TIDMTRAC

RNS Number : 8739N

T42 IOT Tracking Solutions PLC

27 September 2023

27 September 2023

t42 IoT Tracking Solutions Plc

("t42" or the "Company")

Interim Results

t42 IoT Tracking Solutions plc (AIM: TRAC) ("t42" or the

"Company"), which provides real-time tracking, security, and

monitoring solutions for the global supply chain, logistics,

container, and freight market, announces its unaudited results for

the six months ended 30 June 2023.

Business Overview Highlights

-- Continued to refocus the legacy business to shipping container tracking services

-- Further orders for Tetis and Lokies

-- Collaboration into the refrigerated air cargo supply chain,

following a partnership with a leading global firm providing

sustainable solutions across the cold chain

-- Post-period, secured $1.3m financing from strategic partner

H1 Financials Highlights

-- Revenues decreased to $1.7m (H1 2022: $2.2m).

-- Adjusted EBITDA loss of $248,000 (H1 2022: loss of $247,000).

-- Gross margin for the period was 48% (H1 2022: 46%).

-- General expenses decreased to $1.3m (H1 2022: $1.5m).

-- Strong pipeline of potential new orders for financial year 2023 and 2024

Avi Hartmann, CEO of t42, commented:

"It is positive to see the continued adoption of t42 technology

into numerous different channels, including port authorities,

distributors and direct customers. We now take on the challenge of

financing the increasing demand for our products using the

Company's new leasing structure. At the same time it is clear that

we are becoming an increasingly important player in the shipping

container tracking solutions market."

Contacts:

t42 IoT Tracking Solutions Plc

Michael Rosenberg, Chairman 07785 727595

Avi Hartmann, CEO +972 5477 35663

Strand Hanson Limited (Nominated Adviser

and Financial Adviser) James Harris / Richard

Johnson / Robert Collins 020 7409 3494

Peterhouse Capital Limited (Joint Broker)

Lucy Williams / Charles Goodfellow / Eran

Zucker 020 7469 0930

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

CHAIRMAN'S STATEMENT

We are pleased to report the unaudited results of t42 for the

half year ended 30 June 2023 ("H1 2023"). Total revenues were $1.7m

(H1 2022: $2.2m), due to the effects of continued supply chain

issues, together with supplier requirements for upfront payments,

which has impacted our ability to complete many orders in the first

half of this year. We hope to fulfil these orders in the remainder

of the second half of the year. The gross margin for the period

showed an improvement on the previous year to 48% compared to 46%,

with an operational loss prior to financing costs (including

exchange rate impacts) of $0.5m (H1 2022: $0.5m). As already

indicated in previous statements, the results for this year are

expected to be heavily weighted to the second half of the year

based on our expectations from the existing potential order

pipeline. Anticipated orders give management confidence that the

results for the second half of 2023 will show a significant

improvement on 2022 full year results.

Post-period, as announced on 26 July 2023, we successfully

raised $1.3m through a convertible loan provided by Ewave Mobile

Ltd. The loan, which carries an interest of 10%, has enabled us to

pay off the existing $0.55m loan from CSS Alpha Global Pte Ltd

which had a substantially higher interest rate . Ewave Mobile Ltd.

is an international group providing solutions across a range of

sectors including supply chain management. We hope to develop new

business opportunities from this relationship.

During H1 2023, sales of Tetis and Lokies represented 34% and

25% of hardware revenues respectively, compared to 3% and 19% for

the corresponding period in the previous year, demonstrating the

success of the Company's new focus on the more profitable shipping

and freight sectors, while sales of Helios represented 38% of

Company revenue (H1 2022: 70%).

We are in regular contact with the distributors in Latin

America, announced in December 2021 and July 2022. Whilst minimal

sales have been achieved through these channels to date, based on

discussions with the distributors, we continue to anticipate that

more substantial orders will be forthcoming as we seek to gain

traction in these important markets. As recently updated, the

distribution contract with OpenBox has not delivered any sales and

although we remain in contact with them, we are not anticipating

any major sales from them in the near future; as they do not

currently have exclusivity in the USA, this has allowed us to

progress other opportunities in the USA through alternative

channels. Consequently, we signed a contract with another US-based,

leading global company which provides a unified view of in-transit

logistics to detect and correct non-compliance within supply

chains, which, as announced, has already resulted in orders for

several thousand Tetis units during H1 2023.

t42 has incorporated AI technologies into its product design

cycle to improve its development and products. Lokies 2.0 is the

first result of the technologies. Our Lokies 2.0 product is being

appraised by our various customers and new orders are being placed.

