Requisitions General Meetings of Shareholders

of Seven Investment Trusts Currently Managed by Baillie Gifford,

Herald Investment Management, Janus Henderson Investors and

Manulife | CQS Investment Management

Intends to Reconstitute the Boards with

Experienced Directors Who Will “Mind the Gap” Between the Trusts’

Trading Price and Net Asset Value

Details Plan to Quickly Deliver Substantial

Liquidity and Long-Term Returns for All Shareholders

Visit www.mindthegap-uktrusts.com to Sign Up

for Important Campaign Updates, Meet Saba’s Director Candidates and

Learn How to Support Saba’s Resolutions at the General Meetings

Saba Capital Management, L.P. (together with certain of its

affiliates, “Saba” or “we”) today announced that it has

requisitioned the Boards of Directors (the “Boards”) of Baillie

Gifford US Growth Trust PLC (USA:LSE), CQS Natural Resources Growth

& Income PLC (CYN:LSE), Edinburgh Worldwide Investment Trust

PLC (EWI:LSE), European Smaller Companies Trust PLC (ESCT:LSE),

Henderson Opportunities Trust PLC (HOT:LSE), Herald Investment

Trust PLC (HRI:LSE) and Keystone Positive Change Investment Trust

PLC (KPC:LSE) (collectively, the “Trusts”) to convene general

meetings of shareholders (the “General Meetings”) to provide

shareholders the opportunity to vote on resolutions to remove the

Trusts’ existing directors and appoint highly qualified directors

to replace them. Saba is convening the General Meetings because we

believe the current Boards of Directors and investment managers

have failed to perform versus their benchmarks and have, therefore,

required Saba’s investment to narrow the deep trading discounts to

net asset value and deliver returns for shareholders.

In connection with its requisitions, Saba today issued the

following open letter to its fellow shareholders. For more

information on the director candidates and Saba’s plans for the

Trusts, including its intent that the current investment managers

be replaced, visit: www.mindthegap-uktrusts.com.

LEGAL DISCLAIMER: NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION

IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

***

18 December 2024

Fellow Shareholders,

On behalf of Saba Capital Management, L.P. (together with

certain of its affiliates, “Saba” or “we”), I am writing to inform

you that we have requested the Boards of Directors (the “Boards”)

of seven investment trusts (listed below) convene general meetings

(the “General Meetings”). The seven trusts are Baillie Gifford US

Growth Trust PLC, CQS Natural Resources Growth & Income PLC,

Edinburgh Worldwide Investment Trust PLC, European Smaller

Companies Trust PLC, Henderson Opportunities Trust PLC, Herald

Investment Trust PLC and Keystone Positive Change Investment Trust

PLC (collectively, the “Trusts”). We called these General Meetings

because the current Boards have failed to hold the investment

managers accountable for the Trusts’ wide trading discounts to net

asset value (“NAV”) and their inability to deliver sufficient

shareholder returns.

Saba holds an interest in approximately 19% to 29% of each

Trust’s shares, making us the largest investor in each Trust,

aligning our interests with yours and giving us the right to

requisition the General Meetings. We believe that the Boards have

not minded the trading gap, which is why we want to offer you the

opportunity to elect new directors with a concrete plan to deliver

shareholder value.

Saba’s Strong Track Record and Views on

the U.K. Investment Trust Industry

Investment trusts first caught my eye as an individual investor

more than two decades ago, early in my career at Deutsche Bank. I

was drawn to the inconsistency: while some trusts traded near fair

value, others were stuck at a yawning discount. This discrepancy

fascinated me. I saw an opportunity to apply techniques from my

institutional markets experience to a space largely driven by small

investors. It was the perfect arena to combine my analytical skills

and passion for navigating the odds, whether as an investor,

blackjack card counter or chess master.

Today, it’s a core strategy for us at Saba Capital, as we seek

to help millions of individual investors realize significant value.

What has caught my attention for the past three years is that the

U.K. trust industry’s discounts have deepened as a consequence of

investors losing faith in managers after shockingly poor

performance in certain trusts. At the same time, the boards have

not held those managers accountable.

