false

0001083446

0001083446

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): November 7, 2024

ASTRANA HEALTH, INC.

(Exact Name of Registrant as Specified in

Charter)

| Delaware |

001-37392 |

95-4472349 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801

(Address of Principal Executive Offices) (Zip Code)

(626) 282-0288

Registrant’s Telephone Number, Including

Area Code

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

ASTH |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

On November 7, 2024, Astrana Health, Inc. (the

“Company”) issued a press release announcing its financial results for the three and nine months ended September 30, 2024.

A copy of the press release and supplemental data is furnished with this Current Report on Form 8-K as Exhibit 99.1 and Exhibit 99.2,

respectively, and incorporated herein by reference.

In accordance with General Instruction B.2 of

Form 8-K, the information furnished pursuant to this Item 2.02, including Exhibit 99.1 and Exhibit 99.2 furnished herewith, shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ASTRANA HEALTH, INC. |

| |

|

| Date: November 7, 2024 |

By: |

/s/ Brandon K. Sim |

| |

Name: |

Brandon K. Sim |

| |

Title: |

Chief Executive Officer and President |

Exhibit 99.1

Astrana Health, Inc. Reports Third Quarter

2024 Results

Company to Host Conference Call on Thursday,

November 7, 2024, at 2:30 p.m. PT/5:30 p.m. ET

ALHAMBRA, Calif., November 7, 2024

/PRNewswire/ -- Astrana Health, Inc. (“Astrana,” and together with its subsidiaries and affiliated entities, the “Company”)

(NASDAQ: ASTH), a leading provider-centric, technology-powered healthcare company enabling providers to deliver accessible, high-quality,

and high-value care to all, today announced its consolidated financial results for the third quarter ended September 30, 2024.

"Astrana's strong third quarter continues

to reflect the outcomes we are driving with the Astrana care model and value-based care enablement platform. We continued to see strong

organic and inorganic growth across our businesses while delivering high-quality care and managing costs effectively in the quarter. We

are confident in our platform’s ability to continue improving access, quality, and coordination of care for around 1.1 million patients

in local communities nationwide,” said President and CEO of Astrana, Brandon K. Sim.

Financial Highlights for three months ended

September 30, 2024:

All comparisons are to the three months ended

September 30, 2023 unless otherwise stated.

| · | Total revenue of $478.7 million, up 37% from $348.2 million |

| · | Care Partners revenue of $455.8 million, up 42% from $320.9 million |

| · | Net income attributable to Astrana of $16.1 million, down 27% from $22.1 million |

| · | Earnings per share - diluted (“EPS - diluted”) of $0.33, down 30% from $0.47 |

| · | Adjusted EBITDA of $45.2 million, down 13% from $52.0 million |

Financial Highlights for the nine months ended

September 30, 2024:

All comparisons are to the nine months ended

September 30, 2023 unless otherwise stated.

| · | Total revenue of $1,369.3 million, up 32% from $1,033.6 million |

| · | Care Partners revenue of $1,301.4 million, up 36% from $957.3 million |

| · | Net income attributable to Astrana of $50.1 million, up 4% from $48.4 million |

| · | Earnings per share - diluted (“EPS - diluted”) of $1.04, up 1% from $1.03 |

| · | Adjusted EBITDA of $135.3 million, up 15% from $117.6 million |

Recent Operating Highlights

| · | On October 4, 2024, the

Company closed the acquisition of all of the outstanding membership interest

in Collaborative Health Systems, LLC (“CHS”) and all of the outstanding equity interests in Golden Triangle Physician Alliance

and Heritage Physician Networks for an aggregate purchase price of $37.5 million, subject to customary adjustments, plus earnout

payments in an aggregate amount of up to $21.5 million. |

Segment Results for three months ended September 30,

2024:

| | |

Three Months Ended September 30, 2024 | |

| (in thousands) | |

Care

Partners | | |

Care

Delivery | | |

Care

Enablement | | |

Other | | |

Intersegment

Elimination | | |

Corporate

Costs | | |

Consolidated

Total | |

| Total revenues | |

$ | 455,760 | | |

$ | 34,728 | | |

$ | 40,930 | | |

$ | — | | |

$ | (52,708 | ) | |

$ | — | | |

$ | 478,710 | |

| % change vs. prior year quarter | |

| 42 | % | |

| 20 | % | |

| 11 | % | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost of services | |

| 369,835 | | |

| 29,114 | | |

| 19,604 | | |

| — | | |

| (13,335 | ) | |

| — | | |

| 405,218 | |

| General and administrative(1) | |

| 47,139 | | |

| 6,971 | | |

| 15,012 | | |

| — | | |

| (39,370 | ) | |

| 15,315 | | |

| 45,067 | |

| Total expenses | |

| 416,974 | | |

| 36,085 | | |

| 34,616 | | |

| — | | |

| (52,705 | ) | |

| 15,315 | | |

| 450,285 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

$ | 38,786 | | |

$ | (1,357 | ) | |

$ | 6,314 | | |

$ | — | | |

$ | (3 | )(2) | |

$ | (15,315 | ) | |

$ | 28,425 | |

| % change vs. prior year quarter | |

| (4 | )% | |

| 31 | % | |

| (2 | )% | |

| | | |

| | | |

| | | |

| | |

(1) Balance

includes general and administrative expenses and depreciation and amortization.

(2) Income

from operations for the intersegment elimination represents rental income from segments renting from other segments. Rental income is

presented within other income which is not presented in the table.

2024 Guidance:

As we adjust our full-year outlook to incorporate

CHS's financial contribution, we are raising our revenue guidance and narrowing our net income attributable to Astrana, Adjusted EBITDA,

and EPS guidance for the year ending December 31, 2024.

| |

2024 Guidance Range | |

| ($ in millions, except per share amounts) | |

Low | | |

High | |

| Total revenue | |

$ | 1,950 | | |

$ | 2,030 | |

| Net income attributable to Astrana Health, Inc. | |

$ | 52 | | |

$ | 58 | |

| Adjusted EBITDA | |

$ | 165 | | |

$ | 175 | |

| EPS – diluted | |

$ | 1.06 | | |

$ | 1.19 | |

See “Guidance Reconciliation of Net Income

to EBITDA and Adjusted EBITDA” and “Use of Non-GAAP Financial Measures” below for additional information. There can

be no assurance that actual amounts will not be materially higher or lower than these expectations. See “Forward-Looking Statements”

below for additional information.

