This Amendment No. 5 amends and supplements the Statement on Schedule 13D (as

amended from time to time, the "Statement") in respect of the Ordinary Shares,

par value NIS 0.01 per share, ("Ordinary Shares"), of Compugen Ltd. (the

"Issuer"), initially filed with the Securities and Exchange Commission ("SEC")

by the Reporting Persons (as defined in the Statement) on July 7, 2003.

Unless otherwise defined in this Amendment No. 5, capitalized terms have the

meanings given to them in the Statement.

The following amends and supplements Items 2, 5 and 7 of the Statement.

ITEM 2. IDENTITY AND BACKGROUND

Item 2 of the Statement is hereby amended and restated in its entirety as

follows:

(a), (b) and (c): The Reporting Persons.

The following are the names of the reporting persons (the "REPORTING PERSONS"),

the place of organization, principal business, and address of the principal

business or office of each Reporting Person that is a corporation, and the

residence or business address and present principal occupation of each Reporting

Person who is a natural person:

(1) Clal Biotechnology Industries Ltd., ("CBI "), an Israeli public

corporation, with its principal office at the Triangular Tower, 45th floor, 3

Azrieli Center, Tel Aviv 67023, Israel. CBI is a holding company, the activities

of which consist of establishment, acquisition and development of companies in

the life science industry. The outstanding shares of CBI are listed for trading

on the Tel Aviv Stock Exchange ("TASE"). CBI owns directly Ordinary Shares of

the Issuer.

(2) Clal Industries and Investments Ltd. ("CLAL INDUSTRIES"), an Israeli

public corporation, with its principal office at the Triangular Tower, 45th

floor, 3 Azrieli Center, Tel Aviv 67023, Israel. Clal Industries is a holding

company whose principal holdings are in the industrial and technology sectors.

The outstanding shares of Clal Industries are listed for trading on the TASE.

CBI is a majority owned subsidiary of Clal Industries. Clal Industries owns

directly Ordinary Shares of the Issuer. By reason of Clal Industries' control of

CBI, Clal Industries may be deemed beneficial owner of, and to share the power

to vote and dispose of, the Ordinary Shares owned directly by CBI.

(3) IDB Development Corporation Ltd. ("IDB DEVELOPMENT"), an Israeli

private corporation, with its principal office at the Triangular Tower, 44(TH)

floor, 3 Azrieli Center, Tel Aviv 67023, Israel. IDB Development, through its

subsidiaries, organizes, acquires interests in, finances and participates in the

management of companies. Parts of the securities of IDB Development are listed

on the TASE. IDB Development owns the majority of the outstanding shares of, and

controls, Clal Industries. By reason of IDB Development's control of Clal

Industries, IDB Development may be deemed beneficial owner of, and to share the

power to vote and dispose of, the Ordinary Shares beneficially owned by Clal

Industries.

(4) IDB Holding Corporation Ltd., an Israeli public corporation ("IDB

HOLDINGS" or "IDBH"), with its principal office at the Triangular Tower, 44th

floor, 3 Azrieli Center, Tel Aviv 67023, Israel. IDB Holdings is a holding

company that, through its wholly owned subsidiary, IDB Development, organizes,

acquires interests in, finances and participates in the management of companies.

The outstanding shares of IDB Holdings are listed for trading on the TASE. By

reason of IDB Holdings' control of IDB Development, IDB Holdings may be deemed

beneficial owner of, and to share the power to vote and dispose of, the Ordinary

Shares owned beneficially by IDB Development.

Page 10 of 24 pages

The following persons, may by reason of their interests in and

relationships among them with respect to IDB Holdings be deemed to control the

corporations referred to in paragraphs (1) - (4) above:

(5) Mr. Nochi Dankner, whose address is the Triangular Tower, 44(TH) Floor, 3

Azrieli Center, Tel Aviv 67023, Israel. His present principal occupation is

Chairman and Chief Executive Officer of IDB Holding; Chairman of IDB Development

and Clal Industries; director of companies.

(6) Mrs. Shelly Bergman, whose address is 9, Hamishmar Ha'Ezrachi Street,

Afeka, Tel-Aviv, Israel. Her present principal occupation is director of

companies.

(7) Mrs. Ruth Manor, whose address is 26 Hagderot Street, Savion, Israel.

Her present principal occupation is director of companies.

