As

filed with the Securities and Exchange Commission on July 26, 2024.

Registration

No. 333-[●]

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

APTORUM

GROUP LIMITED

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

Aptorum

Group Limited

17

Hanover Square, London W1S 1BN, United Kingdom |

|

N/A |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Share

Option Plan

(Full

title of the plan)

Ian

Huen, Chief Executive Officer

Aptorum

Group Limited

17

Hanover Square, London W1S 1BN, United Kingdom

(Name

and address of agent for service)

+44 20

8092 9299

(Telephone

number, including area code, of agent for service)

With

a copy to:

Louis

Taubman, Esq.

Hunter

Taubman Fischer & Li LLC

950

Third Avenue, 19th Floor

New

York, NY 10022

212-530-2208

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

|

Non-accelerated

filer ☒ |

| |

|

Smaller

reporting company ☐ |

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY

NOTE

This

Registration Statement on Form S-8 (this “Registration Statement”) is being filed with the Securities and Exchange

Commission (the “Commission”) by Aptorum Group Limited (the “Company” or the “Registrant”)

for the purpose of registering 372,441 additional shares of the Company’s Class A ordinary shares, par value $0.00001 per share

(the “Class A Ordinary Share”), that were automatically added and accumulated since January 1, 2020 to the number

of shares authorized for issuance under the Aptorum Group Limited Amended 2017 Share Option Plan adopted by the Company on October 13,

2017 and amended on November 5, 2021(the “Amended 2017 Share Option Plan”), pursuant to an “evergreen”

provision, which allows for an annual increase of the overall share limit on the first day of each calendar year beginning on and including

January 1, 2020 equal to the lesser of (i) 2% of the aggregate number of ordinary shares (on a fully-diluted basis) outstanding

on the immediate preceding December 31 and (ii) such lower number of shares as is determined by the Company’s board.

Pursuant

to the Company’s Registration Statement on Form S-8 (File No. 333-232591) filed by the Registrant on July 10, 2019, as amended

on October 16, 2019 (the “Prior Registration Statement”), the Registrant previously registered an aggregate of 550,000

shares of Class A Ordinary Shares (as adjusted for the reverse split of 1 for 10 effected by the Company effective January 23, 2023)

under the Amended 2017 Share Option Plan. The additional shares of Class A Ordinary Shares being registered by this Registration Statement

are of the same class as those securities registered on the Prior Registration Statements. In accordance with General Instruction E of

Form S-8, the contents of the Prior Registration Statements, together with all exhibits filed therewith or incorporated therein by reference

to the extent not otherwise amended or superseded by the contents hereof or otherwise, are incorporated herein by reference.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

The

documents containing the information specified in Part I of Form S-8 will be delivered in accordance with Rule 428(b)(1) of the Securities

Act of 1933, as amended (the “Securities Act”). Such documents are not required to be filed with the U.S. Securities

and Exchange Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424

of the Securities Act. These documents, and the documents incorporated by reference in Item 3 of Part II of this Registration Statement,

taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

Aptorum

Group Limited (the “Company”) is subject to the informational requirements of the Securities Exchange Act of 1934,

as amended and, accordingly, files periodic reports and other information with the Commission. Reports and other information concerning

the Company filed with the Commission may be inspected and copies may be obtained (at prescribed rates) at the Commission’s Public

Reference Section, Room 1024, 100 F Street, N.E., Room 1580, Washington, D.C. 20549. The Commission also maintains a Web site that contains

reports, proxy and information statements and other information regarding registrants that file electronically with the Commission, including

the Company. The address for the Commission’s Web site is “http://www.sec.gov”. The following documents are incorporated

by reference in this Registration Statement:

| (a) | The

Company’s Annual Report on Form 20-F for the fiscal year ended December 31, 2023 filed

with the Commission on April 30, 2024; |

| (c) | The

description of the Company’s Share Capital contained in the registration statement on Form F-1 (File No. 333-248743) filed with

the Commission on September 11, 2020, which was later amended and declared effective on May 19, 2023. |

Except

to the extent such information is deemed furnished and not filed pursuant to securities laws and regulations, all documents subsequently

filed by the Company pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and, to the extent specifically designated therein, reports on Form 6-K furnished by the Company to the Commission,

in each case, prior to the filing of a post-effective amendment to this Registration Statement indicating that all securities offered

under this Registration Statement have been sold, or deregistering all securities then remaining unsold, shall be deemed to be incorporated

by reference in this Registration Statement and to be a part hereof from the date of filing or furnishing of such documents.

