TIDMTSTL

RNS Number : 1925Q

Tristel PLC

16 October 2023

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

Tristel plc

("Tristel", the "Company" or the "Group")

Audited Preliminary Results

for the year ended 30 June 2023

Sales and adjusted PBT ahead of consensus forecasts

Strongest ever outlook in Tristel's 30 year history driven by

key North American regulatory approvals

Tristel plc (AIM: TSTL), the manufacturer of infection

prevention products for hospitals, announces its audited

preliminary results for the year ended 30 June 2023, showing strong

revenue growth from continuing products well ahead of internal

growth targets. The business continues to be profitable with

high gross margins and remains both debt free and cash

generative.

The Company's core business is the sale to hospitals of its

proprietary chlorine dioxide chemistry for the decontamination of

medical devices under the Tristel brand (86% of total sales), and

for the sporicidal disinfection of environmental surfaces under the

Cache brand (9% of total sales).

Financial Highlights

-- Turnover of GBP36.0m (2022: GBP31.1m), a 16% increase. 22%

growth to GBP36.0m from continuing products (2022: GBP29.6m)

-- Overseas sales continue to grow, up 17% to GBP23.5m (2022:

GBP20.1m), representing 65% of total sales (2022: 65%)

-- Gross margin increased to 81% (2022: 80%)

-- Adjusted EBITDA* margin of 25% (2022: 24%)

-- Adjusted pre-tax profit* of GBP6.2m (2022: GBP4.5m) slightly above consensus forecasts

-- Reported pre-tax profit of GBP5.1m (2022: GBP1.6m)

-- Adjusted EPS* up 39% to 10.67p (2022: 7.68p). Basic EPS of 9.44p (2022: 2.09p)

-- Dividend per share for the full year up 10% to 10.50p (2022: 9.55p)

-- Cash of GBP9.5m (2022: GBP8.9m), with continued strong

operating cashflow of GBP8.4m in the year (2022: GBP5.6m)

* before share-based payments, and impairment of intangibles in

FY 2022

Operational Highlights

-- US FDA Class II device approval for Tristel ULT as a

high-level disinfectant for ultrasound probes, with nationwide

launch underway

-- Regulatory approval in Canada for Tristel OPH as a high-level

disinfectant for ophthalmic devices with first sales recorded in Q1

FY 2024

-- Majority of UK and European regulatory approvals for Cache

product range expected to be secured in FY 2024

-- Continued investment in exciting pipeline of new product innovations

Paul Swinney, Chief Executive of Tristel plc, said: " The

enormous achievement of the year has been the FDA approval, which

enables us to enter the largest healthcare market in the world. We

will also be able to leverage the significance of an FDA approval

in countries that look to the USA regulator for their own practice.

This includes Central and South America. We now have the

opportunity to establish a global footprint for our products and

technology.

We have commenced manufacture and have shipped product to our

first customers in the USA. The outlook for the Company is the

strongest it has been in its 30-year history."

CFO video & investor presentations

Please find a link to a video overview relating to the Company's

preliminary results from the Group's Chief Financial Officer, Liz

Dixon here -

https://stream.brrmedia.co.uk/broadcast/6529123cebb7e6c1a1dcb0da.

Paul Swinney, CEO, and Liz Dixon, CFO, will present the

Company's results via the Investor Meet Company platform today at

11:30 BST. The presentation will also be available for playback

after the event. Investors can sign up to Investor Meet Company for

free and add to meet Tristel plc via:

https://www.investormeetcompany.com/tristel-plc/register-investor

An in-person presentation will take place at 16:30 BST, which is

open to all existing and potential shareholders. T he Company will

welcome investors to 85 Gresham Street, London, EC2V 7NQ from

4.15pm for a 4.30pm start and will be followed by refreshments. If

you would like to attend, please contact Walbrook PR on 020 7933

8780 or email tristel@walbrookpr.com .

The results presentation is available on the Company's website:

https://tristelgroup.com/

For further information please contact:

Tristel plc https://tristelgroup.com/

Paul Swinney, Chief Executive via Walbrook PR

Officer

Liz Dixon, Chief Financial Officer

Walbrook PR Ltd Tel: +44 (0)20 7933 8780 or tristel@walbrookpr.com

Paul McManus / Lianne Applegarth Mob: +44 (0)7980 541 893 / +44 (0)7584

/ 391 303

Charlotte Edgar +44 (0)7884 664 686

Cavendish Tel: +44 (0)20 7220 0500

Geoff Nash/ Charlie Beeson (Corporate

Finance)

Sunila de Silva (ECM)

Chairman's Statement

GROUP STRATEGY

The Group continues to focus on the global hospital market,

using its proprietary chlorine dioxide chemistry for two

applications: the decontamination of medical devices under the

Tristel brand, and the disinfection of environmental surfaces under

the Cache brand.

During the year we achieved the milestone of securing De Novo

clearance for our hand-held high-level disinfectant, Tristel ULT,

from the United States Food and Drug Administration (FDA). The

agency has approved Tristel ULT as a Class II device for endocavity

ultrasound probes and skin surface transducers. This approval

complements an earlier approval that we received from the United

State Environmental Protection Agency (EPA) for our chemistry's use

in the same packaging format, but for general surfaces in the

ultrasound setting. In granting its approval the FDA has created a

new category of high-level disinfectant being a foam or gel. This

format implies application to the device by hand, which is the USP

of Tristel's high-level medical device disinfectants: they are

applied by hand rather than administered inside a machine.

Today, Tristel is the market leader in Europe, Middle East and

Asia-Pacific in manual high-level disinfection of heat sensitive

non-lumened diagnostic medical devices. During the current

financial year we will enter the North American market and our

ambition to become the global market leader can be further pursued.

We are delighted to announce that manufacturing has begun in the

USA and we have already shipped our first orders to customers.

During the year, 35% of our revenues were generated in the

United Kingdom and 65% in the rest of the world. Throughout the 40

countries in which we actively market our products, the number of

diagnostic procedures involving medical devices that can be

disinfected by a Tristel product increased to pre-pandemic levels.

During the year, Tristel medical device disinfectant revenue, which

is driven by the number of diagnostic procedures, increased to

GBP30.8m from GBP25.4m in the previous year, and GBP20.8m in FY19,

the year before COVID-19 disrupted hospital services worldwide.

Our second product range, Cache, made much slower progress

during the year. Revenue was GBP3.3m compared to GBP3.2m in the

previous year. Part of the new Cache range is still in the product

design and testing stage, and a further portion of the range is

waiting for regulatory approvals in key markets. In Europe, CE

marking is required for medical device disinfectants, and whilst

the Cache product range is intended for environmental surfaces,

many of the surfaces around the patient are considered medical

devices requiring CE marking as well as approval under the European

Biocidal Products Regulation. Post Brexit, the UK introduced UKCA

Marking Certification for medical devices, and we are waiting to

receive UKCA approval for the new Cache products.

