American Resources Corporation’s (NASDAQ: AREC) ("American

Resources") wholly-owned subsidiary, American Metals LLC (“American

Metals”), and AI Transportation Acquisition Corp (Nasdaq: AITR), a

publicly-listed special purpose acquisition company (“AITR”), today

announced that American Metals and AITR have executed a definitive

business combination agreement (the “Business Combination

Agreement”) for a proposed business combination (the “Business

Combination”) in a transaction valued at $170,000,000.

Pursuant to the Business Combination Agreement,

each of AITR and American Metals will become wholly-owned

subsidiaries of a newly formed Delaware corporation, Electrified

Materials Corporation ("Pubco"), which will serve as the parent

company of AITR and American Metals following the consummation of

the Business Combination. It is anticipated that the combined

company will be listed on the Nasdaq Stock Market under the ticker

symbol “EMCO.”

American Metals is a cutting-edge recycler of

metals to the electrified economy and processor of used metals and

minerals to be recycled and further refined into new steel-based,

battery-grade and magnet-grade products. Today, American Metals

operates within the U.S. with its origins being the reclamation of

former thermal coal mines. By leveraging its regional logistics and

infrastructure as well as its knowledge and affiliation with

ReElement Technologies Corporation (“ReElement”), an

industry-leading refining technology platform, American Metals

expects to expand its presence in the high-growth market of used

steel, rare-earth elements, battery materials while also cleaning

up old infrastructure left behind from the declining mining

industry.

The exploding demand for these metals worldwide

is expected to result in an undersupply, threatening the

realization of the energy transition. Despite their scarcity, the

recycling rate for many critical metals is below 5%, with total

recycled metals in batteries currently around

1%, and recycling rate of certain rare earths even below

1%, according to the World Economic Forum’s April 24, 2024 report.1

American Metals is uniquely positioned to be a leading producer of

critical metals while contributing to a reduction in global

greenhouse gases. Importantly, American Metals has also established

a complete closed-loop supply chain for such materials through its

non-exclusive partnership with ReElement to refine such material to

battery and magnet grade (lithium, cobalt, nickel, rare earth

elements and copper).

Mark Jensen, Chairman and CEO

of American Resources Corporation said, “This is

an exciting moment for American Metals. Our American Metals

division is uniquely positioned to expand its business in the

recycling marketplace through direct engagements as well as joint

venture partnerships such as with ReElement Technologies

Corporation. The company has been working with additional partners

on cutting edge technologies to reduce labor costs and maximize

margins for shareholders in the recycling process. This business

combination provides American Metals an exciting growth platform to

further capitalize its business to expand its footprint and use of

technology and automation in the recycling business of rare earth

magnets, battery materials, copper, aluminum and ferrous metals,

while also leveraging its partnership with ReElement to aggregate

and process a variety recycled feedstocks. We’re excited to

continue to foster this business combination with the AITR team to

generate attractive value for our shareholders.”

Mr. Yongjin Chen,

Chairman and CEO

of AITR added, “We’re thrilled to partner with the

American Metals team to capitalize on their proven track record and

support the expansion of their operations to meet the demand for

critical metals. Moreover, a significant amount of energy

greenhouse gas emission reductions is possible from the scaleup of

renewable technologies, many of which rely on critical metals. We

have strong confidence in American Metals' management team and

business model. We look forward to a successful closing of the

Business Combination."

The completion of the Business Combination is

subject to regulatory approvals, the approval of the transaction by

the shareholders of AITR and American Metals, and the

satisfaction or waiver of other customary closing conditions.

Throughout the Business Combination, AITR will

endeavor to support American Metals’ business growth to strengthen

American Metals’ position in the high-growth market of used steel

and rare-earth metals markets. American Metals believes that its

planned listing, in addition to creating a capital platform for its

development and gaining the attention of investors in the

international capital markets, will further promote American

Metals’ growth strategy.

Additional information about the Business

Combination, including a copy of the Business Combination

Agreement, will be available in a Current Report on Form 8-K to be

filed by AITR with the Securities and Exchange Commission (the

"SEC"), followed by a Registration Statement on Form S-4 to be

filed by Pubco with the SEC.

Advisors

Rimon P.C. serves as United States legal counsel

to AITR and Ogier (Caymans) serves as Cayman Islands counsel. Loeb

& Loeb LLP serves as United States legal counsel to American

Metals LLC. ARC Group Limited is acting as sole financial advisor

to AITR.

