Provides Updated Guidance for 2024

Acadia Healthcare Company, Inc. (NASDAQ: ACHC) today announced

financial results for the third quarter and nine months ended

September 30, 2024.

Third Quarter Highlights

- Revenue totaled $815.6 million, an increase of 8.7% over the

third quarter of 2023

- Same facility revenue increased 8.6% compared with the third

quarter of 2023, including an increase in revenue per patient day

of 3.6% and an increase in patient days of 4.7%

- Net income attributable to Acadia totaled $68.1 million, or

$0.74 per diluted share

- Adjusted income attributable to Acadia totaled $84.1 million,

or $0.91 per diluted share

- Adjusted EBITDA totaled $194.3 million, an increase of 10.5%

over the third quarter of 2023, excluding provider relief

funds

- Same facility adjusted EBITDA margin increased 100 bps to 29.7%

over the third quarter of 2023

Adjusted income attributable to Acadia and Adjusted EBITDA are

non-GAAP financial measures. A reconciliation of all non-GAAP

financial measures in this press release begins on page 8.

Third Quarter Results Chris Hunter, Chief Executive

Officer of Acadia Healthcare Company, remarked, “Our financial

results for the third quarter of 2024 reflect continued execution

of our growth strategy. We have the scale and expertise to support

patients across the continuum of care. We are proud of the

important work we are doing and are committed to providing safe,

quality care for the patients, families and communities we serve

while creating long-term value for our stockholders.”

Strategic Investments for Long-Term Growth During the

third quarter of 2024, the Company continued to make progress in

meeting its strategic growth objectives. This includes the addition

of 15 beds to existing facilities and the addition of five new CTCs

during the quarter. With these additions, Acadia now operates 164

CTCs across 32 states treating over 72,000 patients daily and

remains on track to open up to 14 new CTCs for the full year.

In the first nine months of the year, the Company opened 79 new

beds at existing facilities. For the full year, the Company expects

to open over 400 new beds at existing facilities, including over

300 beds expected in the fourth quarter.

In the first nine months of the year, the Company also opened

two new facilities, totaling 120 beds. The Company remains on pace

to complete construction on several additional new wholly owned and

joint venture facilities, totaling nearly 700 new beds in the

fourth quarter, including joint venture hospitals in partnership

with Henry Ford Health in Detroit, Michigan, and Intermountain

Health in Denver, Colorado, as well as a new de novo facility in

Madison, Wisconsin, which was completed in October. The number of

new beds available to serve patients by the end of the fourth

quarter is subject to the timing of anticipated state-issued

licenses.

Acadia has 21 joint venture partnerships for 22 hospitals, with

11 hospitals already in operation and 11 additional hospitals

expected to open in the coming years.

Cash and Liquidity Maintaining a strong financial

position to support growth investments and disciplined capital

allocation are top priorities for Acadia. As of September 30, 2024,

the Company had $82.1 million in cash and cash equivalents and

$321.5 million available under its $600 million revolving credit

facility with a net leverage ratio of approximately 2.5x.

Net leverage ratio is a non-GAAP financial

measure. A reconciliation of all non-GAAP financial measures in

this press release begins on page 8.

2024 Financial Guidance Acadia today revised its

previously announced financial guidance for 2024. Revised guidance

reflects the closure of two facilities during the third

quarter(2).

2024

Guidance Range

Revenue(1)

$3.150 to $3.165 billion

Adjusted EBITDA(1)

$725 to $735 million

Adjusted earnings per diluted

share(1)

$3.35 to $3.45

Interest expense

$110 to $120 million

Tax rate

24.5% to 25.5%

Depreciation and amortization

expense

$145 to $155 million

Stock compensation expense

$40 to $45 million

Operating cash flows

$525 to $550 million

Expansion capital

expenditures

$550 to $595 million

Maintenance and IT capital

expenditures

$95 to $105 million

Total bed additions, excluding

acquisitions(3)

Approx. 1,200 beds

(1)

Includes one-time state payments of

approximately $10 million (or $0.09 per diluted share) for the

year, of which approximately $7 million was received in the first

quarter of 2024 and the remainder in the third quarter of

2024.

