Filed

pursuant to Rule 424(b)(3)

Under

the Securities Act of 1933, as amended

Registration

No. 333-283438

PROSPECTUS

405,125 Shares of Common Stock

Pursuant to this prospectus, the selling stockholders

identified herein are offering on a resale basis an aggregate of 405,125 shares (the “Shares”) of common stock, par value

$0.00001 per share, of Cyngn Inc.

We are not selling any shares of our common stock

under this prospectus and will not receive any of the proceeds from the sale of the Shares by the selling stockholders.

The selling stockholders may sell or otherwise

dispose of the Shares in a number of different ways and at varying prices. We provide more information about how the selling stockholders

may sell or otherwise dispose of the Shares covered by this prospectus in the section entitled “Plan of Distribution” on page

13. Discounts, concessions, commissions and similar selling expenses attributable to the sale of the Shares will be borne by the selling

stockholders. We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses) relating to the registration

of the Shares with the Securities and Exchange Commission (the “SEC”).

Our common stock is listed on the Nasdaq Capital Market

under the symbol “CYN”. On November 22, 2024, the last reported sale price of our common stock on the Nasdaq Capital Market

was $6.10 per share.

Investing in our securities involves a high

degree of risk. See “Risk Factors” beginning on page 8 of this prospectus and under similar headings in the documents incorporated

by reference into this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is December 6, 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we have filed with the SEC pursuant to which the selling stockholder named herein may, from time to time, offer and sell or otherwise

dispose of the shares of our common stock covered by this prospectus. You should not assume that the information contained in this prospectus

is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated

by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered

or shares of common stock are sold or otherwise disposed of on a later date. It is important for you to read and consider all information

contained in this prospectus, including the documents incorporated by reference therein, in making your investment decision. You should

also read and consider the information in the documents to which we have referred you under “Where You Can Find More Information”

and “Information Incorporated by Reference” in this prospectus.

We have not authorized anyone to give any information

or to make any representation to you other than those contained or incorporated by reference in this prospectus. You must not rely

upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus does not constitute

an offer to sell or the solicitation of an offer to buy any of our shares of common stock other than the shares of our common stock covered

hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction

to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of

this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as

to the offering and the distribution of this prospectus applicable to those jurisdictions.

PROSPECTUS SUMMARY

This summary highlights information contained

in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider

in making your investment decision. You should read the entire prospectus carefully before making an investment in our securities. You

should carefully consider, among other things, our financial statements and the related notes and the sections entitled “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in, or

incorporated by reference into, this prospectus.

When we refer to Cyngn Inc., and its subsidiaries,

we use the terms “Cyngn,” the “Company,” “us,” “we” and “our.”

Overview

We are an autonomous vehicle

(“AV”) technology company that is focused on addressing industrial uses for autonomous vehicles. We believe that technological

innovation is needed to enable adoption of autonomous industrial vehicles that will address the substantial industry challenges that exist

today. These challenges include labor shortages, high labor costs and work safety.

We integrate our full-stack

autonomous driving software, DriveMod, onto vehicles manufactured by Original Equipment Manufacturers (“OEM”) either via retrofit

of existing vehicles or by integration directly into vehicle assembly. We design the Enterprise Autonomy Suite (“EAS”) to

be compatible with sensors and components from leading hardware technology providers and integrate our proprietary AV software to produce

differentiated autonomous vehicles.

Autonomous driving has common

technological building blocks that remain similar across vehicles and applications. By tapping into these building blocks, DriveMod is

designed to deliver autonomy to new vehicles via streamlined hardware/software integration. This vehicle-agnostic approach enables DriveMod

to expand to new vehicles and novel operational design domains (“ODD”). In short, nearly every industrial vehicle, regardless

of use case, can move autonomously using our technology.

Our approach accomplishes

several primary value propositions:

| |

1. |

Provide autonomous capabilities to industrial vehicles built by established manufacturers that are already trusted by customers. |

| |

|

|

| |

2. |

Generate continual customer value by leveraging the synergistic relationship of autonomous vehicles and data. |

| |

|

|

| |

3. |

Develop consistent autonomous vehicle operation and user interfaces for diverse vehicle fleets. |

| |

|

|

| |

4. |

Complement the core competencies of existing industry players by introducing the leading-edge technologies like Artificial Intelligence (“AI”) and Machine Learning (“ML”), cloud/connectivity, sensor fusion, high-definition mapping, and real-time dynamic path planning and decision making. |

We believe our market positioning

as a technology partner to vehicle manufacturers creates a synergy with incumbent suppliers that already have established sales, distribution,

and service/maintenance channels. By focusing on industrial use cases and partnering with the incumbent OEMs in these markets, we believe

we can source and execute revenue-generating opportunities more quickly.

Our long-term vision is for

EAS to become a universal autonomous driving solution with minimal marginal cost for companies to adopt new vehicles and expand their

autonomous fleets across new deployments. We have already deployed DriveMod software on more than ten different vehicle form factors that

range from stockchasers and stand-on floor scrubbers to 14-seat shuttles and electric forklifts as part of prototypes and proof of concept

projects, demonstrating the extensibility of our AV building blocks.

Our recent progress contributes

to the validation of EAS with OEM partners and end customers. We also continue to build upon our ability to scale our products and generate

novel technological developments. The DriveMod Stockchaser became commercially available in early 2023 starting with the deployment from

our partner-customer US Continental, a California-based leading manufacturer of quality leather and fabric care products. We also launched

the DriveMod Forklift and the DriveMod Tugger as we expand our vehicle-type portfolio fleet through our OEM partnership with BYD and Motrec,

respectively. The DriveMod Tugger was commercially released in early 2024 and is deployed with John Deere and additional paying

customers that have not yet been disclosed.