Any

statement contained herein or in a document all or a portion of which is incorporated or deemed to be incorporated by reference herein

shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein

or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes

such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute

a part of this Registration Statement.

Item

4. Description of Securities.

Not

applicable.

Item

5. Interests of Named Experts and Counsel.

None.

Item

6. Indemnification of Directors and Officers.

Cayman

Islands law does not limit the extent to which a company’s memorandum and articles of association may provide for indemnification

of officers and directors, except to the extent any such provision may be held by the Cayman Islands courts to be contrary to public

policy, such as to provide indemnification against civil fraud or the consequences of committing a crime. Our Memorandum and Articles

require us to indemnify our officers and directors for actions, proceedings, claims, losses, damages, costs, liabilities and expenses

(“Indemnified Losses”) incurred in their capacities as such unless such Indemnified Losses arise from dishonesty of such

directors or officers. This standard of conduct is generally the same as permitted under the Delaware General Corporation Law for a Delaware

corporation.

Insofar

as indemnification for liabilities arising under the Securities Act of 1933, as amended, or the Securities Act, may be permitted to our

directors, officers or persons controlling us under the foregoing provisions, we have been informed that in the opinion of the Securities

and Exchange Commission, or the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore

unenforceable.

Item

7. Exemption from Registration Claimed.

Not

applicable.

Item

8. Exhibits.

| * |

Filed herewith. |

| (1) |

Incorporated

by reference to Exhibit 2.1 of the Company’s Annual Report on Form 20-F, filed on April 30, 2024. |

| (2) |

Incorporated by reference to Exhibit

4.2 of the Company’s Registration Statement on Form S-8, filed on July 10, 2019. |

| (3) |

Incorporated by reference to

Exhibit 99.1 of the Company’s Current Report on Form 6-K, filed on November 17, 2021. |

Item

9. Undertakings.

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of a prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement.

provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) above do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section

15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time will

be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 that is incorporated

by reference in the registration statement will be deemed to be a new registration statement relating to the securities offered therein,

and the offering of such securities at that time will be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of

the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in the City of New York, State of New York, on July 26, 2024.

| |

Aptorum

Group Limited |

| |

|

|

| Date:

July 26, 2024 |

By:

|

/s/

Ian Huen |

| |

|

Ian

Huen

Chief

Executive Officer,

Chairman

of the Board of Directors

(Principal

Executive Officer) |

| |

|

|

| Date:

July 26, 2024 |

By: |

/s/

Martin Siu |

| |

|

Martin

Siu

Head

of Finance

(Principal

Financial Officer) |

POWER

OF ATTORNEY

Each

person whose signature appears below hereby appoints Ian Huen and Martin Siu his true and lawful attorney-in-fact, each acting alone,

with full powers of substitution and resubstitution, with authority to execute in the name of each such person, and to file with the

Securities and Exchange Commission, together with any exhibits thereto and other documents therewith, any and all amendments (including

without limitation post-effective amendments) to this registration statement necessary or advisable to enable the registrant to comply

with the Securities Act and any rules, regulations and requirements of the Securities and Exchange Commission in respect thereof, which

amendments may make such other changes in the registration statement as the aforesaid attorney-in-fact executing the same deems appropriate.