Conference Call and Webcast Information:

Astrana will host a conference call at 2:30 p.m. PT/5:30

p.m. ET today (Thursday, November 7, 2024), during which management will discuss the results of the third quarter ended September 30,

2024. To participate in the conference call, please use the following dial-in numbers about 5 minutes prior to the scheduled conference

call time:

| U.S. & Canada (Toll-Free): |

+1 (888) 272-8703 |

| International (Toll): |

+1 (713) 481-1320 |

The

conference call can also be accessed via webcast at: https://event.choruscall.com/mediaframe/webcast.html?webcastid=qeu83NWd

An

accompanying slide presentation will be available in PDF format on the “IR Calendar” page of the Company’s website

(https://ir.astranahealth.com/news-events/ir-calendar) after issuance of the earnings release and will be furnished as

an exhibit to Astrana’s current report on Form 8-K to be filed with the SEC, accessible at www.sec.gov.

Those who are unable to attend the live conference

call may access the recording at the above webcast link, which will be made available shortly after the conclusion of the call.

Note About Consolidated Entities

The Company consolidates entities in which it

has a controlling financial interest. The Company consolidates subsidiaries in which it holds, directly or indirectly, more than 50% of

the voting rights, and variable interest entities (“VIEs”) in which the Company is the primary beneficiary. Noncontrolling

interests represent third party equity ownership interests in the Company’s consolidated entities (including certain VIEs). The

amount of net income attributable to noncontrolling interests is disclosed in the Company’s consolidated statements of income.

Note

About Stockholders’ Equity, Certain Treasury Stock and Earnings Per Share

As of the date of this press release, 41,048 holdback

shares have not been issued to certain former shareholders of the Company’s subsidiary, Astrana Health Management, Inc. (“AHM”),

formerly known as Network Medical Management, Inc., who were AHM shareholders at the time of closing of the merger, as they have

yet to submit properly completed letters of transmittal to Astrana in order to receive their pro rata portion of Astrana’s common

stock and warrants as contemplated under that certain Agreement and Plan of Merger, dated December 21, 2016, among Astrana, AHM,

Apollo Acquisition Corp. (“Merger Subsidiary”) and Kenneth Sim, M.D., as amended, pursuant to which Merger Subsidiary merged

with and into AHM, with AHM as the surviving corporation. Pending such receipt, such former AHM shareholders have the right to receive,

without interest, their pro rata share of dividends or distributions with a record date after the effectiveness of the merger. The Company’s

consolidated financial statements have treated such shares of common stock as outstanding, given the receipt of the letter of transmittal

is considered perfunctory and Astrana is legally obligated to issue these shares in connection with the merger.

Shares of Astrana’s common stock owned by

Allied Physicians of California, a Professional Medical Corporation (“APC”), a VIE of the Company, are legally issued and

outstanding but excluded from shares of common stock outstanding in the Company’s consolidated financial statements, as such shares

are treated as treasury shares for accounting purposes. Such shares, therefore, are not included in the number of shares of common stock

outstanding used to calculate the Company’s earnings per share.

About Astrana Health, Inc.

Astrana is a leading physician-centric, technology-powered,

risk-bearing healthcare management company. Leveraging its proprietary population health management and healthcare delivery platform,

Astrana operates an integrated, value-based healthcare model, which aims to empower the providers in its network to deliver the highest

quality of care to its patients in a cost-effective manner. Together with our affiliated physician groups and consolidated entities, we

provide coordinated outcomes-based medical care in a cost-effective manner.

Headquartered in Alhambra, California, Astrana

serves over 12,000 providers and approximately 1.1 million patients in value-based care arrangements. Its subsidiaries and affiliates

include management services organizations (MSOs), a network of risk-bearing organizations ("RBOs") that encompasses independent

practice associations ("IPAs"), accountable care organizations ("ACOs"), and state-specific entities such as Restricted

Knox-Keene licensed health plans in California, and care delivery entities across primary, multi-specialty, and ancillary care. For more

information, please visit www.astranahealth.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements about the Company’s guidance

for the year ending December 31, 2024, ability to meet operational goals, ability to meet expectations in deployment of care coordination

and management capabilities, ability to decrease cost of care while improving quality and outcomes, ability to deliver sustainable revenue

and EBITDA growth as well as long-term value, ability to respond to the changing environment, and successful implementation of strategic

growth plans, acquisition strategy, and merger integration efforts. Forward-looking statements reflect current views with respect to future

events and financial performance and therefore cannot be guaranteed. Such statements are based on the current expectations and certain

assumptions of the Company’s management, and some or all of such expectations and assumptions may not materialize or may vary significantly

from actual results. Actual results may also vary materially from forward-looking statements due to risks, uncertainties and other factors,

known and unknown, including the risk factors described from time to time in the Company’s reports filed or furnished with the Securities

and Exchange Commission, including, without limitation the risk factors discussed in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2023, and any subsequent quarterly reports on Form 10-Q.