We secured paid projects with

leading global customers like Arauco, along with additional projects from big brands in the Global 500 and the Fortune 100. Our patent

portfolio expanded with 16 new U.S. patent grants in 2023 and 2 granted in 2024, bringing the total grants to 21.

We intend to continue to pursue

and win additional license agreements with companies that depend heavily on the use of material handling vehicles and that all recognize

the need for automation to i) compete in todays economy, ii) combat the significant labor shortages and escalating costs, and iii) improve

safety. Our approach to securing these opportunities will be a continued direct sales effort coupled with increasing our network of industrial

vehicle dealers that already have significant sales of industrial vehicles.

Our Products

EAS is a suite of technology

and tools that consists of three complementary categories: DriveMod, Cyngn Insight, and Cyngn Evolve.

DriveMod: Industrial Autonomous Vehicle System

We built DriveMod as a modular

software product that is compatible with various sensor and computer hardware components that are widely used throughout the autonomous

vehicle industry. Our software combined with sensors and components from industry leading technology providers covers the end-to-end requirements

that enable vehicles to operate autonomously with leading-edge technology. The modularity of DriveMod allows our AV technology to be compatible

across vehicle platforms as well as indoor and outdoor environments. DriveMod can be retrofitted to existing vehicle assets or integrated

into a manufacturing partner’s vehicles at assembly, providing accessible options for our customers to integrate leading-edge technology

whether their AV adoption strategies are evolutionary or revolutionary.

The core vehicle-agnostic

DriveMod software stack is targeted and deployed to different vehicles through DriveMod Kits, which are the AV hardware systems

that take into account the specific needs of operating the DriveMod software on a specific target vehicle. Then, after prototyping and

productization, DriveMod kits streamline the integration AV hardware and software integration onto vehicles at scale. We expect to create different instances of DriveMod

Kits to support the commercial release of new vehicles on the EAS platform, such as the electric forklifts and other industrial vehicles.

Figure 1: Overview of Cyngn’s autonomous

vehicle technology (DriveMod)

DriveMod’s flexibility

combines with our network of manufacturing and service partners to support customers at different stages of autonomous technology integration.

This allows customers to grow the complexity and scope of their industrial autonomy deployments as their business transforms while continually

capturing returns throughout their transition to full autonomy. EAS will also grant customers access to over-the-air software upgrades,

ad hoc customer support, and flexible consumption based on usage and scale of operations. By lessening both the commercial and technical

burdens of traditional vehicle automation and industrial robotics investments, industrial AVs can become universally available to the

market, even reaching small and medium-sized businesses that may otherwise struggle to adopt Industry 4.0 and 5.0 technology.

Cyngn Insight: Intelligent Control Center

Cyngn Insight is the customer-facing

tool suite for managing AV fleets and aggregating data to extract business insights. Analytics dashboards surface data about the system’s

status, vehicle telemetry, and performance metrics. Cyngn Insight also provides tools to switch between autonomous, manual, and remote

operation when required. This flexibility allows customers to use the autonomous capabilities of the system in a way that is tailored

to their own operational environment. Customers can choose when to operate their DriveMod-powered vehicles autonomously and when to have

human operators operate the vehicles manually or remotely based on their own business needs. When combined, these capabilities and tools

make up the Cyngn Insight intelligent control center that enables flexible fleet management from any location.

Cyngn Insight’s tool

suite includes configurable cloud dashboards that aggregate diverse data streams at several levels of granularity (i.e., site, fleet,

vehicle, module, and component). We can collect data during “open loop” vehicle operation, meaning that the vehicles can be

operated manually while still collecting the rich data enabled by the advanced on-vehicle sensors and computers. Data can be used for

predictive maintenance, operational improvements, educating employees on digital transformation and more.

Cyngn Evolve: Data Optimization Tools

Cyngn Evolve is our internal

tool suite that underpins the relationship between AVs and data. Through a unifying cloud-based data infrastructure, our proprietary data

tools strengthen the positive network effects derived from the valuable new data created by AVs. Cyngn Evolve and its data pipelines facilitate

AI/ML training and deployment, manage data sets, and support driving simulation and grading to test and validate new DriveMod releases,

using both real-world and simulated data.

Figure 2: The Cyngn “AnyDrive”

simulation is part of the Cyngn Evolve toolchain. The simulation environment creates a digital version of the physical world. This allows

for customer data sets to be leveraged and augmented to achieve testing and validation prior to releasing new AV features.

As AV technology expertise

matures globally, there may be opportunities to monetize the sophisticated AV-centric tools of Cyngn Evolve. Currently, we believe that

AV development is confined to small groups of experts. Therefore, Cyngn Evolve is currently an internal EAS tool that we use to advance

DriveMod and Cyngn Insight, our customer-facing EAS products.

Intellectual Property Portfolio

Our ability to drive impact

and growth within the autonomous industrial vehicle market largely depends on our ability to obtain, maintain, and protect our intellectual

property and all other property rights related to our products and technology. To accomplish this, we utilize a combination of patents,

trademarks, copyrights, and trade secrets as well as employee and third-party non-disclosure agreements, licenses, and other contractual

obligations. In addition to protecting our intellectual property and other assets, our success also depends on our ability to develop

our technology and operate without infringing, misappropriating, or otherwise violating the intellectual property and property rights

of third parties, customers, and partners.

Our software stack has over

30 subsystems, including those designed for perception, mapping & localization, decision making, planning, and control. As of the

date of this prospectus, we have 21 granted U.S. patents and submitted 4 pending U.S. patent and expect to continue to file additional

patent applications with respect to our technology in the future.