Pursuant to the requirements of the Securities Act, this registration statement has been signed below by the following persons in the

capacities and on the dates indicated.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities

and on the date indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

|

| By: |

/s/ Ian Huen |

|

Chief

Executive Officer |

|

July 26, 2024 |

| |

Ian Huen |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

|

| By: |

/s/

Martin Siu |

|

Head of Finance |

|

July

26, 2024 |

| |

Martin Siu |

|

(Principal Financial Officer) |

|

|

| |

|

|

|

|

|

| By: |

/s/ Charles

Bathurst |

|

Director |

|

July 26, 2024 |

| |

Charles Bathurst |

|

|

|

|

| |

|

|

|

|

|

| By: |

/s/ Mirko Scherer |

|

Director |

|

July 26, 2024 |

| |

Mirko Scherer |

|

|

|

|

| |

|

|

|

|

|

| By: |

/s/ Justin Wu |

|

Director |

|

July 26, 2024 |

| |

Justin Wu |

|

|

|

|

| |

|

|

|

|

|

| By: |

/s/ Douglas

Arner |

|

Director |

|

July 26, 2024 |

| |

Douglas Arner |

|

|

|

|

II-4

Exhibit 5.1

| |

|

|

| |

Campbells |

| By email |

Registered Foreign Law Firm |

| Aptorum Group Limited |

3002-04, 30/F Gloucester Tower

The Landmark

15 Queen’s Road Central

Hong Kong |

| Floor 4, Willow House, |

|

Cricket Square,

Grand Cayman, KY1-9010

Cayman Islands |

D +852 3708 3020

T +852 3708 3000

F +852 3706 5408

E jnip@campbellslegal.com |

| |

|

| |

campbellslegal.com |

| |

|

| |

Our Ref: 19583-35600

Your Ref: |

| 26 July 2024 |

|

| |

CAYMAN | BVI | HONG KONG |

| |

|

|

Dear Sirs

Aptorum Group Limited – Listing of Class A Ordinary

Shares

We have acted as Cayman Islands legal

advisers to Aptorum Group Ltd. (the “Company”), a Cayman Islands exempted company, in connection with the Company’s

Form S-8 Registration Statement (“S-8 Registration Statement”), filed with the Securities and Exchange Commission (“Commission”)

under the U.S. Securities Act of 1933, as amended to date (the “Act”), relating to the registration and offering of 372,441

Class A Ordinary Shares, par value of $0.00001 each (“Plan Shares”), issuable in accordance with the 2017 Share Option

Plan (as defined below). We are furnishing this opinion as Exhibit 5.1 to the S-8 Registration Statement.

The following opinions are given only

as to, and based on, circumstances and matters of fact existing and known to us on the date of this opinion letter. These opinions only

relate to the laws of the Cayman Islands which are in force on the date of this opinion letter. In giving these opinions we have relied

(without further verification) upon the completeness and accuracy of the Resolutions, the Shareholder Resolutions and the Certificate

of Good Standing (each as defined below). We have also relied upon the following assumptions, which we have not independently verified:

| 1.1 | Copies of documents, conformed copies or drafts of documents provided to us are true and complete copies

of, or in the final forms of, the originals, and translations of documents provided to us are complete and accurate; |

| 1.2 | All signatures, initials and seals are genuine; |

| 1.3 | There is nothing under any law (other than the laws of the Cayman Islands) which would or might affect

the opinions expressed herein; |

| 1.4 | The Plan Shares to be offered and issued by the Company pursuant to the S-8 Registration Statement will

be issued by the Company against payment in full, in accordance with the S-8 Registration Statement and be duly registered in the Company’s

register of members; |

Managing Partner: Shaun Folpp (British Virgin Islands)

Resident Hong Kong Partners: Jenny Nip (England and Wales),

Paul Trewartha (Victoria (Australia)), Jane Hale (Queensland (Australia)) and

James McKeon (Queensland (Australia))

Non-Resident Hong Kong Partner: Robert Searle (Cayman Islands)