FOR MORE INFORMATION, PLEASE CONTACT:

Investor

Relations

(626) 943-6491

investors@astranahealth.com

ASTRANA HEALTH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE DATA)

| | |

September 30,

2024 | | |

December 31,

2023 | |

| | |

| (Unaudited) | | |

| | |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 347,994 | | |

$ | 293,807 | |

| Investment in marketable securities | |

| 2,354 | | |

| 2,498 | |

| Receivables, net | |

| 132,237 | | |

| 76,780 | |

| Receivables, net – related parties | |

| 76,568 | | |

| 58,980 | |

| Income taxes receivable | |

| 16,211 | | |

| 10,657 | |

| Other receivables | |

| 1,120 | | |

| 1,335 | |

| Prepaid expenses and other current assets | |

| 20,506 | | |

| 17,450 | |

| | |

| | | |

| | |

| Total current assets | |

| 596,990 | | |

| 461,507 | |

| | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Land, property and equipment, net | |

| 12,172 | | |

| 7,171 | |

| Intangible assets, net | |

| 109,108 | | |

| 71,648 | |

| Goodwill | |

| 409,711 | | |

| 278,831 | |

| Income taxes receivable | |

| 15,943 | | |

| 15,943 | |

| Loans receivable, non-current | |

| 55,284 | | |

| 26,473 | |

| Investments in other entities – equity method | |

| 34,629 | | |

| 25,774 | |

| Investments in privately held entities | |

| 8,896 | | |

| 6,396 | |

| Restricted cash | |

| 646 | | |

| 345 | |

| Operating lease right-of-use assets | |

| 33,119 | | |

| 37,396 | |

| Other assets | |

| 8,878 | | |

| 1,877 | |

| | |

| | | |

| | |

| Total non-current assets | |

| 688,386 | | |

| 471,854 | |

| | |

| | | |

| | |

| Total assets(1) | |

$ | 1,285,376 | | |

$ | 933,361 | |

| | |

| | | |

| | |

| Liabilities, mezzanine equity and equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 94,811 | | |

$ | 59,949 | |

| Fiduciary accounts payable | |

| 6,041 | | |

| 7,737 | |

| Medical liabilities | |

| 160,279 | | |

| 106,657 | |

| Dividend payable | |

| 638 | | |

| 638 | |

| Finance lease liabilities | |

| 554 | | |

| 646 | |

| Operating lease liabilities | |

| 5,241 | | |

| 4,607 | |

| Current portion of long-term debt | |

| 15,000 | | |

| 19,500 | |

| Other liabilities | |

| 30,364 | | |

| 18,940 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 312,928 | | |

| 218,674 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Deferred tax liability | |

| 2,857 | | |

| 4,072 | |

| Finance lease liabilities, net of current portion | |

| 743 | | |

| 1,033 | |

| Operating lease liabilities, net of current portion | |

| 31,162 | | |

| 36,289 | |

| Long-term debt, net of current portion and deferred financing costs | |

| 423,119 | | |

| 258,939 | |

| Other long-term liabilities | |

| 7,460 | | |

| 3,586 | |

| | |

| | | |

| | |

| Total non-current liabilities | |

| 465,341 | | |

| 303,919 | |

| | |

| | | |

| | |

| Total liabilities(1) | |

| 778,269 | | |

| 522,593 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Mezzanine equity | |

| | | |

| | |

| Noncontrolling interest in Allied Physicians of California, a Professional Medical Corporation ("APC") | |

| (202,512 | ) | |

| (205,883 | ) |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock, $0.001 par value per share; 5,000,000 shares authorized as of September 30, 2024 and December 31, 2023 | |

| | | |

| | |

| Series A Preferred stock, zero authorized and issued and zero outstanding as of September 30, 2024 and 1,111,111 authorized and issued and zero outstanding as of December 31, 2023 | |

| — | | |

| — | |

| Series B Preferred stock, zero authorized and issued and zero outstanding as of September 30, 2024 and 555,555 authorized and issued and zero outstanding as of December 31, 2023 | |

| — | | |

| — | |

| Common stock, $0.001 par value per share; 100,000,000 shares authorized, 47,780,523 and 46,843,743 shares issued and outstanding, excluding 10,598,749 and 10,584,340 treasury shares, as of September 30, 2024 and December 31, 2023, respectively | |

| 48 | | |

| 47 | |

| Additional paid-in capital | |

| 411,334 | | |

| 371,037 | |

| Retained earnings | |

| 293,234 | | |

| 243,134 | |

| Total stockholders’ equity | |

| 704,616 | | |

| 614,218 | |

| | |

| | | |

| | |

| Non-controlling interest | |

| 5,003 | | |

| 2,433 | |

| | |

| | | |

| | |

| Total equity | |

| 709,619 | | |

| 616,651 | |

| | |

| | | |

| | |

| Total liabilities, mezzanine equity and equity | |

$ | 1,285,376 | | |

$ | 933,361 | |

(1) The

Company’s condensed consolidated balance sheets include the assets and liabilities of its consolidated VIEs. The condensed consolidated

balance sheets include total assets that can be used only to settle obligations of the Company’s consolidated VIEs totaling $701.1

million and $540.8 million as of September 30, 2024 and December 31, 2023, respectively, and total liabilities of the Company’s

consolidated VIEs for which creditors do not have recourse to the general credit of the primary beneficiary of $194.1 million and $146.0

million as of September 30, 2024 and December 31, 2023, respectively. These VIE balances do not include $413.3 million of investment

in affiliates and $76.3 million of amounts due to affiliates as of September 30, 2024, and $273.2 million of investment in affiliates

and $107.3 million of amounts due to affiliates as of December 31, 2023, as these are eliminated upon consolidation and not presented

within the condensed consolidated balance sheets.

ASTRANA HEALTH, INC.

CONSOLIDATED STATEMENTS OF INCOME

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

(UNAUDITED)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue | |

| | |

| | |

| | |

| |

| Capitation, net | |

$ | 431,401 | | |

$ | 305,678 | | |

$ | 1,239,885 | | |

$ | 906,430 | |

| Risk pool settlements and incentives | |

| 21,779 | | |

| 15,022 | | |

| 57,564 | | |

| 48,605 | |

| Management fee income | |

| 2,747 | | |

| 9,898 | | |

| 8,429 | | |

| 32,287 | |

| Fee-for-service, net | |

| 18,692 | | |

| 15,892 | | |

| 54,588 | | |

| 41,216 | |

| Other revenue | |

| 4,091 | | |

| 1,683 | | |

| 8,865 | | |

| 5,087 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total revenue | |

| 478,710 | | |

| 348,173 | | |

| 1,369,331 | | |

| 1,033,625 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of services, excluding depreciation and amortization | |

