false

0001859199

0001859199

2024-07-12

2024-07-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange

Act of 1934

Date of Report (date

of earliest event reported): July 12, 2024

reAlpha Tech Corp.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-41839 |

|

86-3425507 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

6515 Longshore Loop,

Suite 100, Dublin, OH 43017

(Address of principal

executive offices and zip code)

(707) 732-5742

(Registrant’s

telephone number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

AIRE |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

Acquisition of AiChat Pte. Ltd.

On July 12, 2024, reAlpha

Tech Corp. (the “Company”) entered into a Business Acquisition and Financing Agreement (the “Acquisition Agreement”),

with AiChat Pte. Ltd., a company incorporated in the Republic of Singapore (“AiChat”), AiChat10X Pte. Ltd., a company incorporated

in the Republic of Singapore (the “Seller”) and Kester Poh Kah Yong (the “Founder”), pursuant to which the Company

acquired from Seller 85% of the ordinary shares of AiChat, an artificial intelligence-powered company that provides conversational customer

experience solutions, that were outstanding immediately prior to the execution of the Acquisition Agreement, with the remaining 15% of

such outstanding ordinary shares of AiChat to be acquired on June 30, 2025 (the “Acquisition”).

In exchange for all of the

ordinary shares of AiChat outstanding immediately prior to the execution of the Acquisition Agreement, and pursuant to the terms and subject

to the conditions of the Acquisition Agreement, the Company agreed to pay the Seller an aggregate purchase price of $1,140,000, consisting

of: (i) $312,000 in restricted shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”),

based on a 10% discount to the 10 day volume weighted average price of the Common Stock as reported on the Nasdaq Capital Market (the

“VWAP Share Price”) and payable to the Seller no later than January 1, 2025 (the “First Tranche Shares”); (ii)

$588,000 in restricted shares of Common Stock, based on a 10% discount to the VWAP Share Price, subject to any Base Case Adjustment (as

defined in the Acquisition Agreement), payable to the Seller no later than April 1, 2025 (the “Second Tranche Shares”); and

(iii) $240,000 in restricted shares of Common Stock, calculated at a 5% discount to the VWAP Share Price, payable to the Seller no later

than December 1, 2025 (the “Third Tranche Shares,” and together with the First Tranche Shares and the Second Tranche Shares,

the “Tranche Shares”). In addition, the Company agreed to subscribe for and purchase from AiChat: (i) 55,710 ordinary shares

of AiChat as of the Acquisition’s closing date, for a subscription price of $60,000; and (ii) 222,841 ordinary shares of AiChat

in accordance with a disbursement scheduled to be determined and agreed to by the Company, AiChat and the Founder, for a total subscription

price of $240,000.

The Tranche Shares will be

subject to a restrictive period of 90 days (the “Restricted Period”) following the date of their respective issuances, during

which period the Seller will not be able to dispose, assign, sell and/or transfer such Tranche Shares, nor make any demand for or exercise

any right or cause to have such Tranche Shares registered under the Securities Act of 1933, as amended (the “Securities Act”).

When issued, each of the Tranche Shares will be deposited into the Seller’s nominated bank, custodial or securities account, and

will subsequently be, following expiration of the foregoing Restricted Period applicable to such Tranche Shares, transferred to the Founder

in proportion to the percentage of his beneficial ownership in the Seller. The aggregate amount of Tranche Shares issuable under the Acquisition

Agreement, for purposes of complying with Nasdaq Listing Rule 5635(a), may in no case exceed 19.99% of the Company’s issued and

outstanding shares of Common Stock immediately prior to the execution of the Acquisition Agreement, or 8,860,213 shares of Common Stock

(the “Cap Amount”), subject to stockholder approval of any shares exceeding such amount. In the event the Tranche Shares issuable

thereunder exceed the Cap Amount, the Company will pay the Seller cash in lieu of such excess shares of Common Stock, based on a formula

set forth in the Acquisition Agreement.

Further, in accordance with

the Acquisition Agreement, the Company agreed to guarantee certain outstanding Singapore-bank loans from AiChat for an aggregate amount

of approximately 862,092 Singapore Dollars (SGD). The Acquisition Agreement also provides for an assignment of all of AiChat’s intellectual

property rights previously owned by the Seller in favor of the Company. Additionally, following the closing of the Acquisition, the Seller

will be required to indemnify the Company and its affiliates for any liability, damages, losses, costs and/or expenses arising out of

any third party claims, suits, actions, demand or judgments relating to the Company and the Acquisition. The Acquisition Agreement also

contains additional representations and warranties, covenants and conditions, in each case, customary for transactions of this type.

The foregoing description

of the Acquisition Agreement in this Current Report on Form 8-K (this “Form 8-K”) does not purport to be a complete description

of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to the full text of the Acquisition

Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information included in

Item 1.01 of this Form 8-K is incorporated by reference into this Item 3.02 to the extent required. The Tranche Shares issuable under

the Acquisition Agreement, when issued, will be exempt from registration under the Securities Act in reliance on Regulation S thereof.

The Seller and Founder represented to the Company, among other things, that each of them is not a “U.S. Person” (as defined

in Rule 902(k) promulgated under the Securities Act) and that each of them will be acquiring the Tranche Shares for investment purposes

and not with a view to, or for sale in connection with any distribution thereof. Appropriate customary restrictive legends will be affixed

to any certificates or other statements evidencing the Tranche Shares.

Item 8.01 Other Events.

On

July 15, 2024, the Company issued a press release announcing the transaction described in Item 1.01 of this Form 8-K. A copy of the press

release is attached as Exhibit 99.1 and is incorporated herein by reference.

The

information set forth and incorporated into this Item 8.01 of this Form 8-K is being furnished pursuant to Item 8.01 of Form 8-K and shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the Company’s

filings under the Securities Act or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation

language in such filings, except to the extent expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and

Exhibits.

(a) Financial statements

of businesses acquired.

The

Company has determined that the Acquisition will not constitute an acquisition of a significant amount of assets (as defined in Instruction

4 of Item 2.01) and, as such, financial statements contemplated by Item 9.01 of Form 8-K are not required to be reported by Form 8-K with

respect to the Acquisition.

(b) Pro forma financial

information.

The

Company has determined that the Acquisition will not constitute an acquisition of a significant amount of assets (as defined in Instruction

4 of Item 2.01) and, as such, pro forma financial information contemplated by Item 9.01 of Form 8-K is not required to be reported by

Form 8-K with respect to the Acquisition.