(8) Mr. Avraham Livnat, whose address is 1 Taavura Junction, Ramle, Israel.

His present principal occupation is Managing Director of Taavura Holdings Ltd.,

an Israeli private company.

Ganden Holdings Ltd. ("GANDEN HOLDINGS"), a private Israeli company, holds,

directly and through Ganden Investments I.D.B. Ltd. ("GANDEN INVESTMENTS"), a

private Israeli company which is an indirect wholly owned subsidiary of Ganden

Holdings, approximately 55.26% of the issued share capital and voting rights of

IDBH as follows: Ganden Investments holds approximately 37.73% of the issued

share capital and voting rights of IDBH, and Ganden Holdings holds directly

approximately 17.53% of the issued share capital and voting rights of IDBH.

Shelly Bergman (one of the controlling shareholders of Ganden Holdings), holds

through a private Israeli company which is wholly owned by her, hold

approximately 4.23% of the issued share capital and voting rights of IDBH.

The controlling shareholders of Ganden Holdings are Nochi Dankner, who

holds, directly and through a company controlled by him, approximately 56.92% of

the issued share capital and voting rights of Ganden Holdings, and his sister,

Shelly Bergman, who held approximately 12.55% of the issued share capital and

voting rights of Ganden Holdings. The aforementioned controlling shareholders

are considered joint holders of approximately 69.47% of the issued share capital

and voting rights of Ganden Holdings by virtue, INTER ALIA, of a co-operation

and pre-coordination agreement between them.

Nochi Dankner's control in Ganden Holdings also arises from an agreement

signed by all the shareholders of Ganden Holdings, pursuant to which Nochi

Dankner was granted, INTER ALIA, veto rights at meetings of the Board of

Directors and the shareholders of Ganden Holdings and its subsidiaries.

Ruth Manor controls Manor Holdings B.A. Ltd. ("MANOR HOLDINGS"), a private

Israeli company, holds, directly and through Manor Investments - IDB Ltd.

("MANOR INVESTMENTS"), a private Israeli company, which is a subsidiary of Manor

Holdings, approximately 13.42% of the issued share capital and voting rights of

IDBH as follows: Manor Investments holds approximately 10.39% of the issued

share capital and voting rights of IDBH and Manor Holdings held directly

approximately 3.03% of the issued share capital and voting rights of IDBH.

Avraham Livnat controls Avraham Livnat Ltd. ("LIVNAT"), a private Israeli

company, holds directly and through Avraham Livnat Investments (2002) Ltd.

("LIVNAT INVESTMENTS"), a private Israeli company which is a wholly-owned

subsidiary of Livnat, approximately 13.43% of the issued share capital and

voting rights of IDBH as follows: Livnat Investments holds approximately 10.34%

of the issued share capital and voting rights of IDBH and Livnat holds directly

approximately 3.09% of the issued share capital and voting rights of IDBH.

Page 11 of 24 pages

Ganden Investments, Manor Investments and Livnat Investments entered into a

Shareholders Agreement dated May 19, 2003 (the "IDB SHAREHOLDERS AGREEMENT")

with respect to their ownership of shares of IDBH constituting in the aggregate

approximately 51.70% of the outstanding shares of IDBH (Ganden Investments -

31.02%; Manor Investments - 10.34%; Livant Investments - 10.34%), for the

purpose of maintaining and exercising control of IDBH as one single group of

shareholders. Any holdings of said entities in IDBH in excess of said 51.70% of

the issued share capital and voting rights of IDBH (as well as the direct

holdings of Ganden Holdings, Manor Holdings, Avraham Livnat Ltd. and Shelly

Bergman's wholly owned company in IDB Holdings) are not subject to IDB

Shareholders Agreement. The IDB Shareholders Agreement provides, among other

things, that Ganden will be the manager of the group as long as Ganden and its

permitted transferees will be the largest shareholders of IDBH among the parties

to the IDB Shareholders Agreement; that the parties to the IDB Shareholders

Agreement will vote together at shareholders' meetings of IDBH as shall be

determined according to a certain mechanism set forth therein; and that they

will exercise their voting power in IDB Holdings for electing their designees as

directors of IDBH and its direct and indirect subsidiaries. The term of the IDB

Shareholders Agreement is twenty years from May 19, 2003.