Saba prefers private engagement with the boards of the trusts we

invest in, but underperformance, persistent trading discounts and

disengaged management teams leave us no choice but to act. The

value creation opportunities are vast when trusts are overseen by

skilled managers and boards operating with best-in-class

governance. This is why we believe change is

urgently needed at these Trusts.

As one of the world’s single-largest investors in investment

trusts, Saba has a track record of pursuing changes that return

discounted trusts to their full NAV and create long-term value for

shareholders. We have negotiated dozens of shareholder-friendly

corporate actions – such as tenders, share buybacks, restructurings

and discount management plans – and changes to investment

approaches in investment vehicles where shareholders had previously

suffered from prolonged poor performance and subpar management.

With our industry expertise, we have identified a clear path

forward to transform these Trusts and deliver greater shareholder

value than under the current Boards and respective investment

managers, as outlined below.1

Mind the Gap: Why Saba Believes New

Boards Are Necessary to Correct Underperformance

Saba is concerned that the current managers’ and Boards’

inability to mind the gap between each Trust’s trading price and

NAV has destroyed significant value for shareholders. It is

important to note that the Trusts’ discounts to NAV have narrowed

significantly over the last six months. We consider this to be a

direct result of Saba building our total stake in these Trusts to

£1.5 billion. Without such buyer demand or the prospect of active

steps being taken to improve returns to shareholders, there is a

risk of the Trusts’ share prices falling and discounts widening

again if we are unsuccessful in our pursuit to reconstitute the

Boards of the seven Trusts.

As evidenced in the chart below, the Trusts have also delivered

underwhelming, and in some cases disastrous, total shareholder

returns (“TSR”) compared to their respective benchmark indices

during the last three years.2,3

Trust

3-Year Average Discount to

NAV

3-Year TSR vs.

Benchmark

USA

-13.8%

-52.8%

KPC

-12.0%

-47.0%

EWI

-12.9%

-43.1%

CYN

-14.0%

-30.0%

HOT

-13.4%

-26.9%

HRI

-14.7%

-7.4%

ESCT

-13.5%

11.0%

Source: Bloomberg. Data is in GBP

and as of 13 December 2024.

The takeaway is clear: the Trusts’ managers and their directors

have failed shareholders. Performance demonstrates that they have

not taken sufficient steps to resolve the Trusts’ structural

issues, depriving shareholders of superior returns. While there are

multiple levers to narrow these persistent discounts, inaction has

been the consistent course of current leadership.

Saba’s Resolutions: Reconstitute the

Trusts’ Boards with Exceptionally Qualified

Directors

The current Boards’ failure to hold management accountable for

the Trusts’ poor performance has left us no choice but to take the

extraordinary step of requisitioning a General Meeting for each of

the seven Trusts. To swiftly capitalize on the significant upside

opportunity for all shareholders, we have requested that each Board

conduct its General Meeting as soon as possible and expect that all

General Meetings will be scheduled, at the latest, by early

February 2025.4

At each of these meetings, shareholders

will have the opportunity to vote on two critical resolutions (the

“Resolutions”) proposed by Saba to 1.) remove all current directors

of the Trusts, and 2.) appoint new, highly qualified candidates to

replace them.5

By fully reconstituting the Trusts’ Boards, we believe that we

can unlock greater value for shareholders and address the long-term

structural issues that have hamstrung the Trusts’ return potential

under current leadership. Each of the director candidates shares a

deep commitment to improving shareholder returns and putting your

interests above their own.

We have proposed to replace the full Board of each Trust with

the director appointees set out in the following table:

Proposed New Directors &

Summary Biographies

Baillie Gifford US Growth

Trust PLC (USA:LSE)

Boaz Weinstein is a leading hedge

fund manager overseeing $5.5 billion in assets at Saba Capital, one

of the world’s single-largest investors in investment trusts with a

track record of pursuing changes that create long-term value for

shareholders.

- Founder and Chief Investment Officer of Saba, which was named

Hedge Fund of the Year by Risk.net and two-time Activist Hedge Fund

Manager of the Year by Institutional Investor.

- Former Co-Head of Global Credit Trading at Deutsche Bank, where

he had dual responsibility for proprietary trading and market

making.

Miriam Khasidy is a legal

professional and former business consultant based in London who has

experience advising clients on growth strategy, operational

optimization, due diligence processes, banking and finance

arrangements, M&A activity and investor relations.