These approvals have taken longer than originally anticipated

but we are confident that the majority will be secured in the

current financial year, giving us the opportunity to deliver

significant growth in sales of the Cache product range going

forward.

INVESTING IN GROWTH

The regulatory environment in which we are operating is becoming

ever more complicated and demanding and we must comply with

parallel (and sometimes competing) regulatory frameworks.

Compliance can only be achieved by building the best Quality

Assurance and Regulatory Affairs teams in a highly competitive

market for such skills and we have invested in this capability

consistently over the course of the past five years. Furthermore,

highly regulated products require highly technical marketing and we

have also invested heavily in our marketing and technical support

functions during the year.

We continue to invest in the best systems for a business of our

size and complexity. The organisation is deeply committed to a

digital transformation programme across all facets of our

operation. Equally, we have committed significant expenditure in

our IT and cyber security infrastructure, increasing spend to

GBP1.2m from GBP0.8m in the previous year.

New product development is a key focus for the Board and we

continued to invest during the year in three areas:

-- The 3T platform which is our app-based Train, Trace and Test

tool that enables a user of a Tristel medical device high-level

disinfectant to record all steps of the decontamination

process.

-- AI - capabilities incorporated into the app that enable

objective verification that the key steps in the decontamination

process have been performed correctly.

-- Colour change technology - visual indicators that provide

compliance training tools for the user and which can be

incorporated into the decontamination process to ensure key steps

in the decontamination process are performed correctly.

We made 62 patent applications during the year and six

applications went to grant. During the year we invested GBP0.9m in

product development and GBP0.3m in securing and maintaining

intellectual property protection.

NORTH AMERICA

During the current financial year, we will launch Tristel ULT in

the United States for the high-level disinfection of ultrasound

probes. Our business partner for North and South America is Parker

Laboratories Inc, located in New Jersey, who will manufacture our

products and will sell Tristel ULT through its well-established

distribution network. Parker's own product range is focussed on the

conductive gels that are used in every ultrasound scan and the

Parker gel and the Tristel hand-applied high-level disinfectant are

perfect complementary products for all ultrasound scans, of which

we estimate 215 million are performed annually in the United

States.

In Canada we have secured approval from Canada Health for

Tristel OPH as a high-level disinfectant for ophthalmic devices and

have appointed Innova Medical as our distributor into the Canadian

ophthalmic market. Sales have commenced in the first quarter of

financial year 2024.

OUR PEOPLE

I would like to thank our employees for their commitment

throughout the year.

Breaking into the North American market is a remarkable

achievement for the Company and the team that worked tirelessly on

the FDA submission over many years. By securing approval from the

FDA we have joined a very small group of high-level disinfectant

products that are approved for sale in the world's largest

ultrasound market, and we have done so with a technology and

product format that our young business invented twenty years ago.

Today, the organisation has matured into a globally recognised

force in the infection prevention industry - an achievement that we

can attribute to the creativity and resourcefulness of our

employees.

RESULTS

Our gross profit margin increased slightly to 81% (restated

2022: 80%). Overheads (excluding share-based payments, depreciation

and amortisation) rose by 14% from GBP17.3m to GBP19.9m,

principally due to the increase in headcount from 204 to 224. The

associated increase in wages and salaries was GBP1.7m (excluding

share-based payments).

Adjusted pre-tax profit (before share-based payments of GBP1.1m

and impairments of nil) rose 35% from GBP4.6m to GBP6.2m. Statutory

pre-tax profit increased to GBP5.1m from GBP1.6m and the statutory

margin rose to 14% from 5%. Charges associated with share-based

payments have been included as adjusting items. Although

share-based compensation is an important aspect of the compensation

of our employees and executives, management believes it is useful

to exclude share-based compensation expenses from adjusted profit

measures to better understand the long-term performance of the

underlying business.

Earnings per share (EPS) (adjusted for the add-back of the

share-based payment charge and impairment charges) was 10.67 pence

(restated 2022: 7.68 pence). Basic EPS was 9.44 pence (restated

2022: 2.09 pence) and diluted EPS was 9.34 pence (restated 2022:

2.07 pence).

See note 9 for reconciliation of non-GAAP measures.

BALANCE SHEET, CASH AND DIVID

The Group has continued to be highly cash generative during the

year and the balance sheet is debt free (with the exception of

lease liabilities). The combined cash and short-term deposit

balance at 30 June 2023 was GBP9.5m, with GBP2.9m being on short

term deposit (2022: GBP8.9m).

The Board is recommending a final dividend of 7.88 pence (2022:

3.93 pence). Combined with the interim dividend of 2.62 pence, the

total dividend pay-out for the year will be 10.5 pence per share, a

10% increase on last year's total dividend pay-out of 9.55 pence,

which included a special dividend of 3 pence. Going forward the

Board's intention is to increase the dividend annually in line with

the year's increase in EPS, committing to minimum dividend growth

of 5%. This final dividend will be paid on 22 December 2023, to

shareholders on the register on 24 November 2023 , the associated

ex-dividend date is 23 November 2023.

OUTLOOK

During 2022 we rationalised our product portfolio to further

improve gross margins, sharpen our focus on the hospital market and

our chlorine dioxide technology. During 2023 the negative impact on

our business of both Brexit and COVID-19 receded and we resumed

both top and bottom-line growth. We now have a normalised

marketplace in all 40 countries in which we operate and access to

the North American market. The growth possibilities for the Company

are stronger than ever.

Dr Bruno Holthof

Non Executive Chair

16 October 2023

Chief Executive's Report

Overview

The year ended 30 June 2023 was encouraging for the Group. The

highlights were:

-- The beneficial impact of the product portfolio

rationalisation, which was completed during 2022, flowed through to

the results for 2023;

-- The negative impact of both Brexit and COVID-19 receded and

we resumed top and bottom-line growth in line with our pre-pandemic

trajectory;

-- We gained clearance from the United States Food and Drug

Administration for our Tristel ULT high-level disinfectant and we

will be actively promoting our medical device disinfectants in

North America during 2024.

Financial targets

In October 2022 we established our financial plan for the three

years to 30 June 2025, which was a continuation of the plan for the

prior three-year period ending in June 2022. The three key

financial targets of both the old and new plans are:

i) sales growth in the range of 10% to 15% per annum as an

annual average over the three years;

ii) the achievement in each year of an EBITDA margin (excluding

share-based payment charge) of at least 25%, and

iii) to increase profit before tax (excluding share-based

payments) year-on-year, independently of the other two targets.

