UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K/A

(Amendment

No. 1)

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

For

the month of: July 2024 (Report No. 4)

Commission

file number: 001-38094

FORESIGHT

AUTONOMOUS HOLDINGS LTD.

(Translation

of registrant’s name into English)

7

Golda Meir

Ness

Ziona 7403650 Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

EXPLANATORY

NOTE

This

Report on Form 6-K/A (this “Amendment”) amends the Report on Form 6-K filed by Foresight Autonomous Holdings Ltd.

(the “Company”) on July 19, 2024 (the “Original 6-K”) solely to include the Company’s Amended

and Restated Compensation Policy as Exhibit A to the Notice of Meeting, Proxy Statement and Proxy Card for the Annual and Extraordinary

General Meeting of Shareholders to be held on August 26, 2024 (the “Meeting”).

Except

as described above, this Amendment speaks as of the original filing date of the Original 6-K and does not amend, update or restate any

information set forth in the Original 6-K or reflect any events that occurred subsequent to the original filing date of the Original

6-K.

CONTENTS

Annual

and Extraordinary General Meeting of Shareholders

Attached

hereto and incorporated by reference herein is (i) the Notice of Meeting, Proxy Statement and Proxy Card for the Annual and Extraordinary

General Meeting of Shareholders of the Company to be held on Sunday, August 26, 2024, and (ii) voting instruction form which will be

sent to holders of American Depositary Shares by The Bank of New York Mellon.

Only

shareholders of record who hold ordinary shares, no par value (the “Ordinary Shares”), or American Depositary Shares

representing Ordinary Shares, of the Company at the close of business on July 22, 2024, will be entitled to vote at the Meeting and any

postponement or adjournments thereof.

This

Report on Form 6-K is incorporated by reference into the Registrant’s Registration Statements on Form F-3 (File No. 333-276709)

and Form S-8 (Registration Nos. 333-229716, 333-239474, 333-268653 and 333-280778), filed with the Securities and Exchange Commission,

to be a part thereof from the date on which this Report is submitted, to the extent not superseded by documents or reports subsequently

filed or furnished.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Foresight

Autonomous Holdings Ltd. |

| |

(Registrant) |

| |

|

|

| Date:

July 22, 2024 |

By: |

/s/

Eli Yoresh |

| |

Name: |

Eli

Yoresh |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

FORESIGHT

AUTONOMOUS HOLDINGS LTD.

NOTICE

OF ANNUAL AND EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

Notice

is hereby given that an Annual and Extraordinary General Meeting (the “Meeting”) of Shareholders of Foresight Autonomous

Holdings Ltd. (the “Company” or “we”, “us” or “our”) will

be held at the Company’s offices, at 7 Golda Meir St., Ness Ziona, Israel (the “Company’s Registered Address”),

on August 26, 2024, at 3:00 p.m. Israel time.

The

Company is a “Dual Company,” as such term is defined in the Israeli Companies Regulations (Relief for Public Companies Traded

on Stock Markets Outside of Israel), 5760–2000.

The

agenda of the Meeting:

| 1. |

To

reappoint Brightman Almagor Zohar, Certified Public Accountants (Deloitte Israel) as the Company’s independent auditor for

the year ending December 31, 2024, and until the next annual general meeting of the shareholders of the Company, and authorization

of the Company’s board of directors (the “Board of Directors”) to determine their remuneration. |

| |

|

| 2. |

To

reappoint four members of the Board of Directors. |

| |

|

| 3. |

To

reappoint Mr. Haim Siboni, to the combined role as the Chairman of the Board of Directors and the Company’s Chief Executive

Officer, and approval of his terms of compensation. |

| |

|

| 4. |

To

approve the Company’s amended compensation policy. |

| |

|

| 5. |

To

approve a grant of Restricted Share Units (“RSUs”) to non-executive directors of the Company. |

| |

|

| 6. |

To

approve a reverse share split of the Company’s issued and outstanding ordinary shares (as defined below) by a ratio of up to

7:1 that would be effectuated on a date to be determined by the Board of Directors. |

| |

|

| 7. |

To

present the Company’s financial statements and annual report for the year ended December 31, 2023. |

The

Board of Directors recommends that you vote in favor of all the proposals, which are described in the attached proxy statement (the “Proxy

Statement”).

Shareholders

of record at the close of business on July 22, 2024 (the “Record Date”) are entitled to notice of and to vote at the

Meeting, either in person or by appointing a proxy to vote in their stead at the Meeting (as detailed below).

A

form of proxy for use at the Meeting is attached to the Proxy Statement, and a voting instruction form, together with a return envelope,

will be sent to holders of American Depositary Shares representing the Company’s ordinary shares, no par value (the “ADS”

and “Ordinary Shares”, respectively). By appointing “proxies,” shareholders and ADS holders may vote at

the Meeting whether or not they attend. If a properly executed proxy in the attached form is received by the Company at least 4 hours

prior to the Meeting, all of the Company’s Ordinary Shares represented by the proxy shall be voted as indicated on the form. ADS

holders should return their voting instruction form by the date set forth therein. Subject to applicable law and the rules of the Nasdaq

Stock Market, in the absence of instructions to the contrary, the Ordinary Shares represented by properly executed and received proxies

will be voted “FOR” all of the proposed resolutions to be presented at the Meeting for which the Board of Directors recommends

a “FOR.” Shareholders and ADS holders may revoke their proxies or voting instruction form (as applicable) at any time before

the deadline for receipt of proxies or voting instruction form (as applicable) by filing with the Company (in the case of holders of

Ordinary Shares) or with the Bank of New York Mellon (in the case of holders of ADSs) a written notice of revocation or duly executed

proxy or voting instruction form (as applicable) bearing a later date.

Shareholders

registered in the Company’s shareholders register in Israel and shareholders who hold Ordinary Shares through members of the Tel

Aviv Stock Exchange may also vote through the attached proxy by completing, dating, signing and mailing the proxy to the Company’s

offices no later than August 26, 2024, at 11:00 a.m. Israel time. Shareholders registered in the Company’s shareholders register

in Israel and shareholders who hold Ordinary Shares through members of the Tel Aviv Stock Exchange who vote their Ordinary Shares by

proxy must also provide the Company with a copy of their identity card, passport or certification of incorporation, as the case may be,

to the Company’s Registered Address, Attention: Eli Yoresh, not less than 48 hours prior to the Meeting. Shareholders who hold

shares through members of the Tel Aviv Stock Exchange and intend to vote their Ordinary Shares either in person or by proxy must deliver

to the Company, no later than August 26, 2024, at 11:00 a.m. Israel time, an ownership certificate confirming their ownership of the

Company’s Ordinary Shares on the Record Date, which certificate must be approved by a recognized financial institution, as required

by the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting), 5760–2000, as amended. Alternatively,

shareholders who hold Ordinary Shares through members of the Tel Aviv Stock Exchange may vote electronically via the electronic voting

system of the Israel Securities Authority up to six hours before the time fixed for the Meeting. You should receive instructions about

electronic voting from the Tel Aviv Stock Exchange member through which you hold your Ordinary Shares.

ADS

holders should return their proxies by the date set forth on their form of proxy.

| |

Sincerely, |

| |

|

| |

Vered

Raz Avayo |

| |

Interim

Chairwoman of the Board of Directors |

| |

|

| |

July

19, 2024 |

FORESIGHT

AUTONOMOUS HOLDINGS LTD.

NESS

ZIONA, ISRAEL

PROXY

STATEMENT

ANNUAL

AND EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO

BE HELD ON AUGUST 26, 2024

The

enclosed proxy is being solicited by the board of directors (the “Board of Directors”) of Foresight Autonomous Holdings

Ltd. (the “Company” or “we”, “us” or “our”) for use at the

Company’s annual and extraordinary general meeting of shareholders (the “Meeting”) to be held at the Company’s

offices, at 7 Golda Meir St., Ness Ziona, Israel, on August 26, 2024, at 3:00 p.m. Israel time, or at any adjournment or postponement

thereof.