(2)

Prior full-year guidance assumed

approximately $17 million of revenue and approximately $1 million

of EBITDA contribution in the second half of the year from

facilities that were closed during the third quarter.

(3)

Company anticipates completing

construction on approximately 1,200 beds, of which approximately

1,000 are expected to be licensed and available to serve patients

by year end, with the remaining beds expected to receive licensure

in the first quarter. The exact number of beds available to serve

patients at year end will depend on timing of anticipated required

licenses.

The Company’s guidance does not include the impact of any future

acquisitions, divestitures, transaction, legal and other costs or

non-recurring legal settlements expense.

Conference Call Acadia will hold a conference call to

discuss its third quarter financial results at 8:00 a.m. Central

Time/9:00 a.m. Eastern Time on Thursday, October 31, 2024. A live

webcast of the conference call will be available at

www.acadiahealthcare.com in the “Investors” section of the website.

The webcast of the conference call will be available for 30

days.

About Acadia Acadia is a leading provider of behavioral

healthcare services across the United States. As of September 30,

2024, Acadia operated a network of 260 behavioral healthcare

facilities with approximately 11,300 beds in 38 states and Puerto

Rico. With approximately 23,500 employees serving more than 80,000

patients daily, Acadia is the largest stand-alone behavioral

healthcare company in the U.S. Acadia provides behavioral

healthcare services to its patients in a variety of settings,

including inpatient psychiatric hospitals, specialty treatment

facilities, residential treatment centers and outpatient

clinics.

Forward-Looking Information This press release contains

forward-looking statements. Generally, words such as “may,” “will,”

“should,” “could,” “anticipate,” “expect,” “intend,” “estimate,”

“plan,” “continue,” and “believe” or the negative of or other

variation on these and other similar expressions identify

forward-looking statements. These forward-looking statements are

made only as of the date of this press release. We do not undertake

to update or revise the forward-looking statements, whether as a

result of new information, future events or otherwise.

Forward-looking statements are based on current expectations and

involve risks and uncertainties and our future results could differ

significantly from those expressed or implied by our

forward-looking statements. Factors that may cause actual results

to differ materially include, without limitation, (i) potential

difficulties in successfully integrating the operations of acquired

facilities or realizing the expected benefits and synergies of our

facility expansions, acquisitions, joint ventures and de novo

transactions; (ii) Acadia’s ability to add beds, expand services,

enhance marketing programs and improve efficiencies at its

facilities; (iii) potential reductions in payments received by

Acadia from government and commercial payors; (iv) the occurrence

of patient incidents, governmental investigations, litigation and

adverse regulatory actions, which could adversely affect the price

of our common stock and result in substantial payments and

incremental regulatory burdens; (v) the risk that Acadia may not

generate sufficient cash from operations to service its debt and

meet its working capital and capital expenditure requirements; (vi)

potential disruptions to our information technology systems or a

cybersecurity incident; and (vii) potential operating difficulties,

including, without limitation, disruption to the U.S. economy and

financial markets; reduced admissions and patient volumes;

increased costs relating to labor, supply chain and other

expenditures; changes in competition and client preferences; and

general economic or industry conditions that may prevent Acadia

from realizing the expected benefits of its business strategies.

These factors and others are more fully described in Acadia’s

periodic reports and other filings with the SEC.

Acadia Healthcare Company,

Inc.