It is hereby clarified that the additional holdings in IDBH as follows:

Ganden Holdings - approximately 17.53%, Ganden Investments - approximately

6.71%, Shelly Bergman - approximately 4.23%, Manor Holdings - approximately

3.03%, Manor Investments - approximately 0.05% and Livnat - approximately 3.09%,

are not included in the IDBH Shareholders Agreement.

Manor Investments is a company owned by Isaac Manor and Ruth Manor. Isaac

Manor and Ruth Manor and their four children, Dori Manor, Tamar Manor Morel,

Michal Topaz and Sharon Vishnia, hold all of the shares of Manor Investments

through two private companies - Manor Holdings and Euro Man Automotive Ltd.

("EURO MAN"), as follows: Ruth and Isaac Manor hold all the shares of Manor

Holdings, which holds 60% of the shares of Manor Investments; In addition, Ruth

and Isaac Manor and their aforementioned children hold all of the shares of Euro

Man, which holds 40% of the shares of Manor Investments, as follows: Ruth Manor

and Isaac Manor each holds 10% of the shares of Euro Man; Dori Manor, Tamar

Manor Morel, Michal Topaz and Sharon Vishnia each hold 20% of the shares of Euro

Man.

Livnat Investments is wholly owned by Livnat, which is entirely held by

Avraham Livnat and his three sons, Zeev Livnat, Zvi Livnat and Shay Livnat, as

follows: Avraham Livnat holds 75% of the voting rights in Livnat and Zvi Livnat

hold 25% of the voting rights in Livnat. In addition, each of Messrs. Zeev

Livnat, Zvi Livnat and Shay Livnat hold, approximately 33.3% of the rights to

capital in Livnat.

By reason of the control of IDB Holdings by Nochi Dankner, Shelly Bergman,

Ruth Manor and Avraham Livnat, and the relations among them, as set forth above,

Nochi Dankner, Shelly Bergman, Ruth Manor and Avraham Livnat may each be deemed

beneficial owner of, and to share the power to vote and dispose of, the Ordinary

Shares beneficially owned by IDB Holdings.

The name, citizenship, residence or business address and present principal

occupation of the directors and executive officers of (i) CBI, (ii) Clal

Industries, (iii) IDB Holdings and (iv) IDB Development are set forth in

Exhibits 1, 2, 3 and 4 attached hereto, respectively, and incorporated herein by

reference.

(d) None of the Reporting Persons or, to the knowledge of the Reporting

Persons, any director or executive officer named in Exhibits 1, 2, 3 and 4 to

this Statement, has, during the last five years, been convicted in any criminal

proceeding, excluding traffic violations and similar misdemeanors.

Page 12 of 24 pages

(e) None of the Reporting Persons or, to the knowledge of the Reporting

Persons, any director or executive officer named in Exhibits 1, 2, 3 and 4 to

this Statement, has, during the last five years, been a party to a civil

proceeding of a judicial or administrative body of competent jurisdiction which

as a result of such proceeding was or is subject to a judgment, decree or final

order enjoining future violations of, or prohibiting or mandating activities

subject to, Federal or state securities laws or finding any violation with

respect to such laws.

(f) The Reporting Persons referred to in (5), (6), (7) and (8) above are

citizens of Israel.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

Item 5 of the Statement is hereby amended and restated in its entirety as

follows:

The Issuer has advised the Reporting Persons that there were 28,512,440

Ordinary Shares outstanding on March 31, 2009. The percentage of Ordinary Shares

outstanding owned by the Reporting Persons set forth in this Statement is based

on this number.

(a), (b) As of July 5, 2009:

(1) CBI is the beneficial owner, and shares with Clal Industries the power

to vote and dispose of 1,311,050 Ordinary Shares, constituting approximately

4.60% of the outstanding Ordinary Shares.

(2) Clal Industries directly owns 10,526 Ordinary Shares. It is the

beneficial owner, and shares with CBI the power to vote and dispose of,

1,321,576 Ordinary Shares owned in the aggregate by Clal Industries and CBI,

representing approximately 4.64% of the outstanding Ordinary Shares. Clal

Industries disclaims beneficial ownership of the CBI Shares.

(3) IDB Development is the beneficial owner, and may be deemed to share

with Clal Industries the power to vote and dispose of, 1,321,576 Ordinary Shares

beneficially owned by Clal Industries, representing approximately 4.64% of the

outstanding Ordinary Shares. IDB Development disclaims beneficial ownership of

the Ordinary Shares beneficially owned by Clal Industries.

