UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended October 31, 2024

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to _____________

Commission File Number: 001-38876

ATIF HOLDINGS LIMITED

(Exact Name of Registrant as Specified in Its Charter)

| British Virgin Islands | | Not Applicable |

| (State of Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 25391 Commercentre Dr., Ste 200, Lake Forest, CA | | 92630 |

| (Address of Principal Executive Offices) | | (ZIP Code) |

308-888-8888

(Registrant’s Telephone Number, Including Area

Code)

Not Applicable

(Former name, former address

and former fiscal year, if changed since last report)

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class | | Trading Symbol | | Name of exchange on which registered |

| Ordinary Shares | | ATIF | | The Nasdaq Stock Market |

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. ☒ YES ☐

NO

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

YES ☐ NO

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☐ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ☐

YES ☒ NO

Indicate the number of shares

outstanding of each of the issuer’s classes of stock, as of the latest practicable date.

As of December 19, 2024,

there were 11,917,452 of the registrant’s ordinary shares issued and outstanding.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form

10-Q contains certain forward-looking statements. The statements herein which are not historical reflect our current expectations and

projections about the Company’s future results, performance, liquidity, financial condition, prospects and opportunities and are

based upon information currently available to us and our management and our interpretation of what we believe to be significant factors

affecting our business, including many assumptions about future events. Such forward-looking statements include statements regarding,

among other things:

| ● | our ability to produce, market

and generate sales of our products and services; |

| ● | our ability to develop and/or

introduce new products and services; |

| ● | our projected future sales,

profitability and other financial metrics; |

| ● | our future financing plans; |

| ● | our anticipated needs for working

capital; |

| ● | the anticipated trends in our

industry; |

| ● | our ability to expand our sales

and marketing capability; |

| ● | acquisitions of other companies

or assets that we might undertake in the future; |

| ● | competition existing today

or that will likely arise in the future; and |

| ● | other factors discussed elsewhere

herein. |

Forward-looking statements, which

involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,”

“should,” “will,” “plan,” “could,” “target,” “contemplate,” “predict,”

“potential,” “continue,” “expect,” “anticipate,” “estimate,” “believe,”

“intend,” “seek,” or “project” or the negative of these words or other variations on these or similar

words. Actual results, performance, liquidity, financial condition and results of operations, prospects and opportunities could differ

materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other

factors, including the ability to raise sufficient capital to continue the Company’s operations. These statements may be found under

Part I, Item 2-“Management’s Discussion And Analysis Of Financial Condition And Results Of Operations,” as well as elsewhere

in this Quarterly Report on Form 10-Q generally. Actual events or results may differ materially from those discussed in forward-looking

statements as a result of various factors, including, without limitation, matters described in this Quarterly Report on Form 10-Q.

In light of these risks and uncertainties,

there can be no assurance that the forward-looking statements contained in this Quarterly Report on Form 10-Q will in fact occur.

Potential investors should not

place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking

to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances

or any other reason.

The forward-looking

statements in this Quarterly Report on Form 10-Q represent our views as of the date of this Quarterly Report on Form 10-Q. Such

statements are presented only as a guide about future possibilities and do not represent assured events, and we anticipate that

subsequent events and developments will cause our views to change. You should, therefore, not rely on these forward-looking

statements as representing our views as of any date after the date of this Quarterly Report on Form 10-Q.

This Quarterly Report on Form

10-Q also contains estimates and other statistical data prepared by independent parties and by us relating to market size and growth and

other data about our industry. These estimates and data involve a number of assumptions and limitations, and potential investors are cautioned

not to give undue weight to these estimates and data. We have not independently verified the statistical and other industry data generated

by independent parties and contained in this Quarterly Report on Form 10-Q. In addition, projections, assumptions and estimates of our

future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty

and risk.

Potential investors should not

make an investment decision based solely on our projections, estimates or expectations.

PART I.

FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

ATIF HOLDINGS LIMITED

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

October 31,

2024 | | |

July

31,

2024 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash and cash equivalents | |

$ | 457,764 | | |

$ | 1,249,376 | |

| Accounts receivable – a related party | |

| 200,000 | | |

| 200,000 | |

| Deposits | |

| 3,000 | | |

| 3,000 | |

| Investment in trading securities | |

| 4,174,290 | | |

| 424,148 | |

| Due from a related party | |

| 900,000 | | |

| 900,000 | |

| Prepaid expenses and other current assets | |

| 50,224 | | |

| 122,224 | |

| Total current assets | |

| 5,785,278 | | |

| 2,898,748 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 53,765 | | |

| 60,047 | |

| Right-of- use assets, net | |

| 45,475 | | |

| 53,793 | |

| TOTAL ASSETS | |

$ | 5,884,518 | | |

$ | 3,012,588 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable, accrued expenses and other current liabilities | |

$ | 584,380 | | |

$ | 957,057 | |

| Taxes payable | |

| 19,985 | | |

| 19,985 | |

| Operating lease liabilities, current | |

| 20,683 | | |

| 11,375 | |

| Total current liabilities | |

| 625,048 | | |

| 988,417 | |

| | |

| | | |

| | |

| Operating lease liabilities, noncurrent | |

| 11,790 | | |

| 20,417 | |

| Long-term payable | |

| 250,000 | | |

| 250,000 | |

| TOTAL LIABILITIES | |

| 886,838 | | |

| 1,258,834 | |

| | |

| | | |

| | |

| Commitments | |

| | | |

| | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Ordinary shares, $0.001 par value, 100,000,000,000 shares authorized, 11,917,452 shares and 11,917,452 shares issued and outstanding as of October 31, 2024 and July 31, 2024, respectively | |

| 11,917 | | |

| 11,917 | |

| Additional paid-in capital | |

| 36,210,985 | | |

| 32,599,985 | |

| Accumulated deficit | |

| (31,225,222 | ) | |

| (30,858,148 | ) |

| Total Shareholders’ Equity | |

| 4,997,680 | | |

| 1,753,754 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 5,884,518 | | |

$ | 3,012,588 | |

The accompanying notes are an integral part of these

unaudited condensed consolidated financial statements.

ATIF HOLDINGS LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

| | |

For the Three Months Ended

October 31, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

(unaudited) | |

| Revenues | |

$ | - | | |

$ | 125,000 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Selling expenses | |

| 72,000 | | |

| 72,000 | |

| General and administrative expenses | |

| 449,109 | | |

| 709,779 | |

| Total operating expenses | |

| 521,109 | | |

| 781,779 | |

| | |

| | | |

| | |

| Loss from operations | |

| (521,109 | ) | |

| (656,779 | ) |

| | |

| | | |

| | |

| Other income (expenses): | |

| | | |

| | |

| Interest expenses, net | |

| (18 | ) | |

| - | |

| Other income, net | |

| 5,895 | | |

| 140,720 | |

| Gain (loss) from investment in trading securities | |

| 148,158 | | |

| (109,404 | ) |

| Total other income, net | |

| 154,035 | | |

| 31,316 | |

| | |

| | | |

| | |

| Loss before income taxes | |

| (367,074 | ) | |

| (625,463 | ) |

| | |

| | | |

| | |

| Income tax provision | |

| - | | |

| - | |

| Net loss and comprehensive loss | |

$ | (367,074 | ) | |

$ | (625,463 | ) |

| | |

| | | |

| | |

| Loss per share – basic and diluted | |

$ | (0.03 | ) | |

$ | (0.06 | ) |

| | |

| | | |

| | |

| Weighted Average Shares Outstanding – Basic and diluted | |

| 11,917,452 | | |

| 9,627,452 | |

The accompanying notes are an integral part of these

unaudited condensed consolidated financial statements.