The COVID-19 pandemic and the disruption to NHS purchasing

patterns caused by Brexit negatively impacted our performance over

the period. The business is now in a much stronger position. For

transparency, our performance against the targets set in 2019 has

been:

Financial year Revenue Annual Average *Adjusted Increase

GBPm revenue revenue EBITDA in profit

growth growth margin before tax

% (excluding

SBP charge)

Ended 30.06.19 (base 26.2 - - - -

year)

-------- --------- --------- ---------- -------------

Ended 30.06.20 31.7 21.0% 21.0% 30.9% Yes

-------- --------- --------- ---------- -------------

Ended 30.06.21 - restated 31.0 -2.2% 9.4% 27.1% No

-------- --------- --------- ---------- -------------

Ended 30.06.22 31.1 0.3% 6.4% 24.0% No

-------- --------- --------- ---------- -------------

Ended 30.06.23 36.0 16% 4.7% 24.9% Yes

-------- --------- --------- ---------- -------------

*See note 9.

Our marketplace and technology

Our entire business is focussed on preventing the transmission

of microbes from one object or person to another. We pursue this

purpose because microbes are the cause of infection in humans. They

can cause illness or death and place a heavy cost on individuals

and society. We achieve our purpose by developing products based

upon a very powerful disinfectant: chlorine dioxide, of which we

have a proprietary formulation.

Our mission is most relevant to hospitals where the risk of

transmission of infection between individuals is highest. Infection

prevention is a basic requirement for the safe and effective

provision of healthcare, true for all hospitals in all countries.

Over 98% of our revenues are of consumable products performing a

vital function that is non-discretionary.

Our strategy focusses upon our proprietary chlorine dioxide

chemistry and two principal applications for it: first, the

high-level disinfection of medical devices under the Tristel brand

(accounting for 86% of continuing product revenues in the year);

and second, the disinfection of surfaces in hospitals under the

Cache brand (accounting for 9% of continuing product revenues in

the year). Within this second activity, we make a distinction

between sporicidal efficacy that is achieved with the use of our

chlorine dioxide chemistry, and the low-level performance claims

that are made by most other disinfectant chemistries. Our objective

is to create a clearly identifiable segment within surface

disinfection for sporicidal products and to be the global market

leader in this segment.

With respect to Tristel, our proposition is unique in two

respects: first, we are the only provider of chlorine dioxide-based

high-level disinfectants validated and regulated for use with

semi-critical medical devices; and second, we are unique in

applying the active ingredient in a manual process. Other

high-level disinfection processes using the active ingredients

peracetic acid and hydrogen peroxide - alternatives to chlorine

dioxide - require automated equipment to contain and control the

chemistry.

Manual application means Tristel products are ideally suited for

hospital departments that carry out diagnostic procedures with

small heat-sensitive medical instruments. These include:

nasendoscopes used in Ear, Nose and Throat departments;

laryngoscope blades used in emergency medicine; cardio echo probes

used in the diagnosis of heart disease; tonometers used in

ophthalmology, and ultrasound probes used in both women and men's

health. In these areas of the hospital, we are the simplest,

quickest, and most affordable high-performance disinfection method

available. Consequently, in geographical markets in which we have

been present for some time, we hold truly significant market

share.

The cleaning and disinfection of environmental surfaces in

hospitals is ubiquitous and the global expenditure by hospitals on

surface disinfection is far greater than the expenditure on

decontaminating medical devices. The capability of a disinfectant

to kill bacterial spores is the defining hallmark of the

best-performing biocides, and chlorine dioxide is one of the elite

chemistries that can kill spores.

Revenue

We segment our business to reflect our corporate strategy and

geographical spread. We have developed distinctly different brands

for the two product categories: Tristel for medical device

disinfection and Cache for sporicidal surface disinfection. Our

strategic intention is to develop the Tristel and Cache brands and

product portfolios with a significant degree of independence from

each other, but both anchored upon our chlorine dioxide technology

platform and using the same sales teams in all countries.

The other product category, which we regard as non-core,

represents a much-reduced number of products that were not

discontinued in our rationalisation programme, and whose remaining

product life span is relatively short.

During the year, the revenue split across these product

categories was:

GBPm Brand Revenue % of total Revenue % of total

2021-22 2022-23

Medical device decontamination

in hospitals Tristel 25.4 82% 30.8 86%

-------- -------- ---------- -------- ----------

Environmental surface disinfection

in hospitals Cache 3.2 10% 3.3 9%

-------- -------- ---------- -------- ----------

Other - non-core Various 1.0 3% 1.9 5%

-------- -------- ---------- -------- ----------

Continuing products 29.6 95% 36.0 100%

-------- ---------- -------- ----------

Discontinued products Various 1.5 5% 0 0%

-------- -------- ---------- -------- ----------

Group 31.1 100% 36.0 100%

-------- ---------- -------- ----------

Revenue by channel

We sell our products directly to end-users in those markets in

which we have established a subsidiary, and through distributors in

markets where we have no corporate presence. During the year, the

revenue split by sales channel was:

2021-22 2022-23 Year-on-Year Percentage

Revenue Revenue change change

Hospital medical device

decontamination: Tristel

--------- --------- ------------- -----------

UK 9.7 11.9 2.2 23%

--------- --------- ------------- -----------

Australia 3.0 3.5 0.5 17%

--------- --------- ------------- -----------

Germany 4.5 5.0 0.5 11%

--------- --------- ------------- -----------

Western Europe 4.2 5.2 1.0 24%

--------- --------- ------------- -----------

Italy 1.0 1.4 0.4 40%

--------- --------- ------------- -----------

Other ROW 3.0 3.8 0.8 27%

--------- --------- ------------- -----------

Tristel global 25.4 30.8 5.4 21%

--------- --------- ------------- -----------

Hospital environmental

surface disinfection:

Cache

--------- --------- ------------- -----------

UK 2.3 2.4 0.1 4%

--------- --------- ------------- -----------

Australia 0.1 0.1 - -

--------- --------- ------------- -----------

Germany 0.1 0.1 - -

--------- --------- ------------- -----------

Western Europe 0.2 0.2 - -

--------- --------- ------------- -----------

Italy 0.0 0.0 - -

--------- --------- ------------- -----------

Other ROW 0.5 0.5 - -

--------- --------- ------------- -----------

Cache global 3.2 3.3 0.1 3%

--------- --------- ------------- -----------

Other revenue: various

brands 1.0 1.9 0.9 90%

--------- --------- ------------- -----------

Continuing products 29.6 36.0 6.4 22%

--------- --------- ------------- -----------

Discontinued products 1.5 0 (1.5) (100%)

--------- --------- ------------- -----------

Group 31.1 36.0 4.9 16%

--------- --------- ------------- -----------

Revenue by geography

The proportion of our revenue generated in overseas markets

continued to increase and reached 65%. The history over the

previous five years is shown in the table below.