| 405,218 | | |

| 275,375 | | |

| 1,148,422 | | |

| 857,648 | |

| General and administrative expenses | |

| 37,803 | | |

| 29,410 | | |

| 112,478 | | |

| 74,648 | |

| Depreciation and amortization | |

| 7,264 | | |

| 4,305 | | |

| 19,801 | | |

| 12,846 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total expenses | |

| 450,285 | | |

| 309,090 | | |

| 1,280,701 | | |

| 945,142 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income from operations | |

| 28,425 | | |

| 39,083 | | |

| 88,630 | | |

| 88,483 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from equity method investments | |

| 1,353 | | |

| (2,104 | ) | |

| 2,887 | | |

| 3,104 | |

| Interest expense | |

| (8,856 | ) | |

| (3,779 | ) | |

| (25,028 | ) | |

| (10,680 | ) |

| Interest income | |

| 3,778 | | |

| 3,281 | | |

| 11,287 | | |

| 9,617 | |

| Unrealized (loss) gain on investments | |

| (561 | ) | |

| (342 | ) | |

| 415 | | |

| (5,875 | ) |

| Other income | |

| 2,673 | | |

| 1,876 | | |

| 4,522 | | |

| 4,265 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total other (expense) income, net | |

| (1,613 | ) | |

| (1,068 | ) | |

| (5,917 | ) | |

| 431 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income before provision for income taxes | |

| 26,812 | | |

| 38,015 | | |

| 82,713 | | |

| 88,914 | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| 7,831 | | |

| 10,042 | | |

| 25,004 | | |

| 30,971 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 18,981 | | |

| 27,973 | | |

| 57,709 | | |

| 57,943 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to non-controlling interest | |

| 2,887 | | |

| 5,914 | | |

| 7,609 | | |

| 9,582 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to Astrana Health, Inc. | |

$ | 16,094 | | |

$ | 22,059 | | |

$ | 50,100 | | |

$ | 48,361 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share – basic | |

$ | 0.34 | | |

$ | 0.47 | | |

$ | 1.05 | | |

$ | 1.04 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share – diluted | |

$ | 0.33 | | |

$ | 0.47 | | |

$ | 1.04 | | |

$ | 1.03 | |

EBITDA

Set forth below are reconciliations of Net Income

to EBITDA and Adjusted EBITDA as well as the reconciliation to Adjusted EBITDA margin for the three and nine months ended September 30,

2024 and 2023. The Company defines Adjusted EBITDA margin as Adjusted EBITDA over total revenue.

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| (in thousands) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net income | |

$ | 18,981 | | |

$ | 27,973 | | |

$ | 57,709 | | |

$ | 57,943 | |

| Interest expense | |

| 8,856 | | |

| 3,779 | | |

| 25,028 | | |

| 10,680 | |

| Interest income | |

| (3,778 | ) | |

| (3,281 | ) | |

| (11,287 | ) | |

| (9,617 | ) |

| Provision for income taxes | |

| 7,831 | | |

| 10,042 | | |

| 25,004 | | |

| 30,971 | |

| Depreciation and amortization | |

| 7,264 | | |

| 4,305 | | |

| 19,801 | | |

| 12,846 | |

| EBITDA | |

| 39,154 | | |

| 42,818 | | |

| 116,255 | | |

| 102,823 | |

| | |

| | | |

| | | |

| | | |

| | |

| (Income) loss from equity method investments | |

| (1,353 | ) | |

| 2,016 | | |

| (2,887 | ) | |

| (3,160 | ) |

| Other, net | |

| 1,206 | (1) | |

| 1,723 | (2) | |

| 2,663 | (3) | |

| 1,507 | (2) |

| Stock-based compensation | |

| 6,163 | | |

| 5,706 | | |

| 19,301 | | |

| 13,364 | |

| APC excluded asset costs | |

| — | | |

| (289 | ) | |

| — | | |

| 3,039 | |

| Adjusted EBITDA | |

$ | 45,170 | | |

$ | 51,974 | | |

$ | 135,332 | | |

$ | 117,573 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total revenue | |

$ | 478,710 | | |

$ | 348,173 | | |

$ | 1,369,331 | | |

$ | 1,033,625 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA margin | |

| 9 | % | |

| 15 | % | |

| 10 | % | |

| 11 | % |

| (1) | Other, net for the three months ended September 30, 2024 relates to non-cash changes related to change

in the fair value of our financing obligation to purchase the remaining equity interests in one of our investments, non-cash changes related

to change in the fair value of the Company’s Collar Agreement, non-cash gain on debt extinguishment related to one of our promissory

note payables, and transaction costs incurred for our investments and tax restructuring fees. |

| (2) | Other, net for the three and nine months ended September 30, 2023 relates to transaction costs incurred

for our investments and tax restructuring fees and non-cash changes related to change in the fair value of our financing obligation to

purchase the remaining equity interests, changes in the fair value of our contingent liabilities, and changes in the fair value of the

Company's Collar Agreement. |

| (3) | Other, net for the nine months ended September 30, 2024 relates to financial guarantee via a letter

of credit that we provided almost three years ago in support of two local provider-led ACOs, non-cash changes related to change in the

fair value of our financing obligation to purchase the remaining equity interests in one of our investments, non-cash changes related

to change in the fair value of the Company’s Collar Agreement, non-cash gain on debt extinguishment related to one of our promissory

note payables, transaction costs incurred for our investments and tax restructuring fees, and reimbursement from a related party of the