ATIF HOLDINGS LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN

EQUITY

FOR THE THREE MONTHS ENDED OCTOBER 31, 2024 AND

2023

| | |

Ordinary Share | | |

Additional Paid in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

deficit | | |

Total | |

| Balance at July 31, 2023 | |

| 9,627,452 | | |

$ | 9,627 | | |

$ | 29,196,350 | | |

$ | (27,666,624 | ) | |

$ | 1,539,353 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (625,463 | ) | |

| (625,463 | ) |

| Balance at October 31, 2023 (unaudited) | |

| 9,627,452 | | |

$ | 9,627 | | |

$ | 29,196,350 | | |

$ | (28,292,087 | ) | |

$ | 913,890 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at July 31, 2024 | |

| 11,917,452 | | |

$ | 11,917 | | |

$ | 32,599,985 | | |

$ | (30,858,148 | ) | |

$ | 1,753,754 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (367,074 | ) | |

| (367,074 | ) |

| Capital contribution | |

| - | | |

| - | | |

| 3,611,000 | | |

| - | | |

| 3,611,000 | |

| Balance at October 31, 2024 (unaudited) | |

| 11,917,452 | | |

$ | 11,917 | | |

$ | 36,210,985 | | |

$ | (31,225,222 | ) | |

$ | 4,997,680 | |

The accompanying notes are an integral part of these

unaudited condensed consolidated financial statements.

ATIF HOLDINGS LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | |

For the Three Months Ended

October 31, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

(unaudited) | |

| Cash flows from operating activities: | |

| | |

| |

| Net loss | |

$ | (367,074 | ) | |

| (625,463 | ) |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 6,282 | | |

| 29,669 | |

| Amortization of right-of-use assets | |

| 7,926 | | |

| 113,116 | |

| Expected credit loss allowance | |

| - | | |

| 26,400 | |

| Gain (loss) from investment in trading securities | |

| (148,158 | ) | |

| 109,403 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| - | | |

| (30,000 | ) |

| Accounts receivable – a related party | |

| - | | |

| 600,000 | ) |

| Prepaid expenses and other current assets | |

| 72,000 | | |

| 57,030 | |

| Contract liabilities | |

| - | | |

| (70,000 | ) |

| Accounts payable, accrued expenses and other current liabilities | |

| (372,677 | ) | |

| 83,842 | |

| Lease liabilities | |

| 1,073 | | |

| (98,644 | ) |

| Net cash (used in) provided by operating activities | |

| (800,628 | ) | |

| 195,353 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of property and equipment | |

| - | | |

| (4,332 | ) |

| Investment in trading securities | |

| - | | |

| (438,108 | ) |

| Proceeds from redemption of investment in trading securities | |

| 9,016 | | |

| - | |

| Loans made to a related party | |

| - | | |

| (17,710 | ) |

| Collection of borrowings from a related party | |

| - | | |

| 20,000 | |

| Net cash provided by (used in) investing activities | |

| 9,016 | | |

| (440,150 | ) |

| | |

| | | |

| | |

| Net decrease in cash | |

| (791,612 | ) | |

| (244,797 | ) |

| Cash, beginning of period | |

| 1,249,376 | | |

| 606,022 | |

| Cash, end of period | |

$ | 457,764 | | |

$ | 361,225 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest expenses | |

$ | - | | |

$ | - | |

| Cash paid for income tax | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Supplemental disclosure of Non-cash financing activities | |

| | | |

| | |

| Capital contribution from a shareholder in the form of trading securities | |

$ | 3,611,000 | | |

$ | - | |

The accompanying notes are an integral part of these

unaudited condensed consolidated financial statements.

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 1 – ORGANIZATION AND DESCRIPTION OF

BUSINESS

ATIF Holdings Limited (“ATIF” or the “Company”),

formerly known as Eternal Fairy International Limited and Asia Times Holdings Limited, was incorporated under the laws of the British

Virgin Islands (“BVI”) on January 5, 2015, as a holding company to develop business opportunities in the People’s

Republic of China (the “PRC” or “China”). The Company adopted its current name on March 7, 2019. The Company

is primarily engaged in providing business advisory and financial consulting services to small and medium-sized enterprise customers.

As of October 31, 2024, the Company’s unaudited

condensed consolidated financial statements reflect the operating results of the following entities:

| Name of Entity | | Date of

Incorporation | | Place of

Incorporation | | % of

Ownership | | Principal Activities |

| Parent company: | | | | | | | | |

| ATIF Holdings Limited (“ATIF”) | | January 5, 2015 | | British Virgin Islands | | Parent | | Investment holding |

| Wholly owned subsidiaries of ATIF | | | | | | | | |

| ATIF Inc. (“ATIF USA”) | | October 26, 2020 | | USA | | 100% | | Consultancy and information technology support |

| ATIF Investment LLC (“ATIF Investment”) | | April 25, 2022 | | BVI | | 100% | | Consultancy and information technology support |

| ATIF BD | | December 22, 2021 | | USA | | 100% owned by ATIF USA | | Consultancy and information technology support |

| ATIF BC | | October 6, 2022 | | USA | | 100% owned by ATIF USA | | Consultancy and information technology support |

| ATIF BM | | October 6, 2022 | | USA | | 100% owned by ATIF USA | | Consultancy and information technology support |

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 2 – LIQUIDITY and GOING CONCERN

For the three months ended October 31, 2024 and

2023, the Company reported a net loss of approximately $0.4 million and $0.6 million, respectively, and operating cash outflows approximately

$0.8 million and operating cash inflows of approximately $0.2 million. In assessing the Company’s ability to continue as a going

concern, the Company monitors and analyzes its cash and its ability to generate sufficient cash flow in the future to support its operating

and capital expenditure commitments. Because of a history of net losses from operations, cash out from operating activities, and the requirement

of additional capital to fund our current operating plan at October 31, 2024, these factors indicate the existence of an uncertainty that

raises substantial doubt about the Company’s ability to continue as a going concern.

As of October 31, 2024, the Company had cash of approximately $0.5

million, short-term investments in trading securities of approximately $4.2 million, due from a related party of $0.9 million and accounts

receivables of $0.2 million due from a related party, which were highly liquid. On the other hand, the Company had current liabilities

of approximately $0.6 million. The Company’s cash and short-term investments in trading securities could well cover the current

liabilities. The Company’s ability to continue as a going concern is dependent on management’s ability to successfully execute

its business plan, which includes increasing revenue while controlling operating cost and expenses to generate positive operating cash

flows and obtain financing from outside sources.

