GBP9.6 million (2021: GBP10.2 million)

unrecognised as a deferred tax asset due to the low probability

that these losses will be utilised.

Financing and Cash

Cash flow from operating activities (excluding Client

Registration Funds) was GBP15.3 million (2021: GBP13.2 million). As

there was minimal movement on the Client Registration Funds in the

year, reported cash from operating activities in accordance with

IFRS was also GBP15.3 million (2021: GBP14.0 million). The

alternative performance measure, by excluding Client Registration

Funds, reflects the Group's available cash position and cash

flow.

The Group repatriates cash from overseas accounts on at least a

weekly basis and policy is to spread Group cash held across UK Tier

1 banks.

The Group's term loan with Lloyds Bank plc, secured on the

Group's freehold properties, is a 10-year fixed term loan expiring

in 2026. Phased interest rate swaps hedge the loan resulting in a

fixed effective interest rate of 3.5%, comprising a margin over the

Sterling Overnight Index Average ('SONIA'), the cost of the loan

arrangement fee and the cost of the swap instruments. The Group has

adopted hedge accounting for the interest rate swaps related to the

bank loan under IFRS 9 Financial Instruments, and the gain on

change in fair value of the interest rate swaps was GBP1,287,000

(2021: gain of GBP763,000) which was recognised in Other

Comprehensive Income.

In December 2021, in addition to the term loan, the Group signed

a revolving credit facility ('RCF') with Lloyds Bank plc in order

to provide additional capital resources to enable the execution of

the Group's acquisition strategy. The RCF is for up to GBP25.0

million, with an additional GBP5.0 million accordion option, for a

term of four years with a possible one year extension. The margin

on drawn sums is 3.3% per annum over SONIA and is 1.1% per annum on

undrawn amounts. Drawn amounts are secured on the Group's assets by

debentures. At 31 December 2022, the RCF remained undrawn.

The RCF has two financial covenants with which the Group needs

to comply if the facility is drawn: (i) the Group's net leverage,

as defined as the net debt divided by the rolling 12 month EBITDA,

should not exceed 2.5; and (ii) the Group's interest cover, as

defined as the rolling 12 month EBITDA divided by the rolling

interest payments on all borrowings, should not be less than 4.0.

Reporting is on a 6 monthly basis unless the net leverage exceeds

2, in which case reporting moves to quarterly until net leverage

returns to below 2 again. For the term of the RCF, the previous

covenants for the term loan are superseded by the covenants of the

RCF and will not apply.

The Group cash balance (excluding Client Registration Funds) at

31 December 2022 was GBP43.6 million (2021: GBP34.3 million) and

net funds were GBP29.5 million (2021: GBP19.0 million). Client

Registration Funds of GBP2.9 million (2021: GBP2.9 million) were

held at the year end. Working capital management during the year

continued to be a focus with debtor days of 43 days at 31 December

2022 (2021: 31 days). A higher level of inventory was held at the

year end to mitigate uncertainty in forward supply, resulting in

inventory days increasing to 197 days at 31 December 2022 (2021: 76

days).

Share Capital

At 31 December 2022, the Company had 45,436,823 ordinary shares

in issue (2021: 45,720,276) and the Company held an additional

749,051 shares in treasury (2021: 465,598). Of the ordinary shares

in issue, 34,800 shares (2021: 104,400) are held by the Frontier

Employee Benefit Trust. The total number of voting rights in the

Company at 31 December 2022 was 45,402,023 (2021: 45,615,876). In

this report, all references to measures relative to the number of

shares in issue exclude shares held in treasury unless explicitly

stated to the contrary.

Jon Brett

Finance Director

Consolidated Income Statement

For the year ended 31 December 2022

Note 2022 2021

GBP000 GBP000

------------------------------------------------------ ---- -------- ---------

Revenue 2 86,301 81,216

Direct operating expenses (47,947) (45,858)

Sales and marketing expenses (9,754) (8,824)

Administrative expenses (17,504) (13,892)

Share of profit/(loss) of equity accounted investment 602 (1,061)

Adjusted operating profit 2 17,602 16,260

Acquisition integration costs (1,128) -

Amortisation of acquisition related intangible assets 7 (3,766) (2,891)

Share-based payment charge (1,612) (727)

Share of profit/(loss) of equity accounted investment 602 (1,061)

Operating profit 11,698 11,581

Finance income 375 19

Finance costs (977) (673)

Profit before tax 11,096 10,927

Tax charge (net of R&D tax credit of GBP530,000

(2021: GBP324,000)) 3 (541) (1,366)

====================================================== ==== ======== =========

Profit for the year 10,555 9,561

====================================================== ==== ======== =========

Earnings per share

Earnings per share (basic) 5 23.2p 22.4p

Earnings per share (diluted) 5 22.6p 21.7p

====================================================== ==== ======== =========

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2022

2022 2021

GBP000 GBP000

----------------------------------------------------------------------------------- ------- --------

Profit for the year attributable to:

Equity holders of the parent 10,555 9,561

Profit for the year 10,555 9,561

------------------------------------------------------------------------------------ ------- --------

Other comprehensive income items

that will or may be reclassified to profit or loss:

Exchange differences on translating foreign operations 2,372 279

Fair value gain on financial instruments 1,499 763

Deferred tax charge on financial instruments (414) (151)

------------------------------------------------------------------------------------ ------- --------

Other comprehensive income items

that will not be reclassed to profit or loss:

Changes in the fair value of equity investments through other comprehensive income - (2,470)

Other comprehensive income/(expense) for the year 3,457 ( 1,579)

------------------------------------------------------------------------------------ ------- --------

Total comprehensive income for the period attributable to:

Equity holders of the parent 14,012 7,982

Total comprehensive income for the year 14,012 7,982

------------------------------------------------------------------------------------ ------- --------