Company for taxes associated with the Excluded Assets spin-off. |

Guidance Reconciliation of Net Income to

EBITDA and Adjusted EBITDA

| | |

2024 Guidance Range | |

| (in thousands) | |

Low | | |

High | |

| Net income | |

$ | 59,340 | | |

$ | 66,240 | |

| Interest expense | |

| 18,750 | | |

| 18,750 | |

| Provision for income taxes | |

| 26,660 | | |

| 29,760 | |

| Depreciation and amortization | |

| 27,500 | | |

| 27,500 | |

| EBITDA | |

| 132,250 | | |

| 142,250 | |

| | |

| | | |

| | |

| Income from equity method investments | |

| (4,250 | ) | |

| (4,250 | ) |

| Other, net | |

| 5,000 | | |

| 5,000 | |

| Stock-based compensation | |

| 32,000 | | |

| 32,000 | |

| Adjusted EBITDA | |

$ | 165,000 | | |

$ | 175,000 | |

Use of Non-GAAP Financial Measures

This press release contains the non-GAAP financial

measures EBITDA and Adjusted EBITDA, of which the most directly comparable financial measure presented in accordance with U.S. generally

accepted accounting principles (“GAAP”) is net income. These measures are not in accordance with, or alternatives to GAAP,

and may be calculated differently from similar non-GAAP financial measures used by other companies. The Company uses Adjusted EBITDA as

a supplemental performance measure of our operations, for financial and operational decision-making, and as a supplemental means of evaluating

period-to-period comparisons on a consistent basis. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation, and

amortization, excluding income or loss from equity method investments, non-recurring and non-cash transactions, stock-based compensation,

and APC excluded assets costs. The Company defines Adjusted EBITDA margin as Adjusted EBITDA over total revenue.

The Company believes the presentation of these

non-GAAP financial measures provides investors with relevant and useful information, as it allows investors to evaluate the operating

performance of the business activities without having to account for differences recognized because of non-core or non-recurring financial

information. When GAAP financial measures are viewed in conjunction with non-GAAP financial measures, investors are provided with a more

meaningful understanding of the Company’s ongoing operating performance. In addition, these non-GAAP financial measures are among

those indicators the Company uses as a basis for evaluating operational performance, allocating resources, and planning and forecasting

future periods. Non-GAAP financial measures are not intended to be considered in isolation, or as a substitute for, GAAP financial measures.

Other companies may calculate both EBITDA and Adjusted EBITDA differently, limiting the usefulness of these measures for comparative purposes.

To the extent this release contains historical or future non-GAAP financial measures, the Company has provided corresponding GAAP financial

measures for comparative purposes. The reconciliation between certain GAAP and non-GAAP measures is provided above.

Exhibit 99.2

| Third Quarter 2024

Earnings Supplement

November 2024

,

:s /

k

A

I

of di

Astrana Health |

| Forward Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements include any statements about the Company's business, financial condition, operating results, plans, objectives, expectations and intentions, expansion plans, estimates of our total addressable

market, our ability to successfully complete and realize the benefits of anticipated acquisitions, integration of acquired companies and any projections of earnings, revenue, EBITDA, Adjusted EBITDA or other

financial items, such as the Company's projected capitation and future liquidity, and may be identified by the use of forward-looking terms such as "anticipate," "could," "can," "may," "might," "potential," "predict,"

"should," "estimate," "expect," "project," "believe," "plan," "envision," "intend," "continue," "target," "seek," "will," "would," and the negative of such terms, other variations on such terms or other similar or

comparable words, phrases or terminology. Forward-looking statements reflect current views with respect to future events and financial performance and therefore cannot be guaranteed. Such statements are

based on the current expectations and certain assumptions of the Company's management, and some or all of such expectations and assumptions may not materialize or may vary significantly from actual

results. Actual results may also vary materially from forward-looking statements due to risks, uncertainties and other factors, known and unknown, including the risk factors described from time to time in the

Company's reports to the U.S. Securities and Exchange Commission (the "SEC"), including without limitation the risk factors discussed in the Company's Annual Report on Form 10-K for the year ended December

31, 2023, and subsequent Quarterly Reports on Form 10-Q.

Because the factors referred to above could cause actual results or outcomes to differ materially from those expressed or implied in any forward-looking statements, you should not place undue reliance on any

such forward-looking statements. Any forward-looking statements speak only as of the date of this presentation and, unless legally required, the Company does not undertake any obligation to update any

forward-looking statement, as a result of new information, future events or otherwise.

This presentation may contain statistics and other data that in some cases has been obtained from or compiled from information made available by third-party service providers. The Company makes no

representation or warranty, express or implied, with respect to the accuracy, reasonableness or completeness of such information.

Use of Non-GAAP Financial Measures

This presentation contains the non-GAAP financial measures EBITDA and Adjusted EBITDA, of which the most directly comparable financial measure presented in accordance with U.S. generally accepted

accounting principles ("GAAP") is net income. These measures are not in accordance with, or alternatives to, GAAP, and may be calculated differently from similar non-GAAP financial measures used by other

companies. The Company uses Adjusted EBITDA as a supplemental performance measure of our operations, for financial and operational decision-making, and as a supplemental means of evaluating period-to-period comparisons on a consistent basis. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation, and amortization, excluding income or loss from equity method investments, non-recurring and non-cash transactions, stock-based compensation, and APC excluded assets costs. Beginning in the third quarter ended September 30, 2022, the Company has revised the calculation for Adjusted

EBITDA to exclude provider bonus payments and losses from recently acquired IPAs, which it believes to be more reflective of its business.

The Company believes the presentation of these non-GAAP financial measures provides investors with relevant and useful information, as it allows investors to evaluate the operating performance of the

business activities without having to account for differences recognized because of non-core or non-recurring financial information. When GAAP financial measures are viewed in conjunction with non-GAAP

financial measures, investors are provided with a more meaningful understanding of the Company's ongoing operating performance. In addition, these non-GAAP financial measures are among those indicators

the Company uses as a basis for evaluating operational performance, allocating resources, and planning and forecasting future periods. Non-GAAP financial measures are not intended to be considered in

isolation, or as a substitute for, GAAP financial measures. Other companies may calculate both EBITDA and Adjusted EBITDA differently, limiting the usefulness of these measures for comparative purposes. To

the extent this Presentation contains historical or future non-GAAP financial measures, the Company has provided corresponding GAAP financial measures for comparative purposes. The reconciliation between

certain GAAP and non-GAAP measures is provided in the Appendix.

The Company has not provided a quantitative reconciliation of applicable non-GAAP measures, such as the projected adjusted EBITDA and adjusted EBITDA margin in 2024 and in future years for planned

acquisitions, to the most comparable GAAP measure, such as net income, on a forward-looking basis within this presentation because the Company is unable, without unreasonable efforts, to provide reconciling

information with respect to certain line items that cannot be calculated. These items, which could materially affect the computation of forward-looking GAAP net income, are inherently uncertain and depend on

various factors, some of which are outside of the Company's control.