Condensed Consolidated

Statements of Operations

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In thousands, except per

share amounts)

Revenue

$

815,634

$

750,334

$

2,379,725

$

2,185,938

Salaries, wages and benefits (including equity-based

compensation expense of $9,467, $8,163, $27,014 and $23,140,

respectively)

428,147

394,150

1,265,427

1,171,960

Professional fees

48,498

45,540

142,236

130,468

Supplies

29,623

27,147

84,153

79,312

Rents and leases

12,389

11,731

36,141

34,880

Other operating expenses

112,137

104,048

322,900

290,798

Income from provider relief fund

—

(4,442

)

—

(4,442

)

Depreciation and amortization

37,641

33,388

110,054

96,969

Interest expense, net

29,924

20,742

86,297

61,651

Legal settlements expense

—

394,181

—

394,181

Loss on impairment

10,459

—

11,459

8,694

Transaction, legal and other costs

8,249

11,247

17,187

26,792

Total expenses

717,067

1,037,732

2,075,854

2,291,263

Income (loss) before income taxes

98,567

(287,398

)

303,871

(105,325

)

Provision for (benefit from) income taxes

27,199

(71,873

)

72,916

(29,907

)

Net income (loss)

71,368

(215,525

)

230,955

(75,418

)

Net income attributable to noncontrolling interests

(3,236

)

(2,185

)

(7,958

)

(3,978

)

Net income (loss) attributable to Acadia Healthcare Company, Inc.

$

68,132

$

(217,710

)

$

222,997

$

(79,396

)

Earnings (loss) per share attributable to Acadia Healthcare

Company, Inc. stockholders: Basic

$

0.74

$

(2.39

)

$

2.44

$

(0.87

)

Diluted

$

0.74

$

(2.39

)

$

2.42

$

(0.87

)

Weighted-average shares outstanding: Basic

91,720

91,168

91,571

90,852

Diluted

92,188

91,168

92,119

90,852

Acadia Healthcare Company,

Inc.

Condensed Consolidated Balance

Sheets

(Unaudited)

September 30,

December 31,

2024

2023

(In thousands)

ASSETS Current assets:

Cash and cash equivalents

$

82,145

$

100,073

Accounts receivable, net

383,945

361,451

Other current assets

185,972

134,476

Total current assets

652,062

596,000

Property and equipment, net

2,679,807

2,266,610

Goodwill

2,264,851

2,225,962

Intangible assets, net

73,139

73,278

Deferred tax assets

2,706

6,658

Operating lease right-of-use assets

122,771

117,780

Other assets

75,121

72,553

Total assets

$

5,870,457

$

5,358,841

LIABILITIES AND

EQUITY Current liabilities:

Current portion of long-term debt

$

71,694

$

29,219

Accounts payable

201,379

156,132

Accrued salaries and benefits

141,470

141,901

Current portion of operating lease liabilities

27,175

26,268

Other accrued liabilities

167,782

532,261

Total current liabilities

609,500

885,781

Long-term debt

1,804,825

1,342,548

Deferred tax liabilities

54,112

1,931

Operating lease liabilities

105,437

100,808

Other liabilities

150,544

140,113

Total liabilities

2,724,418

2,471,181

Redeemable noncontrolling interests

114,521

105,686

Equity: Common stock

918

913

Additional paid-in capital

2,675,882

2,649,340

Retained earnings

354,718

131,721

Total equity

3,031,518

2,781,974

Total liabilities and equity

$

5,870,457

$

5,358,841

Acadia Healthcare Company,

Inc.

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

Nine Months Ended September

30,

2024

2023

(In thousands)

Operating activities: Net income (loss)

$

230,955

$

(75,418

)

Adjustments to reconcile net income (loss) to net cash provided

by operating activities: Depreciation and

amortization

110,054

96,969

Amortization of debt issuance costs

3,061

2,485

Equity-based compensation expense

27,014

23,140

Deferred income taxes

56,133

(21,655

)

Legal settlements expense

—

394,181

Loss on impairment

11,459

8,694

Other

(3,988

)

1,423

Change in operating assets and liabilities, net of effect of

acquisitions: Accounts receivable, net

(20,936

)

(40,227

)

Other current assets

(3,334

)

(77,165

)

Other assets

676

309

Accounts payable and other accrued liabilities

(404,942

)

23,057

Accrued salaries and benefits

(1,841

)

(3,038

)

Other liabilities

8,681

17,723

Government relief funds

—

(4,442

)