Recent Developments

Public Offering

On April 23, 2024, the Company

entered into an underwritten Agreement with Aegis Capital Corp. (“Aegis”), pursuant to which Aegis acted as the Company’s

underwriter on a firm commitment basis in connection with the sale by the Company of an aggregate of 500,000 shares of common stock

in a public offering, which included: (i) 198,000 shares of common stock, and (ii) pre-funded warrants to purchase 302,000 shares

of common stock. The Pre-Funded Warrants had a nominal exercise price of $0.00001. Each share of common stock was sold at an offering

price of $0.10, and each Pre-Funded Warrant was sold at an offering price of $0.09999. On May 3, the Company closed on the sale of an

additional 20,400 shares of common stock, upon exercise by the underwriter of the over-allotment option. The Company received gross proceeds

of approximately $5.2 million before deducting transaction related expenses payable by the Company.

Amended Bylaws

On May 7, 2024, we amended

our Amended and Restated Bylaws (the “Amended Bylaws”), for the purpose of reducing the quorum required to hold meetings of

the stockholders of the Company (the “Quorum Requirement”). The Amended Bylaws reduced the Quorum Requirement from a majority

to one-third (1/3rd) of the voting power of the shares of stock issued and outstanding and entitled to vote at the meeting. The Amended

Bylaws was approved by the Board of Directors of the Company on May 7, 2024.

Reverse Stock Split

At the Annual Meeting of Stockholders

on June 25, 2024, the stockholders of the Company approved the grant of discretionary authority to the board of directors of the Company

to effect a reverse stock split of its outstanding shares of common stock at a specific ratio within a range of one-for-five (1-for-5)

to a maximum of a one-for-one hundred (1-for-100) split. On July 3, 2024, we implemented a 1-for-100 reverse stock split (the “Reverse

Stock Split”) of our common stock. As a result of the Reverse Stock Split, every one hundred (100) shares of our pre-Reverse Stock

Split common stock were combined and reclassified into one share of our common stock. The number of shares of common stock subject to

outstanding options and warrants were also reduced by a factor of one hundred and the exercise price of such securities increased by a

factor of one hundred effective as of July 3, 2024. Our common stock commenced trading on a post- reverse stock split basis on July 5,

2024.

NASDAQ Compliance

On July 19, 2024, the Company

was notified by Nasdaq that the Company has regained compliance with the bid price requirement as set forth in Listing Rule 5550(a)(2),

and that the Company is therefore in compliance with the Nasdaq Capital Market’s listing requirements and will remain listed on

Nasdaq.

Private Placement

On November 12, 2024, the

Company entered into a Securities Purchase Agreement (the “SPA”) with the selling stockholders pursuant to which we sold,

in a private placement, notes with an aggregate principal amount of $4,375,000 (the “Notes”), and received proceeds before

expenses of $3,500,000. As consideration for entering into the SPA, we issued a total of 405,125 shares of common stock of the Company

to the selling stockholders on November 13, 2024.

In connection with the Purchase

Agreement, the Company entered into a registration rights agreement with the Purchasers (the “Registration Rights Agreement”).

Pursuant to the Registration Rights Agreement, we are required to file a resale registration statement, or the Registration Statement,

with the SEC to register for resale the 405,125 shares of common stock by November 28, 2024, and to have such Registration Statement declared

effective within thirty days of filing (sixty days in the event the Registration Statement is reviewed by the SEC). We will be obligated

to pay liquidated damages to the selling stockholders if we fail to file the resale registration statement when required, fail to request

effectiveness within five trading days after being notified that the Registration Statement will not be reviewed or not subject to further

review, fails to respond to comments to the Registration statement within ten calendar days, fail to cause the Registration Statement

to be declared effective by the SEC when required, if we fail to maintain the effectiveness of the Registration Statement or if the Registration

Statement ceases to remain effective. The Company is filing this Registration Statement in satisfaction of its obligation to file a registration

statement under the Registration Rights Agreement.

The selling stockholders’ resale of these shares is being registered on the registration

statement of which this prospectus forms a part.

Cost Reduction

On November 12, 2024,

the Company announced it is implementing a cost reduction plan in order to reduce its average monthly cash burn from

approximately $1.8 million per month to approximately $1 million per month for 90 days. This includes reducing staff from

approximately 80 people to approximately 60 people, temporarily suspending certain non-essential operations and reducing or

eliminating all discretionary expenses.

Our Corporate Information

The Company was originally

incorporated in the State of Delaware on February 1, 2013, under the name Cyanogen, Inc. or Cyanogen. The Company started as a venture

funded company with offices in Seattle and Palo Alto, aimed at commercializing CyanogenMod, direct to consumer and through collaborations

with mobile phone manufacturers. CyanogenMod was an open-source operating system for mobile devices, based on the Android mobile

platform. Cyanogen released multiple versions of its mobile operating system and collaborated with an ecosystem of companies including

mobile phone OEMs, content providers and leading technology partners from 2013 to 2015.

In 2016 the Company’s

management and board of directors, determined to pivot its product focus and commercial direction from the mobile device and telecom space

to industrial and commercial autonomous driving with the hiring of Lior Tal in June 2016 to serve as the company’s chief operating

officer. Mr. Tal, a seasoned executive of startup firms where prior to joining the company, co-founded Snaptu which later was acquired

by Facebook (currently known as Meta Platforms, Inc.), as well as held various leadership roles at Actimize, DiskSites and Odigo; all

of these companies which were also later acquired. Mr. Tal was promoted to chief executive officer in October 2016 and continues to serve

in this role along with chairman of the board. In May 2017, the Company changed its name to CYNGN Inc.

Available Information

Our principal business address

is 1015 O’Brien Dr., Menlo Park, CA 94025, and our telephone number is (650) 924-5905. We maintain our corporate website at https://cyngn.com

(this website address is not intended to function as a hyperlink and the information contained on our website is not intended to

be a part of this prospectus). Information on our website does not constitute a part of, nor is it incorporated in any way, into this

prospectus and should not be relied upon in connection with making an investment decision. We make available free of charge on https://investors.cyngn.com/

our annual, quarterly, and current reports, and amendments to those reports if any, as soon as reasonably practical after we electronically

file such material with, or furnish it to, the SEC. We may from time to time provide important disclosures to investors by posting them

in the Investor Relations section of our website.

