Amazon.com, Inc. (NASDAQ:AMZN) today announced financial results

for its third quarter ended September 30, 2024.

- Net sales increased 11% to $158.9 billion in the third

quarter, compared with $143.1 billion in third quarter 2023.

Excluding the $0.2 billion unfavorable impact from year-over-year

changes in foreign exchange rates throughout the quarter, net sales

increased 11% compared with third quarter 2023.

- North America segment sales increased 9% year-over-year to

$95.5 billion.

- International segment sales increased 12% year-over-year to

$35.9 billion.

- AWS segment sales increased 19% year-over-year to $27.5

billion.

- Operating income increased to $17.4 billion in the third

quarter, compared with $11.2 billion in third quarter 2023.

- North America segment operating income was $5.7 billion,

compared with operating income of $4.3 billion in third quarter

2023.

- International segment operating income was $1.3 billion,

compared with an operating loss of $0.1 billion in third quarter

2023.

- AWS segment operating income was $10.4 billion, compared with

operating income of $7.0 billion in third quarter 2023.

- Net income increased to $15.3 billion in the third

quarter, or $1.43 per diluted share, compared with $9.9 billion, or

$0.94 per diluted share, in third quarter 2023.

- Operating cash flow increased 57% to $112.7 billion for

the trailing twelve months, compared with $71.7 billion for the

trailing twelve months ended September 30, 2023.

- Free cash flow increased to $47.7 billion for the

trailing twelve months, compared with $21.4 billion for the

trailing twelve months ended September 30, 2023.

- Free cash flow less principal repayments of finance leases

and financing obligations increased to $44.9 billion for the

trailing twelve months, compared with $15.9 billion for the

trailing twelve months ended September 30, 2023.

- Free cash flow less equipment finance leases and principal

repayments of all other finance leases and financing

obligations increased to $46.1 billion for the trailing twelve

months, compared with $20.2 billion for the trailing twelve months

ended September 30, 2023.

“As we get into the holiday season, we’re excited about what we

have in store for customers,” said Andy Jassy, Amazon President

& CEO. “We kicked off the holiday season with our biggest-ever

Prime Big Deal Days and the launch of an all-new Kindle lineup that

is significantly outperforming our expectations; and there’s so

much more coming, from tens of millions of deals, to our NFL Black

Friday game and Election Day coverage with Brian Williams on Prime

Video, to over 100 new cloud infrastructure and AI capabilities

that we’ll share at AWS re:Invent the week after Thanksgiving.”

Some other highlights since the company’s last earnings

announcement include that Amazon:

- Held its annual Prime Big Deal Days shopping event, with record

sales, number of items sold, and Prime member participation, saving

Prime members more than $1 billion with deals across its

Store.

- Announced its first-ever fuel savings offer for Prime, saving

U.S. members 10 cents a gallon on fuel at approximately 7,000 bp,

Amoco, and ampm locations.

- Expanded its selection of brands with AllSaints, Beats x Kim,

Estée Lauder, kate spade new york, and more.

- Announced plans to expand Amazon Pharmacy Same-Day Delivery of

medications to nearly half the U.S. in 2025 by accelerating the

roll out of new pharmacies in 20 more U.S. cities by the end of

next year.

- Launched new generative AI-powered features, including:

- Rufus, a generative AI expert shopping assistant, becoming

available in Canada, France, Germany, India, Italy, Spain, and the

UK.

- AI Shopping Guides, which simplifies product research by using

generative AI to pair information about a product category with

Amazon’s wide selection, making it easier for customers to find the

right product for their needs.

- Project Amelia, an AI assistant for sellers that offers

tailored business insights to boost productivity and drive seller

growth.

- Video generation and live image capabilities for advertisers

that makes it fast and easy for brands to deliver compelling

creative for customers through short, animated campaign

images.

- Launched new foundation models in Amazon Bedrock and Amazon

SageMaker, including AI21 Labs’ Jamba 1.5 family, Anthropic’s

upgraded Claude 3.5 Sonnet, Meta’s Llama 3.2, Mistral Large 2, and

multiple Stability AI models.

- Launched new memory-optimized, compute-optimized, and general

purpose Amazon EC2 instances based on AWS’s latest generation

Graviton4 processor, which delivers 75% more memory bandwidth and

30% better compute performance than the previous generation

Graviton chips.

- Launched Oracle Database@AWS for customers to easily and

quickly migrate Oracle workloads to dedicated infrastructure on AWS

with minimal to no database or application changes.