Consolidated Statement of Changes in Shareholders' Equity

For the year ended 31 December 2022

Share Share Treasury Merger Translation Cashflow Retained Total

capital premium shares reserve reserve hedge earnings equity

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------- ---------- -------- -------- -------- ----------- -------- --------- --------

Balance at 1

January 2021 421 9,102 (1,896) 10,343 (1,037) (538) 24,995 41,390

Contributions and

distributions:

Purchase of own

shares - - (562) - - - - (562)

Issue of shares

out of treasury - - 1,216 - - - (1,211) 5

Dividends paid

(Note 6) - - - - - - (1,642) (1,642)

Share-based payment

charge - - - - - - 727 727

Deferred tax

credit on share-based

payment transactions - - - - - - 619 619

Share placement 41 17,732 - - - - - 17,773

------------------------- ---------- -------- -------- -------- ----------- -------- --------- --------

Transactions

with owners 41 17,732 654 - - - (1,507) 16,920

------------------------- ---------- -------- -------- -------- ----------- -------- --------- --------

Profit for the

year - - - - - - 9,561 9,561

Other comprehensive income

items

that will or maybe reclassed

to profit or loss:

Fair value gain

on financial instruments - - - - - 763 - 763

Exchange differences

on translating

foreign operations - - - - 279 - - 279

Deferred tax charge

on financial instruments - - - - - (151) - (151)

Other comprehensive income

items

that will not be reclassed

to profit or loss:

Changes in the

fair value of equity

investments through

other comprehensive

income - - - - - - (2,470) (2,470)

Total comprehensive

income for the

year - - - - 279 612 7,091 7,982

----------------------------- ------ -------- -------- -------- ----------- -------- --------- --------

Balance at 31

December 2021 462 26,834 (1,242) 10,343 (758) 74 30,579 66,292

----------------------------- ------ -------- -------- -------- ----------- -------- --------- --------

Share Share Treasury Merger Translation Cashflow Retained Total

capital premium shares reserve reserve hedge earnings equity

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------- ---------------- -------- -------- -------- ----------- -------- --------- --------

Balance at 1

January 2022 462 26,834 (1,242) 10,343 (758) 74 30,579 66,292

Contributions and

distributions:

Purchase of own

shares - - (1,321) - - - - (1,321)

Issue of shares

out of treasury - - 370 - - - (369) 1

Dividends paid

(Note 6) - - - - - - (2,270) (2,270)

Share-based payment

charge - - - - - - 1,612 1,612

Deferred tax

charge on share-based

payment transactions - - - - - - (127) (127)

Transactions

with owners - - (951) - - - (1,154) (2,105)

----------------------- ---------------- -------- -------- -------- ----------- -------- --------- --------

Profit for the

year - - - - - - 10,555 10,555

Other comprehensive income

items

that will or maybe reclassed

to profit or loss:

Fair value gain

on financial

instruments - - - - - 1,499 - 1,499

Exchange differences

on translating

foreign operations - - - - 2,372 - - 2,372

Deferred tax

charge on financial

instruments - - - - - (414) - (414)

Total comprehensive

income for the

year - - - - 2,372 1,085 10,555 14,012

---------------------------- ----------- -------- -------- -------- ----------- -------- --------- --------

Balance at 31

December 2022 462 26,834 (2,193) 10,343 1,614 1,159 39,980 78,199

---------------------------- ----------- -------- -------- -------- ----------- -------- --------- --------

Consolidated Balance Sheet

At 31 December 2022

Note 2022 2021

GBP000 GBP000

=================================== ============= =========== ==========

Assets

Non-current assets

Acquisition related intangible

assets 7 10,815 13,359

Goodwill 7 14,975 14,360

Property, plant and equipment 23,867 23,384

Investments 10,054 9,239

Derivative financial instruments 1,417 129

Deferred tax assets 4 2,176 2,120

=================================== ============= =========== ==========

63,304 62,591

----------------------------------- ------------- ----------- ----------

Current assets

Inventories 8 2,477 2,454

Trade and other receivables 9 12,992 12,208

Current tax assets 1,607 1,493

Derivative financial instruments 384 -

Cash and cash equivalents

- Client registration funds 10 2,867 2,874

Cash and cash equivalents

- Group cash 10 43,645 34,315

=================================== ============= =========== ==========

63,972 53,344

=================================== ============= =========== ==========

Total assets 127,276 115,935

----------------------------------- ------------- ----------- ----------

Liabilities

Current liabilities

Trade and other payables 11 31,546 30,042

Current tax liabilities 331 776

Provisions 12 849 677

Borrowings 14 1,200 1,200

Lease liabilities 720 1,153

----------------------------------- ------------- ----------- ----------

34,646 33,848

----------------------------------- ------------- ----------- ----------

Non-current liabilities

Provisions 12 248 603

Borrowings 14 12,939 14,123

Lease liabilities 1,162 400

Deferred tax liabilities 4 82 669

========================= ======================= =========== ==========

14,431 15,795

========================= ======================= =========== ==========

Total liabilities 49,077 49,643

========================= ======================= =========== ==========

Net assets 78,199 66,292

========================= ======================= =========== ==========

Shareholders' equity

Share capital 13 462 462

Share premium 26,834 26,834

Treasury shares (2,193) (1,242)

Merger reserve 10,343 10,343

Translation reserve 1,614 (758)

Cash flow hedge reserve 1,159 74

Retained earnings 39,980 30,579

========================= ======================= =========== ==========

Total equity 78,199 66,292

========================= ======================= =========== ==========

Consolidated Statement of Cash Flows

For the year ended 31 December 2022

Note 2022 2021

GBP000 GBP000

---------------------------------------------- ----- -------- ---------

Profit before income tax 11,096 10,927

Adjustments for:

Share of (profit)/loss of equity

accounted investment (602) 1,061

Amortisation of acquisition related

intangible assets 3,766 2,891

Depreciation of property, plant and

equipment 655 719

Reversal of impairment of right-of-use (215) -

assets

Depreciation of right-of-use assets 827 794

Bank charges on derivative financial 359 -

instruments

Net interest cost 602 654

Share-based payment charge 1,612 727

Increase in inventories (23) (1,047)

Increase in receivables (680) (1,385)

(Decrease)/Increase in payables representing

client registration funds (7) 859

Increase in payables excluding balances

representing client registration

funds 1,235 2,494

Decrease in provisions (263) (76)

---------------------------------------------- ----- -------- ---------

Cash generated from operations 18,362 18,618

---------------------------------------------- ----- -------- ---------

Interest paid (808) (646)

UK corporation tax paid (1,017) (3,018)

Foreign corporation tax paid (1,266) (940)

---------------------------------------------- ----- -------- ---------

Cash flows from operating activities 15,271 14,014

---------------------------------------------- ----- -------- ---------

Interest received 271 3

Purchase of property, plant and equipment (92) (544)

Purchase of intellectual property - (4,315)

Purchase of interest in associated

company (213) (12,770)

Purchase of subsidiary undertakings,

net of cash acquired - (1,455)

---------------------------------------------- ----- -------- ---------

Cash flows used in investing activities (34) (19,081)

---------------------------------------------- ----- -------- ---------

Issue of shares out of treasury 1 5

Share placement - 17,773

Repurchase of own shares (1,321) (562)

Dividends paid (2,270) (1,642)

Purchase of derivative financial (531) -

instruments

Repayment of term loan 14 (1,200) (1,200)

Payment of lease liabilities (1,135) (1,297)

---------------------------------------------- ----- -------- ---------

Cash flows from financing activities (6,456) 13,077

---------------------------------------------- ----- -------- ---------

Increase in cash and cash equivalents

in the year 8,781 8,010

Cash and cash equivalents at the

beginning of the year 37,189 29,074

Exchange gain on cash 542 105

---------------------------------------------- ----- -------- ---------

Cash and cash equivalents at the

end of the year 10 46,512 37,189

---------------------------------------------- ----- -------- ---------

Cash and cash equivalents are analysed as follows:

Note 2022 2021

GBP000 GBP000

------------------------------------ ----- -------- --------

Cash and cash equivalents - Client

registration funds 10 2,867 2,874

Cash and cash equivalents - Group

cash 10 43,645 34,315

------------------------------------ ----- -------- --------

46,512 37,189

------------------------------------ ----- -------- --------

Extracts from notes to the financial statements

1. General Information

Science Group plc (the 'Company') together with its subsidiaries

('Science Group' or the 'Group') is an international science,

engineering and technology ('SET') business, supported by a strong

balance sheet.

The Group and Company Financial Statements of Science Group plc

were prepared under the International Financial Reporting Standards

('IFRS') as adopted by the UK in conformity with the requirements

of the Companies Act 2006 and have been audited by Grant Thornton

UK LLP. Accounts are available from the Company's registered

office; Harston Mill, Harston, Cambridge, CB22 7GG.

The Company is incorporated and domiciled in England and Wales

under the Companies Act 2006 and has its primary listing on the

Alternative Investment Market of the London Stock Exchange (SAG.L).

The value of Science Group plc shares, as quoted on the London

Stock Exchange on 31 December 2022, was 395.0 pence per share (31

December 2021: 455.0 pence per share).

Alternative performance measures

The Group uses alternative non-Generally Accepted Accounting

Principles performance measures of 'adjusted operating profit',

'adjusted earnings per share' and 'net funds' which are not defined

within IFRS. These are explained as follows:

(a) Adjusted Operating Profit

The Group calculates this measure by adjusting to exclude

certain items from operating profit namely: amortisation of

acquisition related intangible assets, acquisition integration

costs, share-based payment charges and other specified items that

meet the criteria to be adjusted.

The criteria for the adjusted items in the calculation of

adjusted operating profit is operating income or expenses that are

material and either arise from an irregular and significant event

or the income/cost is recognised in a pattern that is unrelated to

the resulting operational performance. Materiality is defined as an

amount which, to a user, would influence the decision making.

Acquisition integration costs include all costs incurred directly

related to the restructuring, relocation and integration of

acquired businesses. Adjustments for share-based payment charges

occur because: once the cost has been calculated, the Directors

cannot influence the share-based payment charge incurred in

subsequent years; it is understood that many investors/analysts

exclude the cost from their valuation analysis of the business; and

the value of the share option to the employee differs considerably

in value and timing from the actual cash cost to the Group.

The calculation of this measure is shown on the Consolidated

Income Statement.

(b) Adjusted Earnings Per Share

The Group calculates this measure by dividing adjusted profit

after tax by the weighted average number of shares in issue and the

calculation of this measure is disclosed in Note 5. The tax rate

applied to calculate the tax charge in this measure is the tax at

the blended corporation tax rate across the various jurisdictions

rate for the year which is 21.4% (2021: 22.0%) which results in a

comparable tax charge year on year.

(c) Net Funds

The Group calculates this measure as the net of cash and cash

equivalents - Group cash and Borrowings. Client registration funds

are excluded from this calculation because these monies are for the

purpose of payment of registration fees to regulatory bodies. This

cash is separately identified for reporting purposes and is

unrestricted. This measure is calculated as follows:

Note 2022 2021

GBP000 GBP000

================================== ==== ======== ========

Cash and cash equivalents - Group

cash 10 43,645 34,315

Borrowings 14 (14,139) (15,323)

================================== ==== ======== ========

Net funds 29,506 18,992

================================== ==== ======== ========

Alternative performance measures

The Directors believe that disclosing these alternative

performance measures enhances shareholders' ability to evaluate and

analyse the underlying financial performance of the Group.

