FALSE000115903600011590362025-01-082025-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

| | | | | | | | |

| Date of Report (Date of Earliest Event Reported): | | January 8, 2025 |

HALOZYME THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

________________________

Commission File Number 001-32335

| | | | | | | | |

| Delaware | | 88-0488686 |

| (State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

| |

| 12390 El Camino Real | | 92130 |

| San Diego | | (Zip Code) |

| California | | |

| (Address of principal executive offices) | | |

(858) 794-8889

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | | |

| Common Stock, $0.001 par value | HALO | The Nasdaq Stock Market LLC | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 8, 2025, Halozyme Therapeutics, Inc., a Delaware corporation (the “Company”) issued a press release containing information related to the Company’s 2025 financial guidance (the “Press Release”). The Press Release included a summary of preliminary, unaudited estimates regarding the Company’s financial results for the year ended December 31, 2024 (the “Preliminary 2024 Estimates”). A copy of the Press Release is attached as Exhibit 99.1. The Press Release and Preliminary 2024 Estimates are furnished under Item 2.02 of this report and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | Description | |

| | |

| Press release dated January 8, 2025 |

| 104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | Halozyme Therapeutics, Inc.

(Registrant) |

| | | | | |

Dated: | January 8, 2025 | | | By: | /s/ Nicole LaBrosse |

| | | | | Nicole LaBrosse |

| | | | | Senior Vice President, Chief Financial Officer |

Exhibit 99.1

Halozyme Reiterates 2024 Financial Guidance and Raises 2025 and Multi-Year Financial Guidance

Reports Preliminary 2024 Unaudited Estimated Ranges Consistent with Previous Financial Guidance

Raises 2025 Financial Guidance Ranges for Total Revenue to $1,150 - $1,225 million, Representing YoY Growth of 16% - 23%, Adjusted EBITDA of $755 - $805 million, Representing YoY Growth of 24% - 32%, and non-GAAP Diluted EPS of $4.95 - $5.35, Representing YoY Growth of 21% - 30%1,2

Announces New $250 million Accelerated Share Repurchase

Conference Call Scheduled Today at 5:30am PT/8:30am ET

SAN DIEGO, January 8, 2025 -- Halozyme Therapeutics, Inc. (NASDAQ: HALO) (“Halozyme” or the “Company”) today provided a financial update, reiterating full year 2024 financial guidance and raising full year 2025 and multi-year financial guidance. The Company also announced it has recently entered into a new $250 million accelerated share repurchase (ASR) program under its previously announced $750 million share repurchase program.

“Halozyme is at the forefront of drug delivery innovation, fostering a high-growth and durable business underpinned by our proprietary ENHANZE drug delivery technology. This leadership position is reflected in the global launch of nine ENHANZE co-formulated products, a robust pipeline and continuing interest from potential new partners,” said Dr. Helen Torley, president and chief executive officer. “Our 2025 guidance, with projected revenue growth of 16% to 23% and adjusted EBITDA growth of 24% to 32%, is largely driven by VYVGART Hytrulo, which has received strong early acceptance in generalized myasthenia gravis, and is now seeing growing adoption in CIDP following the June 2024 U.S. approval, and by the continued strong growth of Darzalex SC and Phesgo. Three additional products, Ocrevus Zunovo, Tecentriq Hybreza and Opdivo Qvantig, which are in the early stages of commercialization following recent approvals, are projected to contribute modestly in 2025, growing meaningfully from 2026 onwards. The combined continued projected growth of each product in this exciting de-risked portfolio is what resulted in our also raising our multi-year guidance.”

Table 1. 2024 Unaudited Preliminary Estimates of Results for the Twelve Months Ended December 31, 2024

| | | | | | | | |

| | 2024 Estimate | | | |

| Total Revenue | $970 to $1,020 million | | | |

| Royalty Revenue | $550 to $565 million | | | |

| Net Income | $419 to $443 million | | | |

| Adjusted EBITDA | $595 to $625 million | | | |

| GAAP Diluted EPS | $3.22 to $3.40 | | | |

| Non-GAAP Diluted EPS | $4.00 to $4.20 | | | |

Footnotes:

1 Growth rates calculated from 2024 midpoint to low end of 2025 range and high-end of 2025 range. See “2025 Financial Guidance” below.