(d) Exhibits

| + | The schedules and exhibits to this agreement have been omitted

pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to

the SEC upon request. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: July 15, 2024 |

reAlpha Tech Corp. |

| |

|

|

| |

By: |

/s/ Giri Devanur |

| |

|

Giri Devanur |

| |

|

Chief Executive Officer |

3

Exhibit 10.1

DATED THIS 12th DAY OF JULY 2024

AMONG

AICHAT PTE. LTD.

AND

AICHAT10X PTE. LTD.

AND

REALPHA TECH CORP.

AND

POH KAH YONG, KESTER

____________________________________________________________________

BUSINESS ACQUISITION AND FINANCING AGREEMENT

_____________________________________________________________________

This Business Acquisition and Financing Agreement

(this “Agreement”) is made on this 12th day of July 2024 by and among:

| (1) | AiChat Pte. Ltd. (Company UEN No. 201619669M), a company incorporated in the Republic of Singapore,

with its registered office at 20 Malacca Street, #04-00, Malacca Centre, Singapore 048979 (the “Company”); |

| (2) | AiChat10X Pte. Ltd. (Company UEN No. 202404832E), a company incorporated in the Republic of Singapore,

with its registered office at 8 Marina View, #11-05 Asia Square Tower 1, Singapore 018960 (“AiChat10X”); |

| (3) | reAlpha Tech Corp., a Delaware corporation that maintains its principal place of business at 6515

Longshore Loop, Dublin, Ohio 43017, United States of America (“RTC”); and |

| (4) | Poh Kah Yong, Kester (Singapore NRIC No.: S8427711H), a citizen of the Republic of Singapore and

residing at 688B Woodlands Drive 75, #10-26 Singapore 732688 (the “Founder”), |

(each, a “Party”

and collectively, the “Parties”).

WHEREAS

| (A) | The

term sheet attached to Schedule I of this Agreement (the “Term Sheet”) has been entered into by and between the Company,

RTC and the Founder, on 26th June 2024. Capitalized terms used herein and not defined shall have the same meanings ascribed

to them in the Term Sheet. |

| (B) | The

Term Sheet prescribes, inter alia, for the completion of the Shareholder Restructuring prior to the entry into this Agreement

by the Company, RTC and AiChat10X. |

| (C) | The

Shareholder Restructuring has been fully completed and consummated as of the date hereof, and AiChat10X is now the legal and beneficial

owner of all the 1,057,772 ordinary shares of the Company in issue as of immediately prior to the closing of the transactions

contemplated hereby and before giving effect to the share subscriptions contemplated in Clause 1 of this Agreement (such ordinary shares,

the “Company’s Ordinary Shares”). |

| (D) | The resolutions in writing of

AiChat10X (in its capacity as the sole shareholder of the Company) and of the Founder in his capacity as the sole director of the Company,

which approve the entry by the Company into this Agreement, all the matters contemplated by, prescribed for in, and in relation to, this

Agreement, and all such things and acts to be undertaken by the Company, as may be necessary or expedient in connection with, as contemplated

by, and to give effect to, this Agreement, have been fully executed thereby (the “Company BAFA Resolutions”), and copies

thereof have been delivered to RTC by the Company. |

| (E) | The resolutions in writing

of the shareholders of AiChat10X and the sole director of AiChat10X, which approve the entry by AiChat10X into this Agreement, all the

matters contemplated by, prescribed for in, and in relation to, this Agreement, and all such things and acts to be undertaken by AiChat10X,

as may be necessary or expedient in connection with, as contemplated by, and to give effect to, this Agreement, have been fully executed

thereby (the “AiChat10X BAFA Resolutions”), and copies thereof have been delivered to RTC by AiChat10X. |

| (F) | RTC wishes to acquire the

Company’s Ordinary Shares from AiChat10X, and AiChat10X wishes to sell the Company’s Ordinary Shares to RTC, subject to, and

in accordance with, the terms and conditions set out in this Agreement (the “Business Acquisition”). |

| (G) | Except as otherwise provided

in Clause 3.10, RTC has obtained all internal and external approvals in relation to the entry by RTC into this Agreement, all the matters

contemplated by, prescribed for in, and in relation to, this Agreement and the Business Acquisition, and all such things and acts to be

undertaken by RTC, as may be necessary or expedient in connection with, as contemplated by, and to give effect to, this Agreement and

the Business Acquisition (the “RTC Approvals”), and copies of the relevant documents in respect of the RTC Approvals

have been delivered to the Company and AiChat10X by RTC. |

| 1. | The RTC Share Subscription |

| 1.1 | RTC shall, as of the Closing Date, subscribe for and purchase

from the Company an aggregate of for 55,710 new USD denominated ordinary shares of the Company (the “First Subscription

Shares”) for a total subscription price of US$60,000 (the “First Subscription Amount”), pursuant

to this Agreement, which First Subscription Amount was, prior to the date hereof, remitted by RTC to the Company’s nominated bank

account. |

| 1.2 | RTC shall subscribe for and purchase from the company an aggregate of 222,841 new USD denominated

ordinary shares of the Company (the “Second Subscription Shares”) for a total subscription amount of US$240,000

(the “Second Subscription Amount”), pursuant to this Agreement, and RTC shall remit the Second Subscription Amount

in tranches, by wire transfer, to the Company’s nominated bank account in accordance with a disbursement schedule to be determined

and agreed to by the Company, the Founder and RTC as soon as practicable after the date hereof. |

| 1.3 | Upon the receipt of each of the First Subscription Amount and the Second Subscription Amount, in full,

by the Company, in its nominated bank account, the First Subscription Shares and the Second Subscription Shares, respectively, shall be

issued and allotted by the Company in favour of RTC, and registered in the name of RTC by the Company with the Accounting and Corporate

Regulatory Authority of Singapore (“ACRA”), as soon as practicable thereafter. |

| 2. | Transfer of the Company’s Ordinary Shares to RTC |

| 2.1 | In consideration for the First Consideration Amount and Second Consideration Amount (each, as defined

below) to be delivered in accordance with Clauses 3.1 and 3.3, a total of 899,106 ordinary shares of the Company (representing

85% of the Company’s Ordinary Shares) shall be transferred by AiChat10X to RTC, and registered in the name of RTC by the