Our common stock is quoted

on the Nasdaq under the symbol “CYN”. We file annual, quarterly, and current reports, proxy statements and other information

with the U.S. Securities Exchange Commission (the “SEC”) and are subject to the requirements of the Securities and Exchange

Act of 1934, as amended (the Exchange Act). These filings are available to the public on the Internet at the SEC’s website at http://www.sec.gov.

THE OFFERING

| Common Stock to be offered by the selling stockholders |

|

Up to 405,125 shares of common stock. |

| |

|

|

| Terms of the Offering: |

|

The selling stockholders will determine when and how it will sell the shares of common stock offered in this prospectus, as described in “Plan of Distribution.” |

| |

|

|

| Common Stock outstanding prior to this offering |

|

2,431,784 shares of common stock as of November 22, 2024 |

| |

|

|

| Use of proceeds |

|

We will not receive any proceeds from the sale of shares of common stock offered hereby by the selling stockholders. |

| |

|

|

| Risk Factors |

|

An investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus and the similarly titled sections in the documents incorporated by reference into this prospectus. |

| |

|

|

| Nasdaq Capital Market symbol |

|

Our common stock is listed on the Nasdaq Capital Market under the symbol “CYN.” |

RISK FACTORS

An investment in our securities involves a

high degree of risk. Before deciding whether to invest in our securities, you should carefully consider the risks discussed under the

section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and

our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 and other documents that we file with the SEC, which are incorporated

by reference in this prospectus, together with the information included in this prospectus and documents incorporated by reference herein,

and in any free writing prospectus that we have authorized for use in connection with this offering. If any of these risks actually occurs,

our business, financial condition, results of operations or cash flow could be harmed. In such case, the trading price of our common stock

could decline, and our shareholders may lose all or part of their investment in the shares of our common stock. Additional risks and uncertainties

not presently known to us or that we currently believe to be immaterial may also adversely affect our business. In

addition to the other information contained in this prospectus, including the reports we incorporate by reference, you should consider

the following factor before investing in our securities.

We may be unable to repay our indebtedness

under the notes, and any default could harm our financial condition and could lead to us losing our intellectual property assets.

In November 2024, pursuant to

a Securities Purchase Agreement, we issued Senior Notes (the “Notes”) to the selling stockholders. The Notes have an aggregate

principal amount of $4,375,000 with an original issue discount of 20%, and rank senior to any other Company indebtedness and our capital

stock in the event of a liquidation, including the securities being offered hereby. The Notes will mature on the earlier of (a) February

12, 2025 or (b) the closing of one or more subsequent equity, debt or other capital raise(s) or any sale of tangible or intangible assets

with the net proceeds therefrom equal to or in excess of all remaining amounts due under all the Notes outstanding. While the Notes are

outstanding, the Company agreed to certain restrictive covenants, including covenants providing that the Company and its subsidiaries

are not permitted to incur any indebtedness, create any other liens or security interests on property or assets, make payments on any

other indebtedness, change its business, or license our intellectual property, unless the selling stockholders give their prior written

consent, which restrictions could materially adversely impact our operations and prevent or delay the execution of our business plan,

strategic transactions or capital raising efforts.

We may be unable to repay

our indebtedness under the Notes. If we default on the Notes, we will be subject to a 20% interest rate and be required to grant to the

selling stockholders a security interest in the Company’s intellectual property to secure the payment obligations under the Notes.

If the selling stockholders seek to foreclose on their security interest in our intellectual property, we may lose some or all of our

assets, which could cause severe interruptions in our business practices or temporarily or permanently suspend our business operations.

Our failure to repay the Notes and the consequences therefrom may negatively impact our financial condition and business operations and,

in turn, your investment in us.

The sale of a substantial amount of our

common stock, including resale of the shares of common stock held by the selling stockholders in the public market, could adversely affect

the prevailing market price of our common stock.

This prospectus covers the

resale of 405,125 shares of our common stock held by the selling stockholders. Sales of substantial amounts of our common stock in the

public market, or the perception that such sales might occur, could adversely affect the market price of our common stock. We cannot predict

if and when selling stockholders may sell such shares in the public market.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, or the Exchange

Act. Forward-looking statements give current expectations or forecasts of future events or our future financial or operating performance.

We may, in some cases, use words such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would” or the negative of those terms, and similar expressions that convey uncertainty

of future events or outcomes to identify these forward-looking statements.

These forward-looking statements

reflect our management’s beliefs and views with respect to future events, are based on estimates and assumptions as of the date

of this prospectus and are subject to risks and uncertainties, many of which are beyond our control, that could cause our actual results

to differ materially from those in these forward-looking statements. We discuss many of these risks in greater detail in this prospectus

under “Risk Factors” and in our Annual Report on Form 10-K filed with the SEC on March 7, 2024 and our Quarterly Report on

Form 10-Q filed with the SEC on November 11, 2024, as well as those described in the other documents we file with the SEC. Moreover, new

risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors

on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those

contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking

statements.

We undertake no obligation

to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as

may be required by applicable laws or regulations.

USE OF PROCEEDS

We will not receive any of

the proceeds from any sale or other disposition of the shares of common stock covered by this prospectus. All proceeds from the sale of

the Shares will be paid directly to the selling stockholder.

DIVIDEND POLICY

We have never declared or

paid cash dividends on our common stock. Moreover, we do not anticipate paying periodic cash dividends on our common stock for the foreseeable

future. We currently intend to retain all available funds and any future earnings to support our operations and finance the growth and

development of our business. Any future determination about the payment of dividends will be made at the discretion of our board of directors

and will depend upon our earnings, if any, capital requirements, operating and financial conditions and on such other factors as our board

of directors deems relevant.