The accompanying unaudited condensed consolidated

financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of

liabilities in the ordinary course of business. The financial statements do not include any adjustments relating to the recoverability

and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of the

uncertainties described above.

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Basis of Presentation and Principles of Consolidation

The interim unaudited condensed consolidated financial

statements are prepared and presented in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”).

The unaudited condensed consolidated balance sheets

as of October 31, 2024 and for the unaudited condensed consolidated statement of operations and comprehensive loss for the

three months ended October 31, 2024 and 2023 have been prepared without audit, pursuant to the rules and regulations of the SEC and pursuant

to Regulation S-X. Certain information and footnote disclosures, which are normally included in annual financial statements prepared in

accordance with U.S. GAAP, have been omitted pursuant to those rules and regulations. The unaudited condensed consolidated financial statements

should be read in conjunction with the audited financial statements and the notes thereto, included in the Form 10-K for the fiscal year

ended July 31, 2024, which was filed with the SEC on November 13, 2024.

In the opinion of the management, the accompanying

condensed consolidated financial statements reflect all normal recurring adjustments, which are necessary for a fair presentation of financial

results for the interim periods presented. The Company believes that the disclosures are adequate to make the information presented not

misleading. The accompanying condensed consolidated financial statements have been prepared using the same accounting policies as used

in the preparation of the Company’s consolidated financial statements for the year ended July 31, 2024. The results of operations

for the three months ended October 31, 2024 and 2023 are not necessarily indicative of the results for the full years.

The unaudited condensed consolidated financial statements

of the Company include the accounts of the Company and its subsidiaries. All intercompany balances and transactions have been eliminated

upon consolidation.

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Use of Estimates

In preparing the condensed consolidated financial

statements in conformity with U.S. GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities

and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses

during the reporting period. These estimates are based on information as of the date of the condensed consolidated financial statements.

Significant estimates required to be made by management include, but are not limited to, the valuation of accounts receivable, useful

lives of property and equipment and intangible assets, the recoverability of long-lived assets, revenue recognition, provision necessary

for contingent liabilities and realization of deferred tax assets. Actual results could differ from those estimates.

Accounts Receivable, net

On August 1, 2023, the Company adopted Accounting

Standards Update (“ASU”) No. 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on

Financial Instruments (“ASU 2016-13”), using the modified retrospective transition method. ASU 2016-13 replaces the existing

incurred loss impairment model with an expected loss methodology, which will result in more timely recognition of credit losses. Upon

adoption, the Company changed the impairment model to utilize a forward-looking current expected credit losses (CECL) model in place of

the incurred loss methodology for financial instruments measured at amortized cost and receivables resulting from the application of ASC

606, including contract assets. The adoption of the guidance had no impact on the allowance for credit losses for accounts receivable.

After the adoption of ASU 2016-13, The

Company maintains an allowance for credit losses and records the allowance for credit losses as an offset to accounts receivable and

the estimated credit losses charged to the allowance is classified as “General and administrative expenses” in the

condensed consolidated statements of operations and comprehensive loss. The Company uses loss-rate methods to estimate allowance for

credit loss. The Company assesses collectability by reviewing accounts receivable on an individual basis because the Company had

limited customers and each of them has difference characteristics, primarily based on business line and geographical area. In

determining the amount of the allowance for credit losses, the Company multiplied the loss rate with the amortized cost of accounts

receivable. The loss rate refers to the corporate default rate published by credit rating companies, which considers current

economic conditions, reasonable and supportable forecasts of future economic conditions. Delinquent account balances are written-off

against the allowance for credit losses after management has determined that the likelihood of collection is not

probable. For the three months ended October 31, 2023, the Company provided allowance for credit losses of $26,400.

As of October 31, 2024, the accounts receivable was solely from a related party, which committed to repay the outstanding balance in

December 2024. The Company did not provide allowance for credit losses for the three months ended October 31, 2024.

Investment in Trading Securities

Equity securities not accounted for using the

equity method are carried at fair value with changes in fair value recorded in the condensed consolidated statements of operations and

comprehensive income (loss), according to ASC 321 “Investments — Equity Securities”. During the three months ended October

31, 2024 and 2023, the Company purchased certain publicly-listed equity securities through various open market transactions and accounted

for such investments as “investment in trading securities” and subsequently measure the investments at fair value. In addition,

during the three months ended October 31, 2024, the Company was also granted ordinary shares of a listed company as capital contribution

from a shareholder. The Company initially accounted for the share as “investment in trading securities” at fair value by reference

to the prevailing market price on shares grant date, and subsequently measure the share awards at fair value. The Company recognized a

gain of $148,158 and a loss of $109,404 from investments in trading securities for the three months ended October 31, 2024 and 2023.

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Fair Value of Financial Instruments

ASC 825-10 requires certain disclosures regarding

the fair value of financial instruments. Fair value is defined as the price that would be received to sell an asset or paid to transfer

a liability in an orderly transaction between market participants at the measurement date. A three-level fair value hierarchy prioritizes

the inputs used to measure fair value. The hierarchy requires entities to maximize the use of observable inputs and minimize the use of

unobservable inputs. The three levels of inputs used to measure fair value are as follows:

| |

● |

Level 1 – inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| |

|

|

| |

● |

Level 2 – inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, quoted market prices for identical or similar assets in markets that are not active, inputs other than quoted prices that are observable and inputs derived from or corroborated by observable market data. |

| |

|

|

| |

● |

Level 3 – inputs to the valuation methodology are unobservable. |

Fair value of investment in trading securities are based on quoted

prices in active markets. The carrying amounts of the Company’s other financial instruments including cash and cash equivalents,

accounts receivable due from a related party, deposits, due from related parties, accounts payable, and accrued

expenses and other current liabilities approximate their fair values because of the short-term nature of these assets and liabilities.

For lease liabilities and long-term payable, fair value approximates their carrying value at the year-end as the interest rates used to

discount the host contracts approximate market rates. For the three months ended October 31, 2024 and 2023, there are no transfers between

different levels of inputs used to measure fair value.

Revenue Recognition

The Company recognizes revenue in accordance with

ASC 606 Revenue from Contracts with Customers (“ASC 606”).

To determine revenue recognition for contracts with

customers, the Company performs the following five steps: (i) identify the contract with the customer, (ii) identify the performance

obligations in the contract, (iii) determine the transaction price, including variable consideration to the extent that it is probable

that a significant future reversal will not occur, (iv) allocate the transaction price to the respective performance obligations

in the contract, and (v) recognize revenue when (or as) the Company satisfies the performance obligation.

The Company recognizes revenue when it transfers its

goods and services to customers in an amount that reflects the consideration to which the Company expects to be entitled in such exchange.

For the three months ended October 31, 2023, the Company primarily

generated revenues from consulting services to customers who would like to go public. For the three months ended October 31, 2024, the

Company did not generate revenues. As of October 31, 2024, amount of $400,000 was contracted but not yet recognized as revenues.