2017-18 2018-19 2019-20 2020-21 2021-22 2022-23

Revenue split %

-------- -------- -------- -------- -------- --------

UK 49% 45% 40% 37% 35% 35%

-------- -------- -------- -------- -------- --------

Overseas 51% 55% 60% 63% 65% 65%

-------- -------- -------- -------- -------- --------

Annual revenue growth

%

-------- -------- -------- -------- -------- --------

UK 2% 9% 7% -10% -3% 14%

-------- -------- -------- -------- -------- --------

Overseas 19% 26% 32% 3% 2% 17%

-------- -------- -------- -------- -------- --------

*Sales made to international distributors are included within

overseas in the above table to align with the location of the end

customer. As these sales originate within the UK subsidiary, for

segmental reporting purposes they are included within the UK.

We have 14 subsidiaries selling directly into the hospital

marketplace in the United Kingdom, Belgium, the Netherlands,

France, Italy, Germany, Switzerland, Poland, Hong Kong, China,

Malaysia, Singapore, Australia, and New Zealand. We have

subsidiaries in the United States, Japan, India, Spain and Ireland

which are not yet active in terms of selling. We closed our Russian

subsidiary early in FY22.

During the year, in another 26 countries, we sold products

through national distributors.

Our Strategic Assets

We consider the assets that enable the Group to achieve its

strategic goals to be:

Our chlorine dioxide chemistry

There are three critically important elements that account for

the unique positioning of our chlorine dioxide chemistry:

1. The proprietary formulation,

2. Our focus over two decades on exploring the potential for

chlorine dioxide in the decontamination of medical instruments.

There is another application for chlorine dioxide chemistry which

all other businesses have concentrated upon which is water

treatment. From the inception of our business in the 1990's we

looked in a different direction - towards medical device

disinfection - a direction which others have not followed, and this

has given us the pioneer's advantage,

3. The length of time that we have enjoyed this pioneer position

has allowed us to collate a significant body of knowledge,

including published scientific data, the testimony of almost two

decades of safe use, a significant global footprint of regulatory

approvals and a library of proven compatibility with hundreds of

medical instruments, all of which would take a new entrant

significant time and cost to match.

Our regulatory programme succeeded in attaining 16 approvals for

11 products in nine countries during the year. This includes FDA

grant of the De Novo request for Tristel ULT.

Intellectual property protection

On 30 June 2023, we held 142 patents granted in 32 countries

providing legal protection for our products.

In its broadest sense, our intellectual property relates to:

1. Patents, trademarks and registered designs,

2. The scientific validation of our chemistry and our products

that have entered the public domain, via a number of peer-reviewed

and published papers,

3. The certification by medical device manufacturers that our

chemistry is compatible with their products. We enjoy official

compatibility with the instrumentation of 56 medical device

manufacturer, with respect to 1,449 of their individual models.

Our people possess an unrivalled body of knowledge relating both

to infection prevention and to chlorine dioxide, and they are a key

asset for the future of our business. Their domain knowledge

relates to the manufacture of chlorine dioxide-based products and

their development. The Company's R&D investment focusses

exclusively on our proprietary technology, searching for

improvements in microbial efficacy, reductions in hazards, and

greater efficiency in manufacture. In parallel, we invest in the

creation of packaging and delivery forms that enhance and simplify

the delivery of the chemistry and the user experience.

Progress in North America

The Company made significant progress in North America during

the year. The key event in June was the clearance by the FDA which

completed its review of the Company's De Novo request for

classification (Class II) of Tristel ULT as a high-level

disinfectant, and granted its approval for sale.

Tristel Duo, the Company's intermediate level disinfectant

approved by the US Environmental Protection Agency (EPA) for use on

the ultrasound console and the non-invasive parts of the endocavity

probe, was registered in all states in the USA.

The nationwide launch of Tristel ULT will commence on October

2023. The Company has established a manufacturing base with Parker

Laboratories Inc., New Jersey, and will utilise Parker's national

distribution network for the ultrasound market.

In Canada, the Company launched Tristel OPH as a high-level

disinfectant for ophthalmic devices at the country's Infection

Prevention Conference in May 2023.

Outlook

The enormous achievement of the year has been to gain FDA

approval, thereby gaining access to the largest healthcare market

in the world and creating the opportunity to leverage the

significance of an FDA approval in countries that look to the USA

regulator for their own practice. This includes Central and South

America. We now have the opportunity to establish a global

footprint for our products and technology. The outlook for the

Company is the strongest it has been in its 30 year history.

Paul Swinney

Chief Executive Officer

Tristel plc

Tristel plc

Consolidated Income Statement for the Year Ended 30 June

2023

*Restated

2023 2022

Note GBP 000 GBP 000

Revenue 3 36,009 31,123

Cost of sales (6,834) (6,182)

---------- -----------------------

Gross profit 29,175 24,941

Distribution expenses (323) (282)

Share based payments (1,061) (596)

Depreciation, amortisation and impairments (2,618) (5,216)

Administrative expenses, excluding share-based

payments, depreciation, amortisation and impairment (19,896) (17,265)

---------- -----------------------

Total administrative expenses (23,575) (23,077)

---------- -----------------------

Other operating income 4 167

Operating profit 5,281 1,749

---------- -----------------------

Finance income 10 1

Finance costs (179) (195)

---------- -----------------------

Net finance cost (169) (194)

---------- -----------------------

Profit before tax 5,112 1,555

Income tax expense 4 (651) (568)

---------- -----------------------

Profit for the year 4,461 987

========== =======================

Profit attributable to:

Owners of the company 4,461 987

========== =======================

Earnings per share from total and continuing

operations attributable to equity holders of

the parent

2023 2022

Restated

Basic - pence 6 9.44 2.09

Diluted - pence 6 9.34 2.07

The above results were derived from continuing operations.

* The Group has reconsidered its accounting policy for the

presentation of distribution costs in the income statement. The

prior year income statement has been restated for the

reclassification of costs between cost of sales and distribution

costs. As a result, the prior year has been restated to reflect a

decrease in the cost of sales of GBP282,000 with a corresponding

increase in distribution expenses. Note 8 details the only change

to the profit before tax and profit after tax for financial year

2022.

