Zegona Communications PLC Holding(s) in Company

22 Octubre 2024 - 5:21AM

RNS Regulatory News

RNS Number : 1508J

Zegona Communications PLC

22 October 2024

TR-1:

Standard form for notification of major holdings

ZEGONA COMMUNICATIONS PLC

2.

Reason for Notification

A change in the percentage holding of

voting rights due to a further issue of shares

3.

Details of person subject to the notification

obligation

City

of registered office (if applicable)

Country of registered office (if applicable)

4.

Details of the shareholder

|

Name

|

City

of registered office

|

Country of registered office

|

|

EJLSHM FUNDING LIMITED

|

London

|

United Kingdom

|

5.

Date on which the threshold was crossed or

reached

6.

Date on which Issuer notified

7.

Total positions of person(s) subject to the notification

obligation

|

|

% of

voting rights attached to shares (total of 8.A)

|

% of

voting rights through financial instruments (total of 8.B 1 + 8.B

2)

|

Total of both in % (8.A + 8.B)

|

Total number of voting rights held in issuer

|

|

Resulting situation on the date on

which threshold was crossed or reached

|

68.92%

|

0.00

|

68.92%

|

523,240,603

|

|

Position of previous notification

(if applicable)

|

74.31%

|

0.00

|

74.31%

|

523,240,603

|

8.

Notified details of the resulting situation on the date on which

the threshold was crossed or reached

8A.

Voting rights attached to shares

|

Class/Type of shares ISIN code(if possible)

|

Number of direct voting rights (DTR5.1)

|

Number of indirect voting rights (DTR5.2.1)

|

% of

direct voting rights (DTR5.1)

|

% of

indirect voting rights (DTR5.2.1)

|

|

GB00BVGBY890

|

523,240,603

|

-

|

68.92%

|

-

|

|

Sub Total 8.A

|

523,240,603

|

68.92%

|

8B1.

Financial Instruments according to (DTR5.3.1R.(1)

(a))

|

Type

of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Number of voting rights that may be acquired if the instrument

is exercised/converted

|

% of

voting rights

|

|

|

|

|

|

|

|

Sub Total 8.B1

|

|

|

|

8B2.

Financial Instruments with similar economic effect according to

(DTR5.3.1R.(1) (b))

|

Type

of financial instrument

|

Expiration date

|

Exercise/conversion period

|

Physical or cash settlement

|

Number of voting rights

|

% of

voting rights

|

|

|

|

|

|

|

|

|

Sub Total 8.B2

|

|

|

|

9.

Information in relation to the person subject to the notification

obligation

Full chain of controlled undertakings

through which the voting rights and/or the financial instruments

are effectively held starting with the ultimate controlling natural

person or legal entities (please add additional rows as

necessary)

|

Ultimate controlling person

|

Name

of controlled undertaking

|

% of

voting rights if it equals or is higher than the notifiable

threshold

|

% of

voting rights through financial instruments if it equals or is

higher than the notifiable threshold

|

Total of both if it equals or is higher than the notifiable

threshold

|

|

Amicorp Trustees (UK)

Limited

|

EJLSHM Holdings Limited

|

0.00%

|

0.00%

|

0.00%

|

|

Amicorp Trustees (UK)

Limited

|

EJLSHM Funding Limited

|

68.92%

|

0.00%

|

68.92%

|

10.

In case of proxy voting

The

number and % of voting rights held

The

date until which the voting rights will be held

11.

Additional Information

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

HOLFLFFIIILFFIS

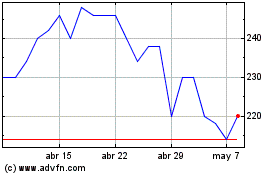

Zegona Communications (LSE:ZEG)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Zegona Communications (LSE:ZEG)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024