Also, as previously notified, we are strengthening the research and

development collaboration with a leading global firm providing

sustainable solutions across the refrigerated air cargo supply

chain, which has the potential to develop into a significant

customer relationship.

The Company's new leasing structure, which offers services while

structuring payments for both devices and SaaS fees on a monthly

payment basis as a leasing contract, has been well-received, with

an increasing numbers of orders being achieved using this

mechanism. The Company has several large orders pending and

indications of more in the near future. .

In addition, the vehicle market is still contributing to the

Company's revenues, and we continue to receive very positive

feedback from our clients following the launch of the new Helios M

4G. During 2023, we also concluded a project in Africa for securing

and managing a fleet providing procurement, production, storage and

distribution of medical supplies.

FINANCIAL REVIEW

Group revenues for the period were $1.7m, compared with $2.2m

for the six-month ended 30 June 2022.

Gross margin for the 6 months to 30 June 2023 increased to 48%,

compared with 46% for the corresponding period in 2022.

Total operating expenses for the 6 months to 30 June 2023 were

$1.3m (2022: $1.5m).

Net loss after taxation for the six months to 30 June 2023

increased to $0.8m compared with the 2022 net loss of $0.2m, mainly

due to financing costs.

The Group recorded an exchange rate profit of $0.03m (2022:

$0.4m) resulting from the strengthening of the US dollar relative

to the Israeli Shekel.

The Group balance sheet showed a slight decrease in trade

receivables to $0.59m, compared with $0. 65 m as of 30 June 202 2

.

Group inventories at the period end were $1.5m compared to $2.2m

as of 30 June 2022.

Trade payables at the period end were stable at $1.3m, compared

with $1.6m and $1.1m as of 30 June 2022 and 31 December 2022,

respectively.

Net cash provided in operating activities for the 6 months to 30

June 2023 was $0.1m, compared with net cash used by operating

activities for the 6 months to 30 June 2022 of $0.8m.

LEASE MODEL AND SHORT TERM LIABILITIES

The Company has several large orders pending and indications of

more in the near future. However, since several of these orders are

based on the new leasing structure the Company may need to raise

additional funds towards the end of 2023 or early 2024 in order to

take advantage of these opportunities and others in the pipeline.

The Company is both investigating the most appropriate leasing

structure, and also exploring options to raise the desired capital,

including to assist with current short term obligations which may

hold back growth with a preference for non-equity should this be

available .

As further noted in Note 5a below, the Company has in issue

unsecured convertible loans enabling the lenders to convert such

loans at an exercise price of GBP0.15 per share at any time,

subject to regulatory provisions, up to December 31, 2023. If not

converted, the loans will be repayable on December 31, 2023.

Discussions are underway with the providers of these loans on the

structure and timing of the loan repayment. While the Company is

hopeful of a resolution to such discussions, the Company may

require additional financing for the repayment of such loans by 31

December 2023. It should be noted that there is no guarantee that

such funding will be available, or as to the terms of such

funding.

OUTLOOK

We anticipate that the second half of 2023 will show

significantly improved results based on existing and anticipated

orders from a wide number of clients. Increasingly however,

existing and potential customers are favoring placing orders under

the new leasing structure. Inevitably the scale of these future

orders, in the remainder of 2023 and beyond, will be dependent on

the necessary funding being secured, which may delay some future

opportunities. We expect that as additional funding is secured, we

will see a consequent increase in orders being received. In

addition, sales of both Tetis and Lockies are increasing alongside

the considerable market acceptance of our technology.