2 Adjusted EBITDA and non-GAAP Diluted EPS are non-GAAP financial measures. See “Note Regarding Use of Non-GAAP Financial Measures” below for an explanation of these measures.

Financial Outlook for 2025

The Company is raising its financial guidance for 2025. For the full year 2025, the Company expects:

•Total revenue of $1,150 million to $1,225 million, representing growth of 16% to 23% over projected 2024 total revenue, primarily driven by increases in royalty revenue and product sales from XYOSTED®.

•Revenue from royalties of $725 million to $750 million, representing growth of 30% to 35% over 2024.

•Adjusted EBITDA of $755 million to $805 million, representing growth of 24% to 32% over 2024.

•Non-GAAP diluted earnings per share of $4.95 to $5.35, representing growth of 21% to 30% over 2024. The Company’s earnings per share guidance does not consider the impact of potential future share repurchases.

Table 2. 2025 Financial Guidance

| | | | | | | | | | | | | | | | | | | | |

| | | Previous Guidance Range | | New Guidance Range | Expected YoY Growth1 | | | |

| Total Revenue | | $1,095 to $1,170 million | | $1,150 to $1,225 million | 16% to 23% | | | |

| Royalty Revenue | | $650 to $675 million | | $725 to $750 million | 30% to 35% | | | |

| Adjusted EBITDA | | $710 to $760 million | | $755 to $805 million | 24% to 32% | | | |

| Non-GAAP Diluted EPS | | $4.45 to $4.85 | | $4.95 to $5.35 | 21% to 30% | | | |

Footnote:

1 Growth rates calculated from 2024 midpoint to low end of 2025 range and high-end of 2025 range.

Website and Conference Call

Halozyme will host an Investor Conference Call today, Wednesday, January 8 at 5:30am PT/8:30am ET. On the call, Dr. Helen Torley, President and Chief Executive Officer, and Nicole LaBrosse, Chief Financial Officer, will provide preliminary unaudited full year 2024 results and updated 2025 and multi-year financial guidance. Pre-registration of the live call can be accessed via link here: https://registrations.events/direct/Q4I871904593. A webcast of the live call and presentation materials (which will be available 15 minutes before the start of the call) will be available through the "Investors" section of Halozyme's corporate website at ir.halozyme.com.

About Halozyme

Halozyme is a biopharmaceutical company advancing disruptive solutions to improve patient experiences and outcomes for emerging and established therapies. As the innovators of ENHANZE® drug delivery technology with the proprietary enzyme rHuPH20, Halozyme’s commercially-validated solution is used to facilitate the subcutaneous delivery of injected drugs and fluids, with the goal of improving the patient experience with rapid subcutaneous delivery and reduced treatment burden. Having touched more than 800,000 patient lives in post-marketing use in nine commercialized products across more than 100 global markets, Halozyme has licensed its ENHANZE® technology to leading pharmaceutical and biotechnology companies including Roche, Takeda, Pfizer, Janssen, AbbVie, Eli Lilly, Bristol-Myers Squibb, argenx, ViiV Healthcare, Chugai Pharmaceutical and Acumen Pharmaceuticals.

Halozyme also develops, manufactures and commercializes, for itself or with partners, drug-device combination products using its advanced auto-injector technologies that are designed to provide commercial or functional advantages such as improved convenience, reliability and tolerability, and enhanced patient comfort and adherence. The Company has two commercial proprietary products, Hylenex® and XYOSTED®, partnered commercial products and ongoing product development programs with Teva Pharmaceuticals and Idorsia Pharmaceuticals.

Halozyme is headquartered in San Diego, CA and has offices in Ewing, NJ and Minnetonka, MN. Minnetonka is also the site of its operations facility.

For more information visit www.halozyme.com and connect with us on LinkedIn and Twitter.