- Entered a strategic collaboration with Databricks to accelerate

the development of custom models built with Databricks Mosaic AI on

AWS, and for Databricks to leverage AWS Trainium chips as the

preferred AI chip to help customers improve price-performance when

building generative AI applications.

- Signed AWS agreements with several large enterprise companies

such as The Australia and New Zealand Banking Group Limited,

Booking.com, Capital One, Datadog, Epic Games, Fast Retailing, Itaú

Unibanco, Luma AI, National Australia Bank, Sony, T-Mobile, Toyota,

and Veeva.

- Launched Season 2 of The Lord of the Rings: The Rings of Power

to positive reviews from customers and critics alike, ranking as

Prime Video’s most watched returning season ever by hours

watched.

- Drew more than 17 million viewers to the Cowboys-Giants

Thursday Night Football game, the most-streamed NFL regular season

game ever.

- Added Apple TV+ to Prime Video’s collection of over 100 add-on

subscription channels in the U.S.

- Announced a new Kindle lineup, including a reimagined Kindle

Scribe with generative AI, the Kindle Colorsoft with a color

display, and the fastest Kindle Paperwhite ever.

- Announced investments in the Delivery Service Partner program

of $2.1 billion in North America to support safety programs,

training, incentives, and more, as well as 25 billion yen in Japan

to support last mile delivery innovation, and safety and technology

for drivers.

- Announced plans to hire 250,000 people across its U.S.

operations ahead of the holiday season. All seasonal employees earn

at least $18 per hour and have access to comprehensive benefits

like health care.

- Announced plans for AWS to invest £8 billion over five years in

the UK, supporting 14,000 jobs annually.

- Removed plastic air pillows from all delivery packaging at

fulfillment centers globally, including expanding its use of paper

filler made from 100% recycled content across North America to

replace plastic air pillows.

- Mobilized Disaster Relief by Amazon to support communities

around the world impacted by natural disasters. In the U.S., Amazon

leveraged its Disaster Relief Hub in Atlanta to support communities

impacted by Hurricanes Helene and Milton with donated goods,

logistics support, and technology. In Europe, Amazon mobilized its

global logistics infrastructure, inventory, teams, and technology

to provide rapid assistance for flooding across the region.

For additional highlights from the quarter, visit

aboutamazon.com/news/company-news/amazon-earnings-q3-2024-highlights.

Financial Guidance

The following forward-looking statements reflect Amazon.com’s

expectations as of October 31, 2024, and are subject to substantial

uncertainty. Our results are inherently unpredictable and may be

materially affected by many factors, such as fluctuations in

foreign exchange rates, changes in global economic and geopolitical

conditions and customer demand and spending (including the impact

of recessionary fears), inflation, interest rates, regional labor

market constraints, world events, the rate of growth of the

internet, online commerce, cloud services, and new and emerging

technologies, and the various factors detailed below.

Fourth Quarter 2024 Guidance

- Net sales are expected to be between $181.5 billion and $188.5

billion, or to grow between 7% and 11% compared with fourth quarter

2023. This guidance anticipates an unfavorable impact of

approximately 10 basis points from foreign exchange rates.

- Operating income is expected to be between $16.0 billion and

$20.0 billion, compared with $13.2 billion in fourth quarter

2023.

- This guidance assumes, among other things, that no additional

business acquisitions, restructurings, or legal settlements are

concluded.

Conference Call Information

A conference call will be webcast live today at 2:00 p.m.

PT/5:00 p.m. ET, and will be available for at least three months at

amazon.com/ir. This call will contain forward-looking statements

and other material information regarding the Company’s financial

and operating results.

Forward-Looking Statements

These forward-looking statements are inherently difficult to

predict. Actual results and outcomes could differ materially for a

variety of reasons, including, in addition to the factors discussed

above, the amount that Amazon.com invests in new business

opportunities and the timing of those investments, the mix of

products and services sold to customers, the mix of net sales

derived from products as compared with services, the extent to

which we owe income or other taxes, competition, management of

growth, potential fluctuations in operating results, international

growth and expansion, the outcomes of claims, litigation,

government investigations, and other proceedings, fulfillment,

sortation, delivery, and data center optimization, risks of

inventory management, variability in demand, the degree to which

the Company enters into, maintains, and develops commercial

agreements, proposed and completed acquisitions and strategic

transactions, payments risks, and risks of fulfillment throughput

and productivity. Other risks and uncertainties include, among

others, risks related to new products, services, and technologies,

security breaches, system interruptions, government regulation and

taxation, and fraud. In addition, global economic and geopolitical

conditions and additional or unforeseen circumstances,

developments, or events may give rise to or amplify many of these

risks. More information about factors that potentially could affect

Amazon.com’s financial results is included in Amazon.com’s filings

with the Securities and Exchange Commission (“SEC”), including its

most recent Annual Report on Form 10-K and subsequent filings.

