TIDMTIME

RNS Number : 6552N

Time Finance PLC

26 September 2023

26 September 2023

Time Finance plc

("Time Finance", the "Group" or the "Company")

Final Results for the year ended 31 May 2023

Strong growth in Revenue, PBT and EPS

Own-Book origination and lending portfolio significantly

increase

Time Finance plc (AIM: TIME), the AIM listed independent

specialist finance provider, is pleased to announce its final

results for the year ended 31 May 2023.

Commenting on the results, Tanya Raynes, Non-executive Chair,

said:

"The Group's strong financial performance over the past year

further strengthens our confidence in the strategic plan and the

capability of our team to deliver it. Revenue and profits increased

strongly during the period with the lending book and Net Tangible

Assets both standing at record highs; cash reserves remain solid

and arrears have remained static and are well below pre-pandemic

levels, notwithstanding the significant and ongoing growth in the

lending book. With the balance sheet further strengthened through

this organic growth the delivery of our strategic plan remains well

on track."

Financial Highlights:

-- Revenue of GBP27.6m (2022: GBP23.6m), an increase of 17%

-- Profit Before Tax ("PBT") of GBP4.2m (2022: GBP1.1m), an

increase of 281%

-- Earnings per share ("EPS") (fully diluted) of 3.7pps (2022:

1.0pps)

-- Own-Book deal origination of GBP73.4m (2022: GBP64.4m), an

increase of 14%

-- Lending book of GBP170.1m at 31 May 2023 (2022: GBP136.8m),

an increase of 24%

-- Consolidated Net Assets at 31 May 2023 of GBP61.7m (2022:

GBP58.1m), an increase of 15%

-- Consolidated Net Tangible Assets at 31 May 2023 of GBP34.2m

(2022: GBP30.5m), an increase of 12%

-- Future visibility of earnings with unearned income of

GBP21.2m (2022: GBP16.7m), an increase of 27%

-- Net deals in arrears at 31 May 2021 of 6% (31 May 2022: 7%),

an improvement of 1%

Operational Highlights:

-- Ratio of own-book lending to broked-on lending increased to

96% vs 4% during the year (up from 87% vs 13% in the prior

year)

-- Strong growth within both Invoice Finance division (lending

increased 30% over previous year to GBP56m) and in the "Hard Asset"

offering within the Asset Finance division (up 55% to GBP62m)

-- Business streamlining completed with divestment of non-core,

consumer mortgage brokerage

-- Supportive funding partners with unused lending headroom of

approximately GBP50m

Ed Rimmer, Chief Executive Officer, added:

" The financial year to 31 May 2023 marked the halfway point in

our four-year, medium-term strategic plan through to the end of May

2025. Our performance to date and the steps taken throughout the

year suggest we are well on track to achieve our stated

targets.

The Group remains very well positioned to take advantage of the

opportunities that the market presents, whilst our gathering

trading momentum provides real optimism in our ability to increase

shareholder value through the delivery of our stated four-year

strategy."

The Board continues to expect the Group's trading for the

current financial year to 31 May 2024 to be in line with market

expectations.

Chief Executive Officer, Ed Rimmer, and Chief Financial Officer,

James Roberts, will deliver a live presentation relating to these

audited annual results and the simultaneously released Q1 trading

update via the Investor Meet Company platform at 1.00pm BST today.

The presentation is open to all existing and potential shareholders

and questions can be submitted at any time during the live

presentation via the Investor Meet Company dashboard. Investors can

sign up to Investor Meet Company for free and add to meet Time

Finance plc via:

https://www.investormeetcompany.com/time-finance-plc/register-investor

.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (as amended), which forms

part of domestic UK law pursuant to the European Union (Withdrawal)

Act 2018. Upon publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

For further information, please

contact:

Time Finance plc

Ed Rimmer, Chief Executive Officer 01225 474230

James Roberts, Chief Financial Officer 01225 474230

C avendish Securities plc (NOMAD

and Broker) 0207 2 20 0500

Ben Jeynes / Charlie Combe (Corporate

Finance)

Michael Johnson / George Budd (Sales)

Walbrook PR 0207 933 8780

Paul Vann / Joe Walker 07768 807631

Timefinance@walbrookpr.com

About Time Finance:

Time Finance's core strategy is to focus on providing the

finance UK SMEs require to fund their businesses. It offers a

multi-product range for SMEs including asset, loan, invoice and

vehicle finance. While primarily an 'own-book' lender the Group

does operates a 'hybrid' lending and broking model enabling it to

optimize business levels through market and economic cycles.

More information is available on the Company website

www.timefinance.com .

Chair's Report

For the year ended 31 May 2023

Performance and dividend

This was another year where the macroeconomic backdrop remained

significantly challenging. The war in Ukraine and global supply

chain issues persisted. In the UK, the various changes in

government during September and October 2022 created political and

economic turmoil. The steep rise in energy and commodity prices,

combined with wage rise pressures in a tight UK labour market,

resulted in a high inflation economy and the Bank of England

responded with sharp interest rate rises. The combined effect has

been a cost-of-living crisis that looks set to continue for some

time to come.

While these economic headwinds present very real challenges for

UK businesses, we remain focused on continuing to provide an

essential lifeline of working capital to our SME customers,

alongside growth enabling investment for those customers who are

finding opportunity in these disrupted markets. Our Purpose is to

"help UK businesses to thrive and survive" and is at the centre of

everything we do, underpinning our aspiration to support the needs

and ambitions of UK businesses.