Note Regarding 2024 Preliminary Results

The financial results presented herein are preliminary, estimated, and unaudited. They are subject to the completion and finalization of the Company’s financial and accounting close procedures. They reflect management’s estimates based solely upon information available to management as of the date of this press release. Further information learned during the completion and finalization of these procedures may alter the final results. These preliminary estimates should not be considered a substitute for the financial information to be filed with the Securities and Exchange Commission on the Company’s Form 10-K for the year ended December 31, 2024 once it becomes available. There is a possibility that the Company’s financial results for the twelve months ended December 31, 2024 could vary materially from these preliminary estimates. Accordingly, you should not place undue reliance upon this preliminary information.

Note Regarding Use of Non-GAAP Financial Measures

In addition to disclosing financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this press release and the accompanying tables contain certain non-GAAP financial measures. The Company reports earnings before interest, taxes, depreciation, and amortization (“EBITDA”), adjusted EBITDA, Non-GAAP diluted earnings per share and non-GAAP diluted shares and guidance with respect to those measures, in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The Company calculates non-GAAP diluted earnings per share excluding share-based compensation expense, amortization of debt discounts, intangible asset amortization, one-time changes, if any, such as changes in contingent liabilities, inventory adjustments, impairment charges, and certain adjustments to income tax expense. The Company calculates non-GAAP diluted shares excluding the dilutive impact of convertible notes which is used in calculating non-GAAP diluted earnings. The Company calculates EBITDA excluding interest, taxes, depreciation and amortization. The Company calculates adjusted EBITDA excluding one-time items, if any such as changes in contingent liabilities, inventory adjustments and impairment charges. Reconciliations between GAAP and Non-GAAP financial measures are included at the end of this press release. The Company does not provide reconciliations of forward-looking adjusted measures to GAAP due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for changes in share-based compensation expense and the effects of any discrete income tax items. For the same reasons,

the Company is unable to address the probable significance of the unavailable information. The Company provides non-GAAP financial measures that it believes will be achieved, however it cannot accurately predict all of the components of the adjusted calculations and the U.S. GAAP measures may be materially different than the non-GAAP measures.

The Company evaluates other items of income and expense on an individual basis for potential inclusion in the calculation of Non-GAAP financial measures and considers both the quantitative and qualitative aspects of the item, including (i) its size and nature, (ii) whether or not it relates to the Company’s ongoing business operations and (iii) whether or not the Company expects it to occur as part of the Company’s normal business on a regular basis. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures presented by other companies. These non-GAAP financial measures are not meant to be considered in isolation and should be read in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP, and are not prepared under any comprehensive set of accounting rules or principles. In addition, from time to time in the future there may be other items that the Company may exclude for purposes of its non-GAAP financial measures, and the Company may in the future cease to exclude items that it has historically excluded for purposes of its non-GAAP financial measures.

The Company considers these non-GAAP financial measures to be important because they provide useful measures of the operating performance of the Company, exclusive of factors that do not directly affect what the Company considers to be its core operating performance, as well as unusual events. The non-GAAP measures also allow investors and analysts to make additional comparisons of the operating activities of the Company’s core business over time and with respect to other companies, as well as assessing trends and future expectations. The Company uses non-GAAP financial information in assessing what it believes is a meaningful and comparable set of financial performance measures to evaluate operating trends, as well as in establishing portions of our performance-based incentive compensation programs.