Additional Information

Our investor relations website is amazon.com/ir and we encourage

investors to use it as a way of easily finding information about

us. We promptly make available on this website, free of charge, the

reports that we file or furnish with the SEC, corporate governance

information (including our Code of Business Conduct and Ethics),

and select press releases, which may contain material information

about us, and you may subscribe to be notified of new information

posted to this site.

About Amazon

Amazon is guided by four principles: customer obsession rather

than competitor focus, passion for invention, commitment to

operational excellence, and long-term thinking. Amazon strives to

be Earth’s Most Customer-Centric Company, Earth’s Best Employer,

and Earth’s Safest Place to Work. Customer reviews, 1-Click

shopping, personalized recommendations, Prime, Fulfillment by

Amazon, AWS, Kindle Direct Publishing, Kindle, Career Choice, Fire

tablets, Fire TV, Amazon Echo, Alexa, Just Walk Out technology,

Amazon Studios, and The Climate Pledge are some of the things

pioneered by Amazon. For more information, visit amazon.com/about

and follow @AmazonNews.

AMAZON.COM, INC.

Consolidated Statements of

Cash Flows

(in millions)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

Twelve Months Ended

September 30,

2023

2024

2023

2024

2023

2024

CASH, CASH EQUIVALENTS, AND RESTRICTED

CASH, BEGINNING OF PERIOD

$

50,067

$

71,673

$

54,253

$

73,890

$

35,178

$

50,081

OPERATING ACTIVITIES:

Net income

9,879

15,328

19,801

39,244

20,079

49,868

Adjustments to reconcile net income to net

cash from operating activities:

Depreciation and amortization of property

and equipment and capitalized content costs, operating lease

assets, and other

12,131

13,442

34,843

37,164

47,528

50,984

Stock-based compensation

5,829

5,333

17,704

17,016

23,310

23,335

Non-operating expense (income), net

(990

)

(141

)

(409

)

2,498

3,036

2,159

Deferred income taxes

(1,196

)

(1,317

)

(4,412

)

(3,040

)

(7,779

)

(4,504

)

Changes in operating assets and

liabilities:

Inventories

808

(1,509

)

(1,194

)

(2,818

)

1,986

(175

)

Accounts receivable, net and other

(3,584

)

(701

)

(901

)

774

(5,641

)

(6,673

)

Other assets

(3,134

)

(4,537

)

(9,463

)

(10,293

)

(13,511

)

(13,095

)

Accounts payable

2,820

(477

)

(5,415

)

(5,754

)

4,437

5,134

Accrued expenses and other

(1,321

)

129

(9,022

)

(6,946

)

(3,245

)

(352

)

Unearned revenue

(25

)

421

949

2,396

1,454

6,025

Net cash provided by (used in) operating

activities

21,217

25,971

42,481

70,241

71,654

112,706

INVESTING ACTIVITIES:

Purchases of property and equipment

(12,479

)

(22,620

)

(38,141

)

(55,165

)

(54,733

)

(69,753

)

Proceeds from property and equipment sales

and incentives

1,181

1,342

3,361

3,559

4,513

4,794

Acquisitions, net of cash acquired,

non-marketable investments, and other

(1,629

)

(622

)

(5,458

)

(4,547

)

(6,289

)

(4,928

)

Sales and maturities of marketable

securities

1,393

8,069

4,059

12,726

9,742

14,294

Purchases of marketable securities

(219

)

(3,068

)

(1,053

)

(13,472

)

(1,286

)

(13,907

)

Net cash provided by (used in) investing

activities

(11,753

)

(16,899

)

(37,232

)

(56,899

)

(48,053

)

(69,500

)

FINANCING ACTIVITIES:

Proceeds from short-term debt, and

other

216

1,725

17,395

2,588

28,002

3,322

Repayments of short-term debt, and

other

(8,095

)

(1,820

)

(19,339

)

(2,453

)

(35,136

)

(8,791

)

Proceeds from long-term debt

—

—

—

—

8,235

—

Repayments of long-term debt

—

(2,183

)

(3,386

)

(6,682

)

(4,643

)

(6,972

)

Principal repayments of finance leases

(1,005

)

(402

)

(3,605

)

(1,710

)

(5,245

)

(2,489

)

Principal repayments of financing

obligations

(64

)

(78

)