Specifically, the adjusted operating profit measure is used

internally in order to assess the underlying operational

performance of the Group, aid financial, operational and commercial

decisions and in determining employee compensation. The adjusted

EPS measure allows the shareholder to understand the underlying

value generated by the Group on a per share basis. Net funds

represent the Group's cash available for day-to-day operations and

investments. As such, the Board considers these measures to enhance

shareholders' understanding of the Group results and should be

considered alongside the IFRS measures.

Going concern

The Directors have considered the current cash balance of

GBP43.6 million (excluding client registration funds) and assessed

forecast future cash flows for the next 18 months. There are no

events or conditions which cast significant doubt on the ability of

the Group to continue as a going concern. In support, as explained

in the Statement of Executive Chair, the Group revenue and

operating profit grew year on year and cash generated from

operations was GBP18.4 million during the year ended 31 December

2022. The Group ended the year with net funds of GBP29.5 million,

and with the undrawn Revolving Credit Facility ('RCF') of GBP25.0

million. The Directors are satisfied that the Group has adequate

cash and financing resources to continue in operational existence

for the foreseeable future, being a period of at least a year

following the approval of the accounts and therefore continue to

adopt the going concern basis of accounting in preparing the annual

Financial Statements.

2. Segment Information

The Group's segmental reporting shows the performance of the

operating businesses separately from the value generated by the

Group's significant freehold property assets and the Corporate

costs. The Services Operating Business consists of two divisions:

(i) R&D Consultancy, and (ii) Regulatory & Compliance.

Financial information is provided to the Chief Operating Decision

Makers ('CODMs') in line with this structure: the divisions and

service lines in the Services Operating Businesses; the Product

Operating Business (Frontier); the Freehold Properties and

Corporate costs.

The Services Operating divisions (including the service lines)

have been aggregated resulting in one Services Operating Business

segment because the divisions and the services they provide have

similar economic characteristics such as similar long-term average

gross margins, trends in sales growth and operating cash flows and

are also similar in respect of their nature, delivery and types of

customers that the services are provided to. This aggregation does

not impact the user's ability to understand the entity's

performance, its prospects for future cash flows or the user's

decisions about the entity as a whole as it is a fair

representation of the performance of each service line.

Services Operating Business revenue includes all consultancy

fees and other revenue includes recharged materials and expenses

relating directly to the Services Operating Business activities.

Product Operating Business revenue includes sales of chips and

modules which are incorporated into digital radios. The Freehold

Properties segment includes the results for the two freehold

properties owned by the Group. Income is derived from third party

tenants from the Harston Mill site and from the Services and

Product Operating Businesses which have been charged fees

equivalent to market-based rents for their utilised property space

and associated costs. Corporate costs include PLC/Group costs. The

segmental analysis is reviewed to operating profit. Other resources

are shared across the Group.

Services Operating Business 2022 2021

GBP000 GBP000

------------------------------------------------------ -------- =======

Services revenue 58,242 52,879

Other 2,423 2,840

------------------------------------------------------ -------- -------

Revenue 60,665 55,719

------------------------------------------------------ -------- =======

Adjusted operating profit 16,200 14,122

Amortisation of acquisition related intangible assets (1,463) (1,495)

Share-based payment charge (1,249) (502)

Operating profit 13,488 12,125

------------------------------------------------------ -------- -------

Product Operating Business 2022 2021

GBP000 GBP000

------------------------------------------------------ -------- -------

Product revenue 24,979 24,936

------------------------------------------------------ -------- -------

Revenue 24,979 24,936

------------------------------------------------------ -------- -------

Adjusted operating profit 3,869 5,156

Amortisation of acquisition related intangible assets (2,303) (1,396)

Share-based payment charge (265) (240)

------------------------------------------------------ -------- -------

Operating profit 1,301 3,520

------------------------------------------------------ -------- -------

Freehold Properties 2022 2021

GBP000 GBP000

------------------------------ ------- -------

Inter-company property income 3,436 3,046

Third party property income 657 561

------------------------------ ------- =======

Revenue 4,093 3,607

------------------------------ ------- =======

Adjusted operating profit 132 361

Share-based payment charge (42) (27)

------------------------------ ------- -------

Operating profit 90 334

------------------------------ ------- -------

Corporate 2022 2021

GBP000 GBP000

------------------------------------------------------ ------- =======

Adjusted operating loss (2,599) (3,379)

Acquisition integration costs (1,128) -

Share-based payment (charge)/credit (56) 42

Share of profit/(loss) of equity accounted investment 602 (1,061)

------------------------------------------------------ ------- -------

Operating loss (3,181) (4,398)

------------------------------------------------------ ------- -------

Group 2022 2021

GBP000 GBP000

------------------------------------------------------ -------- -------

Services revenue 58,242 52,879

Product revenue 24,979 24,936

Third party property income 657 561

Other 2,423 2,840

------------------------------------------------------ -------- -------

Revenue 86,301 81,216

------------------------------------------------------ -------- -------

Adjusted operating profit 17,602 16,260

Acquisition integration costs (1,128) -

Amortisation of acquisition related intangible assets (3,766) (2,891)

Share-based payment charge (1,612) (727)

Share of profit/(loss) of equity accounted investment 602 (1,061)

------------------------------------------------------ --------

Operating profit 11,698 11,581

Net finance costs (602) (654)

------------------------------------------------------ --------

Profit before income tax 11,096 10,927

Income tax charge (541) (1,366)