Tristel Plc

Consolidated Statement of Comprehensive Income for the Year

Ended 30 June 2023

2023 2022

GBP 000 GBP 000

Profit for the year 4,461 987

Items that may be reclassified subsequently to

profit or loss

Foreign currency translation gains/(losses) (214) 138

-------- --------

Total comprehensive income for the year 4,247 1,125

======== ========

Total comprehensive income attributable to:

Owners of the company 4,247 1,125

======== ========

Tristel Plc

(Registration number: 04728199)

Consolidated Statement of Financial Position as at 30 June

2023

Restated Restated

30 June 30 June 1 July

Note 2023 2022 2021

GBP000 GBP000 GBP000

Assets

Non-current Assets

Property, plant and equipment 2,922 2,791 3,119

Right of use assets 4,905 5,568 6,083

Goodwill 5,156 5,242 5,265

Intangible assets 4,757 4,318 6,704

Deferred tax assets 1,286 1,826 2,822

---------- --------- ---------

19,026 19,565 23,993

---------- --------- ---------

Current assets

Inventories 4,569 4,420 4,266

Trade and other receivables 7,081 5,851 5,255

Income tax receivable 1,146 962 170

Short term investments 2,432 - -

Cash and cash equivalents 7,113 8,883 8,094

---------- --------- ---------

22,341 20,116 17,785

---------- --------- ---------

Total assets 41,367 39,681 41,778

========== ========= =========

Equity and liabilities

Equity

Share capital 7 474 473 471

Share premium 14,188 13,996 13,600

Foreign currency translation

reserve (279) (65) (203)

Merger reserve 2,205 2,205 2,205

Retained earnings 14,089 13,078 15,334

---------- --------- ---------

Equity attributable to owners

of the company 30,677 29,687 31,407

Non-controlling interests 7 7 7

Total Equity 30,684 29,694 31,414

---------- --------- ---------

Non-Current liabilities

Lease liabilities 4,321 4,854 5,372

Deferred tax liabilities 599 720 637

---------- --------- ---------

4,920 5,574 6,009

---------- --------- ---------

Current Liabilities

Trade and other payables 4,801 3,222 3,476

Income tax payable 103 - -

Lease liabilities 859 942 629

---------- --------- ---------

5,763 4,413 4,355

---------- --------- ---------

Total liabilities 10,683 9,987 10,364

---------- --------- ---------

Total equity and liabilities 41,367 39,681 41,778

========== ========= =========

Tristel Plc

Consolidated Statement of Changes in Equity for the Year Ended

30 June 2023

Foreign

Share Share currency Merger Retained Non- controlling Total

capital premium translation reserve earnings Total interests equity

Note GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000

At 1 July 2022 473 13,996 (65) 2,205 12,371 28,980 7 28,987

Deferred tax asset

restatement 8 - - - - 333 333 - 333

IFRS 16

Restatement 8 - - - - 374 374 - 374

-------- -------- ------------ -------- --------- -------- ---------------- --------

As restated at 1

July 2022 473 13,996 (65) 2,205 13,078 29,687 7 29,694

Profit for the

year - - - - 4,461 4,461 - 4,461

Exchange

difference on

translation

of foreign

operations - - (214) - - (214) - (214)

-------- -------- ------------ -------- --------- -------- ---------------- --------

Total

comprehensive

income - - (214) - 4,461 4,247 - 4,247

Dividends - - - - (4,511) (4,511) - (4,511)

New share capital

subscribed 7 1 192 - - - 193 - 193

Share based

payment

transactions - - - - 1,061 1,061 - 1,061

-------- -------- ------------ -------- --------- -------- ---------------- --------

At 30 June 2023 474 14,188 (279) 2,205 14,089 30,677 7 30,684

======== ======== ============ ======== ========= ======== ================ ========

Right of use assets, deferred tax asset, lease liabilities and

retained earnings for the prior year have been restated. See note

8.

Foreign Restated* Restated*

Share Share currency Merger Retained Restated* Non- controlling Total

capital premium translation reserve earnings Total interests equity

Note GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000

At 1 July 2021 - 471 13,600 (203) 2,205 14,687 30,760 7 30,767

Deferred tax

asset

restatement 8 - - - - 333 333 - 333

IFRS 16

restatement 8 - - - - 314 314 - 314

As at 1 July

2021 restated 471 13,600 (203) 2,205 15,334 31,407 7 31,414

Profit for the

year - - - - 987 987 - 987

Exchange

difference on

translation

of foreign

operations - - 138 - - 138 - 138

-------- -------- ------------ -------- --------- --------- ---------------- ---------

Total

comprehensive

income - - 138 - 987 1,125 - 1,125

Dividends - - - - (3,091) (3,091) - (3,091)

New share

capital

subscribed 7 2 396 - - - 398 - 398

Deferred tax

through equity - - - - (795) (795) - (795)

Current tax

through equity - - - - 47 47 - 47

Share based

payment

transactions - - - - 596 596 - 596

-------- -------- ------------ -------- --------- --------- ---------------- ---------

At 30 June 2022

- restated 473 13,996 (65) 2,205 13,078 29,687 7 29,694

======== ======== ============ ======== ========= ========= ================ =========

Tristel Plc

Consolidated Statement of Cash Flows for the Year Ended 30 June

2023

Restated

2023 2022

Cash flows from operating activities GBP000 GBP000

Profit before tax 5,112 1,555

Adjustments to cash flows from non-cash items

Depreciation of leased assets 1,000 968

Depreciation of plant, property & equipment 734 632

Impairment of goodwill 68 67

Amortisation of intangible assets 816 1,105

Impairment of intangibles - 2,439

Share based payments - IFRS 2 1,061 596

Loss on disposal of property, plant and equipment 69 20

Lease interest 177 193

Other interest 2 2

Finance income (10) (1)

------- --------

9,029 7,576

Working capital adjustments

(Increase)/decrease in inventories (149) (154)

(Increase)/decrease in trade and other receivables (1,230) (596)

(Decrease)/increase in trade and other payables 1,330 114

Lease interest paid (177) (193)

Corporation tax paid (313) (772)

------- --------

Net cash flow from operating activities 8,490 5,726

------- --------

Cash flows from investing activities

Interest received 10 1

Purchase of intangible assets (1,570) (898)

Purchase of property plant and equipment (853) (305)

Cash deposit to short term investments (2,432) -

------- --------

Net cash used in investing activities (4,845) (1,202)

------- --------

Cash flows from financing activities

Payment of lease liabilities (1,126) (1,103)

Share issues 7 193 398

Dividends paid 5(4,511) (3,091)

------- --------

Net cash used in financing activities (5,444) (3,796)

------- --------

Net increase in cash and cash equivalents (1,799) 728

Cash and cash equivalents at the beginning

of the year 8,883 8,094

Exchange differences on cash and cash equivalents 29 61

------- --------

Cash and cash equivalents at the end of the

year 7,113 8,883

======= ========

Net Funds - liabilities from financing activities and cash and

cash equivalents

Leases Cash and Short term Total

cash equivalents investments

GBP000 GBP000 GBP000 GBP000

Net funds at 30 June 2021

(restated) (6,251) 8,094 - 1,843

Cash movement - 728 - 728

Payment of lease liabilities 1,103 - - 1,103

Lease interest (194) - - (194)

Acquisition - leases (427) - - (427)

Foreign exchange adjustments (27) 61 - (34)

------- ----------------- ------------ ------

Net funds as at 30 June 2022

(restated) (5,796) 8,883 - 3,087

------- ----------------- ------------ ------

Cash movement - (1,799) 2,432 633

Payment of lease liabilities 1,126 - - 1,126

Lease interest (176) - - (176)

Acquisition - leases (469) - - (465)

Terminations - leases 127 - - 124

Foreign exchange adjustments 7 29 - 36

------- ----------------- ------------ ------

Net funds as at 30 June 2023 (5,180) 7,113 2,432 4,365

------- ----------------- ------------ ------

1 Accounting Policies

Basis of accounting

This financial information has been prepared in accordance with

UK adopted international accounting standards and in accordance

with the provisions of the Companies act 2006.