This financial year concluded the second full year of our

four-year strategy, and it is very pleasing to report Revenue of

GBP27.6m (2022: GBP23.6m) with Profit Before Tax of GBP4.2m (2022:

GBP1.1m). Fully diluted Earnings Per Share were 3.73p (2022:

1.00p). Our balance sheet was further strengthened during the year

with Net Tangible Assets rising to GBP34.2m (2022: GBP30.5m). At

the same time, net deal arrears remained relatively consistent at

6% of the gross exposure (2022: 7%), demonstrating the continued

effectiveness of our credit risk policy, which seeks to

appropriately balance the needs of both our customers and our

business.

Our business strategy continues to pursue aggressive growth

targets for own book lending. This requires application of our

available cash resources into leveraging our funding facilities to

maximum effect. Our lending objectives remain focussed on the

growth of shareholder value rather than dividend distribution.

Hence, we continue to view cash resources as being best deployed to

support business growth and, for the time being, not used for

dividend payments. This will be kept under review.

Our strategy

Time Finance is positioned as a risk-mitigated alternative

finance provider, recognised as having a highly relevant and

flexible offering of business finance products for a

well-diversified and expanding base of UK businesses. Our core

products are primarily Asset Finance and Invoice Finance augmented

by Commercial Loans and our recently launched Asset Based Lending

product.

There has been significant financial and operational progress

made since rolling-out the revised four-year strategy just over two

years ago. In addition, the robustness of the planning process has

itself been substantially improved, ensuring the actions and

resources required to meet key objectives are well understood

across the business, with clear performance measures and

accountability for outcomes.

A key pillar of our current strategy is the focus on

significantly growing our secured own-book lending, and there has

been continued traction against this goal with own-book origination

of GBP73.4m during the financial year (2022: GBP64.4m). This

produces a compounding pipeline of future unearned income and is

hence significant in driving the underlying value of the

Company.

We have recognised for some time the importance to our strategy

of internal system improvements in order to support our customer

experience and business efficiencies. I am pleased to report that

there has been tangible progress during this financial year, the

benefits of which have been directly enjoyed by both our customers

and colleagues. There remains, however, a significant task ahead of

us with respect to system improvements and how we use technology to

transform outcomes. You can expect further updates as we continue

on this journey.

Governance and culture

The business operates in a regulated environment and a key

responsibility for the Board is to ensure that strong and effective

governance operates throughout the Group. The Board has four

sub-committees, namely 'Audit', 'Remuneration', 'Nomination', and

'Governance and Risk'. Membership comprises only of non-executive

directors with the committees meeting on a regular basis and, as

and when appropriate, inviting members of the senior management

team to enable well informed discussion and decision making, as

well as gaining appropriate levels of assurance.

The culture within Time Finance is of paramount importance to

us. A key objective as we went into this financial year was to

refresh our values. Across the business we challenged ourselves to

ensure that our values represent a cohesive and relevant statement

of who we are and what we stand for. This is important as our

values are what we use to guide our behaviours and decisions as we

go about our daily business of helping UK businesses. Our values -

putting People First, being Bold, being Flexible, and being Genuine

- set a clear framework to enable us to deliver excellent outcomes

for our customers. They enable us to be responsive and agile,

whilst also ensuring highly responsible attitudes and behaviours in

every member of our team.

We continue to embed Environmental, Social and Governance

("ESG") as part of our business strategy. The themes of our ESG

approach include a good working environment for our colleagues,

doing great work within our local communities, addressing our

carbon footprint impact, and investment in systems and training -

with the benefits being long-term sustainable growth, improved

service levels and enhanced operational resilience.

Our people

The depth of experience and understanding within the business of

the needs, challenges and aspirations of UK SMEs positions us to

navigate a challenging marketplace for the mutual success of the

business and our customers. Our colleagues throughout the business

are highly resourceful, driven, and committed, and on behalf of the

Board, I wish to record our sincere gratitude for all their efforts

and results.

Aside from excellent financial and operational performance by

our dedicated and capable colleagues, highlights for this year have

included an all-employee conference held in March, delivery of a

refreshed set of values, and the ongoing charity work by the team.

I remain in awe of the commitment to charity work by so many of our

colleagues; it is genuinely humbling and inspiring.

I would like to express my thanks to Ed Rimmer, our CEO, and

James Roberts, our CFO, for their leadership and execution in what

has been a significant year for the business. I am also delighted

to welcome both Tracy Watkinson and Paul Hird to the Board as

Non-Executive Directors. Both Tracy and Paul bring new skills and

insight and will offer fresh challenges to the Executive team. At

the same time, I would like to extend my sincere thanks to Julian

Telling and Ron Russell who will be standing down following the

Annual General Meeting in early November. Both Julian and Ron have

been integral to the development of the business over many years

and their experience, insight and humour will be missed.

Outlook

Whilst the economic and political environment is uncertain and

challenging, the financial performance for the year supports our

confidence in our strategic plan and the capability of our team to

deliver it. The main pillars of focus remain looking after our

customers' needs in a responsible and agile way, and supporting and

empowering our people to be the best they can be, in order to

achieve strong and sustainable growth of the business, for the

benefit of all our stakeholders.

Time Finance continues to benefit from being a provider of a

range of financial products across multiple business sectors and

has no overweight dependence on any specific business category. The

continued strengthening of our balance sheet, and access to the

required cash resources for the planned growth, leaves us positive

about the future performance of the business.

In my second statement as Chair, I would like to extend my

thanks to all of our stakeholders for their continued support.

