false

0001083446

0001083446

2024-11-08

2024-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): November 8, 2024

ASTRANA HEALTH, INC.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

001-37392 |

95-4472349 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801

(Address of Principal Executive Offices) (Zip Code)

(626) 282-0288

Registrant’s Telephone Number, Including

Area Code

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ASTH |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On November 8, 2024, Astrana Health, Inc.

(the “Company”) issued a press release and presentation announcing that it and certain direct and indirect subsidiaries party

thereto entered into an Asset and Equity Purchase Agreement (the “Purchase Agreement”) with PHP Holdings, LLC, a Delaware

limited liability company (“PHPH”), PHS Holdings, LLC, a Delaware limited liability company (“PHS”), Prospect

Intermediate Holdings, LLC, a Delaware limited liability company (“PIH” and, together with PHPH and PHS, the “Prospect

Equity Sellers”), certain other related entities party thereto (such entities, the “Prospect Asset Sellers” and, together

with the Prospect Equity Sellers, the “Sellers”) and Prospect Medical Holdings, Inc., a Delaware corporation (“Prospect”),

as Seller Representative. Under the terms of the Purchase Agreement, subject to satisfaction of customary conditions, the Company will

purchase all of the outstanding equity interests of Prospect Health Services RI, Inc. (d/b/a Prospect ACO Rhode Island), Alta Newport

Hospital, LLC (d/b/a Foothill Regional Medical Center) (the “Hospital”) and Prospect Health Plan, Inc., and substantially

all the assets of certain direct and indirect subsidiaries of PHPH, for an aggregate purchase price of $745 million, subject to customary

adjustments, plus the assumption of certain identified liabilities of the Sellers (the “Transaction”).

The Company also announced that, to provide

additional financial flexibility for the Company, in connection with the execution of the Purchase Agreement, the Company entered into

a commitment letter (the “Commitment Letter”), dated as of November 8, 2024, with Truist Bank and JPMorgan Chase Bank, N.A.

(together, the “Banks”) and the other affiliates of the Banks party thereto, pursuant to which the Banks committed to provide

(x) a 364-day senior secured bridge term loan in an aggregate principal amount of up to $1,095 million (the “Bridge Facility”)

and (y) a five-year senior secured revolving credit facility in an aggregate principal amount of up to $100 million. The Company intends

to use the proceeds of the Bridge Facility, together with cash on hand, to fund the Transaction, to refinance the Company’s existing

credit facilities and to pay for fees, costs and expenses incurred in connection with the foregoing. The funding of the Bridge Facility

provided for in the Commitment Letter is contingent on the satisfaction of customary conditions, including but not limited to (i) the

execution and delivery of definitive documentation with respect to the Bridge Facility in accordance with the terms set forth in the

Commitment Letter, and (ii) the consummation of the Transaction in accordance with the Purchase Agreement. Amounts funded under the Bridge

Facility, if any, will be reduced by the aggregate amount of gross proceeds that the Company elects to raise in a long-term debt and/or

equity financing transaction on or prior to the closing of the Transaction as further set forth in the Commitment Letter.

Copies of the press release and

presentation are filed as Exhibit 99.1 and Exhibit

99.2, respectively, to this Current Report on Form 8-K (this “Report”) and incorporated herein by

reference.

The information contained in this Item 7.01

of this Report, including the exhibits referenced herein, is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section. Such information shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended,

or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing. The

furnishing of this information will not be deemed an admission as to the materiality of any information contained herein.

Forward-Looking Statements

This Report contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These statements include

words such as “forecast,” “guidance,” “projects,” “estimates,” “anticipates,”

“believes,” “expects,” “intends,” “may,” “plans,” “seeks,” “should,”

or “will,” or the negative of these words or similar words. Forward-looking statements involve certain risks and uncertainties,

and actual results may differ materially from those discussed in each such statement. A number of important factors could cause actual

results to differ materially from those included within or contemplated by the forward-looking statements, including, but not limited

to, risks arising from the diversion of management’s attention from the Company’s ongoing business operations, an increase

in the amount of costs, fees and expenses and other charges related to the Transaction described in this Report, outcome of any litigation

that the Company, the Sellers or Prospect may become subject to relating to such Transaction, the extent of, and the time necessary to

obtain, any regulatory approvals required for completion of the Transaction, risks of disruption to the Company’s business as a