Tristel plc, the Group's ultimate parent company, is a public

limited company incorporated and domiciled in the United

Kingdom.

Basis of consolidation

The Group financial statements consolidate those of the Company

and all of its subsidiary undertakings drawn up to 30 June 2023.

Subsidiaries are entities over which the Group has rights or is

exposed to variable returns from its involvement with the investee

and has the power to affect those returns by controlling the

financial and operating policies so as to obtain benefits from its

activities. The Group obtains and exercises control through voting

rights or IP held.

Unrealised gains on transactions between the Group and its

subsidiaries are eliminated. Unrealised losses are also eliminated

unless the transaction provides evidence of an impairment of the

asset transferred. Amounts reported in the financial statements of

subsidiaries have been adjusted where necessary to ensure

consistency with the accounting policies adopted by the Group.

Acquisitions of subsidiaries are dealt with by the acquisition

method. The acquisition method involves the recognition at fair

value of all identifiable assets and liabilities, at the

acquisition date, regardless of whether or not they were recorded

in the financial statements of the subsidiary prior to acquisition.

These fair values are also used as the basis for subsequent

measurement in accordance with the Group accounting policies.

Goodwill is stated after separating out identifiable intangible

assets. Goodwill represents the excess of the aggregate of the

consideration transferred and the amount of non-controlling

interest over the fair value of the Group's share of the

identifiable net assets of the acquired subsidiary at the date of

acquisition.

Non-controlling interests, presented as part of equity,

represent a proportion of a subsidiary's profit or loss and net

assets that is not held by the Group. The Group attributes total

comprehensive income or loss of subsidiaries between the assets of

the parent and the non-controlling interests based on their

respective ownership interests.

Subsidiaries

Subsidiaries are entities controlled by the Group. The Group

'controls' an entity when it is exposed to, or has rights to,

variable returns from its involvement with the entity and has the

ability to affect those returns through its power over the entity.

The financial statements of subsidiaries are included in the

consolidated financial statements from the date on which control

commences until the date on which control ceases. Interests in

subsidiaries are accounted for at cost less accumulated impairment

losses.

Step acquisitions

Prior to control being obtained, the Company accounts for its

investment in the equity interests of an acquiree in accordance

with the nature of the investment by applying the relevant

standard, e.g. IFRS 11 Joint Arrangements or IFRS 9 Financial

Instruments. As part of accounting for the business combination,

the Company remeasures any previously held interest at fair value

and takes this amount into account in the determination of goodwill

as noted above. Any resultant gain or loss is recognised in profit

or loss or other comprehensive income as appropriate.

Audit exemption

The Directors confirm that in accordance with sections 479A and

479C of the Companies Act 2006, Tristel Plc, as parent company of

the below entities, has given a parental guarantee to enable those

companies to claim exemption from audit. This guarantee relates to

the year ended 30 June 2023. The members of this companies have

agreed to the exemption from the audit by virtue of the guarantee

given by Tristel Plc, for the year ended 30 June 2023.

-- Tristel International Limited - Registered number

07874262

-- Scorcher Idea Limited - Registered number 04602679

-- Tristel Solutions Limited - Registered number 03518312

Changes in accounting policy

Since 30 June 2023 a number of standards, amendments to or

interpretations of standards have been issued as shown by the

following two tables, as follows:

Adoption of new and revised standards

The following accounting standards, interpretations and

amendments have been adopted by the Group in the Year Ended 30 June

2023:

Amendments to the following standards:

IFRS 3 Business combinations

IAS 16 Property, plant and equipment

IAS 37 provisions, contingent liabilities and contingent assets

These amended standards did not have a material effect on the

Group.

Accounting standards not yet adopted by the Group

The following accounting standards, interpretations and

amendments have been issued by the IASB but had either not been

adopted by the UK or were not yet effective in the UK at 30 June

2023:

IAS 1 Presentation of Financial Statements: Non current liabilities

with covenants

IAS 12 Income Taxes: deferred tax related to assets and liabilities

arising from a single transaction and International tax reform - pillar

two model rules

IAS 7 Amendment in relation to Supplier finance

IFRS 16 Leases: A mendment - Leases on sale and leaseback

IFRS 17 Insurance Contracts

The Directors do not expect the standards above to have a

material effect and have chosen not to adopt any of the above

standards and interpretations earlier than required.

2. Publication non-statutory accounts

The financial information set out above does not constitute the

company's statutory accounts for the years ended 30 June 2023 or

2022 but is derived from those accounts. Statutory accounts for

2022 have been delivered to the registrar of companies, and those

for 2023 will be delivered in due course. The auditor has reported

on those accounts; their reports were (i) unqualified, (ii) did not

include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006.

The Board of Tristel plc approved the release of this

Preliminary Announcement on 16 October 2023.

Segmental Analysis

3

The Group has reassessed it's operating segments and Group

revenue lines are split into fourteen geographic regions, which

span the different Group entities. In accordance with IFRS 8,

aggregation criteria has been applied to six operating segments

where similar economic characteristics are shared. The directors

consider the operating segments to have similar economic

characteristics as they have similar operating margins, and the

nature of products sold, and customers are similar. Management

consider these operating regions under six reportable segments. The

geographic segments consider the location of the sale and product

type sold, which is split into three sub divisions. The Company's

operating segments are identified initially from the information

which is reported to the chief operating decision maker which for

Tristel is the CEO.

The first product division concerns the manufact ure and sale of

medical device decontamination products which are used primarily

for infection control in hospitals. These products generates

approximately 86% of Company revenues (2022: 82%).

The second division which constitutes 9% (2022: 10%) of the

business activity, relates to the manufacture and sale of hospital

environmental surface disinfection products.

The third division addresses the pharmaceutical and personal

care product manufacturing industries, veterinary and animal

welfare sectors and has generated 5% (2022: 8%) of the Company's

revenues this year. A number of the products contained within this

division were discontinued during the prior year.

The operation is monitored and measured on the basis of the key

performance indicators of each segment, these being revenue and

profit before tax, and strategic decisions are made on the basis of

revenue and profit before tax generating from each segment.