(4) IDB Holdings and the Reporting Persons who are natural persons may be

deemed to share the power to vote and dispose of the 1,321,576 Ordinary Shares

beneficially owned by IDB Development, constituting approximately 4.64% of the

outstanding Ordinary Shares. IDB Holdings and the Reporting Persons who are

natural persons disclaim beneficial ownership of such shares.

Based on information furnished to the Reporting Persons, the Reporting

Persons are not aware of any executive officer or director named in Exhibit 1-4

to the Statement, beneficially owning any Ordinary Shares.

(c) None of the Reporting Persons or, to the Reporting Persons' knowledge, any

of the executive officers and directors named in Exhibits 1 through 4 to this

Statement, purchased or sold any Ordinary Shares in the sixty days preceding

July 5, 2009, except as set forth below:

Page 13 of 24 pages

CBI made the following sales of Ordinary Shares, all of which were made in open

market transactions on the NASDAQ:

AMOUNT OF ORDINARY PRICE PER SHARE

DATE SHARES (US $)

------------- --------------- ---------------

June 24, 2009 19,296 1.558

June 25, 2009 85,094 1.651

June 26, 2009 99,255 1.587

June 29, 2009 100,000 1.791

June 30, 2009 27,800 2.062

July 1, 2009 27,300 1.976

July 2, 2009 17,700 1.912

(d) Not applicable.

(e) Not applicable.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

Item 7 of the Statement is hereby amended and restated in its entirety as

follows:

Exhibit # Description

Exhibits 1-4 Name, citizenship, business address, present principal occupation

and employer of executive officers and directors of (1) CBI (2)

Clal Industries (3) IDB Development and (4) IDB Holding.

Exhibit 5 Joint Filing Agreement between Clal Industries and CBI

authorizing Clal Industries to file this Schedule 13D and any

amendments hereto (1)

Exhibit 6 Joint Filing Agreement between Clal Industries and IDB

Development authorizing Clal Industries to file this Schedule 13D

and any amendments hereto (1)

Exhibit 7 Joint Filing Agreement between Clal Industries and IDB Holding

authorizing Clal Industries to file this Schedule 13D and any

amendments hereto (1)

Exhibit 8 Joint Filing Agreement between Clal Industries and Mr. Dankner

authorizing Clal Industries to file this Schedule 13D and any

amendments hereto (1)

Exhibit 9 Joint Filing Agreement between Clal Industries and Mrs. Bergman

authorizing Clal Industries to file this Schedule 13D and any

amendments hereto (1)

Exhibit 10 Joint Filing Agreement between Clal Industries and Mrs. Manor

authorizing Clal Industries to file this Schedule 13D and any

amendments hereto (1)

Exhibit 11 Joint Filing Agreement between Clal Industries and Mr. Livnat

authorizing Clal Industries to file this Schedule 13D and any

amendments hereto (1)

(1) Previously filed as Exhibits 5-11 to Amendment No. 1 to the Schedule 13D

with the SEC on July 31, 2008, and incorporated herein by reference.

Page 14 of 24 pages

SIGNATURE

After reasonable inquiry and to the best of knowledge and belief of the

undersigned, the undersigned hereby certify that the information set forth in

this Statement is true, complete and correct.

Dated: July 20, 2009

CLAL BIOTECHNOLOGY INDUSTRIES LTD.

IDB DEVELOPMENT CORPORATION LTD.

IDB HOLDING CORPORATION LTD.

NOCHI DANKNER

SHELLY BERGMAN

AVRAHAM LIVNAT

RUTH MANOR

By: CLAL INDUSTRIES AND INVESTMENTS LTD.

/s/ Yehuda Ben Ezra, /s/ Gonen Bieber

-------------------------------------

Yehuda Ben Ezra, and Gonen Bieber authorized

signatories of Clal Industries and Investments

Ltd. for itself and on behalf of Clal

Biotechnology Industries Ltd., IDB Holding

Corporation Ltd, IDB Development Corporation

Ltd., Nochi Dankner, Shelly Bergman, Avraham

Livnat and Ruth Manor pursuant to the agreements

annexed as exhibits 5-11 to this Schedule 13D.

Page 15 of 24 pages

Exhibit 1

(Information provided as of July 20, 2009 in response

to Items 2 through 6 of Schedule 13D)

Executive Officers and Directors of

Clal Biotechnology Industries Ltd.