- Former Director at Pantechnicon Capital LLC, an alternative

investment manager, and former Executive Director at Caerus Group,

a real estate investment and development company.

- Former U.S. Capital Markets Associate at Clifford Chance LLP,

an international law firm where she specialized in advising and

managing disclosure requirements and complex execution mechanics

for cross-border transactions.

CQS Natural Resources Growth

& Income PLC (CYN:LSE)

Paul Kazarian is the Principal

Executive Officer of Saba’s publicly traded investment trusts,

leads Saba’s investment trust and exchange-traded fund strategy and

products, and has extensive experience as an investment trust

director.

- Partner and Closed-End Fund Portfolio Manager at Saba.

- Serves on the Board of Trustees of various publicly traded

trusts.

Marc Loughlin is an investment and

exchange-traded fund expert with nearly three decades of experience

on the buy- and sell-side of the sector.

- Director of Closed-End Fund and Exchange-Traded Fund Trading

Solutions at WallachBeth Capital, a leading provider of

institutional execution services.

- Former Head of Non-Standard Arbitrage at Société Générale in

London, where he spent 13 years, and Head of U.S. Closed-End Fund

Sales at Canaccord Genuity.

Edinburgh Worldwide Investment

Trust PLC (EWI:LSE)

Paul Kazarian. See bio above.

Jonathan Zucker is a seasoned

investment manager and former lawyer with 13 years of experience in

the investment and finance industries.

- Principal of JOAD Investments, a private investment firm, since

2011.

- Former Assistant District Attorney at The Bronx County District

Attorney’s Office in New York City.

European Smaller Companies

Trust PLC (ESCT:LSE)

Paul Kazarian. See bio above.

Doug Hirsch has significant

investment experience, which includes serving on the Board of

Directors of several investment funds and an affiliate of a

formerly publicly traded U.K. company.

- Founder and Managing Partner of Seneca Capital Investments, a

value-oriented, event-driven investment partnership, which is now a

family office.

- Serves on the Board of Directors for several funds managed by

Greenlight Capital and an affiliate of Cerberus Capital Management,

and previously served on the Board of Directors of Smith New Court

New York, an affiliate of Smith New Court PLC, Britain’s largest

independent stockbroker until its sale to Merrill Lynch.

Henderson Opportunities Trust

PLC (HOT:LSE)

Paul Kazarian. See bio above.

Simon Reeves is a wealth management

industry veteran, with more than 25 years of investment experience,

specializing in advising high-net-worth individuals and

families.

- Managing Partner at Pasadena Private Financial Group, a private

wealth advisory firm catering to affluent families and their

businesses. Former Member of the American Stock Exchange and CBOE

making markets in stock options.

- Currently on the investment committee of the Catalyst Fund, an

early-stage venture fund led by the Alliance for SoCal Innovation.

Previously served on the Board of Directors of Saddleback Memorial

Foundation, one of southern California’s leading hospital chains,

helping manage their endowment.

Herald Investment Trust PLC

(HRI:LSE)

Paul Kazarian. See bio above.

Jassen Trenkow is a former finance

and banking executive with 20 years of experience at Wall Street’s

top banking institutions.

- Founder and Managing Partner of DynamiCOO, where he serves as

an on-demand Chief Operating Officer for companies of various

sizes.

- Former Head of Finance Structural Reform and Transformation at

Barclays, and Former Chief Operating Officer of Goldman Sachs Asset

Management in Asia.

Keystone Positive Change

Investment Trust PLC (KPC:LSE)

Paul Kazarian. See bio above.

John Karabelas has 25 years of

experience in fixed income investments, including overseeing the

development, implementation and operation of credit products for a

global bank’s institutional investor client base.

- Head of US Institutional Sales at MUFG since 2019.

- Former Partner and President of Kildonan Castle Asset

Management, an opportunistic credit alternative asset management

firm.

The Plan: Deliver Substantial Liquidity

& Long-Term Returns for Shareholders

We have identified a clear path forward to transform these seven

Trusts and deliver greater value than you could otherwise realize

under the current Boards and managers. Our plan is simple: with a

reconstituted Board, we intend to provide shareholders with

long-overdue liquidity options alongside the opportunity for

greater long-term returns under a new investment strategy and

manager.