Cayman Islands and British Virgin Islands

| 1.5 | The A&R Memorandum and Articles (as defined below) remain in full force and effect and are unamended; |

| 1.6 | The Resolutions and the Shareholder Resolutions were duly passed in the manner prescribed in the then

effective memorandum and articles of association of the Company and the resolutions contained in the Resolutions and the Shareholder Resolutions

are in full force and effect at the date hereof and have not been amended, varied or revoked in any respect; |

| 1.7 | The authorised shares of the Company as set out in the A&R Memorandum and Articles have not been amended;

and |

| 1.8 | The minute book and corporate records of the Company as maintained at its registered office in the Cayman

Islands are complete and accurate in all material respects, and all minutes and resolutions filed therein represent a complete and accurate

record of all meetings of the shareholders and directors (or any committee thereof) (duly convened in accordance with the then effective

Memorandum and Articles of Association of the Company) and all resolutions passed at the meetings, or passed by written consent as the

case may be. |

We have reviewed originals, copies, drafts or conformed copies

of the following documents and such other documents or instruments as we deem necessary:

| 2.1 | A copy of the S-8 Registration Statement relating to the registration of the Plan Shares to be granted

pursuant to the terms of the 2017 Share Option Plan; |

| 2.2 | A copy of the Aptorum Group Limited 2017 Share Option Plan (as amended) (the “2017 Share Option

Plan”); |

| 2.3 | A copy of the certificate of incorporation issued by the Registrar of Companies in the Cayman Islands

on 13 September 2010; |

| 2.4 | A copy of the Company’s certificate of incorporation on change of name issued by the Registrar of

Companies in the Cayman Islands on 3 March 2017; |

| 2.5 | A copy of the certificate of incorporation of change of name issued by the Registrar of Companies in the

Cayman Islands dated 19 October 2017; |

| 2.6 | A copy of the statutory registers of directors and officers, members, mortgages and charges of the Company

as maintained at its registered office in the Cayman Islands, Campbells Corporate Services Limited on 24 July 2024; |

| 2.7 | A copy of the third amended and restated Memorandum and Articles of Association of the Company adopted

by special resolutions on 21 February 2023 and filed with the Registrar of Companies (the “A&R Memorandum and Articles”); |

| 2.8 | Certificate of Good Standing in respect of the Company issued by the Registrar of Companies in the Cayman

Islands dated 3 July 2024 (the “Certificate of Good Standing”); |

| 2.9 | Copies of the written resolutions of the board of directors of the Company dated 3 October 2017, and 26

July 2024 (together, the “Resolutions”); |

| 2.10 | A copy of the shareholder resolutions of the Company dated 13 October 2017 (the “Shareholder Resolutions”);

and |

| 2.11 | The records of proceedings of the Company on file with, and available for inspection on 24 July 2024,

at the Grand Court of the Cayman Islands. |

Based upon the foregoing and subject

to the qualifications set out below and having regard to such legal considerations as we deem relevant, we are of the opinion that:

| 3.1 | The Company has been duly incorporated as an exempted company with limited liability and is validly existing

and in good standing under the laws of the Cayman Islands. |

| 3.2 | The Plan Shares to be issued by the Company under the 2017 Share Option Plan have been duly and validly

authorised. |

| 3.3 | When issued and paid for in accordance with the terms of the 2017 Share Option Plan and in accordance

with the Resolutions, the Plan Shares will be legally issued, fully paid and non-assessable. As a matter of Cayman law, a share is only

issued when it has been entered in the register of members (shareholders). |

| 4.1 | We make no comment with respect to any representations and warranties which may be made by or with respect

to the Company in any of the documents or instruments cited in this opinion or otherwise with respect to the commercial terms of the transactions

the subject of this opinion. |

| 4.2 | In this opinion, the phrase “non-assessable” means, with respect to the Registered Securities,

that a shareholder shall not, solely by virtue of its status as a shareholder, be liable for additional assessments or calls on the Registered