Astrana Health 2 |

| Third Quarter 2024 Performance Highlights

($ in millions, except for per share information)

Q32024

financial results

Revenue $478.7

Net Income attr. to ASTH $16.1

Adjusted EBITDA1 $45.2

EPS - Diluted $0.33

Astrana Health

$348.2

Revenue

37%

$478.7

Net Income attr. To ASTH

(27)%

$22.1

$16.1

Q3 2023 Q3 2024 Q3 2023 Q3 2024

Adjusted EBITDA2 EPS - Diluted

(13)% (30)%

$52.0

$45.2

$0.47

$0.33

Q3 2023 Q3 2024 Q3 2023 Q3 2024

1. See "Reconciliation of Net Income to EBITDA and Adjusted EBITDA," "Updated Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA" and "Use of Non-GAAP Financial

Measures" slides for more information.

2. As guided to in previous quarters, Adjusted EBITDA was lower relative to the same period last year due to a timing difference in when certain incentive dollars were booked and the move to

accruing ACO results throughout the year. On a year-to-date basis, Adjusted EBITDA has grown 15%, from $117.6 million in the nine months of 2023 to $135.3 million in the nine months of 2024. 3 |

| Third Quarter 2024 Highlights and Recent Updates

Care Partners

Closed the planned acquisition of Collaborative Health Systems, adding a network of

2,500+ PCPs serving over 100,000 primarily Medicare members across states in the South

and along the East coast

+ Organically added over 200 primary care providers and over 900 specialists to our

networks across our core markets to set the stage for future membership growth

+ Partnered with SCAN Health Plan to launch a Medicare Advantage offering designed for

specific populations of older adults

.. 20

Care Delivery I] .

+ Opened 2 new de novo primary care clinics in Las Vegas, Nevada

.. . Astrana Health 4 |

| Financial Profile

Revenue ($ in millions) Adj. EBITDA ($ in millions)

$561

$687

-29% CAGR

$774

$1,144

$1,387

% Adjusted EBITDA Margins

$165.0-

$1,950- $175.0

$2,030 -26% CAGR

$54.2

$102.8

$140.0

$146.6

$133.5

2019 2020 2021 2022 2023 2024E 2019 20202 20212 20222 20232 2024E

Astrana Health

10% 15% 17% 12% 11% 9%

Note: For more information, see "Reconciliation of Net Income to EBITDA and Adjusted EBITDA", "Updated Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA", and "Use of Non-GAAP Financial Measures" slides for more information

1. The Company defines Adjusted EBITDA margin as Adjusted EBITDA over total revenue

2. 2020-2021 Adj. EBITDA benefitted from tailwinds of lower utilization during the COVID-19 pandemic. Return to pre-pandemic utilization in 2022 and 2023 5 |

| Quarter over Quarter Segment Revenue

Revenue

$ in millions

Care Partners

High-performing network

of aligned providers

Care Delivery

High-quality system of

employed providers

Care Enablement

Full-stack tech, clinical, and

operations platform

Other Inter-company

Total

Q3 2024

Q2 2024

Q1 2024

Q4 2023

Q3 2023

$455.8 $34.7 $40.9 $0.0 $(52.7) $478.7

$463.3 $34.9 $36.2 $0.0 $(48.0) $486.3

$382.3 $30.7 $33.3 $0.0 $(42.0) $404.4

$326.8 $38.1 $33.4 $0.2 $(45.5) $353.0

$320.9 $29.0 $36.9 $0.3 $(38.9) $348.2

.. . Astrana Health

Note: Numbers may not total due to rounding. Certain amounts disclosed in the prior periods have been recast to conform to the current period presentation. Specifically, segments are presented net

of intrasegment eliminations. 6 |

| Astrana Updates Guidance for 2024

($ in millions, except for per share information)

Q32024

financial results

Actual 2024 Previous 2024 New

FY 2023 Guidance Guidance

Results Range Ranges

Revenue $478.7 Total Revenue $1,386.7 $1,750 - $1,850 $1,950 - $2,030

Net Income attr. to ASTH $16.1 Net Income attr. to ASTH $60.7 $54 - $66 $52 - $58

Adjusted EBITDA2 $45.2 Adjusted EBITDA2 $146.6 $165 - $185 $165 - $175

EPS - Diluted $0.33 EPS - Diluted $1.29 $1.12 - $1.36 $1.06 - $1.19

Astrana Health

1. Raised revenue guidance and narrowed net income attr. to ASTH, Adjusted EBITDA, and EPS guidance to incorporate CHS's financial contribution

2. See "Reconciliation of Net Income to EBITDA and Adjusted EBITDA," "Updated Guidance Reconciliation of Net Income to EBITDA and Adjusted EBITDA" and "Use of Non-GAAP Financial Measures" slides

for more information. There can be no assurance that actual amounts will not be materially higher or lower than these expectations. See "Forward-Looking Statements" on slide 2. 7 |

| With the closing of CHS, Astrana's footprint spans coast to coast

Astrana marketsl

Jil ,At

_ mew

Astrana Health

Note: Collaborative Health Systems acquisition closed shortly after quarter end as of October 4th, 2024

1. Astrana markets with at least 3,000 members, except for Arizona 's membership which is proforma for 2025. 8 |

| Our Value-Based Care Business is Diverse

Revenue by Typel

90% 4% 4%

Capitation, net Risk Pool Settlements & Incentives Management Fee Income Fee-for-service, net Other Income