Net cash provided by operating activities

12,992

346,036

Investing activities: Cash paid for

acquisitions, net of cash acquired

(53,550

)

(349

)

Cash paid for capital expenditures

(486,891

)

(285,410

)

Proceeds from sale of property and equipment

10,227

633

Other

(2,935

)

(1,925

)

Net cash used in investing activities

(533,149

)

(287,051

)

Financing activities: Borrowings on long-term

debt

350,000

—

Borrowings on revolving credit facility

210,000

40,000

Principal payments on revolving credit facility

(15,000

)

(35,000

)

Principal payments on long-term debt

(40,968

)

(15,938

)

Payment of debt issuance costs

(1,518

)

—

Repurchase of shares for payroll tax withholding, net of proceeds

from stock option exercises

(824

)

(45,193

)

Contributions from noncontrolling partners in joint ventures

3,500

2,538

Distributions to noncontrolling partners in joint ventures

(2,972

)

(3,480

)

Other

11

30

Net cash provided by (used in) financing activities

502,229

(57,043

)

Net (decrease) increase in cash and cash equivalents

(17,928

)

1,942

Cash and cash equivalents at beginning of the period

100,073

97,649

Cash and cash equivalents at end of the period

$

82,145

$

99,591

$

-

$

-

Effect of acquisitions: Assets acquired, excluding

cash

$

59,235

$

6,766

Liabilities assumed

(4,185

)

(128

)

Contingent consideration issued in connection with an acquisition

(1,500

)

—

Redeemable noncontrolling interest resulting from an acquisition

—

(6,289

)

Cash paid for acquisitions, net of cash acquired

$

53,550

$

349

Acadia Healthcare Company,

Inc.

Operating Statistics

(Unaudited, Revenue in

thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

% Change

2024

2023

% Change

Same Facility Results (1) Revenue

$

802,555

$

739,335

8.6

%

$

2,334,956

$

2,148,408

8.7

%

Patient Days

800,880

764,703

4.7

%

2,332,369

2,260,513

3.2

%

Admissions

50,368

49,397

2.0

%

147,617

147,130

0.3

%

Average Length of Stay (2)

15.9

15.5

2.7

%

15.8

15.4

2.8

%

Revenue per Patient Day

$

1,002

$

967

3.6

%

$

1,001

$

950

5.3

%

Adjusted EBITDA margin (3)

29.7

%

29.3

%

40 bps

29.3

%

28.8

%

50 bps Adjusted EBITDA margin excluding income from provider relief

fund

29.7

%

28.7

%

100 bps

29.3

%

28.6

%

70 bps Facility Results Revenue

$

815,634

$

750,334

8.7

%

$

2,379,725

$

2,185,938

8.9

%

Patient Days

815,126

779,296

4.6

%

2,375,477

2,306,109

3.0

%

Admissions

51,513

50,302

2.4

%

151,082

150,237

0.6

%

Average Length of Stay (2)

15.8

15.5

2.1

%

15.7

15.3

2.4

%

Revenue per Patient Day

$

1,001

$

963

3.9

%

$

1,002

$

948

5.7

%

Adjusted EBITDA margin (3)

28.2

%

28.7

%

-50 bps

27.9

%

28.0

%

-10 bps Adjusted EBITDA margin excluding income from provider

relief fund

28.2

%

28.1

%

10 bps

27.9

%

27.8

%

10 bps (1) Same facility results for the periods presented

include facilities we have operated for more than one year and

exclude certain closed services. (2) Average length of stay is

defined as patient days divided by admissions. (3) For each of the

three and nine months ended September 30, 2023, includes income

from provider relief fund of $4.4 million.

Acadia Healthcare Company,

Inc.

Reconciliation of Net Income

Attributable to Acadia Healthcare Company, Inc. to Adjusted

EBITDA

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(in thousands)

Net income (loss) attributable to Acadia Healthcare Company,

Inc.