Company with ACRA, as soon as practicable after the execution of this Agreement (the “First Share Transfer”). |

| 2.2 | For the purposes of effecting the First Share Transfer: |

| (a) | AiChat10X shall deliver the requisite share transfer form and relevant share certificate(s) and any

other documents required to transfer legal and beneficial ownership in the relevant shares to RTC, upon which time the First Share Transfer

will deemed complete and effective; |

| (b) | the Company shall institute the relevant lodgments and/or filings with ACRA in connection therewith

as soon as practicable after the execution of this Agreement; |

| (c) | the Company shall enter RTC’s name in the Company’s register of members as the legal and

beneficial owner of 899,106 ordinary shares of the Company, and issue the share certificate bearing the name of RTC as the registered

owner thereof, in accordance with the requirements of the Companies Act 1967 of Singapore or otherwise, and deliver such share certificate

to RTC within fourteen (14) days after the date of the execution of this Agreement; and |

| (d) | the Company shall deliver an updated ACRA Bizfile Report to RTC forthwith, which reflects RTC as the

holder of 899,106 ordinary shares of the Company. |

| 2.3 | In consideration for the Third Consideration Amount (as defined

below) to be delivered in accordance with Clause 3.5, 158,666 ordinary shares of the Company (representing 15% of the Company’s

Ordinary Shares) shall be transferred by AiChat10X to RTC, and registered in the name of RTC by the Company with ACRA, on 30th

June 2025 (the “Second Share Transfer”). |

| 2.4 | For the purposes of effecting the Second Share Transfer: |

| (a) | AiChat10X shall deliver the requisite share transfer form and relevant share certificate(s) and any

other documents required to transfer legal and beneficial ownership in the relevant shares to RTC, upon which time the Second Share Transfer

will deemed complete and effective; |

| (b) | the Company shall forthwith institute the relevant lodgments and/or filings with ACRA in connection

therewith on 30th June 2025; |

| (c) | the Company shall enter RTC’s name in the Company’s register of members as the legal and

beneficial owner of 158,666 ordinary shares of the Company, and issue the share certificate bearing the name of RTC as the registered

owner thereof, in accordance with the requirements of the Companies Act 1967 of Singapore or otherwise, and deliver such share certificate

to RTC not later than fourteen (14) days after 30th June 2025; and |

| (d) | the Company shall deliver an updated ACRA Bizfile Report to RTC forthwith after 30th June

2025, which reflects RTC as the holder of 158,666 ordinary shares of the Company. |

| 3. | Payment of the Consideration Amount |

| 3.1 | RTC shall issue shares

of its common stock, par value $0.001 per share (the “Common Stock”), equivalent

to US$312,000 (the “First Consideration Amount”),

in the name of AiChat10X, at and based on a 10% discount to the VWAP Share Price (as defined

herein), no later than 1st January 2025 (the “RTC Tranche I Shares”),

and RTC shall deposit the RTC Tranche I Shares into AiChat10X’s nominated bank, custodial or securities account (the “10X

Custodial Account”) following the issuance thereof. |

| 3.2 | AiChat10X shall not (i)

dispose, assign, sell and/or transfer any of the RTC Tranche I Shares in any manner whatsoever(ii) enter into any transaction which is

designed to, or might reasonably be expected to, result in the disposition, whether by actual disposition or effective economic disposition

due to cash settlement or otherwise of the RTC Tranche I Shares, or (iii) make any demand for or exercise any right or cause to be filed

a registration, including any amendments thereto, for the registration of the RTC Tranche I Shares or publicly disclose the intention

to do any of the foregoing, for a period of 90 days (the “Restricted Period”) after

the receipt of the RTC Tranche I Shares in the 10X Custodial Account. |

| 3.3 | RTC shall issue shares

of Common Stock equivalent to US$588,000 (the “Second Consideration Amount”),

in the name of AiChat10X, at and based on a 10% discount to the VWAP Share Price, no later than

1st April 2025 (the “RTC Tranche II Shares”), subject to any Base

Case Adjustment (as defined herein), and RTC shall deposit the RTC Tranche II Shares into the 10X Custodial Account following the issuance

thereof. |

| 3.4 | AiChat10X shall not (i)

dispose, assign, sell and/or transfer any of the RTC Tranche II Shares in any manner whatsoever, (ii) enter into any transaction which

is designed to, or might reasonably be expected to, result in the disposition, whether by actual disposition or effective economic disposition

due to cash settlement or otherwise of the RTC Tranche II Shares, or (iii) make any demand for or exercise any right or cause to be filed

a registration, including any amendments thereto, for the registration of the RTC Tranche II Shares or publicly disclose the intention

to do any of the foregoing, during the Restricted Period after the receipt of the RTC Tranche II Shares in the 10X Custodial Account. |

| 3.5 | RTC shall issue shares of Common Stock equivalent of US$240,000 of

RTC listed NASDAQ shares (the “Third Consideration Amount”) in the name of

AiChat10X at a 5% discount to the VWAP Share Price no later than 1st December

2025 (the “RTC Tranche III Shares and together with the RTC Tranche I Shares and

RTC Tranche II Shares, the “Tranche Shares”), and RTC shall deposit the RTC

Tranche III Shares into the 10X Custodial Account following the issuance thereof. |

| 3.6 | AiChat10X shall not (i)

dispose, assign, sell and/or transfer any of the RTC Tranche III Shares in any manner whatsoever, (ii) enter into any transaction which

is designed to, or might reasonably be expected to, result in the disposition, whether by actual disposition or effective economic disposition

due to cash settlement or otherwise of the RTC Tranche III Shares, or (iii) make any demand for or exercise any right or cause to be

filed a registration, including any amendments thereto, for the registration of the RTC Tranche III Shares or publicly disclose the intention

to do any of the foregoing, during the Restricted Period after the receipt of the RTC Tranche III Shares in the 10X Custodial Account. |

| 3.7 | For the purposes of this

Agreement, the “VWAP Share Price” means the ten (10) day volume weighted average

price of the Common Stock as reported on the Nasdaq Capital Market (“Nasdaq”). |

| 3.8 | Subject to Clause 3.9,

after the expiry of each Restricted Period referred to above (each, a “Lock-up Period”),

the Founder shall receive such number of Tranche Shares in proportion to the percentage of the Founder’s beneficial ownership in

AiChat10X (the “Founder’s RTC Shares”). |

| 3.9 | Upon the expiry of each

Lock-up Period, AiChat10X shall immediately deposit the Founder’s RTC Shares into an escrow account (the “Escrow Account“)

to be managed by one of the Lenders (as defined herein), who shall be appointed for this purpose by a majority of the other Lenders as

their representative and authorised signatory in respect thereof (the “Escrow Account Manager”),

and to effectuate the matters contained in Clause 4.7. |

| 3.10 | Notwithstanding anything

to the contrary contained in this Agreement, under no circumstances shall the aggregate number of Tranche Shares (inclusive of the Founder’s