Address is: Azrieli Center, Triangular Tower, Tel Aviv 67023, Israel

(Citizenship the same as country of residence unless otherwise noted)

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Avi Fischer Chairman of the Board Executive Vice President of IDB

3 Azrieli Center, Holding; Deputy Chairman of IDB

Triangular Tower, Development; Co-Chief Executive

Tel Aviv, Israel Officer of Clal Industries and

Investments Ltd.

Aahron Schwartz Director Vice President of Teva Pharmaceutical

5 Basel St. Industries Ltd.

Petach Tikva, Israel

Gavriel Barabash Director General Director of Sourasky Medical

17 Beny Neviim st. Center, Tel Aviv

Ramt Gan. Israel

Tamar Manor Morel* Director CTO Biotechnology of Clal Industries

3 Azrieli Center, and Investments Ltd.

Triangular Tower,

Tel Aviv, Israel

Jonathan Kaplan Director Controlling shareholder of Jonathan

7 Jabotinsky st. Kaplan consulting & Investments

Ramt - Gan, Israel Ltd.

Ehud Raanani External Director Department Director of Cardiac Surgery,

69 Hapards st. Sheba Medical Center Tel Hashomer.

Hod - Hasharon, Israel

Avraham Zigelman External Director Director of Companies

8 Ori Caesary st.

Tel Aviv, Israel

Ruben Krupik Chief Executive officer Chief Executive officer of Clal

14 A Abba Hill Silver st. Biotechnology Industries Ltd and Arte

Ramt Gan, Israel Venture Group Ltd.

Amos Bankirer Vice President Partner of Arte Venture Group Ltd.

14 A Abba Hill Silver st.

Ramt Gan, Israel

Gil Milner Vice President Financial Financial Manager and Comptroller of

14 A Abba Hill Silver st. Manager and Comptroller. Clal Biotechnology Industries Ltd.

Ramt Gan, Israel

Page 16 of 24 pages

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Nitsa Einan Vice President and General Counsel of Clal Industries and

3 Azrieli Center, General Counsel. Investments Ltd. and Clal Biotechnology

Triangular Tower, Industries Ltd.

Tel Aviv, Israel

Ofer Goldberg Vice President Group Partner and Director of Arte

14 A Abba Hill Silver st. Venture Ltd.

Ramt Gan, Israel

Ofer Gonen Vice President Partner and Director of Arte Venture

14 A Abba Hill Silver st. Group Ltd.

Ramt Gan, Israel

Joshua Hazenfrtz Internal Auditor Internal Auditor of Clal Biotechnology

52 Menahem Begin Road Industries Ltd.

Ramt Gan, Israel

*Mrs. Tamar Manor Morel is a citizen of Israel and France.

Page 17 of 24 pages

Exhibit 2

(Information provided as of July 20, 2009 in response

to Items 2 through 6 of Schedule 13D)

Executive Officers and Directors of

Clal Industries and Investments Ltd.

Address is: 3 Azrieli Center, Triangle Tower, Tel Aviv 67023, Israel

(Citizenship the same as country of residence unless otherwise noted)

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Nochi Dankner Chairman of the Board of Chairman and Chief Executive Officer

3 Azrieli Center, Directors and Co-Chief of IDB Holding; Chairman of IDB

the Triangular Tower 44(TH) floor, Executive. Development, DIC and Clal Industries

Tel Aviv 67023, Israel and Investments Ltd.; Businessman

and Director of companies

Avi Fischer Director Executive Vice President of IDB

3 Azrieli Center, Holdings; Deputy Chairman of IDB

the Triangular Tower 45(TH) floor, Development; Co-Chief Executive

Tel Aviv 67023, Israel Officer of Clal Industries and

Investments Ltd.

Refael Bisker Director Chairman of Property and Building

3 Azrieli Center, Corporation Ltd.; Co-Chairman of

the Triangular Tower 44(TH) floor, Super-Sol Ltd.

Tel Aviv 67023, Israel

Marc Schimmel* Director Director of UKI Investments

54-56 Euston St.,

London NW1 U.K.

Yecheskel Dovrat Director Economic consultant and director

1 Nachshon St., of companies.

Ramat Hasharon, Israel.

Eliahu Cohen Director Chief Executive Officer of IDB

3 Azrieli Center, Development.

the Triangular Tower 44(TH) floor,

Tel Aviv 67023, Israel

Shay Livnat Director President of Zoe Holdings Ltd.

