Aptorum Group Limited (Nasdaq: APM) (“Aptorum Group” or “We”), a

clinical stage biopharmaceutical company dedicated to meeting unmet

medical needs in oncology, autoimmune diseases and infectious

diseases, today announced financial results for the fiscal year

ended December 31, 2023, and provided an update on corporate

developments.

Mr. Ian Huen, Chief Executive Officer and Executive Director of

Aptorum Group, commented, “Throughout 2023, we have maintained a

strategic focus on the progression of our lead projects to

effectively utilize our resources. Additionally, the previously

announced proposed reverse merger with YOOV Group Holding

demonstrates our commitment to shareholder interests and our

continuous pursuit of opportunities that enhance our corporate

value.”

Corporate Highlights

On March 1, 2024, the Group entered into an Agreement and Plan

of Merger (the “Merger Agreement”) by and among Company, and YOOV

Group Holding Limited, a company organized under the laws of

British Virgin Islands (“YOOV”). The Merger Agreement was

unanimously approved by Company’s and YOOV’s boards of directors

(each board of directors, the “Board”), respectively. If the Merger

Agreement is approved by Company’s and YOOV’s shareholders (and the

other closing conditions are satisfied or waived in accordance with

the Merger Agreement), and upon consummation of the transactions

contemplated by the Merger Agreement, the Group will incorporate a

wholly-owned subsidiary under the laws of the British Virgin

Islands (“Merger Sub”) that will merge with and into YOOV, with

YOOV surviving the merger as a wholly-owned subsidiary of the Group

(collectively, the “Merger”). The Group, upon the closing of the

merger is referred to herein as the “combined company.” Upon

consummation of the transaction, YOOV will become a wholly-owned

subsidiary of the Group, and the existing YOOV shareholders and

existing Group shareholders will own approximately 90% and 10%,

respectively, of the outstanding shares of the combined company.

The consummation of this merger remains uncertain as it is

contingent upon the fulfillment of specific closing conditions.

Fiscal Year End Financial

Results

Aptorum Group reported a net loss of $4.3 million in 2023, as

compared to $11.5 million in 2022. The decrease in net loss were

largely attributed to disciplined cost control measures and a

strategic concentration on our lead projects. These efforts led to

a decrease in net loss by $7.2 million.

Research and development expenses were $5.2 million in 2023 as

compared to $9.2 million in 2022. As a consequence of exclusive

emphasis on its lead projects and suspension of non-lead projects,

there was a notable decrease in the utilization of external

consultants and full impairment of patents related to these

non-lead projects. Moreover, the payroll expenses for research and

development staff decreased as a result of the reversal of deferred

cash bonus payables to employees and consultants, and reduction of

employees during the current period. The reversal was due to the

Group’s agreements with employees and consultants to discharge the

Group’s obligation to settle their outstanding deferred cash bonus

payables from previous years in exchange of fully vested ordinary

shares.

General and administrative fees were $1.9 million in 2023 as

compared to $5.2 million in 2022. The decrease in general and

administrative fees was primary due to the reversal of deferred

cash bonus payables to employees and reduction of employees during

the current period. The reversal was due to the Group’s agreements

with employees to discharge the Group’s obligation to settle their

outstanding deferred cash bonus payables from previous years in

exchange of fully vested ordinary shares.

Legal and professional fees were $2.5 million in 2023 as

compared to $2.9 million in 2022. The decrease in legal and

professional fees was mainly due to less consulting services

engaged during 2023 as a consequence of exclusive emphasis on its

lead projects and suspension of non-lead projects.

Aptorum Group reported $2.0 million of cash as of December 31,

2023 compared to $5.0 million of cash and cash equivalents and

restricted cash as of December 31, 2022. The decrease was mainly

due to the cash and cash equivalents used in operating activities

of $7.7 million and repayment of bank loan of $3 million, partly

offset by the proceeds from issuance of Class A Ordinary Shares

through an at-the-market offering of $1.6 million, loan from

related parties of $2.5 million, and proceeds from issuance of

convertible notes of $3.0 million in 2023.