(198

)

(247

)

(260

)

(320

)

Net cash provided by (used in) financing

activities

(8,948

)

(2,758

)

(9,133

)

(8,504

)

(9,047

)

(15,250

)

Foreign currency effect on cash, cash

equivalents, and restricted cash

(502

)

690

(288

)

(51

)

349

640

Net increase (decrease) in cash, cash

equivalents, and restricted cash

14

7,004

(4,172

)

4,787

14,903

28,596

CASH, CASH EQUIVALENTS, AND RESTRICTED

CASH, END OF PERIOD

$

50,081

$

78,677

$

50,081

$

78,677

$

50,081

$

78,677

SUPPLEMENTAL CASH FLOW INFORMATION:

Cash paid for interest on debt, net of

capitalized interest

$

465

$

266

$

1,821

$

1,215

$

2,450

$

2,002

Cash paid for operating leases

2,692

2,940

7,687

9,116

10,052

11,882

Cash paid for interest on finance

leases

76

71

234

217

318

291

Cash paid for interest on financing

obligations

50

47

150

161

205

207

Cash paid for income taxes, net of

refunds

2,628

2,004

6,982

8,162

8,677

12,359

Assets acquired under operating leases

3,345

3,571

11,075

11,235

15,844

14,212

Property and equipment acquired under

finance leases, net of remeasurements and modifications

183

186

431

409

748

620

Property and equipment recognized during

the construction period of build-to-suit lease arrangements

93

21

308

89

618

138

Property and equipment derecognized after

the construction period of build-to-suit lease arrangements, with

the associated leases recognized as operating

492

—

1,212

—

3,063

162

AMAZON.COM, INC.

Consolidated Statements of

Operations

(in millions, except per share

data)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2024

2023

2024

Net product sales

$

63,171

$

67,601

$

179,184

$

190,085

Net service sales

79,912

91,276

225,640

260,082

Total net sales

143,083

158,877

404,824

450,167

Operating expenses:

Cost of sales

75,022

80,977

212,186

227,395

Fulfillment

22,314

24,660

64,524

70,543

Technology and infrastructure

21,203

22,245

63,584

64,973

Sales and marketing

10,551

10,609

31,468

30,783

General and administrative

2,561

2,713

8,806

8,496

Other operating expense (income), net

244

262

613

587

Total operating expenses

131,895

141,466

381,181

402,777

Operating income

11,188

17,411

23,643

47,390

Interest income

776

1,256

2,048

3,429

Interest expense

(806

)

(603

)

(2,469

)

(1,836

)

Other income (expense), net

1,031

(27

)

649

(2,718

)

Total non-operating income (expense)

1,001

626

228

(1,125

)

Income before income taxes

12,189

18,037

23,871

46,265

Provision for income taxes

(2,306

)

(2,706

)

(4,058

)

(6,940

)

Equity-method investment activity, net of

tax

(4

)

(3

)

(12

)

(81

)

Net income

$

9,879

$

15,328

$

19,801

$

39,244

Basic earnings per share

$

0.96

$

1.46

$

1.93

$

3.76

Diluted earnings per share

$

0.94

$

1.43

$

1.89

$

3.67

Weighted-average shares used in

computation of earnings per share:

Basic

10,322

10,501

10,286

10,447

Diluted

10,558

10,735

10,452

10,705

AMAZON.COM, INC.

Consolidated Statements of

Comprehensive Income

(in millions)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2024

2023

2024

Net income

$

9,879

$

15,328

$

19,801

$

39,244

Other comprehensive income (loss):

Foreign currency translation adjustments,

net of tax of $36, $(45), $4, and $43

(1,388

)

1,911

(738

)

178

Available-for-sale debt securities:

Change in net unrealized gains (losses),

net of tax of $(18), $(55), $(52), and $(282)

62

167

174

944

Less: reclassification adjustment for

losses (gains) included in “Other income (expense), net,” net of

tax of $0, $0, $(15), and $(1)

3

—

48

4

Net change

65

167

222

948

Other, net of tax of $0, $3, $0, and

$1

—

(3

)

—

(4

)

Total other comprehensive income

(loss)

(1,323

)

2,075

(516

)

1,122

Comprehensive income

$

8,556

$

17,403

$

19,285

$

40,366

AMAZON.COM, INC.