31 HaLechi St.,

Bnei Brak 51200, Israel

David Leviatan Director Director of Companies.

18 Mendele St.,

Herzeliya, Israel

Page 18 of 24 pages

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Isaac Manor** Director Chairman of companies in the motor

26 Hagderot St., vehicle sector of the David Lubinski

Savion, Israel Ltd. Group.

Dori Manor** Director Chief Executive Officer of companies

17 Kerem Hazitim St., in the motor vehicle sector of the

Savion, Israel David Lubinski Ltd. group.

Adiel Rosenfeld, Director Representative in Israel of Aktiva

42 Ha'Alon St., group.

Timrat 36576, Israel

Liora Polachek External Director Independent Lawyer, Partner and

46 He Beiyyar st., Director at Sitan Polachek Attorney.

Tel Aviv, Israel

Zeev Ben- Asher External Director Managers Coacher and organizational

20 Carmely st., consultant.

Ramt- Gan, Israel

Zvi Livnat Co- Chief Executive Executive Vice President of IDB

3 Azrieli Center, Holding; Deputy Chairman of IDB

the Triangular Tower 45(TH) floor, Development; Co-Chief Executive

Tel Aviv 67023, Israel Officer of Clal Industries and

Investments Ltd.

Boaz Simons, Senior Vice President Vice President of Clal Industries and

3 Azrieli Center, Investments Ltd.

the Triangular Tower 45(TH) floor,

Tel Aviv 67023, Israel

Guy Rosen, Senior Vice President Vice President of Clal Industries and

3 Azrieli Center, Investments Ltd. Chairman of Israir

the Triangular Tower 45(TH) floor, Airlines and Truism Ltd

Tel Aviv 67023, Israel

Gonen Bieber,*** Vice President and Financial Manager of Clal Industries

3 Azrieli Center, Financial Manager. and Investments Ltd.

the Triangular Tower 45(TH) floor,

Tel Aviv 67023, Israel

Nitsa Einan Vice President and General General Counsel of Clal Industries

3 Azrieli Center, Counsel. and Investments Ltd. and Clal

the Triangular Tower 45(TH) floor, Biotechnology Industries Ltd.

Tel Aviv 67023, Israel

Yehuda Ben Ezra Vice President and Comptroller of Clal Industries and

3 Azrieli Center, Comptroller. Investments Ltd.

the Triangular Tower 45(TH) floor,

Tel Aviv 67023, Israel

Page 19 of 24 pages

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Tal Mund Vice President Business Development of Clal

3 Azrieli Center, Industries and Investments Ltd.

the Triangular Tower 45(TH) floor,

Tel Aviv 67023, Israel

Ilan Amit, Internal Auditor Internal Auditor of Clal Industries

3 Azrieli Center, and Investments Ltd.

the Triangular Tower 45(TH) floor,

Tel Aviv 67023, Israel

* Mr. Mark Schimmel is a citizen of Great Britain.

** Mr. Isaac Manor and Mr. Dori Manor are citizens of Israel and France

*** Mr. Gonen Bieber is a citizen of Israel and the Republic of Germany.

Page 20 of 24 pages

Exhibit 3

(Information provided as of July 20, 2009 in response

to Items 2 through 6 of Schedule 13D)

Executive Officers and Directors of

IDB Development Corporation Ltd.

Address is: 3 Azrieli Center, Triangular Tower, Tel Aviv 67023, Israel

(Citizenship the same as country of residence unless otherwise noted)

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Nochi Dankner Chairman of the Chairman and Chief Executive Officer of

3 Azrieli Center, Board of Directors IDB Holding; Chairman of IDB

The Triangular Tower, 44(TH) floor, Development, DIC and Clal Industries

Tel-Aviv 67023, Israel and Investments Ltd.; Businessman and

Director of companies.

Zehava Dankner Director Director of companies.

64 Pinkas Street,

Tel Aviv 62157, Israel

Avi Fischer Deputy Chairman of Executive Vice President of IDB Holding;

3 Azrieli Center, the Board of Deputy Chairman of IDB Development;

The Triangular Tower, 45(TH) floor, Directors Co-Chief Executive Officer of Clal

Tel-Aviv 67023, Israel Industries and Investments Ltd.