The Company provides various consulting services to

its members, especially to those who have the intention to be publicly listed in the stock exchanges in the United States and other countries.

The Company categorizes its consulting services into three Phases:

Phase I consulting services primarily include due

diligence review, market research and feasibility study, business plan drafting, accounting record review, and business analysis and recommendations.

Management estimates that Phase I normally takes about three months to complete based on its past experience.

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Revenue Recognition (continued)

Phase II consulting services primarily include reorganization,

pre-listing education and tutoring, talent search, legal and audit firm recommendation and coordination, VIE contracts and other public-listing

related documents review, merger and acquisition planning, investor referral and pre-listing equity financing source identification and

recommendations, and independent directors and audit committee candidate’s recommendation. Management estimates that Phase II normally

takes about eight months to complete based on its past experience.

Phase III consulting services primarily include shell

company identification and recommendation for customers expecting to become publicly listed through reverse merger transaction; assistance

in preparation of customers’ public filings for IPO or reverse merger transactions; and assistance in answering comments and questions

received from regulatory agencies. Management believes it is very difficult to estimate the timing of this phase of service as the completion

of Phase III services is not within the Company’s control.

Each phase of consulting services is stand-alone and

fees associated with each phase are clearly identified in service agreements. Revenue from providing Phase I and Phase II consulting services

to customers is recognized ratably over the estimated completion period of each phase as the Company’s performance obligations related

to these services are carried out over the whole duration of each Phase. Revenue from providing Phase III consulting services to customers

is recognized upon completion of the reverse merger transaction or IPO transaction when the Company’s promised services are rendered

and the Company’s performance obligations are satisfied. Revenue that has been billed and not yet recognized is reflected as deferred

revenue on the balance sheet.

Depending on the complexity of the underlying service

arrangement and related terms and conditions, significant judgments, assumptions, and estimates may be required to determine when substantial

delivery of contract elements has occurred, whether any significant ongoing obligations exist subsequent to contract execution, whether

amounts due are collectible and the appropriate period or periods in which, or during which, the completion of the earnings process occurs.

Depending on the magnitude of specific revenue arrangements, adjustment may be made to the judgments, assumptions, and estimates regarding

contracts executed in any specific period.

Income Taxes

The Company accounts for income taxes under ASC 740.

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the consolidated

financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities

are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected

to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the

period including the enactment date. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount

expected to be realized.

An uncertain tax position is recognized only if it

is “more likely than not” that the tax position would be sustained in a tax examination. The amount recognized is the largest

amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more

likely than not” test, no tax benefit is recorded. Penalties and interest incurred related to underpayment of income tax are classified

as income tax expense in the period incurred. The Company did not have unrecognized uncertain tax positions or any unrecognized liabilities,

interest or penalties associated with unrecognized tax benefit as of October 31, 2024. As of October 31, 2024, all of the Company’s

income tax returns for the tax years ended December 31, 2019 through December 31, 2023 remain open for statutory examination

by relevant tax authorities.

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Segment reporting

Operating segments are defined as components of an

enterprise about which separate financial information is available that is evaluated regularly by the chief operating decision maker (“CODM”),

or decision making group, in deciding how to allocate resources and in assessing performance. The Company’s CODM is Mr. Liu,

the Chairman of the Board of Directors and CEO.

The Company’s organizational structure is based

on a number of factors that the CODM uses to evaluate, view and run its business operations which include, but not limited to, customer

base, homogeneity of service and technology. The Company’s operating segments are based on such organizational structure and information

reviewed by the CODM to evaluate the operating segment results. Based on management’s assessment, the management has determined

that the Company now operates in one operating segment with one reporting segment as of October 31, 2024 and July 31, 2024, which is the

consulting service business.

Risks and Uncertainty

As of October 31, 2024, the Company held cash and

cash equivalents of $114,721 deposited in the banks located in the U.S., which were insured by FDIC up to $250,000, and held cash and

cash equivalents of $343,043 deposited in the investment bank accounts located in the U.S.

Accounts receivable are typically unsecured and derived

from revenue earned from customers, thereby exposed to credit risk. The risk is mitigated by the Company’s assessment of its customers’

creditworthiness and its ongoing monitoring of outstanding balances.

The Company has a concentration of its revenues and receivables with

specific customers. For the three months ended October 31, 2024, the Company did not generate revenues. For the three months ended October

31, 2023, three customers accounted for 48%, 40% and 12% of the Company’s consolidated revenue, respectively.

As of October 31, 2024 and July 31, 2024, one and

one related party customer accounted for 100% and 100% of the Company’s consolidated accounts receivable, respectively.

For the three months ended October 31, 2023, substantially all of the

Company’s revenues was generated from providing going public related consulting services to customers. For the three months ended

October 31, 2024, the Company did not generate revenues. The Company plans to mitigate the risks by transitioning its consulting services

from the PRC based customers to more international customers.

| (c) |

Other risks and uncertainties |

The Company’s business, financial condition

and results of operations may also be negatively impacted by risks related to natural disasters, extreme weather conditions, health epidemics

and other catastrophic incidents, which could significantly disrupt the Company’s operations.

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Recent Accounting Pronouncements

In December 2023, the FASB issued ASU 2023-09,

which is an update to Topic 740, Income Taxes. The amendments in this update related to the rate reconciliation and income taxes

paid disclosures improve the transparency of income tax disclosures by requiring (1) adding disclosures of pretax income (or loss)

and income tax expense (or benefit) to be consistent with U.S. Securities and Exchange Commission (the “SEC”) Regulation S-X

210.4-08(h), Rules of General Application — General Notes to Financial Statements: Income Tax Expense, and (2) removing

disclosures that no longer are considered cost beneficial or relevant. For public business entities, the amendments in this Update are

effective for annual periods beginning after December 15, 2024. For entities other than public business entities, the amendments

are effective for annual periods beginning after December 15, 2025. Early adoption is permitted for annual financial statements that

have not yet been issued or made available for issuance. The amendments in this update should be applied on a prospective basis. Retrospective

application is permitted. The Company is in the process of evaluating the impact of ASU 2023-09 on the consolidated financial statements.

In October 2023, the FASB issued ASU 2023-06,

Disclosure Improvements — Codification Amendments in Response to SEC’s Disclosure Update and Simplification Initiative

which amend the disclosure or presentation requirements of codification subtopic 230-10 Statement of Cash Flows — Overall, 250-10

Accounting Changes and Error Corrections — Overall, 260-10 Earnings Per Share — Overall, 270-10

Interim Reporting — Overall, 440-10 Commitments — Overall, 470-10 Debt — Overall, 505-10

Equity — Overall, 815-10 Derivatives and Hedging — Overall, 860-30 Transfers and Servicing — Secured

Borrowing and Collateral, 932-235 Extractive Activities — Oil and Gas — Notes to Financial Statements, 946-20

Financial Services — Investment Companies — Investment Company Activities, and 974-10 Real Estate — Real

Estate Investment Trusts — Overall. The amendments represent changes to clarify or improve disclosure and presentation

requirements of the above subtopics. Many of the amendments allow users to more easily compare entities subject to the SEC’s existing

disclosures with those entities that were not previously subject to the SEC’s requirements. Also, the amendments align the requirements

in the codification with the SEC’s regulations. For entities subject to existing SEC disclosure requirements or those that must

provide financial statements to the SEC for securities purposes without contractual transfer restrictions, the effective date aligns with

the date when the SEC removes the related disclosure from Regulation S-X or Regulation S-K. Early adoption is not allowed.