Michael Rosenberg OBE

Non-Executive Chairman

_______________

T42 IOT TRACKING SOLUTIONS PLC

UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

JUNE 30, 2023

T42 IOT TRACKING SOLUTIONS PLC

UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

JUNE 30, 2023

INDEX

UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS: PAGE

Independent Auditors' report on review of interim financial

information 2

Interim Condensed Consolidated Statements of Financial

Position 3

Interim Condensed Consolidated Statements of Comprehensive

Loss 4

Interim Condensed Consolidated Statements of Changes

in Deficit 5

Interim Condensed Consolidated Statements of Cash Flows 6

Notes to the Interim Condensed Consolidated Financial

Statements 7-14

Jerusalem, September 27, 2023

Review Report of Independent Auditors

to the Shareholders of

t42 IoT Tracking Solutions PLC

Introduction

We have reviewed the accompanying condensed consolidated interim statements

of financial position of t42 IoT Tracking Solutions PLC and its consolidated

companies (hereinafter - "the Group") as of June 30, 2023 and 2022

and the related condensed consolidated interim statements of comprehensive

loss, changes in shareholders' equity and cash flows for the six months

then ended. Preparation and presentation of these condensed consolidated

financial statements in conformity with International Accounting Standard

No. 34 "Interim Financial Reporting" are the responsibility of the

Group's board of directors and management. Our responsibility is to

express a conclusion on these interim consolidated financial statements

based on our review.

Scope of Review

We conducted our review in accordance with Review Standard ( Israel)

No. 2410 of the Israel Accounting Standards Board, "Review of Interim

Financial Information for Interim Periods Performed by the Auditor

of an Entity". A review consists principally of inquiries of Company

personnel, analytical procedures applied to the financial data and

other review procedures. A review is substantially less in scope than

an audit conducted in accordance with International Standards on Auditing

and consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, we are not aware of any material modifications

that should be made to these interim consolidated financial statements

in order for them to be in conformity with International Accounting

Standard No. 34.

Without qualifying our conclusion, we draw attention to Note 1 (c)

in the financial statements regarding the Company's efforts to raise

additional funds.

Barzily & Co.

Certified Public Accountants.

A Member of MSI Worldwide

T42 IOT TRACKING SOLUTIONS PLC

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION

U.S. Dollars in thousands

June 30 December

31

Note 2023 2022 2022

----------------- ------------- ------------

Unaudited Unaudited Audited

----------------- ------------- ------------

ASSETS

NON-CURRENT ASSETS :

Property, plant and equipment,

net 503 591 546

Rights of use assets, net 1,004 1,0 64 981

Intangible assets, net 3 998 1,028 1,021

Income Tax Authorities 57 58 57

----------------- ------------- ------------

Total Non-Current Assets 2,562 2,7 41 2,605

----------------- ------------- ------------

CURRENT ASSETS :

Cash and cash equivalents 215 311 174

Inventories 1,499 2,234 1,581

Trade receivables (net of allowance

for doubtful accounts of $ 67 ,

$462 and $ 450 thousand as of June

30, 2023 and 2022 and December

31, 2022) 587 645 488

Other accounts receivable 25 98 71

Short-term deposit 132 131 130

----------------- ------------- ------------

Total Current Assets 2,458 3,419 2,444

----------------- ------------- ------------

6,124

----------------- ------------- ------------

TOTAL ASSETS 5,020 6,1 60 5,049

============= ============

LIABILITIES AND EQUITY

EQUITY (DEFICIT) (1,289) 93 (538)

----------------- ------------- ------------

NON- CURRENT LIABILITIES:

Long-term loans from banks, net

of current maturities 103 178 142

Amortized cost of a convertible

loan 5 306 824 292

Conversion component of a convertible

loan at fair value 5 14 215 27

Long term leasehold liabilities 778 8 88 790

Warrants at fair value 5 - 87 -

----------------- ------------- ------------

Total Non-Current Liabilities 1,201 2,1 92 1,251

----------------- ------------- ------------

CURRENT LIABILITIES:

Short-term bank credit 40 61 42

Short-term loans and current maturities

of long-term loans 620 927 789

Warrants at fair value 5 52 - 77

Trade payables 1, 302 1,606 1,144

Related parties 6 7 72 708 744

Other accounts payable 645 442 260

Leasehold liabilities 119 131 112

Conversion component of a convertible

loan at fair value 5 - - 7

Amortized cost of a loan and a

convertible loan 5 1,558 - 1,161

----------------- ------------- ------------

Total Current Liabilities 5,108 3,8 75 4,336

----------------- ------------- ------------

TOTAL LIABILITIES AND EQUITY 5, 020 6,160 5,049

================= ============= ============

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

September 27, 2023

--------------------------------- --------

Date of Approval of the Financial

Statements Director

T42 IOT TRACKING SOLUTIONS PLC

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

LOSS

U.S. Dollars in thousands

Year Ended

Six Months Ended December

June 30 31

Note 2023 2022 2022

--------- --------- ----------

Unaudited Unaudited Audited

--------- --------- ----------

Revenues 1,707 2,177 4,041

Cost of sales 7 (895) (1,181) (2,358)