Zvi Livnat Deputy Chairman of Executive Vice President of IDB Holding;

3 Azrieli Center, the Board of Deputy Chairman of IDB Development;

The Triangular Tower, 45(TH) floor, Directors Co-Chief Executive Officer of Clal

Tel-Aviv 67023, Israel Industries and Investments Ltd.

Refael Bisker Director Chairman of Property and Building

3 Azrieli Center, Corporation Ltd.; Co-Chairman of

The Triangular Tower, 44(TH) floor, Shufersal Ltd.

Tel-Aviv 67023, Israel

Jacob Schimmel Director Co- Managing Director of UKI

7 High field Gardens, Investments.

London NW11 9HD, United Kingdom

Shay Livnat Director President of Zoe Holdings Ltd.

3 Azrieli Center,

The Triangular Tower, 45(TH) floor,

Tel-Aviv 67023, Israel

Eliahu Cohen Director and Chief Chief Executive Officer of IDB

3 Azrieli Center, Executive Officer Development.

The Triangular Tower 44(TH) floor,

Tel-Aviv 67023, Israel

Isaac Manor (*) Director Chairman of companies in the motor

103 Kahanman Street, vehicle sector of the David Lubinski

Bnei brak 51553, Israel Ltd. group.

Page 21 of 24 pages

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Dori Manor (*) Director Chief Executive Officer of companies in

103 Kahanman Street, the motor vehicle sector of the David

Bnei brak 51553, Israel Lubinski Ltd. group.

Abraham Ben Joseph Director Director of companies.

87 Haim Levanon Street,

Tel-Aviv 69345, Israel

Amos Malka Director Director of companies

18 Nahal Soreq Street,

Modi'in 71700, Israel

Prof. Yoram Margalioth Director Senior lecturer (expert on tax laws) at

16 Ha'efroni Street, the Faculty of Law in the Tel Aviv

Raanana 43724, Israel University.

Irit Izakson Director Director of companies.

15 Great Matityahou Cohen Street,

Tel-Aviv 62268, Israel

Lior Hannes Senior Executive Senior Executive Vice President of IDB

3 Azrieli Center, Vice President Development; Chief Executive Officer of

The Triangular Tower, 44(TH) floor, IDB Investments (U.K.) Ltd.

Tel-Aviv 67023, Israel

Dr. Eyal Solganik Executive Vice Executive Vice President and Chief

3 Azrieli Center, President and Chief Financial Officer of IDB Development;

The Triangular Tower, 44(TH) floor, Financial Officer Chief Financial Officer of IDB Holding.

Tel-Aviv 67023, Israel

Ari Raved Vice President Vice President of IDB Development.

3 Azrieli Center,

The Triangular Tower, 44(TH) floor,

Tel-Aviv 67023, Israel

Gonen Bieber ** Vice President Vice President of IDB Development

3 Azrieli Center,

The Triangular Tower, 45(TH) floor,

Tel-Aviv 67023, Israel

Haim Gavrieli Executive Vice Executive Vice President of IDB

3 Azrieli Center, President Development.

The Triangular Tower, 44(TH) floor,

Tel-Aviv 67023, Israel

Haim Tabouch Vice President and Vice President and Comptroller of IDB

3 Azrieli Center, Comptroller Development; Comptroller of IDB Holding.

The Triangular Tower, 44(TH) floor,

Tel-Aviv 67023, Israel

Inbal Tzion Vice President and Vice President and Corporate Secretary

3 Azrieli Center, Corporate Secretary of IDB Development; Corporate Secretary

The Triangular Tower, 44(TH) floor, of IDB Holding.

Tel-Aviv 67023, Israel

Ilan Amit, Internal Auditor Internal Auditor of IDB Development

3 Azrieli Center, Corporation Ltd.

the Triangular Tower 45(TH) floor,

Tel Aviv 67023, Israel

(*) Mr. Issac Manor and Mr. Dori Manor are citizens of Israel and France.

(**) Mr. Bieber is a citizen of Israel and the Republic of Germany.

Page 22 of 24 pages

EXHIBIT 4

(Information provided as of July 20, 2009 in response

to Items 2 through 6 of Schedule 13D)

Executive Officers, Directors and Persons Controlling

IDB Holding Corporation Ltd.