RTC Shares) (collectively, the “Shares”) issuable under this Agreement in connection

with the Business Acquisition, and any other shares of Common Stock to be issued by RTC which could be aggregated with the Shares in

connection with the Business Acquisition under Nasdaq Listing Rule 5635(a), exceed 19.99% of RTC’s issued and outstanding shares

of Common Stock immediately before consummation of this Agreement and any other transactions being consummated by RTC in connection with

the Business Acquisition (the “Cap Amount”), unless RTC has obtained either (i)

its stockholders’ approval of the issuance of more shares of Common Stock than the Cap Amount, pursuant to Nasdaq Listing Rule

5635(a), or (ii) a waiver from Nasdaq of RTC’s compliance with Nasdaq Listing Rule 5635(a). To the extent that the issuance of

shares of Common Stock under this Agreement would cause the Shares issuable herein to exceed the Cap Amount, RTC, in lieu of issuing

such shares of Common Stock, shall pay the Company in cash an amount equal to (x) the aggregate number of Shares that exceed the Cap

Amount times (y) the VWAP Share Price of the Common Stock as reported on Nasdaq as of the day prior to such issuance. |

| 3.11 | The Tranche Shares (inclusive of the Founder’s RTC Shares) will

be issued in reliance upon the exemption from securities registration afforded by Rule 903 of Regulation S (“Regulation S”)

of the Securities Act of 1933, as amended (the “Securities Act”). |

| 4. | The Company’s Credit Facility Restructuring |

| 4.1 | The Company has outstanding Singapore corporate bank loan

facilities in an aggregate amount of approximately SGD 862,092 (the “Bank Loans”) granted by various banks

in Singapore (the “Banks”) as of the date hereof. |

| 4.2 | The Company shall use its best endeavours to procure the approval of the Banks for the changes in the

Company’s shareholding pursuant hereto. |

| 4.3 | It is the intention of the Parties to maintain the Bank Loans after the date hereof, until such time

that RTC and the Company secure an alternative source of financing to repay the Bank Loans. The Founder shall remain as a personal guarantor

of the Bank Loans after the date hereof, and RTC shall also issue a corporate guarantee in respect of the Bank Loans as soon as practicable

after the date hereof. |

| 4.4 | In connection with the matters contemplated herein, it is the intention of the Parties to procure the

approval of each of the Banks for the removal and discharge of the other 3 personal guarantors of their respective Bank Loans, namely,

Matthew Loh Guang Wei, Yong Siong Wee and Li Jing. |

| 4.5 | The Company’s approximate outstanding SGD 163,213 third-party loan shall be refinanced

by the Company after the date hereof on a best-efforts basis. |

| 4.6 | SGD 75,000 of the Company’s outstanding SGD 306,024 loan extended by the Founder

and his family members (the “Founder’s Loan”), shall be repaid by the Company thereto by 1st August

2024, and the remaining outstanding amount thereunder shall be repaid by the Company thereto over a period of 2 years after the date

hereof from the Company’s cash flows. |

| 4.7 | The Company’s approximate outstanding SGD 231,075 in loans extended by certain shareholders

of AiChat10X (the “Lenders”) to the Company, and guaranteed by the Founder, shall be repaid to the Lenders by the Founder,

by way of the disposal of the Founder’s RTC Shares held in the Escrow Account by the Escrow Account Manager on his behalf, in a

manner to be mutually determined and agreed upon by RTC, the Lenders and the Founder after the date hereof. |

| 4.8 | The repayment by the Company of a SGD 278,731 loan extended by Toku Pte. Ltd. will be determined

by RTC and the Company and resolved as soon as practicable after the date hereof. |

| 5.1 | The Parties shall determine, agree on and finalise as soon as practicable after the date hereof, the

Company’s base case revenue, operating cost, EBITDA and any other relevant financial deliverables, and the impact thereof in relation

to the calculation of the number of RTC Tranche II Shares to be issued by RTC in the name of AiChat10X (“Base Case Adjustment”). |

| 6. | Management Team Retention |

| 6.1 | The Company and the Founder shall procure that the Founder,

in his capacity as the Company’s chief executive officer (“CEO”), the Company’s chief marketing officer

(“CMO”), Valerie Cheng, and the Company’s chief product officer (“CPO”), Dave Chuang, shall

remain employed in their respective capacities as CEO, CMO and CPO (each, a “Key Employee” and collectively, the “Key

Employees”), for a period of not less than 3 years after the date hereof, on terms to be mutually agreed among each Key Employee,

the Company and RTC, and enshrined in new employment contracts in respect of each Key Employee (the “Key Employee Employment

Contracts”), as soon as practicable after the date hereof. |

| 6.2 | The Key Employee Employment Contracts shall contain provisions, to be mutually determined and agreed

between the Company, RTC and the Key Employees, in relation to the Key Employees’ entitlement to equity participation in RTC under

RTC’s 2022 Equity Incentive Plan (the “Plan”) |

| 6.3 | All outstanding salaries, commissions and/or other dues owing and payable by the Company to each of the

Key Employees (collectively, the “Outstanding Key Employee Dues”) are as follows: |

| (a) | Poh Kah Yong, Kester (CEO): SGD 60,722 (salary); |

| (b) | Valerie Cheng (CMO): SGD 98,617.48 (commissions)

and SGD 5,000 (employee share option plan); and |

| (c) | Dave Chuang (CPO): SGD 64,683.15 (salary) and

SGD 15,000 (employee share option plan). |

| 6.4 | The Outstanding Key Employee Dues shall also account for,

and include, all unpaid Singapore Central Provident Fund contributions in the context of the Key Employees’ unpaid salaries and

commissions, which are due and payable by the Key Employees and the Company, in their respective capacities as employees and employer,

for the purposes of calculating the Outstanding Key Employee Dues (the “Outstanding CPF Payments”). |

| 6.5 | The Outstanding Key Employee Dues, including the Outstanding

CPF Payments, shall be fully satisfied and discharged by the Company, and where applicable, the Key Employees, in the following manner: |

| (a) | Each Key Employee’s outstanding unpaid salary and/or commission shall be paid thereto by the Company

in 12 equal instalments (each, an “Instalment”). The first Instalment shall be paid by the Company to each Key Employee