Tanya Raynes

Chair - 26 September 2002

Chief Executive Officer's Report

For the year ended 31 May 2023

Introduction

Time Finance is a multi-product, alternative finance provider to

UK SMEs, predominantly funding transactions on its own book, but

with the ability to broke-out business that falls outside of its

credit policy. The business offers two core products, Asset Finance

and Invoice Finance, and, to a smaller degree, Commercial Loans

along with an Asset Based Lending solution that was launched during

the year. The financial results for the business for the year ended

31 May 2023 consolidate the results of the two trading divisions

along with a central cost centre.

The post Covid-19 recovery that started to positively impact the

business in the early part of 2022 continued to provide

opportunities for alternative finance providers. With the various

government funding schemes largely coming to an end, and

significant challenges facing SMEs in the shape of rising costs,

supply chain disruptions and spiralling interest rates, access to

finance became of vital importance again to small businesses.

Having made good progress with our strategic plan that was put in

place in June 2021, we were in a good position to capitalise on

these developments, and I am pleased with the overall performance

and financial results for the year.

The positive results achieved are due to the commitment and hard

work shown by all our colleagues across the business. Like all

businesses, a lot of disruption was evident during the pandemic and

significant resilience was shown by our entire team. A sensible

balance has now been achieved in terms of providing flexible

working and this is now a permanent feature of the business. Whilst

this enables people to work from home if their role allows,

creating a vibrant atmosphere in the office is still an important

part of Time Finance being a "people" business. Our SME clients and

customers value a high degree of human interaction and providing

flexibility to them is therefore a key part of the proposition.

Sustainable, robust business model

Time Finance has maintained sound operational principles

designed to develop a robust business including:

- a widely spread lending book with security taken to support

lending facilities and a suitable margin achieved on each deal to

justify the risk taken.

- fixed interest rates are charged for the term of the lending

in both the Asset and Loan divisions. Interest rates incurred on

borrowings drawn down are also fixed for the term in these

divisions. Our policy is, wherever possible, to match the term of

borrowings drawn to the term of lending provided and this has been

of utmost importance over the trading period given the significant

increase in interest rates.

- underwriting is carried out by people as opposed to automated

systems for credit decisions. Although an essential element of the

business' development continues to be the deployment of IT systems

and improved efficiencies, it is essential that the end credit

decisions are taken by people given the markets we operate in.

- a realistic approach to provisioning with total provisions

carried in the balance sheet at 31 May 2023 amounting to GBP4.2m,

representing approximately 3% of the net lending portfolio. A

detailed internal review of provisioning is undertaken on a

quarterly basis, led by our Director of Risk and our CFO and the

recommendations made are presented to the Board for approval.

Market positioning and new business origination

Time Finance provides the main finance products that UK SMEs

require for their day-to-day working capital requirements and fixed

asset investments in order to grow their businesses over the longer

term. Since the Global Financial Crisis of 2008, the lending market

has transformed with the traditional banks no longer being the

automatic port of call for small business finance. Many alternative

finance providers have emerged in the form of challenger banks,

fin-tech lenders and independent providers such as Time Finance,

who generally offer more flexibility and a high level of focus on

customer service. As we are not a retail deposit taker, wholesale

funding facilities are utilised at competitive rates. In order to

make an acceptable margin on lending, the business chooses to

operate in the "Tier 2" market segment, therefore serving SMEs

typically at the smaller end of the market.

New business own-book origination for the year to 31 May 2023

amounted to GBP73.4m, 14% up on the GBP64.4m achieved the previous

year. 96% of all origination was funded on our own balance sheet

with only 4% broked-on, in line with our strategy.

Financial results

Revenue for the year to 31 May 2023 was GBP27.6m, an increase of

GBP4.0m (17%) year-on-year. Profit before tax was GBP4.2m, a

significant increase on the previous year (GBP1.1m). Total gross

receivables stood at GBP170.1m, a record level, compared with

GBP136.8m on 31 May 2022, a 24% increase and a key part of our

strategy to grow own-book lending. Total active borrowing

facilities as at 31 May 2023 amounted to GBP148m (2022: GBP148m),

of which GBP98m was drawn (2022: GBP78m). Consolidated Net Tangible

Assets stood at GBP34.2m (2022: GBP30.5m), an increase of 12%. Net

cash and cash equivalents held at 31 May 2023 was GBP3.8m (2022:

GBP2.9m).

The strength of the balance sheet, together with its liquidity

in the form of available operational debt facilities for lending

and cash held, ensure we are well-placed to take advantage of

future opportunities over the short to medium term.

Operational progress

The year to 31 May 2023 saw good progress made with respect to

our four-year strategic plan. The move away from "non-core"

activities was completed with the divestment of the consumer loans

brokerage in October 2022 and also the exiting of the wider

unsecured loans market in December 2022. This has allowed the

business to fully focus on secured Business-to-Business lending

with strong growth coming from both the Invoice Finance division

(lending up 30% on the previous year to GBP56m) and the "Hard

Asset" offering within the Asset Finance division (up 55% to

GBP62m). Lending across these two core products equated to

approximately 70% of total advances at year-end and is very much

where we see the majority of future growth coming from. As a

result, the new business effort was further scaled-up to support

this strategy and I look forward to seeing the results of this over

the next twelve months.