Upon

the receipt of a properly executed proxy in the form enclosed, the persons named as proxies therein will vote the Company’s American

Depositary Shares (“ADSs”) representing the Company’s ordinary shares, no par value (the “Ordinary

Shares”) covered thereby in accordance with the directions of the shareholders executing the proxy. In the absence of such

directions, and except as otherwise mentioned in this proxy statement (the “Proxy Statement”), the Ordinary Shares

represented thereby will be voted in favor of each of the proposals described in this Proxy Statement.

Two

or more shareholders present, personally or by proxy, holding no less than one third of the Company’s outstanding Ordinary Shares,

shall constitute a quorum for the Meeting. If within half an hour from the time the Meeting is convened a quorum is not present, the

Meeting shall stand adjourned until the same day, at 3:30 p.m. (half an hour later) Israel time. If a quorum is not present at the second

meeting at the time appointed for such meeting, any number of shareholders present personally or by proxy shall be deemed a quorum and

shall be entitled to deliberate and to resolve in respect of the matters for which the Meeting was convened. Abstentions and broker non-votes

are counted as Ordinary Shares present for the purpose of determining a quorum.

Pursuant

to the Israeli Companies Law, 5799-1999 (the “Companies Law”), Proposals No. 1, 2, 5, and 6 described hereinafter,

require the affirmative vote of shareholders present at the Meeting, in person or by proxy, and holding Ordinary Shares amounting in

the aggregate to at least a majority of the votes actually cast by shareholders with respect to such proposals (a “Simple Majority”).

Pursuant

to the Companies Law, Proposals No. 3 and 4 described hereinafter, require the affirmative vote of the Company’s shareholders

holding at least a majority of the Company’s Ordinary Shares present, in person or by proxy, and voting on the matter, provided

that either: (i) the majority of the shares that are voted at the Meeting in favor of such Proposals, excluding abstentions, includes

a majority of the votes of shareholders who are not controlling shareholders or do not have a personal interest in the Proposal; or (ii)

the total number of shares of the shareholders mentioned in clause (i) above that are voted against such Proposal does not exceed two

percent (2%) of the total voting rights in the Company (the “Special Majority”).

For

purposes of a Special Majority vote, “personal interest” is defined under the Companies Law as: (1) a shareholder’s

personal interest in the approval of an act or a transaction of the Company, including (i) the personal interest of any of his or her

relatives (which includes for these purposes foregoing shareholder’s spouse, siblings, parents, grandparents, descendants, and

spouse’s descendants, siblings, and parents, and the spouse of any of the foregoing); (ii) a personal interest of a corporation

in which a shareholder or any of his/her aforementioned relatives serve as a director or the chief executive officer, owns at least 5%

of its issued share capital or its voting rights or has the right to appoint a director or chief executive officer; and (iii) a personal

interest of an individual voting via a power of attorney given by a third party (even if the empowering shareholder has no personal interest),

and the vote of an attorney-in-fact shall be considered a personal interest vote if the empowering shareholder has a personal interest,

and all with no regard as to whether the attorney-in-fact has voting discretion or not, but (2) excludes a personal interest arising

solely from the fact of holding shares in the Company.

For

this purpose, a “controlling shareholder” is any shareholder that has the ability to direct the Company’s activities

(other than by means of being a director or office holder of the Company). A person is presumed to be a controlling shareholder if he

or she holds or controls, by himself or together with others, one half or more of any one of the “means of control” of a

company; in the context of a transaction with an interested party, a shareholder who holds 25% or more of the voting rights in the company

if no other shareholder holds more than 50% of the voting rights in the company, is also presumed to be a controlling shareholder. “Means

of control” is defined as any one of the following: (i) the right to vote at a general meeting of a company, or (ii) the right

to appoint directors of a company or its chief executive officer.

Proposal

No. 7 will not involve a vote by the shareholders, and accordingly there is no proposed resolution.

Any

shareholder of the Company holding: (i) at least one percent of the outstanding voting rights of the Company wishing to add an additional

agenda item for the meeting, or (ii) at least five percent of the outstanding voting rights of the Company and wishing to submit a proposed

director candidate to be considered for election at the Meeting or removal from office of a member of the Board of Directors, may do

so by submitting such proposed item in writing to the Company’s offices at c/o Mr. Eli Yoresh, Chief Financial Officer, at 7 Golda

Meir St., Ness Ziona, Israel, no later than July 26, 2024. To the extent that there are any additional agenda items that the Board determines

to add as a result of any such submission, the Company will publish an updated agenda and proxy card with respect to the Meeting, no

later than August 2, 2024, to the U.S. Securities and Exchange Commission (the “SEC”) on Form 6-K, and will be made

available to the public on the SEC’s website at www.sec.gov and in addition at www.magna.isa.gov.il or https://maya.tase.co.il/.

Holders

of Ordinary Shares or holders of ADSs representing Ordinary Shares wishing to express their position on an agenda item for this Meeting

may do so by submitting a written statement (a “Position Statement”) to the Company’s offices, c/o Mr. Eli Yoresh,

at 7 Golda Meir St., Ness Ziona, Israel. Any Position Statement received will be furnished to the SEC on Form 6-K and will be made available

to the public on the SEC’s website at www.sec.gov and in addition at www.magna.isa.gov.il or https://maya.tase.co.il/. Position

Statements should be submitted to the Company no later than August 16, 2024. A shareholder is entitled to contact the Company directly

and receive the text of the proxy card and any Position Statement.

PROPOSAL

1

TO

REAPPOINT BRIGHTMAN ALMAGOR ZOHAR, CERTIFIED PUBLIC ACCOUNTANTS (DELOITTE ISRAEL), AS INDEPENDENT AUDITOR OF THE COMPANY

Under

the Companies Law, the appointment of an independent auditor requires the approval of the shareholders of the Company.

The

Board of Directors has authorized and approved the reappointment of the accounting firm of Brightman, Almagor Zohar, Certified Public

Accountants (Deloitte Israel) (“Deloitte Israel”), as the Company’s independent auditor for the year ending

December 31, 2024, and until the next annual general meeting of the shareholders of the Company.

The

Board of Directors believes that the reappointment of Deloitte Israel as the Company’s independent auditor is appropriate and in

the best interests of the Company and its shareholders. Deloitte Israel has served in this position since 2016.

For

additional information on the fees paid by the Company and its subsidiaries to Deloitte Israel in each of the previous two fiscal years,

please see Item 16C. ‘Principal Accountant Fees and Services’ in the Company’s annual report on Form 20-F for the year

ended December 31, 2023, filed with the SEC on March 27, 2024.

The

Company’s shareholders are requested to adopt the following resolution:

“RESOLVED,

to reappoint Deloitte Israel as the Company’s independent auditor for the year ending December 31, 2024, and until the next annual

general meeting of the Company’s shareholders, and to authorize the Company’s Board of Directors to determine their remuneration.”

The

approval of this proposal, as described above, requires the affirmative vote of a Simple Majority.

The

Board of Directors unanimously recommends that the shareholders vote FOR the above proposal.

PROPOSAL

2

To

reappoint FOUR members of the board of directors

It

is proposed to reappoint Mr. Haim Siboni (who also serves as the Company’s Chief Executive Officer and Chairman of the Board of

Directors), Mr. Ehud Aharoni, Mr. Moshe Scherf and Ms. Vered Raz-Avayo as members of the Board of Directors to hold office until the

close of the next annual general meeting. Mr. Aharoni is an independent director, as classified under the Companies Law and Nasdaq Stock

Market rules. Ms. Raz-Avayo is an independent director, as classified under the Nasdaq Stock Market rules. Mr. Scherf is the husband

of Ms. Sivan Siboni Scherf, VP Human Resources, who is the daughter of Mr. Haim Siboni. Each director nominee has certified to us that

he or she complies with all requirements under the Companies Law for serving as a director.

