UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of October

2024

Commission File Number: 001-38764

Aptorum Group Limited

17 Hanover Square

London W1S 1BN, United Kingdom

(Address of principal executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

As previously disclosed in our Current Report

on Form 6-Ks filed with the Securities and Exchange Commission (the “SEC”) on March 6, 2024 and May 31, 2024, Aptorum

Group Limited, a Cayman Islands exempted company with limited liability (“Aptorum” or the “Company”),

entered into an Agreement and Plan of Merger, dated March 1, 2024 and amended on May 28, 2024 (as it may be amended, supplemented or otherwise

modified from time to time, the “Merger Agreement”) with YOOV Group Holding Limited, a company organized under the

laws of British Virgin Islands (“YOOV”).

On October 25, 2024,

the parties to the Merger Agreement entered into a certain termination agreement (the “Termination Amendment”), pursuant

to which the parties agreed to terminate the Merger Agreement on the date thereof (the “Termination Date”), and the

Merger Agreement shall be null and void and of no further force or effect.

The foregoing description

of the Termination Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the

Termination Agreement, which is filed hereto as Exhibit 10.1

Financial Statements and Exhibits.

Exhibits.

The following exhibits are attached.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: October 25, 2024

| |

Aptorum Group Limited |

| |

|

|

| |

By: |

/s/ Ian Huen |

| |

|

Ian Huen |

| |

|

Chief Executive Officer |

2

Exhibit 2.1

TERMINATION AGREEMENT

This TERMINATION AGREEMENT (this “Agreement”)

is made as of October 25, 2024 by and between Aptorum Group Limited, an exempted company incorporated in Cayman Islands with limited liability

(the “ListCo”) and YOOV Group Holding Limited (the “Company”).

RECITALS

Reference is made to the Agreement and Plan of

Merger by and between the ListCo and the Company dated as of March 1, 2024 and amended on May 28, 2024 (the “Merger Agreement”).

The ListCo and the Company wish to terminate the Merger Agreement on the terms and conditions set forth herein.

NOW THEREFORE, in consideration

of the foregoing and the mutual covenants and agreements herein contained, and intending to be legally bound hereby, the ListCo and the

Company hereby agree as follows:

1.

Termination of the Merger Agreement. In accordance with Section 10.01(a) of the Merger Agreement, the parties hereto

hereby agree to terminate the Merger Agreement in its entirety effective immediately upon the execution of this Agreement by each of the

parties hereto, and the Merger Agreement shall be null and void and of no further force or effect. Neither party shall have any further

rights or obligations thereunder or with respect thereto, except as specifically set forth herein.

2. Releases.

Upon the termination of the Merger Agreement, each party hereto, on its own behalf and on behalf of its principals, affiliates,

subsidiaries, directors, officers, stockholders, employees, agents, representatives, and successors and assigns of each of them,

hereby irrevocably, fully and unconditionally releases and forever discharges the other party and each of its past or present

principals, affiliates, directors, officers, stockholders, employees, agents, representatives, and successors and assigns of each of

them, from and against any and all present and future claims, counterclaims, demands, actions, suits, causes of action, damages,

controversies and liabilities, including, without limitation, any costs, expenses, bills, penalties or attorneys’ fees,

whether know or unknown, contingent or absolute, foreseen or unforeseen, and whether in law, equity or otherwise, that could have

been asserted in any court or forum and relating in any way to any conduct, occurrence, activity, expenditure, promise or

negotiation arising from or relating to the Merger Agreement.

3. Representations

and Warranties. Each of the parties hereto hereby represents and warrants to the other party that: (a) it has full power and

authority to enter into this Agreement and to perform its obligations hereunder in accordance with the provisions of this Agreement,

(b) this Agreement has been duly authorized, executed and delivered by such party, and (c) this Agreement constitutes a legal, valid

and binding obligation of such party, enforceable in accordance with its terms.

4. Entire

Agreement. This Agreement contains the entire understanding of the parties with respect to the subject matter hereof and

supersede all prior agreements, understandings, discussions and representations, oral or written, with respect to such matters.

5. Governing

Law. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall be governed

by and construed and enforced in accordance with the internal laws of the State of New York, without regard to the principles of

conflicts of law thereof.

6. Assignment. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective

heirs, executors, administrators, legal representatives, successors and permitted assigns. Except as expressly provided herein, this Agreement

may not be assigned by either party without the prior written consent of the other. Any assignment in violation of this paragraph will

be null and void.

7. Execution.

This Agreement may be executed in two or more counterparts, all of which when taken together shall be considered one and the same

agreement and shall become effective when counterparts have been signed by each party and delivered to the other party, it being

understood that both parties need not sign the same counterpart. In the event that any signature is delivered by facsimile or e-mail

transmission, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature

is executed) with the same force and effect as if such facsimile or e-mail signature page were an original thereof.

8. Future

Assurances. At the request of either party hereto, and without further consideration, the other party hereto will execute

and deliver such other documents, forms, agreements, or instruments as may be reasonably requested for the completion of the

transactions contemplated hereby.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have executed

and delivered this Agreement, or caused it to be executed and delivered by their duly authorized officers, as of the date first above

written.

| |

Aptorum Group Limited |

| |

|

|

| |

By: |

/s/ Ian Huen |

| |

Name: |

Ian Huen |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

YOOV Group Holding Limited |

| |

|

|

| |

By: |

/s/ Wong Ling Yan Philip |

| |

Name: |

Wong Ling Yan Philip |

| |

Title: |

Chief Executive Officer |

3

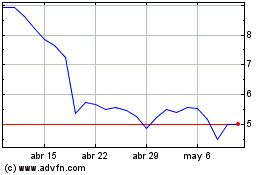

Aptorum (NASDAQ:APM)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

Aptorum (NASDAQ:APM)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025