Blaize, Inc. and BurTech Acquisition Corp. Announce Closing of Business Combination

13 Enero 2025 - 4:25PM

Business Wire

BurTech Acquisition Corp. (“BurTech”) (NASDAQ: BRKH), a

publicly-traded special purpose acquisition company, and Blaize,

Inc. (“Blaize”), a provider of purpose-built, artificial

intelligence (“AI”)-enabled edge computing solutions, today

announced the completion of their previously announced business

combination (the “Business Combination”). The combined company will

operate under the name Blaize Holdings, Inc. and begin trading on

Nasdaq under the ticker symbols “BZAI” and “BZAIW” on January 14,

2025. The Business Combination, approved at a special meeting of

BurTech shareholders on December 23, 2024, begins a new period in

Blaize’s growth in bringing artificial intelligence to the

edge.

The Business Combination marks a major milestone for Blaize as

it continues building its transformative new compute solution that

unites silicon and software to optimize AI from the edge to the

core. Blaize has strong traction with over $400 million in a

qualified pipeline of prospective customers it expects to engage in

2025 and a global footprint with Tier 1 supply chain

relationships.

“Today is an exciting milestone on Blaize’s journey of powering

the next generation of computing,” said Dinakar Munagala, CEO of

Blaize. “AI-powered edge computing is the future due to its low

power consumption, low latency, cost-effectiveness and data privacy

advantages. Blaize is well-positioned with our full-stack hardware

and software solution purpose-built for edge computing.”

“We are pleased to announce the successful completion of our

merger, marking a significant milestone in bringing value for our

shareholders,” said Shahal Khan, CEO and chairman of BurTech.

“AI-powered edge computing is redefining what is possible across a

broad range of sectors, from security and monitoring to enterprise

edge AI to autonomous systems. We’re so thrilled to partner with

Blaize as it delivers the next generation of computing.”

Advisors

Norton Rose Fulbright US LLP and Loeb & Loeb LLP acted as

legal counsel to BurTech. Jefferies served as a Capital Markets

Advisor to BurTech and was represented by Kirkland & Ellis LLP.

Latham & Watkins LLP acted as legal counsel to Blaize. KeyBanc

Capital Markets served as strategic advisor to Blaize, and Sidley

Austin LLP acted as legal counsel to KeyBanc Capital Markets. In

addition, D.A. Davidson & Co., Rosenblatt Securities, and Roth

Capital Partners, LLC acted as Capital Markets Advisors to Blaize,

and Blueshirt Capital Advisors is serving as an investor relations

advisor to Blaize.

About BurTech

BurTech (NASDAQ: BRKH) is a special-purpose acquisition company

dedicated to partnering with exceptional businesses and providing

them with the resources and expertise to excel in the public

market. With a focus on delivering long-term value to stockholders

and supporting innovative companies, BurTech is committed to

creating success stories in technology industries. With steadfast

stockholders, a robust financial footing, and an unyielding

commitment to innovation, BurTech is a visionary force in the

technology world.

About Blaize

Blaize provides a full-stack programmable processor architecture

suite and low-code/no-code software platform that enables AI

processing solutions for high-performance computing at the

network’s edge and in the data center. Blaize solutions deliver

real-time insights and decision-making capabilities at low power

consumption, high efficiency, minimal size, and low cost. Blaize

has raised over $330 million from strategic investors such as

DENSO, Mercedes-Benz AG, Magna, and Samsung and financial investors

such as Franklin Templeton, Temasek, GGV, Bess Ventures, BurTech LP

LLC, Rizvi Traverse, and Ava Investors. Headquartered in El Dorado

Hills (CA), Blaize has more than 200 employees worldwide with teams

in San Jose (CA) and Cary (NC), and subsidiaries in Hyderabad

(India), Leeds and Kings Langley (UK), and Abu Dhabi (UAE).

Cautionary Statement Regarding Forward Looking

Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the U.S. Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the U.S.

Securities Exchange Act of 1934, as amended (the “Exchange Act”)

that are based on beliefs and assumptions and on information

currently available to Blaize, including statements regarding

Blaize’s business plans and growth strategies, market

opportunities, customer pipeline and financial prospects. In some

cases, you can identify forward-looking statements by the following

words: “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing,” “target,” “seek” or

the negative or plural of these words, or other similar expressions

that are predictions or indicate future events or prospects,

although not all forward-looking statements contain these words.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this

document, including but not limited to: (i) changes in domestic and

foreign business, market, financial, political and legal

conditions; (ii) the expected benefits of the Business Combination

are not obtained; (iii) the ability to meet stock exchange listing

standards following the consummation of the Business Combination;

(iv) the risk that the Business Combination disrupts current plans

and operations of Blaize as a result of the consummation of the

Business Combination; (v) failure to realize the anticipated

benefits of the Business Combination, which may be affected by,

among other things, competition, the ability of the combined

company to grow and manage growth profitably, maintain

relationships with customers and suppliers and retain its

management and key employees; (vi) costs related to the Business

Combination; (vii) changes in applicable law or regulations; (viii)

the outcome of any legal proceedings that may be instituted against

Blaize; (ix) the effects of competition on Blaize’s future

business; (x) the ability of the combined company to issue equity

or equity-linked securities or obtain debt financing; (xi) the

enforceability of Blaize’s intellectual property rights, including

its copyrights, patents, trademarks and trade secrets, and the

potential infringement on the intellectual property rights of

others; and (xii) those factors discussed under the heading “Risk

Factors” in the definitive proxy statement/prospectus filed on

December 6, 2024 by Blaize Holdings, Inc. and other documents

filed, or to be filed, by Blaize Holdings, Inc. with the SEC.

Nothing in this communication should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. Blaize does not

undertake any duty to update these forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250109306974/en/

Media Contact: Leo Merle Blaize info@blaize.com

Mark Roberts The Blueshirt Group for Blaize ir@blaize.com

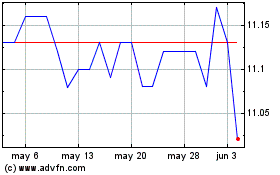

BurTech Acquisition (NASDAQ:BRKH)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

BurTech Acquisition (NASDAQ:BRKH)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025