on the date of the receipt by the Company of the First Subscription Amount, and each subsequent Instalment shall be paid by the Company

to each Key Employee on the date which falls 30 days after the date of the preceding Instalment; |

| (b) | the outstanding employee share option plan amounts due and owing to the relevant Key Employees shall

be reconciled with the Plan attributable to the relevant Key Employees in a manner to be determined thereby with RTC forthwith after the

date hereof; and |

| (c) | the Outstanding CPF Payments shall be regularised and discharged by the Company forthwith in accordance

with applicable laws and regulations in Singapore. |

| 7. | Board of Directors of the Company |

| 7.1 | RTC, the Founder and AiChat10X shall mutually determine and

agree on the constitution of, and the number of directors to be appointed to, the board of directors of the Company (the “Board”),

as soon as practicable after the date hereof. |

| 7.2 | A meeting of the Board shall be convened within one (1) month

after the end of every quarter, and the first meeting of the Board shall be convened on the date which falls three (3) months after the

date hereof. |

| 7.3 | Except as otherwise set forth in the Plan, the board of directors

of RTC shall administer the Plan awards. The Board shall, amongst other things, administer entitlements of the Key Employees and any

other applicable employees, as well as all general employee compensation matters on an ongoing basis, and it shall determine the key

financial decisions and matters of the Company, subject to the approval of the board of directors of RTC. |

| 8. | Representations, Warranties and Undertakings |

| 8.1 | Each of the Company, the

Founder and AiChat10X hereby represents and warrants to RTC that, as of the date hereof: |

| (a) | AiChat10X is the legal

and beneficial owner of the Company’s Ordinary Shares and it has absolute title thereto, free and clear of any and all encumbrances; |

| (b) | upon the registration by

the Company of the Company’s Ordinary Shares in the name of RTC with ACRA pursuant to Clauses 2.1 and 2.3 or otherwise, RTC shall

be the sole legal and beneficial owner thereof, and it shall have absolute title thereto, free and clear of any and all encumbrances; |

| (c) | there are no options (including,

without limitation, an option or right of pre-emption, right of first refusal or conversion), agreements, or understanding (whether exercisable

now or in the future and whether contingent or otherwise) entered into by the Company and/or AiChat10X which entitles any person to purchase,

encumber, transfer, redeem, convert or dispose of the Company’s Ordinary Shares (save and except for the transactions contemplated

herein); |

| (d) | no order has been made

and no resolution has been passed with respect to the Company’s winding up or for a provisional liquidator or judicial manager

to be appointed in respect thereof, no petition has been presented and no meeting has been convened for the purpose of the Company’s

winding up or judicial management, and no claims or proceedings before any court, tribunal or judicial authority are in progress or pending

against or relating to the Company; and |

| (e) | the Company’s accounting

books and records, have been fairly and properly maintained in accordance with applicable laws and consistently applied accounting principles. |

| 8.2 | Each Party hereby represents,

warrants and undertakes to the other Parties that as of the date hereof: |

| (a) | it has full legal right, power and authority to enter into, execute,

deliver, perform and observe the terms of this Agreement; |

| (b) | where it is a corporation, it is duly organized, validly existing and

in good standing under the laws of the jurisdiction in which it is registered and/or incorporated, and that it has all the requisite corporate

power and authority to own its assets and to carry on its business as now conducted; |

| (c) | this Agreement has been duly and validly executed and delivered by it,

and constitutes its legal, valid and binding obligations, enforceable against it in accordance with the terms of this Agreement; |

| (d) | it is free to enter into this Agreement and that the transactions contemplated

hereunder are not in conflict with, or will result in, any breach of any of the terms of, or constitute a default under, any other contractual

or other obligation to which it is bound, party or subject; |

| (e) | the execution of this Agreement and its promises, agreements and/or

undertakings under this Agreement do not violate any law, rule, regulation or order applicable thereto; and |

| (f) | to the best of its knowledge, no litigation, arbitration or administrative

proceeding is taking place, pending or, to its knowledge, threatened against it, which will have a material impact on the Business Acquisition,

this Agreement, and/or the transactions contemplated thereby. |

| 8.3 | Each of AiChat10X and the

Founder (each, a “RTC Share Recipient”) hereby further represents and warrants to

RTC, as of the date hereof and as of the issuance of the Tranche Shares and/or the Founder’s RTC Shares (as applicable, the “RTC

Shares”), as follows: |

| (a) | Investment Purpose.

Each RTC Share Recipient is acquiring the RTC Shares for its or his own account for investment only and not with a view towards, or for

resale in connection with, the public sale or distribution thereof, except pursuant to sales registered or exempted from registration

under the Securities Act; provided, however, that by making the representations herein, such RTC Share Recipient reserves the right to

dispose of the RTC Shares at any time in accordance with or pursuant to an effective registration statement covering the RTC Shares or

an available exemption under the Securities Act. |

| (b) | Legends. Each RTC

Share Recipient understands that until such time as the RTC Shares have been registered under the Securities Act or may be sold pursuant

to Rule 144, Rule 144A under the Securities Act, Regulation S, or other applicable exemption without any restriction as to the number

of securities as of a particular date that can then be immediately sold, the RTC Shares may bear a restrictive legend in substantially

the following form (and a stop-transfer order may be placed against transfer of such RTC Shares): |

“THESE

SHARES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THESE SECURITIES MAY

NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SHARES UNDER

THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL (WHICH COUNSEL SHALL BE SELECTED BY THE HOLDER), IN A GENERALLY ACCEPTABLE

FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144, RULE 144A, REGULATION S, OR OTHER APPLICABLE

EXEMPTION UNDER SAID ACT.”

| (c) | Non-U.S. Person Status.