About Aptorum Group

Aptorum Group Limited (Nasdaq: APM) is a clinical stage

biopharmaceutical company dedicated to the discovery, development

and commercialization of therapeutic assets to treat diseases with

unmet medical needs, particularly in oncology (including orphan

oncology indications) and infectious diseases. The pipeline of

Aptorum is also enriched through the co-development of PathsDx

Test, a novel molecular-based rapid pathogen identification and

detection diagnostics technology, with Accelerate Technologies Pte

Ltd, commercialization arm of the Singapore’s Agency for Science,

Technology and Research.

For more information about the Company, please visit

www.aptorumgroup.com.

Disclaimer and Forward-Looking

Statements

This press release does not constitute an offer to sell or a

solicitation of offers to buy any securities of Aptorum Group.

This press release includes statements concerning Aptorum Group

Limited and its future expectations, plans and prospects that

constitute “forward-looking statements” within the meaning of the

US Private Securities Litigation Reform Act of 1995. For this

purpose, any statements contained herein that are not statements of

historical fact may be deemed to be forward-looking statements. In

some cases, you can identify forward-looking statements by terms

such as “may,” “should,” “expects,” “plans,” “anticipates,”

“could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential,” or “continue,” or

the negative of these terms or other similar expressions. Aptorum

Group has based these forward-looking statements, which include

statements regarding projected timelines for application

submissions and trials, largely on its current expectations and

projections about future events and trends that it believes may

affect its business, financial condition and results of

operations.

These forward-looking statements speak only as of the date of

this press release and are subject to a number of risks,

uncertainties and assumptions including, without limitation, risks

related to its announced management and organizational changes, the

continued service and availability of key personnel, its ability to

expand its product assortments by offering additional products for

additional consumer segments, development results, the company’s

anticipated growth strategies, anticipated trends and challenges in

its business, and its expectations regarding, and the stability of,

its supply chain, and the risks more fully described in Aptorum

Group’s Form 20-F and other filings that Aptorum Group may make

with the SEC in the future. As a result, the projections included

in such forward-looking statements are subject to change and actual

results may differ materially from those described herein.

Aptorum Group assumes no obligation to update any

forward-looking statements contained in this press release as a

result of new information, future events or otherwise.

This press release is provided “as is” without any

representation or warranty of any kind.

APTORUM GROUP LIMITED

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

For Years Ended December 31,

2023 and 2022

(Stated in U.S.

Dollars)

Year Ended December 31,

2023

Year Ended December 31,

2022

Revenue

Healthcare services income

$

431,378

$

1,295,889

Operating expenses

Cost of healthcare services

(420,812

)

(1,215,824

)

Research and development expenses

(5,198,329

)

(9,219,595

)

General and administrative fees

(1,930,637

)

(5,220,405

)

Legal and professional fees

(2,538,161

)

(2,888,140

)

Other operating expenses

(1,067,690

)

(261,038

)

Total operating expenses

(11,155,629

)

(18,805,002

)

Other income, net

Loss on investments in marketable

securities, net

(9,266

)

(134,134

)

Gain on long-term investments

6,353,888

5,588,051

Interest (expense) income, net

(121,145

)

146,588

Sundry income

159,799

383,506

Total other income, net

6,383,276

5,984,011

Net loss

(4,340,975

)

(11,525,102

)

Net loss attributable to non-controlling

interests

1,516,328

1,725,542

Net loss attributable to Aptorum Group

Limited

$

(2,824,647

)

$

(9,799,560

)

Net loss per share attributable to Aptorum

Group Limited

- Basic(1)

$

(0.62

)

$

(2.75

)

- Diluted(1)

$

(0.62

)

$

(2.75

)

Weighted-average shares outstanding

- Basic(1)

4,521,133

3,569,484

- Diluted(1)

4,521,133

3,569,484

Net loss

$

(4,340,975

)