Segment Information

(in millions)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2023

2024

2023

2024

North America

Net sales

$

87,887

$

95,537

$

247,314

$

271,911

Operating expenses

83,580

89,874

238,898

256,200

Operating income

$

4,307

$

5,663

$

8,416

$

15,711

International

Net sales

$

32,137

$

35,888

$

90,957

$

99,486

Operating expenses

32,232

34,587

93,194

97,009

Operating income (loss)

$

(95

)

$

1,301

$

(2,237

)

$

2,477

AWS

Net sales

$

23,059

$

27,452

$

66,553

$

78,770

Operating expenses

16,083

17,005

49,089

49,568

Operating income

$

6,976

$

10,447

$

17,464

$

29,202

Consolidated

Net sales

$

143,083

$

158,877

$

404,824

$

450,167

Operating expenses

131,895

141,466

381,181

402,777

Operating income

11,188

17,411

23,643

47,390

Total non-operating income (expense)

1,001

626

228

(1,125

)

Provision for income taxes

(2,306

)

(2,706

)

(4,058

)

(6,940

)

Equity-method investment activity, net of

tax

(4

)

(3

)

(12

)

(81

)

Net income

$

9,879

$

15,328

$

19,801

$

39,244

Segment Highlights:

Y/Y net sales growth:

North America

11

%

9

%

11

%

10

%

International

16

12

9

9

AWS

12

19

13

18

Consolidated

13

11

11

11

Net sales mix:

North America

61

%

60

%

61

%

60

%

International

23

23

23

22

AWS

16

17

16

18

Consolidated

100

%

100

%

100

%

100

%

AMAZON.COM, INC.

Consolidated Balance

Sheets

(in millions, except per share

data)

(unaudited)

December 31, 2023

September 30, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

73,387

$

75,091

Marketable securities

13,393

12,960

Inventories

33,318

36,103

Accounts receivable, net and other

52,253

51,638

Total current assets

172,351

175,792

Property and equipment, net

204,177

237,917

Operating leases

72,513

76,527

Goodwill

22,789

23,081

Other assets

56,024

71,309

Total assets

$

527,854

$

584,626

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable

$

84,981

$

84,570

Accrued expenses and other

64,709

60,602

Unearned revenue

15,227

16,305

Total current liabilities

164,917

161,477

Long-term lease liabilities

77,297

79,802

Long-term debt

58,314

54,890

Other long-term liabilities

25,451

29,306

Commitments and contingencies

Stockholders’ equity:

Preferred stock ($0.01 par value; 500

shares authorized; no shares issued or outstanding)

—

—

Common stock ($0.01 par value; 100,000

shares authorized; 10,898 and 11,026 shares issued; 10,383 and

10,511 shares outstanding)

109

110

Treasury stock, at cost

(7,837

)

(7,837

)

Additional paid-in capital

99,025

115,934

Accumulated other comprehensive income

(loss)

(3,040

)

(1,918

)

Retained earnings

113,618

152,862

Total stockholders’ equity

201,875

259,151

Total liabilities and stockholders’

equity

$

527,854

$

584,626

AMAZON.COM, INC.

Supplemental Financial

Information and Business Metrics

(in millions, except per share

data)

(unaudited)

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q3 2024

Y/Y %

Change

Cash Flows and Shares

Operating cash flow -- trailing twelve

months (TTM)

$

61,841

$

71,654

$

84,946

$

99,147

$

107,952

$

112,706

57

%

Operating cash flow -- TTM Y/Y growth

74

%

81

%

82

%

82

%

75

%

57

%

N/A

Purchases of property and equipment, net

of proceeds from sales and incentives -- TTM

$

53,963

$

50,220

$

48,133

$

48,998

$

54,979

$

64,959

29

%

Principal repayments of finance leases --

TTM

$

5,705

$

5,245

$

4,384

$

3,774

$

3,092

$

2,489

(53

)%

Principal repayments of financing

obligations -- TTM

$

244

$

260

$

271

$

304

$

306

$

320

23

%

Equipment acquired under finance leases --

TTM (1)

$

269

$

239

$

310

$

306

$

425

$

492

106

%

Principal repayments of all other finance

leases -- TTM (2)

$

631

$

694

$

683

$

761

$

794

$

785

13

%

Free cash flow -- TTM (3)

$

7,878

$

21,434

$

36,813

$

50,149

$

52,973

$

47,747

123

%

Free cash flow less principal repayments

of finance leases and financing obligations -- TTM (4)

$

1,929

$

15,929

$

32,158

$

46,071

$

49,575

$

44,938

182

%

Free cash flow less equipment finance

leases and principal repayments of all other finance leases and

financing obligations -- TTM (5)