The Group's revenues from external customers are divided into

the following geographical areas:

Hospital Hospital Other Total Profit

medical device environmental revenues 2023 Before

decontamination surface Tax 2023

disinfection

GBP000 GBP000 GBP000 GBP000 GBP000

UK to UK

and Overseas

distributors 11,895 2,381 1,017 15,294 4,179

Australia 3,504 22 134 3,660 165

Germany 4,979 40 89 5,108 230

Western

Europe 5,244 240 347 5,831 262

Italy 1,429 5 - 1,434 65

Other ROW 3,766 608 309 4,683 211

Total 30,817 3,296 1,896 36,009 5,112

================= ===============

Hospital Hospital Other Total Profit

medical device environmental revenues 2022 Before

decontamination surface Tax 2022

disinfection

GBP000 GBP000 GBP000 GBP000 GBP000

UK to UK

and Overseas

distributors 9,749 2,301 1,559 13,610 768

Australia 2,964 45 83 3,091 139

Germany 4,502 16 114 4,632 208

Western

Europe 4,234 283 321 4,838 218

Italy 1,007 3 - 1,010 45

Other ROW 2,965 530 447 3,942 177

Total 25,422 3,178 2,523 31,123 1,555

----------------- --------------- ---------- ------- ----------

Revenues from external customers in the Company's domicile

(United Kingdom), as well as its other major markets (Rest of the

World) have been identified on the basis of internal management

reporting systems, which are also used for VAT purposes.

R evenues derived from the UK (the largest CGU stated above) for

2023 were GBP15.924m (2022: GBP13.610m). Revenues from all overseas

subsidiaries total GBP20.085m (2022: GBP17.513 m.)

Hospital medical device decontamination revenues were derived

from a large number of customers but include GBP6.133m from a

single customer in UK which makes up 20% of this product category's

revenue (2022: GBP4.572m, being 18%). Hospital environmental

surface disinfection revenues were derived from a number of

customers but include GBP1.82m from a single customer in the UK

which makes up 5% of this product category's revenue (2022:

GBP1.636m, being 51%). Other revenues also were derived from a

number of customers, with the largest customer in the UK

accountable for GBP0.172m, which represents 7% of revenue for that

product category (2022: GBP0.124m, 5% from a single customer).

During the year 22 % of the Group's total revenues were earned from

a single customer (2022: 20%).

Hospital Hospital Other revenues Total 2023

medical device environmental

decontamination surface disinfection

GBP000 GBP000 GBP000 GBP000

Revenue

From external

customers 30,816 3,296 1,897 36,009

Cost of material (4,494) (1,437) (903) (6,834)

Gross profit 26,323 1,859 993 29,175

Gross margin 85% 56% 51% 81%

Centrally incurred income and expenses

not attributable to individual segments:

Distribution costs (323)

Depreciation and amortisation of non-financial

assets (2,618)

Other administrative expenses (19,896)

Share-based payments (1,061)

Other income 4

Operating profit 5,281

Operating profit can be reconciled to

Group profit before tax as follows:

Finance (expense) (169)

Total profit before tax 5,112

Hospital Hospital Other revenues Total 2022

medical device environmental

decontamination surface disinfection

GBP000 GBP000 GBP000 GBP000

Revenue

From external

customers 25,422 3,178 2,523 31,123

Cost of material (3,883) (1,236) (1,063) (6,182)

Gross profit 21,539 1,942 1,460 24,941

Gross margin 85% 61% 58% 80%

Centrally incurred income and expenses

not attributable to individual segments:

Distribution costs (282)

Depreciation and amortisation of non-financial

assets (2,772)

Other administrative expenses (17,270)

Share-based payments (596)

Other income 167

Impairment of intangible assets (2,439)

Operating profit 1,749

-------------------

Operating profit can be reconciled to

Group profit before tax as follows:

Finance (expense) (194)

-------------------

Total profit before tax 1,555

===================

4. Income Tax

Tax charged in the income statement

2023 2022

GBP000 GBP000

Current taxation

Current tax 285 284

Current tax adjustment to prior periods (53) -

------ ------

232 284

Deferred tax

Arising from origination and reversal of temporary

differences 817 114

UK deferred tax adjustment to prior periods (476) 314

Tax rate effect 78 (144)

------ ------

419 284

------ ------

Tax expense in the income statement 651 568

====== ======

The tax on profit before tax for the year is lower than the

standard rate of corporation tax in the UK (2022 - higher than the

standard rate of corporation tax in the UK) of 20% (2022 -

19%).

The differences are reconciled below:

2023 2022

GBP 000 GBP 000

Profit before tax 5,112 1,555

======== ========

Corporation tax at standard rate 1,048 295

Adjustment in respect of prior years (529) 314

Expenses not deductible for tax purposes 285 55

Increase from effect of foreign tax rates 46 25

Utilisation of previously recognised tax losses,

recognised tax losses carried forward and other

differences 464 118

Tax rate differences 78 (144)

Enhanced relief on qualifying scientific research

expenditure (98) (95)

Patent box relief (643) -

--------

Total tax charge 651 568

======== ========

5. Dividends

Amounts recognised as distributions to equity

holders in the year:

2023 2022

GBP000 GBP000

Ordinary shares of 1p each

Final dividend for the year ended 30 June

2022 of 3.93p (2021: 3.93p) per share 1,856 1,854

Special dividend for the Year Ended 30 June

2022 of 3.00p per share (2021: nil) 1,417 -

Interim dividend for the Year Ended 30 June

2023 of 2.62p (2022: 2.62p) per share 1,238 1,237

------ ------

4,511 3,091

Proposed final dividend for the Year Ended

30 June 2023 of 7.88p (2022: 3.93p) per share 3,728 1,856

Special dividend for the Year Ended 30 June

2022 of 3.00p per share (2021: nil) - 1,417

The proposed final dividend is subject to approval by

shareholders at the forthcoming Annual General Meeting and has not

been included as a liability in the financial statements.