As part of our multi-product offering, we launched an Asset

Based Lending ("ABL") proposition in April 2023. This was targeted

at the smaller end of this market where there is less competition

and less pressure on margins. As well as providing the customer

with a wider range of funding solutions, it also allows the

business to retain client and customer relationships for a longer

period. These facilities tend to be fewer in number but larger in

value; getting a regular flow of business during the new year is

therefore a key objective.

The Invoice Finance division had a particularly successful year,

benefiting from increasing interest rates where the rises can be

immediately passed on to clients through the variable rate

agreements in place. Record new business volumes were seen with

some larger facilities taken on, including a GBP2m facility in

December 2022 which represented the single largest new facility put

in place. Client attrition was also lower than anticipated, which

contributed to the growth in the lending book.

We have continued to invest in our people with some important

additions made to the team during the year. In July 2022 a new role

was created, Head of Credit, and we were delighted to recruit a

high-calibre individual with appropriate skills and experience to

enable the business to take on larger and more complex asset

finance business. Overall, within the Hard Asset section of the

Asset Finance division, the average deal size increased from GBP22k

to GBP36k between May 2022 and May 2023. There has also been an

increase over the same timeframe in the single customer exposure

limit from GBP500k to GBP750k. Another key focus of recruitment was

around Business Improvement and our efforts to drive efficiency and

focus on enhancing the customer journey. A number of key benefits

have been delivered over the last twelve months in this regard,

including significant improvements to our core Asset Finance

operating system; introducing electronic document signing in the

Invoice Finance division; and the launch of a new HR system

allowing us to automate our employee appraisal and performance

management process.

There has been a concerted effort to support teams across the

business given the pressure on cost-of-living expenses, and this

has been positively received. Communication has also been improved

through the provision of regular webinars and in person "Team

Talks" at our four office locations in Bath, Reading, Manchester

and Warrington, with the objective of maximising engagement across

the business. The entire team was also brought together for the

first time since the pandemic at an all-staff conference held in

March 2023. This proved to be a highly successful event which we

will be looking to repeat in the future. We will also be measuring

the level of engagement through a formal colleague survey due to

take place in the Autumn of 2023.

Tanya Raynes's first full year in the Chair role has also been a

significant benefit and I am grateful for her support and guidance

during the year.

Culture, compliance and governance

Time Finance is a customer focused business, and its purpose is

"to help UK businesses thrive and survive". During the later part

of the financial year, we took the opportunity to refresh and

relaunch our cultural values, and these are shown below.

-- We Put People First - We are a "people business", empowering

all our colleagues to make a difference

-- We Are Bold - We have the courage to do things differently

and make the most of our opportunities

-- We Are Flexible - We have a can-do attitude and take a commercial approach to business

-- We Are Genuine - Integrity and transparency are at the heart

of how we build trust and foster great relationships

A plan has been agreed as to how these values will be embedded

into the day-to-day business and this is a key priority for the new

financial year.

We continue to have high standards for compliance and governance

for all our activities, referenced to the principles and guidelines

of the Financial Conduct Authority and the codes of conduct of the

relevant industry bodies. All colleagues are required to act in

accordance with our cultural values to uphold the following:

-- To act with integrity, due skill, care and diligence

-- To be open and cooperative with regulators

-- To pay due regard to the interests of customers and clients and treat them fairly

Outlook

Given the significant challenges faced by SMEs in the shape of

increased interest rates and inflationary costs, the provision of

finance will be more important than ever over the coming twelve

months. This presents both opportunities and threats to alternative

lenders such as Time Finance and getting the balance right in how

these are managed will determine the level of success we can

achieve. With the senior management team we now have in place and

the work that has been undertaken over the last two years to

re-engineer the business, I believe we are well placed to succeed

and continue to grow in a responsible manner.

Ed Rimmer

Chief Executive Officer - 26 September 2002

Group Strategic Priorities

For year ended 31 May 2023

Time Finance continues to be an alternative provider of finance

to the high-street and challenger banks, serving predominantly SMEs

with finance requirements ranging from GBP5,000 to GBP2.5m. The

Group primarily provides Invoice Finance and Asset Finance and, to

a lesser degree, Commercial Loans. It lends mainly from its own

balance sheet but with the ability to broker-on business that does

not meet lending parameters. This would mainly be due to the size

of a transaction, pricing or credit quality.

In June 2021, a new, four-year strategic plan was put in place.

At the time, the UK economy was still recovering from the Covid-19

pandemic, with all businesses facing significant uncertainty. As

mentioned in the previous sections, this uncertainty has increased

over the last two years, however, SMEs have proved to be extremely

resilient. This is in part due to the support provided by

alternative lenders such as ourselves and we are proud to play our

part in helping UK businesses thrive and survive.

Strategic Objectives

The key objectives of the four-year plan to 31 May 2025 are

to:

-- More than double the Group's gross lending book from GBP115m as at June 2021

-- Achieve revenue and PBTE levels in excess of GBP30m and GBP7m respectively

This was to be achieved through the following strategic

initiatives:

-- Focusing on core own-book lending products

-- Predominantly focusing on secured lending with an increasing average deal size

-- Investing in key people

-- Continuing to reposition the brand and invest in marketing

-- Bringing further liquidity into the business as and when required

Good progress has been made in delivering the plan during the

year and summaries on each of the above initiatives are set out

below.