------------------------------------------------------ -------- -------

Profit for the period 10,555 9,561

------------------------------------------------------ -------- -------

Geographical and currency revenue analysis

Primary geographic markets 2022 2021

GBP000 GBP000

---------------------------- -------- --------

United Kingdom 13,240 11,883

Other European Countries 10,621 12,228

North America 35,878 29,065

Asia 26,047 27,680

Other 515 360

---------------------------- -------- --------

86,301 81,216

============================ ======== ========

Currency 2022 2021

GBP000 GBP000

========== ======= =======

US Dollar 54,663 50,153

Euro 2,669 3,070

Sterling 28,969 27,985

Other - 8

========== ======= =======

86,301 81,216

---------- ------- -------

3. Income Tax

The tax charge comprises:

Year ended 31 December Note 2022 2021

GBP000 GBP000

========================================= ==== ======= =======

Current taxation (2,666) (4,269)

Current taxation - adjustment in respect

of prior years 539 (481)

Deferred taxation 4 643 2,975

Deferred taxation - adjustment in

respect of prior years 413 85

R&D tax credit 530 324

========================================= ==== ======= =======

(541) (1,366)

----------------------------------------- ---- ------- -------

The adjustments in prior years are due to estimation differences

related to the tax charge.

The corporation tax on Science Group's profit before tax differs

from the theoretical amount that would arise using the blended

corporation tax rate across the various jurisdictions applicable to

profits of the consolidated companies of 21.4% (2021: 22.0%) as

follows:

2022 2021

GBP000 GBP000

================================================ ========= =========

Profit before tax 11,096 10,927

================================================ ========= =========

Tax calculated at domestic tax rates applicable

to profits in the respective countries (2,374) (2,401)

Expenses not deductible for tax purposes (389) (543)

Adjustment in respect of prior years - current

tax 539 (481)

Adjustment in respect of prior years - deferred

tax 413 85

Movement in deferred tax due to change in

tax rate (35) (313)

Share scheme movements 281 44

Losses used in year 569 1,033

(Derecognition)/recognition of tax losses

as deferred tax asset (190) 1,119

Share of profit/(loss) of equity accounted

investment 115 (233)

R&D tax credit 530 324

================================================ ========= =========

Tax charge (541) (1,366)

------------------------------------------------ --------- ---------

The Group claims Research and Development tax credits under both

the R&D expenditure credit scheme and the Small or Medium-sized

Scheme. In the current year, the Group recognised a tax credit of

GBP0.5 million (2021: GBP0.3 million). The Group performed a

reasonable estimate of all amounts involved to determine the

R&D tax credits to be recognised in the period to which it

relates.

4. Deferred Tax

The movement in deferred tax assets and liabilities during the

year by each type of temporary difference is as follows:

Accelerated Tax losses Share- Acquisition Other temporary Total

capital based payment related differences

allowances intangible

GBP000 GBP000 assets GBP000

GBP000 GBP000 GBP000

========================= =========== ========== ============== =========== =============== =======

At 1 January 2021 (1,767) 1,001 775 (2,118) 293 (1,816)

Credited/(charged)

to the Income Statement 1,721 1,119 (5) 174 (34) 2,975

Deferred tax relating

to acquisitions - - - (246) - (246)

Credited to the

Income Statement

(adjustment in respect

of prior year) - - - - 85 85

Credited/(charged)

to Equity - - 619 - (151) 468

Effect of movements

in exchange rates - - - (15) - (15)

========================= =========== ========== ============== =========== =============== =======

At 31 December 2021 (46) 2,120 1,389 (2,205) 193 1,451

------------------------- ----------- ---------- -------------- ----------- --------------- -------

(Charged)/credited

to the Income Statement (131) (190) 506 588 (130) 643

Credited to the

income statement

(adjustment in respect

of prior year) 129 - - - 284 413

Charged to Equity - - (127) - (414) (541)

Effect of movements

in exchange rates 76 246 - (194) - 128

========================= =========== ========== ============== =========== =============== =======

At 31 December

2022 28 2,176 1,768 (1,811) (67) 2,094

------------------------- ----------- ---------- -------------- ----------- --------------- -------

2022 2021

GBP000 GBP000

------------------------- ------- -------

Deferred tax assets 2,176 2,120

Deferred tax liabilities (82) (669)

Net deferred tax assets 2,094 1,451

--------------------------- ------- -------

At 31 December 2022, Science Group had GBP26.7 million (2021:

GBP27.8 million) of tax losses of which GBP17.1 million (2021:

GBP17.6 million) related to trading losses in Frontier. Of the

Frontier losses, GBP8.7 million (2021: GBP10.0 million) is

recognised as a deferred tax asset which is anticipated to be used

to offset future taxable profits. The balance of GBP8.4 million

(2021: GBP7.6 million) has not been recognised as a deferred tax

asset due to the uncertainty in the timing of utilisation of these

losses. Aside from Frontier, the Group has other tax losses of

GBP9.6 million (2021: GBP10.2 million) unrecognised as a deferred

tax asset due to the low probability that these losses will be

utilised.

Factors affecting future tax charges

From 1 April 2023 the UK corporation tax will increase from 19%

to 25%. Deferred tax assets and liabilities were calculated at the

substantively enacted corporation tax rates in the respective

jurisdictions, taking into account the impact of any known future

changes.

5. Earnings Per Share

The calculation of earnings per share is based on the following

result and weighted average number of shares:

2022 2021

----------------------------- ------------------------ ------------------ -------------------------

Profit Weighted Pence Profit Weighted Pence

after tax average per share after average per share

number tax number

GBP000 of shares of shares

GBP000

============================= ========== ============ ========== ======= ============ ==========

Basic earnings per ordinary

share 10,555 45,525,568 23.2 9,561 42,660,991 22.4

Effect of dilutive potential

ordinary shares: share

options - 1,268,082 (0.6) - 1,435,102 (0.7)

============================= ========== ============ ========== ======= ============ ==========

Diluted earnings per

ordinary share 10,555 46,793,650 22.6 9,561 44,096,093 21.7

----------------------------- ---------- ------------ ---------- ------- ------------ ----------

Only the share options granted are dilutive.