Safe Harbor Statement

In addition to historical information, the statements set forth in this press release include forward-looking statements including, without limitation, statements concerning the Company’s financial performance (including preliminary results for the fiscal year ended December 31, 2024 and the Company’s expected financial outlook for 2025) and expectations for future growth, profitability, total revenue, royalty revenue, EBITDA, Adjusted EBITDA, and non-GAAP diluted earnings-per-share. Forward-looking statements regarding the Company’s ENHANZE® drug delivery technology may include the possible benefits and attributes of ENHANZE®, its potential application to aid in the dispersion and absorption of other injected therapeutic drugs and facilitating more rapid delivery and administration of higher volumes of injectable medications through subcutaneous delivery. Forward-looking statements regarding the Company’s business may include potential growth and receipt of royalty and milestone payments driven by our partners’ development and commercialization efforts, potential new clinical trial study starts and clinical data, regulatory submissions and product launches, the size and growth prospects of our partners’ drug franchises, potential new or expanded collaborations and collaborative targets and regulatory review, and potential approvals of new partnered or proprietary products, and the potential timing of these events. These forward-looking statements are typically, but not always, identified through use of the words “expect,” “believe,” “enable,” “may,” “will,” “could,” “intends,” “estimate,” “anticipate,” “plan,” “predict,” “probable,” “potential,” “preliminary,” “possible,” “should,” “continue,” and other words of similar meaning and involve risk and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Actual results could differ materially from the expectations contained in these forward-looking statements as a result of several factors, including unexpected levels of revenues, expenditures and costs, unexpected results or delays in the growth of the Company’s business, or in the development, regulatory review or commercialization of the Company’s partnered or proprietary products, regulatory approval requirements, unexpected adverse events or patient outcomes and competitive conditions. These and other factors that may result in differences are

discussed in greater detail in the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission. Except as required by law, the Company undertakes no duty to update forward-looking statements to reflect events after the date of this release.

Contacts:

Tram Bui

VP, Investor Relations and Corporate Communications

609-359-3016

tbui@halozyme.com

Samantha Gaspar

Teneo

212-886-9356

samantha.gaspar@teneo.com

The following tables reconcile, for the twelve months ended December 31, 2024, the Company’s estimated ranges of 2024 EBITDA and 2024 Adjusted EBITDA to the Company’s estimated ranges of 2024 Net Income, and 2024 Non-GAAP Diluted EPS to the Company’s estimated ranges of 2024 GAAP Diluted EPS.

Halozyme Therapeutics, Inc.

GAAP to Non-GAAP Reconciliations

Preliminary Net Income and Diluted EPS

(Unaudited)

(In millions, except per share amounts)

| | | | | | | | |

| | Twelve Months Ended

December 31, 2024 |

| GAAP Net Income | | $ 419 - 443 |

| Adjustments | | |

| Investment and other income | | (23) - (23) |

| Interest expense | | 18 - 18 |

| Income tax | | 100 - 105 |

| Depreciation and amortization | | 82 - 82 |

| EBITDA | | 595 - 625 |

| Adjustments | | — |

| Adjusted EBITDA | | $ 595 - 625 |

| | |

| GAAP Diluted EPS | | $ 3.22 - 3.40 |

| Adjustments | | |

| Share-based compensation | | 0.32 - 0.35 |

| Amortization of debt discount | | 0.06 - 0.06 |

| Amortization of intangible assets | | 0.55 - 0.55 |

Income tax effect of above adjustments(1) | | (0.15) - (0.16) |

| Non-GAAP Diluted EPS | | $ 4.00 - 4.20 |

| | |

| GAAP Diluted Shares | | 129.8 - 130.4 |

| Adjustments | | |

Adjustment for dilutive impact of senior 2028 Convertible Notes(2) | | (0.4) - (0.4) |

| Non-GAAP Diluted Shares | | 129.4 - 130.0 |

Note: Dollar amounts, as presented, are rounded. Consequently, totals may not add up.

(1)Adjustments relate to taxes for the reconciling items, as well as excess benefits or tax deficiencies from stock-based compensation, and the quarterly impact of other discrete items.

(2)Adjustment made for the dilutive effect of our Convertible Senior Notes due 2028 when the effect is not the same on a GAAP and non-GAAP basis for the reporting period.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

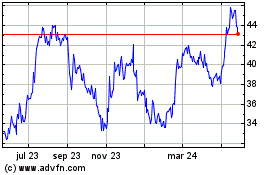

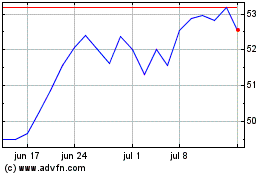

Halozyme Therapeutics (NASDAQ:HALO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Halozyme Therapeutics (NASDAQ:HALO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025