Focus on core own-book lending products

The remaining "non-core" division, the consumer bridging loans

business in Cardiff, was divested in October 2022. This was the

last remaining consumer finance business after the rationalisation

plan embarked on in the previous financial year and left the Group

with a clear market position; being an alternative lender to

small-medium sized businesses, offering two core products: Asset

and Invoice Finance. Although a smaller part of the proposition, we

continue to offer Commercial Loans as developing our multi-product

offering remains a key objective. In April 2023, we also launched

an Asset Based Lending ("ABL") proposition aimed at businesses who

need to raise finance against a wider range of assets, including

debtors, plant & machinery, property and stock. This has been

well received in the market with our first transaction completed in

May. During the year we increased our gross lending book by 24% to

GBP170m and we expect this trend is to continue over the course of

our medium-term plan.

Predominantly focus on secured lending with an increasing

average deal size

In the majority of cases, tangible security is taken to underpin

our lending. This involves taking title to professionally valued

fixed assets or book debts, supported by registering debentures

and/or property charges. A key aim over the last twelve months was

to increase the average ticket size of the 'Hard' asset business

which reduced significantly during the pandemic when market demand

led to smaller assets being funded. I am pleased to report that

this has been achieved with the average deal size increasing from

GBP22k in FY21/22 to GBP36k in FY22/23 and during Q4 this increased

further to GBP40k. The maximum limit to any one customer within the

Hard Asset division also increased from GBP500k to GBP750k. In

addition, we took the decision to exit the unsecured loans market

where most of the business was sub GBP25k and not secured by a

tangible asset. The one exception to this overall trend, is the

'soft' asset strategy where the Group has a niche position in

funding smaller transactions that provide a wide spread of risk at

higher yields, funding business critical assets.

During the year we repositioned this offering, targeting mainly

lends up to GBP15k with an auto approval system implemented to

improve efficiencies. The majority of future growth, however, will

continue to come from the Hard Asset and Invoice Finance

businesses, along with the ABL offering.

Investment in key resources

In order to grow the business, the Group has continued to invest

in a number of key recruits. We appointed a Head of Credit in June

2022 and his skills and experience have been crucial in supporting

the move to increase the hard asset deal size and maximum customer

limit. The sales teams within both Asset and Invoice Finance have

been expanded further and by the end of September 2023 the overall

New Business team will have doubled in size since inception of our

current plan. We also invested in Business Improvement, focusing on

improving efficiencies and ultimately the customer journey. A

number of projects have been successfully delivered over the last

twelve months, including enhancements to our operating system in

the Asset Finance division, the introduction of electronic

signatures for executing legal documents in our Invoice Finance

division and a new Group-wide HR platform that has allowed us to

digitalise the employee appraisal process.

Reposition the brand and investment in marketing

Since the Group was rebranded to Time Finance at the end of

2020, we have worked hard to reposition the business in line with

our strategy and this has delivered some pleasing results over the

past twelve months. Our PR strategy, promoting our core business

news and client case studies and testimonials, led to a 26%

increase in media coverage achieved across key industry titles in

the regional and national press. We also invested in our digital

presence and SEO efforts which complemented our traditional

marketing channels, achieving a 201% increase in website traffic.

We continue to invest in our in-house marketing team, combined with

external agency partnerships, to further strengthen the Time

Finance brand within the commercial finance market and we are

pleased that these efforts were recognised through being awarded

'Asset Finance Provider of the Year' at the 2023 Asset Finance

Connect awards ceremony.

Bring further liquidity into the business as and when

required

During the financial year, a healthy liquidity position was

maintained with sufficient cash resources in place to deliver our

current plan. As the growth accelerates further, however, we will

likely need to review the current funding strategy. Finding

suitable long-term liquidity at sensible pricing is therefore a key

focus over the course of the next twenty four months.

Key performance indicators

The Board and the Senior Management Team regularly review and

monitor key metrics in assessing the performance of the Group. Some

of these key metrics used to track the Group's meaningful progress

are detailed below.

-- Continuing Operations Revenue - GBP27.0m (prior year GBP22.5m)

-- Continuing Operations Gross Profit margin - 59% (prior year 64%)

-- Continuing Operations Profit Before Tax- GBP4.1m (prior year GBP1.4m)

-- Continuing Operations Diluted Earnings Per Share - 3.63p (prior year 1.38p)

-- Own-Book New Business Origination - GBP73.4m (prior year GBP64.4m)

-- Core business own book vs broked-on ratios - 96/4 (prior year 87/13)

Refreshed Strategy

During the second half of the financial year, we took the

opportunity to refresh the current strategy along with our purpose,

values and key objectives. This process proved to be highly

beneficial, providing a more robust linkage with our financial

budgets and forecasts for the next two years. A summary of the

refreshed plan is shown below.

Our Purpose

"To help UK businesses to thrive and survive"

Our Objectives

-- Ambitious growth in our target markets

-- Improve customer experience and productivity

-- Prepare our people for the future

-- Build strong foundations

Each of the above have a number of initiatives in place in order

to deliver the set targets and I look forward to reporting on

progress as we travel through the year.

Principal risks and uncertainties

'Principal risks' are defined as a risk or a combination of

risks that, given the Group's current position, could seriously

affect its performance, future prospects or reputation. These risks

could potentially materially threaten the business model,

performance, solvency or liquidity, or prevent the delivery of the

strategic objectives outlined above. The Board has overall

responsibility for ensuring that risk is appropriately managed

across the Group and, through the Governance and Risk Committee,

has established the Group's appetite to risk; approved its

structure, methodologies and policies; and management roles and

responsibilities.