Each RTC Share Recipient further represents and warrants to RTC, as of the date hereof and as of the issuance of the RTC Shares, that:

(i) it or he is not a U.S. person as that term is defined under Regulation S; (ii) at the time the acquisition of the RTC Shares was

originated, such RTC Share Recipient was outside the United States and is outside of the United States as of the date of the execution

and delivery of this Agreement; (iii) such RTC Share Recipient is acquiring the RTC Shares for its or his own account and not on behalf

of any U.S. person, and the acquisition of such RTC Shares has not been pre-arranged with a purchaser in the United States. |

| (d) | Reliance on Exemptions;

Opinion. Each RTC Share Recipient understands that (i) the offering of the RTC Shares have not and will not be registered under the

Securities Act, (ii) the RTC Shares will be “restricted securities” (as that term is defined under Rule 144(a)(3) of the

Securities Act and such RTC Shares may not be resold unless they are registered under the Securities Act or an exemption from registration

is available), (iii) the RTC Shares are being issued to such RTC Share Recipient in reliance on specific exemptions from the registration

requirements of United States federal and state securities laws, and (iv) RTC is relying in part upon the truth and accuracy of, and

such RTC Share Recipient’s compliance with, the representations, warranties, agreements, acknowledgments and understandings set

forth herein in order to determine the availability of such exemptions and the eligibility of each RTC Share Recipient to acquire the

RTC Shares. |

| (e) | Information. Each

RTC Share Recipient and its or his advisors, if any, have been furnished with all materials relating to the business, finances and operations

of RTC and other information such RTC Share Recipient deemed material to making an informed investment decision regarding its acquisition

of the RTC Shares which have been requested by the RTC Share Recipients. Each RTC Share Recipient acknowledges that it or he has reviewed

the SEC Documents (as defined below), which are available on the SEC’s (as defined below) website (www.sec.gov) at no charge. Each

RTC Share Recipient acknowledges that it or he may retrieve all SEC Documents from such website and such RTC Share Recipient’s

access to such SEC Documents through such website shall constitute delivery of the SEC Documents to such RTC Share Recipient. Each RTC

Share Recipient and its or his advisors, if any, have been afforded the opportunity to ask questions of RTC and its management. Each

RTC Share Recipient understands that his investment in the RTC Shares involves a high degree of risk. Each RTC Share Recipient is financially

sophisticated sufficiently to evaluate the merits and risks of this investment. Each RTC Share Recipient has sought such accounting,

legal, and tax advice as it or he has considered necessary to make an informed investment decision with respect to its acquisition of

the RTC Shares. Without limiting the foregoing, each RTC Share Recipient has carefully considered the potential risks relating to RTC

and the acquisition of the RTC Shares, including those risks described in the SEC Documents, and each RTC Share Recipient fully understands

that the RTC Shares are a speculative investment that involves a high degree of risk of loss of its or his entire investment. As used

herein: (i) “SEC Documents” means all reports, schedules, forms, statements and

other documents filed under the Securities Act and the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated

thereunder, by RTC with the SEC, including any amendments thereto and any exhibits included therein and financial statements and schedules

thereto and documents incorporated by reference therein; and (ii) “SEC” means the

U.S. Securities and Exchange Commission. |

| (f) | No Governmental Review.

Each RTC Share Recipient understands that no United States federal or state any governmental or regulatory authority or body has passed

on or made any recommendation or endorsement of the RTC Shares, or the fairness, suitability or merits of an investment in the RTC Shares. |

| (g) | General Solicitation.

No RTC Share Recipient is acquiring the RTC Shares as a result of any advertisement, article, notice or other communication published

in any newspaper, magazine or similar media or broadcast over television or radio or presented at any seminar or any other general solicitation

or general advertisement. Each RTC Share Recipient represents that it has a relationship with RTC preceding the offering of the RTC Shares |

| 8.4 | Notwithstanding the provisions

hereof, the representations, warranties, undertakings and agreements contained herein shall continue to subsist for so long as may be

necessary for the purposes of giving effect to them. |

| 8.5 | AiChat10X hereby agrees to take responsibility for, and to indemnify,

defend and hold harmless RTC against, any liability, damages, losses, costs and/or expenses (including, but not limited to, legal fees

and litigation expenses), incurred by or imposed upon RTC, and/or any of the directors, officers, employees and affiliates thereof, in

connection with any third party claims, suits, actions, demands or judgments relating to, and associated with, the Company, arising prior

to the date hereof, and the consummation of the Business Acquisition. |

| 9.1 | AiChat10X, PT AiChat Teknologies Indonesia (“PT AiChat”)

and the Company have entered into an IP assignment deed on 8th July 2024, in relation to the assignment and transfer of all

the intellectual property rights currently legally and beneficially owned by, and/or registered in the name of, the Company and PT AiChat

(the “IP”), from the Company and PT AiChat to AiChat10X (the “IP Assignment

Deed”). The IP Assignment Deed is attached to Schedule II hereto. |

| 9.2 | AiChat10X shall maintain the ownership of the IP pursuant to the IP

Assignment Deed until 30th June 2025, when RTC shall become the sole shareholder of the Company, pursuant to, and in

accordance with, the terms and conditions set out in this Agreement. |

| 9.3 | Upon the registration of RTC as the sole shareholder of the Company,

pursuant to, and in accordance with, the terms and conditions set out in this Agreement, AiChat10X shall enter into a further IP assignment

deed with RTC in relation to the assignment and transfer of the IP from AiChat10X to RTC forthwith, the consideration for which shall

be the performance of RTC’s obligations under this Agreement, and after which RTC will assume the sole proprietary ownership of

the IP (the “RTC IP Transfer”). |

| 10.1 | From

the date of this Agreement, without the prior written consent of RTC, each of the other Parties agrees not to disclose the existence

of this Agreement, its contents or any information provided by one Party to another in connection with the Business Acquisition or the

RTC IP Transfer to any other third parties (other than such Party’s affiliates, directors, officers, employees, agents, lawyers and advisors),

nor to make any written or other public disclosures regarding the Business Acquisition or the RTC

IP Transfer, other than as required by law or as requested by any applicable governmental authority or stock exchange. |

| 10.2 | No announcement regarding the Business Acquisition or the RTC IP Transfer shall be made by the Founder,

the Company and/or AiChat10X without the prior written consent of RTC. |

| 11.1 | Each Party shall be entitled to rely upon and assume, without independent verification, the accuracy

and completeness of all information furnished by the other Parties in connection herewith (or their agents, advisors, affiliates or

subsidiaries), and it shall have no obligation to verify the accuracy or completeness of any such information. |

| 11.2 | Each Party agrees to promptly (a) notify the other Parties upon discovery that any information provided

in accordance herewith is, or may be, inaccurate, untrue, incomplete or misleading, and (b) inform and keep informed the other Parties

of any material developments that may (directly or indirectly) have any effect on this Agreement and the matters contemplated herein. |

| 12.1 | Each Party shall bear and be responsible for its own costs and expenses

relating to the negotiation, preparation, execution and performance by it of this Agreement and of each document referred to in it. |

| 12.2 | All taxes or other government charges assessed against or otherwise

payable by any Party relating to the First Share Transfer and the Second Share Transfer, including any capital gains taxes incurred by

any Party shall be the exclusive responsibility of, and shall be borne by, such Party. |

| 12.3 | Any stamp duty payable on this Agreement and/or in respect of the registration by the Company of the