In

their capacity as members of the Board of Directors, the reappointed directors, other than Mr. Siboni, shall be entitled to fees equal

to the fixed amount set forth in the second and third appendices of the Companies Regulations (Rules concerning Compensation and Expenses

of an External Director), 5760-2000. For Mr. Siboni’s compensation, please see Proposal no. 3 herein.

In

addition, in their capacity as members of the Board of Directors, the reappointed directors shall continue to be entitled to the same

insurance, indemnification and exculpation arrangements as are currently in effect for the Company’s officers and directors; all

of which are in accordance with the Company’s Articles of Association (the “Articles”) and the Company’s

current compensation policy. For details regarding the Company’s current compensation policy, and of the Company’s proposal

to approve the amended and restated compensation policy, see Proposal No. 4 herein.

A

brief biography of each nominee is set forth below:

Mr.

Haim Siboni has served as the Company’s Chief Executive Officer and on the Board of Directors since January 2016. Mr. Siboni

has also served as the chief executive officer and as a director of Magna B.S.P. Ltd. (“Magna”), the Company’s

significant shareholder, since January 2001. Mr. Siboni also serves as Chairman of the Board of Directors since July 2021. Mr. Siboni

has many years of professional experience, as well as a broad skillset, in fields such as engineering, marketing and business management

of electronics, video, TV, multimedia, computerized systems, line and wireless telecommunication, design and development of systems and

devices – including electro-optic radar systems.

Mr.

Ehud Aharoni has served on the Board of Directors as

an independent director since January 2016. Mr. Aharoni has also served on our Audit and Compensation Committee since January 2016. Mr.

Aharoni serves as the CEO and Academic Director of Lahav Executive Education, Coller School of Management, Tel-Aviv University, and a

former lecturer at the school’s MBA and EMBA courses in Strategy, Innovation Strategy and Global Strategy. In 2004 he established

the Eli Hurvitz Institute of Strategic Management at the School and served as its Executive director between 2004-2019 and since 2019,

has acted as a consultant to it. Mr. Aharoni is one of the founders of the Israel Directors Institute, serving on behalf of the Lahav

Executive Education, Coller School of Management as vice-chairman. Prior his role at Lahav, Mr. Aharoni served as an independent strategic

consultant to leading Israeli firms and organizations. Mr. Aharoni holds a bachelor’s degree in statistics and operations research

and an M.B.A. with a concentration in Finance and a continuation M.B.A. with a concentration in International Management, all from the

Tel Aviv University.

Mr.

Moshe Scherf has served on the Board of Directors since

July 2021. Mr. Scherf has been providing legal services to Magna since 2016. Mr. Scherf has had a private law practice specializing in

commercial litigation, dispute resolution and family law since 2013. Mr. Scherf lectures in the fields of civil law in various law faculties

in Israel and was also a teaching assistant in several law courses. Mr. Scherf holds a LLB from Ono Academic College and an LLM from

Bar Ilan University and is a member of the Israeli Bar Association.

Ms.

Vered Raz-Avayo has served on the Board of Directors as

an independent director since July 2017. Ms. Raz-Avayo has over 20 years of managerial and consulting experience in finance encompassing

a wide range of industries in Israel and overseas, including real estate investment, diamonds, jewelry and aviation. During the years

1999 to 2010, Mrs. Raz-Avayo served as chief financial officer at one of the companies under the Leviev group. In addition, during the

last 14 years Ms. Raz-Avayo has been an external director of several publicly traded companies. Currently, Ms. Raz-Avayo is an external

director at Apollo Power Ltd., a director at Nayax Ltd. (TASE:NYAX) and a director in Shikun & Binui Energy Ltd. Ms. Raz-Avayo is

a certified public accountant in Israel, and holds a B.A. in Business Administration – Accounting and Finance, from the College

of Management, and an M.F.A. in Film, TV and Screenwriting, from the Faculty of Arts of the Tel Aviv University.

The

Company’s shareholders will be requested to adopt the following resolutions at the Meeting:

| 1. |

“RESOLVED,

to reappoint Mr. Haim Siboni as a member of the Company’s Board of Directors, until the next annual general meeting of the

Company’s shareholders.” |

| |

|

| 2. |

“RESOLVED,

to reappoint Ms. Vered Raz-Avayo as a member of the Company’s Board of Directors, until the next annual general meeting of

the Company’s shareholders.” |

| |

|

| 3. |

“RESOLVED,

to reappoint Mr. Ehud Aharoni as member of the Company’s Board of Directors, until the next annual general meeting of the Company’s

shareholders.” |

| |

|

| 4. |

“RESOLVED,

to reappoint Mr. Moshe Scherf as member of the Company’s Board of Directors, until the next annual general meeting of the Company’s

shareholders.” |

The

approval of these proposals, as described above, requires the affirmative vote of a Simple Majority.

The

Board of Directors unanimously recommends that the shareholders vote FOR the above proposals.

PROPOSAL

3

TO

REAPPOINT MR. HAIM SIBONI TO A COMBINED ROLE AS THE COMPANY’S CHAIRMAN OF THE BOARD OF DIRECTORS AND CHIEF EXECUTIVE OFFICER AND

TO APPROVE THE TERMS OF HIS COMPENSATION

Mr.

Haim Siboni has served as our Chief Executive Officer and on the Board since January 2016. On July 8, 2021, the shareholders of the Company

approved, following the approval of our Board of Directors, to appoint Mr. Siboni for the combined role of Chairman of the Board of Directors

and Chief Executive Officer of the Company, for a period of three years commencing on the date of the said meeting.

Pursuant

to Section 121(c) of the Companies Law, the appointment of a person to the combined role of Chairman of the Board of Directors and Chief

Executive Officer of the Company, is required to be approved by the Company’s shareholders by a Special Majority and can be made

for a period of up to three years each. Therefore, and pursuant to the resolution of the Board of Directors approving same, it is proposed

to reappoint Mr. Siboni for the combined role of Chairman of the Board of Directors and Chief Executive Officer of the Company (the “Combined

Role”) for a period of three years, commencing on the date of the Meeting.

Pursuant

to Mr. Siboni’s current services agreement (through a wholly owned corporation of Mr. Siboni), which was approved by the Company’s

shareholders on July 8, 2021, for a period of three years (the “Services Agreement”), Mr. Siboni is entitled to a

monthly consideration of NIS 80,000 (approximately $22,000), plus VAT (the “Monthly Consideration”). In addition,

the Company shall bear travel and other expenses that are incurred in the course of Mr. Siboni’s Combined Role.

Under

the Services Agreement, Mr. Siboni shall act as chief executive officer to the Company and Foresight Automotive Ltd., the Company’s

wholly owned subsidiary (the “Services”). The Services will include general roles of a chief executive officer, as

requested by the Board of Directors from time to time. Mr. Siboni will render the Services faithfully and diligently for the benefit

of the Company and the Subsidiaries, with at least 80% of his working time devoted for the performance of the Services.

It

is proposed, following the approval of the Audit, Compensation and Financial Statements Review Committee of the Board of Directors (the

“Committee”) and Board of Directors, to approve the Services Agreement under the same terms and conditions. In the

event that the Board of Directors determines to increase the scope of the Services, the Monthly Consideration will be increased proportionally.

Mr. Siboni will not be entitled to additional compensation as a member or Chairman of the Board of Directors, if so reappointed.

In

addition, it is proposed, following the approval of the Committee and Board of Directors, to grant Restricted Share Units, which will

be settled in Ordinary Shares of the Company (“RSUs”), to Mr. Siboni, under the Company’s 2024 Share Incentive

Plan (the “Plan”), subject to the approval of the Amended and Restated Compensation Policy (as defined and set forth

in Proposal No. 4 herein).

