Huize Launches Customized Mid-Tier Medical Insurance Product “PrimeMed” in Partnership with CCIC and MSH CHINA

16 Enero 2025 - 4:00AM

Huize Holding Limited, (“Huize”, the “Company” or “we”) (NASDAQ:

HUIZ), a leading insurance technology platform connecting

consumers, insurance carriers and distribution partners digitally

through data-driven and AI-powered solutions in Asia, today

announced the launch of “PrimeMed”, a customized mid-tier medical

insurance product, in collaboration with China Continent Property

& Casualty Insurance Co., Ltd. (CCIC) and MSH CHINA Enterprise

Services Co., Ltd. (MSH CHINA). Designed to provide scarce,

high-cost medical resources such as specialized and international

departments in public hospitals and designated private medical

institutions, this new solution addresses the need for flexible and

affordable insurance coverage.

“PrimeMed”’s key features include:

- Flexible deductibles: three plan

options are offered, including zero or low shared deductibles,

making inpatient services across different medical institutions

more accessible while streamlining enrollment and claims

processing.

- Children’s coverage: allows parents

to insure children under 18, expanding protection options for the

family.

- Relative deductible scheme: enables

compensation from other sources (such as public health insurance)

to offset deductibles, improving the accessibility of

benefits.

- Affordable premiums: annual

premiums start from RMB958 for the primary age group, with options

to add accident outpatient emergency coverage and receive family

package discounts.

With these innovative and flexible features,

“PrimeMed” offers premium healthcare services at a price point

designed to appeal to consumers seeking an affordable upgrade from

traditional million-yuan medical insurance products.

Mr. Cunjun Ma, Chairman and Chief Executive

Officer of Huize, commented, “As public awareness and spending on

mid-to-high level medical care services continue to grow, we

developed ‘PrimeMed’ to meet a critical need for comprehensive

coverage. The product provides access to multiple hospital types

and departments, as well as out-of-hospital medications and

imported medical devices expenses, ensuring broader protection for

individuals and families seeking higher-quality healthcare. Our

partner MSH CHINA, a high-end health insurance service provider,

strengthens the product offering with their extensive hospital

network across top-tier Chinese hospitals and established billing

relationships, ensuring seamless access to premium medical care.

Additionally, in line with the government’s initiative for the

differentiated development of basic medical insurance and

commercial insurance, ‘PrimeMed’ provides a personalized upgrade in

commercial medical care, extending coverage to areas that basic

insurance often does not reach—such as imported drugs, specialized

medical devices and complex surgeries. This solution exemplifies

our commitment to addressing gaps in the healthcare system and

developing innovative insurance solutions that cater to the

evolving needs of our customers, contributing to better healthcare

outcomes.”

About Huize Holding

Limited

Huize Holding Limited is a leading

insurance technology platform connecting consumers, insurance

carriers and distribution partners digitally through data-driven

and AI-powered solutions in Asia. Targeting mass affluent

consumers, Huize is dedicated to serving consumers for

their life-long insurance needs. Its online-to-offline integrated

insurance ecosystem covers the entire insurance life cycle and

offers consumers a wide spectrum of insurance products, one-stop

services, and a streamlined transaction experience across all

scenarios. By leveraging AI, data analytics, and digital

capabilities, Huize empowers the insurance service chain

with proprietary technology-enabled solutions for insurance

consultation, user engagement, marketing, risk management, and

claims service.

For more information, please

visit http://ir.huize.com or follow us on social media via

LinkedIn (https://www.linkedin.com/company/huize-holding-limited),

Twitter (https://twitter.com/huizeholding) and Webull

(https://www.webull.com/quote/nasdaq-huiz).

About MSH CHINA Enterprise Services Co.,

Ltd.Founded in 2001, MSH China serves as the Asia-Pacific

headquarters of MSH INTERNATIONAL. With offices in major cities

including Shanghai, Beijing, Guangzhou, Shenzhen, and Chengdu, MSH

China provides premium health insurance solutions to both corporate

and individual clients. The company has a professional team of

nearly 500 employees, with over 70 specialists holding medical

backgrounds, offering services in more than ten languages,

including Chinese, English, and French. As part of MSH

INTERNATIONAL, a global leader in international health insurance,

MSH China is committed to delivering innovative, high-quality

health services to clients across China and the Asia-Pacific

region.

For more information, please visit:

https://www.mshasia.com/

About China Continent

Property & Casualty Insurance Co., Ltd. Founded in

2003, China Continent Property & Casualty Insurance Co., Ltd.

(CCIC) is a national property & casualty insurance company,

fully owned by China Re Group (stock code: 1508.HK), the only

state-owned reinsurance group in China. The company operates 39

branches and more than 2,100 sub-branches nationwide, with nearly

46,000 employees.

For more information, please visit:

http://www.ccic-net.com.cn/en/

For investor and media inquiries, please

contact:

Investor RelationsKenny

LoInvestor Relations Managerinvestor@huize.com

Media

Relationsmediacenter@huize.com

Christensen In ChinaMs. Dee

WangPhone: +86-10-5900-1548Email: dee.wang@christensencomms.com

In U.S.Ms. Linda BergkampPhone:

+1-480-614-3004Email: linda.bergkamp@christensencomms.com

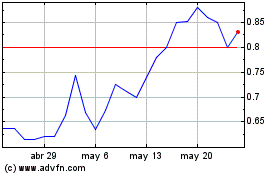

Huize (NASDAQ:HUIZ)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

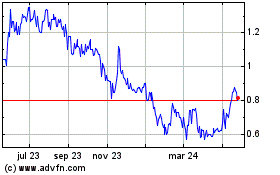

Huize (NASDAQ:HUIZ)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025