$

6,734

$

20,241

$

35,549

$

48,778

$

51,448

$

46,150

128

%

Common shares and stock-based awards

outstanding

10,794

10,792

10,788

10,788

10,871

10,872

1

%

Common shares outstanding

10,313

10,330

10,383

10,403

10,490

10,511

2

%

Stock-based awards outstanding

481

462

406

385

381

361

(22

)%

Stock-based awards outstanding -- % of

common shares outstanding

4.7

%

4.5

%

3.9

%

3.7

%

3.6

%

3.4

%

N/A

Results of Operations

Worldwide (WW) net sales

$

134,383

$

143,083

$

169,961

$

143,313

$

147,977

$

158,877

11

%

WW net sales -- Y/Y growth, excluding

F/X

11

%

11

%

13

%

13

%

11

%

11

%

N/A

WW net sales -- TTM

$

538,046

$

554,028

$

574,785

$

590,740

$

604,334

$

620,128

12

%

WW net sales -- TTM Y/Y growth, excluding

F/X

13

%

12

%

12

%

12

%

12

%

12

%

N/A

Operating income

$

7,681

$

11,188

$

13,209

$

15,307

$

14,672

$

17,411

56

%

F/X impact -- favorable

$

104

$

132

$

85

$

72

$

29

$

16

N/A

Operating income -- Y/Y growth, excluding

F/X

128

%

338

%

379

%

219

%

91

%

55

%

N/A

Operating margin -- % of WW net sales

5.7

%

7.8

%

7.8

%

10.7

%

9.9

%

11.0

%

N/A

Operating income -- TTM

$

17,717

$

26,380

$

36,852

$

47,385

$

54,376

$

60,599

130

%

Operating income -- TTM Y/Y growth,

excluding F/X

10

%

99

%

197

%

252

%

205

%

129

%

N/A

Operating margin -- TTM % of WW net

sales

3.3

%

4.8

%

6.4

%

8.0

%

9.0

%

9.8

%

N/A

Net income

$

6,750

$

9,879

$

10,624

$

10,431

$

13,485

$

15,328

55

%

Net income per diluted share

$

0.65

$

0.94

$

1.00

$

0.98

$

1.26

$

1.43

53

%

Net income -- TTM

$

13,072

$

20,079

$

30,425

$

37,684

$

44,419

$

49,868

148

%

Net income per diluted share -- TTM

$

1.26

$

1.93

$

2.90

$

3.56

$

4.18

$

4.67

142

%

(1)

For the twelve months ended September 30,

2023 and 2024, this amount relates to equipment included in

“Property and equipment acquired under finance leases, net of

remeasurements and modifications” of $748 million and $620

million.

(2)

For the twelve months ended September 30,

2023 and 2024, this amount relates to property included in

“Principal repayments of finance leases” of $5,245 million and

$2,489 million.

(3)

Free cash flow is cash flow from

operations reduced by “Purchases of property and equipment, net of

proceeds from sales and incentives.”

(4)

Free cash flow less principal repayments

of finance leases and financing obligations is free cash flow

reduced by “Principal repayments of finance leases” and “Principal

repayments of financing obligations.”

(5)

Free cash flow less equipment finance

leases and principal repayments of all other finance leases and

financing obligations is free cash flow reduced by equipment

acquired under finance leases, which is included in “Property and

equipment acquired under finance leases, net of remeasurements and

modifications,” principal repayments of all other finance lease

liabilities, which is included in “Principal repayments of finance

leases,” and “Principal repayments of financing obligations.”

AMAZON.COM, INC.

Supplemental Financial

Information and Business Metrics

(in millions)

(unaudited)

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q3 2024

Y/Y %

Change

Segments

North America Segment:

Net sales

$

82,546

$

87,887

$

105,514

$

86,341

$

90,033

$

95,537

9

%

Net sales -- Y/Y growth, excluding F/X

11

%

11

%

13

%

12

%

9

%

9

%

N/A

Net sales -- TTM

$

331,633

$

340,677

$

352,828

$

362,288

$

369,775

$

377,425

11

%

Operating income

$

3,211

$

4,307

$

6,461

$

4,983

$

5,065

$

5,663

31

%

F/X impact -- favorable (unfavorable)

$

(7

)

$

(27

)

$

(13

)

$

8

$

8

$

(28

)

N/A

Operating income -- Y/Y growth, excluding

F/X

N/A

N/A

N/A

454

%

58

%

32

%

N/A

Operating margin -- % of North America net

sales

3.9

%

4.9

%

6.1

%

5.8

%

5.6

%

5.9

%

N/A

Operating income -- TTM

$

3,457

$

8,176

$

14,877

$

18,962

$

20,816

$

22,172

171

%

Operating margin -- TTM % of North America

net sales

1.0

%

2.4

%

4.2

%

5.2

%

5.6

%

5.9

%

N/A

International Segment:

Net sales

$

29,697

$

32,137

$

40,243

$

31,935

$

31,663

$

35,888

12

%

Net sales -- Y/Y growth, excluding F/X

10

%

11

%

13

%

11

%

10

%

12

%

N/A

Net sales -- TTM

$

121,003

$

125,420

$

131,200

$

134,012

$

135,978

$

139,729

11

%

Operating income (loss)

$

(895

)

$

(95

)

$

(419

)

$

903

$

273

$

1,301

N/A

F/X impact -- favorable (unfavorable)

$

32

$

228

$

160

$

(3

)

$

(94

)

$

43

N/A

Operating income (loss) -- Y/Y growth

(decline), excluding F/X

(48

)%

(87

)%

(74

)%

N/A

N/A

N/A

N/A

Operating margin -- % of International net

sales

(3.0

)%

(0.3

)%

(1.0

)%

2.8

%

0.9

%

3.6

%

N/A

Operating income (loss) -- TTM

$

(6,836

)

$

(4,465

)

$

(2,656

)

$

(506

)

$

662

$

2,058

N/A

Operating margin -- TTM % of International

net sales

(5.6

)%

(3.6

)%

(2.0

)%

(0.4

)%

0.5

%

1.5

%

N/A

AWS Segment:

Net sales

$

22,140

$

23,059

$

24,204

$

25,037

$

26,281

$

27,452

19

%

Net sales -- Y/Y growth, excluding F/X

12

%

12

%

13

%

17

%

19

%

19

%

N/A

Net sales -- TTM

$

85,410

$

87,931

$

90,757

$

94,440

$

98,581

$

102,974

17

%

Operating income

$

5,365

$

6,976

$

7,167

$

9,421

$

9,334

$

10,447

50

%

F/X impact -- favorable (unfavorable)

$

79

$

(69

)

$

(62

)

$

67

$

115

$

1

N/A

Operating income -- Y/Y growth (decline),

excluding F/X

(8

)%

30

%

39

%

83

%

72

%

50

%

N/A

Operating margin -- % of AWS net sales

24.2

%

30.3

%

29.6

%

37.6

%

35.5

%

38.1

%

N/A

Operating income -- TTM

$

21,096

$

22,669

$

24,631

$

28,929

$

32,898

$

36,369

60

%

Operating margin -- TTM % of AWS net

sales

24.7

%

25.8

%

27.1

%

30.6

%

33.4

%

35.3

%

N/A

AMAZON.COM, INC.

Supplemental Financial

Information and Business Metrics

(in millions, except employee

data)

(unaudited)

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q3 2024

Y/Y %

Change

Net Sales

Online stores (1)

$

52,966

$

57,267

$

70,543

$

54,670

$

55,392

$

61,411

7

%

Online stores -- Y/Y growth, excluding

F/X

5

%

6

%

8

%

7

%

6

%

8

%

N/A

Physical stores (2)

$

5,024

$

4,959

$

5,152

$

5,202

$

5,206

$

5,228

5

%

Physical stores -- Y/Y growth, excluding

F/X

7

%

6

%

4

%

6

%

4

%

5

%

N/A

Third-party seller services (3)

$

32,332

$

34,342

$

43,559

$

34,596

$

36,201

$

37,864

10

%

Third-party seller services -- Y/Y growth,

excluding F/X

18

%

18

%

19

%

16

%

13

%

10

%

N/A

Advertising services (4)

$

10,683

$

12,060

$

14,654

$

11,824

$

12,771

$

14,331

19

%

Advertising services -- Y/Y growth,

excluding F/X

22

%

25

%

26

%

24

%

20

%

19

%

N/A

Subscription services (5)

$

9,894

$

10,170

$

10,488

$

10,722

$

10,866

$

11,278

11

%

Subscription services -- Y/Y growth,

excluding F/X

14

%

13

%

13

%

11

%

11

%

11

%

N/A

AWS

$

22,140

$

23,059

$

24,204

$

25,037

$

26,281

$

27,452

19

%

AWS -- Y/Y growth, excluding F/X

12

%

12

%

13

%

17

%

19

%

19

%

N/A

Other (6)