The

recommended grant consists of 9,000,000 RSUs (equal to 300,000 ADSs), to be granted to Mr. Siboni (or to a company wholly owned by him)

(the “Grant of RSUs to Mr. Siboni”), and to bear the VAT expenses accrued in relation to such grant. The value of

the Grant of RSUs to Mr. Siboni and its terms are in line with the Company’s amended and restated compensation policy (brought

for approval as Proposal No. 4 in this Proxy Statement). The value of the proposed Grant of RSUs to Mr. Siboni, amounts, as of July 15,

2024, to a total of approximately NIS 1,080,000 (approximately US$300,000), and on an annual basis, approximately NIS 360,000 (approximately

$100,000).

Together

with the outstanding options to purchase up to 10,113,000 Ordinary Shares of the Company (equal to 337,100 ADSs), granted to Mr. Siboni

in aggregate in the past, Mr. Siboni’s holdings resulting from the exercise of such options and the Grant of RSUs to Mr. Siboni,

will be equal to approximately 3.8% of the Company’s issued and outstanding share capital on a fully diluted basis as of the date

of this Proxy Statement.

The

RSUs under the Grant of RSUs to Mr. Siboni shall vest quarterly commencing July 1, 2024, and over a period of 36 months in 12 equal portions.

The vesting of RSUs under the Grant of RSUs to Mr. Siboni shall accelerate upon the termination of his services with the Company, resulting

from a change of control in the Company or other exit event. In the event that Mr. Siboni ceases to provide services to the Company (except

in certain events specified in the Plan), all of such unvested RSUs shall expire immediately.

The

RSUs are granted to Mr. Siboni in accordance with Section 3(i) of the Israeli Income Tax Ordinance, 1961.

In

making its recommendation to the Company’s shareholders with respect to the Services Agreement and the Grant of RSUs to Mr. Siboni,

the Committee and the Board of Directors each considered various factors, including, among others: (a) that the compensation Mr. Siboni

receives reflects a fair and reasonable value for his vital services in relation to the Company’s success; (b) Mr. Siboni’s

position, responsibilities and previous compensation arrangements, including Mr. Siboni’s contemplated appointment to the Combined

Role; and (c) all the terms and conditions of the Services Agreement, including the Monthly Consideration, shall remain unchanged with

respect to the terms and conditions approved by the Company’s shareholders on July 8, 2021.

The

Committee and Board of Directors found the terms of the Services Agreement and the Grant of RSUs to Mr. Siboni reasonable under the circumstances,

under market conditions, and that the approval thereof is in the best interests of the Company. The Committee and Board of Directors

determined that the terms of the Services Agreement are in accordance with the Company’s Current as well as Amended and Restated

Compensation Policy (as defined herein), and that the terms of the Grant of RSUs to Mr. Siboni are in accordance with the Amended and

Restated Compensation Policy.

The

Company’s shareholders are requested to adopt the following resolutions:

| 1. |

“RESOLVED,

to reappoint Mr. Haim Siboni to the Combined Role of Chairman of the Board of Directors and Chief Executive Officer of the Company,

for a period of three years commencing on the date of the Meeting.” |

| |

|

| 2. |

“RESOLVED,

to approve the Services Agreement between the Company and Mr. Haim Siboni, as set forth in Proposal No. 3 of the Proxy Statement.” |

| |

|

| 3. |

“RESOLVED,

to approve the Grant of RSUs to Mr. Haim Siboni and to bear the VAT expenses accrued in relation to such grant, as set forth in Proposal

No. 3 of the Proxy Statement, subject to the approval of the Amended and Restated Compensation Policy (as set forth in Proposal No.

4 to the Proxy Statement).” |

The

approval of these proposals, as described above, requires the affirmative vote of a Special Majority (as defined in this proxy statement).

Please

note that we consider it highly unlikely that any of our shareholders is a controlling shareholder or has a personal interest in this

proposal (other than as previously disclosed Magna and certain of relatives of Mr. Siboni). However, as required under Israeli law, the

enclosed form of proxy requires that you specifically indicate whether you are, or are not, a controlling shareholder or have a personal

interest in this proposal. Without indicating to this effect, we will not be able to count your vote with respect to this proposal.

The

Board of Directors unanimously recommends that the shareholders vote FOR the above proposals.

PROPOSAL

4

To

APPROVE the Company’s AMENDED compensation policy

Pursuant

to the Companies Law, all Israeli public companies, including dual-listed companies such as the Company, are required to adopt a written

compensation policy for their executives that addresses certain items prescribed by the Companies Law and serves as a flexible framework

for executive and director compensation. Furthermore, according to the Companies Law, the compensation policy must generally be periodically

reviewed by the compensation committee and the board of directors and needs to be reapproved once every three years by the board of directors,

following recommendation by the compensation committee, and by a Special Majority of the company’s shareholders.

On

January 31, 2022, the Company’s shareholders determined not to approve the compensation policy brought for their approval (the

“Current Compensation Policy”). Following the opposition of the shareholders, the Committee and the Board of Directors,

in their respective meetings on March 29, 2022, and March 31, 2022, re-examined the Current Compensation Policy, determined to adopt

it and resolved that adopting the Current Compensation Policy would be beneficial to the Company, taking into consideration the shareholders’

opposition.

On

May 26, 2024, and July 8, 2024, the Committee, and on May 27, 2024, and July 8, 2024, the Board of Directors, in their respective meetings,

reviewed in depth the terms of the Current Compensation Policy, evaluated the need for adjustments and approved, and recommended the

shareholders to approve, that the Current Compensation Policy be slightly amended as reflected in Exhibit A hereto (the

“Amended and Restated Compensation Policy”).

When

considering the Amended and Restated Compensation Policy, the Committee and Board of Directors considered numerous factors, including

the advancement of the Company’s objectives, the Company’s business plan and its long-term strategy, and creation of appropriate

incentives for directors and executive officers. The Committee and the Board of Directors also considered, among other things, the Company’s

risk management, size and the nature of its operations, the continuous growth of the Company over the years, the increased complexity

of its business and the growing competition over talented managers in the technology sector, the market practice and reviewed various

data and information they deemed relevant.

Similar

to the Current Compensation Policy, the proposed Amended and Restated Compensation Policy is designed to promote retention and motivation

of directors and executive officers, incentivize superior individuals’ excellence, align the interests of the Company’s directors

and executive officers with the long-term performance of the Company and provide a risk management tool. To that end, a portion of an

executive officer compensation package is targeted to reflect the Company’s short and long-term goals, as well as the executive

officer’s individual performance, while taking into account each executive’s skills, education, expertise and achievements.

The Amended and Restated Compensation Policy includes limitations on the ratio between the variable and the total compensation of an

executive officer and minimum vesting periods for equity-based compensation.

Pursuant

to the proposed Amended and Restated Compensation Policy and similar to the Current Compensation Policy, the compensation that may be

granted to an executive officer may include base salary, annual performance bonus, special bonus, equity-based compensation, benefits

and termination of employment arrangements.

The

main changes in the Amended and Restated Compensation Policy in comparison to the Current Compensation Policy are as follows: (i) extending

the maximum expiration date of options granted to Company officers from no later than seven years following the vesting date of an option,

to ten years following the vesting date of the respective installment of the share-based payment; (ii) increasing the maximum aggregate

dilution for all of the share-based payment awarded to the Company’s officers, employees and consultants from 15% to 18%; and (iii)

including recently adopted clawback policy, which contains compensation recovery provisions that

allow the Company under certain conditions to recover bonuses paid in excess on basis of results which were discovered as incorrect or

restated in the Company’s financial statements. The Committee and the Board of Directors determined that it is advisable

to retain all other provisions of the Current Compensation Policy.

A

marked copy of the Amended and Restated Compensation Policy indicating the proposed amendments is attached hereto as Exhibit A.

The

shareholders of the Company are requested to adopt the following resolution:

“RESOLVED,

to approve the Amended and Restated Compensation Policy for the Company’s directors and officers, in the form attached as Exhibit

A to the Proxy Statement, as of the date of this Meeting and for a three-year period as prescribed under applicable law, as set forth

in Proposal No. 4 of the Proxy Statement.”