The calculation of adjusted earnings per share is as

follows:

2022 2021

----------------------------- ------------------------- -------- --------- ---------- ----------

Adjusted* Weighted Pence Adjusted* Weighted Pence

profit average per share profit average per share

after number after number

tax of shares tax of shares

GBP000 GBP000

============================= ========= ========== ============ ========= ========== ==========

Adjusted basic earnings

per ordinary share 13,362 45,525,568 29.4 12,173 42,660,991 28.5

Effect of dilutive potential

ordinary shares: share

options - 1,268,082 (0.8) - 1,435,102 (0.9)

============================= ========= ========== ============ ========= ========== ==========

Adjusted diluted earnings

per ordinary share 13,362 46,793,650 28.6 12,173 44,096,093 27.6

----------------------------- --------- ---------- ------------ --------- ---------- ----------

* Calculation of adjusted profit after tax:

2022 2021

GBP000 GBP000

=============================================== ======= =======

Adjusted operating profit 17,602 16,260

Finance income 375 19

Finance costs (977) (673)

=============================================== ======= =======

Adjusted profit before tax 17,000 15,606

Tax charge at the blended corporation tax rate

across the various jurisdictions 21.4% (2021:

22.0%) (3,638) (3,433)

=============================================== ======= =======

Adjusted profit after tax 13,362 12,173

----------------------------------------------- ------- -------

The tax charge is calculated using the blended corporation tax

rate across the various jurisdictions in which the Group companies

are incorporated.

6. Dividends

The final dividend for 2021 of GBP2.3 million was paid in June

2022 (2021: GBP1.6 million paid in June 2021).

The Board has proposed a final dividend for 2022 of 5.0 pence

per share (2021: 5.0 pence per share). The dividend is subject to

approval by shareholders at the next Annual General Meeting and the

expected cost of GBP2.3 million has not been included as a

liability as at 31 December 2022.

7. Intangible Assets

Technology Customer Goodwill Total

relationships

GBP000 GBP000 GBP000 GBP000

=============================== =========== =============== ======== =======

Cost

At 31 January 2021 6,792 13,647 15,882 36,321

Acquisitions through business

combination 1,031 238 664 1,933

Additions 4,315 - - 4,315

Effect of movement in exchange

rates 168 30 39 237

=============================== =========== =============== ======== =======

At 31 December 2021 12,306 13,915 16,585 42,806

Effect of movement in exchange

rates 1,350 428 615 2,393

------------------------------- ----------- --------------- -------- -------

At 31 December 2022 13,656 14,343 17,200 45,199

------------------------------- ----------- --------------- -------- -------

Accumulated amortisation

At 1 January 2021 1,132 8,786 - 9,918

Amortisation charged in year 1,305 1,586 - 2,891

Effect of movement in exchange

rates 27 19 - 46

=============================== =========== =============== ======== =======

At 31 December 2021 2,464 10,391 - 12,855

Amortisation charged in year 2,172 1,594 - 3,766

Effect of movement in exchange

rates 335 221 - 556

------------------------------- ----------- --------------- -------- -------

At 31 December 2022 4,971 12,206 - 17,177

------------------------------- ----------- --------------- -------- -------

Accumulated impairment

At 1 January, 31 December 2021

and 31 December 2022 - 7 2,225 2,232

------------------------------- ----------- --------------- -------- -------

Carrying amount

At 31 December 2021 9,842 3,517 14,360 27,719

=============================== ----------- --------------- -------- -------

At 31 December 2022 8,685 2,130 14,975 25,790

------------------------------- ----------- --------------- -------- -------

Goodwill and acquisition related intangible assets recognised

arose from acquisitions during 2013, 2015, 2017, 2019 and 2021. The

discount rates used for goodwill impairment reviews and the

carrying amount of goodwill is allocated as follows:

2022 2021

---------------------------- -------------------- --------------------

Pre-tax Pre-tax

discount GBP000 discount GBP000

rate rate

============================ ========= ========= ========= =========

R&D Consultancy 16.8% 3,383 14.2% 3,383

Leatherhead Research 16.9% 650 14.1% 650

TSG - America 15.2% 2,874 16.4% 2,570

TSG - Europe 16.6% 4,546 15.8% 4,546

Frontier Smart Technologies

Group 17.5% 3,522 14.1% 3,211

14,975 14,360

---------------------------- --------- --------- --------- ---------

Impairment review of goodwill

The Group tests goodwill annually for impairment or more

frequently if there are indications that goodwill might be

impaired. The recoverable amounts of the Cash Generating Units

('CGUs') are determined from value in use. The key assumptions for

the value in use calculations are those regarding the discount

rates and growth rates of revenue and costs.

The Group prepares the cash flow forecasts derived from the most

recent annual financial plan approved by the Board and extrapolates

cash flows for the following four years based on forecast rates of

growth or decline in revenue by the CGU.

The Group monitors its post-tax weighted average cost of capital

and those of its competitors using market data. In considering the

discount rates applying to CGUs, the Directors have considered the

relative sizes, risks and the inter-dependencies of its CGUs. The

impairment reviews use a discount rate adjusted for pre-tax cash

flows and are included in the table above.

8. Inventories

2022 2021

GBP000 GBP000

================= ======= =======

Raw materials 263 304

Work in progress 485 793

Finished goods 1,729 1,357

=================== ======= =======

2,477 2,454

----------------- ------- -------

9. Trade and Other Receivables

2022 2021

GBP000 GBP000

================================= ======= =======

Current assets:

Trade receivables 9,983 9,406

Provision for impairment (207) (75)

================================= ======= =======

Trade receivables - net 9,776 9,331

Amounts recoverable on contracts 1,152 1,202

Other receivables 90 103

VAT 215 96

Prepayments 1,759 1,476

================================= ======= =======

12,992 12,208

--------------------------------- ------- -------

All amounts disclosed above, except for prepayments, are

receivable within 90 days.