As well as regular external reviews and audits from the Group's

statutory auditors and the quarterly audits from a number of its

funding partners, the Group has numerous internal checks and

balances. Initial responsibility rests with the Senior Management

Team which manages the business divisions and functions with line

managers responsible for identifying and managing risks arising in

their business areas. This is augmented by the Group's central and

independent Compliance, Finance and Risk functions with

responsibility for reporting to the Board. The Group has a Director

of Risk who reviews all significant credit exposures and a Head of

Compliance who reviews all significant operating risks and

adherence to regulatory requirements.

The key risks identified and which the Board has reasonable

expectation are appropriately mitigated are:

-- Credit Risk

The risk of default, potential write-off, disruption to cash

flow and increased recovery costs on a debt that is either not

repaid individually or if there is a wider market deterioration.

This is mitigated by the Group adopting prescribed lending policies

and adhering to strict credit and underwriting criteria

specifically tailored to each business area. The Group also has the

ability to 'broke-on' certain business rather than write it on its

own-book if it is deemed necessary to manage risk.

-- Funding Risk

The risk of the Group not being able to meet its current and

future financial obligations over time, specifically that funding

is not available to meet the Group's growth targets. The Group has

funding facilities across Block Discounting, a Secured Loan Note

programme and Back-to-Back invoice finance facilities, aggregating

to GBP148m with ample headroom to meet its growth targets for the

medium future. As detailed previously, should the opportunity arise

to grow considerably faster than the medium-term plan anticipates,

then the Group could decide to augment its funding with additional

liquidity.

-- Regulatory Risk

The risk of legal or regulatory action resulting in fines,

penalties and sanctions that could arise from the Group's failure

to identify and adhere to regulatory requirements in the UK. In

addition, there is the risk that new or enhanced regulations could

adversely impact the Group. The Group employs a Head of Compliance,

who manages an independent compliance department with access to

external advisors. The department looks both internally at the

Group ensuring its practices are appropriate and externally at

future developments to ensure the Group is prepared to adopt any

changes in regulation as and when they arise.

Summary

SMEs continue to face significant challenges with increasing

interest rates, high inflation, disrupted supply chains and, in

many sectors, a shortage of labour. Access to finance in order to

provide the vital working capital for businesses to function and

grow is therefore increasing in importance and this provides

significant opportunities to alternative lenders like Time Finance.

We have a clear strategy to not only maximise these opportunities,

but ensure growth is achieved in a sensible and robust way, given

the risks the economic environment also poses.

Ed Rimmer

Chief Executive Officer

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 31 MAY 2023

Continuing Discontinued Continuing Discontinued

Operations Operations Total Operations Operations Total

2023 2023 2023 2022 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

Revenue 26,968 602 27,570 22,488 1,123 23,611

Other Income - - - 22 7 29

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

Total Revenue 26,968 602 27,570 22,510 1,130 23,640

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

Cost of Sales (11,172) (227) (11,399) (8,061) (587) (8,648)

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

GROSS PROFIT 15,796 375 16,171 14,449 543 14,992

Administrative

expenses (11,371) (277) (11,648) (11,059) (712) (11,771)

Exceptional Items (70) (10) (80) (1,685) (184) (1,869)

Share-based payments (125) - (125) (43) - (43)

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

OPERATING PROFIT 4,230 88 4,318 1,662 (353) 1,309

Finance costs (152) - (152) (255) - (255)

Finance income 1 - 1 1 - 1

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

PROFIT BEFORE

INCOME TAX 4,079 88 4,167 1,408 (353) 1,055

Adjusted earnings

before tax, exceptional

items and share-based

payments 4,274 98 4,372 3,136 (169) 2,967

Exceptional items (70) (10) (80) (1,685) (184) (1,869)

Share-based payments (125) - (125) (43) - (43)

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

PROFIT BEFORE

INCOME TAX 4,079 88 4,167 1,408 (353) 1,055

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

Income tax (720) - (720) (134) - (134)

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

PROFIT FOR THE

YEAR 3,359 88 3,447 1,274 (353) 921

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

Profit attributable

to: Owners of the

parent company 3,359 88 3,447 1,274 (353) 921

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

Earnings per share

expressed in pence

per share

Basic 3.63 0.10 3.73 1.38 (0.38) 1.00

Diluted 3.63 0.10 3.73 1.38 (0.38) 1.00

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 31 MAY 2023

PROFIT FOR THE

YEAR 3,359 88 3,447 1,274 (353) 921

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

OTHER COMPREHENSIVE - - - - - -

INCOME

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

TOTAL COMPREHENSIVE

INCOME FOR THE

YEAR 3,359 88 3,447 1,274 (353) 921

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

Total comprehensive

income attributable

to: Owners of the

parent company 3,359 88 3,447 1,274 (353) 921

-------------------------- ------------ ------------- ---------- ------------ ------------- ----------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31 MAY 2023

2023 2022

GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Goodwill 27,263 27,263

Intangible assets 231 298

Property, plant and equipment 238 320

Right-of-use property, plant &

equipment 573 30

Trade and other receivables 58,530 50,344

Deferred tax 1,236 1,036

-------- --------

88,071 79,291

-------- --------

CURRENT ASSETS

Trade and other receivables 91,847 70,852

Cash and cash equivalents 3,772 3,170

-------- --------

95,619 74,022

-------- --------

TOTAL ASSETS 183,690 153,313

======== ========

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 9,252 9,252

Share premium 25,543 25,543

Employee shares 231 106

Treasury shares (770) (820)