For all other entities, the amendments will be effective two years later from the date of the SEC’s removal. The Company is

in the process of evaluating the impact of ASU 2023-06 on the consolidated financial statements.

Recently issued ASUs by the FASB, except for the ones

mentioned above, have no material impact on the Company’s condensed consolidated results of operations or financial position.

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 4 – PREPAID EXPENSES AND OTHER CURRENT

ASSETS

Prepaid expenses and other current assets consisted

of the following:

| | |

October 31, 2024 | | |

July 31, 2024 | |

| | |

(unaudited) | | |

| |

| Prepayment for advertising service fee (a) | |

$ | 48,000 | | |

$ | 120,000 | |

| Others | |

| 2,224 | | |

| 2,224 | |

| Total | |

$ | 50,224 | | |

$ | 122,224 | |

NOTE 5 – PROPERTY, PLANT AND EQUIPMENT, NET

Property and equipment, net consisted of the following:

| | |

October 31, 2024 | | |

July 31, 2024 | |

| | |

(unaudited) | | |

| |

| Furniture, fixtures and equipment | |

$ | 209,290 | | |

$ | 209,290 | |

| Less: accumulated depreciation | |

| (155,525 | ) | |

| (149,243 | ) |

| Property and equipment, net | |

$ | 53,765 | | |

$ | 60,047 | |

Depreciation expense was $6,282 and $9,669 for the

three months ended October 31, 2024 and 2023, respectively.

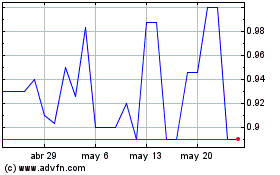

NOTE 6 – INVESTMENTS IN TRADING SECURITIES

As of October 31, 2024 and July 31, 2024, the balance of investments

in trading securities represented (i) certain equity securities of listed companies purchased through various open market transactions

by the Company during the relevant periods. The investments are initially recorded at cost, and subsequently measured at fair value with

the changes in fair value recorded in other income (expenses), net in the condensed consolidated statement of operations and comprehensive

loss, and (ii) 7,850,000 ordinary shares of a listed company granted by a shareholder as capital contribution. The ordinary

shares were granted on October 28, 2024 and were subject to 1933Act restrictions until March 2025. As of October 31, 2024,

the fair value of the 7,850,000 ordinary shares was $3,730,320. The Company initially accounted for the share as “investment in

trading securities” at fair value by reference to the prevailing market price on shares grant date, and subsequently measure the

share awards at fair value.

For the three months ended October 31, 2024 and

2023, the Company recognized an increase in fair value of investments of $148,158 and a decrease in fair value of $109,404, respectively.

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 7 – OPERATING LEASES

As of October 31, 2024, the Company leases offices

space under one non-cancelable operating lease with a related party lessor (Note 10).

The Company’s lease agreements do not contain

any material residual value guarantees or material restrictive covenants. Rent expenses for the three months ended October 31, 2024 and

2023 were $9,000 and $125,679, respectively.

The Company elected the package of practical expedients,

which allows the Company to not reassess whether any existing contracts contain a lease, to not reassess historical lease classification

as operating or finance leases, and to not reassess initial direct costs. The Company has not elected the practical expedient to use hindsight

to determine the lease term for its leases at transition. The Company combines the lease and non-lease components in determining the right-of-use

(“ROU”) assets and related lease obligation. Adoption of this standard resulted in the recording of operating lease ROU assets

and corresponding operating lease liabilities as disclosed below. ROU assets and related lease obligations are recognized at commencement

date based on the present value of remaining lease payments over the lease term.

The following table presents the operating lease related

assets and liabilities recorded on the balance sheets as of October 31, 2024 and July 31, 2024.

| | |

October 31, 2024 | | |

July 31, 2024 | |

| | |

(unaudited) | | |

| |

| Right-of- use assets | |

$ | 45,475 | | |

$ | 53,793 | |

| | |

| | | |

| | |

| Operating lease liabilities, current | |

| 20,683 | | |

$ | 11,375 | |

| Operating lease liabilities, noncurrent | |

| 11,790 | | |

| 20,417 | |

| Total operating lease liabilities | |

$ | 32,473 | | |

$ | 31,792 | |

The weighted average remaining lease terms and discount

rates for all of operating leases were as follows as of October 31, 2024 and July 31, 2024:

| | | October 31, 2024 | | | July 31, 2024 | |

| | | (unaudited) | | | | |

| Remaining lease term and discount rate | | | | | | |

| Weighted average remaining lease term (years) | | | 1.33 | | | | 1.58 | |

| Weighted average discount rate | | | 8.50 | % | | | 8.50 | % |

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 7 – OPERATING LEASES (continued)

The following is a schedule of maturities of lease

liabilities as of October 31, 2024 and July 31, 2024:

| | |

October 31, 2024 | | |

July 31, 2024 | |

| | |

(unaudited) | | |

| |

| 2025 | |

$ | 14,000 | | |

$ | 14,000 | |

| 2026 | |

| 21,000 | | |

| 21,000 | |

| Total lease payments | |

| 35,000 | | |

| 35,000 | |

| Less: imputed interest | |

| (2,527 | ) | |

| (3,208 | ) |

| Present value of lease liabilities | |

$ | 32,473 | | |

$ | 31,792 | |

NOTE 8 – ACCOUNTS PAYABLE, ACCRUED EXPENSES

AND OTHER CURRENT LIABILITIES, AND OTHER LONG-TERM LIABILITIES

Accounts payable, accrued expenses and other current liabilities consisted

of the following:

| | |

October 31, 2024 | | |

July 31, 2024 | |

| | |

| (unaudited) | | |

| | |

| Accounts payable, accrued expenses and other current liabilities: | |

| | | |

| | |

| Accrued litigation fee, current (a) | |

$ | 500,000 | | |

$ | 750,000 | |

| Investment securities payable | |

| - | | |

| 69,621 | |

| Others | |

| 84,380 | | |

| 137,436 | |

| | |

$ | 584,380 | | |

$ | 957,057 | |

| Other long-term liabilities: | |

| | | |

| | |

| Accrued litigation fee, noncurrent (a) | |

$ | 250,000 | | |

$ | 250,000 | |

NOTE 9 – ADDITIONAL PAID-IN CAPITAL

On October 28, 2024, the Company was granted

7,850,000 ordinary shares of a listed company by a shareholder as capital contribution. The ordinary shares were subject to 1933 Act

restrictions until March 2025. The Company initially accounted for the share as “investment in trading securities” at

fair value of $3,611,000, with corresponding account charged to “additional paid-in capital”.