Gross profit 812 996 1,683

Operating expenses:

Research and development (52) (60) (125)

Selling and marketing (263) (323) (652)

General and administrative (974) (1,098) (2,250)

Other income (expenses) 1 6 (40) (29)

--------- --------- ----------

(1, 27 3) (1,521) (3,056)

--------- --------- ----------

Operating loss ( 46 1) (525) (1,373)

Finance income 25 413 814

Finance expenses (318) (110) (447)

--------- --------- ----------

Net finance Income (expenses) 8 (293) 303 367

--------- --------- ----------

Total comprehensive loss for

the year ( 75 4) (222) (1,006)

========= ========= ==========

Loss per share:

Basic and diluted loss per

share (in dollars) 4 (0.014) (0.004) (0.019)

========= ========= ==========

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

T42 IOT TRACKING SOLUTIONS PLC

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

U.S. Dollars in thousands

Capital

Share Reserve

Capital Premium Capital for Share-based Accumulated

* on Shares Reserve payment Loss Total

------------ ----------- -------- ---------------- ------------------ --------

(Unaudited) - 13,531 89 1,246 (15,404) (538)

Balance- January

1,

2023

Share based

payment

- Note 4 - - 4 - 4

Comprehensive loss

for the period - - - (754) (754)

----------------

Balance - June 30,

2023 - 13,531 89 1,250 (16,158) (1,288)

============= =========== ======== ================ ================== ========

(Unaudited)

Balance- January

1,

2022 - 13,351 89 1,151 (14,398) 193

Exercise of

options

(Note 4) - 74 74

Share based

payment - 48 - 48

Comprehensive loss

for the period - - - - (222) (222)

----------------

Balance- June 30,

2022 - 13,425 89 1,199 (14,620) 93

============= =========== ======== ================ ================== ========

(Audited)

Balance- January

1,

2022 - 13,351 89 1,151 (14,398) 193

Issuance of share

capital

(net of expenses) - 180 - - - 180

Share based

payment - - - 95 - 95

Comprehensive loss

for the year - - - - (1,006) (1,006)

----------------

Balance- December

31, 2022 - 13,531 89 1,246 (15,404) (538)

============= =========== ======== ================ ================== ========

* An amount less than one thousand.

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

T42 IOT TRACKING SOLUTIONS PLC

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. Dollars in thousands

Six Months Ended Year Ended

June 30 December

31

2023 2022 2022

--------- ---------- -----------------

CASH FLOWS FROM (FOR) OPERATING ACTIVITIES: Unaudited Unaudited Audited

--------- ---------- -----------------

Comprehensive loss (754) (222) (1,006)

Adjustments to reconcile net loss to

net cash provided by

(used in) operating activities:

Depreciation and amortization 225 211 437

Interest expense and exchange rate differences 55 (221) (374)

Share-based payment expense 4 48 95

Inventory write down - - -

Intangible assets impairment - - -

Capital gain - - (24)

Changes in assets and liabilities:

Decrease (Increase) in inventories 82 (444) 209

Decrease in trade receivables, net (99) 34 191

Decrease (Increase) in other receivables 46 62 89

Increase in Income Tax Authorities - (1) -

Increase (Decrease) in trade payables 158 72 (90)

Increase (Decrease) in other payables 385 (297) (478)

Net cash provided by (used in) operating

activities 102 (758) (951)

--------- ---------- -----------------

CASH FLOWS FOR INVESTING ACTIVITIES:

Purchases of property and equipment (8) (333) (318)

Decrease (Increase) in short-term deposits (2) 23 24

Purchase of intangible assets (72) (83) (166)

Net cash used in investing activities (82) (393) (460)

--------- ---------- -----------------

CASH FLOWS FROM FINANCING ACTIVITIES:

Repayment of short-term bank credit,

net (2) 37 (152)

Receipt (Repayment) of short-term loans

from banks, net (135) (65) -

Receipt of l ong-term loans - - -

Receipt of loans , net 250 - 250

Proceeds from (Repayment to) shareholders

and related parties, net 28 (4) 28

Repayment of Leasehold liability (86) (80) (174)

Receipt (Repayment) of long-term loans (34) (34) (81)