Address is: 3 Azrieli Center, Triangular Tower, Tel Aviv 67023, Israel

(citizenship is Israel, unless otherwise noted)

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Nochi Dankner Chairman of the Chairman and Chief Executive Officer of

3 Azrieli Center, Board of Directors IDB Holding; Chairman of IDB

The Triangular Tower, 44(TH) floor, and Chief Executive Development, DIC and Clal Industries and

Tel-Aviv 67023, Israel Officer Investments Ltd.; Businessman and

Director of companies.

Isaac Manor (*) Deputy Chairman of Chairman of companies in the motor

103 Kahanman Street, the Board of vehicle sector of the David Lubinski

Bnei brak 51553, Israel Directors Ltd. group.

Arie Mientkavich Vice Chairman of Chairman of Elron; Deputy Chairman of

14 Betzalel Street, the Board of Gazit-Globe Ltd. and Chairman of

Jerusalem 94591,Israel Directors Gazit-Globe Israel (Development) Ltd.

Zehava Dankner Director Director of companies.

64 Pinkas Street,

Tel Aviv 62157, Israel

Lior Hannes Director Senior Executive Vice President of IDB

3 Azrieli Center, Development; Chief Executive Officer of

The Triangular Tower, 44(TH) floor, IDB Investments (U.K.) Ltd.

Tel-Aviv 67023, Israel

Refael Bisker Director Chairman of Property and Building

3 Azrieli Center, Corporation Ltd.; Co-Chairman of

The Triangular Tower, 44(TH) floor, Shufersal Ltd.

Tel-Aviv 67023, Israel

Jacob Schimmel Director Co- Managing Director of UKI

7 High field Gardens, Investments.

London NW11 9HD, United Kingdom

Shaul Ben-Zeev Director Chief Executive Officer of Avraham

Taavura Junction, Livnat Ltd.

Ramle 72102, Israel

Eliahu Cohen Director Chief Executive Officer of IDB

3 Azrieli Center, Development.

The Triangular Tower, 44(TH) floor,

Tel-Aviv 67023, Israel

Page 23 of 24 pages

NAME & ADDRESS POSITION CURRENT PRINCIPAL OCCUPATION

-------------- -------- ----------------------------

Dori Manor (*) Director Chief Executive Officer of companies in

103 Kahanman Street, the motor vehicle sector of the David

Bnei brak 51553, Israel Lubinski Ltd. group.

Meir Rosenne Director Attorney.

8 Oppenheimer Street, Ramat Aviv,

Tel Aviv 69395, Israel

Shmuel Lachman External Director Information technology consultant.

9A Khilat Jatomir Street,

Tel Aviv 69405, Israel

Zvi Dvoresky External Director Chief Executive officer of Beit Kranot

3 Biram Street, Trust Ltd.

Haifa 34986, Israel

Zvi Livnat Director and Executive Vice President of IDB Holding;

3 Azrieli Center, Executive Vice Deputy Chairman of IDB Development;

The Triangular Tower, 45(TH) floor, President Co-Chief Executive Officer of Clal

Tel-Aviv 67023, Israel Industries and Investments Ltd.

Avi Fischer Executive Vice Executive Vice President of IDB Holding;

3 Azrieli Center, President Deputy Chairman of IDB Development;

The Triangular Tower, 45(TH) floor, Co-Chief Executive Officer of Clal

Tel-Aviv 67023, Israel Industries and Investments Ltd.

Dr. Eyal Solganik Chief Financial Chief Financial Officer of IDB Holding;

3 Azrieli Center, Officer Executive Vice President and Chief

The Triangular Tower, 44(TH) floor, Financial Officer of IDB Development.

Tel-Aviv 67023, Israel

Haim Tabouch Comptroller Comptroller of IDB Holding; Vice

3 Azrieli Center, President and Comptroller of IDB

The Triangular Tower, 44(TH) floor, Development.

Tel-Aviv 67023, Israel

Ilan Amit, Internal Auditor Internal Auditor of IDB Holding

3 Azrieli Center, Corporation Ltd.

the Triangular Tower 45(TH) floor,

Tel Aviv 67023, Israel

* Mr. Issac Manor and Mr. Dori Manor are citizens of Israel and France.

Page 24 of 24 pages

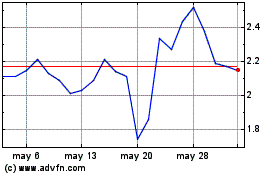

Compugen (NASDAQ:CGEN)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Compugen (NASDAQ:CGEN)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024