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 10 – RELATED PARTY TRANSACTIONS

| 1) |

Nature of relationships with related parties |

The table below sets forth the major related parties

and their relationships with the Company, with which the Company entered into transactions during the three months ended October

31, 2024 and 2023, or recorded balances as of October 31, 2024 and July 31, 2024:

| Name | | Relationship with the Company |

| Mr. Jun Liu | | The Chief Executive Officer of the Company |

| Huaya | | Wholly owned by Mr. Pishan Chi, the former Chief Executive Officer of the Company |

| Asia International Securities Exchange Co., Ltd. | | Wholly owned by Mr. Jun Liu |

| Zachary Group LLC (“Zachary Group”) | | Wholly owned by Mr. Jun Liu |

| 2) | Transactions with related parties |

| | |

October 31,

2024 | | |

July 31, 2024 | |

| | |

(unaudited) | | |

| |

| Provision of consulting services to related parties | |

| | |

| |

| Asia International Securities Exchange Co., Ltd. | |

$ | - | | |

$ | 200,000 | |

| | |

$ | - | | |

$ | 200,000 | |

In June 2022, the Company entered into an office lease

agreement with Zachary Group. Pursuant to the agreement, the Company would lease the office space for a lease term of 5 years,

matured in May 2027. The monthly rental fee was $20,000, payable on a monthly basis. On March 1, 2024, the Company and Zachary Group modified

the lease agreement to reduce the lease term and office space. The modified agreement was for a lease term of 2 years through February

2026, and monthly rental fee was $3,000, payable on a monthly basis. For the three months ended October 31, 2024 and 2023, the Company

recorded rental expenses of $9,000 and $60,000, respectively.

For the three months ended October 31, 2024, the Company did not collected

or repaid loans to related parties.

For the three months ended October 31, 2023, the Company repaid loans of

$17,710 to Asia International Securities Exchange Co., Ltd. The loans were interest free and was repayable on demand. For the three months

ended October 31, 2023, the Company collected loans of $20,000 from Huaya.

| 3) |

Balances with related parties |

As of October 31, 2024 and July 31, 2024, the balances

due from related parties were as follows:

| | |

October 31,

2024 | | |

July 31,

2024 | |

| | |

(unaudited) | | |

| |

| Accounts receivable: | |

| | |

| |

| Asia International Securities Exchange Co., Ltd. | |

$ | 200,000 | | |

$ | 200,000 | |

| | |

$ | 200,000 | | |

$ | 200,000 | |

| Other receivable: | |

| | | |

| | |

| Asia International Securities Exchange Co., Ltd. (a) | |

$ | 900,000 | | |

$ | 900,000 | |

| | |

$ | 900,000 | | |

$ | 900,000 | |

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 11 – TAXES

The Company is subject to income taxes on an entity

basis on income arising in or derived from the tax jurisdiction in which each entity is domiciled.

British Virgin Islands

Under the current laws of the British Virgin Islands,

the Company and ATIF Investment are not subject to tax on income or capital gains in the British Virgin Islands. Additionally, upon payments

of dividends to the shareholders, no British Virgin Islands withholding tax will be imposed.

USA

For the US jurisdiction, ATIF Inc., ATIF BC, ATIF

BM, ATIF BD are subject to federal and state income taxes on its business operations. The federal tax rate is 21% and state tax rate is

8.84%. The Company also evaluated the impact from the recent tax reforms in the United States, including the Coronavirus Aid, Relief,

and Economic Security Act (“CARES Act”) and Health and Economic Recovery Omnibus Emergency Solutions Act (“HERO Act”),

which both were passed in 2020, no material impact on the Company is expected based on the analysis. The Company will continue to

monitor the potential impact going forward.

For the three months ended October 31, 2024 and 2023, the Company did

not incur income tax expenses.

The Company’s deferred tax assets primarily

derived from the net operating loss (“NOL”). The Company periodically evaluates the likelihood of the realization of deferred

tax assets, and reduces the carrying amount of the deferred tax assets by a valuation allowance to the extent it believes a portion or

all of the deferred tax assets will not be realized. The Company considers many factors when assessing the likelihood of future realization

of the deferred tax assets, including its recent cumulative earnings experience, expectation of future income, the carry forward periods

available for tax reporting purposes, and other relevant factors. As of October 31, 2024 and July 31, 2024, management believes that the

realization of the deferred tax assets appears to be uncertain and may not be realizable in the near future. Therefore, a 100% valuation

allowance has been provided against the deferred tax assets.

Uncertain tax positions

The Company accounts for uncertainty in income taxes

using a two-step approach to recognizing and measuring uncertain tax positions. The first step is to evaluate the tax position for recognition

by determining if the weight of available evidence indicates that it is more likely than not that the position will be sustained on audit,

including resolution of related appeals or litigation processes, if any. The second step is to measure the tax benefit as the largest

amount that is more than 50% likely of being realized upon settlement. Interest and penalties related to uncertain tax positions are recognized

and recorded as necessary in the provision for income taxes. In the case of transfer pricing issues, the statute of limitation is ten

years. There is no statute of limitation in the case of tax evasion. There were no uncertain tax positions as of October 31, 2024 and

July 31, 2024 and the Company does not believe that its unrecognized tax benefits will change over the next twelve months.

ATIF HOLDINGS LIMITED

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 12 – CONTIGENCIES

From time to time, the Company is a party to various

legal actions arising in the ordinary course of business. The Company accrues costs associated with these matters when they become probable

and the amount can be reasonably estimated. Legal costs incurred in connection with loss contingencies are expensed as incurred.

Pending Legal Proceeding with Boustead Securities,

LLC (“Boustead”)

On May 14, 2020, Boustead filed a lawsuit

against the Company and LGC for breaching the underwriting agreement Boustead had with each of the Company and LGC, in which Boustead

was separately engaged as the exclusive financial advisor to provide financial advisory services to the Company and LGC.

Boustead’s Complaint alleges four causes

of action against the Company, including breach of contract; breach of the implied covenant of good faith and fair dealing; tortious interference

with business relationships and quantum meruit.

On October 6, 2020, ATIF filed a motion to dismiss

Boustead’s Complaint pursuant to Federal Rule of Civil Procedure 12(b)(6) and 12(b)(5). On October 9, 2020, the United States

District Court for the Southern District of New York directed Boustead to respond to the motion or amend its Complaint by November 10,

2020. Boustead opted to amend its complaint and filed the amended complaint on November 10, 2020. Boustead’s amended

complaint asserts the same four causes of action against ATIF and LGC as its original complaint. The Company filed another motion to dismiss

Boustead’s amended complaint on December 8, 2020.