The

approval of the above proposal, as described above, requires the affirmative vote of a Special Majority (as defined in this proxy statement).

Please

note that we consider it highly unlikely that any of our shareholders is a controlling shareholder or has a personal interest in this

proposal (other than officers or their relatives who hold Ordinary Shares of the Company, whether directly or through companies controlled

by them). However, as required under Israeli law, the enclosed form of proxy requires that you specifically indicate whether you are,

or are not, a controlling shareholder or have a personal interest in this proposal. Without indicating to this effect, we will not be

able to count your vote with respect to this proposal.

The

Board of Directors unanimously recommends a vote FOR on the above proposal.

PROPOSAL

5

To

APPROVE A Grant of Restricted Share Units to Non-Executive Directors of the company

Under

the Companies Law, the terms of compensation, including grant of equity-based compensation, of a director of a public company incorporated

under the laws of Israel, such as the Company, requires the approval of the compensation committee, the board of directors and, subject

to certain exceptions, the shareholders (in that order).

Following

discussions held by the Committee and the Board of Directors in their respective meetings on July 8, 2024 and on July 15, 2024, the Committee

and the Board of Directors, in their respective meetings, approved and recommended to the Company’s shareholders to approve, a

grant of RSUs to the Company’s non-executive and non-external directors: Mr. Ehud Aharoni, Mr. Moshe Scherf and Ms. Vered Raz-Avayo

(the “Non-Executive Directors”), under the Plan, as follows, subject to their reappointment as members of the Company’s

Board of Directors as set forth in Proposal No. 2 above, and the approval of the Amended and Restated Compensation Policy as set forth

in Proposal No. 4 above (the “Grant of RSUs to Non-Executive Directors”).

| Name |

|

Title |

|

Previous

Options Granted |

|

RSUs

Suggested for Grant |

|

%

of the Company’s issued and outstanding share capital on a fully diluted basis 1 |

| Ehud

Aharoni |

|

Independent

Director |

|

1,000,000

(equal to 33,333 ADSs) |

|

1,050,000

(equal to 35,000 ADSs) |

|

0.41% |

| Vered

Raz-Avayo |

|

Independent

Director |

|

850,000

(equal to 28,333 ADSs) |

|

1,050,000

(equal to 35,000 ADSs) |

|

0.38% |

| Moshe

Scherf |

|

Director |

|

400,000

(equal to 13,333 ADSs) |

|

1,050,000

(equal to 35,000 ADSs) |

|

0.29% |

| Total |

|

2,250,000

(equal to 74,999 ADSs) |

|

3,150,000

(equal to 105,000ADSs) |

|

1.08% |

The

RSUs under the Grant of RSUs to each of Non-Executive Directors shall vest quarterly commencing July 1, 2024, and over a period of 36

months in 12 equal portions. The vesting of the RSUs under the Grant of RSUs to Non-Executive Directors shall accelerate upon the termination

of a Non-Executive Director’s service with the Company, resulting from a change of control in the Company or other exit event.

In the event that any of the Non-Executive Directors will cease to serve on the Company’s Board of Directors (except in certain

events specified in the Plan), all of such Non-Executive Director’s unvested RSUs under the Grant of RSUs to Non-Executive Directors

shall expire immediately.

The

RSUs are granted in accordance with the capital gain track of Section 102 of the Israeli Income Tax Ordinance, 1961.

The

value of the proposed Grant of RSUs to each of the Non-Executive Directors, amounts, as of July 15, 2024, to a total of approximately

NIS126,000 (approximately US$35,000), and on an annual basis, approximately NIS42,000 (approximately $11,667).

In

making its recommendation with regard to the approval of the Grant of RSUs to Non-Executive Directors, the Committee and the Board of

Directors, each have also considered, among other factors: (a) the factors included in the Compensation Policy, including among others,

the position, responsibilities, background and experience of the Non-Executive Directors; (b) that the Grant of RSUs to Non-Executive

Directors reflects a fair and reasonable value for the Executive Directors’ services; and (c) the Grant of RSUs to Non-Executive

Directors is an expression to Company’s desire to maintain the threshold of directors’ current equity-based compensation,

taking into account (i) options previously granted to Non-Executive Directors, and (ii) the dilution of the Company’s share capital

since the previous grant of options to the Non-Executive Directors.

The

Committee and the Board of Directors found the Grant of RSUs to Non-Executive Directors reasonable under the circumstances, under market

conditions, and that the approval thereof is in the best interests of the Company and is in accordance with the Amended and Restated

Compensation Policy (brought for approval as Proposal No. 4 in this Proxy Statement).

The

shareholders of the Company are requested to adopt the following resolution:

“RESOLVED,

to grant to each of Mr. Ehud Aharoni, Mr. Moshe Scherf and Ms. Vered Raz-Avayo, RSUs, subject to their reappointment as members of the

Company’s Board of Directors and subject to the approval of the Amended and Restated Compensation Policy, as set forth in Proposal

No. 5 of the Proxy Statement.”

Approval

of this proposal, as described above, requires the affirmative vote of a Simple Majority.

The

Board of Directors unanimously recommends a vote FOR on the above proposal.

1

Reflecting the Grant of RSUs to each Non-Executive Director together with the outstanding options to purchase Ordinary Shares of

the Company, granted in aggregate to each Non-Executive Director in the past.

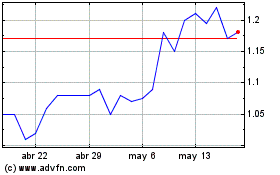

PROPOSAL

6

TO

APPROVE A REVERSE SHARE SPLIT OF THE COMPANY’S ISSUED AND OUTSTANDING ORDINARY SHARES BY A RATIO OF UP TO 7:1 THAT WOULD BE EFFECTUATED

ON A DATE TO BE DETERMINED BY THE BOARD OF DIRECTORS

Due

to the decline in the share price of the Company’s Ordinary Shares, the Company’s Board of Directors recommends a reverse

share split of our issued and outstanding Ordinary Shares to make such Ordinary Shares more attractive to a broader range of investors,

including professional investors, institutional investors and the general investing public and so that it may generate additional interest

and trading in our Ordinary Shares trading on the Tel Aviv Stock Exchange.

Therefore,

it is proposed to approve a reverse split of the Company’s issued and outstanding Ordinary Shares by a ratio of up to 7:1 (the

“Reverse Split”). If the Reverse Split is approved by our shareholders, the Board of Directors will have the authority

to decide on the ratio of and on which date to effectuate the Reverse Split, if at all. Following such determination by our Board of

Directors, we shall issue a press release announcing the effective date of the Reverse Split.

The

Reverse Split would be effectuated simultaneously for all of the issued and outstanding Company’s Ordinary Shares, and the exchange

ratio would be the same for all Ordinary Shares. The Reverse Split would affect all of our shareholders uniformly and would not affect

any shareholder’s percentage ownership interests in the Company, relative voting rights or other rights. Ordinary Shares issued

pursuant to the Reverse Split would remain fully paid and non-assessable. If the Reverse Split is implemented, the number of issued and

outstanding Ordinary Shares would be reduced in accordance with the Reverse Split ratio, while the number of authorized Ordinary Shares

shall remain unchanged. In addition, if the Reverse Split is implemented, the exercise price and the number of Ordinary Shares issuable

pursuant to outstanding options and warrants would be adjusted pursuant to the terms of the respective options and warrants in connection

with the Reverse Split. Furthermore, upon completion of the Reverse Split, the number of Ordinary Shares issuable pursuant to the Company’s

2016 Equity Incentive Plan and 2024 Share Incentive Plan shall be appropriately adjusted (including the number of the RSUs under the

Grant of RSUs to Mr. Siboni and under the Grant of RSUs to Non-Executive Directors, to the extent approved by the shareholders at the

Meeting).