If appointed, the new directors will transparently assess all

go-forward options available to the Trusts, including:

- Offering liquidity events, including tender offers and share

buybacks, so that all shareholders immediately have the opportunity

to receive substantial liquidity near NAV, if they wish.

- Terminating the Trusts’ current investment management

agreements.

- Replacing the Trusts’ current investment managers.

- Refocusing the Trusts’ investment mandates on purchasing

discounted trusts and/or combining them with other investment

trusts, where appropriate, to realize scale benefits and

synergies.

The Opportunity: Unlock Value with a

Proven Investment Manager

Saba has seen demand from investors to bring a product similar

to our CEFS exchange-traded fund, which actively invests in

discounted closed-end funds, to the U.K. market. This campaign

answers this call.

At each Trust where shareholders pass our Resolutions, the Board

will be changed immediately, and each newly appointed Board will

consider the optimal investment strategy and manager going forward.

If a new Board, in accordance with its fiduciary duties, decides to

proceed with replacing the existing manager and introducing a new

investment policy, we anticipate the following process:

- The anticipated notice period of three months (EWI, KPC), six

months (CYN, ESCT, HOT, USA) and 12 months (HRI) for each

investment management agreement will be followed.

- If the Board of a Trust decides to proceed with the termination

of any existing investment management agreement, new arrangements

will be considered and put in place prior to its expiry.

- We intend to propose Saba as the new investment manager to each

of the Boards for their consideration.

- If a Board ultimately decides to vote on the appointment of

Saba, Mr. Weinstein and Mr. Kazarian will recuse themselves from

voting on Board decisions related to Saba.

- To ensure compliance with the highest standards of governance,

it is intended that one or more further independent directors will

also be appointed to each Board as soon as reasonably possible

following the Trusts’ General Meetings.

If the director candidates are

appointed, they intend to first assess options to provide

shareholders the opportunity to achieve substantial liquidity near

NAV if they do not wish to remain in a Trust with a new investment

manager and mandate. If a newly reconstituted Board

selects Saba as the new investment manager, we intend to deliver

attractive terms and greater value to shareholders by shifting the

Trusts’ investment mandates to focus on purchasing discounted

trusts consistent with our successful strategy at CEFS, as

investors have consistently called for.

Vote “FOR” Saba’s Resolutions at

the Upcoming General Meetings

As shareholders, you deserve an investment that provides

reliable returns, Boards that advocate for your best interests and

managers that are focused on delivering enhanced value.

If you are ready for positive change, then we strongly urge you

to vote in favour of the

Resolutions as we firmly believe they are the only credible,

long-term way to earn outsized returns on your investment. Saba

believes that passing all the Resolutions is in the best interests

of each Trust and its shareholders. Accordingly, Saba will exercise

all our voting rights in favour of each Resolution at the Trusts’

General Meetings.

We look forward to continuing this dialogue with you and

appreciate your consideration. We are available to discuss our

Resolutions and our campaign to #MindTheGap.

Sincerely,

Boaz Weinstein Founder & Chief Investment Officer, Saba

Capital

***

SABA HOLDINGS IN EACH TRUST

As of 18 December 2024, Saba, directly or indirectly, has the

following aggregate interest in each of the Trusts (including at

least a 5% holding of shares in each Trust):

Trust

Manager of Interest

Aggregate Interest6

Baillie Gifford US Growth Trust

PLC

Saba Capital Management, L.P.

25.2%

CQS Natural Resources Growth

& Income PLC

Saba Capital Management, L.P.

25.1%

Edinburgh Worldwide Investment Trust

PLC

Saba Capital Management, L.P.

21.1%

European Smaller Companies Trust

PLC

Saba Capital Management, L.P.

29.1%

Henderson Opportunities Trust

PLC

Saba Capital Management, L.P.

23.4%

Herald Investment Trust PLC

Saba Capital Management, L.P.

18.6%

Keystone Positive Change Investment Trust

PLC

Saba Capital Management, L.P.