Revenue By Payer Typel

54% 32% 11% 3%

Revenue by Risk Arrangementu

Medicare Medicaid Commercial Other Third Parties

67% of cap. revenue anticipated from full-risk by 1/1/2025

61%

i

I 39%

Full-risk Partial-risk

Members by Risk Arrangement3

30% 70%

.. . Astrana Health

1. Revenue for the three months ended September 30, 2024

2. Revenue by risk arrangement represents capitation revenue only

3. Members by risk arrangement represent Care Partners membership only as of October 1, 2024

Full-risk Partial-risk

9 |

| Selected Financial Results

.. . Astrana Health |

| Summary of Selected Financial Results

$ in thousands except per share data

Revenue

Three Months Ended September 30,

2024 2023

Nine Months Ended September 30,

2024 2023

Capitation, net 431,401 $ 305,678 $ 1,239,885 $ 906,430

Risk pool settlements and incentives 21,779 15,022 57,564 48,605

Management fee income 2,747 9,898 8,429 32,287

Fee-for-service, net 18,692 15,892 54,588 41,216

Other revenue 4,091 1,683 8,865 5,087

Total revenue 478,710 348,173 1,369,331 1,033,625

Total expenses 450,285 309,090 1,280,701 945,142

Income from operations 28,425 39,083 88,630 88,483

Net income 18,981 $ 27,973 $ 57,709 $ 57,943

Net income attributable to noncontrolling interests 2,887 5,914 7,609 9,582

Net income attributable to Astrana Health 16,094 $ 22,059 $ 50,100 $ 48,361

Earnings per share - diluted 0.33 $ 0.47 $ 1.04 $ 1.03

EBITDA1 39,154 $ 42,818 $ 116,255 $ 102,823

Adjusted EBITDA1 45,170 $ 51,974 $ 135,332 $ 117,573

Astrana Health 1. See "Reconciliation of Net Income to EBITDA and Adjusted EBITDA" and "Use of Non-GAAP Financial Measures" slides for more information. 11 |

| Segment Results

For the three months ended September 30, 2024

$ in thousands Care

Partners

Care

Delivery

Care

Enablement Other Intersegment

Elimination

Corporate

Costs

Consolidated

Total

Total revenues $ 455,760 34,728 40,930 - (52,708) - 478,710

% change vs prior year quarter 42% 20% 11% 37%

Cost of services 369,835 29,114 19,604 (13,335) 405,218

General and administrative expenses' 47,139 6,971 15,012 (39,370) 15,315 45,067

Total expenses 416,974 36,085 34,616 (52,705) 15,315 450,285

Income (loss) from operations $ 38,786 (1,357) 6,314 (3)2 (15,315) 28,425

% change vs prior year quarter (4%) 31% (2%) (27%)

Astrana Health

1. Balance includes general and administrative expenses and depreciation and amortization.

2. Income from operations for the intersegment elimination represents rental income from segments renting from other segments. Rental income is presented within other income,

which is not presented in the table.

12 |

| Balance Sheet Highlights

$ in millions 9/30/2024 12/31/2023 $ Change

Cash and cash equivalents and

investments in marketable $350.3 $296.3 $54.0

securities1

Working capital $284.1 $242.8 $41.3

Total stockholders' equity $709.6 $616.7 $92.9

1. Excluding restricted cash

.. . Astrana Health 13 |

| Reconciliation of Net Income to EBITDA & Adjusted

EBITDA

$ in thousands

Three Months Ended September 30,

2024 2023

Nine Months Ended September 30,

2024 2023

Net Income 18,981 27,973 57,709 57,943

Interest Expense 8,856 3,779 25,028 10,680

Interest income (3,778) (3,281) (11,287) (9,617)

Provision for income taxes 7,831 10,042 25,004 30,971

Depreciation and amortization 7,264 4,305 19,801 12,846

EBITDA 39,154 42,818 116,255 102,823

Income from equity method investments (1,353) 2,016 (2,887) (3,160)

Other, net 1,2062 1,7233 2,6634 1,5073

Stock-based compensation 6,163 5,706 19,301 13,364

APC excluded assets costs (289) 3,039

Adjusted EBITDA 45,170 $ 51,974 $ 135,332 $ 117,573

Adjusted EBITDA margin' 9% 15% 10% 11%

Astrana Health

1. The Company defines Adjusted EBITDA margin as Adjusted EBITDA over total revenue.

2. Other, net for the three months ended September 30, 2024 relates to non-cash changes related to change in the fair value of our financing obligation to purchase the remaining equity interests in one of

our investments, non-cash changes related to change in the fair value of the Company's Collar Agreement, non-cash gain on debt extinguishment related to one of our promissory note payables, and

transaction costs incurred for our investments and tax restructuring fees.

3. Other, net for the three and nine months ended September 30, 2023 relates to transaction costs incurred for our investments and tax restructuring fees and non-cash changes related to change in the

fair value of our financing obligation to purchase the remaining equity interests, changes in the fair value of our contingent liabilities, and changes in the fair value of the Company's Collar Agreement.

4. Other, net for the nine months ended September 30, 2024 relates to financial guarantee via a letter of credit that we provided almost three years ago in support of two local provider-led ACOs, non-cash

changes related to change in the fair value of our financing obligation to purchase the remaining equity interests in one of our investments, non-cash changes related to change in the fair value of the

Company's Collar Agreement, non-cash gain on debt extinguishment related to one of our promissory note payables, transaction costs incurred for our investments and tax restructuring fees, and

reimbursement from a related party of the Company for taxes associated with the Excluded Assets spin-off. |

| Reconciliation of Net Income to EBITDA & Adjusted

EBITDA (continued)

For the twelve months ended TTM Ended Year Ended

$ in millions September 30, 2024 2023 2022 2021 2020 2019

Net Income $ 57.6 $ 57.8 $ 45.7 $ 46.1 $ 122.1 15.8

Interest expense 30.4 16.1 7.9 5.4 9.5 4.7

Interest income (15.9) (14.2) (2.0) (1.6) (2.8) (2.0)

Provision for income taxes 26.0 32.0 40.9 31.7 56.3 10.0

Depreciation and amortization 24.7 17.7 17.5 17.5 18.4 18.3

EBITDA' 122.9 109.5 110.1 99.1 203.5 46.8

Goodwill impairment - - - - 2.0

Income (loss) from equity

method investments (4.9) (5.1) (5.7)6 5.36 (0.3) 6 2.9

Gain on sale of equity method

investment - - (2.2)