Proceeds from issue of shares , net - 74 180

--------- ---------- -----------------

Net cash provided by (used in) financing

activities 21 (72) 51

--------- ---------- -----------------

Increase (Decrease) in cash and cash

equivalents 41 (1,223) (1,360)

Cash and cash equivalents at the beginning

of the period 174 1,534 1,534

--------- ---------- -----------------

Cash and cash equivalents at the end

of the period 215 311 174

========= ========== =================

Appendix A - Additional Information

Interest paid during the period 189 (73) 251

========= ========== =================

Appendix B - Non-cash financing activities

Issuance of shares to a related party

in payment of debt 103 - -

==== === =======

Issuance, of a convertible loan note

in lieu of settlement of a supplier debt - 418 319

==== === =======

The Company had non-cash activities in the period of entering into

new lease agreements of 103 thousand $.

The accompanying notes are an integral part of the interim

condensed consolidated financial statements.

T42 IOT TRACKING SOLUTIONS PLC

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

U.S. Dollars in thousands

NOTE 1 GENERAL INFORMATION

-

a. The Reporting Entity

1. t42 IoT Tracking Solutions PLC ("the Company") was incorporated

in Jersey on November 28, 2012. The Group provides real-time

tracking, security, and monitoring solutions for the global

supply chain, logistics, container, and freight market.

See Note 1 (c) regarding the Company's efforts to raise additional

funds.

The Company fully owns t42 Ltd., an Israeli company that engages

in the same field, and Starcom Systems Limited, a company in

Jersey.

The Company's shares are admitted for trading on the London

Stock Exchange's AIM market.

Address of the official Company office in Israel of t42 Ltd.

is:

96 Derech Ramatayim, Hod-Hasharon, Israel.

Address of the Company's registered office in Jersey of Starcom

Systems Limited is:

IFC5, St Helier, Jersey, JE1 1ST

b. Definitions in these financial statements:

1. International Financial Reporting Standards (hereinafter:

"IFRS") - Standards and interpretations adopted by the International

Accounting Standards Board (hereafter: "IASB") that include international

financial reporting standards (IFRS) and international accounting

standards (IAS), with the addition of interpretations to these

Standards as determined by the International Financial Reporting

Interpretations Committee (IFRIC) or interpretations determined

by the Standards Interpretation Committee (SIC), respectively.

2. The Company - t42 IoT Tracking Solutions PLC

3. The subsidiaries - t42 Ltd. and Starcom Systems Limited.

4. Starcom Jersey - Starcom Systems Limited.

5. T42 Israel - t42 Ltd.

6. The Group - t42 IoT Tracking Solutions PLC and the Subsidiaries.

7. Related party - As determined by International Accounting

Standard No. 24 in regard to related parties.

Significant event during and

c. after the period:

During July 2023, the Company raised $1.3m (before expenses) to

support both existing orders and the Company's new lease-based

order strategy and to repay certain existing loans. The funding is

in the form of a secured convertible loan ("Loan") provided to t42

Limited by Ewave Mobile Ltd.) ("Lender"), an international group

providing solutions across a range of sectors, including supply

chain management.

T42 IOT TRACKING SOLUTIONS PLC

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

U.S.

Dollars

in

thousands

The Loan, which carries interest at 10% per annum, payable

quarterly on the principal drawn, was drawn down as

to $600,000 immediately, $400,000 in three equal tranches

during August 2023, and the balance of $300,000 by 30

September 2023.

The Loan, together with accrued interest at the time

of conversion, may be converted, at the discretion of

the Lender, at any time prior to the Loan repayment

date of 20 January 2025, into such number of new t42

ordinary shares as corresponds to 29.5% of the Company's

issued ordinary share capital immediately following

such conversion. The Loan may be converted in part,

on a pro rata basis to the above terms.

In order to meet the cashflow requirements deriving

from the growing current and future backlog of orders

and managing current and potential activities in the

remainder of 2023, the Company will be dependent on

the necessary funding being secured.

T42 IOT TRACKING SOLUTIONS PLC

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

U.S. Dollars in thousands

NOTE 2 - BASIS OF PREPARATION AND CHANGE IN THE GROUP'S ACCOUNTING

POLICIES

Basis of preparation

a.

The interim consolidated financial statements have been

prepared in accordance with generally accepted accounting

principles for the preparation of financial statements

for interim periods, as prescribed in International Accounting

Standard No. 34 ("Interim Financial Reporting").