Securities by the Company or its creditors (except in exceptional circumstances, such as involving fraud, the establishment of an agency

relationship or an illegal or improper purpose or other circumstance in which a court may be prepared to pierce or lift the corporate

veil). |

| 4.3 | To maintain the Company in good standing under the laws of the Cayman Islands, annual filing fees must

be paid and returns made to the Registrar of Companies within the time frame prescribed by law. |

We hereby consent to filing of this

opinion as an exhibit to the S-8 Registration Statement and to the reference to our name in the S-8 Registration Statement. In giving

our consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the

rules and regulations of the Commission thereunder, with respect to any part of the Registration Statement, including this opinion and

an exhibit or otherwise.

Yours faithfully

Exhibit 23.1

Independent

Registered Public Accounting Firm’s Consent

We consent to the incorporation by reference in

this Registration Statement of Aptorum Group Limited on Form S-8 of our report dated April 30, 2024, with respect to our audits of the

consolidated financial statements of Aptorum Group Limited as of December 31, 2023 and 2022 and for each of the three years in the period

ended December 31, 2023 appearing in the Annual Report on Form 20-F of Aptorum Group Limited for the year ended December 31, 2023.

/s/ Marcum Asia CPAs llp

Marcum Asia CPAs llp

New York

July 26, 2024

NEW YORK OFFICE ● 7 Penn Plaza ● Suite

830 ● New York, New York ● 10001

Phone 646.442.4845 ● Fax 646.349.5200 ●

www.marcumasia.com

Exhibit

107

CALCULATION

OF FILING FEE TABLES

Form

S-8

(Form

Type)

APTORUM

GROUP LIMITED

(Exact

name of Registrant as specified in its charter)

Table

1: Newly Registered Securities

Security Type | |

Security

Class Title | |

Fee

Calculation

Rule (2) | |

Amount

Registered (1) | | |

Proposed

Maximum

Offering

Price Per

Unit (2) | | |

Maximum Aggregate Offering Price

(2) | | |

Fee Rate | | |

Amount

of

Registration Fee | |

| | |

| |

| |

| | |

| | |

| | |

| | |

| |

| Equity | |

Class A

ordinary

shares, par value

$0.00001 | |

Rule 457(c)

and 457(h) | |

| 372,441 | (3) | |

US$ | 3.364 | | |

US$ | 1,252,892 | | |

$

$ | 147.60

per

1,000,000 | | |

US$ | 184.93 | |

| | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Total

Offering Amounts | |

| — | | |

US$ | 1,252,892 | | |

| — | | |

US$ | 184.93 | |

| | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Total

Fee Offsets | |

| — | | |

| — | | |

| — | | |

| | |

| | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

Fee Due | |

| — | | |

| — | | |

| — | | |

US$ | 184.93 | |

| (1) | Covers

Class A ordinary shares, par value US$0.00001 per share (“Class A Ordinary Shares”), of Aptorum Group Limited (the

“Registrant”) issuable pursuant to the Amended 2017 Share Option Plan (the “Amended 2017 Share Option Plan”).

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement

also covers an indeterminate number of additional Class A Ordinary Shares that may be offered and issued to prevent dilution resulting

from share splits, share dividends or similar transactions. |

| (2) | Estimated

solely for purposes of calculating the registration fee pursuant to Rule 457(h)(1) and Rule 457(c) under the Securities Act, and based

on the average of the high and low sales price per share of the Registrant’s Class A Ordinary Shares on the Nasdaq Stock Market

LLC on July 23, 2024. |

| (3) | Consists

of 372,441 Class A Ordinary Shares that were added automatically under an evergreen provision since January 1, 2020 to the number of

shares authorized for issuance under the Amended 2017 Share Option Plan. |

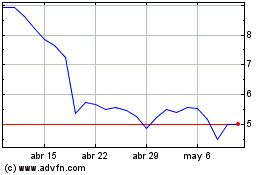

Aptorum (NASDAQ:APM)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Aptorum (NASDAQ:APM)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025