10. Cash and Cash Equivalents

2022 2021

GBP000 GBP000

============================= =========================== ==========

Cash and cash equivalents

- Group cash 43,645 34,315

Cash and cash equivalents - Client

registration funds 2,867 2,874

===================================== =================== ==========

46,512 37,189

----------------------------- --------------------------- ----------

The Group receives cash from clients, primarily in North

America, for the purpose of payment of registration fees to

regulatory bodies. This cash is separately identified for reporting

purposes and is unrestricted.

In connection with the Scheme of Arrangement, as referenced in

Note 15, GBP12.6 million of Group cash was held in escrow at 31

December 2022 (2021: GBPnil).

11. Trade and Other Payables

2022 2021

GBP000 GBP000

========================== ======= =======

Current liabilities:

Contract liabilities 19,679 17,061

Trade payables 1,689 2,591

Other taxation and social

security 1,460 1,346

VAT 250 224

Accruals 8,468 8,820

============================ ======= =======

31,546 30,042

-------------------------- ------- -------

12. Provisions

Dilapidations Restructuring Legal Other Total

GBP000 GBP000 GBP000 GBP000 GBP000

==================================== =============== ============= ======= ======== =======

At 1 January 2021 764 80 479 14 1,337

Provisions made during the year 89 - 248 6 343

Provisions used during the year (5) (10) (30) - (45)

Provisions reversed during the year (84) - (265) (20) (369)

Effect of movements in exchange rates 6 - 8 - 14

At 1 January 2022 770 70 440 - 1,280

Provisions made during the year 44 - 190 - 234

Provisions used during the year (2) - (152) - (154)

Provisions reversed during the year (164) (30) (149) - (343)

Effect of movements in exchange rates 58 - 22 - 80

----------------------------------------- ---------- ------------- ------- -------- -------

At 31 December 2022 706 40 351 - 1,097

------------------------------------ --------------- ------------- ------- -------- -------

Current liabilities 458 40 351 - 849

Non-current liabilities 248 - - - 248

------------------------------------ --------------- ------------- ------- -------- -------

At 31 December 2021 770 70 440 - 1,280

------------------------------------ --------------- ------------- ------- -------- -------

Current liabilities 167 70 440 - 677

Non-current liabilities 603 - - - 603

------------------------------------ --------------- ------------- ------- -------- -------

Dilapidation provisions have been recognised at the present

value of the expected obligation. These discounts will unwind to

their undiscounted value over the remaining lives of the leases via

a finance charge within the income statement.

The average remaining life of the leases as at 31 December 2022

is 1.4 years (2021: 2 years).

The restructuring provision relates to the costs associated with

the closure of some non-trading Group entities.

Legal provisions reflect the best estimate of the future cost of

responding to US subpoenas relating to litigation and

investigations directed at third parties.

The other provision related to warranty provisions made in

respect of certain product sales.

13 . Called-up Share Capital

2022 2021

GBP000 GBP000

=================================== ============= ==========

Allotted, called-up and fully paid

Ordinary shares of GBP0.01 each 462 462

----------------------------------- ------------- ----------

Number Number

=================================== ============= ==========

Allotted, called-up and fully paid

Ordinary shares of GBP0.01 each 46,185,874 46,185,874

----------------------------------- ------------- ----------

The allotted, called-up and fully paid share capital of the

Company as at 31 December 2022 was 46,185,874 shares (2021:

46,185,874) and the total number of ordinary shares in issue

(excluding treasury shares) was 45,436,823 (2021: 45,720,276). Of

the ordinary shares in issue, 34,800 shares (2021: 104,400) are

held by the Frontier Smart Technologies Employee Benefit Trust. The

total number of voting rights in the Company is 45,402,023 (2021:

45,615,876).

14. Borrowings

2022 2021

GBP000 GBP000

---------------------------- ------- -------

Current bank borrowings 1,200 1,200

Non-current bank borrowings 12,939 14,123

---------------------------- ------- -------

Total borrowings 14,139 15,323

---------------------------- ------- -------

2022 2021

GBP000 GBP000

------------------------------------- ------- -------

Opening balance 15,323 16,507

Repayments in the year (1,200) (1,200)

Amortisation of loan arrangement fee 16 16

Total borrowings 14,139 15,323

------------------------------------- ------- -------

During the year ended 31 December 2016, the Group entered into a

10-year fixed term loan of GBP15 million which is secured on the

freehold properties of the Group and on which interest is payable

based on SONIA plus 2.6% margin. During the year ended 31 December

2019, the Group increased this existing loan by GBP4.8 million to

GBP17.5 million on similar terms. The repayment profile of the loan

is GBP1.2 million per annum over the term with the remaining

balance repaid on expiry of the loan in 2026. Costs directly

associated with entering into the loan (including the loan

increase), have been offset against the balance outstanding and are

being amortised over the period of the loan.

During the year ended 31 December 2020, the Group drew a further

GBP1.5 million of loan funds from the GBP17.5 million existing loan

agreement. This was on similar terms and with no change to the loan

repayment profile (i.e. the quarterly repayments remained the same

and the loan balance remains payable on 30 September 2026). Costs

directly associated with entering into the additional loan, have

been offset against the balance outstanding and are being amortised

over the period of the loan.

At 31 December 2022, the amount outstanding on the term loan was

GBP14.2 million (2021: GBP15.4 million).

The reconciliation of bank loans interest expense is shown

below.