The interim consolidated financial information should

be read in conjunction with the annual financial statements

as of December 31, 2022 and for the year ended on that

date and with the notes thereto.

The significant accounting policies applied in the annual

financial statements of the Company as of December 31,

2022 are applied consistently in these interim consolidated

b. financial statements.

Revenue from a contract with a customer with a significant

finance component

The Group entered a contract with a client that has a

significant financing component considering the length

of time between the customers' payment and the transfer

of the products, as well as the prevailing interest rate

c. in the market. As such, the transaction price for these

contracts is discounted, using the interest rate implicit

in the contract and finance income is recorded accordingly.

Use of estimates and judgments

The preparation of financial statements in conformity

with IFRS requires management of the Company to make

judgments, estimates and assumptions that affect the

application of accounting policies and the reported amounts

of assets, liabilities, income and expenses. Actual results

may differ from these estimates.

The judgment of management, when implementing the Group

accounting policies and the basic assumptions utilized

in the estimates that are bound up in uncertainties are

consistent with those that were utilized to prepare the

annual financial statements.

Information about critical judgment in applying accounting

policies that have a significant effect on the amounts

recognized in the consolidated financial statements is

included in the following Notes:

Note 5 - financial liabilities of convertible loans and

warrants.

Exchange rates:

d.

As of June 30 As of December

31

2023 2022 2022

Exchange rate of NIS

in U.S. $ 0.27 0.286 0.284

Exchange rate of U.S.

$ in GBP 0.79 0.826 0.83

Year Ended

Six Months Ended December 31

June 30

2023 2022 2022

Change of NIS in U.S.

$ (4.9%) (11.27%) (11.6%)

Change of U.S. $ in GBP (4.6%) 11.68% 12.2%

T42 IOT TRACKING SOLUTIONS PLC

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

U.S. Dollars in thousands

NOTE 3 INTANGIBLE ASSETS, NET

-

Total

Cost: Unaudited

Balance as of January

1, 2023 1,884

Additions during the period 72

Balance as of June 30,

2023 1,956

------------

Accumulated Depreciation:

Balance as of January

1, 2023 (863)

Amortization during the

period (95)

Balance as of June 30,

2023 (958)

------------

Impairment of assets -

Net book value as of June

30, 2023 998

============

Total

Cost: Unaudited

Balance as of January

1, 2022 1,718

Additions during the period 83

Balance as of June 30,

2022 1,801

-----------

Accumulated Depreciation

:

Balance as of January

1, 2022 (684)

Amortization during the

period (89)

Balance as of June 30,

2022 (773)

-----------

Impairment of assets -

-----------

Net book value as of June

30, 2022 1,02 8

===========

Total

Cost: Unaudited

Balance as of January

1, 2022 1,718

Additions during the year 166

Balance as of December

31, 2022 1,884

--------------

Accumulated Amortization

:

Balance as of January

1, 2022 (684)

Depreciation during the

year (179)

Balance as of December

31, 2022 (863)

--------------

Net book value as of December

31, 2022 1,021

==============

T42 IOT TRACKING SOLUTIONS PLC

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

U.S. Dollars in thousands

NOTE 4 SHARE CAPITAL

-

a. Composition - ordinary shares of no-par value, issued

and outstanding - 5 4 ,026,822 shares and 54,026,822

shares as of June 30, 202 3 , and December 31, 2022,

respectively.

b. A Company share grants to its holder voting rights, rights

to receive dividends and rights to net assets upon dissolution.

c. Weighted average number of shares used for calculation

of basic and diluted loss per share:

June 30 June 30 December 31

2023 2022 2022

----------------- ----------------- -------------------

Unaudited Unaudited Audited

----------------- ----------------- -------------------

Number 54,026,822 52,833,452 52,830,858

================= ================= ===================

The following table lists the number of share options and

warrants with the exercise prices of share options during the

reported period:

Six months ended Twelve months ended

June 30, 2023 December 31, 2022

------------------------ ----------------------------

Unaudited Audited

------------------------ ----------------------------

Weighted

Number of average

options exercise Number of Weighted average

and warrants price options exercise price

------------- --------- ---------- ----------------

GBP GBP

------------------------ ----------------------------

Share options outstanding at

beginning of period 12,545,222 0.177 10,122,112 0.2 06

Share options granted during

the period - - 2,976,185 0.07

Shares options exercised during

the period - - (500,000) 0.12

Share options expired during

the period 1,138,339 0.37 (53,075) 0.12

Share options outstanding at

end of period 11,406,883 0.158 12,545,222 0.177

============= ========= ========== ================

Share options exercisable at

end of period 11,243,883 0. 152 12,215,555 0.171

============= ========= ========== ================

For the six months ended June 30, 2023 and 2022 the Company

recognized share based payment expenses, in the amount of $4 and

$48, respectively.