On August 25, 2021, the United States District

Court for the Southern District of New York granted ATIF’s motion to dismiss Boustead’s first amended complaint. In its order

and opinion, the United States District Court for the Southern District of New York allowed Boustead to move for leave to amend its causes

of action against ATIF as to breach of contract and tortious interference with business relationships, but not breach of the implied covenant

of good faith and fair dealing and quantum meruit. On November 4, 2021, Boustead filed a motion seeking leave to file a second amended

complaint to amend its cause of action for Breach of Contract. The Court granted Boustead’s motion for leave and Boustead filed

the second amended complaint on December 28, 2021 alleging only breach of contract and dropping all other causes of action alleged in

the original complaint. On January 18, 2022, the Company filed a motion to dismiss Boustead’s second amended complaint. Boustead

filed its opposition on February 1, 2022 and the Company replied on February 8, 2022.

On July 6, 2022, the Court denied our motion to

dismiss the second amended complaint. Thereafter, on August 3, 2022, the Company filed a motion to compel arbitration of Boustead’s

claims in California. Briefing on the Company’s motion to compel concluded on August 23, 2022. Since the agreement between ATIF

and Boustead contains a valid arbitration clause that applies to Boustead’s breach of contract claim, and the parties have not engaged

in discovery, on February 14, 2023, the Court ordered that ATIF’s motion to compel arbitration is granted and this case is stayed

pending arbitration.

On March 10, 2023, Boustead, filed Demand for

Arbitration against ATIF (the Respondent) before JAMS in California and the assigned JAMS case Ref. No. is 5220002783. On May 25, 2023,

ATIF filed its answer to deny Boustead’s Demand for Arbitration, which was unsuccessful and the arbitration process was initiated.

The arbitrator ordered a motion to be filed by Boustead for a determination of contact interpretation, prior to extensive discovery into

issues such as the alleged merits and damages, and to determine whether the contract interpretation should allow the matter to further

proceed. Boustead had filed the Motion for Contract Interpretation Determination. ATIF filed its opposition to that Motion on October

16, 2023. The hearing on the motion was held on November 8, 2023, during which the arbitrator extended the hearing to February 29, 2024.

The arbitrator also established December 15, 2023, as the deadline for Boustead to submit its reply regarding the contract interpretation

issues raised by the Company. Simultaneously, the Company was granted until February 12, 2024, to present its response brief.

On September 24, 2024, the Company and Boustead entered into a settlement

agreement, pursuant to which the Company shall pay a total amount of $1,000,000 to Boustead. The payment is made in three instalments,

the first instalment of $250,000 is payable upon execution of the settlement agreement, the second instalment of $500,000 is payable before

March 1, 2025, and the final instalment of $250,000 is payable before December 31, 2025.

Pending Legal Proceeding with J.P Morgan Securities

LLC (“JPMS”)

On December 22, 2023, J.P Morgan Securities LLC (“JPMS”)

filed a lawsuit in the Superior Court of California, County of Orange, bearing Case Number 30-2023-01369978-CU-FR-CJC against ATIF Holdings

Limited (“Holdings”), ATIF Inc., ATIF-1 GP, LLC (ATIF-1 GP”), and two officers of Holdings and ATIF Inc., Jun Liu and

Zhiliang “Ian” Zhou, alleging and asserting that it is entitled to recover $5,064,160 in damages plus interest and attorneys’

fees relating to a stock transaction by ATIF-1 GP.

The parties have agreed to attempt to mediate the

dispute before proceeding to litigation. A mediation was held on May 6, 2024, but the parties could not come to a resolution. The

Defendants’ time to respond to the lawsuit was May 20, 2024. On May 15, 2024, the Defendants filed a Petition with the Superior

Court of California seeking to compel arbitration under the operative agreements and stay the underlying State Court action. On or about

August 16, 2024, the parties agreed that JPMS and ATIF-1 GP, LLC would submit any disputes between the two of them only, to FINRA arbitration,

and stay the California state court case pending such arbitration. At this time, the management is still in the process of evaluating

the claims and defenses.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion and

analysis should be read together with the Company’s annual report on Form 10-K for the fiscal year ended July 31, 2024 and the consolidated

financial statements and notes included therein (collectively, the “2024 Annual Report”), as well as the Company’s condensed

consolidated financial statements and the related notes included in this report. Pursuant to Instruction 2 to paragraph (b) of Item 303

of Regulation S-K promulgated by the SEC, in preparing this discussion and analysis, the Company has presumed that readers have access

to and have read the disclosure under the same heading contained in the 2024 Annual Report. This discussion and analysis contains forward-looking

statements. Please see the cautionary note regarding these statements at the beginning of this report.

Business Overview

We offer financial consulting

services to small and medium-sized enterprise customers in Asia and North America. Our goal is to become an international financial consulting

company with clients and offices throughout Asia. Since our inception in 2015, the focus of our consulting business has been providing

comprehensive going public consulting services designed to help SMEs become public companies on suitable markets and exchanges.

On January 4, 2021, we established

an office in California, USA, through our wholly owned subsidiary ATIF Inc., a California corporation, and launched, in addition to our

business consulting services, additional service models consisting of asset management, investment holding and media services to expand

our business with a flexible business concept to achieve a goal of high growth revenue and strong profit growth.

Our financial consulting services

We launched our consulting services

in 2015. Our aim was to assist Chinese enterprises by filling the gaps and forming a bridge between PRC companies and overseas stock markets

and exchanges. We have a team of qualified and experienced personnel with legal, regulatory, and language expertise in several jurisdictions

outside the U.S. Our services were designed to help small and medium-sized enterprises (“SME”) in China achieve their goal

of becoming public companies. In May 2022, we shifted our geographic focus from China to North America emphasizing on helping mid and

small companies in North America become public companies on the U.S. capital markets. We would create a going public strategy for each

client based on many factors of such client, including our assessment of the client’s financial and operational situations, market

conditions, and the client’s business and financing requirements. Since our inception and up to the date of this report, we have

successfully helped nine Chinese enterprises to be quoted on the U.S. OTC markets and are currently assisting our other clients in their

respective going public efforts. Most of our current and past clients have been Chinese, U.S. and Mexican companies, and we plan to expand

our operations to other Asian countries, such as Malaysia, Vietnam, and Singapore with continuing focus on the North American market in

the coming years.

For

the three months ended October 31, 2024 and 2023, we provided consulting services to none and three customers, respectively, which

primarily engaged the Company to provide consulting services relating to going public in the US through IPO, reverse merger and

acquisition. From April 2022 through the date of this report, the Company entered into consulting agreements with nine customers,

among which three are based in the North America.

Our total revenue generated from consulting services amounted to $nil

and approximately $0.1 million for the three months ended October 31, 2024 and 2023, respectively.

Key Factors that Affect our Business

We believe the following key factors

may affect our consulting services:

Our business success depends on our ability to acquire customers

effectively.

Our customer acquisition channels

primarily include our sales and marketing campaigns and existing customer referrals. In order to acquire customers, we have made significant

efforts in building mutually beneficial long-term relationships with local government, academic institutions, and local business associations.

In addition, we also market our consulting services through social media, such as WeChat and Weibo. If any of our current customer acquisition

channels becomes less effective, we are unable to continue to use any of these channels or we are not successful in using new channels,

we may not be able to attract new customers in a cost-effective manner or convert potential customers into active customers or even lose

our existing customers to our competitors. To the extent that our current customer acquisition and retention efforts become less effective,

our service revenue may be significantly impacted, which would have a significant adverse effect on our revenues, financial condition,

and results of operations.