Retained earnings 27,419 23,972

-------- --------

TOTAL EQUITY 61,675 58,053

-------- --------

LIABILITIES

NON-CURRENT LIABILITIES

Trade and other payables 52,822 39,033

Financial liabilities - borrowings 1,319 2,344

Lease Liability 428 -

-------- --------

54,569 41,377

-------- --------

CURRENT LIABILITIES

Trade and other payables 65,207 51,956

Financial liabilities - borrowings 1,625 1,879

Tax payable 423 28

Lease Liability 191 20

-------- --------

67,446 53,883

-------- --------

TOTAL LIABILITIES 122,015 95,260

-------- --------

TOTAL EQUITY AND LIABILITIES 183,690 153,313

======== ========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 MAY 2023

Called Retained Share Treasury Employee Total

up Share Earnings Premium Shares Shares Equity

Capital

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 May

2021 9,252 23,051 23,543 (790) 63 57,119

Total comprehensive

income - 921 - - - 921

Transactions with

owners

Purchase of treasury

shares - - - (30) - (30)

Value of employee

services - - - - 43 43

Balance at 31 May

2022 9,252 23,972 25,543 (820) 106 58,053

========== ========== ========= ========= ========= =========

Total comprehensive

income - 3,447 - - - 3,447

Transactions with

owners

Sale of treasury shares - - - 50 - 50

Value of employee

services - - - - 125 125

Balance at 31 May

2023 9,252 27,419 25,543 (770) 231 61,675

========== ========== ========= ========= ========= =========

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 MAY 2023

Continuing Discontinued Continuing Discontinued

Operations Operations Total Operations Operations Total

2023 2023 2023 2022 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cash generated from

operations

Profit before tax 4,079 88 4,167 1,401 (346) 1,055

Depreciation &

amortisation

charges 422 1 423 571 40 611

Finance costs 152 - 152 236 - 236

Finance income (1) - (1) (1) - (1)

(Gain)/loss on disposal

of

property, plant and

equipment 17 - 17 12 134 146

(Increase) / Decrease in

trade and other

receivables (29,201) 20 (29,181) (22,147) 359 (21,788)

Increase / (Decrease) in

trade and other payables 27,056 (16) 27,040 15,632 (84) 15,548

Movement in other

non-cash

items 944 (435) 509 1,288 (46) 1,242

-------------------------- ---------------------- ------------- ---------- ------------ ------------- ----------

Cash flows from 3,468 (342) 3,126 (3,008) 57 (2,951)

operating

activities

Interest paid (152) - (152) (236) - (236)

Tax paid (541) - (541) (430) - (430)

-------------------------- ---------------------- ------------- ---------- ------------ ------------- ----------

Net cash from operating

activities 2,755 (342) 2,433 (3,674) 57 (3,617)

-------------------------- ---------------------- ------------- ---------- ------------ ------------- ----------

Cash flows from investing

activities

Purchase of software,

property,

plant & equipment (129) - (129) (149) (5) (154)

Interest received 1 - 1 1 - 1

-------------------------- ---------------------- ------------- ---------- ------------ ------------- ----------

Net cash from investing

activities (128) - (128) (148) (5) (153)

-------------------------- ---------------------- ------------- ---------- ------------ ------------- ----------

Cash flows from financing

activities

Payment of lease

liabilities (170) - (170) (178) (21) (199)

Loan repayments in year (1,025) - (1,025) (731) - (731)

Changes in overdrafts (254) - (254) (40) (9) (49)

Net cash from financing

activities (1,449) - (1,449) (949) (30) (979)

-------------------------- ---------------------- ------------- ------------ ------------- ----------

(Decrease)/increase in

net

cash and cash

equivalents 1,198 (342) 856 (4,771) 22 (4,749)

Net cash and cash

equivalents

at beginning of year 2,574 342 2,916 7,674 (9) 7,665

Net cash and cash

equivalents

at end of year 3,772 - 3,772 2,903 13 2,916

-------------------------- ---------------------- ------------- ---------- ------------ ------------- ----------

A CCOUNTING POLICIES

Basis of preparation

These financial statements have been prepared in accordance with

International Financial Reporting Standards ("IRFS") as adopted in

the United Kingdom and by the International Financial Reporting

Interpretations Committee ("IFRIC") interpretations and with those

parts of the Companies Act 2006 applicable to companies reporting

under IFRS. The financial statements have been prepared under the

historical cost convention.

1. SEGMENTAL REPORTING

The Group provides a range of financial services and product

offerings throughout the UK. This financial year has seen the Group

has amend its reporting on a segmental basis to more accurately

reflect the fact it has only two core trading divisions, namely:

Asset Finance and Invoice Finance. The Group's ancillary product

offerings, Commercial Loans and Vehicles fleet brokering are

included within the Asset Finance segment as they operate under the

same management team, office locations and with the same

back-office teams.

The operating segments, therefore, reflect the Group's

organisational and management structures. The Group reports

internally on these segments in order to assess performance and

allocate resources. The segments are differentiated by the type of

products provided.

The segmental results and comparatives are presented with

intergroup charges allocated to each division based on actual

revenues generated. Intergroup expenses are recharged at cost and

largely comprise; plc Board and listing costs, Marketing,

Compliance, IT and Human Resource costs.