T42 IOT TRACKING SOLUTIONS PLC

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

U.S. Dollars in thousands

NOTE 5 - FINANCIAL LIABILITIES OF CONVERTIBLE LOANS AND WARRANTS

a. During December 2021, the Company received, from third parties,

loans in the total amount of $1,251,000 (GBP925,000) in the form

of unsecured convertible loans enabling the lenders to convert

the loans at an exercise price of GBP0.15 per share at any time,

subject to regulatory provisions, up to December 31, 2023.

The convertible loans attract interest at the rate of 8% per annum

calculated by reference to the principal amount of the convertible

loans. If not converted, the loans will be repayable on December

31, 2023.

In addition, the lenders received:

- fully vested warrants to subscribe a total of 1,541,667 further

shares at an exercise price of GBP0.17 per share; any unexercised

warrants expire at the end of two-years from grant, and fully vested

warrants to subscribe a total of 1,541,667 further shares at an

exercise price of GBP0.19 per share; any unexercised warrants expire

at the end of three-years from grant.

The loan was evaluated and divided into different components by

an independent appraiser: Conversion component at fair value, Warrants

at fair value and Amortized cost of loan, with Transaction costs

allocated according to the component's fair value ratio (please

see table in 5(d) below). The part of the expenses that is attributed

to the amortized cost of the loan was reduced from its cost. An

effective interest rate was calculated for the liability of the

loan, based on its amortization table.

b. During December 2022, the Israeli subsidiary entered into a

loan agreement with CSS Alpha Global Pte Ltd for the provision

of a 12-month secured US$500,000 debt facility. The Agreement provided,

inter alia, for interest at 2 per cent per month, with 9 monthly

repayments starting 3 months after drawdown. Security is by way

of a second charge on assets, a personal, guarantee from the Company's

CEO, limited to 20 per cent of the loan and a deposit with CSS

of 3,000,000 new t42 shares. In addition, warrants for a total

of 2,976,185 shares in t42 were issued to CSS, exercisable at 7p

per share over 5 years. The initial drawdown was provided in December

2022, the second and last drawdown was provided in January, 2023.

The Company repaid $42,000 during the 6 month reported period,

and another $300,000 after the reported period. This loan will

shortly be fully repaid.

c. In December 2022, the Company issued a GBP265,000 convertible

loan note (CLN) to a supplier, to be applied in lieu of settlement

of a supplier debt, assisting with the Company's cashflow management.

The CLN bears interest at 3% per annum, payable quarterly, and

is repayable by 31 December 2024. The CLN is convertible at 9p

per share at the discretion of the holder. In addition, the Company

has the right to enforce conversion of GBP100,000 of the CLN in

the event t42's share price exceeds 12p and the balance if the

share price exceeds 15p.

7

d. Total revaluation expenses regarding the loan's components in

the statement of comprehensive loss for the reported period are

set below:

Loan component Conversion Warrant

component

--------------- ----------- --------

Balance as of January

1, 2022 857 279 118

Additions during the year 480 27 77

Finance (income) expenses 131 (272) (117)

Payments (15) - -

Balance as of December

31, 31, 2022 1,453 34 78

Additions during the year 250 - -

Finance (income) expenses 2 74 (20) (26)

Payments (113)

Conversion - - -

Balance as of June 30,

2023 1,864 14 52

T42 IOT TRACKING SOLUTIONS PLC

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

U.S. Dollars in thousands

e. For the period ended June 30, 2023, the estimated fair values

of the Warrants and the Convertible component were measured by an

independent appraiser as follows:

Period ended

June 30,

2023

-----------------

Expected term 0.5-4.5 Years

Expected average volatility 40%

Expected dividend yield -

Risk-free interest rate 5.341%

Fair value at the end of the period GBP0-0.0176

The level of the fair value hierarchy is level two.