In

the event that the Reverse Split results in shareholders having fractional shares, the treatment of such fractional shares shall be coordinated

with the Tel Aviv Stock Exchange, in accordance with its rules and instructions, and in accordance with the Articles.

Upon

the implementation of the Reverse Split, we intend to treat Ordinary Shares held by shareholders through a bank, broker, custodian or

other nominee in the same manner as registered shareholders whose shares are registered in their names. Banks, brokers, custodians or

other nominees will be instructed to affect the Reverse Split for their beneficial holders holding our Ordinary Shares in their name.

However, these banks, brokers, custodians or other nominees may have different procedures than registered shareholders for processing

the Reverse Split. Shareholders who hold our Ordinary Shares with a bank, broker, custodian or other nominee and who have any queries

in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

The

Board of Directors has determined that no adjustment will be made to the number of Ordinary Shares underlying each ADS, and each ADS

will continue to represent thirty of our Ordinary Shares. However, the Board of Directors may decide to further adjust the Ordinary Shares

per ADS ratio in connection with the Reverse Split or otherwise.

THE

U.S. AND ISRAELI TAX CONSEQUENCES OF THE REVERSE SPLIT MAY DEPEND UPON THE PARTICULAR CIRCUMSTANCES OF EACH SHAREHOLDER. ACCORDINGLY,

EACH SHAREHOLDER IS ADVISED TO CONSULT THE SHAREHOLDER’S TAX ADVISOR WITH RESPECT TO ALL OF THE POTENTIAL TAX CONSEQUENCES TO THE

SHAREHOLDER OF THE REVERSE SPLIT.

The

shareholders of the Company are requested to adopt the following resolution:

“RESOLVED,

to approve a reverse share split of the Company’s issued and outstanding Ordinary Shares by a ratio of up to 7:1, to be effective

at the ratio and on a date to be determined by the Board of Directors, as set forth in the Proposal No. 6 of the Proxy Statement.”

The

approval of this proposal, as described above, requires the affirmative vote of a Simple Majority.

The

Board of Directors unanimously recommends that the shareholders vote FOR the above proposal.

PROPOSAL

7

PRESENTATION

OF THE COMPANY’S FINANCIAL STATEMENTS AND

ANNUAL

REPORT FOR THE YEAR ENDED DECEMBER 31, 2023

Pursuant

to the Companies Law, the Company is required to present the Company’s financial statements and annual report for the year ended

December 31, 2023, to the Company’s shareholders. Our financial statements and annual report for the year ended December 31, 2023,

filed on Form 20-F with the SEC on March 27, 2024, are available on the SEC’s website at the following address:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1691221/000149315224011506/form20-f.htm

And

on the Israel Securities Authority’s distribution website at the following address:

https://www.magna.isa.gov.il/details.aspx?reference=2024-02-027673&file=1&id=01185#?id=01185&reference=2024-02-027673&file=1&ft=1

At

the Meeting, shareholders will have an opportunity to review, ask questions and comment on the Company’s audited consolidated financial

statements and annual report for the year ended December 31, 2023.

This

agenda item will not involve a vote by the shareholders, and accordingly there is no proposed resolution.

Your

vote is important! Shareholders are urged to complete and return their proxies promptly in order to, among other things, ensure action

by a quorum and to avoid the expense of additional solicitation. If the accompanying proxy is properly executed and returned in time

for voting, and a choice is specified, the shares represented thereby will be voted as indicated thereon. EXCEPT AS MENTIONED OTHERWISE

IN THIS PROXY STATEMENT, IF NO SPECIFICATION IS MADE, THE PROXY WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY

STATEMENT. Shareholders who hold shares of the Company through members of the Tel Aviv Stock Exchange and who wish to participate in

the Meeting, in person or by proxy, are required to deliver proof of ownership to the Company, in accordance with the Companies Regulations

(Proof of Ownership of a Share For Purposes of Voting at General Meetings), 5760-2000. Such shareholders wishing to vote by proxy are

requested to attach their proof of ownership to the enclosed proxy.

Proxies

and all other applicable materials should be sent to the Company’s office at 7 Golda Meir St., Ness Ziona 7403650, Israel.

ADDITIONAL

INFORMATION

We

are subject to the informational requirements of the United States Securities Exchange Act of 1934, as amended (the “Exchange

Act”), as applicable to foreign private issuers. Accordingly, we file reports and other information with the SEC.

All

documents, which we will file on the SEC’s EDGAR system, will be available for retrieval on the SEC’s website at http://www.sec.gov.

As a Dual Company (as defined in the Israeli Companies Regulations (Concessions for Public Companies Traded on Stock Markets Outside

of Israel), 5760-2000) we also file reports with the Israel Securities Authority. Such reports can be viewed on the Israel Securities

Authority distribution website at http://www.magna.isa.gov.il and the Tel Aviv Stock Exchange website at http://www.maya.tase.co.il.

As

a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing certain disclosure and procedural requirements

for proxy solicitations. In addition, we are not required under the Exchange Act to file periodic reports and financial statements with

the SEC as frequently or as promptly as United States companies whose securities are registered under the Exchange Act. The Notice of

the Annual and Extraordinary General Meeting of Shareholders and the Proxy Statement have been prepared in accordance with applicable

disclosure requirements in the State of Israel.

YOU

SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROXY STATEMENT OR THE INFORMATION FURNISHED TO YOU IN CONNECTION WITH THIS PROXY

STATEMENT WHEN VOTING ON THE MATTERS SUBMITTED TO SHAREHOLDER APPROVAL HEREUNDER. WE HAVE NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION

THAT IS DIFFERENT FROM WHAT IS CONTAINED IN THIS DOCUMENT. THIS PROXY STATEMENT IS DATED JULY

19, 2024. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS DOCUMENT IS ACCURATE AS OF ANY DATE OTHER THAN JULY

19, 2024, AND THE MAILING OF THIS DOCUMENT TO SHAREHOLDERS SHOULD NOT CREATE ANY IMPLICATION TO THE CONTRARY.

| |

By

Order of the Board of Directors |

| |

|

| |

Foresight

Autonomous Holdings Ltd. |

| |

|

| |

Vered

Raz Avayo, Interim Chairwoman of the Board of Directors |

Exhibit

A

Amended

and Restated Compensation Policy

Foresight

Autonomous Holdings Ltd.

(the

“Company”)

Remuneration

Policy for Company’s Office Holders

| 1.1 | Pursuant

to the provisions of the Companies Law, 1999 (hereafter – “the Companies Law”),

on May 27 and July 8, 2024, the Company’s Board of Directors approved a remuneration

policy (hereafter – “the remuneration policy”) with respect to the

terms of service and employment of Company’s office holders1 (hereafter

– “the office holders”), after discussing and considering the recommendations

of the Company’s Remuneration Committee regarding this matter. |

| 1.2 | The

provisions of the remuneration policy shall be subject to the provisions of any cogent law

applicable to the Company and its office holders in any territory. |

| 1.3 | The

underlying principles and purposes of the Remuneration Policy are as follows: (a) promoting

the Company’s goals, its work plan and its policy for the long-term; (b) remunerating

and providing incentives to office holders, while considering the risks that the Company’s

activities involve; (c) adjusting the remuneration package to the size of the Company and

the nature and scope of its activities; (d) creating incentives that are suitable to Company’s

office holders by remunerating those entitled for remuneration under the Remuneration Policy

in accordance with their positions, areas of responsibility and contribution to the development

of the Company’s business, the promotion of its targets and the maximization of profits

in the short and long-term, taking into account, among other things, the need to recruit

and retain qualified, highly-skilled officers in a global and competitive market; and (e)

adjusting the remuneration of office holders to the contribution of the office holder to

the achievement of the Company’s goals and maximization of its profits. |

| 1.4 | This

Remuneration Policy is a multi-annual policy that will be effective for a period of three

years from the date of its approval, in accordance with Section 267A(c) of the Companies

