Bionano Announces Closing of $10 Million Registered Direct Offering Priced At-the-Market under Nasdaq Rules

06 Enero 2025 - 3:30PM

Bionano Genomics, Inc. (Nasdaq: BNGO) today announced the closing

of its previously announced registered direct offering priced

at-the-market under Nasdaq rules for the purchase and sale of an

aggregate of 39,682,540 shares of its common stock (or common stock

equivalents) and warrants to purchase up to an aggregate of

39,682,540 shares of common stock (the “Warrants”), at a combined

offering price of $0.252 per share of common stock (or per common

stock equivalent) and accompanying Warrant. The Warrants have an

exercise price of $0.252 per share and will be exercisable

beginning on the effective date of stockholder approval of the

issuance of the shares of common stock upon exercise of the

Warrants (the “Stockholder Approval”). The Warrants will expire on

the five-year anniversary of the Stockholder Approval.

H.C. Wainwright & Co. acted as the exclusive

placement agent for the offering.

The aggregate gross proceeds to the Company from

the offering were approximately $10 million, before deducting the

placement agent’s fees and other offering expenses payable by the

Company. The potential additional gross proceeds to the Company

from the Warrants, if fully exercised on a cash basis, will be

approximately $10 million. No assurance can be given that the

Stockholder Approval will be achieved or that any of the Warrants

will be exercised. The Company intends to use the net proceeds from

this offering, together with its existing cash and cash equivalents

and available-for-sale securities, for general corporate purposes,

including working capital, research and development expenses,

repayment or redemption of existing indebtedness and capital

expenditures.

The securities described above were offered and

sold by the Company in a registered direct offering pursuant to a

“shelf” registration statement on Form S-3 (File No. 333-270459)

that was originally filed with the Securities and Exchange

Commission (the “SEC”) on March 10, 2023, and became effective on

May 8, 2023. The offering of the securities in the registered

direct offering was made only by means of a base prospectus and

prospectus supplement that forms a part of the effective

registration statement. A final prospectus supplement and the

accompanying base prospectus relating to the registered direct

offering has been filed with the SEC and is available on the SEC’s

website at www.sec.gov. Electronic copies of the final prospectus

supplement and the accompanying base prospectus may also be

obtained from H.C. Wainwright & Co., LLC at 430 Park Avenue,

3rd Floor, New York, NY 10022, by phone at (212) 856-5711 or e-mail

at placements@hcwco.com.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described herein, nor shall there be any sale of these securities

in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or other

jurisdiction.

About Bionano

Bionano is a provider of genome analysis

solutions that can enable researchers and clinicians to reveal

answers to challenging questions in biology and medicine. The

Company’s mission is to transform the way the world sees the genome

through optical genome mapping (OGM) solutions, diagnostic services

and software. The Company offers OGM solutions for applications

across basic, translational and clinical research. The Company also

offers an industry-leading, platform-agnostic genome analysis

software solution, and nucleic acid extraction and purification

solutions using proprietary isotachophoresis (ITP) technology.

Through its Lineagen, Inc. d/b/a Bionano Laboratories business, the

Company also offers OGM-based diagnostic testing services.

For more information, visit www.bionano.com or

www.bionanolaboratories.com.

Bionano’s products are for research use only and

not for use in diagnostic procedures.

Forward-Looking Statements of Bionano

Genomics

This press contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995 that involve risks and uncertainties. Words such as

“believe,” “can,” “could,” “may” “potential” and similar

expressions (as well as other words or expressions referencing

future events, conditions or circumstances and the negatives

thereof) convey uncertainty of future events or outcomes and are

intended to identify these forward-looking statements.

Forward-looking statements include statements regarding our

intentions, beliefs, projections, outlook, analyses or current

expectations concerning, among other things, the use of proceeds

from the offering, the exercise of the Warrants in cash prior to

their expiration, and the receipt of the Stockholder Approval. Each

of these forward-looking statements involves risks and

uncertainties.

Actual results or developments may differ

materially from those projected or implied in these forward-looking

statements. Factors that may cause such a difference

include the risks and uncertainties associated with: the

timing and amount of revenue we are able to recognize in a given

fiscal period; the impact of adverse geopolitical and

macroeconomic events, such as recent and potential future bank

failures and the ongoing conflicts between Ukraine and Russia and

in the Middle East, on our business and the global economy; general

market conditions, including inflation and supply chain

disruptions; challenges inherent in developing, manufacturing and

commercializing products; our ability to further deploy new

products and applications and expand the markets for our technology

platforms; our expectations and beliefs regarding future growth of

the business and the markets in which we operate; changes in our

strategic and commercial plans; our ability to continue as a going

concern, which requires us to manage costs and obtain significant

additional financing to fund our strategic plans and

commercialization efforts; our ability to cure any deficiencies in

compliance with Nasdaq Listing Rules that could adversely affect

our ability to raise capital and our financial condition and

business; our ability to consummate any strategic alternatives; the

risk that if we fail to obtain additional financing we may seek

relief under applicable insolvency laws; and other risks and

uncertainties including those described in our filings with the

Securities and Exchange Commission (“SEC”), including, without

limitation, our Annual Report on Form 10-K for the year ended

December 31, 2023 and in other filings subsequently made by us with

the SEC. All forward-looking statements contained in this press

release speak only as of the date on which they were made and are

based on management’s assumptions and estimates as of such date. We

are under no duty to update any of these forward-looking statements

after the date they are made to conform these statements to actual

results or revised expectations, except as required by law. You

should, therefore, not rely on these forward-looking statements as

representing our views as of any date subsequent to the date the

statements are made. Moreover, except as required by law, neither

we nor any other person assumes responsibility for the accuracy and

completeness of the forward-looking statements contained in this

press release.

CONTACTSCompany Contact:Erik

Holmlin, CEOBionano Genomics, Inc.+1 (858)

888-7610eholmlin@bionano.com

Investor Relations:David R. HolmesGilmartin

Group+1 (858) 366-3243david.holmes@gilmartinir.com

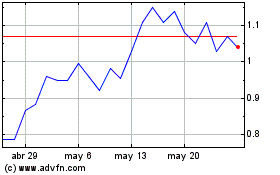

Bionano Genomics (NASDAQ:BNGO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Bionano Genomics (NASDAQ:BNGO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025