Company’s Ordinary Shares in RTC’s name pursuant to this Agreement shall be borne and paid for by the Company. |

| 13. | Governing Law and Jurisdiction |

| 13.1 | This Agreement shall be governed by and be construed in accordance

with the laws of the Republic of Singapore. |

| 13.2 | Any dispute arising out of or in connection with this Agreement, including any question regarding its

existence, validity or termination, shall be referred to and finally resolved by arbitration administered by the Singapore International

Arbitration Centre in accordance with the Arbitration Rules of the Singapore International Arbitration Centre for the time being in force,

which rules are deemed to be incorporated by reference in this clause. |

| 13.3 | The seat of the arbitration shall be Singapore. The tribunal shall consist of one arbitrator. The language

of the arbitration shall be English. |

| 14.1 | Any notice or communication to be given by one Party to another Party in connection with this Agreement

shall be in writing in English and signed by or on behalf of the Party giving it. Such notice may be delivered by hand, email, registered

post or courier. |

| 14.2 | A notice shall be effective upon receipt and shall be deemed to have been received (a) at the time of

delivery, if delivered by hand, registered post or courier or (b) at the time of transmission if delivered by email. The addresses and

email addresses of the Parties for the purpose of this Clause 14 are: |

AiChat Pte. Ltd.

Email:

For the Attention of: Kester Poh

AiChat10X Pte. Ltd.

Email:

For the Attention of: Kester Poh

reAlpha Tech Corp.

6515 Longshore Loop, Dublin

Ohio 43017, United States of America

Email:

For the Attention

of: Giri Devanur / Mike Logozzo

Poh Kah Yong, Kester

Email:

| 15.1 | If, at any time, any provision

(or part thereof) of this Agreement is or becomes illegal, invalid or unenforceable in any respect under any law of any jurisdiction,

neither the legality, validity or enforceability of the remaining provisions nor the legality, validity or enforceability of such provision

under the law of any other jurisdiction will in any way be affected or impaired. |

| 15.2 | The rights, powers, privileges and remedies provided for in this Agreement

are cumulative and are not exclusive of any rights, powers, privileges or remedies provided by any applicable laws, regulations or otherwise. |

| 15.3 | This Agreement embodies all the terms and conditions agreed upon amongst

the Parties as to the subject matter of this Agreement and supersedes and cancels in all respects all previous agreements and undertakings,

amongst the Parties (if any) with respect to the subject matter hereof, whether such be written or oral. |

| 15.4 | This Agreement shall not be altered, changed, supplemented or amended

except by written instruments signed by the Parties. The waiver by either Party of a breach of any provision of this Agreement will not

operate as or be deemed a waiver of any subsequent breach by that Party. |

| 15.5 | The Parties agree that, to effectuate the purpose and objects of this

Agreement, and in consideration for the provisions contained herein, the Parties shall enter into such further documents as may be expedient

and mutually agreed upon. |

| 15.6 | This Agreement may be executed in any number of counterparts, each of

which when executed shall constitute a duplicate original, but all the counterparts shall together constitute the one Agreement. Transmission

of an executed counterpart of this Agreement (but for the avoidance of doubt not just a signature page) by email (in PDF, JPEG or other

accepted electronic format) shall take effect as delivery of an executed counterpart of this Agreement. |

| 15.7 | No Party may assign or transfer any right or liability under this Agreement

without the prior written consent of the other Parties; provided, however, that RTC may, without consent of the other Parties, assign

or transfer any right or liability under this Agreement in connection with a sale, merger, consolidation, reorganization, change of control

or similar transaction of RTC, whether by sale of stock, merger, sale of all or substantially all of RTC’s assets, operation of

law or otherwise. Any purported assignment in contravention of this Clause 15.7 shall be null and void. |

| 15.8 | All amounts herein denominated in a currency other than US Dollars shall, to the extent necessary or required, be converted into US

Dollars based on the applicable exchange rate as published in the Wall Street Journal on the relevant date of calculation. |

| 15.9 | This Agreement will be

binding on and be for the benefit of the successors, trustees and permitted assigns of the Parties.

|

IN WITNESS WHEREOF the Parties

have executed this Agreement the day and year first above written.

| Signed by POH KAH YONG, KESTER |

} |

| for and on behalf of |

} |

| AICHAT PTE. LTD. |

|

| |

|

| By: |

/s/ Poh Kah Yong, Kester |

|

| |

|

| Signed by POH KAH YONG, KESTER |

} |

| for and on behalf of |

} |

| AICHAT10X PTE. LTD. |

|

| |

|

| By: |

/s/ Poh Kah Yong, Kester |

} |

| |

|

| Signed by GIRI DEVANUR |

} |

| for and on behalf of |

} |

| REALPHA TECH CORP. |

|

| |

|

| By: |

/s/ Giri Devanur |

} |

| |

|

| Signed by POH KAH YONG, KESTER |

|

| |

|

| By: |

/s/ Poh Kah Yong, Kester |

} |

| |

} |

SCHEDULE I

THE TERM SHEET

(see attached)

SCHEDULE II

IP ASSIGNMENT

DEED

(see attached)

14 | P a g e

Exhibit 99.1

reAlpha Tech Corp. acquires AiChat Pte. Ltd.

Dublin, OH, July 15, 2024 [BUSINESS WIRE]

– reAlpha Tech Corp. (“reAlpha” or the “Company”) (Nasdaq: AIRE), a real estate technology company developing

and commercializing artificial intelligence (“AI”) technologies, today announced that it has acquired 85% of the outstanding

equity in AiChat Pte. Ltd. (“AiChat”).

AiChat is an award winning Singapore-based company

that develops AI-powered conversational customer experience solutions that provide enterprise customers with intelligent chatbots and

automation tools that improve customer interactions and operational efficiency. The Company will acquire the remaining 15% on June 30,

2025.

The total purchase price is $1.14 million, which

is payable in shares of the Company’s common stock in three tranches beginning no later than January 1, 2025. The Company has also

agreed to infuse $300,000 into AiChat at such time determined by the parties. This strategic acquisition marks a significant milestone

in reAlpha’s growth trajectory and underscores its commitment to expanding its technological capabilities and market presence in

the Asia-Pacific (APAC) region.

reAlpha expects that integrating AiChat’s conversational

AI and customer experience platform, which supports over 250 languages, into its business will enhance reAlpha’s technological capabilities

by providing customers with more robust and intelligent customer interaction tools due to the sentiment analysis and machine learning

capabilities from AiChat’s platform.