Law. This policy shall be brought forward for re-approval by the Company’s Board of

Directors and the general meeting of its shareholders (at the recommendation of the Company’s

Remuneration Committee) after three years have elapsed since the date of approval thereof

and so forth, unless any changes need to be made to the remuneration policy in accordance

with the law and/or in accordance with the Company’s needs. |

| 1.5 | Without

derogating from the provisions set out in Section 1.4 above, the Company’s Remuneration

Committee and Board of Directors shall check, from time to time, whether the remuneration

that is granted under this policy, does, indeed, comply with the terms of this policy and

the parameters set therein for each Company office holder. |

| 1.6 | This

remuneration policy is based, among other things, on the Company’s assessments as to

the competitive environment in which it operates and the challenge it faces in recruiting

and retaining high-quality officers in such an environment; it is also based on employment

terms generally accepted in public companies operating in the Company’s area of activity

and on existing employment agreements between the Company and its office holder, which –

in order to remove any doubt – this policy cannot change. |

| 2. | The

remuneration policy |

| 2.1 | Components

of the remuneration policy |

In

accordance with the Company’s remuneration policy, the remuneration of the Company’s office holders shall be based on all

or some of the following components:

| 2.1.1 | Basic

salary component 2– basic salary/monthly consultation fees; |

| 2.1.2 | Social

and related benefits - social benefits as prescribed by law (pension savings, contributions

towards severance pay, contributions towards training fund, vacation pay, sick leave, recreation

pay, etc.) and related benefits, such as company vehicle/vehicle maintenance, telephone expenses,

meals at the workplace, gifts on public holidays, etc. |

1

The meaning of the term “office holder” is as defined in the Companies

Law, i.e., general manager, chief business manager, deputy general manager, vice-general

manager, any person filling any of these positions in the Company even if he holds a different

title, and any other manager directly subordinate to the general manager.

2

Whenever the term “basic salary” is used in this remuneration policy, it refers to the “gross” monthly

salary of that office holder, excluding any social benefits and related benefits). Whenever the term “annual basis salary”

is used, it means the basic salary for the month of December in the relevant year times 12

| 2.1.3 | Variable

cash remuneration (bonus) – short and medium-term remuneration, which includes

annual bonuses, which are based on results and achievement of targets. The Company may also

determine that a certain office holder will be paid discretionary annual bonuses, taking

into account his/her contribution to the Company and the restrictions placed under this policy. |

| 2.1.4 | Variable

equity-based remuneration – share-based payment or another long-term remuneration

(subject to the existence of valid long-term remuneration plans and provided that the Company

decides to award such remuneration). |

(the

components in sections 2.1.3 and 2.1.4 above shall be called hereafter: “the variable components”).

At

the time of approval of the remuneration package of an office holder, the Remuneration Committee and Board of Directors of the Company

shall assess the compliance of each of those components and of the total cost of employment with the criteria set out in this plan.

| 2.2 | Parameters

for reviewing remuneration terms |

As

a general rule, some or all of the following parameters will be taken into account when reviewing the remuneration terms of a Company

office holder.

| 2.2.1 | Education,

skills, expertise, tenure (specifically in the Company and in the office holder’s field

of expertise in general), professional experience and achievements of the office holder; |

| 2.2.2 | The

role of the office holder, his areas of responsibility and his employment terms under previous

wage agreements entered into with this office holder; |

| 2.2.3 | The

office holder’s contribution to the Company’s business, the achievement of its

strategic goals and implementation of its work plans, the maximization of its profits and

the enhancement of its strength and stability. |

| 2.2.4 | The

extent of responsibility delegated to the office holder. |

| 2.2.5 | The

Company’s need to recruit or retain an office holder with unique skills, knowledge

or expertise. |

| 2.2.6 | Whether

a material change has been made to the role or function of the office holder, or to the Company’s

requirements from this office holder. |

| 2.2.7 | The

size of the Company and the nature of its activities. |

| 2.2.8 | As

to service and employment terms that include retirement grants – the term of service

or employment of the office holder, the terms of his service and employment over the course

of this period, the Company’s performances in the said period, the office holder’s

contribution to the achievement of the Company’s goals, the maximization of its profits

and the circumstances of the retirement. |

| 2.2.9 | (a)

The market conditions of the industry in which the Company operates at any relevant time,

including the office holder’s salary compared to the salaries of other office holders

working in similar positions (or in position of comparable level) in companies whose characteristics

are similar to those of the Company in terms of its activity (as described in section 2.3.1

below; (b) the availability of suitable candidates that can serve as office holders in the

Company, the recruitment and retainment of the office holders and the need to offer an attractive

remuneration package in a global competitive market; and (c) changes in the Company’s

area of activity and in the scope and complexity of its activities. |

| 2.3.1 | For

the purpose of determining the payroll that can be offered to an office holder upon recruitment,

the Company will review from time to time the payroll generally accepted in the relevant

markets for similar positions in companies, which are similar to the Company in terms of

its area of activity/scope of activity/complexity of activity/market value/ revenues and

other relevant parameters (if such companies exist). The Company will strive that the number

of companies in such comparison will be not less than five. |

| 2.3.2 | The

payroll review will be conducted by the Company itself, or by an external advisor, at the

Company’s discretion. |

| 2.4 | Remuneration

terms to new office holders |

As

a general rule, the remuneration terms of new office holders shall be approved before they start working for the Company and not in retrospect,

except in exceptional circumstances.

| 2.5 | The

ratio between the remuneration of office holders and the remuneration of all other Company

employees |

The

ratio between the cost of terms of service and employment of Company’s office holders 3 and the cost of payroll4

of all other Company employees (on a full-time basis):

| The

ratio between the average cost of salary of office holders and the average cost of salary of all other Company employees shall not

exceed: |

|

Active

Chairman of the Board of Directors: up to 4 times

CEO:

up to 4 times

VPs

(and other office holders who report to the CEO): up to 2.5 times |

| |

|

|

| The

ratio between the cost of median payroll of office holders to cost of median payroll of of all other Company employees shall not

exceed: |

|

Active

Chairman of the Board of Directors: up to 4 times

CEO:

up to 4 times

VPs

(and other office holders who report to the CEO): up to 2.5 times |

In

the opinion of the Company’s Remuneration Committee and Board of Directors, the said ratio is reasonable and appropriate and does

not have an adverse effect on work relations in the Company, taking into account the nature of the Company, its size, the manpower mix

employed therein, its area of activity and the areas of responsibility of each office holder.

| 2.6 | Basic

salary, benefits and other related benefits |

| 2.6.1 | The

basic salary of a new Company office holder shall be determined taking into accounts the

parameters described in section 2.2 above and the conclusions of the payroll review described

in section 2.3 above (should such a review be conducted). |

| 2.6.2 | The

basic salary shall be in absolute numbers. The Company may determine that an office holder’s

salary shall be linked to a certain currency or index. |

| 2.6.3 | In

any case, the monthly cost of payroll4 shall not exceed the maximum amount set

out below in respect of full-time position (linked to the Consumer Price Index commencing

December 2018): |

| Position |

|

Maximum

monthly cost of payroll in ILS* |

| |

|

|

| Active

chairman of the Board of Directors |

|

85,000 |

| Company’s

CEO |

|

140,000 |

| Vice

Presidents and other office holders who report to the CEO |

|

75,000 |

| |

* |

The

amounts presented above are in respect of a full-time position; those amounts shall change in proportion to the scope of position

of the office holder. |

3

Cost of terms of service and employment of Company office holders for the purpose of this analysis include the existing remuneration

of the office holders and an amount that reflects the annual bonus ceiling (as defined below) that is set by the remuneration policy

set forth below.