Our consulting business faces strong market competition.

We are currently facing intense

market competition. Some of our current or potential competitors have significantly more financial, technical, marketing, and other resources

than we do and may be able to devote greater resources to the development, promotion, and support of their customer acquisition and retention

channels. In light of the low barriers to entry into the financial consulting industry, we expect more players to enter this market and

increase the level of competition. Our ability to differentiate our services from other competitors will have a significant impact on

our business growth in the future.

Our business depends on our ability to attract and retain key personnel.

We rely heavily on the expertise

and leadership of our directors and officers to maintain our core competence. Under their leadership, we have been able to achieve rapid

expansion and significant growth since our inception in 2015. As our business scope increases, we expect to continue to invest significant

resources in hiring and retaining a deep talent pool of financial consultancy professionals. Our ability to sustain our growth will depend

on our ability to attract qualified personnel and retain our current staff.

Results of Operations

The following table summarizes

the results of our operations for the three months ended October 31, 2024 and 2023, respectively, and provides information regarding the

dollar and percentage increase or (decrease) during such periods.

| | |

For the three months ended | | |

Changes | |

| | |

October 31,

2024 | | |

October 31,

2023 | | |

Amount

Increase

(Decrease) | | |

Percentage

Increase

(Decrease) | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | - | | |

$ | 125,000 | | |

$ | (125,000 | ) | |

| (100 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling expenses | |

| 72,000 | | |

| 72,000 | | |

| - | | |

| 0 | % |

| General and administrative expenses | |

| 449,109 | | |

| 709,779 | | |

| (260,670 | ) | |

| (37 | )% |

| Total operating expenses | |

| 521,109 | | |

| 781,779 | | |

| (260,670 | ) | |

| (33 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (521,109 | ) | |

| (656,779 | ) | |

| (135,670 | ) | |

| (21 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expenses): | |

| | | |

| | | |

| | | |

| | |

| Interest expenses, net | |

| (18 | ) | |

| - | | |

| 18 | | |

| 100 | % |

| Other income, net | |

| 5,895 | | |

| 140,720 | | |

| (134,825 | ) | |

| (96 | )% |

| Gain (loss) from investment in trading securities | |

| 148,158 | | |

| (109,404 | ) | |

| (257,562 | ) | |

| (235 | )% |

| Total other income, net | |

| 154,035 | | |

| 31,316 | | |

| 122,719 | | |

| 392 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| (367,074 | ) | |

| (625,463 | ) | |

| (258,389 | ) | |

| (41 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax provision | |

| - | | |

| - | | |

| - | | |

| 0 | % |

| Net loss | |

$ | (367,074 | ) | |

$ | (625,463 | ) | |

$ | (258,389 | ) | |

| (41 | )% |

Revenues. Our

total revenue decreased by approximately $0.1 million, or 100%, from approximately $0.1 million for the three months ended October 31,

2023, to $nil in for the three months ended October 31, 2024.

For the three months ended

October 31, 2024, we did not provided services to customers and did not recognize revenues. For the three months ended October 31, 2023,

we provided certain IPO assistance services to three customers and recognized revenues of $0.1 million.

General and administrative

expenses. Our general and administrative expenses decreased by approximately $0.3 million, or 37%, from approximately $0.7 million

for the three months ended October 31, 2023, to approximately $0.4 million for the three months ended October 31, 2024.

Our general and administrative

expenses primarily consisted of salary and welfare expenses of management and administrative team, professional expenses, office expenses,

operating lease expenses. The decrease in general and administrative expenses was primarily due to a decrease of approximately $0.2 million

in payroll expenses because we adjusted monthly payroll expenses to Mr. Jun Liu from $20,000 to $1 since February 2024, and a decrease

of approximately $0.1 million in office expenses.

Gain (loss) from investment

in trading securities. Loss from investment in trading securities represented fair value changes from investment in trading securities,

which was measured at market price. For the three months ended October 31, 2024 and 2023, we recorded an investment gain of approximately

$0.1 million and an investment loss of approximately $0.1 million, respectively.

Income taxes. We

are incorporated in the British Virgin Islands. Under the current laws of the British Virgin Islands, we are not subject to tax on income

or capital gains in the British Virgin Islands. Additionally, upon payments of dividends to the shareholders, no British Virgin Islands

withholding tax will be imposed.

ATIF Inc, ATIF BD, ATIF BC and

ATIF BM were established in the U.S and are subject to federal and state income taxes on its business operations. The federal tax rate

is 21% and state tax rate is 8.84%. We also evaluated the impact from the recent tax reforms in the United States, including the Coronavirus

Aid, Relief, and Economic Security Act (“CARES Act”) and Health and Economic Recovery Omnibus Emergency Solutions Act (“HERO

Act”), which were both passed in 2020, No material impact on the ATIF US is expected based on our analysis. We will continue to

monitor the potential impact going forward.

For the three months ended

October 31, 2024 and 2023, we did not recognized income tax expenses.

Net income (loss).

As a result of foregoing, net loss was approximately $0.4 million for the three months ended October 31, 2024, a decrease of approximately

$0.2 million from net loss of $0.6 million for the three months ended October 31, 2023.

Liquidity and Capital Resources

To date, we have financed our

operations primarily through cash flows from operations, working capital loans from our major shareholders, proceeds from our initial

public offering, and equity financing through public offerings of our securities. We plan to support our future operations primarily from

cash generated from our operations and cash on hand. However, the Company may need to raise the cash flow from related parties, and there

is no assurance that the Company will be able to obtain funds on commercially acceptable terms, if at all.

Liquidity and Going concern

For the three months ended

October 31, 2024 and 2023, the Company reported a net loss of approximately $0.4 million and $0.6 million, respectively, and operating

cash outflows approximately $0.8 million and operating cash inflows of approximately $0.2 million. In assessing the Company’s ability

to continue as a going concern, the Company monitors and analyzes its cash and its ability to generate sufficient cash flow in the future

to support its operating and capital expenditure commitments. Because of a history of net losses from operations, cash out from operating

activities, and the requirement of additional capital to fund our current operating plan at October 31, 2024, these factors indicate the

existence of an uncertainty that raises substantial doubt about the Company’s ability to continue as a going concern.

As of October 31, 2024, the

Company had cash of approximately $0.5 million, short-term investments in trading securities of approximately $4.2 million, due from a

related party of $0.9 million and accounts receivables of $0.2 million due from a related party, which were highly liquid. On the other

hand, the Company had current liabilities of approximately $0.6 million. The Company’s cash and short-term investments in trading

securities could well cover the current liabilities. The Company’s ability to continue as a going concern is dependent on management’s

ability to successfully execute its business plan, which includes increasing revenue while controlling operating cost and expenses to

generate positive operating cash flows and obtain financing from outside sources.

The unaudited condensed consolidated

financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of

liabilities in the ordinary course of business. The financial statements do not include any adjustments relating to the recoverability