6. Earnings per share

The calculations of earnings per share

are based on the following profits and

number of shares:

2023 2022

GBP000 GBP000

Retained profit for the financial year

attributable to equity holders of the

parent 4,461 987

------ ------

Shares Shares

'000 '000

Number Number

Weighted average number of ordinary shares

for the purpose of basic earnings per

share 47,247 47,187

Share options 111 582

------ ------

47,358 47,769

====== ======

Earnings per ordinary share

Basic 9.44p 2.09p

Diluted 9.34p 2.07p

The Group also presents an adjusted basic earnings per share

figure which excludes the fair value movement on investments and

impairments and share-based payments charges:

2023 2022

GBP000 GBP000

Retained profit for the financial year

attributable to equity holders of the

parent 4,461 987

------ ------

Adjustments:

Impairment of intangible assets - 2,439

Share based payments 1,061 596

------ ------

Tax on share-based-payments and impairment

of intangible assets (483) (400)

------ ------

Net adjustments 578 2,635

Adjusted earnings 5,039 3,622

====== ======

Adjusted basic earnings per ordinary

share 10.67p 7.68p

====== ======

7. Share Capital

Allotted, called up and fully paid shares

2023 2022

No. 000 GBP 000 No. 000 GBP 000

Ordinary of GBP0.01 each 47,309 473.09 47,244 472.44

Number GBP000

30 June 2022 47,249,993 473

Issued during the year 85,000 1

---------- ---------

30 June 2023 47,309,993 474

========== =========

85,000 ordinary shares of 1 pence each, related to the exercise

of employee share options were issued during the year. (2022:

155,550). The weighted average exercise price was GBP2.07 (2022:

GBP3.15 ). The exercise of employee share options in the year

resulted in a movement in the share premium account of GBP192,000

(2022: GBP396,000).

8. Prior year restatement

Restatement 1

During the current financial year the group adopted a suite of

lease accounting software. The software has outlined the need for

a restatement of the financial position of prior years which is

detailed below. These differences emerged from varying discount

rate applications and omitted leases, which in current year have

been supplied by an independent third party due to the lack of borrowing

within the Group and rectified respectively. As a result of the

restatement, the operating profit before tax and profit after tax

for the year ended 30 June 2022 has increased by GBP60k from GBP927k

to GBP987k. As a result of the restatement the Earnings per share

for the prior year are restated to GBP2.09 previously GBP1.96. Diluted

earnings per share for the prior year are also restated to GBP2.07,

previously GBP1.94.

Restatement 2

During the current financial year it was identified that a corporate

tax receivable balance had incorrectly been recorded as a sales

tax payable in the prior year. There was no adjustment required

to the 1 July 2022 statement of financial position and no change

to the tax charge.

Restatement 3

During the current financial year it was identified that no adjustment

had previously been made for the tax effect of unrealised intra-group

profits. The correction of this has no material profit effect in

the current or prior year and has been moved to retained earnings

as detailed below.

Consolidated 2022

statement of Previously Restatement Restatement Restatement 2022

financial reported 1 2 3 Restated

position 2022 GBP000 GBP000 GBP000 GBP000 GBP000

Right of use assets 5,209 359 - - 5,568

Current liabilities

- lease

liabilities (814) (128) - - (942)

Non-current -

lease liabilities (4,997) 143 - - (4,854)

Deferred tax asset 1,493 - - 333 1,826

Income tax

receivable 713 - 249 - 962

Trade and other

payables (3,222) - (249) - (3,471)

Retained earnings 12,371 374 - 333 13,078

Consolidated Restatement Restatement Restatement 2021

statement of 2021 Previously 1 2 3 Restated

financial reported

position 2021 GBP000 GBP000 GBP000 GBP000 GBP000

Right of use

assets 5,423 660 - - 6,083

Current

liabilities

- lease

liabilities (629) (250) - - (879)

Non-current -

lease

liabilities (5,276) (96) - - (5,372)

Deferred tax

asset 2,489 - - 333 2,822

Retained

earnings 14,687 374 - 333 15,334

9. Non-GAAP measures

Income statement reconciliation

The group presents adjusted profit measures (operating

profit/EBIT, Profit after tax, Profit before tax and EBITDA) by

making adjustments for costs and profits, which management believes

to be significant by virtue of their size, nature or incidence.

Such items may include, but are not limited to, share based

payments expense, impairments, fair value movements on investments

and restructuring. In addition, the group presents EBITDA and

adjusted EBITDA (adjusted in the same manner) as management

believes that this is an important metric for the shareholders. The

group uses adjusted measures to evaluate performance and as a

method to provide shareholders with clear and consistent reporting.

See below reconciliation of operating profit (EBIT), profit before

tax, net profit and EBITDA to the respective adjusted measures.

2023 2023

Statutory Adjusted

Adjusted profit measures Notes GBP000 2 GBP000

Operating profit (EBIT) 5,281 1,061 6,342

Net finance costs 4 (169) - (169)

Profit before tax 5,112 1,061 6,173

Income tax expense 8 (651) (483) (1,134)

Profit attributable to equity

shareholders 4,461 578 5,039

========== ====== =========

Effective tax rate 13% 46% 18%

---------- ------ ---------

Profit before tax margin 14% 17%

Profit for the year 4,461 578 5,039

Income tax expense 651 486 1,134

Net finance cost 169 - 169

Depreciation, amortisation

and impairments 2,618 - 2,618

---------- ------ ---------

EBITDA 7,899 1,061 8,960

---------- ------ ---------

Revenue for the year 36,009 - 36,009

EBITDA margin 22% - 25%

2023

Statutory

ROCE GBP000

Total assets - restated 41,367

Current liabilities (5,763)

Capital employed 35,604

EBIT 5,281

ROCE 15%

Specific adjusting

items

2022 2022

Statutory Adjusted

Adjusted profit measures Notes GBP000 1 2 GBP000

Operating profit (EBIT) 1,749 2,439 596 4,784

Net finance costs 4 (194) - - (194)

Profit before tax 1,555 2,439 596 4,590

Income tax expense - restated 8 (568) (463) 63 (968)

---------- -------- ----- ---------

Profit attributable to equity

shareholders 987 1,976 659 3,622

========== ======== ===== =========

Effective tax rate 37% 19% 11% 21%

---------- -------- ----- ---------

Profit before tax margin 5% 15%

Profit for the year 987 1,976 659 3,622

Income tax expense 568 463 (63) 968

Net finance cost 194 - - 194

Depreciation, amortisation

and impairments 5,211 (2,439) - 2,772

EBITDA 6,960 - 596 7,556

---------- -------- ----- ---------

Revenue for the year 31,123 - - 31,123

EBITDA margin 22% - - 24%

Restated

2022

Statutory

ROCE GBP000

Total assets - restated 39,681

Current liabilities (4,413)

Capital employed 35,268

EBIT 1,689

ROCE 5%

Specific adjusting items are as follows:

1. Impairment of intangibles in relation to prior year product

rationalisation

2. Share based payment charges under IFRS 2

10. Annual Report

Printed copies of the annual report and financial statements,

along with the notice of AGM, will be sent to shareholders prior to

the Company's Annual General Meeting taking place on 19 December

2023 in London. The accounts will be available on line shortly at

https://tristelgroup.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GPGUUUUPWPPA

(END) Dow Jones Newswires

October 16, 2023 02:00 ET (06:00 GMT)

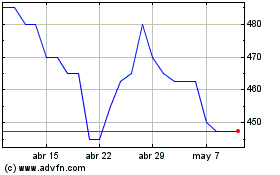

Tristel (LSE:TSTL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Tristel (LSE:TSTL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025