result of the public announcement of the Transaction, the occurrence of any event, change or other circumstance that could give rise to

the termination of the agreements relating to the Transaction, an inability to complete the Transaction in a timely manner or at all,

including due to a failure of any condition to the closing of the Transaction to be satisfied or waived by the applicable party, the occurrence

of any event, change or other circumstance that could give rise to the termination of any of the agreements to the Transaction, a decline

in the market price for the Company’s common stock if the Transaction is not completed, risks that the Transaction disrupts current

plans and operations of the Company or Sellers and potential difficulties in Sellers’ employee retention as a result of the Transaction,

the Company’s ability to successfully obtain funding of, and pay the interest and principal on, the Bridge Facility provided for

in the Commitment Letter, and the ability to implement business plans, forecasts and other expectations after the completion of the Transaction,

realize the intended benefits of the Transaction, and identify and realize additional opportunities following the Transaction, as well

as the other risks and uncertainties identified in filings by the Company with the Securities and Exchange Commission, including the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023, as may be amended or supplemented by additional risk factors set forth

in subsequent quarterly reports on Form 10-Q and other reports filed with the Securities and Exchange Commission. The Company does not

undertake any responsibility to update any of these factors or to announce publicly any revisions to any of the forward-looking statements

contained in this or any other document, whether as a result of new information, future events, or otherwise, except as may be required

by any applicable securities laws.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ASTRANA HEALTH, INC. |

| |

|

| Date: November 8, 2024 |

By: |

/s/ Brandon K. Sim |

| |

Name: |

Brandon K. Sim |

| |

Title: |

Chief Executive Officer and President |

Exhibit 99.1

Astrana Health Announces Definitive Agreement

to Acquire

Certain Businesses and Assets of Prospect Health System

ALHAMBRA, Calif., November 8, 2024 /PRNewswire/ -- Astrana Health,

Inc. (“Astrana,” and together with its subsidiaries and affiliated entities, the “Company”) (NASDAQ: ASTH), a

leading provider-centric, technology-powered healthcare company enabling providers to deliver accessible, high-quality, and high-value

care to all, today announced that it and its affiliated professional entities have entered into a definitive agreement to acquire Prospect

Health ("Prospect"), which consists of certain businesses and assets relating to Prospect Health System, including its California

licensed health care service plan (Prospect Health Plan), medical groups in California, Texas, Arizona and Rhode Island (Prospect Medical

Groups), management service organization (Prospect Medical Systems), pharmacy (RightRx), and Alta Newport Hospital dba Foothill Regional

Medical Center, a fully accredited acute care hospital with 177 licensed beds.

Prospect is an integrated care delivery system which facilitates and

coordinates the delivery of high-quality clinical care for all. With a network of around 3,000 primary care providers and 10,000 specialists

across Southern California, Texas, Arizona, and Rhode Island, Prospect is enabling providers to deliver payer-agnostic, patient-centered

care to approximately 610,000 members across Medicare Advantage, Medicaid, and Commercial lines of business.

"The acquisition of Prospect would represent the combination of

two organizations with decades-long histories of enabling independent providers and coordinating the delivery of high-quality care for

all. We believe that our organizations share a common culture of patient centricity and a shared mission to provide high-quality care

tailored to local communities," said Brandon K. Sim, President and CEO of Astrana.

"This strategic transaction will significantly expand our provider

network and enhance our ability to offer increased access, quality, and value for our members. Prospect’s established presence in

key markets also opens new opportunities for Astrana, particularly in geographically adjacent Orange County, California, where we today

have limited operations. We believe this acquisition continues to solidify Astrana as our nation’s leading healthcare delivery platform,

enabling us to deliver technology-driven, longitudinal, and patient-centered care to an estimated combined 1.7 million members across

the country."

Jim Brown, CEO of Prospect, said, “We are excited at the opportunity

to partner with Astrana to build a larger, stronger, and more coordinated care delivery network which we expect will benefit our communities

by increasing access, quality, value, and efficiency. We believe the strong cultural alignment, cohesive missions, and clear financial

and operational synergies between our companies make Astrana the ideal partner for us. We look forward to working together to further

our joint mission of delivering high-quality, affordable, and accessible care for all.”