PRIVATE PLACEMENT OF SHARES OF COMMON STOCK

On November 12, 2024, we entered

into a Securities Purchase Agreement (the “Purchase Agreement”) with the selling stockholders pursuant to which we sold, in

a private placement, notes with an aggregate principal amount of $4,375,000, and received proceeds before expenses of $3,500,000. As consideration

for entering into the Purchase Agreement, we issued a total of 405,125 shares of common stock, or the Shares, of the Company to the selling

stockholders on November 13, 2024, which shares are included in this prospectus.

In connection with the Purchase

Agreement, the Company entered into a registration rights agreement with the Purchasers (the “Registration Rights Agreement”).

Pursuant to the Registration Rights Agreement, we are required to file a resale registration statement, or the Registration Statement,

with the SEC to register for resale the 405,125 shares of common stock by November 28, 2024, and to have such Registration Statement declared

effective within thirty days of filing (sixty days in the event the Registration Statement is reviewed by the SEC). We will be obligated

to pay liquidated damages to the selling stockholders if we fail to file the resale registration statement when required, fail to request

effectiveness within five trading days after being notified that the Registration Statement will not be reviewed or not subject to further

review, fails to respond to comments to the Registration statement within ten calendar days, fail to cause the Registration Statement

to be declared effective by the SEC when required, if we fail to maintain the effectiveness of the Registration Statement or if the Registration

Statement ceases to remain effective. The Company is filing this Registration Statement in satisfaction of its obligation to file a registration

statement under the Registration Rights Agreement.

SELLING STOCKHOLDERS

The shares of common stock

being offered by the selling stockholders are those previously issued to the selling stockholders. In accordance with the terms of a registration

rights agreement with the selling stockholders, this prospectus generally covers the resale of the shares of common stock issued to the

selling stockholders in the “Private Placement of Shares of Common Stock” described above. We are registering the shares of

common stock in order to permit the selling stockholders to offer the shares of common stock for resale from time to time. Except for

the ownership of the shares of common stock, the selling stockholders have not had any material relationship with us within the past three

years.

The table below lists the selling

stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the selling stockholders.

The second column lists the number of shares of common stock beneficially owned by each selling stockholder based on its ownership of

the shares of common stock as of November 22, 2024. The third column lists the shares of common stock being offered by the selling stockholders

pursuant to this prospectus. The fourth column assumes the sale of all of the shares of common stock offered by the selling stockholders

pursuant to this prospectus.

The selling stockholders may

sell all, some or none of their shares of common stock in this offering. See “Plan of Distribution.”

| Name of Selling Stockholder | |

Number of

Shares of

Common

Stock

Owned

Prior to

Offering | | |

Maximum

Number of

Shares of

Common

Stock

to be Sold

Pursuant

to this

Prospectus | | |

Number of

Shares of

Common

Stock

Owned After

Offering | |

| Altium Growth Fund, LP(1) | |

| 57,875 | | |

| 57,875 | | |

| - | |

| Bigger Capital Fund, LP(2) | |

| 57,875 | | |

| 57,875 | | |

| - | |

| Efrat Investments(3) | |

| 57,875 | | |

| 57,875 | | |

| - | |

| Empery Master Onshore, LLC(4) | |

| 3,038 | | |

| 3,038 | | |

| - | |

| Empery Tax Efficient, LP(5) | |

| 1,013 | | |

| 1,013 | | |

| - | |

| Empery Debt Opportunity Fund, LP (6) | |

| 36,462 | | |

| 36,462 | | |

| - | |

| L1 Capital Global Opportunities Master Fund(7) | |

| 57,875 | | |

| 57,875 | | |

| - | |

| S.H.N Financial Investments Ltd(8) | |

| 75,237 | | |

| 75,237 | | |

| - | |

| 3i, LP(9) | |

| 57,875 | | |

| 57,875 | | |

| - | |

| (1) |

Altium Capital Management, LP, the investment manager of Altium Growth Fund, LP, has voting and investment power over these securities. Jacob Gottlieb is the managing member of Altium Capital Growth GP, LLC, which is the general partner of Altium Growth Fund, LP. Each of Altium Growth Fund, LP and Jacob Gottlieb disclaims beneficial ownership over these securities. The principal address of Altium Capital Management, LP is 152 West 57th Street, 20th Floor, New York, NY 10019. |

| (2) | Michael Bigger, Managing Member of Bigger Capital Fund,

LP may be deemed to have sole voting and dispositive power with respect to the shares held by Bigger Capital Fund, LP. The address

of Bigger Capital Fund, LP is 11700 W Charleston Blvd 170-659. Las Vegas, NV 89135. |

| (3) | Pinny Rotter, CIO of Efrat Investors by be deemed to have sole voting

and dispositive power with respect to the shares held by Efrat Investments. The address of Efrat Investments is 54 Lenox Ave., Clifton,

NJ 07012. |

| (4) | Empery Asset Management LP, the authorized agent of Empery Master Onshore, LLC

(“EMO”), has discretionary authority to vote and dispose of the shares held by EMO and may be deemed to be the

beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset

Management LP, may also be deemed to have investment discretion and voting power over the shares held by EMO. EMO, Mr. Hoe and Mr.

Lane each disclaim any beneficial ownership of these shares. The address of Empery Master Onshore, LLC is c/o Empery Asset

Management, LP, 1 Rockefeller Plaza, Suite 1205, New York, NY 10020. |

| (5) | Empery Asset Management LP, the authorized agent of Empery Tax Efficient, LP

(“ETE”), has discretionary authority to vote and dispose of the shares held by ETE and may be deemed to be the

beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset

Management LP, may also be deemed to have investment discretion and voting power over the shares held by ETE. ETE, Mr. Hoe and Mr.