2022 2021

GBP000 GBP000

------------------------------------- ------- -------

Interest expense 533 580

Interest paid (517) (564)

Amortisation of loan arrangement fee (16) (16)

------------------------------------- ------- -------

Interest accrual at the year end - -

------------------------------------- ------- -------

In December 2021 Science Group plc signed a Revolving Credit

Facility ('RCF') with Lloyds Bank plc in order to provide

additional capital resources to enable the execution of the Group's

acquisition strategy. The RCF is for up to GBP25.0 million, with an

additional GBP5.0 million accordion option, for a term of four

years with a one-year extension. The margin on drawn sums is 3.3%

per annum over the Sterling Overnight Index Average ('SONIA') and

is 1.1% per annum on undrawn amounts. Drawn amounts are secured on

the Group's assets by debentures. The RCF is in addition to the

Group's existing term loan.

The RCF has two financial covenants with which the Group needs

to comply if the facility is drawn: (i) the Group's net leverage,

as defined as the net debt divided by the rolling 12 month EBITDA,

should not exceed 2.5; and (ii) the Group's interest cover, as

defined as the rolling 12 month EBITDA divided by the rolling

interest payments on all borrowings, should not be less than 4.0.

Reporting is on a 6 monthly basis unless the net leverage exceeds

2.0, in which case reporting moves to quarterly until net leverage

returns to below 2.0 again. For the term of the RCF, the previous

covenants for the term loan are superseded by the covenants of the

RCF and will not apply.

The reconciliation of RCF interest expense is shown below.

2022 2021

GBP000 GBP000

------------------------------------ ------- -------

Interest expense 349 -

Interest paid (268) -

Amortisation of RCF arrangement fee (81) -

------------------------------------ ------- -------

Interest accrual at the year end - -

------------------------------------ ------- -------

In accordance with an agreed repayment schedule with the bank,

bank borrowings are repayable to Lloyds Bank plc as follows:

2022 2021

GBP000 GBP000

====================== ======= =======

Within one year 1,200 1,200

Between 1 and 2 years 1,200 1,200

Between 2 and 5 years 11,800 3,600

Over 5 years - 9,400

====================== ======= =======

14,200 15,400

---------------------- ------- -------

In order to address interest rate risk, the Group entered into

phased interest rate swaps in order to fully hedge the loan

resulting in a 10-year fixed effective interest rate of 3.5%. The

interest rates on the swaps range from 0.4% to 1.3% which when

combined with the margin on the loan economically fix the finance

cost at 3.5%.

The notional amount on the interest rate swaps reduces in line

with the repayment of the term loan, so an effective hedge remains

throughout the term of the loan. There are 4 active swaps in place

at 31 December 2022, totalling GBP14.2 million. Of this total,

GBP2.8 million will mature in September 2025 and the remaining

balance of GBP11.4 million will mature in September 2026. The fair

value of the swaps at 31 December 2022 was an asset of GBP1,417,000

(2021: GBP129,000).

15. Post balance sheet events

Since the year end the Group has completed the acquisition of TP

Group plc, which adds significant scale to the Group and provides a

strategic entry into the defence sector. The acquisition of TP

Group plc commenced with an initial holding of 10.2% on 9 August

2021. The Group increased its shareholding with further share

acquisitions across 2021 and 2022. In October 2022, the Group made

an offer to acquire the remaining shares in TP Group plc through a

court-approved Scheme of Arrangement. This became effective on 26

January 2023. Including the payment in January 2023 and excluding

advisory fees, the total cost of acquiring shares in TP Group plc

was GBP25.4 million.

The acquisition was progressive and occurred over 18 months and

judgement has been exercised in order to determine the following

key dates:

(i) the date at which TP Group plc became an associate of the

Group. This was determined by reference to the ability to exercise

significant influence over TP Group plc; and

(ii) the date at which the Group obtained control over TP Group

plc. This was determined by reference to the holding of voting

shares exceeding 50%.

The fair value of the assets and liabilities in relation to this

acquisition have not been presented as the work is ongoing to

perform the valuations, in particular:

(i) the factors that make up goodwill to be recognised;

(ii) the fair value of the equity interest immediately before

the acquisition date and any gain or loss recognised as a result of

remeasuring to fair value the equity interest held before the

acquisition; and

(iii) the fair values of the assets acquired and the liabilities

assumed.

16. Statement by the Directors

Whilst the information included in this preliminary announcement

has been prepared in accordance with the recognition and

measurement criteria of International Financial Reporting Standards

('IFRSs') as adopted by the UK in conformity with the requirements

of the Companies Act 2006, this announcement does not itself

contain sufficient information to comply with IFRSs. The accounting

policies adopted in this preliminary announcement are consistent

with the Annual Report for the year ended 31 December 2022.

The financial information set out above, which was approved by

the Board on 20 March 2023, is derived from the full Group accounts

for the year ended 31 December 2022 and does not constitute the

statutory accounts within the meaning of section 434 of the

Companies Act 2006. The Group accounts on which the auditors have

given an unqualified report, which does not contain a statement

under section 498(2) or (3) of the Companies Act 2006 in respect of

the accounts for 2022, will be delivered to the Registrar of

Companies in due course.

The Board of Science Group approved the release of this

preliminary announcement on 20 March 2023.

The Annual Report for the year ended 31 December 2022 will be

posted to shareholders in due course and will be delivered to the

Registrar of Companies following the Annual General Meeting of the

Company. The report will also be available on the investor

relations page of the Group's website. Further copies will be

available on request and free of charge from the Company

Secretary.

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FBLLLXXLLBBL

(END) Dow Jones Newswires

March 21, 2023 03:00 ET (07:00 GMT)

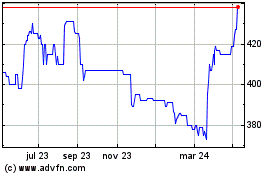

Science (LSE:SAG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

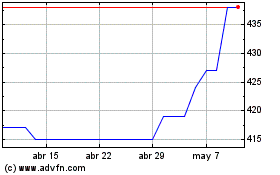

Science (LSE:SAG)

Gráfica de Acción Histórica

De May 2023 a May 2024