Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

13 Septiembre 2024 - 4:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, DC 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2024

Commission File No. 001-36848

Check-Cap Ltd.

Check-Cap Building Abba Hushi Avenue

P.O. Box 1271

Isfiya, 3009000, Mount Carmel, Israel

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES.)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

This Form 6-K is being incorporated by reference

into Check-Cap Ltd.’s Registration Statements on Form F-3 (File No. 333-211065, 333-225789 and 333-262401) and Form S-8 (File No.

333-203384, 333-226490 and 333-259666) filed with the Securities and Exchange Commission, to be a part thereof from the date on which

this Report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

Appointment of Director

On September

5, 2024, the Board of Directors (the “Board”) of Check-Cap Ltd. (the “Company”) appointed

Carlos Cheung to serve as a director to hold office until the next annual meeting of shareholders of the Company, or until earlier resignation

or removal, to fill an existing vacancy of the Board, as set forth in Article 42 of the Company’s Articles of Association.

Appointment of Interim Chief Financial Officer

On September

8, 2024, the Company appointed David Benaim as the Company’s Interim Chief Financial Officer of the Company (the “Interim

CFO”) to replace Iris Even-Tov who departed the Company. In connection with Mr. Benaim’s appointment as Interim CFO, the Company

entered into a Services Agreement by and between the Company and Mr. Benaim (the “Services Agreement”). Pursuant to the Services

Agreement, the Company will pay Mr. Benaim a monthly fee in an amount equal to US$12,000 in consideration of his services. Additionally,

in the event that the Company is required to prepare and Mr. Benaim plays a lead role in preparing an audited annual financial statement

of the Company for the 2024 fiscal year, the Company will pay Mr. Benaim an additional US$25,000.

Entry into a Loan Agreement and Amending

Letter

On September 8, 2024, the Board approved and ratified

a Loan Agreement (the “Loan Agreement”) with Nobul AI Corp. (“Nobul”). Pursuant to the Loan Agreement, the Company

agreed to provide Nobul a loan (the “Loan”) in the principal amount of US$6.0 million. The principal outstanding under the

Loan will bear interest at 5% per annum, both before and after demand, default, and judgment, and will be payable annually in arrears.

The aggregate amount of the Loan and any accrued and unpaid interest thereon will be due and be paid on the date that is 30 days following

the date the Business Combination Agreement, dated March 25, 2024, entered into by and between the Company and Nobul (the “BCA”),

is terminated or the business combination contemplated thereunder is consummated.

In addition, on September 8, 2024, the Board approved

and ratified an amending letter (the “Amending Letter”) with Nobul. The Amending Letter amends the BCA and obligates the Company

to deposit US$11.0 million into a designated, segregated and interest-bearing bank account. Funds deposited into this account may be disbursed

upon the mutual written agreement of the designated representatives of Nobul and the Company (being their respective board chairs) in

order to fund the pursuit of accretive acquisition targets or other growth initiatives of Nobul and for no other purpose. Any funds so

disbursed will reduce the Net Cash Target (as defined in the BCA) on a dollar-for-dollar basis. In the event that the BCA is terminated,

then, subject to the payment of any termination fees triggered by Section 9.3(c) of the BCA, funds remaining in the segregated account

upon termination, together with interest earned thereon, will accrue to and will be for the account and benefit of the Company.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Check-Cap Ltd. |

| |

|

|

| Date: September 13, 2024 |

By: |

/s/ David Lontini |

| |

|

Name: |

David Lontini |

| |

|

Title: |

Board Chair, Check-Cap Ltd. |

2

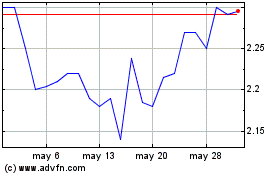

Check Cap (NASDAQ:CHEK)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Check Cap (NASDAQ:CHEK)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024