$

1,344

$

1,226

$

1,361

$

1,262

$

1,260

$

1,313

7

%

Other -- Y/Y growth (decline), excluding

F/X

26

%

(3

)%

8

%

23

%

(6

)%

5

%

N/A

Stock-based Compensation

Expense

Cost of sales

$

251

$

193

$

227

$

174

$

266

$

193

(1

)%

Fulfillment

$

932

$

732

$

823

$

636

$

944

$

696

(5

)%

Technology and infrastructure

$

4,043

$

3,284

$

3,533

$

2,772

$

3,670

$

2,961

(10

)%

Sales and marketing

$

1,303

$

1,111

$

1,216

$

932

$

1,224

$

1,012

(9

)%

General and administrative

$

598

$

509

$

520

$

447

$

618

$

471

(8

)%

Total stock-based compensation expense

$

7,127

$

5,829

$

6,319

$

4,961

$

6,722

$

5,333

(9

)%

Other

WW shipping costs

$

20,418

$

21,799

$

27,326

$

21,834

$

21,965

$

23,501

8

%

WW shipping costs -- Y/Y growth

6

%

9

%

11

%

10

%

8

%

8

%

N/A

WW paid units -- Y/Y growth (7)

9

%

9

%

12

%

12

%

11

%

12

%

N/A

WW seller unit mix -- % of WW paid units

(7)

60

%

60

%

61

%

61

%

61

%

60

%

N/A

Employees (full-time and part-time;

excludes contractors & temporary personnel)

1,461,000

1,500,000

1,525,000

1,521,000

1,532,000

1,551,000

3

%

Employees (full-time and part-time;

excludes contractors & temporary personnel) -- Y/Y growth

(decline)

(4

)%

(3

)%

(1

)%

4

%

5

%

3

%

N/A

(1)

Includes product sales and digital media

content where we record revenue gross. We leverage our retail

infrastructure to offer a wide selection of consumable and durable

goods that includes media products available in both a physical and

digital format, such as books, videos, games, music, and software.

These product sales include digital products sold on a

transactional basis. Digital media content subscriptions that

provide unlimited viewing or usage rights are included in

“Subscription services.”

(2)

Includes product sales where our customers

physically select items in a store. Sales to customers who order

goods online for delivery or pickup at our physical stores are

included in “Online stores.”

(3)

Includes commissions and any related

fulfillment and shipping fees, and other third-party seller

services.

(4)

Includes sales of advertising services to

sellers, vendors, publishers, authors, and others, through programs

such as sponsored ads, display, and video advertising.

(5)

Includes annual and monthly fees

associated with Amazon Prime memberships, as well as digital video,

audiobook, digital music, e-book, and other non-AWS subscription

services.

(6)

Includes sales related to various other

offerings, such as health care services, certain licensing and

distribution of video content, and shipping services, and our

co-branded credit card agreements.

(7)

Excludes the impact of Whole Foods

Market.

Amazon.com, Inc. Certain

Definitions

Customer Accounts

- References to customers mean customer accounts established when

a customer places an order through one of our stores. Customer

accounts exclude certain customers, including customers associated

with certain of our acquisitions, Amazon Payments customers, AWS

customers, and the customers of select companies with whom we have

a technology alliance or marketing and promotional relationship.

Customers are considered active when they have placed an order

during the preceding twelve-month period.

Seller Accounts

- References to sellers means seller accounts, which are

established when a seller receives an order from a customer

account. Sellers are considered active when they have received an

order from a customer during the preceding twelve-month

period.

AWS Customers

- References to AWS customers mean unique AWS customer accounts,

which are unique customer account IDs that are eligible to use AWS

services. This includes AWS accounts in the AWS free tier. Multiple

users accessing AWS services via one account ID are counted as a

single account. Customers are considered active when they have had

AWS usage activity during the preceding one-month period.

Units

- References to units mean physical and digital units sold (net

of returns and cancellations) by us and sellers in our stores as

well as Amazon-owned items sold in other stores. Units sold are

paid units and do not include units associated with AWS, certain

acquisitions, certain subscriptions, rental businesses, or

advertising businesses, or Amazon gift cards.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030305950/en/

Amazon Investor Relations amazon-ir@amazon.com amazon.com/ir

Amazon Public Relations amazon-pr@amazon.com amazon.com/pr

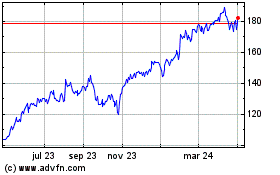

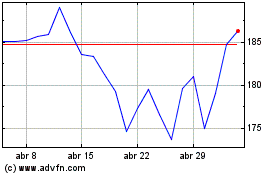

Amazon.com (NASDAQ:AMZN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Amazon.com (NASDAQ:AMZN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024