Lane each disclaim any beneficial ownership of these shares. The address of Empery Tax Efficient, LP is c/o Empery Asset Management,

LP, 1 Rockefeller Plaza, Suite 1205, New York, NY 10020. |

| (6) | Empery Asset Management LP, the authorized agent of Empery Debt

Opportunity Fund, LP (“EDOF”), has discretionary authority to vote and dispose of the shares held by EDOF and may be deemed

to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset

Management LP, may also be deemed to have investment discretion and voting power over the shares held by EDOF. EDOF, Mr. Hoe and Mr.

Lane each disclaim any beneficial ownership of these shares. The address of Empery Debt Opportunity Fund, LP is c/o Empery Asset Management,

LP, 1 Rockefeller Plaza, Suite 1205, New York, NY 10020. |

| (7) | David Feldman and Joel Arber are the Directors of L1 Capital

Global Opportunities Master Fund, Ltd. As such they may be deemed to be beneficial owners of such shares of common stock. The business

address of L1 Capital Global Opportunities Master Fund., Ltd. is 161A Shedden Road, 1 Artillery Court, PO Box 10085, Grand Cayman KY1-1001,

Cayman Islands. |

| (8) | Nir Shamir and Hadar Shamir have shared power to vote and dispose

of the securities held by S.H.N Financial Investments Ltd and may be deemed to be the beneficial owners of such shares of common stock.

The address of S.H.N Financial Investments Ltd is Arik Einstein 3, Herzliya, Israel. |

| (9) |

3i Management LLC is the general partner of 3i, LP, and Maier Joshua Tarlow is the manager of 3i Management LLC. As such, Mr. Tarlow exercises sole voting and investment discretion over securities beneficially owned directly or indirectly by the 3i, LP and 3i Management LLC. Mr. Tarlow disclaims beneficial ownership of the securities beneficially owned directly by 3i, LP and indirectly by 3i Management LLC. The business address of each of the aforementioned parties is 2 Wooster Street, 2nd Floor, New York, NY 10013. We have been advised that none of Mr. Tarlow, 3i Management LLC, or 3i, LP is a member of the Financial Industry Regulatory Authority, or FINRA, or an independent broker-dealer, or an affiliate or associated person of a FINRA member or independent broker-dealer. |

PLAN OF DISTRIBUTION

Each Selling Stockholder of

the Shares and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities

covered hereby on the principal Trading Market or any other stock exchange, market or trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following

methods when selling securities:

| |

● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately negotiated transactions; |

| |

|

|

| |

● |

settlement of short sales; |

| |

|

|

| |

● |

in transactions through broker-dealers that agree with the selling stockholders to sell a specified number of such securities at a stipulated price per security; |

| |

|

|

| |

● |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a combination of any such methods of sale; or |

| |

|

|

| |

● |

any other method permitted pursuant to applicable law. |

The selling stockholders may

also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under

this prospectus.

Broker-dealers engaged by

the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts

to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a

customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in

compliance with FINRA Rule 2121.

In connection with the sale

of the securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling

stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities

to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with

broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders and

any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning

of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any

profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. Each selling stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly

or indirectly, with any person to distribute the securities.

The Company is required to

pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify

the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus

effective until the earlier of (i) the date on which the securities may be resold by the selling stockholders without registration and

without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance

with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities

have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities

will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in

certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable

state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and

regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market

making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M, prior to the commencement

of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the Exchange Act and the rules

and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the Common Stock by the selling

stockholders or any other person. We will make copies of this prospectus available to the selling stockholders and have informed them

of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule

172 under the Securities Act).

DESCRIPTION OF CAPITAL STOCK

The following summary of the terms of our common

stock is subject to and qualified in its entirety by reference to our certificate of incorporation and bylaws, copies of which are on

file with the SEC as exhibits to previous filings with the SEC. Please refer to “Where You Can Find More Information” below

for directions on obtaining these documents.

General

Our authorized capital stock

consists of 200,000,000 shares of common stock, $.00001 par value per share, and 10,000,000 shares of preferred stock, $.00001 par value

per share.

As of the date of this prospectus,

there were 2,431,784 shares of our common stock issued and outstanding held by approximately 64 holders of record, and no shares of our

preferred stock issued and outstanding.

Common Stock

Our certificate of incorporation,

as amended and restated (“Certificate of Incorporation”) authorize us to issue up to 200,000,000 shares of common stock, $0.00001

par value. Each holder of our common stock is entitled to one (1) vote for each share held of record on all voting matters we present

for a vote of stockholders, including the election of directors. Holders of common stock have no cumulative voting rights or preemptive

rights to purchase or subscribe for any stock or other securities, and there are no conversion rights or redemption or sinking fund provisions

with respect to our common stock. All shares of our common stock are entitled to share equally in dividends from sources legally available

when, and if, declared by our Board of Directors.

Our Board of Directors is

authorized to issue additional shares of common stock not to exceed the amount authorized by the Certificate of Incorporation, on such

terms and conditions and for such consideration as the Board may deem appropriate without further stockholder action.

In the event of our liquidation

or dissolution, all shares of our common stock are entitled to share equally in our assets available for distribution to stockholders.

However, the rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the

rights of the holders of shares of preferred stock that have been issued or shares of preferred stock that our Board of Directors may

decide to issue in the future.

Preferred Stock

Our Certificate of Incorporation

authorize us to issue up to 10,000,000 shares of preferred stock, $0.00001 par value. Our Board of Directors is authorized, without further

action by the stockholders, to issue shares of preferred stock and to fix the designations, number, rights, preferences, privileges, and

restrictions thereof, including dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences and sinking

fund terms. We believe that the Board of Directors’ power to set the terms of, and our ability to issue preferred stock, will provide

flexibility in connection with possible financing or acquisition transactions in the future. The issuance of preferred stock, however,

could adversely affect the voting power of holders of common stock and decrease the amount of any liquidation distribution to such holders.