$

(11,525,102

)

Other comprehensive (loss)

income

Exchange differences on translation of

foreign operations

(44,430

)

35,826

Other comprehensive (loss) income

(44,430

)

35,826

Comprehensive loss

(4,385,405

)

(11,489,276

)

Comprehensive loss attributable to

non-controlling interests

1,516,328

1,725,542

Comprehensive loss attributable to the

shareholders of Aptorum Group Limited

(2,869,077

)

(9,763,734

)

(1)

All per share amounts and shares

outstanding for all periods have been retroactively restated to

reflect APTORUM GROUP LIMITED’s 1 for 10 reverse stock split, which

was effective on January 23, 2023.

APTORUM GROUP LIMITED

CONSOLIDATED BALANCE

SHEETS

December 31, 2023 and

2022

(Stated in U.S.

Dollars)

December 31, 2023

December 31, 2022

ASSETS

Current assets:

Cash

$

2,005,351

$

1,882,545

Restricted cash

-

3,130,335

Accounts receivable

47,709

174,426

Inventories

-

27,722

Marketable securities, at fair value

-

102,481

Amounts due from related parties, net

961

129,677

Due from brokers

-

652

Loan receivable from related parties,

net

-

875,956

Other receivables and prepayments

422,071

744,008

Total current assets

2,476,092

7,067,802

Property and equipment, net

1,663,926

2,825,059

Operating lease right-of-use assets

182,057

347,000

Long-term investments

16,098,846

9,744,958

Intangible assets, net

147,347

752,705

Long-term deposits

71,823

129,847

Total Assets

$

20,640,091

$

20,867,371

LIABILITIES AND EQUITY

LIABILITIES

Current liabilities:

Amounts due to related parties

$

79,180

$

12,693

Accounts payable and accrued expenses

1,894,341

6,166,807

Operating lease liabilities, current

125,232

310,548

Bank loan

-

3,000,000

Convertible notes

-

3,013,234

Total current liabilities

2,098,753

12,503,282

Operating lease liabilities,

non-current

99,485

30,784

Convertible notes to a related party

3,058,500

-

Loan payables to related parties

-

500,000

Total Liabilities

$

5,256,738

$

13,034,066

Commitments and contingencies

-

-

EQUITY

Class A Ordinary Shares ($0.00001 par

value, 9,999,996,000,000 shares authorized, 2,937,921 shares issued

and outstanding as of December 31, 2023; $10.00 par value;

6,000,000 shares authorized, 1,326,953 shares issued and

outstanding as of and 2022(1))

$

31

$

13,269,528

Class B Ordinary Shares ($0.00001 par

value; 4,000,000 shares authorized, 2,243,776 shares issued and

outstanding as of December 31, 2023; $10.00 par value; 4,000,000

shares authorized, 2,243,776 shares issued and outstanding as of

December 31, 2022(1))

22

22,437,754

Additional paid-in capital

93,018,528

45,308,080

Accumulated other comprehensive (loss)

income

(10,623

)

33,807

Accumulated deficit

(68,161,722

)

(65,337,075

)

Total equity attributable to the

shareholders of Aptorum Group Limited

24,846,236

15,712,094

Non-controlling interests

(9,462,883

)

(7,878,789

)

Total equity

15,383,353

7,833,305

Total Liabilities and Equity

$

20,640,091

$

20,867,371

(1)

All per share amounts and shares

outstanding for all periods have been retroactively restated to

reflect APTORUM GROUP LIMITED’s 1 for 10 reverse stock split, which

was effective on January 23, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424559376/en/

Aptorum Group Limited Investor Relations Department

investor.relations@aptorumgroup.com +44 20 80929299

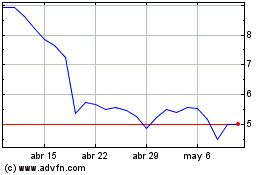

Aptorum (NASDAQ:APM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Aptorum (NASDAQ:APM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024