29.2%

Saba’s interest in each Trust is currently less than 30% of the

issued share capital of each relevant Trust. Although Saba has no

current intention to acquire 30% or more of any Trust, following

the potential replacement of applicable investment managers, Saba,

as a shareholder, intends to explore possible means by which

portfolios of the Trusts may be aggregated, where appropriate, to

realise scale benefits and synergies.

***

White & Case LLP is acting as legal adviser to Saba Capital

Management, L.P.

About Saba

Saba Capital Management, L.P. is a global alternative asset

management firm that seeks to deliver superior risk-adjusted

returns for a diverse group of clients. Founded in 2009 by Boaz

Weinstein, Saba is a pioneer of credit relative value strategies

and capital structure arbitrage. Saba has offices in New York City

and London. Learn more at www.sabacapital.com.

DISCLAIMER

Saba Capital Management, L.P. (“Saba”) is publishing this

announcement solely for the information of other shareholders in

each of Baillie Gifford US Growth Trust PLC (USA:LSE), CQS Natural

Resources Growth & Income PLC (CYN:LSE), Edinburgh Worldwide

Investment Trust PLC (EWI:LSE), European Smaller Companies Trust

PLC (ESCT:LSE), Henderson Opportunities Trust PLC (HOT:LSE), Herald

Investment Trust PLC (HRI:LSE) and Keystone Positive Change

Investment Trust PLC (KPC:LSE) (the “Trusts”). This

announcement is not intended to be and does not constitute or

contain any investment recommendation as defined by Regulation (EU)

No 596/2014 (as it forms part of the domestic law in the United

Kingdom by virtue of the European Union (Withdrawal) Act 2018). No

information in this announcement should be construed as

recommending or suggesting an investment strategy. Nothing in this

announcement or in any related materials is a statement of or

indicates or implies any specific or probable value outcome in any

particular circumstance. This announcement is provided merely for

general informational purposes and is not intended to be, nor

should it be construed as (1) investment, financial, tax or legal

advice, or (2) a recommendation to buy, sell or hold any security

or other investment, or to pursue any investment style or strategy.

Neither the information nor any opinion contained in this

announcement constitutes an inducement or offer to purchase or sell

or a solicitation of an offer to purchase or sell any securities or

other investments in the Trusts or any other trust by Saba or any

of its affiliates in any jurisdiction. This announcement does not

consider the investment objective, financial situation, suitability

or the particular need or circumstances of any specific individual

who may access or review this announcement and may not be taken as

advice on the merits of any investment decision. This announcement

is not intended to provide the sole basis for evaluation of, and

does not purport to contain all information that may be required

with respect to, any potential investment in the Trusts. Any person

who is in any doubt about the matters to which this announcement

relates should consult an authorised financial adviser or other

person authorised under the UK Financial Services and Markets Act

2000. To the best of Saba’s ability and belief, all information

contained herein is accurate and reliable, and has been obtained

from public sources that Saba believes to be accurate and reliable.

However, such information is presented “as is”, without warranty of

any kind, whether express or implied, and Saba has not

independently verified the data contained therein. All expressions

of opinion are subject to change without notice, and Saba does not

undertake to update or supplement any of the information, analysis

and opinion contained herein.

The reference herein to CEFS (and Saba as its portfolio manager)

is solely provided for context in discussing the proposals related

to the Trusts and is not intended to be, nor is it, an offer to

sell interests of that fund or any other Saba-managed or subadvised

vehicle.

Saba may continue transacting in the shares and securities of

the Trusts, and/or derivatives referenced to them (which may

include those providing long and short economic exposure) for an

indefinite period following the date of this announcement and may

increase or decrease its interests in such shares, securities

and/or derivatives at any time.

FORWARD LOOKING STATEMENTS

This announcement contains certain forward-looking statements

and information that are based on Saba’s beliefs, as well as

assumptions made by, and information currently available to, Saba.