Astrana plans to make significant investments in Prospect and its infrastructure

in order to further enhance access and quality of care for patients in local communities. The partnership between Astrana and Prospect

will help ensure that healthcare remains local and personalized for patients across four states.

Additional details regarding Astrana’s planned acquisition of

Prospect can be found on the Company’s Investor Relations website.

Transaction Details

Under the terms of the agreement, subject to satisfaction of customary

conditions, Astrana plans to acquire the Prospect businesses and assets for a purchase price of $745 million. Astrana expects to fund

the transaction using a combination of cash on hand and a $1,095 million 364-day senior secured bridge commitment provided by Truist Bank

and J.P. Morgan.

Prospect is expected to generate approximately $1.2 billion in revenue

with expected adjusted EBITDA of approximately $81 million for the twelve months ending December 31, 2024.

Astrana’s acquisition of Prospect is expected to close in the

middle of 2025, subject to regulatory approval and other customary closing conditions.

Advisors

J.P. Morgan Securities LLC is serving as exclusive financial advisor

to Astrana, and Russ August & Kabat LLP is serving as legal advisor for Astrana. Morgan Stanley & Co. LLC is serving as lead financial

advisor to Prospect, and Sheppard, Mullin, Richter & Hampton LLP is serving as legal advisor to Prospect. Guggenheim Partners is also

serving as a financial advisor to Prospect.

Conference Call and Webcast Information:

Astrana will host a conference call at 5:30 a.m.

PT/8:30 a.m. ET today (Friday, November 8, 2024), during which management will discuss the details of the transaction. To participate

in the conference call, please use the following dial-in numbers about 5 minutes prior to the scheduled conference call time:

| U.S. & Canada (Toll-Free): |

+1 (877) 858-9810 |

| International (Toll): |

+1 (201) 689-8517 |

The conference call can also be accessed via webcast at: https://event.choruscall.com/mediaframe/webcast.html?webcastid=26JyTYKy.

An accompanying slide presentation will be available

in PDF format on the “IR Calendar” page of the Company’s website (https://ir.astranahealth.com/news-events/ir-calendar)

after issuance of the press release and will be furnished as an exhibit to Astrana’s current report on Form 8-K to be filed with

the SEC, accessible at www.sec.gov.

Those who are unable to attend the live conference

call may access the recording at the above webcast link, which will be made available shortly after the conclusion of the call.

About Astrana Health, Inc.

Astrana is a leading provider-centric, technology-powered healthcare

company enabling providers to deliver accessible, high-quality, and high-value care to all. Leveraging its proprietary end-to-end technology

solutions, Astrana operates an integrated healthcare delivery platform that enables providers to successfully participate in value-based

care arrangements, thus empowering them to deliver high quality care to patients in a cost-effective manner.

Headquartered in Alhambra, California, Astrana serves over 12,000

providers and over 1.1 million Americans in value-based care arrangements. Its subsidiaries and affiliates include management services

organizations (MSOs), affiliated independent practice associations (IPAs), accountable care organizations (ACOs), and care delivery entities

across primary, multi-specialty, and ancillary care. For more information, please visit www.astranahealth.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. These statements include

words such as “forecast,” “guidance,” “projects,” “estimates,” “anticipates,”

“believes,” “expects,” “intends,” “may,” “plans,” “seeks,” “should,”

or “will,” or the negative of these words or similar words. Forward-looking statements involve certain risks and uncertainties,

and actual results may differ materially from those discussed in each such statement. A number of important factors could cause actual

results to differ materially from those included within or contemplated by the forward-looking statements, including, but not limited

to, risks arising from the diversion of management’s attention from the Company’s ongoing business operations, an increase

in the amount of costs, fees and expenses and other charges related to the acquisition described in this press release, outcome of any

litigation that the Company or Prospect may become subject to relating to such acquisition, the extent of, and the time necessary to obtain,

any regulatory approvals required for completion of the acquisition, risks of disruption to the Company’s business as a result of

the public announcement of the acquisition, the occurrence of any event, change or other circumstance that could give rise to the termination

of the agreements relating to the acquisition, an inability to complete the acquisition in a timely manner or at all, including due to

a failure of any condition to the closing of the acquisition to be satisfied or waived by the applicable party, the occurrence of any

event, change or other circumstance that could give rise to the termination of any of the agreements to the acquisition, a decline in

the market price for the Company’s common stock if the acquisition is not completed, risks that the acquisition disrupts current