About American Resources Corporation

American Resources Corporation (NASDAQ: AREC) is

a next-generation, environmentally and socially responsible

supplier of high-quality raw materials to the new infrastructure

market. The American Resources is focused on the extraction and

processing of metallurgical carbon, an essential ingredient used in

steelmaking, critical and rare earth minerals for the

electrification market, and reprocessed metal to be recycled.

American Resources has a growing portfolio of operations located in

the Central Appalachian basin of eastern Kentucky and southern West

Virginia where premium quality metallurgical carbon and rare earth

mineral deposits are concentrated.

American Resources has established a nimble,

low-cost business model centered on growth, which provides a

significant opportunity to scale its portfolio of assets to meet

the growing global infrastructure and electrification markets while

also continuing to acquire operations and significantly reduce

their legacy industry risks. Its streamlined and efficient

operations are able to maximize margins while reducing costs. For

more information visit americanresourcescorp.com or connect with

the American Resources on Facebook, Twitter, and LinkedIn.

About American Metals LLC

American Metals LLC (“American Metals”) was

formed by, and is a wholly-owned subsidiary of, American Resources

Corp (Nasdaq: AREC). American Metals is a cutting-edge recycler of

metals for the electrified economy. It controls the preprocessing

of both end of life magnets, batteries and ferrous metals that

enables American Metals to ensure a domestic supply chain for

copper, aluminum, steel, plastic as well as rare earth and battery

elements through its refining partnership with ReElement

Technologies, LLC, another wholly-owned subsidiary of American

Resources Corp.

About AI Transportation

Acquisition Corp.

AI Transportation Acquisition Corp. (“AITR”) is

a blank check company formed for the purpose of effecting a merger,

capital stock exchange, asset acquisition, share purchase,

reorganization or similar business combination with one or more

businesses. Efforts to identify a prospective target business will

not be limited to a particular business, industry or sector or

geographical region. On November 8, 2023, AITR consummated an

initial public offering of its units, with each unit consisting of

one ordinary share and one right to receive one-eighth (1/8) of one

ordinary share upon consummation of AITR’s initial business

combination.

Important

Information About the Proposed Business Combination and Where to

Find It

For additional

information on the proposed transaction, see AITR’s Current Report

on Form 8-K, which will be filed concurrently with this press

release. In connection with the proposed transaction, AITR intends

to file relevant materials with the SEC, including a registration

statement on Form S-4, which will include a proxy

statement/prospectus, and other documents regarding the proposed

transaction. AITR’s shareholders and other interested persons are

advised to read, when available, the preliminary proxy statement/

prospectus and the amendments thereto and the definitive proxy

statement and documents incorporated by reference therein filed in

connection with the proposed business combination, as these

materials will contain important information about American Metals

and AITR and the proposed business combination.

Promptly after the Form S-4 is declared

effective by the SEC, AITR will mail the definitive proxy

statement/prospectus and a proxy card to each shareholder entitled

to vote at the meeting relating to the approval of the business

combination and other proposals set forth in the proxy

statement/prospectus. Before making any voting or investment

decision, investors and shareholders of AITR are urged to carefully

read the entire registration statement and proxy

statement/prospectus, when they become available, and any other

relevant documents filed with the SEC, as well as any amendments or

supplements to these documents, because they will contain important

information about the proposed transaction. The documents filed by

AITR with the SEC may be obtained free of charge at the SEC’s

website at www.sec.gov, or by directing a request to AITR, 10 East

53rd Street, Suite 3001, New York, New York 10022.

Participants

in the Solicitation

AITR and certain of

its directors, executive officers and other members of management

and employees may, under SEC rules, be deemed to be participants in

the solicitation of proxies from AITR’s shareholders in connection

with the proposed transaction. A list of the names of those

directors and executive officers and a description of their

interests in AITR will be included in the proxy

statement/prospectus for the proposed business combination when

available at www.sec.gov.

Information about

AITR’s directors and executive officers and their ownership of AITR

shares of common stock is set forth in AITR’s final prospectus for

its for its initial public offering filed with the SEC on November

9, 2023, and as amended and filed on November 13, 2023, as modified

or supplemented by any Form 3 or Form 4 filed with the SEC since

the date of such filing. Other information regarding the interests

of the participants in the proxy solicitation will be included in

the proxy statement/prospectus pertaining to the proposed business

combination when it becomes available. These documents can be

obtained free of charge from the source indicated above.