These statements include, but are not limited to, statements about

strategies, plans, objectives, expectations, intentions,

expenditures and assumptions and other statements that are not

historical facts. When used herein, words such as “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “plan” and “project” and

similar expressions (or their negative) are intended to identify

forward-looking statements. These statements reflect Saba’s current

views with respect to future events, are not guarantees of future

performance and involve risks and uncertainties that are difficult

to predict. Further, certain forward-looking statements are based

upon assumptions as to future events that may not prove to be

accurate. Actual results, performance or achievements may vary

materially and adversely from those described herein. There is no

assurance or guarantee with respect to the prices at which any

securities of the Trusts or any other trust will trade, and such

securities may not trade at prices that may be implied herein. Any

estimates, projections or potential impact of the opportunities

identified by Saba herein are based on assumptions that Saba

believes to be reasonable as of the date hereof, but there can be

no assurance or guarantee that actual results or performance will

not differ, and such differences may be material and adverse. No

representation or warranty, express or implied, is given by Saba or

any of its officers, employees or agents as to the achievement or

reasonableness of, and no reliance should be placed on, any

projections, estimates, forecasts, targets, prospects or returns

contained herein. Neither Saba nor any of its directors, officers,

employees, advisers or representatives shall have any liability

whatsoever (for negligence or misrepresentation or in tort or under

contract or otherwise) for any loss howsoever arising from any use

of information presented in this announcement or otherwise arising

in connection with this announcement. Any historical financial

information, projections, estimates, forecasts, targets, prospects

or returns contained herein are not necessarily a reliable

indicator of future performance. Nothing in this announcement

should be relied upon as a promise or representation as to the

future. Nothing in this announcement should be considered as a

profit forecast.

PERMITTED RECIPIENTS

In relation to the United Kingdom, this announcement is being

issued only to, and is directed only at, (i) investment

professionals specified in Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005 as amended

(the “Order”), (ii) high net worth entities, and other

persons to whom it may lawfully be communicated, falling within

Article 49(2)(a) to (d) of the Order and (iii) persons to whom an

invitation or inducement to engage in investment activity (within

the meaning of section 21 of the Financial Services and Markets Act

2000) in connection with the issue or sale of any securities of the

Trusts or any member of their respective groups may otherwise

lawfully be communicated or caused to be communicated (all such

persons together being referred to as “Permitted

Recipients”). Persons who are not Permitted Recipients must not

act or rely on the information contained in this announcement.

DISTRIBUTION

Not for release, publication or distribution, in whole or in

part, directly or indirectly, in, into or from any jurisdiction

where to do so would constitute a violation of the relevant laws of

that jurisdiction. The distribution of this announcement in certain

countries may be restricted by law and persons who access it are

required to inform themselves and to comply with any such

restrictions. Saba disclaims all responsibility where persons

access this announcement in breach of any law or regulation in the

country of which that person is a citizen or in which that person

is residing or is domiciled.

1 The Trusts’ investment managers include Baillie Gifford,

Herald Investment Management, Janus Henderson Investors and

Manulife | CQS Investment Management. 2 The list of benchmark

indices includes S&P 500 Index (USA), MSCI ACWI Index (KPC),

S&P Global Small Cap Index (EWI), MSCI World Energy Sector

Index (CYN), FTSE All-Share Index (HOT), Russell 2000 Tech Index

(HRI) and MSCI Europe ex U.K. Small Cap Index (ESCT). 3 Source:

Bloomberg. TSR data is inclusive of dividends and as of 13 December

2024. 4 Following receipt of the notice in accordance with

applicable law and each Trust’s articles of association. 5 For USA,

there will be a third resolution to reduce the minimum permitted

board size from three to two directors. 6 Having consulted with the

Takeover Panel, Saba is not aware of other interests or holdings in

any Trust of persons considered by the Takeover Panel to be acting

in concert with it.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241217573649/en/

Investor Contact Alliance

Advisors Timothy Marshall / Adam Riches, 0800-102-6570

saba@allianceadvisors.com

Media Contact Longacre

Square Partners Charlotte Kiaie / Kate Sylvester, +1-646-386-0091

ckiaie@longacresquare.com / ksylvester@longacresquare.com

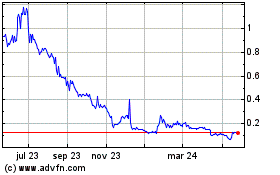

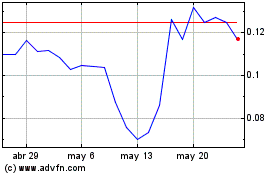

CYNGN (NASDAQ:CYN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

CYNGN (NASDAQ:CYN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024