$

68,132

$

(217,710

)

$

222,997

$

(79,396

)

Net income attributable to noncontrolling interests

3,236

2,185

7,958

3,978

Provision for (benefit from) income taxes

27,199

(71,873

)

72,916

(29,907

)

Interest expense, net

29,924

20,742

86,297

61,651

Depreciation and amortization

37,641

33,388

110,054

96,969

EBITDA

166,132

(233,268

)

500,222

53,295

Adjustments: Equity-based compensation expense (a)

9,467

8,163

27,014

23,140

Transaction, legal and other costs (b)

8,249

11,247

17,187

26,792

Legal settlements expense (c)

—

394,181

—

394,181

Loss on impairment (d)

10,459

—

11,459

8,694

Adjusted EBITDA

$

194,307

$

180,323

$

555,882

$

506,102

Adjusted EBITDA margin

23.8

%

24.0

%

23.4

%

23.2

%

Income from provider relief fund

—

(4,442

)

—

(4,442

)

Adjusted EBITDA excluding income from provider relief fund

$

194,307

$

175,881

$

555,882

$

501,660

Adjusted EBITDA margin excluding income from provider relief

fund

23.8

%

23.4

%

23.4

%

22.9

%

See footnotes on page 10.

Acadia Healthcare Company,

Inc.

Reconciliation of Net Income

Attributable to Acadia Healthcare Company, Inc. to

Adjusted Income Attributable

to Acadia Healthcare Company, Inc.

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(in thousands, except per

share amounts)

Net income (loss) attributable to Acadia Healthcare Company,

Inc.

$

68,132

$

(217,710

)

$

222,997

$

(79,396

)

Adjustments to income: Transaction, legal and other

costs (b)

8,249

11,247

17,187

26,792

Legal settlements expense (c)

—

394,181

—

394,181

Loss on impairment (d)

10,459

—

11,459

8,694

Provision for (benefit from) income taxes

27,199

(71,873

)

72,916

(29,907

)

Adjusted income before income taxes attributable to Acadia

Healthcare Company, Inc.

114,039

115,845

324,559

320,364

Income tax effect of adjustments to income (e)

29,960

28,756

79,614

79,947

Adjusted income attributable to Acadia Healthcare Company, Inc.

84,079

87,089

244,945

240,417

Income from provider relief fund, net of taxes

—

(3,237

)

—

(3,237

)

Adjusted income attributable to Acadia Healthcare Company, Inc.

excluding income from provider relief fund

$

84,079

$

83,852

$

244,945

$

237,180

Weighted-average shares outstanding - diluted (f)

92,188

91,655

92,119

91,684

Adjusted income attributable to Acadia Healthcare Company,

Inc. per diluted share

$

0.91

$

0.95

$

2.66

$

2.62

Income from provider relief fund, net of taxes, per diluted share

—

(0.04

)

—

(0.04

)

Adjusted income attributable to Acadia Healthcare Company, Inc.,

excluding income from provider relief fund, per diluted share

$

0.91

$

0.91

$

2.66

$

2.58

See footnotes on page 10.

Acadia Healthcare Company, Inc. Footnotes We have

included certain financial measures in this press release,

including those listed below, which are “non-GAAP financial

measures” as defined under the rules and regulations promulgated by

the SEC. These non-GAAP financial measures include, and are

defined, as follows: •

EBITDA: net income (loss) attributable to

Acadia Healthcare Company, Inc. adjusted for net income

attributable to noncontrolling interests, provision for (benefit

from) income taxes, net interest expense and depreciation and

amortization. •

Adjusted EBITDA:

EBITDA adjusted for equity-based compensation expense, transaction,

legal and other costs, legal settlements expense and loss on

impairment. •

Adjusted EBITDA excluding

income from provider relief fund: Adjusted EBITDA adjusted

for income from provider relief fund. •

Adjusted EBITDA margin: Adjusted EBITDA divided by

revenue. •

Adjusted EBITDA margin

excluding income from provider relief fund: Adjusted EBITDA

excluding income from provider relief fund divided by revenue.