The presence of outstanding preferred stock could also have the effect of delaying, deterring, or preventing a change in control of our

Company.

Outstanding Warrants

As of November 22, 2024, we had

65,271 outstanding warrants with a weighted average exercise price of $285.29 per share, with a weighted average remaining life of 5 years.

Outstanding Options

As of November 22, 2024, we

have 161,716 outstanding options with a weighted average exercise price of $97.39 per share, with a weighted average remaining contractual

life of 6.4 years.

Restricted Stock Units (RSU)

As of November 22, 2024, we

have 2,400 outstanding RSUs.

Anti-Takeover Provisions

Certificate of Incorporation and Bylaw Provisions

Our amended and restated certificate

of incorporation and our amended and restated bylaws will include a number of provisions that may have the effect of deterring hostile

takeovers or delaying or preventing changes in control of our management team, including the following:

Classified Board. Our

fifth amended and restated certificate of incorporation and amended and restated bylaws provide that our board of directors will be classified

into three classes of directors, each of which will hold office for a three-year term. In addition, directors may only be removed from

the board of directors for cause and only by the approval of two-thirds of the combined vote of our then outstanding shares of common

stock. A third party may be discouraged from making a tender offer or otherwise attempting to obtain control of us as it is more difficult

and time consuming for stockholders to replace a majority of the directors on a classified board of directors.

Supermajority Approvals.

Our amended and restated bylaws require the approval of two-thirds of the combined vote of our then-outstanding shares of our common stock

to amend our bylaws. This will have the effect of making it more difficult to amend our amended and restated bylaws to remove or modify

certain provisions.

Advance Notice Requirements

for Stockholder Proposals and Director Nominations. Our amended and restated bylaws provide advance notice procedures for stockholders

seeking to bring business before our annual meeting of stockholders, or to nominate candidates for election as directors at any meeting

of stockholders. Our amended and restated bylaws will also specify certain requirements regarding the form and content of a stockholder’s

notice. These provisions may preclude our stockholders from bringing matters before our annual meeting of stockholders or from making

nominations for directors at our meetings of stockholders.

Issuance of Undesignated

Preferred Stock. Our board of directors has the authority, without further action by the holders of our common stock, to issue up

to 10,000,000 shares of undesignated preferred stock with rights and preferences, including voting rights, designated from time to time

by the board of directors. The existence of authorized but unissued shares of preferred stock will enable our board of directors to render

more difficult or discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest, or otherwise.

Issuance of Unissued Stock.

Our shares of unissued common stock are available for future issuance without stockholder approval, subject to certain protections afforded

to our preferred stock pursuant to our certificate of incorporation, as amended and restated. We may utilize these additional shares for

a variety of corporate purposes, including future public offerings to raise additional capital, to facilitate corporate acquisitions,

payment as a dividend on the capital stock or as equity compensation to our service providers under our equity compensation plans. The

existence of unissued and unreserved common stock may enable our board of directors to issue shares to persons friendly to current management

thereby protecting the continuity of our management. Also, if we issue additional shares of our authorized, but unissued, common stock,

these issuances will dilute the voting power and distribution rights of our existing common stockholders.

Delaware Law

We are governed by the provisions

of Section 203 of the DGCL. In general, Section 203 prohibits a public Delaware corporation from engaging in a “business combination”

with an “interested stockholder” for a period of three years after the date of the transaction in which the person became

an interested stockholder, unless:

| ● | the business combination or

transaction which resulted in the stockholder becoming an interested stockholder was approved by the board of directors prior to the

time that the stockholder became an interested stockholder; |

| ● | upon consummation of the transaction

which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock

of the corporation outstanding at the time the transaction commenced, excluding shares owned by directors who are also officers of the

corporation and shares owned by employee stock plans in which employee participants do not have the right to determine confidentially

whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| ● | at or subsequent to the time

the stockholder became an interested stockholder, the business combination was approved by the board of directors and authorized at an

annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least two-thirds of the outstanding

voting stock which is not owned by the interested stockholder. |

In general, Section 203 defines

a “business combination” to include mergers, asset sales and other transactions resulting in financial benefit to a stockholder

and an “interested stockholder” as a person who, together with affiliates and associates, owns, or within three years did

own, 15% or more of the corporation’s outstanding voting stock. These provisions may have the effect of delaying, deferring or preventing

changes in control of our company.

Choice of Forum

Our amended and restated certificate

of incorporation provide that unless the Company consents in writing to the selection of an alternative forum, the Court of Chancery of

the State of Delaware will be the exclusive forum for any derivative action or proceeding brought on our behalf; any action asserting

a breach of fiduciary duty by any of our directors, officers or other employees to us or our stockholders; any action asserting a claim

against the Company, our directors or officer or employees directors arising pursuant to any provision of the DGCL, our amended and restated

certificate of incorporation or amended and restated bylaws or any other action asserting a claim against us our directors or officers

or employees that is governed by the internal affairs doctrine. This choice of forum provision does not apply to actions brought to enforce

a duty or liability created by the Exchange Act or any other claim for which federal courts have exclusive jurisdiction.

Furthermore, unless we consent

in writing to the selection of an alternative forum, the federal district courts of the United States shall be the exclusive forum for

the resolution of any complaint asserting a cause of action arising under the Securities Act. We intend for this provision to apply to

any complaints asserting a cause of action under the Securities Act despite the fact that Section 22 of the Securities Act creates concurrent

jurisdiction for the federal and state courts over all actions brought to enforce any duty or liability created by the Securities Act

or the rules and regulations promulgated thereunder. The enforceability of similar choice of forum provisions in other companies’

certificates of incorporation has been challenged in legal proceedings, and it is possible that a court could find these types of provisions

in our certificate of incorporation to be inapplicable or unenforceable.