4

“Cost of payroll” – basic salary + benefits in terms of cost to the employer.

| 2.6.4 | Social

benefits5, related benefits, reimbursement of expenses |

The

remuneration package may include benefits that are generally acceptable in the market, such as vacation pay6, contributions

towards pension, life insurance, training fund saving, health insurance, social rights and benefits, mobile phone (including grossing

up of the taxable value of the phone), internet and landline, gifts on public holidays, recreation, medical tests, medical insurance

and/or undertaking such an insurance policy and other expenses, all as approved by the Remuneration Committee and the Company’s

Board of Directors, at their discretion and in accordance with the applicable Company policy.

Company

office holders shall be entitled to receive participation in vehicle expenses or a Company vehicle (including by way of leasing) in accordance

with acceptable standards for office holders holding similar positions in companies operating in the Company’s area of activity,

or in companies, whose scope of activities is similar to that of the Company, including grossing up the taxable value of this benefit,

fuel expenses, licensing, insurance and other related expenses.

| 2.6.6 | Insurance,

indemnification and exemption |

| 2.6.6.1 | Company’s

office holders shall be entitled to insurance coverage to be provided by a liability insurance

policy of directors and office holders, which the Company will purchase from time to time,

subject to the approvals required by law. |

| 2.6.6.2 | Subject

to the provisions of the law, as amended from time to time, and without detracting from the

provisions of section 2.6.6.1 above, the Company’s office holders shall be entitled

to benefit from coverage provided by a liability insurance of directors and office holders,

which the Company will purchase from time to time, subject to the approval of the Remuneration

Committee alone (and the approval of the Board of Directors, if required by law), provided

that the insurance policy meets the following criteria and provided that the engagement with

the insurer is entered into under market conditions and will not have a material effect on

the Company’s profitability, its assets or liabilities: |

Directors

and office holders in the Company shall be entitled to benefit from coverage provided by a liability insurance of directors and office

holders, in a limit of $ 50 million per claim and over the insurance period covered by that policy (plus $ 3 million litigation expenses

in excess of the abovementioned limit) (the “policy”). Total annual premium that the Company will pay to an insurance company

for the policy and the deductible amount shall be in accordance with market conditions at the date of acquiring the policy, provided

that such amounts are not substantial to the Company. The policy will renew each year, in similar conditions and subject to the approvals

required by law, for additional periods of 18 months each.

5

As to an office holder that has entered into engagement with the Company whereby no

employer-employee relationship exists, the Company may pay the social benefits described

above on top of his salary in lieu of the said expenses.

6

An office holder shall be entitled to annual leave as prescribed by law, but the Company grant him further paid leave up to a ceiling

of 24 working days per year. The Company may allow the office holder to accumulate vacation days over his term of office in accordance

with Company’s procedures.

In

the event of a material change in the risks applicable to the Company or if the policy is not renewed, the Company will be entitled to

purchase a Run-Off coverage for a period of up to 7 years (the “Run-Off Period”), at a premium to the Run-Off Period which

is in accordance with market conditions, provided that such amount is not substantial to the Company.

In

addition, the Company shall be entitled to purchase a POSI insurance policy (Public Offering of Securities Insurance) that will supplement

the insurance coverage for events that were not taken into account at the time of purchasing the insurance policy (such as a share offering,

share offering in a foreign stock exchange, financing, or publication of a prospectus, etc. in limit and the maximal coverage that shall

not exceed $ 15 million. The premium and the deductible amount shall be in accordance with market conditions at the date of acquiring

such policy, provided that such amounts are not substantial to the Company.

The

Purpose of the abovementioned insurance policies is to entitle the Company’s directors and office holders a defense against lawsuits,

while the conditions of the insurance policies are determined in negotiations between the Company and the insurance companies, taking

under account the Company’s size and fields of activities, the geographical spread of the Company’s operations, the risk

management policy of the Company, the number of office holders insured by the policies, and customary and acceptable conditions in the

market in such field.

| 2.6.6.3 | The

Company’s office holders may be entitled to an indemnification arrangement in accordance

with arrangements that are normally acceptable and subject to the provisions of the law and

the Company’s articles of association. The overall amount of indemnification per event

to all office holders shall not exceed 25% of the effective shareholders’ equity of

the Company (the maximum indemnification amount). For that purpose, the “effective

shareholders’ equity of the Company” means the amount of the Company’s

shareholders’ equity in accordance with the last consolidated audited or reviewed financial

statements of the Company (as applicable) at the time of actual payment of the indemnification.

It is hereby clarified, that the indemnification shall be paid in excess of any amount paid

under the liability insurance of directors and office holders, which the Company has purchased

or will purchase from time to time. |

| 2.6.6.4 | Company

office holders may be entitled to an exemption arrangement in accordance with arrangements

that are normally acceptable and subject to the provisions of the law and the Company’s

articles of association. |

| 2.7 | Remuneration

in connection with termination of employment |

| 2.7.1 | Advance

notice period |

| 2.7.1.1 | An

office holder may be entitled to advance notice period or payment in lieu of advance notice

period. The advance notice period shall be determined for each and every office holder, taking

into account the parameters listed in section 2.2 above. |

| 2.7.1.2 | As

a general rule, the advance notice period of an office holder shall not exceed 3 months for

an office holder who was employed in the Company for less than 3 years, and shall not exceed

6 months for an office holder who was employed in the Company more than 3 years. The Remuneration

Committee and Board of Directors of the Company, and where required – the General Meeting

of the Company’s shareholders, may, at their discretion, taking into account the position

of the office holder, his area of responsibility and his other remuneration components, approve

an advance notice period that is different than the one specified above. |

| 2.7.1.3 | Over

the course of the advance notice period, the office holder shall continue to do his job in

the Company at the request of the Company, unless the Company decides that he will not do

so, in which case the office holder may be entitled to continue and receive over the advance

notice period all employment and service terms, which were agreed upon in his employment

agreement. |

| 2.7.1.4 | The

service and employment terms of the office holders may include a provision whereby the Company

may terminate the employment of the office holder without an advance notice period in cases

which deny eligibility for severance pay according to the law, including the following cases:

(a) conviction of an offence involving moral turpitude; (b) an office holder who will conduct

himself in a disloyal and/or unreliable and/or dishonest manner in his relations with the

Company and/or while carrying out actions on its behalf and/or will harm the Company’s

reputation; (c) in case the office holder will breach the confidentiality duty towards the

Company and/or his duty to protect the Company rights which were developed due to or as part

of his work at the Company; (d) Any other case in which the Company is legally entitled to

refrain from payment of severance pay. |

The

scope of severance pay will be determined immediately prior to the employment of the office holder, or during his employment, to the

extent such employment is not expecting to terminate soon. Severance pay shall not be increased immediately prior to termination of employment.

In general, an office holder who are a Company employee, will be entitled to Severance pay constituting 100% of his law monthly salary.

The Company will strive that new employment agreements with office holders will include provisions in accordance with Section 14 to the

Israeli Severance Pay Law, 5723-1963. Notwithstanding the foregoing, in the event that the employment of a certain office holder will

terminate under circumstances which allow to deny eligibility for severance pay by law, in whole or in part, the Company will release

to such office holder only his payment to the manager’s insurance/pension plan and education fund.

| 2.7.3 | Retirement

/ Adaptation period |

| 2.7.3.1. | Subject

to the approval of Remuneration Committee and Board of Directors of the Company, and where

required – the General Meeting of the Company’s shareholders and subject to the

provisions of the law, as amended from time to time, the office holder may be entitled to

an adaptation period that will not exceed six months, provided he was employed in the Company

for at least two years, after the end of the advance notice period. Over the adaptation period,

the office holder will receive his salary and other related employment terms as described

above. An office holder may be entitled to retirement grants provided that such grant was

determined in the engagement agreement with such office holder, provided further that he

did not end his service in Company under circumstances which, as determined by the Company’s

Board of Directors, deny eligibility for severance pay, in such case will not be entitled

to any retirement grant. |

| 2.7.4.3 | When

determining the amount of the retirement grant, the Company will take into account, among