•

Adjusted income before income taxes

attributable to Acadia Healthcare Company, Inc.: net income

(loss) attributable to Acadia Healthcare Company, Inc. adjusted for

transaction, legal and other costs, legal settlements expense, loss

on impairment and provision for (benefit from) income taxes.

•

Adjusted income attributable to

Acadia Healthcare Company, Inc.: Adjusted income before

income taxes attributable to Acadia Healthcare Company, Inc.

adjusted for the income tax effect of adjustments to income.

•

Adjusted income attributable to

Acadia Healthcare Company, Inc. excluding income from provider

relief fund: Adjusted income attributable to Acadia

Healthcare Company, Inc. adjusted for income from provider relief

fund. •

Net leverage ratio:

Long-term debt (excluding $9.7 million of unamortized debt issuance

costs, discount and premium) less cash and cash equivalents divided

by Adjusted EBITDA for the trailing twelve months. The

non-GAAP financial measures presented herein are supplemental

measures of our performance and are not required by, or presented

in accordance with, generally accepted accounting principles in the

United States (“GAAP”). The non-GAAP financial measures presented

herein are not measures of our financial performance under GAAP and

should not be considered as alternatives to net income or any other

performance measures derived in accordance with GAAP or as an

alternative to cash flow from operating activities as measures of

our liquidity. Our measurements of these non-GAAP financial

measures may not be comparable to similarly titled measures of

other companies. We have included information concerning the

non-GAAP financial measures in this press release because we

believe that such information is used by certain investors as

measures of a company’s historical performance. We believe these

measures are frequently used by securities analysts, investors and

other interested parties in the evaluation of issuers of equity

securities, many of which present similar non-GAAP financial

measures when reporting their results. Because the non-GAAP

financial measures are not measurements determined in accordance

with GAAP and are thus susceptible to varying calculations, the

non-GAAP financial measures, as presented, may not be comparable to

other similarly titled measures of other companies. Our

presentation of these non-GAAP financial measures should not be

construed as an inference that our future results will be

unaffected by unusual or nonrecurring items. The Company is

not able to provide a reconciliation of projected Adjusted EBITDA

and adjusted earnings per diluted share, where provided, to

expected results due to the unknown effect, timing and potential

significance of transaction-related expenses and the tax effect of

such expenses. (a) Represents the equity-based

compensation expense of Acadia. (b) Represents transaction, legal

and other costs incurred by Acadia primarily related to legal,

government investigations, management transition, termination,

restructuring, acquisition and other similar costs. (c) Represents

legal settlements expense related to the Desert Hills litigation.

(d) Represents non-cash impairment charges related to the closure

of certain facilities. (e) Represents the income tax effect of

adjustments to income based on tax rates of 26.3% and 24.8% for the

three months ended September 30, 2024 and 2023, respectively, and

24.5% and 25.0% for the nine months ended September 30, 2024 and

2023, respectively. (f) For the three and nine months ended

September 30, 2023, approximately 0.5 million and 0.8 million

outstanding shares of restricted stock and shares of common stock

issuable upon exercise of outstanding stock option awards,

respectively, have been included in the calculation of

weighted-average shares outstanding-diluted. These shares are

excluded from the calculation of diluted earnings per share in the

condensed consolidated statement of operations because the net loss

for the three and nine months ended September 30, 2023 causes such

securities to be anti-dilutive.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030593005/en/

Investor Contact: Patrick Feeley Senior Vice President, Investor

Relations (615) 861-6000

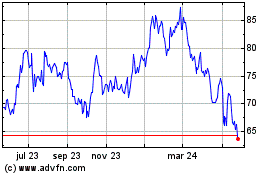

Acadia Healthcare (NASDAQ:ACHC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

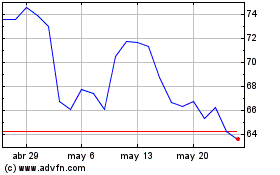

Acadia Healthcare (NASDAQ:ACHC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024