Limitations of Liability and Indemnification

Our Certificate of Incorporation

limits the liability of directors to the maximum extent permitted by the DGCL. The DGCL provides that directors of a corporation will

not be personally liable for monetary damages for breach of their fiduciary duties as directors.

Our bylaws, as amended, provide

that we will indemnify our directors and officers to the fullest extent permitted by law, and may indemnify employees and other agents.

Our bylaws also provide that we are obligated to advance expenses incurred by a director or officer in advance of the final disposition

of any action or proceeding.

Our bylaws, as amended, subject

to the provisions of the DGCL, contain provisions which allow the corporation to indemnify any person against liabilities and other expenses

incurred as the result of defending or administering any pending or anticipated legal issue in connection with service to us if it is

determined that person acted in good faith and in a manner which he or she reasonably believed was in the best interest of the corporation.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 as amended, or the Securities Act, may be permitted

to our directors, officers and controlling persons, we have been advised that in the opinion of the Securities and Exchange Commission,

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

The limitation of liability

and indemnification provisions in our bylaws may discourage stockholders from bringing a lawsuit against directors for breach of their

fiduciary duties. They may also reduce the likelihood of derivative litigation against directors and officers, even though an action,

if successful, might provide a benefit to us and our stockholders. Our results of operations and financial condition may be harmed to

the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions.

At present, there is no pending

litigation or proceeding involving any of our directors or officers as to which indemnification is required or permitted, and we are not

aware of any threatened litigation or proceeding that may result in a claim for indemnification.

Transfer Agent and Registrar

The transfer agent and registrar

for our common stock is Continental Stock Transfer & Trust Company.

Listing

Our common stock is listed

on The Nasdaq Capital Market under the symbol “CYN.”

LEGAL MATTERS

Certain legal matters with

respect to the validity of the securities being offered by this prospectus will be passed upon by Sichenzia Ross Ference Carmel LLP, New

York, New York.

EXPERTS

The consolidated balance sheets

of the Company as of December 31, 2023 and 2022, the related consolidated statements of operations, stockholders’ equity and cash

flows for each of the two years in the period ended December 31, 2023 and the related notes, have been audited by Marcum LLP, the independent

registered public accounting firm of the Company, as stated in their report, which includes an explanatory paragraph as to the Company’s

ability to continue as a going concern, which is incorporated herein by reference. Such financial statements have been incorporated herein

by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate

by reference” information into this prospectus, which means that we can disclose important information to you by referring you to

another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and

subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in

this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this

prospectus to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies

or replaces that statement.

This prospectus and any accompanying prospectus

supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

| ● | Our Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, filed with the SEC on March 7, 2024. |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 9, 2024. |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the SEC on August 8, 2024. |

| ● | Our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the SEC on November 7, 2024. |

| ● | Our Current Reports on Form

8-K filed on February 21, 2024, April 24, 2024, May 10, 2024, May 17, 2024, June 25, 2024, July 9, 2024, and November 12, 2024. |

| ● | The description of our common

stock contained in our Registration Statement on Form 8-A, registering our common stock under Section 12(b) under the Exchange Act, filed

with the SEC on October 19, 2021. |

We also incorporate by reference

into this prospectus all documents (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on

such form that are related to such items) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act after the date of the initial registration statement of which this prospectus is a part and prior to the effectiveness of such registration

statement and all documents that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after

the date of this prospectus but prior to the termination of the offering. These documents include periodic reports, such as Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements.

Any statement contained herein

or in a document incorporated or deemed to be incorporated by reference into this document will be deemed to be modified or superseded

for purposes of the document to the extent that a statement contained in this document or any other subsequently filed document that is

deemed to be incorporated by reference into this document modifies or supersedes the statement.

You may request, orally or

in writing, a copy of any or all of the documents incorporated herein by reference. These documents will be provided to you at no cost,

by contacting: Cyngn Inc., Attention: Corporate Secretary, 1015 O’Brien Dr., Menlo Park, CA 94025, phone number (650) 924-5905.

In addition, copies of any or all of the documents incorporated herein by reference may be accessed at our website at www.cyngn.com. The

information on such website is not incorporated by reference and is not a part of this prospectus.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC

a registration statement under the Securities Act for the securities offered by this prospectus. This prospectus does not contain all

of the information in the registration statement and the exhibits and schedule that were filed with the registration statement. For further

information with respect to us and our securities, we refer you to the registration statement and the exhibits and schedule that were

filed with the registration statement. Statements contained in this prospectus about the contents of any contract or any other document

that is filed as an exhibit to the registration statement are not necessarily complete, and we refer you to the full text of the contract

or other document filed as an exhibit to the registration statement. The SEC maintains a website that contains reports, proxy and information

statements, and other information regarding registrants that file electronically with the SEC. The address of the website is www.sec.gov.

We file periodic reports under

the Exchange Act, including annual, quarterly and special reports, and other information with the SEC. These periodic reports and other

information are available for inspection and copying at the SEC regional offices, public reference facilities and on the website of the

SEC referred to above.

We make available free of

charge on or through our internet website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K,

and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable

after we electronically file such material with, or furnish it to, the SEC. The information found on our website, www.cyngn.com, other

than as specifically incorporated by reference in this prospectus, is not part of this prospectus.

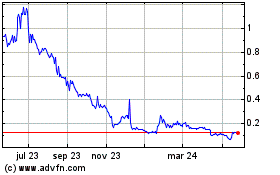

CYNGN (NASDAQ:CYN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

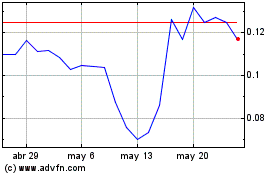

CYNGN (NASDAQ:CYN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024