Additionally, reAlpha believes that AiChat’s

platform capabilities and already established sales channels will increase usage and visibility of its technologies and platforms, including

Claire, reAlpha’s commission-free homebuying platform, which in turn is expected to lead to more customers using reAlpha’s

platforms when seeking real estate solutions, including homebuyers purchasing a home via Claire. As a result of this acquisition, reAlpha

believes its brand and market position in the AI industry will be further bolstered by leveraging AiChat’s brand and expertise in

such industry.

The global conversational AI market, the industry

AiChat operates in, is projected to expand from $13.2 billion in 2024 to $49.9 billion by 2030, growing at a compound annual growth rate

(CAGR) of 24.9% over the forecast period.

Giri Devanur, CEO of reAlpha, commented, “We

are thrilled to welcome AiChat to the reAlpha group. We believe this accretive acquisition is a large step in our journey to bring the

global real estate industry into the digital era. AiChat’s innovative platform and talented team will accelerate our efforts to

make Claire set the new standard for efficiency, accessibility and reliability when it comes to buying a new home.”

Kester Poh, AiChat’s CEO and founder, along with

the key management team, are expected to continue to lead AiChat as part of the reAlpha group. reAlpha believes that this will ensure

continuity and leverage their domain expertise to drive forward the combined company’s vision. Mr. Poh added, “Joining forces

with reAlpha opens up exciting new opportunities for AiChat. We look forward to integrating our technology with reAlpha’s resources

and expertise, which will help us to enhance our product offerings and expand our market leadership.”

For additional details concerning the terms of

this acquisition, please reference the Company’s Current Report on Form 8-K which will be filed with the U.S. Securities and Exchange

Commission (the “SEC”).

About reAlpha Tech Corp.

reAlpha is a real estate technology company with

a mission to shape the property technology, or “proptech,” market landscape through the commercialization of artificial intelligence

technologies and strategic synergistic acquisitions that complement our business model. For more information about reAlpha, visit www.realpha.com.

About Claire

Claire, announced on April 24, 2024, is reAlpha’s

generative AI-powered, zero-commission homebuying platform. The tagline: No fees. Just keys.TM

Claire’s introduction aligns with major shifts

in the real estate sector after the National Association of Realtors (NAR) agreed to settle certain lawsuits after they were found to

have violated antitrust laws, resulting in inflated fees paid to buy-side agents. This development is expected to result in the end of

the standard 6 percent sales commission, which equates to approximately $100 billion in realtor fees paid annually. Claire offers a cost-free

alternative for homebuyers by utilizing an AI-driven workflow that assists them through the home buying process.

Homebuyers can use Claire’s conversational

interface to guide them through every step of their journeys, from property search to closing the deal. By offering support 24/7, Claire

is poised to make the homebuying process more efficient, enjoyable and cost-efficient. Claire matches buyers with their dream homes using

over 400 data attributes and provides insights into market trends and property values. Additionally, Claire can assist with questions,

booking property tours, submitting offers, and negotiations.

Currently, Claire is under limited availability

for homebuyers located in Palm Beach, Miami-Dade and Broward counties in South Florida, but we are actively seeking new MLS and brokerage

licenses that will allow us to expand into a larger number of U.S. states.

For more information on Claire, please visit www.reAlpha.com

About AiChat Pte. Ltd.

AiChat Pte. Ltd. is a Singapore-based company

that develops AI-powered conversational customer experience solutions. Its platform leverages artificial intelligence to provide businesses

with intelligent chatbots and automation tools that improve customer interactions and operational efficiency. For more information about

AiChat, visit www.aichat.com.

Forward-Looking Statements

The information in this press release includes

“forward-looking statements”. Forward-looking statements include, among other things, statements about the AiChat acquisition;

the anticipated benefits of the AiChat acquisition, reAlpha’s ability to anticipate the future needs of the short-term rental market;

future trends in the real estate, technology and artificial intelligence industries, generally; and reAlpha’s future growth strategy

and growth rate. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”,

“could”, “might”, “plan”, “possible”, “project”, “strive”, “budget”,

“forecast”, “expect”, “intend”, “will”, “estimate”, “anticipate”,

“believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations

of them or similar terminology. Factors that may cause actual results to differ materially from current expectations include, but are

not limited to: reAlpha’s limited operating history and that reAlpha has not yet fully developed its AI-based technologies; reAlpha’s

ability to commercialize its developing AI-based technologies; whether reAlpha’s technology and products will be accepted and adopted

by its customers and intended users; reAlpha’s ability to integrate the business of aAiChat into its existing business and the anticipated

demand for AiChat’s services; the inability to maintain and strengthen reAlpha’s brand and reputation; the inability to accurately

forecast demand for short-term rentals and AI-based real estate focused products; the inability to execute business objectives and growth

strategies successfully or sustain reAlpha’s growth; the inability of reAlpha’s customers to pay for reAlpha’s services;

changes in applicable laws or regulations, and the impact of the regulatory environment and complexities with compliance related to such

environment; and other risks and uncertainties indicated in reAlpha’s SEC filings. Forward-looking statements are based on the opinions

and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors

that could cause actual events or results to differ materially from those anticipated in the forward-looking statements. Although reAlpha

believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations

will prove to be correct. reAlpha’s future results, level of activity, performance or achievements may differ materially from those

contemplated, expressed or implied by the forward-looking statements, and there is no representation that the actual results achieved

will be the same, in whole or in part, as those set out in the forward-looking statements. For more information about the factors that

could cause such differences, please refer to reAlpha’s filings with the SEC. Readers are cautioned not to put undue reliance on

forward-looking statements, and reAlpha does not undertake any obligation to update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except as required by law.

For media inquiries, please contact:

ICR on behalf of reAlpha

media@realpha.com

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

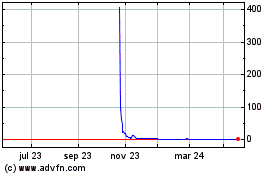

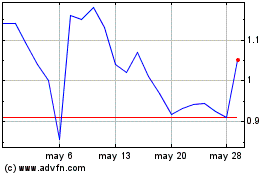

reAlpha Tech (NASDAQ:AIRE)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

reAlpha Tech (NASDAQ:AIRE)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024