Other, net 7.47 6.22 3.33 (1.7) 4 (0.5) 4 -

Stock-based compensation 28.0 22.0 16.1 6.7 3.4 0.9

APC excluded assets costs 10.9 14.0 16.26 26.46 (103.3)6 1.5

Adjusted EBITDA1 164.3 $ 146.6 $ 140.0 $ 133.5 $ 102.8 $ 54.2

Net Revenue 1,722.4 $ 1,386.7 $ 1,144.2 $ 773.9 $ 687.2 $ 560.6

Adjusted EBITDA Margins 10% 11% 12% 17% 15% 10%

1. See "Use of Non-GAAP Financial Measures" slide for more information; 2. Other, net for the year ended December 31, 2023 consists of nonrecurring transaction costs and tax restructuring fees incurred, non-cash gains and losses related to the

changes in the fair value of our financing obligation to purchase the remaining equity interests, contingent liabilities, and the Company's Collar Agreement, and excise tax related to a nonrecurring buyback of the Company's stock from APC.; 3. Other,

net for the year ended December 31, 2022 consists of one-time transaction costs incurred and non-cash gains and losses related to the changes in the fair value of our financing obligation to purchase the remaining equity interests and contingent

considerations.; 4. Other, net for the years ended December 31, 2021 and 2020 relate to COVID-19 relief payments recognized in 2021 and 2020; 5. The Company defines Adjusted EBITDA margin as Adjusted EBITDA over total revenue; 6. Certain

APC minority interests where APC owns the asset but not the right to the dividends is reclassified from APC excluded asset costs to income from equity method investments; 7. Other, net for TTM ended September 30, 2024 consists of non-cash

gain on debt extinguishment related to one of our promissory note payables, a reimbursement from a related party of the Company for taxes associated with the Excluded Assets spin-off, a financial guarantee via a letter of credit that we provided

almost three years ago in support of two local provider-led ACOs, nonrecurring transaction costs and tax restructuring fees incurred, non-cash gains and losses related to the changes in the fair value of our financing obligation to purchase the

remaining equity interests, contingent liabilities, and the Company's Collar Agreement, and excise tax related to a nonrecurring buyback of the Company's stock from APC 15 |

| Updated Guidance Reconciliation of Net Income to

EBITDA & Adjusted EBITDA

2024 Guidance Range

(in thousands, $) Low High

Net Income 59,340 66,240

Interest expense 18,750 18,750

Provision for income taxes 26,660 29,760

Depreciation and amortization 27,500 27,500

EBITDA 132,250 142,250

Loss (income) from equity method investments (4,250) (4,250)

Other, net 5,000 5,000

Stock-based compensation 32,000 32,000

Adj. EBITDA 165,000 175,000

Note: See "Use of Non-GAAP Financial Measures" slide for more information.

Astrana Health 16 |

| Astrana Health At-a-Glance

Astrana Health is a healthcare platform that organizes and

empowers providers to drive accessible, high-quality, and high-value care for all patients through a provider-centric,

technology-driven approach via its three business segments:

• n+)

Care Partners

Affiliated and employed provider network, empowered to take risk

across all health plan lines of business to deliver integrated care

Care Delivery

Flexible footprint of owned primary care and multi-specialty clinics with

employed providers who deliver personalized care

Care Enablement

Full-stack technology and solutions platform, empowering providers to

deliver the best possible care to all patients in their communities

Astrana Health

A platform with...

Scale

1.1million

Members in value-based care

20+

Payer partners

12,000+

Astrana Health providers'

32+

Markets

Demonstrable Clinical Outcomes

v45%

Fewer hospital admissions2

Financial Strength3

$1.72B

TTM Revenue

Note: For more information, see "Reconciliation of Net Income to EBITDA and Adjusted EBITDA" and "Use of Non-GAAP Financial Measures" slides for more information

1. Includes contracted and employed providers in our provider network, across all specialties, and including both Consolidated and Managed providers

2. Astrana Health figures based on analysis of Jan-Sep 2024 internal data from all Medicare Advantage members and compared against relevant benchmark

3. For the period ended September 30, 2024

$164.3M

TTM Adj. EBITDA

17 |

| Astrana Flexibly Supports Patients and Providers

Quarter ended 9/30/2024

$ in thousands

Total VBC membersl, K

Total revenues, $

Income from operations,

% Margin

Primary Revenue Model

Degree of Risk

Care Partners

High-performing network

of aligned providers

in Care Delivery

High-quality system of

employed providers

47) Care Enablement

Full-stack tech, clinical, and

operations platform

-840K -800K -1M

$455,760 $34,728 $40,930

$38,786 ($1,357) $6,314

9% (4%) 15%

Partial & full-risk PM PM2

Partial & full-risk

Partial & full-risk PM PM2

Fee-for-service

Partial & full-risk

Percent of collections/revenue

N/A

Percent of premium opp. 80-90% 80-90% 10-15%

LT profitability target 10-20% 10-20% 20-30%

Astrana Health

1. Members in value-based care arrangements for Care Partners or Care Enablement; unique visits over LTM for Care Delivery, both as of September 30, 2024

2. PMPM: Per member per month 18 |

| 0

AMR

inve

rr

o

Investor Relations

Asher Dewhurst

(626) 943-6491

a anahealth.com

Agtrana Health |

Cover

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity File Number |

001-37392

|

| Entity Registrant Name |

ASTRANA HEALTH, INC.

|

| Entity Central Index Key |

0001083446

|

| Entity Tax Identification Number |

95-4472349

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1668 S. Garfield Avenue

|

| Entity Address, Address Line Two |

2nd Floor

|

| Entity Address, City or Town |

Alhambra

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91801

|

| City Area Code |

626

|

| Local Phone Number |

282-0288

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

ASTH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

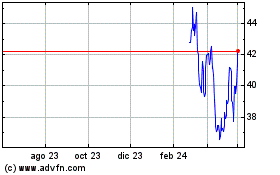

Astrana Health (NASDAQ:ASTH)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

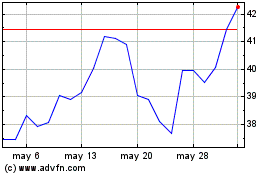

Astrana Health (NASDAQ:ASTH)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024