plans and operations of the Company or Prospect and potential difficulties in Prospect’s employee retention as a result of the acquisition,

the Company’s ability to successfully obtain funding of, and pay the interest and principal on, the Bridge Facility provided for

in the Commitment Letter, and the ability to implement business plans, forecasts and other expectations after the completion of the acquisition,

realize the intended benefits of the acquisition, and identify and realize additional opportunities following the acquisition, as well

as the other risks and uncertainties identified in filings by the Company with the Securities and Exchange Commission, including the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023, as may be amended or supplemented by additional risk factors set forth

in subsequent quarterly reports on Form 10-Q and other reports filed with the Securities and Exchange Commission. The Company does not

undertake any responsibility to update any of these factors or to announce publicly any revisions to any of the forward-looking statements

contained in this or any other document, whether as a result of new information, future events, or otherwise, except as may be required

by any applicable securities laws.

Pro Forma Measures

This press release includes pro forma information that gives effect

to the consummation of the acquisition. The combined company forward-looking financial data are for illustrative purposes only and should

not be relied on as necessarily being indicative of future results. The assumptions and estimates underlying the combined company forward-looking

financial data are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and

uncertainties that could cause actual results to differ materially from those contained in the prospective financial information, including

those under “Forward Looking Statements” above. Combined company forward-looking financial data is inherently uncertain due

to a number of factors outside of the Company’s or Prospect’s control. Accordingly, there can be no assurance that the prospective

results are indicative of future performance of the combined company after completing the proposed acquisition or that actual results

will not differ materially from those presented in the combined company forward-looking financial data. Inclusion of combined company

forward-looking financial data in this press release should not be regarded as a representation by any person that the results contained

in the prospective financial information will be achieved. Readers are cautioned not to place undue reliance on the pro forma combined

company financial information.

Use of Non-GAAP Financial Measures

This press release contains the non-GAAP financial measure Adjusted

EBITDA, of which the most directly comparable financial measure presented in accordance with U.S. generally accepted accounting principles

(“GAAP”) is net income. This measure is not in accordance with, or an alternative to, GAAP, and may be calculated differently

from similar non-GAAP financial measures used by other companies. The Company uses Adjusted EBITDA as a supplemental performance measure

of its operations, for financial and operational decision-making, and as a supplemental means of evaluating period-to-period comparisons

on a consistent basis. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation, and amortization, excluding income

or loss from equity method investments, non-recurring and non-cash transactions, and stock-based compensation.

The Company believes the presentation of this non-GAAP financial measure

provides investors with relevant and useful information, as it allows investors to evaluate the operating performance of the business

activities without having to account for differences recognized because of non-core or non-recurring financial information. When GAAP

financial measures are viewed in conjunction with non-GAAP financial measures, investors are provided with a more meaningful understanding

of the Company’s ongoing operating performance. In addition, this non-GAAP financial measure is among those indicators the Company

uses as a basis for evaluating operational performance, allocating resources, and planning and forecasting future periods. Non-GAAP financial

measures are not intended to be considered in isolation, or as a substitute for, GAAP financial measures. Other companies may calculate

Adjusted EBITDA differently, limiting the usefulness of this measure for comparative purposes. The Company has not provided a quantitative

reconciliation of the projected adjusted EBITDA in 2024 for Prospect to the most comparable GAAP measure, net income, on a forward-looking

basis within this press release because the Company is unable, without unreasonable efforts, to provide reconciling information with respect

to certain line items that cannot be calculated. These items, which could materially affect the computation of forward-looking GAAP net

income, are inherently uncertain and depend on various factors, some of which are outside of the Company’s control.

FOR MORE INFORMATION, PLEASE CONTACT:

Investor Relations

(626) 943-6491

Asher Dewhurst, ICR Westwicke

investors@astranahealth.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

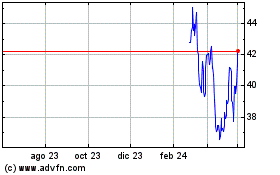

Astrana Health (NASDAQ:ASTH)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

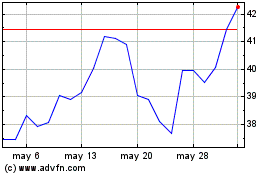

Astrana Health (NASDAQ:ASTH)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024