For the year ended 31 May Asset Invoice Other TOTAL

2023 Finance Finance GBP'000 GBP'000

GBP'000 GBP'000

Revenue 16,540 10,679 351 27,570

Cost of sales (8,389) (2,784) (226) (11,399)

------------------------------------ --------- --------- --------- ---------

GROSS PROFIT 8,151 7,895 125 16,171

Administrative expenses (6,009) (4,040) (1,599) (11,648)

Exceptional items - (34) (46) (80)

Share-based payments (26) (11) (88) (125)

------------------------------------ --------- --------- --------- ---------

OPERATING PROFIT 2,116 3,810 (1,608) 4,318

Finance costs (75) (14) (63) (152)

Finance income 1 - - 1

PROFIT BEFORE INCOME TAX 2,042 3,796 (1,671) 4,167

Intra-group recharges (855) (816) 1,671 -

PROFIT BEFORE INCOME TAX 1,187 2,980 - 4,167

Adjusted earnings before

interest, tax,

exceptional items and share-based

payments 2,068 3,841 (1,534) 4,372

Exceptional items - (34) (46) (80)

Share-based payments (26) (11) (88) (125)

------------------------------------ --------- --------- --------- ---------

PROFIT BEFORE INCOME TAX 2,042 3,796 (1,671) 4,167

------------------------------------ --------- --------- --------- ---------

For the year ended 31 May Asset Invoice Other TOTAL

2022 (restated) Finance Finance GBP'000 GBP'000

GBP'000 GBP'000

Revenue 15,810 7,809 21 23,640

Cost of sales (7,380) (1,268) - (8,648)

GROSS PROFIT 8,430 6,541 21 14,992

Administrative expenses (5,997) (3,078) (2,696) (11,771)

Exceptional items (1,308) (76) (485) (1,869)

Share-based payments - (5) (38) (43)

OPERATING PROFIT 1,125 3,382 (3,198) 1,309

Finance costs (192) (3) (60) (255)

Finance income 1 - - 1

PROFIT BEFORE INCOME TAX 934 3,379 (3,258) 1,055

Intra-group recharges (2,181) (1,077) 3,258 -

PROFIT BEFORE INCOME TAX (1,247) 2,302 - 1,055

Adjusted earnings before

interest, tax,

exceptional items and share-based

payments 2,242 3,460 (2,735) 2,967

Exceptional items (1,308) (76) (485) (1,869)

Share-based payments - (5) (38) (43)

------------------------------------ --------- --------- --------- ---------

PROFIT BEFORE INCOME TAX 934 3,379 (3,258) 1,055

------------------------------------ --------- --------- --------- ---------

2. PROFIT BEFORE INCOME TAX

The profit before income tax is stated after charging:

2023 2022

GBP'000 GBP'000

Depreciation - owned assets 289 388

Amortisation - computer software 134 223

Net credit loss charge 2,437 930

Funding facility interest charges 4,547 2,515

Introducer commissions 2,868 3,014

Fees payable to the Company's auditor

for audit of Company's subsidiaries 68 72

Fees payable to the Company's auditor

for the audit of the Company 16 14

3. DIVIDS

2023 2022

GBP'000 GBP'000

Ordinary shares GBP0.10 each

Final - -

Interim - -

============ ============

Total - -

============ ============

The Directors do not propose a final dividend relating to this

financial period (2022: 0.0p per share). Future dividends will be

kept under review.

4. EARNINGS PER SHARE

Earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the year. For diluted

earnings per share, the weighted average number of shares is

adjusted to assume conversion of all dilutive potential ordinary

shares.

There are no dilutive items impacting the Group and, as such,

the Basic EPS and Diluted EPS are identical. Any share options that

are vested are fully expected to be met from the Group's Employee

Benefit Trust. Therefore, issuance of new shares is not expected to

be required and as a result, there is no associated dilution.

2023

Weighted

average Per-share

Earnings number of amount

GBP'000 shares pence

Basic

EPS

Earnings attributable to ordinary

shareholders 3,447 92,512,704 3.73

Diluted EPS

Adjusted earnings 3,447 92,512,704 3.73

========= =========== ==========

2022

Weighted

average Per-share

Earnings number of amount

GBP'000 shares pence

Basic

EPS

Earnings attributable to ordinary

shareholders 921 92,512,704 1.00

Diluted EPS

Adjusted earnings 921 912,512,704 1.00

========= ============ ==========

5. PUBLICATION OF NON-STATUTORY ACCOUNTS

The financial information set out in this announcement does not

comprise the Group's statutory accounts for the years ended 31 May

2023 and 31 May 2022. The financial information has been extracted

from the statutory accounts of the Group for the years ended 31 May

2023 and 31 May 2022. The auditors' opinion on those accounts was

unmodified and did not contain a statement under section 498 (1) or

498 (3) Companies Act 2006 and did not include references to any

matters to which the auditor drew attention by the way of emphasis.

The statutory accounts for the year ended 31 May 2022 have been

delivered to the Registrar of Companies. Those for the year ended

31 May 2023 will be delivered to the Registrar of Companies

following the Company's Annual General Meeting.

6. ANNUAL REPORT AND ANNUAL GENERAL MEETING

The Annual Report and Accounts will be available from the

Company's website, www.timefinance.com , from 26 September 2023.

Notice of the Annual General Meeting, which will be held at the

Apex Hotel, Bath, BA1 2DA on 7 November 2023 at 10am, will be

communicated electronically or posted to Shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR LFMITMTATMIJ

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

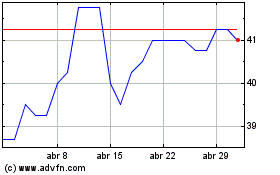

Time Finance (LSE:TIME)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Time Finance (LSE:TIME)

Gráfica de Acción Histórica

De May 2023 a May 2024