American Metals and

its directors and executive officers may also be deemed to be

participants in the solicitation of proxies from the shareholders

of AITR in connection with the proposed business combination. A

list of the names of such directors and executive officers and

information regarding their interests in the proposed business

combination will be included in the proxy statement/prospectus for

the proposed business combination.

Additional information

regarding the participants in the proxy solicitation and a

description of their direct and indirect interests is included in

the proxy statement/prospectus filed with the SEC on Form S-4.

Shareholders, potential investors and other interested persons

should read the proxy statement/ prospectus carefully when it

becomes available before making any voting or investment decisions.

You may obtain free copies of these documents from the sources

indicated above.

Cautionary

Statement Regarding Forward-Looking Statements

Certain statements

contained in this press release constitute “forward-looking

statements” within the meaning of federal securities laws.

Forward-looking statements may include, but are not limited to,

statements with respect to (i) trends in the financial advisory

industry, including changes in demand and supply related to

American Metals’ products; (ii) American Metals’ growth prospects

and American Metals’ market size; (iii) American Metals’ projected

financial and operational performance including relative to its

competitors; (iv) new product and service offerings American Metals

may introduce in the future; (v) the potential transaction,

including the implied enterprise value, the expected post-closing

ownership structure and the likelihood and ability of the parties

to consummate the potential transaction successfully; (vi) the risk

the proposed business combination may not be completed in a timely

manner or at all, which may adversely affect the price of AITR

securities; (vii) the failure to satisfy the conditions to the

consummation of the proposed business combination, including the

approval of the proposed business combination by the shareholders

of AITR; (viii) the effect of the announcement or pendency of the

proposed business combination on AITR’s or American Metals’

business relationships, performance and business generally; (ix)

the outcome of any legal proceedings that may be instituted against

AITR or American Metals related to the proposed business

combination or any agreement related thereto; (x) the ability to

maintain the listing of AITR on Nasdaq; (xi) the price of AITR’s

securities, including volatility resulting from changes in the

competitive and regulated industry in which American Metals

operates, variations in performance across competitors, changes in

laws and regulations affecting American Metals’ business and

changes in the combined capital structure; (xii) the ability to

implement business plans, forecasts, and other expectations after

the completion of the proposed business combination and identify

and realize additional opportunities; and (xiii) other statements

regarding AITR’s or American Metals’ expectations, hopes, beliefs,

intentions and strategies regarding the future.

In addition, any

statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions are forward-looking statements. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intends,” “outlook,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “would,” and similar

expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject, are subject to risks and uncertainties.

You should carefully

consider the risks and uncertainties described in the “Risk

Factors” section of AITR’s final prospectus filed with the SEC on

November 9, 2023, and as amended and filed on November 13, 2023,

for its initial public offering and, the proxy statement/prospectus

relating to this transaction, which is expected to be filed by AITR

with the SEC, other documents filed by AITR from time to time with

SEC, and any risk factors made available to you in connection with

AITR, American Metals, and the transaction. These forward-looking

statements involve a number of risks and uncertainties (some of

which are beyond the control of American Metals and AITR) and other

assumptions, that may cause the actual results or performance to be

materially different from those expressed or implied by these

forward-looking statements. AITR and American Metals caution that

the foregoing list of factors is not exclusive.

No Offer or

Solicitation

This press release

relates to a proposed business combination between AITR and

American Metals, and does not constitute a proxy statement or

solicitation of a proxy and does not constitute an offer to sell or

a solicitation of an offer to buy the securities of AITR or

American Metals, nor shall there be any sale of any such securities

in any state or jurisdiction in which such offer, solicitation, or

sale would be unlawful prior to registration or qualification under

the securities laws of such state or jurisdiction.

Contacts

American Resources or American Metals Contact:Mark

LaVerghettaVice President of Corporate Finance and

Communications317-855-9926 ext.

0investor@americanresourcescorp.com

AI Transportation Acquisition CorpMr. Yongjin ChenChief

Executive Officer10 East 53rd Street, Suite 3001New York, NY

10022Email: chenyongjin@ds-cap.com

SOURCE: AI Transportation

Acquisition Corp and American Resources Corporation

1 Special Meeting on Global Collaboration, Growth and Energy for

Development 2024 | World Economic Forum (weforum.org)

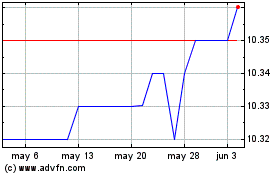

AI Transportation Acquis... (NASDAQ:AITR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

AI Transportation Acquis... (NASDAQ:AITR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024