Common Stock Market Value measured in calculation $0.05 5

f. In March 2022, 500,000 ordinary shares of no par value were

issued at a price of 12p per share following the exercise of

warrants by directors.

T42 IOT TRACKING SOLUTIONS PLC

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

U.S. Dollars in thousands

NOTE 6 SHAREHOLDERS AND RELATED PARTIES

-

a. Related parties that own the controlling shares in the

Group are:

Mr. Avraham Hartman ( 10.53 %) and Mr. Uri Hartman ( 5.56

%) .

b. Short-term balances: June 30 December

31

2023 2022 2022

---------- ------------------ ---------

Unaudited Unaudited Audited

---------- ------------------ ---------

Credit balance

Avi Hartmann (21) (15) (20)

Uri Hartmann (554) (508) (545)

Total Credit balance (575) (523) (565)

---------- ------------------ ---------

Loans

Avi Hartmann 49 53 69

Uri Hartmann (246) (238) (248)

---------- ------------------ ---------

Total Loans (197) (185) (179)

---------- ------------------ ---------

Total Short-term

balances (772) (708) (744)

========== ================== =========

c. Transactions: Six Months Ended Year Ended

June 30 December

31

2023 2022 2022

---------- ---------- -------------

Unaudited Unaudited Audited

---------- ---------- -------------

Total salaries, services

rendered and related

expenses for shareholders 178 195 381

========== ========== =============

Total share-based payment

expenses 2 2 3

========== ========== =============

Non-executive directors'

fees 38 56 95

========== ========== =============

Interest to related

parties 5 5 10

========== ========== =============

NOTE 7 - COST OF SALES

Six Months Ended Year Ended

June 30 December

31

2023 2022 2022

---------- ---------- -----------

Unaudited Unaudited Audited

---------- ---------- -----------

Purchases and other 882 1,536 1,970

Amortization 95 89 180

(Decrease) Increase in

Inventory (82) (444) 208

895 1,181 2,358

========== ========== ===========

T42 IOT TRACKING SOLUTIONS PLC

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

U.S. Dollars in thousands

NOTE 8 - NET FINANCE (INCOME) EXPENSES

Six Months Ended Year Ended

June 30 December

31

2023 2022 2022

---------- ---------- -----------

Unaudited Unaudited Audited

---------- ---------- -----------

Exchange rate differences 25 292 455

Evaluation of Warrants

and Convertible component

of loan (117) 96 359

Bank charges (31) (40) (50)

Interest to banks and

others (163) (40) (382)

Interest to suppliers - - (5)

Interest to related parties (5) (5) (10)

Interest income from - - -

deposits

Net finance income (expenses) (291) 30 3 367

========== ========== ===========

NOTE 9 SEGMENTATION REPORTING

-

Differentiation policy for the segments:

The Company's management has defined its segmentation policy

based on the financial essence of the different segments.

This refers to services versus goods, delivery method and

allocated resources per sector.

On this basis, the following segments were defined: Hardware

and SaaS.

Segment information regarding the reported segments:

Hardware SaaS Total

---------- ------- ---------

Period Ended 30.06.2023:

(Unaudited)

Segment revenues 728 979 1,707

Cost of sales (753) (142) (895)

---------- ------- ---------

Gross profit (25) 837 812

Period Ended 30.06.2022:

(Unaudited)

Segment revenues 1,086 1,091 2,177

Cost of sales (1,056) (125) (1,181)

---------- ------- ---------

Gross profit 30 966 996

Year Ended 31.12.2022:

(Audited)

Segment revenues 2,065 1,976 4,041

Gross profit (loss) (2,105) (253) (2,358)

---------- ------- ---------

(40) 1,723 1,683

NOTE 10 SIGNIFICANT EVENTS DURING AND AFTER THE REPORTED PERIOD

-

See Note 1 (c).

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BDGDCCXDDGXR

(END) Dow Jones Newswires

September 27, 2023 08:43 ET (12:43 GMT)

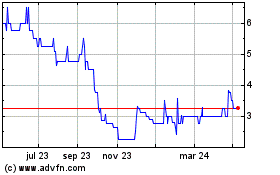

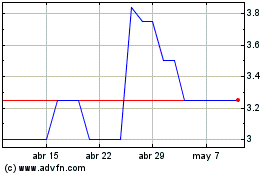

T42 Iot Tracking Solutions (LSE:TRAC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

T42 Iot Tracking Solutions (LSE:TRAC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024